The car industry ex China is reeling, between conventional car markers having trouble adapting to the EV/hybrid world (where EV new entrants have considerable advantages via the vehicles’ much lower mechanical complexity), European manufacturers being whacked by the new normal of much higher energy prices, and Trump tariffs disrupting supply chains to the critically important US market. We’ll examine with the dire straits at Nissan, once a bedrock maker of solid mid-range cars (I have some fondness for Nissan; the first car I drove regularly was my parents’ second car, a lime green Datsun), as a new window into these accelerating problems

Readers are invited to pile on, since I am not a vehicle maven and are likely quite a few issues from the customer or product/product line end that we’ll skip over in getting to the broad outlines of the precipitous decline of a once-storied company. The fall of Nissan, as far as I can tell, does not have a simple though line, unlike Boeing (“Great engineering company merges with defense contractor run by beancounters and financiers, putting the money men in charge, who proceed to cost cut and disinvest into bad products and performance”).

Regulars no doubt have noticed our pointing to unheard of factory closings by Volkswagen in Germany, a direct casualty of the decision to cut the EU off from cheap Russian energy as much as possible and a poster child of the blowback to European manufacturers. But before we turn to Nissan, a new story at the Financial Times shows the extent to which other established Western carmarkers are struggling. From Stellantis chief executive Carlos Tavares resigns:

Stellantis chief executive Carlos Tavares has resigned following a sharp decline in financial performance at the world’s fourth-largest carmaker, marking an abrupt exit for one of the automotive industry’s most high-profile leaders.

In a statement on Sunday, Stellantis, which owns the Peugeot, Fiat and Jeep brands, said the company’s board accepted the resignation of Tavares…

People familiar with Tavares’ departure said there were increasing tensions between him and other Stellantis board members on how to put the company back on track following a steep decline in reported profits in 2024 due to slumping sales in the US and Europe. Stellantis’ shares have fallen 43 per cent this year.

Mind you, Stellanis is not in serious financial trouble. The pink paper notes that even with negative 2024 cash flow on the order of €5 billion to €10 billion, still has a very solid balance sheet.1

Nissan as of early November initiated an emergency turnaround plan after a second cut to its 2024 profit forecasts. But the coverage in major outlets like the Financial Times described the deep cuts planned without even mentioning the impending cash crunch (might the reason be that the Financial Times is Japanese owned?). From its account then:

Nissan has launched an emergency turnaround plan that includes 9,000 job losses and a voluntary 50 per cent pay cut for chief executive Makoto Uchida after unveiling it had fallen to a quarterly loss.

Japan’s third-largest carmaker said it would slash global production capacity by 20 per cent and cut costs by ¥400bn ($2.6bn). It downgraded its full-year profit forecast for the second time this year, this time by 70 per cent.

The crisis at Nissan came as it failed to counter a slowdown in global electric vehicle sales with a strong hybrid offering, which has helped rivals Toyota and Honda….

