The day after the Wall Street Journal ran Why This Frothy Market Has Me Scared, it published More Men Are Addicted to the ‘Crack Cocaine’ of the Stock Market. We encourage you to read both in full.

We’ll focus on the latter, which is an important and well-researched piece. But it is striking how its profiles of investment-gambling addictions ignore one issue and go light on another: how much of the lofty stock market levels are the result of the actions of frenetic traders, and how this compulsion is at least as much due to efforts by interface designers to create trading junkies as the Purdue Pharma schemes to create Oxycontin abusers. A problem, of course, is that drugs that create physical and psychological dependency aren’t viewed in our society as the same as being hooked psychologically, even though cocaine specifically is addictive only psychologically.

On the vertiginous market levels, we’ll see in due course whether hoary old notions are still operative. One is that bull markets don’t end until the last bear has thrown in the towel. I am old enough to remember the dot-com mania, when valuing companies that were never, ever, going to make a dime in profit based on “eyeballs” was seen as perfectly reasonable. People I had thought to be sane pretty much all came to try to get a piece of this supposed new paradigm, which included traditional companies trying to position themselves as Internet plays. Stock market investors do not seem to me to yet be that collectively deranged. But the Journal cites metrics that suggest otherwise. From its account:

Bulls are everywhere. Bears are hard to find. This shows up in sentiment, in surveys and in the capitulation of the permabears.

Sentiment is euphoric, according to Citigroup’s Levkovich indicator. This index combines lots of measures and suggests investors have only been more positive twice, in the postpandemic SPAC/cannabis/green bubble and in the dot-com bubble of 1999-2000….

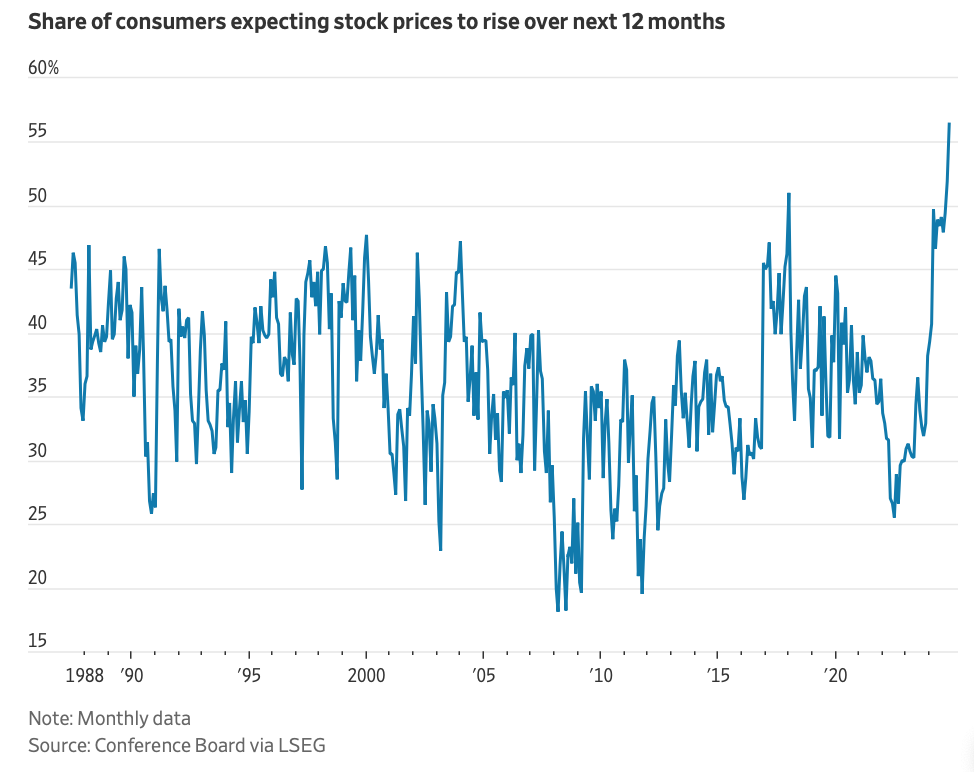

Other signs of optimism. Investment newsletter writers have rarely been more bullish or less bearish, according to the weekly survey by Investors Intelligence. Households have never been so confident that stocks will rise over the next year, according to the Conference Board’s monthly survey.

