Yves here. Below, Wolf Richter demonstrates how fabulously overvalued Tesla stock is. Yours truly is not a stock jockey, but even allowing for that, I have difficulty thinking of any previous case where the valuation of a large-cap company was held aloft essentially based on the cult of personality of its founder. Admittedly, a cohort of Tesla equity buyers have long been true believers; recall how Tesla stock was very richly valued when there were genuine questions as to whether it would ever become profitable.

A second interesting question is how much Musk’s political clout will fade when Tesla stock price falls to more realistic levels, which is quite a long way. Admittedly Musk’s ownership of Twitter is now a big source of his power. But the popular press likes to over-hype celebrities until their fortunes turn, and then pile on them. And Musk has a very thin skin. So a Musk reversal of fortune, even though he is virtually assured to remain comfortably a billionaire, could be an interesting spectacle.

There’s also the related of if and when recriminations will start in the US as to why our carmakers are being so comprehensively shellacked in the EV market by Chinese producers. Back in the late 1970s and 1980s, the US business press regularly and pointedly criticized the loss of US manufacturing prowess, then to Germany and Japan, with fingers pointed at sclerotic US executives. I see comparatively little of this sort of thing now. Apparently we now have the best of all possible elites.

Admittedly, US car buyers will be shielded from that reality of the superiority of China’s EVs as long as possible by tariffs and other import restrictions. But there’s a stunning failure to acknowledge that higher-than-necessary transportation costs translate into uncompetitive labor costs. This effect is admittedly not anywhere as pronounced as for housing. Note that Germany recognized that issue explicitly, promoting (until recently) affordable rental costs and strong tenant rights so that renters could and often did stay in the same flat for decades. The US seems to have lost the plot, that our rentier capitalism, with high housing, healthcare costs, higher education, and now car costs, can’t become competitive unless these are brought under control. With the extreme bloat in those categories, and the industry incumbents wielding great political power, I’m not holding my breath.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

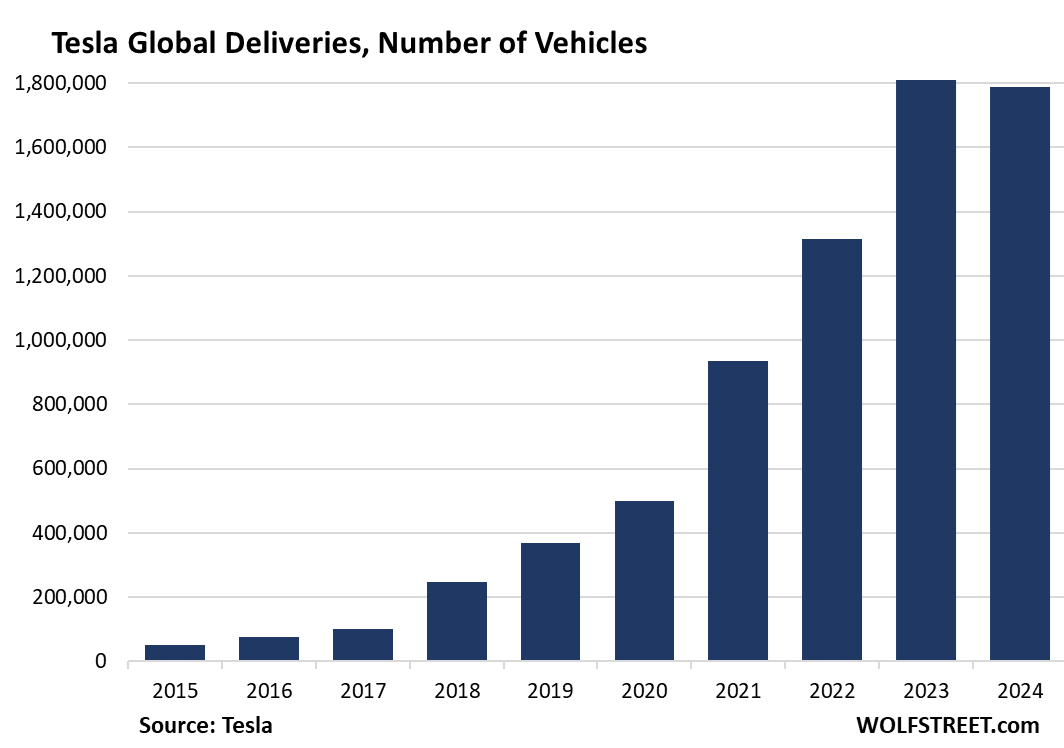

Tesla reported today that global deliveries for the whole year 2024 fell by 1.1% to 1.789 million vehicles, as is Q4 deliveries ticked up only 2.3% year-over-year to 495,570, a new record by a hair. And the growth story is over.