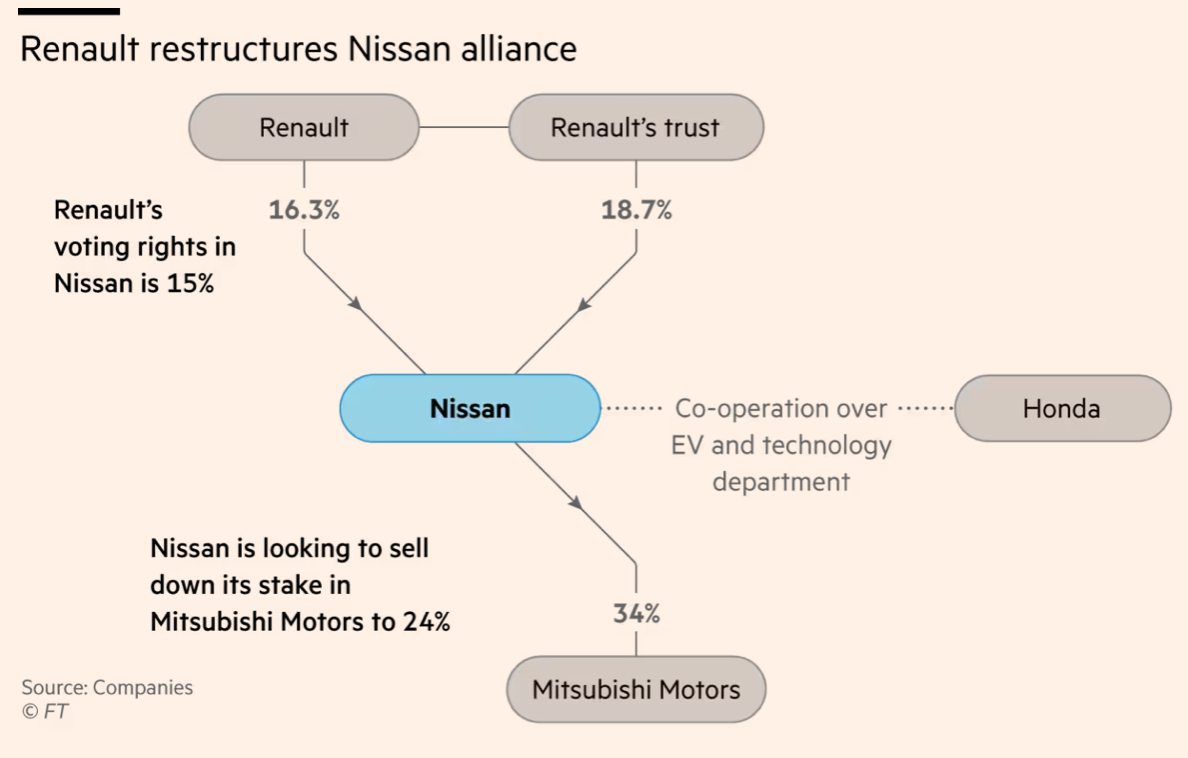

As part of the measures, Nissan also cut its stake in alliance partner Mitsubishi Motors on Thursday from 34 per cent to 24 per cent to bolster its balance sheet.

Nissan recently turned to a partnership with Honda to survive the competition after a long-standing alliance with France’s Renault significantly weakened in recent years. The two Japanese companies plan to roll out a new electric vehicle before the end of the decade and jointly develop software to go toe-to-toe with Chinese rivals.

This additional tidbit from the Guardian account on the same date:

The company said it was facing a severe situation as it battled with higher costs for sales and in its factories, as well as having too many cars with dealers in the US in particular, which can force the company to give steep discounts.

If “severe situation” is an exact translation (or what was said in English, since Japanese executives tend to use Japanese formulations in their spoken English), that is Stage 4 disease level dire.

And indeed, less than two weeks later, keying off the November 7 presentation, from Nikkei Asia Nissan bleeds cash as sales slump and expenses mount:

The company’s cash flows reflect its struggles. Operating cash flow for its automotive business in April-September came to minus 234 billion yen. In addition to slow sales, the piling up of inventory has been among the contributing factors.

Nissan’s cash flow for capital investments for the period reached minus 214.3 billion yen. Combined, overall free cash flow totaled minus 448.3 billion yen. In the first half of the previous fiscal year, the company saw a positive free cash flow of 193.9 billion yen.

Compared with other April-September periods, the cash flow deficit is close to the 504.6 billion yen recorded in 2020, during the coronavirus pandemic. It exceeds the minus 414.9 billion yen recorded in 2019, when Nissan announced a global downsizing and laid off about 12,500 employees.

Due mainly to the deterioration of its free cash flow, Nissan’s cash and equivalents on hand stood at about 1.4 trillion yen at the end of September, down 575.9 billion yen from the end of March. But for now, the company’s cash on hand itself is still sizeable, so “the financing risk is minor,” said Takao Matsuzaka, chief analyst at Daiwa Securities.

Concerns about raising funds in the medium-to-long term are emerging, due in part to a decline in creditworthiness. On Nov. 8, S&P Global said that if the company cannot stabilize its earnings, downward pressure on its creditworthiness will intensify.

S&P has given Nissan a long-term issuer rating of BB+, below investment grade, while Japan’s Rating and Investment Information classifies it as A and Moody’s ranks it at Baa3, the lowest of its investment-grade ratings.

More recent statements by company insiders belie the cheery take by the Daiwa analyst, particularly in light of the junk/borderline junk and deteriorating credit outlook. Nikkei describes in some detail how the higher interest rate environment versus bond refinancings needed starting in March 2026 are looming. It then continues:

Another concern is that operating and investing cash flows are likely to continue to be negative. Although the company aims to reduce fixed and variable costs by 400 billion yen per year by cutting jobs and production, it has few prospects for new products that would significantly improve the balance of payments in the near future.

A November 26 Financial Times story similarly signaled distress. From Nissan seeks anchor investor to help it through make-or-break 12 months. The new source of woes is that the Nissan-Renault tie-up, which a headline search shows have been wobbly for a while, is now moving towards a breakup:

Nissan is searching for an anchor investor to help it survive a make-or-break year as longtime partner Renault sells down its holding in the crisis-hit Japanese carmaker.

Two people with knowledge of the talks said Nissan was seeking a long-term, steady shareholder such as a bank or insurance group to replace some of Renault’s equity holding, as Nissan finalises the terms of its new electric vehicle partnership with arch-rival Honda.

“We have 12 or 14 months to survive,” said a senior official close to Nissan.

The article floats the cheery idea that perhaps Honda will take Renault out of its stake, since the two have increased their business collaboration. Hardcore car sites dismiss the notion as not not in Honda’s interest, both by virtue of the sheer size of the investment and Nissan’s cash-bleeding state. Of course, it is possible that the Japanese government could pressure Honda into making a rescue (but why should a Japanese car maker go that far in accommodating a European one?). That might not be so crazy if Nissan got some bond financing guarantees, as did Chrysler in its bailout. Another possibility is Japanese insurers are muscled into helping a deal, reducing the load on a Honda.