And fund managers shifted after the election to be more overweight U.S. stocks than any time since 2013, pretty much as all-in on the U.S. as they have ever been, according to Bank of America’s survey. Money is pouring into funds at an exceptionally high rate too, close to new highs…

This time will be different. Rosenberg thinks investors have shifted away from the standard metric of price against one-year forward earnings to look further out, because of the prospects for an AI-driven productivity boom. Even those who think markets will eventually return to something like normal, such as Goldman Sachs, don’t expect issues soon.

Again, prototypically, market bubbles feature a blowout, where insane-looking prices spike high. The final giddy phase of the dot-com boom lasted three months. So the party may have some way further to run.

Now to the market addiction story, which makes very clear that “addiction” is no hyperbole. Men with financial speculation habits (it seems they are are all men) are showing up at Gamblers Anonymous and in therapists’ offices in increasing numbers. From the Journal:

At Gamblers Anonymous in the Murray Hill neighborhood of Manhattan, one man called options “the crack cocaine” of the stock market. Another said he faced hundreds of thousands of dollars in trading losses after borrowing from a loan shark to double down on stocks. And one young man brought his mom and girlfriend to celebrate one year since his last bet.

They were among a group of about 60 people, almost all men, who sat in rows of metal folding chairs in a crowded church basement that evening. Some shared their struggle with addiction—not on sports apps or at Las Vegas casinos—but using brokerage apps like Robinhood.

Many of the men, and scores of others around the country, discovered trading and betting during the pandemic boom that began in 2020. Some were drawn in by big wins in meme stocks and other viral stock sensations, leading them into even higher-octane wagers that offer the chance to put up a small amount of cash for a potentially mammoth return—or more often, a crushing loss.

Remember that Robinhood in particular was accused of setting out to generate not merely excitement, but a dopamine rush that users would seek out again and again. Forbes described how even the SEC took notice, in Dopamine-Driven Trading On Robinhood Raises Suitability Concerns For The SEC:

Suitability is an ethical issue as well as a legal issue. There is mounting evidence that for many investors, trading on Robinhood is totally unsuitable. At the top of my unsuitability list are investors who suffer from gambling addiction. In 2013, the American Psychiatric Association reclassified problematic gambling behavior from being an impulse control disorder, such as kleptomania, to being a disorder related to substance abuse and addiction, such as those associated with alcohol and drugs. Ironically, Robinhood was founded in 2013, the same year that pathological gambling was reclassified.

Gambling addiction is dopamine related, and is part of the phenomenon author Anna Lembke calls “Dopamine Nation,” the title of her new best seller. Lembke describes how addictions stem from people seeking pleasure, where sensations of pleasure involve dopamine flows rising above baseline.

Studies document that people who suffer from gambling addiction differ from others in at least two respects. First, gambling addicts find it more difficult to generate dopamine highs. Therefore, they need more powerful stimuli than others to induce the same kinds of highs. Second, relative to others, the executive portion of gambling addicts’ brains is weaker, which leads them to experience greater difficulty with self-control. Taking these two features together means that gambling addicts need to take greater risks to achieve the same psychological highs than others, and are more prone to do so, even when they know they might be behaving imprudently.

Using digital prompts, the Robinhood platform does a superb job of generating stimuli which activate the dopamine-based reward centers in its users’ brains. This can be akin to giving candy to a baby, and for gambling addicts akin to providing them with enough rope to hang themselves. There is research to suggest that a portion of the brain connected to vision plays an important role in regulating how much risk people seek, plausibly by impacting dopamine flows in regions of the brain associated with anticipation.

Mind you, social media sites also try to create compulsive users, reportedly by deploying emotionally charged items, which in practice often translates into extreme or provocative content, to generate engagement. But social media has a less strong visual element, and the platforms cannot generate particularly seductive items, but merely amplify what they see as the most enticing of user-provided material. The Addiction Center identified some Robinhood design elements that hooked vulnerable customers:

Is The App Promoting Gambling?

