Yves here. Angry Bear called our attention to this Trump tax cuts post, and also helpfully added some charts from its linked sources, which we are also including. Even though the press has repeatedly pointed out that the Trump tax bennies overwhelmingly benefitted the well off, there does not seem to be much discontent about that in the middle classes. It seems most people are easily placated by getting their own breaks and don’t think too hard about the overall program. If readers have heard otherwise from those in their social circle, please pipe up in comments.

One claim below that I suspect many will dispute is that eliminating the Obamacare individual mandate, as in the tax penalty for not spending money they did not have on too often thin policies, was harmful to lower-income workers. I personally know four lower-income earners who complained bitterly about the penalty before Trump ended it. They could not afford a policy even with the subsidies, and so the “penalty” was, as intended, punitive

By Beverly Moran, Professor Emerita of Law, Vanderbilt University. Originally published at The Conversation; charts courtesy Angry Bear

The Tax Cuts and Jobs Act, a set of tax cuts Donald Trump signed into law during his first term as president, will expire on Dec. 31, 2024. As Trump and Republicans prepare to negotiate new tax cuts in 2025, it’s worth gleaning lessons from the president-elect’s first set of cuts.

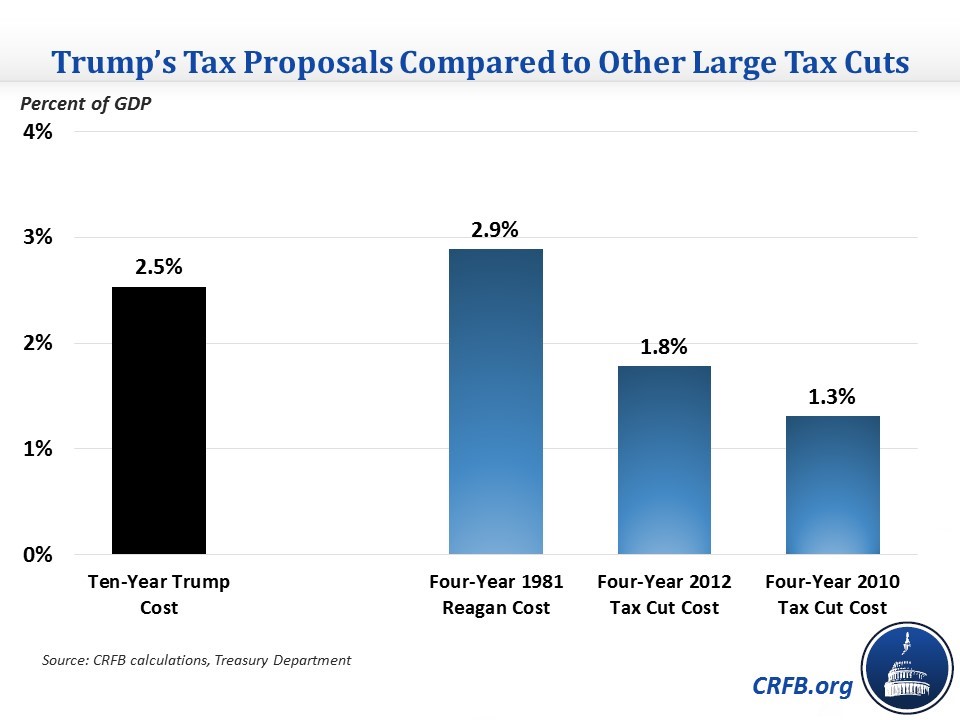

As a percent of GDP, the ten-year cost of Trump’s tax plan exceeds the four-year cost of every tax cut since the Economic Recovery Tax Act of 1981, the major tax cut passed in the first year of Ronald Reagan’s Presidency that cost 2.9 percent of GDP over four years. The four-year cost, as a percent of GDP, of Trump’s tax plans is likely similar or slightly less to the ten-year cost, so the statement likely holds true on an apples-to-apples basis as well. Is Trump’s Tax Cut the Largest Since Reagan?

The 2017 cuts were the most extensive revision to the Internal Revenue Code since the Ronald Reagan administration. The changes it imposed range from the tax that corporations pay on their foreign income to limits on the deductions individuals can take for their state and local tax payments.