One has to think that ultimately Nissan is too big to fail from a Japanese perspective, as the US Big Three were after the global financial crisis. Remember what is at risk is not just Nissan’s direct employment but also that of its many subcontractors. But I welcome input from any readers plugged into current views in Japan.

Note that aside from the rate of the cash burn, circling vultures are adding to the sense of urgency. Again from the Financial Times:

But the search for an anchor investor has become even more critical with the turmoil at Nissan attracting investments from Singapore-based Effissimo Capital Management and Hong Kong’s Oasis Management, two of the most high-profile activists in Asia whose campaigns have previously targeted the likes of Toshiba and Nintendo.

Interestingly, the Daily Mail has just published two good new pieces on Nissan going into a financial nosedive. Nissan is of interest due to its manufacturing plant in Sunderland. While a big chunk of the story re-reports the Financial Times, Major car manufacturer ‘on the brink of collapse’ as official claims company has ‘just 12 months to survive,’ it identified additional stressors:

Nissan also last month called for urgent action to avoid car makers being penalised for the slowdown in electric vehicle sales in the UK which the firm blamed on outdated targets in the country’s Zero Emissions Vehicles Mandate.

The mandate forces firms to increase the proportion of EVs they sell each year until a total ban on new petrol and diesel motors in 2030.

This year, EVs must make up 22 per cent of a firm’s car sales and 10 per cent of van sales, with the threshold rising annually and makers facing a £15,000 fine for every sale beyond it.

Labour’s 2030 target is five years earlier than that set by former Tory prime minister Rishi Sunak.

And Nissan said that missing the target would lead to significant fines for manufacturers unless credits are purchased from EV-only brands – none of which manufacture in the UK….

The Society of Motor Manufacturers and Traders has voiced fears that the pace of the transition could hit car makers as demand for zero-emission vehicles ‘failed to meet ambition’.

The organisation forecasts a slowdown in consumer demand meant EV sales would only reach 18.5 per cent of the total market, against the 2024 ZEV Mandate target of 22 per cent.

The newer Daily Mail account gave a bit more detail on some of Nissan’s emergency responses:

Nissan’s head of manufacturing Hideyuki Sakamoto told a news conference last month: ‘Globally, we currently have 25 vehicle production lines. Our current plan is to reduce the operational maximum capacity of these 25 lines by 20 per cent.

‘One specific method for this is to change the line speed and shift patterns, thereby increasing the efficiency of operational personnel.’

This video, which gives a short-form look at Nissan’s product and sales problems in many key markets, takes issue with the idea that production cuts are a solution. Or to echo the language uses above, that Nissan can achieve efficiencies with so much investment in fixed production lines. As we have said repeatedly, direct factory labor is a small part of total car costs, estimated typically at 3%. So if you cut volumes, you will don’t do much to reduce variable costs while fully loaded costs can (will?) be higher on a unit basis.

Other useful topics are the consequences of Nissan not having a hybrid for the US market, the damage done by a big 2023 year end inventory overhang, and China eating Nissan’s lunch in Southeast Asia, with Thailand as the poster child (loss of 80% of dealer employees):

The quick takes on Nissan are much less kind. If things are this bad on the product side, it’s not easy to see how Nissan can be salvaged:

Nissan has 12-14 months to survive and they attempt to find a Hail Mary investor to save the company.

Recent Chinese brands have overtaken Nissan sales in many Asian countries, which Nissan used to dominate.

Nissan has spent the last 10 years making garbage/unreliable cars and… pic.twitter.com/wlksHBHSAy

— Edward G. 🇺🇸🦅 (@realEdwardG) November 28, 2024

Again, we’ll see how much Nissan is serving as an early warning of how bad things can get at other automaker soon enough. And don’t forget that the Trump tariffs are set to be a big spanner as far as teh critically important US market is concerned.

____

1 This section from a Magic Markets podcast gives an idea of some of Stellantis’ tsuris:

If we move on quickly to Stellantis, the polony as we like to call it, all of the brands that sort of don’t really belong together. But Stellantis is trying their best to bring them together by building platforms that all these brands then share. Unfortunately, what that does is it somewhat dilutes the brand value and the heritage.

South America was their only good news story. Much like at Volkswagen, which is why I said it’s a bit odd. In Q3, South America was up 14% and the rest was just a mess. North America down 36%, which is ridiculous. Stellantis cannot sell Jeeps. It’s just incredible. Europe down 17%, so they can’t sell Citrons and Peugeot and Alfas and Fiats in Europe. It’s not good. Alas, my beloved Maserati, my favorite car brand of all, down 60% in terms of unit sales. But the product range is just really silly at the moment. So it’s no real surprise. Stellantis has pretty much been making a mess of almost everything they’ve touched for a while. No good news there then.

Nissan once had a nice line-up with 280Z and Laurel and Patrol. They lost their edge. The tie up with Renault brought them into Daimler-Benz where Renault had a tie-up. Nissan diesels were in Mercedes vans and the Mercedes pick-up was originally a Nissan Navarra I believe.