One of the earmarks of gambling is volatility. Some days you win a jackpot, and the next, you could lose $7,000. It is essentially what makes gambling so attractive. Unfortunately, it is a huge problem in the United States. Roughly 1% of adults are battling a gambling disorder, which is why researchers and competing companies are sounding the alarm on Robinhood. According to whistleblowers, the app is using exploitative practices to induce gambling in its users.

Robinhood’s Design

Much like gambling apps, experts claim Robinhood uses cues that promote addiction. The behaviors are similar to a gambling disorder. For example, when a new member joins the platform, an image of a digital scratch-off lottery ticket pops up on their screen. The picture is a welcome stub, a gift for joining Robinhood’s community. The app’s stub promises a free share of stock worth anywhere from $2.50 to $200. If the new trader wants the prize, they have to play by ”scratching off” the image like a lotto ticket.

At first, the interaction seems harmless, even fun. Yet, Keith Whyte, the National Council on Problem Gambling executive director, warns that Robinhood’s styling has features like common betting apps. He claims it encourages immediacy and frequent engagement. Through its design, Robinhood induces dopamine rushes (pleasure neurotransmitter).

By promising a free yet unknown gift, the company immediately triggers dopamine responses among their new users. The trigger is what keeps them coming back.

Some of Robinhood’s many alleged dopamine inducing features include:

- Green confetti to celebrate transactions.

- A constant update of stock related articles.

- A colorful, eye-catching interface.

- Emoji phone notifications.

- One-click trading for instant gratification.

- Free stocks in the shape of lottery tickets.

- Waitlists where users can improve their position by tapping up to 1,000 times per day.

Research indicates that a flow of uncertainty and rewards hooks users. Much like drugs or alcohol, incertitude stimulates the brain’s reward system. Over time this repeated exposure can lead to addiction. Other studies show that volatility can even enhance cravings or the desire for drugs. The market’s waves and Robinhood’s fun interface are keeping users too loyal.

We’ll return to the Journal to get some crude indicators of the growth and current extent of this problem:

Doctors and counselors say they are seeing more cases of compulsive gambling in financial markets, or an uncontrollable urge to bet. They expect the problem to worsen. The stock market has climbed 23% this year and bitcoin recently topped $100,000 for the first time, tempting many people to pile into speculative trades. Wall Street keeps introducing newer and riskier ways to play the market through stock options or complex exchange-traded products that use borrowed money and compound the risk for investors….

Pennsylvania’s gambling hotline has fielded more calls tied to gambling in stocks and crypto since 2021 than it did in the prior six years combined. At a New York-based treatment center, Safe Foundation, clinical director Jessica Steinmetz estimates about 10% of patients are seeking help for addictions tied to trading. Before 2020, there were no such patients….

Addiction counselors say gambling in financial markets often goes undetected and can be tough to track because individuals confuse their actions with investing. Unlike sports betting apps such as FanDuel and DraftKings, most brokerage apps don’t post warnings about gambling or offer hotlines to seek help.

The proliferation of financial instruments, along with flashy brokerage apps that make them easy to trade, has also helped some gamblers convince themselves that they weren’t actually placing bets.