But Tesla’s EV competitors are making hay in the rapidly growing EV market. Tesla’s biggest EV competitor, China’s BYD, announced that deliveries of its battery-electric vehicles in 2024 jumped by 12%, to 1.764 million EVs. In Q4, it delivered 595,413 EVs, up by 13.1% year-over-year, outpacing Tesla’s Q4 deliveries by 100,000 vehicles or by 20%!

Other Chinese EV makers, whose names are familiar in the US because their shares/ADRs are traded in the US markets, announced big gains in EV sales in 2024, including:

Li Auto Inc. [LI], annual sales: +33% to 500,508 EVs; Nio [NIO], annual sales: +39% to 221,970 EVs; and Xpeng [XPEV], annual sales: +34% to 190,068 EVs.

Even US legacy automakers GM and Ford have been reporting big increases in their battery-electric EV sales in the US in 2024 through Q3 (Q4 deliveries will be announced over the next days):

- Ford EV sales in 2024 through Q3, in the US: +45% to 67,689 EVs

- GM EV sales in 2024 through Q3, in the US: +24% to 70,450 EVs

GM killed its popular Bolt and Bolt EUV in 2023 but came out with a bunch of new models that just recently have hit dealer lots. So in Q3, GM’s EV sales jumped by 60% year-over-year.

So this decline at Tesla in 2024 is a sign of trouble at Tesla – is Musk the biggest problem there now? – while overall EV sales continue to grow at a rapid pace, even as ICE vehicle sales have stalled at low levels.

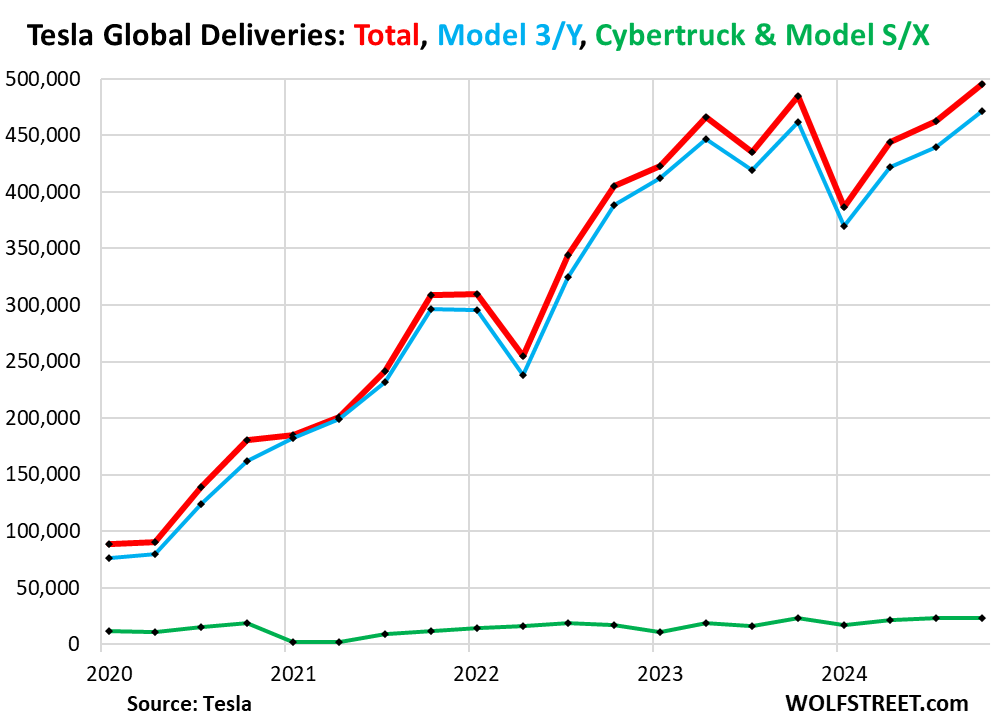

For Q4, Tesla’s deliveries eked out a record at 495,570 vehicles, just 2.3% above Q4 2023 (red in the chart below), including:

- Model Y and Model 3: 471,930 (+2.3% year-over-year, blue)

- Cybertruck, Model S, and Model X: just 23,640 (+2.9% year-over-year, green).