Trump promised middle-class benefits at the time, but in practice more than 80% of the cuts went to corporations, tax partnerships and high-net-worth individuals. The cost to the U.S. deficit was huge − a total increase of US$1.9 trillion from 2018 to 2028, according to estimates from the Congressional Budget Office. The tax advantage to the middle class was small.

Advantages for Black Americans were smaller still. As a scholar of race and U.S. income taxation, I have analyzed the impact of Trump’s tax cuts. I found that the law has disadvantaged middle-income, low-income and Black taxpayers in several ways.

Cuts Worsened Disparities

These results are not new. They were present nearly 30 years ago when my colleague William Whitford and I used U.S. Census Bureau data to show that Black taxpayers paid more federal taxes than white taxpayers with the same income. In large part that’s because the legacy of slavery, Jim Crow and structural racism keeps Black people from owning homes.

The federal income tax is full of advantages for home ownership that many Black taxpayers are unable to reach. These benefits include the ability to deduct home mortgage interest and local property taxes, and the right to avoid taxes on up to $500,000 of profit on the sale of a home.

It’s harder for middle-class Black people to get a mortgage than it is for low-income white people. This is true even when Black Americans with high credit scores are compared with white Americans with low credit scores.

When Black people do get mortgages, they are charged higher rates than their white counterparts.

Trump did not create these problems. But instead of closing these income and race disparities, his 2017 tax cuts made them worse.

Black taxpayers paid higher taxes than white taxpayers who matched them in income, employment, marriage and other significant factors.

Broken Promises, Broken Trust

Fairness is an article of faith in American tax policy. A fair tax structure means that those earning similar incomes should pay similar taxes and stipulates that taxes should not increase income or wealth disparities.

Trump’s tax cuts contradict both principles.

Proponents of Trump’s cuts argued the corporate rate cut would trickle down to all Americans. This is a foundational belief of “supply side” economics, a philosophy that President Ronald Reagan made popular in the 1980s.

From the Reagan administration on, every tax cut for the rich has skewed to the wealthy.

Just like prior “trickle down” plans, Trump’s corporate tax cuts did not produce higher wages or increased household income. Instead, corporations used their extra cash to pay dividends to their shareholders and bonuses to their executives.

Over that same period, the bottom 90% of wage earners saw no gains in their real wages. Meanwhile, the AFL-CIO, a labor group, estimates that 51% of the corporate tax cuts went to business owners and 10% went to the top five highest-paid senior executives in each company. Fully 38% went to the top 10% of wage earners.

In other words, the income gap between wealthy Americans and everyone else has gotten much wider under Trump’s tax regime.

Stock Market Inequality

Trump’s tax cuts also increased income and wealth disparities by race because those corporate tax savings have gone primarily to wealthy shareholders rather than spreading throughout the population.

The reasons are simple. In the U.S., shareholders are mostly corporations, pension funds and wealthy individuals. And wealthy people in the U.S. are almost invariably white.

Sixty-six percent of white families own stocks, while less than 40% of Black families and less than 30% of Hispanic families do. Even when comparing Black and white families with the same income, the race gap in stock ownershipremains.

These disparities stem from the same historical disadvantages that result in lower Black homeownership rates. Until the Civil War, virtually no Black person could own property or enter into a contract. After the Civil War, Black codes – laws that specifically controlled and oppressed Black people – forced free Black Americans to work as farmers or servants.

State prohibitions on Black people owning property, and public and private theft of Black-owned land, kept Black Americans from accumulating wealth.

Health Care Hit

That said, the Trump tax cuts hurt low-income taxpayers of all races.

One way they did so was by abolishing the individual mandate requiring all Americans to have basic health insurance. The Affordable Care Act, passed under President Barack Obama, launched new, government-subsidized health plans and penalized people for not having health insurance.

Department of the Treasury data shows almost 50 million Americans were covered by the Affordable Care Act since 2014. After the individual mandate was revoked, between 3 million and 13 million fewer people purchased health insurance in 2020.

Ending the mandate triggered a large drop in health insurance coverage, and research shows it was primarily lower-income people who stopped buying subsidized insurance from the Obamacare exchanges. These are the same people who are the most vulnerable to financial disaster from unpaid medical bills.

Going without insurance hurt all low-income Americans. But studies suggest the drop in Black Americans’ coverage under Trump’s plan outpaced that of white Americans. The rate of uninsured Black Americans rose from 10.7% in 2016 to 11.5% in 2018, following the mandate’s repeal.