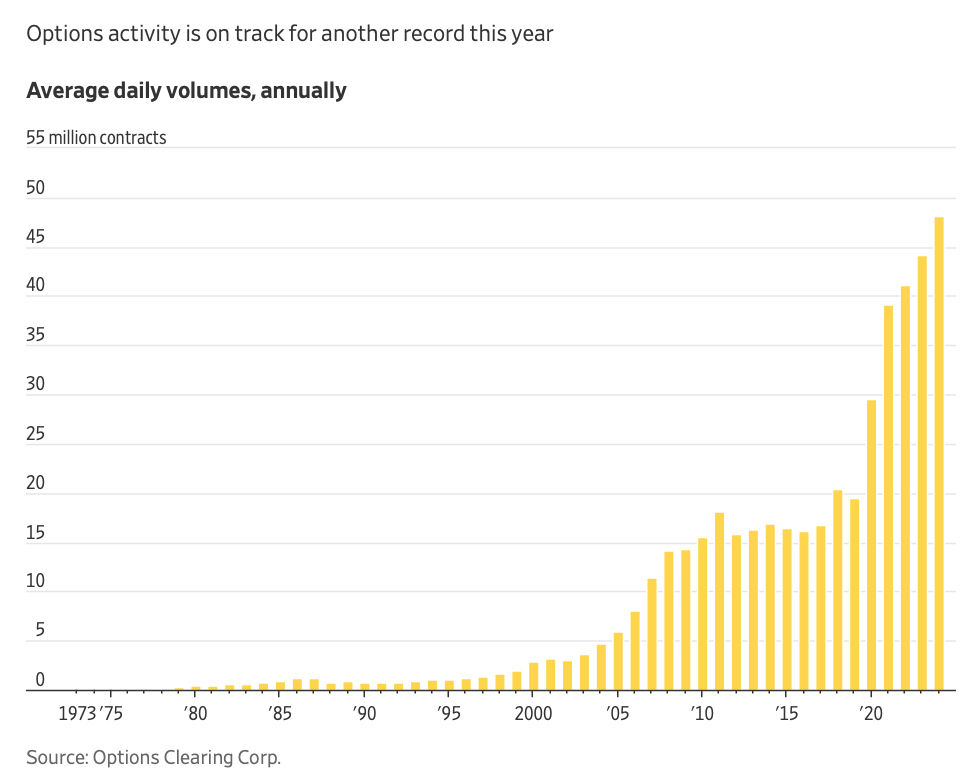

The article further points out that the high level of stock options is particularly enticing to trading junkies and that the riskiest version of options trading has exploded:

Activity in options is on track to smash another record this year. Trading in contracts expiring the same day, which are the riskiest, has soared to make up more than half of all trades in the market for S&P 500 index options this year, according to figures from SpotGamma. These trades are more electric than traditional stocks, with the potential to rocket higher or plunge to zero within minutes.

Of course, aside from being dangerous and potentially disastrous for the addicts, this activity represents a further perversion of the ostensible role of securities investment. As Keynes said:

Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.

Have they tried Ozempic for stock traders? It is supposed to decrease all sorts of cravings? Should the government provide Ozempic for free? How about just putting Ozempic in the water supply going to well off communities like Greenwich Conn. or Montclair NJ or Palo Alto Ca. to control the stock traders who are in high density in these locales. Sooner or later the bears will be rewarded. The question is whether any will be solvent when the reward comes. Raising short term capital gains tax rates to confiscatory levels might help even more than psychotherapy or Ozempic.

From your lips to Elon’s ears, lol – tho’ I suspect this might be one off-label use he does not approve of…..

I can imagine it won’t be long before we are reading about this subject again only substituting online sports betting for the stock market.

This is an interesting counterpart to the article I read yesterday in Harpers which argues almost exactly the opposite, that it’s the passive investors and not the active gamblers that are going to ruin the whole stock market – https://harpers.org/archive/2024/06/what-goes-up-andrew-lipstein-401k-doomsday-index-fund-catastrophe/

Maybe they’re both partly correct. All I know is that just about every asset you can think of seems grossly overvalued right now.

The average investor does not have access to super fast computers that are located near the stock exchange, but the institutional investors probably do.

My main issue with gambling other than wagering too much when losing and not enough when winning, was being in action.

The preferred game being blackjack, I remember putting in Herculean-like sessions in the green felt jungle of say 52 hours in the seat-save for restroom breaks.

I only went to a lone Gamblers Anonymous meeting, and I was a piker in the scheme of things compared to the stories being told of robbing Paul to play Peter’s parlay and such. The most insidious thing about gambling being that there aren’t many outward signs of an addict in the throes of chance & consequences.

This was 40 years ago, when you had to drive or fly a fair distance to gamble, now QWERTY has made it so easy~

I started going to the horse races when I was barely a teenager, and it was a man’s world, baby. Same thing with casino gambling, the few women-folk might be playing slot machines, but you rarely saw them making meaningful bets @ table games.

Fitting that the most prominent TV ad for FanDuel during the NFL games features a woman, on her own in a sports bar, making parlays. The legalization of sports betting outside Vegas, on site, was a huge freaking mistake. Crypto of course is like sports betting but being under the influence of a designer drug that lasts for years until the crash and burn.

I think on account of both the racetrack and casinos being so overly male dominated, that a woman would instinctively feel out of place, but how out of place could you be online?

Gambling and war are similar pursuits in some fashion-a series of battles resulting in ultimate defeat for one side, and both traditionally have been a male pursuit.