Anyway Nissan diesels were EU Certified by France and gave Mercedes a reputation for dirty engines way outside the EU norms. Nissan had a reputation for dirty diesels and that cost them.

Daimler unwound the Renault deal snd the Chinese became the main shareholders with Geely and Horse Power International Corp making ICE power plants in China

Thus Europe has given up ICE manufacturing and will rely on China. Since EVs do not sell and have zero resale as batteries are 40% price it is a bad time to find U.K. and Germany destroying their steel industry.

Hard to see how you make cars if you import steel and batteries and then have the EU local content problem whereby you incur tariffs and Nissan was U.K. biggest car exporter to EU

I wonder if something else isn’t going on, namely the lower level of auto sales is yet another victim of the end of the sugar rush and distortions of protected zero interest rates. Like housing, people look at their monthly payment(s) in deciding what to do. Despite subsidized financing from the auto companies people just can keep to afford buying cars at the pre pandemic levels. According to FRED, in the teens to the pandemic US car and light truck sales ran circa 17 million units per year. We had a surge, pent-up demand, coming out of the pandemic supply disruptions and have settled into the 15 – 16 million range. As auto companies have high operating and financial leverage it is no surprise that some are now under stress.

death by 990 small cuts and 10 big ones.

lot of different cross-currents….one of which: the world has too many mainstream brands, from the established names to Chinese newcomers (Xiaomi).

the industry is hyper-competitive, particularly in China. The Japanese market is structurally shrinking. Nissan had an (IMO) awful US line-up, despite one or two gems. And creating a “luxury” division in the 80’s that became a lead weight around 2008 didn’t help.

then (to bury the lede) throw in lousy management.

Interest rates combined with much higher auto prices post COVID are definitely part of it. Higher financing costs cut into affordability and tamp down demand.

I also think the cars currently hitting the market were designed for a different economic environment. More people were targeting something close to luxury vehicles with higher price tags instead of releasing bare bones economy models at a lower price point. Now there’s a glut of expensive vehicles most people can’t afford.

You do realise car prices have doubled inntjevpadt decade ? In 2016 a Ford Fiesta kn U.K. cost £10,345 and in 2023 it cost £19,350

Nissan Qashqai from £18,545 to £30,135

Incomes in U.K. stagnated after 2008

Cheapest VW Golf in Germany €31,145

2021 it cost €20,700

50 years ago average car price Germany was 38% annual average salary today 2024?it is 10 months average salary

This.

Fully a year ago, legacy U.S. “buff-book” Motor Trend published a piece detailing how, after calculating for acquisition cost, interest, maintenance and depreciation, and insurance, only 37.5 percent of U.S. households could afford to purchase a new car. The author also questioned why anyone would want to be spending over $2,000 a month on a dull appliance that would be underwater as a trade-in almost immediately.

According to the Detroit News, the average new car transaction price is $47,870 (from north of $50K thanks to incentives), but this is against a U.S. median household income of $57,617. These numbers simply don’t add up when you consider greedflation on the necessities of life such as food and energy plus job precarity.

Nissan built their brand in the U.S. and Europe on unglamorous but “affordable” family cars with thin profit margins made-up by volume and tariff breaks from local manufacturing and assembly. This market segment has simply dried-up.

UK used to be the only country in the world where Ford was bigger than GM — because Ford Escort, Ford Cortina, Ford Capri were the cars people bought in preference to Vauxhall

All gone

part is proft-driven, part is that it’s expensive to comply with modern fuel efficiency and safety standards.

One reason why all vehicles

have the same profile …there are only finite ways to maximize aerodynamics and design a less deadly front-end for pedestrians…and there are more maintenance-demanding CVTs on offer

it truly is death by 1000 cuts for the 2nd tier of automakers

,,,and yet the US continues to build its cities so single-occupant autos dominate the roads, and are absolutely necessary to commute to work, shop, school, etc. I’d call sprawl “stupid,” but it would have to rise several levels to reach stupid.

My first cool car was a used 1976 280Z that I bought in 1980, a reliable Japanese E-type of sorts…

Got my Tacoma serviced last month at the dealership and walked around looking at their pathetic new car inventory, which had quite a few Tundras and a Sequoia with a MSRP of $90k that must have had $40k in cash stuffed into the glovebox, as I couldn’t see the added on value otherwise. Maybe they had 40 new cars in stock.

Next door at the Nissan dealership, the lot was well and truly loaded to capacity with new cars and no idle space, twas like an out of balance yin and yang-the 2 Nippon dealerships.

I was a Toyota person, then a Nissan person, now a Hyundai person. So far the Hyundai has given me the least trouble but my Nissan lasted a long time (with my help).

And the car maven take as I understand it is that Nissan started going downhill when it hooked up with Renault early this century. Before that Nissans were considered to be as reliable as Toyota but with a bit more cutting edge engineering.

