The Wall Street Journal published a seemingly pretty good piece, Elite Colleges Have a Looming Money Problem. However the funding squeeze has long been in the making and it might have behooved the Journal to call more attention to the management lapses earlier.

Readers are likely broadly familiar with the operating side. We’ll turn to the Journal’s account soon, but the very short version is that college tuitions have risen strongly over time, without an improvement in university economics, due to wild bulking up of the adminisphere, significantly due to the weird perceived need to chase donors to fund a higher cost base that did not translate into improved instruction or more funding of research.

Instead, the improvement was pure Potemkin: glitzier dorms, fancy gyms, so as to create more donor naming opportunities. Pray tell, since when does glamorous housing translate into sharper minds? But one can see from a social engineering standpoint why some may have favored getting students used to living high. They’d be more easily tracked into elite-suitable, well-paying (or deemed as suitable employ by well-paid spousal material), since taking a more modestly paid but arguably more productive-to-the-public post would amount to a lifestyle hit.

The Journal does correctly point out that a a whole series of bad policies and practices are coming home to roost, to the degree that even heftily endowed universities are having to engage in some rethink. However, it seems extremely unlikely that they will engage in desirable and one might argue necessary changes, like returning to their roots as schools of higher learning, rather than hedge funds and real estate investors with education subsidiaries.1

Having lived lavishly for so many years, the top schools are now feeling pinched for (at least) two reasons. First is a falloff in new donations due to unhappiness among Zionist donors over what they deemed to be insufficient crackdowns on university protests over genocide in Gaza and student criticism of Israel’s apartheid. Second is that Trump China/immigrant-bashing has resulted in reduced applications and enrollments of foreign nationals, who were very attractive to these institutions because many paid full fees, effectively subsidizing other students. Even if Trump does not make this situation directly worse by tightening visa rules, a continued strong dollar will exert a dampening effect.

But to those who have been following our work on private equity, CalPERS, and investment management over the years, the cheeky part of the Journal account is depicting underwhelmeing investment performance at university endowment offices, which typically have very well paid in-house teams that then select outside managers, as if that were news. It most assuredly is not.

The story unwittingly signals that it’s really not on top of this topic by making former Harvard president Larry Summers the first expert it cited:

Former Harvard President and former U.S. Treasury Secretary Larry Summers estimated this year that if Harvard had been able to just keep up with other Ivies and “large endowment schools” in the past several years, it would have $20 billion more. For perspective, he says that just $1 billion could fund 100 professorships or permanently cover tuition for 100 students.

Two paragraphs later:

During the financial crisis, when donations plunged and costs rose, Harvard also faced steep investment losses and collateral calls on derivatives. With some investments hard to sell and money already committed to the university, HMC had to exit some stakes at distressed prices and the university was forced to postpone capital projects and borrow to cover the shortfall.

Today it doesn’t face the same derivatives exposure….

Help me. Summers was the arsonist who burned all that Harvard money! From a 2013 post :

Summers, unduly impressed with his own economic credentials, overruled two successive presidents of Harvard Management Corporation (the in-house fund management operation chock full of well qualified and paid money managers that invest the Harvard endowment). Not content to let the pros have all the fun, Summers insisted on gambling with the university’s operating funds, which are the monies that come in every year (tuition and board payments, government grants, the payments out of the endowment allotted to the annual budget). His risk-taking left the University with over $2 billion in losses and unwind costs and forced wide-spread budget cuts, even down to getting rid of hot breakfasts….

Without overburdening you with detail on the swaps that blew up Summers’ piggy bank (see this Bloomberg story for the particulars) let there be no doubt that Summers signed up to be a chump to Wall Street. As Epicurean Dealmaker remarked when the Bloomberg expose came out (emphasis ours):

Now forward swaps, or forward start swaps—which behave like normal swaps except the offsetting fixed and floating rate payments are scheduled to start at a date certain in the future—by themselves count as little more than rank interest rate speculation, specifically in this instance as a bet that short-term interest rates will rise in the future. They can make a great deal of sense when an issuer intends to sell bonds in the relatively near future and when the issuer wants to hedge against budgetary uncertainty by converting floating rate obligations into fixed rate debt. That being said, I have rarely encountered a corporate client who feels confident enough about both their absolute funding needs and current and impending market conditions to enter into a forward swap starting more than nine months into the future. Entering into a forward start swap for debt you do not intend to issue up to 20 years in the future sounds like either rank hubris or free money for Wall Street swap desks.