I was channel surfing youtube a month back and landed on a video where the host suddenly veered off script:

“I’m not going to lie, being a youtuber isn’t all glitz and glamour. But it sure is better than my last job, doing data analytics for an online gambling company. You see, we discovered that our biggest whales were, uh, SINGLE MOMS. So my whole job turned into trying to figure out how to get SINGLE MOMS addicted to our GAMBLING APP. That sucked. Anyway, back to this product review!”

And no doubt after he quit I’m sure he was swifty replaced by another analytics twerp less scrupulous about thinking of people as things. As well as other twerps who may not be targeting single moms, but who have my Robinhood using nephew in their sights instead.

If you ever need a signal that a market correction is in the offing, the WSJ paragraphs cited above provide it:

Here’s the exuberance:

Here’s the signal:

“This time will be different.“, usually followed by some analyst’s self-serving pseudo analysis of investor mentality: “Rosenberg thinks investors have…”

Here’s the truth:

No, it won’t be different. Markets will correct, because a) they are a mean-reverting system, and b) they are highly susceptible to exogenous shocks.

Also, as a financial industry person, I continue to be surprised at the very low bar of due diligence [“client suitability”] required to let any semi-educated financial tyro trade options. Industry traders have to have a separate license for options trading. Maybe more wives who have had their joint account wiped out should be suing the brokerages that permit their moron husbands to trade options.

Years ago when I worked in the WAMU corporate HQ building, I met a broker from First Union and he invited me up to his office to talk shop one day. He told me about various option strategies he used with his well heeled clients. When I asked how many other brokers used these strategies with their clients, I was quite surprised when he said “Most of the other brokers don’t even know what I’m talking about”.

If licensed brokers aren’t always so sharp with options trading, having a bunch of amateurs trading 45 million contracts per day is probably not going to end well for a lot of people.

Quite fitting then that the chief executive of the nation oversaw numerous casino bankruptcies.

Casinos are superbly well regulated for the bettors. Investors and lenders are on their own.

I don’t know if that refutes my point: they are well-regulated to guarantee a net gain for the house, and as you say, investors and lenders are on their own. Sounds about right, and not inconsistent with my observation: to him, everyone is a potential chump (with the exception of a few alpha males whom he senses are stronger than him) – some of his bankruptcies were strategic, and he was a notorious deadbeat with contractors and vendors – and you don’t need to suffer from TDS to recognize that about him.

And what was your point? I answered your non sequitur with respect to this article with another.

How does Trump being lousy at running casinos have anything to do with apps-generated financial markets gambling addiction?

The point that it’s all reflective of the unique combination of incompetence, parasitism and predation that seems to rule over us now… and that Trump, his acute political intuitions and psychologically destabilizing effects on liberals notwithstanding, is one incarnation of it.

There was quite a telling moment on Thursday Night football when Al Michaels was reminiscing about the only time the Chargers ever played in a Superbowl against the 49’ers and got walloped but covered the 18 point spread, and then he said ‘of course I could have never mentioned such things on air back then’…

When YouTube comics like Drew Gooden are posting about gambling In the USA, you know we have a problem.

Guess side hustles aren’t enough. Now you need at least three jobs and to lose all your money on apps.

Timely article being Quad witching day, the last of 2024 and Biden’s reign of debt.

“”Trading in contracts expiring the same day, which are the riskiest, has soared to make up more than half of all trades in the market for S&P 500 index options this year, according to figures from SpotGamma.””

The ODTE phenomenon has been wild to watch. Pure gambling (or just liquidity) depending on your pov.

“”The best bang for the buck 9-11am is 0dte and 12-3 1dte in my opinion IF you plan on holding the trade for 3-20 minutes if you want to ride the trend all day, …”” per a Reddit poster.

As a seller of premium on dividend paying stocks only, I’ve come to see the value of my portfolio as secondary to its income generation ability. Like a sports team or piece of commercial property, its value fluctuates.

Yes – otherwise known as the “Buy and Hold Forever” approach. Investing, not day-trading. Price fluctuations are not stressful if 1) you own good companies with solid management; and 2) you don’t have to sell. Just keep clipping the coupons/ cashing the dividend checks, all is good.