’97 Altima lasted forever. We enjoyed a common-rail diesel in Germany in 2003 (Sunderland?) but switched to a Kraut designed Hyundai i30CW after 240K. Now that Biden’s forbidden BYD’s PHEVs (watch Trump let them in from Mexico) or simply electrify a bike? There’s a Tesla Cybertruck up W85th, that’s yet to burst into flames & burn up the surrounding Kias & Rivians. If you post about Tesla’s fatality-rate & trapped passengers, X shadow-bans you, so nobody knows how close we are to Carmaggedon?

My wife’s Maxima (IIRC a 99?) transmission failed at 65k. Was $8k to replace so dumped that car for a Hyundai. Wife wanted the 100k mi powertrain warranty.

Hard to think about Nissan without bringing up Ghosn and the strange things there.

I’d spend $17.95/yr on inspection for two decades & aside from a broken timing chain guide & distributor o-ring (changed on my desk in a Birmingham pipe mill) I’d watched a number of folks buy “Renault” Nissans despite my dire warnings. I’d bought the Hyundai in Philly, on TrueCar for $14,780 (it’s what London used for cop cars, Rio & Australia use as taxis. 75cu/ft in back. Everything came free, KYB, Brenbo, Tokico parts, 50/50 weight distribution. Dorky enough It’s not been stolen in NYC.

the closest things to affordable pick-ups are the Ford Maverick and Hyundai Santa Cruz.

Whole bunch of reasons the carmakers don’t want to sell <$45,000 pickups

Yeah, pickup truck prices are completely insane, but all vehicle prices have jumped like crazy since 2020 or so. Good thing Americans don’t need them to get to work from that house they cannot afford either.

Looking at Nissan, I wonder how much of the current problems are that they’ve lost the SE Asia market.

If the whole China tariff things persist how much all of the Western automakers will get locked out of not only China, but also other markets? And what does that mean for Western automakers with plants in China?

My Maverick hybrid is a pretty well designed vehicle. City driving mpg is definitely in the 40s. Very roomy inside and good truck bed space for a small truck. Plays well with our Android phones. I waited so long for it that I got a 2024 for the price of a 2023 edition, so it’s cheaper than most mid size sedans.

Still, I’m looking to sell it soon. I don’t get the appeal of trucks. The truck bed makes it harder to haul most things compared to a crossover/hatchback because you have to tie everything down carefully. The sightlines are okay but nowhere near as good as my Forester. Just slightly harder to park and get around. Why do dudes love trucks so much?

Metaphorical penis extension.

It’s maybe only a bit better than hearsay / anecdata, but when I was looking for a car a few years ago, I repeatedly came across warnings about Nissan specifically among the Japanese brands. People would just casually make them too, or even react with jokes, like it was common knowledge (in car magazines, on web forums, personal convos).

It may not have been entirely fair because IIRC the issues were more prevalent in the early 2010s, but corrosion (relatively poor steel in the frames) and CVTs burning out were the big ones. Transmission replacements in particular have a way of scaring people off, myself included. On the flip side, I do know some people who felt good about their Sentras or Altimas as starter cars.

More generally than the lack of a hybrid / battery EV offering though, I don’t think they had a strong way to stand out among competitors except going cheap. Toyota has the Prius, Honda has standout ICE features, Subaru has AWD & other outdoor-friendly designs, and Mazda keeps some unique selling points. To compete in that space with only a lower price and a reputation for poor quality? I’m not surprised they’re struggling.

Same. Everyone I’ve known that had a Nissan in say the past 15 years has had a lot of big problems with them and warned me off. They swore they’d never get another one.

That is why I won’t buy a Nissan. Their reliability isn’t good. I want a vehicle I can drive that doesn’t have any problems. My last few vehicles have been Toyotas. Other than routine maintenance I haven’t had a single problem.

The only Nissans I ever drove, I leased ( one for two years and another for three years between 97 and 2002).

it is not hearsay. early failure of Jatco CVTs (Nissan subsidiary) crippled Nissan’s reputation as a reliable “Japanese” brand

This, Louis. Jatco is a captive Nissan subsidiary. Those CVT trannies chronically die young, and Nissan under cost-slashing Carlos Ghosn installed them up and down the lineup—even the ostensibly sporty Maxima and ostensibly luxurious Infiniti models. Look at various Nissan models over 5 years old, and the Consumer Reports survey’s breakout of trouble by category shows rows of blood-red dots under “Transmission—Major.”

Ghosn’s regime gutted the quality in numerous other ways as well. I read in a trade pub several years ago an anonymous industry observer who said their quality standards had become so lax, if they got a huge batch of body parts that were out of spec, rather than eat them, they’d have an equally large batch of the adjoining parts made equally out of spec so they could use them. Imagine crash repairs on that. They also started their R&D budgets for a decade, and as a result, now have no new products in the pipeline.

Nissan used to be able to hang onto a niche by selling on price. Now they can’t even do that. Once a brand’s image is poisoned, it’s over.

(IMO) anothet product to a absolutely avoid is Nissan’s 3-cylinder variable displacement engine found in the Nissan Rogue…a Rube Goldberg contraption serving as an engi e

IMO

We bought a Nissan all-electric Ariya last April and it is an excellent car. We had a Leaf for five years before that and the Ariya is a big improvement. It has over 300 miles of range in warm weather, four wheel drive, comfortable, and great in the snow. A better car than a Tesla imho and is still eligible for the $7,500 tax credit. I hope Nissan stays in business long enough to honor the warranty, if needed.