The next unintended tell the use of the work of the dean of quant analytics and investment, Richard Ennis, right after the first mention of Summers:

But even Harvard’s peer group isn’t doing as well as it could. Veteran investment consultant Richard Ennis wrote this month that high costs and “outdated perceptions of superiority” have stymied Ivy League endowment returns, which could have been worth 20% more since the 2008 financial crisis if invested in a classic stock and bond mix.

That section makes it sound as if the Ennis finding about endowments having high expenses and as a result, flagging performance was news. It isn’t. Ennis has been publicizing his findings about this for years. See some of our posts on his papers: New Study Slams Public Pension Funds’ Alternative Investments as Drag on Performance and An Indictment of the “Standard Model” for Pension and Endowment Investing in 2020 and Endowments’ Money Management Destroying Value Demonstrates Economic Drain of Asset Management Business in 2021.

Even worse, the Journal does not explain why endowments have become investment laggards. This is the further discussion of Ennis’ work:

Harvard has more than three-quarters of its endowment in private equity, hedge funds or real estate and just 14% in publicly traded stocks. Harvard Management Co. doesn’t break out fees in its reports and a spokesman didn’t provide that information, but Ennis estimates that the all-in cost of management for such assets is easily 3%, which is a gigantic drag.

This does not give any clue as to why costs are out of line. Ennis made the point clear in the an early 2020 paper we highlighted. From our post:

We are embedding an important new study by Richard Ennis, in the authoritative Journal of Portfolio Management…

Ennis’ conclusions are damning. Both the pension funds and the endowments generated negative alpha, meaning their investment programs destroyed value compared to purely passive investing.

Educational endowments did even worse than public pension funds due to their higher commitment level to “alternative” investments like private equity and real estate. Ennis explains that these types of investments merely resulted in “overdiversification.” Since 2009, they have become so highly correlated with stock and bond markets that they have not added value to investment portfolios. From the article:

Alternative investments ceased to be diversifiers in the 2000s and have become a significant drag on institutional fund performance. Public pension funds underperformed passive investment by 1.0% a year over a recent decade; the annual shortfall of endowments is 1.6% a year.

Note that we’ve been telling readers since we started covering private equity regularly, in 2014, that it did not outperform equities on a risk-adjusted basis. The case against private equity has only gotten stronger over the years. Yet investors like CalPERS and Harvard finessed the flagging returns by adjusting benchmarks and in CalPERS’ case lowering the risk premium, without providing a credible justification, from 300 basis points to 150.

The Journal also omits one reason for endowments’ undue enthusiasm for alternatives: to curry favor with, or at least not alienate, big fund managers among its alumni who have been or might become big donors.

Admittedly, these top schools are facing pressure on a new front: being less than fully tax exempt by virtue of those fat endowments. Again from the Journal:

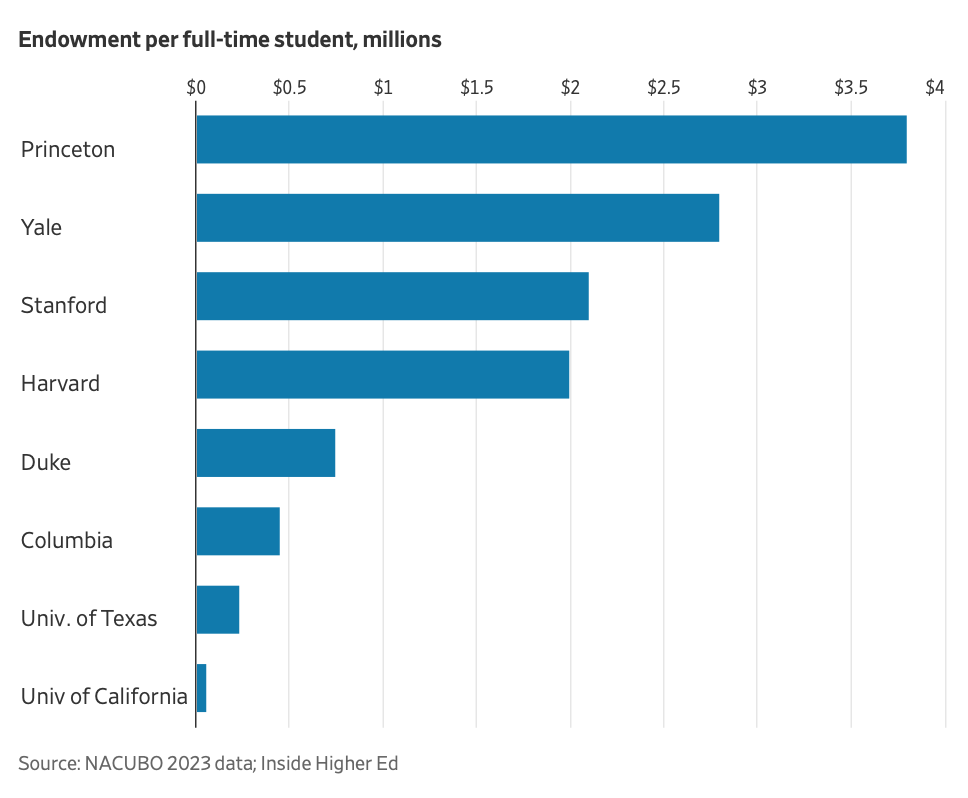

Two Trump administration policies could further weigh on Ivies’ finances. One is a 1.4% tax on income levied as part of the 2017 Tax Cuts and Jobs Act on endowments larger than $500,000 per student at schools with more than 500 students. A few dozen schools have had to pay it and there is talk of increasing the levy.

The article concludes that like overvalued stocks, universities have considerable downside risks:

Domestic demographics won’t help. Paul Weinstein Jr. of the Progressive Policy Institute writes that, starting next year, colleges will face an “enrollment cliff” that will see them lose 575,000 students over four years. Yet a booming stock market and competition for student tuition dollars has led to massive growth in university bureaucracies far exceeding tenured staff hires. More than three million people are employed by four-year colleges and Weinstein notes that some actually have more non-faculty employees than students, including Duke and Caltech.

The more elite the college, the less they will suffer from a drop in overall U.S. enrollment…A drop in stocks, or a reckoning that reveals their opaque private-equity funds aren’t as valuable as they look on paper, would leave a mark, though.

Some Journal readers objected to the criticism of Caltech’s level of non-faculty workers, contending that many were working on funded research and thus paying their own way. But they did complain about tenured faculty often being paid $200,000 to $400,000 a year. I find more disturbing the number how earn even more than their uni compensation on outside consulting. This is particularly true for law and business profs at top schools.

The general point remains: smaller, less well endowed schools are already under duress, with some even closing. Even the biggest, fattest institutions look set to feel some pain. The open question seems to be how much.

_____

1 For instance, Columbia University is the third biggest land-owner in New York City, after the city itself and the Catholic Church.

https://www.nytimes.com/2016/11/06/business/the-money-management-gospel-of-yales-endowment-guru.html

November 6, 2016

The Money Management Gospel of Yale’s Endowment Guru

By GERALDINE FABRIKANT

As he has done for decades, once a week David F. Swensen convenes his staff — including his cadre of apprentices — for a morning-long meeting among the Gothic revival flourishes and crenelations of the Yale Universitycampus to debate investment ideas.

Mr. Swensen, 62, runs the school’s $25.4 billion endowment, one of the largest in the country. Usually he is joined by his intellectual sparring partner, Dean Takahashi, his senior director. It amounts to an internship in the world of managing a university’s billions — and the young analysts have a front-row seat.

“It was like watching a 70-year-old married couple go at it in full force,” recalled Andrew Golden, who was one of those Swensen acolytes in the 1980s.

But forget what you think about internships and fetching doughnuts for the bosses. The meetings are supposed to be a crucible of ideas, and the analysts — some of whom stay in the positions for years — recalled bringing their own proposals in the early days, and having to defend them or face the music. “It could be jarring to have your own view shredded by them,” Mr. Golden said.

As for Mr. Swensen, it’s an environment that brings together two things he loves: thinking about investments and teaching other people how to think about them. “They are twin passions of mine,” he said during a recent interview in his sun-filled corner office at the endowment’s headquarters on Yale’s New Haven campus. Certainly no school has incubated as many endowment managers as Yale.

Mr. Swensen is legendary in the rarefied world of endowment management. He has pioneered an investment strategy that expanded Yale’s portfolio from a plain-vanilla mix of stocks and bonds to substantial holdings in real estate, private equity and venture capital, along with other alternatives. Until then, the typical endowment was far more conservative.