The Consumer Price Index Conundrum

The Trump tax cuts also altered how the Internal Revenue Service calculates inflation adjustments for over 60 different provisions. These include the earned income tax credit and the child tax credit – both of which provide cash to low-wage workers – and the wages that must pay Social Security taxes.

Previously, the IRS used the consumer price index for urban consumers, which tracks rising prices by comparing the cost of the same goods as they rise or fall, to calculate inflation. The government then used that inflation number to adjust Social Security payments and earned income tax credit eligibility. It used the same figure to set the amount of income that is taxed at a given rate.

The Trump tax cuts ordered the IRS to calculate inflation adjustments using the chained consumer price index for urban consumers instead.

The difference between these two indexes is that the second one assumes people substitute cheaper goods as prices rise. For example, the chained consumer price index assumes shoppers will buy pork instead of beef if beef prices go up, easing the impact of inflation on a family’s overall grocery prices.

The IRS makes smaller inflation adjustments based on that assumption. But low-income neighborhoods have less access to the kind of budget-friendly options envisioned by the chained consumer price index.

And since even middle-class Black people are more likely than poor white people to live in low-income neighborhoods, Black taxpayers have been hit harder by rising prices.

What cost $1 in 2018 now costs $1.26. That’s a painful hike that Black families are less able to avoid.

The imminent expiration of the Trump tax cuts gives the upcoming GOP-led Congress the opportunity to undertake a thorough reevaluation of their effects. By prioritizing policies that address the well-known disparities exacerbated by these recent tax changes, lawmakers can work toward a fairer tax system that helps all Americans.

Lets say the rich pay 50% tax that will not help lower income people , because usa government dont use that money to help lower income people. Why would anyone care about rich paying more tax if that money dont go to social programs .

Because preventing income and wealth inequality is one of the main functions of taxes. Among other things it’s obvious that democracy works better when everyone has the same resources available.

For more extensive treatment of the issues, see for example The Spirit Level (wikipedia). On multiple different categories of social and health problems, economic inequality makes things much worse for everybody.

A tax expert makes precisely this point regularly. You have to look both at whether spending is progressive or regressive along with taxation.

I get your point, but it’s not even necessarily what it “pays for.” Putting a cap on how much wealth people can accumulate is a social good unto itself. You hear all this talk about “getting money out of politics” which strikes me as comically naive. No reasonable person should expect that if someone amasses Jeff Bezos or Elon Musk levels of wealth, he won’t then use that wealth to influence or control the political system. You can’t have those kinds of wealth disparities and not have an accompanying disparity in political power. This is a massive part of why any attempts at political reform fail.

Having changed jobs and switched employers quite often every 3 to 4 years, I will say good riddance to that penalty. Horrible intention must have accompanied that as a legitimate need when filing taxes. Flattened the tax code by erasing that onerous need to chart, by month, the changes in health coverage. Good riddance that form of social engineering via the ACA implementation.

As for how much the very rich pay in taxes, I weep small tears for them; they have available to them vast resources to delay paying taxes and the viable small industry of tax experts and attorneys at their beck and call. As per an old prophet in sandals, we will always have the rich to put up with.

There was a lot of criticism of Obama’s proposals for using the chained CPI to calculate benefits, with a lot of the discussion centered around SS and Medicare. I guess it’s a function of how much attention I paid or didn’t pay, but I didn’t recall discussion of this in regard to provisions of the Trump tax cuts. Trump also considered using chained CPI in calculating the poverty rate.

https://www.cbpp.org/press/statements/trump-administration-floating-changes-to-poverty-measure-that-would-reduce-or

Almost to a person, everyone I know still parrots that neoliberalism is a good thing, that government does more harm than good, that we live in a meritocracy and if you can’t get your kids into Ivy, and I can, it is because my kids worked harder, that government deficits are bad and can, and should, only be solved by cutting spending, that if we end all the subsidy programs the lazy masses will actually go get a job.

No amount of explaining or showing real data has an impact on them. And most would describe themselves as socially progressive and highly educated (my group of friends almost all have advanced degrees from ‘elite’ universities)/

I suspect that short of a collapse, or revolution, it is pointless to even try. Because when I do I get nothing but flak back.

I must add that the MSM also do nothing but reinforce these fictions.