Long-winded headline should read: Japanese car maker gets taken over by non-Japanese management style and forgets its Japanese roots (consistently hitting singles instead of always swinging for a home run, continual improvement. long-term planning). Hilarity ensues.

another aspect is that US vehicle sales have not matched pre-Covid highs….

and the vehicles that did sell were pickups and mid-size and bigger crossovers …an area in which Nissan has a weak portfolio

No, I totally disagree. The whole history of Ghosn’s involvement needs to be reviewed.

Nissan old technology works. Cars frankly bore me but 11 years ago I bought a brand new Dacia Duster – cost 14 k – which from new has done 115k miles,with just a regular service and tyre changes etc.

I bought it on the advice of a Rumanian car freak who worked for me who btw has been so successful in the UK motor business that he now drives a Maserati!

His advice – Buy the Nissan Renault model made in Rumania with technology 8 to 10 years old but well proved.

His advice seems to have been correct.From being the first adopter in my area they are now everywhere and especially popular in France I believe.

Mostly writing this as a car enthusiast, so there are a few opinions ahead.

Datsun/Nissan used to be a brand that had vehicles that appealed to a broad spectrum of people, including the enthusiasts that friends and family would ask for advice when it came to purchasing the next family hauler appliance. I – and I know I’m not the only enthusiast out there who has to do this – actually had a brief look at their website before writing this because I couldn’t remember what the Nissan lineup even looked like these days. Heck, I even forgot about the Ariya that Chas mentioned above, and I’m somewhat EV-curious these days. Oddly enough I know more about Hyundai’s electric offerings than Nissan’s, and I’m pretty sure Nissan advertises theirs more.

That said, the rest of the lineup comes across as pretty old. I seem to remember that during the reign of King Carlos (of Renault, not of Spain) that investments at Nissan had lower priority than investments at Renault, with the techonology transfer mostly going to Renault, too. Might have to spend some time digging into this, though. I think that’s showing in their line up as most of the cars don’t appear to have changed much, if anything in the last 5-10 years. Plus, not many of them have a reputation of being great and a top choice – most of them are more “ah yes, I guess they also make one of these”. Nissan in the US also seem to mostly cater to the same demographic that Mitsubishi has been catering to for a while now, ie cars for people who don’t have the most stellar credit and need/want a brand new car. That seems to impact the resale value, for starters.

Which brings me to the enthusiast offering and halo cars. Nissan USA has two of those – the 400Z, and the GT-R. The 400Z looks pretty decent on paper so given that Subaru/Toyota and Mazda don’t seem to have that many problems selling a fair number of sporty two-seater(ish) cars, albeit at $10k less a pop, one would think Nissan shouldn’t have much trouble shifting a reasonable number of 400Zs priced in the mid-40s. Instead, someone on a sports car forum I’m on recently asked if anyone had actually seen one in the wild. Apparently some had been spotted in the greater LA area, but otherwise, zilch.

Which brings us to their halo car, the GT-R. When it came out in 2008, it was a technological tour de force that played in Porsche 911 turbo territory performance wise, but for “regular” non-turbo 911 money. They’re still selling this model in 2024 and while performance and price have gone up, competitors like Porsche are several model generations past where they were in 2008. That’s for a car that’s MSRP’d somewhere in the $120k-$150k range depending on exact model, although I wouldn’t be surprised if Nissan isn’t making any money off them. Keep in mind that the previous three generations of the Nissan (Skyline) GT-R together were only sold for 13 model years altogether, and each generation was a noticeable improvement over the previous one.

All in all, I can’t say I’m surprised by these news, and I suspect that (probably due to financial constraints) they weren’t able to keep up developing vehicles the same way their competitors did and probably ended up riding the elevator all the way down as a result. Plus, with inflation being what it was/is and the general resulting belt tightening, most car manufacturers are hurting so it’s not a surprise that it’ll affect the weaker members of the herd first.

Not a vehicle maven either, and distressed at the buying process. Need to buy one that can go off road and tow. Toyotas are reliable quality, but the prices are insane no matter the age of the vehicle. They deliberately keep production low to keep prices high; there is essentially a shortage of quality vehicles in this category. Nissan should have a competitive entry in this category to meet the need, it does not.

Lots of other car-makers have off-road offerings at better prices. And every one comes with warnings about poor quality and reliability. Can’t imagine how hard it must be to turn the ship of a car company to restore good quality, but that’s what a bunch of companies need to do right now. With prices of everything high, nobody can afford to go in debt for a year or two of salary, for an item of junky quality.

I have driven the Nissan pickups for probably 30 years. During that time, they have had 2 updates. The v6 engine is phenomenally reliable. And for the size, tow more than Toyota Tacomas and has some guts. 4 wheel drive has been without issue. The transmission (manual) in one was replaced at 150k. The main issue with wanting to replace them at 200k was the classic rust issue (still from the Datsun days), not engine trouble. And flaky door handles and stuff. So not too bad, from 90’s to 2020 outdoors and off road in northern mn. But the new frontier might not be the same platform it sounds like (Renault?)