Tho’ yes, of course, companies change, their competition changes, today’s stable General Electric can be run into the ground by incompetent frauds like Neutron Jack. You need to keep abreast of things – but there is a reason why research shows the best returning mutual funds are Insurance Co. pooled funds – why? They have a much lower churn rate.

The non-rich majority-type person will never be able to own enough stock-shares to be able to live on dividend streams. Only rich people can view stocks like that.

Non-rich majority-type people can only view stock shares the same way we view lottery tickets, and hope we have bought some winning stock shares which we can re-sell later at a winning price. ( Maybe the managers of the millions of shares we collectively “own” through 401ks and whatever are managed in a manner other than lottery tickets. Wouldn’t it be pretty to think so?)

If I were actually rich enough to owe on a house and live in it, wouldn’t I be better off pre-paying my mortgage down to zero and then physically investing in the house and yard to make it a semi-survivalist live-in doomstead than to throw the money away on stockery lottery tickets?

Regarding the paywalled WSJ links, I have found that MSN tends to repost the articles in full without a paywall. I can usually find this quickly by web-searching the complete article title. The interface is somewhat more annoying (given the occasional inline advert), but the text is there:

https://www.msn.com/en-us/money/top-stocks/more-men-are-addicted-to-the-crack-cocaine-of-the-stock-market/ar-AA1wcrdW

Thanks, will put that one in.

The first link to Yahoo doesn’t appear to work the same as MSN, it redirects to the paywalled version of the article. Luckily, there’s an MSN link for that one too (see below). Perhaps the MSN results are prioritized in my searches on account of my usage of DuckDuckGo

https://www.msn.com/en-us/money/top-stocks/why-this-frothy-market-has-me-scared/ar-AA1w0RB8

Oddly, now upon testing again, even the MSN links are instantly redirecting without allowing the “expand the article” functionality. Maybe we’re watching live some loophole-closing…

yeah, same. No access in France.

This works:

Why This Frothy Market Has Me Scared

I wonder if the WSJ article has a hidden agenda. Considering it is targeting RObin Hood, could their agenda be to hamper small investors?

You are seriously defending RobinHood? It does not help small investors, it affirmatively hurts them by desensitizing them to risk and getting them to overtrade, which is a great way to lose money to the benefit of financial intermediaries.

And you can trade very cheaply via tons of brokers. It’s not as if RobinHood provides any uniquely valuable service.

Listening to crypto bros explain how an ‘asset’ with little utility and ZERO intrinsic value, is a sure route to riches, never fails to amuse.

Unintentional humor is the best kind, and everybody’s a genius in the red heat of the ultimate bubble, a bubble of Seinfeldian proportions, its a bubble about nothing.

Econ. prof. in 1973: “The stock market is the only form of gambling that’s legal in all 50 states.”

And that was before the “Financial Services Modernization Act” (and CFMA etc.). Now it seems that the “stock market” is a giant Ponzi racket. And now the Crypto Craze seems to be the latest Tulip Mania hysteria.

The financialized US economy is mostly based on scams, extortion and snake oil. .

Sure has seemed that way to me. However, so many people are drinking the kool aid that it is now the norm to accept the prevailing narrative concerning the stock market and worse, crypto. I’ve heard many of my friends pointing to the fact that their retirement is in the stock market and going gang busters so the economy is good and they have no worries about the future. One friend is a renter, in the same apartment for years, so she doesn’t even have the security of owning her own home in retirement if everything goes pear shaped – but she is not worried. . .

Check out Franco Berardi’s work on the connection between stimulant drugs, the dot-com bubble, and exhaustion.

I thought that was the idea!

There is an Abacus out there somewhere. If anybody susses it out please let me know.

The proliferation of options is definitely crazy. Options travel through time and space. The popular options pricing model (Black-Scholes) is based on thermodynamics. The interactions are complex, and you need to model to have any idea about how the investment might perform over time through expiration. Unleashing this on retail, particularly 0DTE, oh man. This is definitely not just long (or short) stock, which is pretty easy to understand, and without margin involves no leverage.

I’m not surprised RobinHood stock has been on a tear lately. Addicted customers. What’s not to love?

At least TastyTrade has a ton of (good) options educational material.