The thrust of Walter Scheidel’s “The Great Leveler” is that inequality increases until one of four events occurs:

A plague that kills many people, forcing the wealthy to pay higher wages to the survivors.

A world war with many deaths, which also ups lower wage labor.

A financial collapse.

A revolution.

I read the book some years ago, but, as I recall, Scheidel has summarized this thesis in some freely available papers and interviews. His view is over thousands of years.

As I recall Scheidel appears to offer little hope that the current system will be changed from internal pressure.

But climate change, resource shortages and the detachment of the USA and EU elites from the concerns of their populations may force some changes.

The amping up of censorship and surveillance MAY indicate that the elite are worried.

The elite solution to inequality is to “grow the economic pie”.

But if real economic growth must shrink due to resource shortages, then what?

I suspect Great Britain will be showing the developed world the effects of “de-growth” soon.

Did getting rid of the state and local tax deduction hurt rich homeowners with high incomes in high income tax states or poor Black people? The corporate tax situation is wrong on so many levels. They ought to just get rid of it and tax the end recipients, the stockholders or the executives. A lower capital gains tax seems to be fair. Inflation makes things go up in price so there is a so called profit but it really is created by the government so people are getting taxed twice with capital gains….so taxing real estate sales of residential homes is basically stealing money from the citizens since virtually all of the long term gain is inflation based. Real estate always goes up but the real return is not much. A million dollar house today is essentially a 50,000 house in 1977 (my house, for example). So the argument that Black people are poor because of real estate discrimination seems weak. Legal tax evasion is the biggest problem. Foundations are great ways to avoid taxes. Private business jets and so called business travel is tax avoidance. A value added tax is always cursed as a tax on the poor but it is easier to collect and harder to evade. In Europe it works pretty well.

Inheritance taxes should be confiscatory with no loopholes if we do not want a hereditary upper class in America and if we want to select Blacks as a class that needs a lift up we could allocate those revenues to Black people. Intermarriage would lead to losing a percentage of the benefit of financial transfers from the estates of dead white people. Maybe a colorimeter could be used to determine a Black’s right to a certain sum of money. But looking at the Obamas it seems as if strivers want to be in the hereditary upper class meaning they do not want inheritance taxes. All of this could be solved legislatively if we had strict campaign finance reform in the US…..which no one wants, especially the Black Congressional Caucus.

Most poors would probably disagree about the ‘Individual Mandate’.

People were dancing in the street because they weren’t being forced to buy so-called insurance that covered nothing and charged an arm and a leg for the privilege.

I am (sort of) surprised that the article does not mention the big increase in the standard deduction. This was a substantial benefit for me, especially now that my house is paid off. The biggest benefits go to anyone who does not pay a McMansion level of mortgage interest every month, or who does not have other large itemized deductions. That should include lots of people who rent or own cheap houses in flyover country.

Am I missing something?

Re “Study Shows They Made Income Inequality Worse and Especially Hurt Black Americans”

As designed . . .

I think the opening sentence is a bit misleading. It’s my understanding that the Trump tax cuts from 2017 made the corporate and business tax cuts permanent, while only the individual tax cuts are temporary and up for renewal in 2025.

This means significantly less wiggle room to reduce wealth inequality and the deficit.

I don’t agree with her assessment of post-Civil War black land ownership. I think there was a steady accumulation of mostly farmland by blacks until by 1910 they owned millions of acres. The problem was when the initial buyers started dying off, they didn’t necessarily have wills, and as their children and grandchildren headed off to work in the North during the ’20s and ’30s, property was either sold or was inherited by families as a group. Thus we wound up with the ‘heirs land’ problem, that makes black descendants vulnerable to predatory real estate agents, lawyers, et cetera.

Wealth itself comes with a problem: finding skilled professionals to help manage it. I think this has historically been a particular issue for black people as there have been few professionals in the black community, and the lawyers were often civil rights oriented rather than real estate lawyers or general lawyers comfortable handling wills and estates. They sometimes found white lawyers, of course, but getting over the racial divide to consult them was not always easy.

The past fifty years have brought lots of changes for middle class people wanting to manage their savings. The 401-k and 403-B, the IRA, both conventional and Roth, the HSA, 457 plans, and many other innovations can be tapped by people who have the right work situations and sufficient disposable income, and they can generally be handled without professional help.

Who knows about them? Not many people. Who can save enough to maximize use of them? Not many people.