And through his graduates, his investment style has spread to the nation’s prominent schools and foundations…

Inside Higher Ed has been keeping track of this trend. There were more closures and mergers in 2024 than the previous year. Odds are good we’ll see more closures and mergers in 2025 than we did in 2024.

As a parent of kids who are looking into attending college soon, I am asking a lot of different questions than with my previous college students. If it’s a private school, I’m asking to get information on their bonds and debts while on a tour. I’m asking for contingency plans in case the school closes. I’m asking for proof of their status with accreditation bodies. If the school is public I’m asking for the accreditation status and I’m asking for what happens if enrollment collapses and they have to merge with another program.

I’m not sure there’s even a German word for this feeling. I am happy to see these smug bastards get what’s coming to them. I’m happy to see they’re actually having to consider what value they offer students beyond services most students never use. But I hate that I’m putting more money at risk to support my kids with an ever decreasing chance at returns. I hate that I’m looking at spending more money for 1 year of college expenses per kid than I did for 4 years prior to 2000. I just hope not too many kids futures are compromised by the hubris that got us here.

Thank you. These are great questions. We are about to start our first round of college visits (UCSD, USD, UCLA, UC-Irvine, LMU and Stanford).

I am super curious how they responded to financial questions. I assume the public schools have to publish this information somewhere. The private school endowments have this info somewhere.

The Arizona state schools are in financial trouble (particularly the US) to the point I think there might even be fraud. I know the UA is certainly guilty of overbuilding and selling naming rights to stadiums and anything you can put a sign on. ASU has had trouble in their athletic department which seems to be a sign of problems to come.

From USA Today, Athletic Budgets of Public Institutions-2023:

This is a goldmine of information that no institution wants us to know. The following is difficult to read, but here are your public schools.

Institution/Revenue/Expenses/Allocated/Real Net

UCLA/$103.1M/$131.1M/$30.6M/-$30.6M

UCSD/$28.9M/$24.7M/$26.9M/-$22.7M

UC-Irvine/$24.9M/$25.2M/$20.4M/-$20.6M

Arizona/$124.4M/$124.9M/$31.1M/-$31.7M

ASU/$121.1M/$124.0M/$19.3M/-$22.2M

Among private schools, only Notre Dame, Stanford, USC and a few others are in the black.

“Allocated” is the money received from student activity fees and other sources outside the athletic department but inside the institution.

Ask them if the institution and students really get their money’s worth in subsidizing athletics. They will say, “Of course! Football and basketball bring in a lot more than they cost!”

If you look carefully at the data, there are only 25/232 (10.8%) public NCAA Division I/II institutions that are in the black without dipping into students’ and/or their parents’ bank accounts and the institution. These are the usual suspects in the SEC, Big10, Big12, Pac12 (which doesn’t exist as of 2024). The University of Connecticut allocates $55.3M out of a $99.0M athletic budget. Small institutions are way in the red.

Perhaps one should allocate some of the influx of college donor money to the promotion of athletics?

It is possible that administrators excuse large athletic budgets because big donors “support” the teams and the schools with money that isn’t counted in the above data.

Some students may like having teams and may be willing to pay via their fees.

People should investigate many of those same kinds of questions when applying for a job.

Employers do all kinds of checks on potential employees.

How would jobseekers investigate many of those same kinds of questions without getting themselves branded as troublemakers and being ejected from the application process?

Baby steps. I think it would be fair enough to start with a law that says if the employer requires a credit check on the employee, then the employee should be allowed to receive a credit report on the employer.

Too much like right to ever happen…

I regret every minute I spent in university and the corporate world. For the former, I was persistently stressed out because of academic deadlines, I had no money, and the environment is counter to what my introverted nature requires for learning. For the latter, it was a colossal waste of my time to supplicate to various employers about how much I wanted to be employed at all the numerous corporations I interviewed with. Holy cow am I bad at interviewing. There were a handful of times where a potential employer asked me to authorize a credit check, and I agreed under one condition: You check my credit report, and I will check yours. I might as well have said, “Please call security and have them show me the exit.”

We here at NC are typically sympathetic to the plight of labor. I have seen plenty of articles and comments here that state explicitly how terribly impractical school is, yet I don’t commonly see anecdotes about how repulsive job interviewing is. By the way, I am a much nicer guy than my writing style would suggest. Learning life skills is quite important to me now. I would be more than happy to show you all the practical things I have learned, though I would undoubtedly take a swipe at the worthlessness of school and its exorbitant fees.