Not sure what to get and my 2014 model is at 200k. Btw, I always buy a vehicle that is 4 or 5 years old. Cheaper and leaves more resources in the ground! Though it sounds like they keep making new ones just pile up and sit on lots anyway.

Even Toyota is having quality issues – 100k+ Tundra and Sequoia were recalled due to “machining debris in the engine” which necessitated a full replacement (https://pressroom.toyota.com/toyota-recalls-certain-model-year-2022-2023-toyota-tundra-and-lexus-lx-vehicles/).

Note that this occurred when Toyota shifted from a 5.7L V-8 engine to a 3.4L turbo V-6. So did Toyota really not clean machining debris out of 100k+ engines or is there an underlying issue (as some enthusiasts have suggested) with swapping the V-8 for a turbo V-6 in this particular application? Above my pay-grade but seems a possibility.

Cars are a 20th century technology and Nissan may be the first major car company domino to go down.

EVs won’t save the industry as an increasing number of cities around the world start to do what Paris is now doing – discouraging car use, or banning them outright.

From what I understand(I live in Yokohama), even Toyota’s profits depend on their ability to squeeze their contractors – and they really cannot be squeezed anymore.

The plaque on the wall of apartment building in Mannheim where Carl Benz built his first car suggests it might be a 19th century technology

The plaque on the wall of an apartment building on 79th and CPW in Manhattan marks the site of the first pedestrian killed by a car in the US. September 1899.

One major stressor that owning an “older” motor vehicle induces is the hunt for spare parts for repairs and renovations. My Dodge Chrysler vehicles are now both officially “dinosaurs.” One needs to find parts for them in the “bone yards.” Indeed, both of our D/C vehicles are fully discontinued now. Even aftermarket parts are thin on the ground.

So, Nissan is entering a Death Spiral? It’s a sign of the impending major shake-out in the motor vehicle sphere.

If this trend continues, expect to see a devolution of North American social structure back to the late eighteen-hundreds levels. The “lower classes” will be restricted in their physical, and thus social mobility. Do notice that there is no rational national policy concerning public transportation at present in America. Since public transportation projects follow the familiar long-term schedules common to big industrial and infrastructure development, this item of the public sphere might actually be abandoned.

Welcome to the New World Order 2.0, where everything old is new again. Prepare to assume the position and end up barefoot and pregnant, or at least constipated.

The search for aftermarket parts is already happening for my 2005 Honda cr-v for the trim and accessory parts. The DEALER told me they would have to go to a junk yard type scenario to replace a side mirror. So far, “function” parts are still not a problem probably because of the overlap of parts in their car models.

We don’t even bother with the dealer anymore for our 1996 Ford truck.

Walkable/bike-able cities, along with a good train system, would actually deliver the freedom car ads promise.

Laudable objectives, but requiring massive infrastructure refits if one were to keep present city locations. Something like Brasilia, a built from the ground up metropolis, seems the “easiest” way to accomplish the transition. All of which requires political will, which seems to have been sold to the highest bidder, and thus degraded beyond the dreams of sadists and -philes everywhere.

One would expect the best chance for such a transformation to come is as a response to a major civilizational collapse, say a Jackpot or two.

Alternative Headline: “Companies surprised that Capitalism actually works.”

After decades of reduced quality, feature creep, and raising prices, customers have eventually stopped buying. As someone else already mentioned above, vehicle prices have far outpaced inflation over the past few years. Meanwhile they keep cutting corners on reliability and make it harder and harder to repair your own car. If some car manufacturer would step in to sell a reliable car that had minimal features and fair price tag, I bet they could make a killing.

Anecdotally, my niece just turned 16 and is trying to find a decent used car under $10k and is having a hell of a time. My first car I bought in 1998 for $1500 was actually a Nissan Pulsar. It had it’s problems but was, relatively easy to work on (it had a manual transmission and zero power anything). And I kept it running for 4 years until it got totaled in a flood.

My dad still has his Chevy 1500 pickup he bought in 1996 (and which I learned to drive on) and it has over 300k miles. Aside from some rust issues on the frame, the engine still runs good (but has been worked on a few times). Today’s cars seem to barely last 10 years.

I have a 1997 Chevy full-size van, the rust will kill it before anything mechanical goes

You might want to acquaint yourself with FluidFilm if you don’t know it yet.

Saved my rusty bacon several times already.

And no, I’m not in anyway involved with them.

Cheap high performance EVs are an extinction level threat for all ICE manufacturers. Serves them right for resting on their laurels for so many years while selling bigger and bigger SUVs and trucks.

And once autonomous driving becomes more practical, I think that they will really disrupt car ownership patterns as people simply order cars to their location, “drive” to their destination, then have the car self drive to the next customer. The fleet size would be dramatically reduced along with need for garages and parking spaces. This could also change the nature of bus public transit, as people exiting public transport hubs could get grouped into small self driving vans that drop them off at their home.