This may be small consolation but I absolutely loathed conducting interviews on the hiring side at least as much as I dreaded being interviewed myself (which fortunately was rare: I only had to endure being interviewed 5 times over the course of a 33 year career).

Schadenfreude

My response to Chris: Your last paragraph says it all for me! My parents paid for an excellent education at a small, private university with a good reputation for me in the early 1980’s – $10,000 a year including room and board in a dorm, small classes and professors who knew my name and a precious group who genuinely cared about my intellectual development. That university is not only unaffordable but has sold out to the money grubbers. Everyone I know of conscience, left long ago.

used to work at a pension fund that got burned (opportunity cost wise) by overweighting all sorts of alt. investments in the mid/late-90s. then they finally decided to go 100% S&P 500 for the long-term stuff.

unless they changed after I left, should have worked out very nicely for them.

>86% of investors (individual or institutions) are best served by some-sort passive investing via indexes/ETFs.

Everyone likes to think that they are a “sophisticated investor,” lol. My perfect contrarian indicator, my cousin’s husband, (unsolicited) show me his portfolio and explained his strategy over Christmas. Every time that he has done this so far, the end is near in whatever he says is the new fad!

Tell us what he’s bought so we can short it!

should be no surprise…bitcoin, semis, Palantir. (all you oil and Phase III biotech investors are safe from the hot money touch of death, lol)

Not so different from degenerate horse players who dis their peers as chumps, while claiming that their “system” gets them over. I can still hear my uncle make with this, and in the end he was sweeping up used tickets and going through them at home, hoping to find a stray place or show ticket someone had inadvertently tossed…

Summers is a nepo baby with an oversized ego and the perfect illustration of Dunning-Kruger when it comes to his economic acumen. That has been obvious for decades, why Harvard let him touch anything financial boggles the mind. Surely Harvard has no dearth of well-connected individuals to choose from, and some of them might even be halfway competent.

There are people who have some sort of “field” about them, that charms other people and makes them seem competent. I’ve met a couple. For some of them the “field” isn’t very strong, and after a couple of weeks or months you can see what terrible people they really are. Others, like Bill Clinton, Obama, and Biden, have very strong “fields,” and there are few people who eventually see what they really are. I don’t understand it, but then I’m not properly wired; I lack some emotions that seems to be common to other people. And, of course, I have my own Dunning-Kreuger proglems.

I wonder if some far less wealthy college donors are also pulling back from giving after watching their schools cave to wealthy Zionist donors.

It was not a good look to see University presidents bounced by their schools because they didn’t cater to wealthy donors’ desires enough or strongly enough.

That is an interesting line of thought. One can only hope.

Yes, I have wondered the same. If I was a rich donor and disagreed with the treatment of those students of conscience, I’d find another place to give my money.

Many of the people sitting on the boards of these universities and who are also major donors are from the financial sector, with many of those from private equity etc. How much of the destruction and hollowing out of US corporations has been funded by these tax free endowments, producing huge returns for the financial managers of the private equity funds? Would be interesting to see how much these endowments are actually being used as tax free PE, REIT, and VC funding devices.

The top universities are private corporations, set up as fake “non-profits” that enrich insiders, they should be taxed just like other corporations.

Thank you very, very much for this post.

re: “college tuitions have risen strongly over time, without an improvement in university economics, due to wild bulking up of the adminisphere,…” This has been a joke for a long time, for over 20 years in academia. ( See the Administratium Joke. I’ve also heard the joke told with the Morons particles referred to as Memo-ons.)

Many faculty joked the unis are selling a 4-year vacation cruise plus credential instead of education.

As for touting Larry Summers as an authority on elite colleges’ finances, the jokes write themselves.

I’ll stop now.

adding: imo, this all began in the 1980s years when US and state legislatures started defunding public colleges, in the name of financing tax cuts. (Thank you, Howard Jarvis.) Where once the state legislatures and US govt provided 25%- 50% of college subsidized funding, now colleges were left to make up that funding loss by other means however they could.

https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2019/10/two-decades-of-change-in-federal-and-state-higher-education-funding

This cut off of public funding drove public colleges to see their undergrad enrollees as “customers” to be catered to in order to increase enrollment and as such increased what remained of public financing for public universities.

But what about the elite, ivy private colleges? They do not exist in a vacuum. And here we are. / my 2 cent

Shorter: Greed is not good.

adding, adding, (OK, I did not stop, heh): these days, large public colleges see television revenue returns from broadcasting their Basketball and Football competitions as their financial saviour. Who is interested in watching a Harvard/Yale game? Not much TV revenue (or betting) returns there, imo. / ;)

A friend of mine worked in the purchasing and surplus sale dept of the Uni where I used to live. He told me that the vice president of the college ordered a $7000 rug for his office… this is what kids’ tuitition is going for.

“…he[Larry Summers] says that just $1 billion could fund 100 professorships or permanently cover tuition for 100 students.”

Is that quote correct? I thought 1 billion was 1000 millions. Does it cost $10 million to fund 1 Ivy professor or permanently cover tuition for 1 Ivy student? [What does it mean to permanently cover tuition for 1 Ivy student? Does it mean acceptance letter to grave?]

Summers may have meant the $1B as an ongoing investment fund. A 10% annual return would be $100M to divvy amongst 100 exhorbitantly paid professors ($1M each). If those professors only made $500K then a 5% investment return would do it.

Summers is clearly no investment Titan.

My local Ivy, (Brown), just announced that it is facing a $40 million (3%) budget deficit in the current year.

Probably has nothing to do with the recent increased affiliation with the largest local hospital/medical providers group (formerly Lifespan, now Brown University Health). It’s definately NOT a merger, but Lifespan is handing over a major chunk of its investments to Brown, “creating the capacity for increased returns”, plus Brown gets several seats on the Lifespan Board.

Brown only has seven administrators making more than $1,000,000, so there’s obviously no bloat to be cut there.

What is the current condition of Brown’s endowment fund? And for what purposes is the endowment fund used, if not for direct education? Enquiring minds would like to know. / ;)

How do all these billions support professors and students? How can an institution with billions in its endowment cost the best part of $100,000 per annum while providing a slimmed down and dumbed down education? Why are so many more administrators needed today than a generation or two ago … other than to provide opportunities to “wet their beaks?” If the present day large university is a hedge fund with a sideline in education, why is it tax exempt?

Federal regulations and DEI: The Title IX administrator is now a stand alone position at my community college; many of the Deans have been elevated to Vice-President status with expanded support staff; all communication with students is now done online—requiring a VP-Director of IT with massive support staff; and credential inflation for many other positions (There is now a separate Dean for ‘student discipline’—current incumbent has a Ph.Ed. and doesn’t understand FERPA rules.)

And lastly the current student population is likely very different than you experienced in college. Many (not all) are frightened by the college experience and consume hours of mental health resources.

And, at my local community college, many of the buidings/grounds have massive deferred maintenance costs—new construction wildly expensive.

“Second is that Trump China/immigrant-bashing has resulted in reduced applications and enrollments of foreign nationals,” I must disagree. For the last four years the country has literally been invaded, both over the border, and – though it gets little attention – perhaps at least as much through visa overstayers. Far from ‘bashing’ immigrants they have been getting the doors flung open for them. I would suggest two reasons for decreased foreign enrollment:

1. If you can just walk over the border and settle here de-facto permanently with subsidized rent and medical care etc., why would you go into massive debt to get the same thing? We’ve devalued citizenship and thus reduced the ability of colleges to serve as high-class coyotes.

2. China has many problems but opportunities there have still risen relative to the United States, and the “push” factor is steadily decreasing.

Sorry, this is Making Shit Up. The unis themselves are reporting reduced enrollment. Your factoids about illegal immigrants are irrelevant to the behavior of wealth foreigners, who would NEVER choose the hardship and risk of illegal entry and do not need to avail themselves of Medicaid, FFS.

And do not forget, create more bank loans to pay developers to build these white elephants. The excess of the universities has a lot in common with the excesses of real estate and finance generally. And like big finance, the universities are expecting bailouts for being too big to fail.

And don’t forget all that NYU property in Lower Manhattan.

NYU, a real estate development company with a higher ed subsidiary.

I got an MA and teaching license there thirty years ago. Even then, in a grad program (well, sort of) the overwhelming majority of my classes were taught by adjuncts; only three of sixteen were taught by full-time tenured faculty.

The University of Washington has vast amounts of property also.

My small liberal arts Alma Mater in Memphis has had a 25% enrollment declined. The past 10-15 years it went on a building spree knowing there is a baby bust coming. With the enrollment drop, the school has closed 2 dorms and it is going to renovate them. It hasn’t occurred to them that those dorms may never get filled again.