I do hope Subaru pulls through. I do love my Forester and would like to have buy a Forester hybrid for my next car.

Subaru will be fine. I haven’t owned one but I hear nothing but good things about Subaru. A friend who is a mechanic says they are reliable and very easy to work on if something fails. Around here they are near impossible to find used which is further testament to their reliability.

My wife’s current vehicle is a 2015 Nissan Rogue with 90,000 miles on it. It has been reliable. We call it the salt mobile as we drive it when the roads are salty, sloppy thus keeping our other two vehicles away from salt as much as possible which kills a car well before its time. The Rogue is showing no signs of rust, that is impressive. Per recommendation from my mechanic friend she changes her CVT transmission fluid at half the Nissan recommended mileage interval. She bought one of them extended car warranties (I was not in favor of that) so we will see how that turns out. BUT, her next vehicle will be a Subaru.

We had excellent experience with Honda vehicles before 2001 but not so great afterward. “Toyota reliability” in our opinion is total BS. No more Toyota or Honda for us. Chrysler and Ford products have been banned from my household since the mid-70’s, they were junk then and are just as bad now.

We’ve owned our Forester for 7+ years with almost no issues besides a mysterious fuel line breakage and an manufacturer defect this year. Mysterious because our mechanic couldn’t believe it had happened, said that it basically never occurs except in really old rusted out vehicles. But it was fixed for less than $100 plus the cost of towing. The latent defect was repaired for free at our Subaru dealer.

We test drove quite a few vehicles when we shopped around for this car. Everything else in its class felt like driving a cave. The Forester was airy with great sightlines and everything just made sense. The cargo room is fantastic and easy to manage. We did end up waiting almost an extra year to buy it because we wanted the next iteration of EyeSight and improved sound buffering (it’s not quite as good as the Acura RDX that I also really liked except for the price tag and MPG, but the level is kept at very comfortable for long road trips).

Don’t know about quality but Honda and Toyota seemed to have really gone off the rails in recent years with their aggressive styling and price jumps. Subaru and Mazda seems to keep more of their original spirit going with comparatively reasonably priced vehicles that do what their customers want of them. I think they also look much better.

I own a Ford Maverick hybrid and I think it’s a very well designed vehicle for the price. Quite a few Fords in the extended family and they actually seem fine and pretty durable.

Dutch petrolhead living in France, I have owned several Nissans in the past. I fondly remember them as no-nonsense, perhaps even a bit staid, very reliable cars that never presented any problems. No-worry vehicles, so to speak.

This relative bliss ended with the Nissan-Renault agreement. Quality really took a nosedive then. Electrical gremlins, corrosion, bad transmissions, all kinds of nastiness not seen before in your Nissan. Don’t take my word for it, the Internet is full of horror stories.

I now avoid Nissans at all costs, just like anything produced by Stellantis. But that’s another story that will no doubt find its way here shortly.

I really hope that Stellantis “rescues” Nissan, so that then we will see British Leyland 2.0.

More proof that post-modern western civ has run out of ideas….even our auto bailouts are tropes!

Honda’s sales have been collapsing for the past few years, from 5.3 million in 2019 to 3.7 million in 2023. This year so far Honda’s China sales are down over 20% in the first half of the year and in recent months have been down over 40% compared to the same month in 2023 (sales were 1.2 million in China for the whole of 2023). Sales are up a bit in North America and Japan, but not enough to offset the China losses. Honda is in no position to rescue Nissan; the only rescuers may be the Japanese government.

Mitsubishi also announced last week that they are pulling out of China. This is just the start as German and Japanese car sales in China are collapsing with the increasing EV share there (now over 50%).

I love my 2002 Q45 with 113k miles on it. I’m expecting it to last longer than I do (I’m 73, good health).

I owned one Nissan, a (sporty) Sentra SE-R in the late ’90s. It was one of the best cars that I have ever owned.

I am currently in a situation where my family has been uprooted because of a family medical issue and have been forced to set up household for four months including renting a car to drive. We’ve had a few rentals so far, but by the best car of the bunch was a Nissan Rouge. Solid, nice, the interior was designed was well laid out so there was nothing weird that fought with ergonomics. We not have a new generation Toyota Tacoma and its honestly trash. It is obvious Toyota is in full crapification mode. The interior is very bizarre compared to my daily driver which is a 2015 4Runner, the motor is not inspiring, mileage is meh with a smaller tank so the range is still poor, plastic everywhere under the car which would not last 1/2 an actual winter. The worst trait for the car is above 70mph the car is such an aerodynamic slug that it own turbulence (and wind noise) which makes the car a bit unstable at speed. The price Toyota is asking for these things is also staggering for what is in my opinion quite the downgrade to the venerable Tacoma.

As far back as 2015 Sergio Marchionne (then CEO of Fiat-Chrysler) was calling for industry consolidation. They haven’t gotten there fast enough and the Chinese are only accelerating the process.

Why not merge Mitsu and Nissan lines into one