The Cybertruck had been the great hoopla-hope-promise, and it has been in production for a full year, but deliveries are apparently growing at a modest pace:

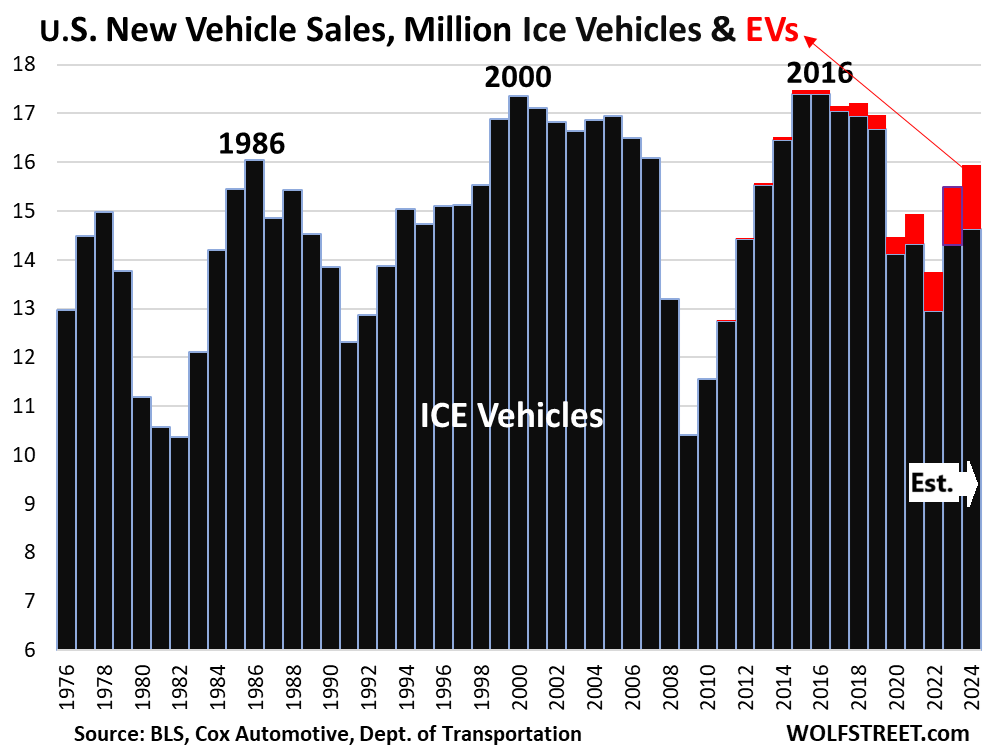

The other automakers will report their US delivery figures over the next few days. So while we wait, let’s assume that EV sales grew by only 10% in the US in 2024, dragged down by Tesla, after having grown by 46% in 2023. Then total EV sales would exceed 1.3 million (EV = red segments), while ICE vehicle sales, including hybrids, would come in at about 14.6 million (ICE = black columns). And Tesla’s role in the EV segment, while still large, is diminishing rapidly, as other EV models surge:

So How Much Should Tesla Be Worth?

With stagnating vehicle sales, losing market share, getting passed by a Chinese competitor (BYD), as other competitors catch up, Tesla is now in the same position as Ford and GM, that trade at P/E ratios between the single digits and maybe 15.

P/E ratios currently:

- Ford: 11.1

- GM: 5.5

- Stellantis: 2.7

- Honda: 7.3

- Toyota: 9.6

- Tesla: 103.2

These legacy automakers with their low P/E ratios are not good deals. They’re not undervalued. That’s where automaker stocks are – and for a good reason.

The auto industry in the US, as you can see from the chart above, has been a no-growth industry for decades, interrupted by big plunges, bankruptcies, and bailouts. Similar dynamics played out in Europe, Japan, and other developed markets.

Only rampant price increases and going forever upscale have allowed automakers to increase their dollar-revenues, even as unit sales stagnated and fell. In fact, because they kept pushing up prices of their models to increase their profit margins and dollars sales, their unit sales have fallen because their models have gotten too expensive.

Tesla is still hyping a lot of stuff that it’s going to blow your socks off with, like it used to hype the Cybertruck, the Semi, and all the other things. The biggest two hype-and-hoopla elements currently are AI and a robotaxi that doesn’t exist yet.

So OK, let’s give Tesla’s hype and hoopla the benefit of the doubt, and say that as Ford trades at a P/E ratio of 11.1, Toyota at 9.6, Honda at 7.3, and GM at 5.5, then Tesla should reasonably trade at a P/E ratio of up to 15 maybe, to be valued for reality. So divide Tesla’s current share price of $378 by about 7, to get a share price of $54, at which point it would trade with at a P/E ratio of about 15, still far higher than the major automakers in the US. It still would be relatively high for an automaker.

I’m obviously just kidding. Wall Street doesn’t care about reality or P/E ratios. Wall Street sells hype and hoopla, and Musk has long known this, and has perfectly played this game, which allowed him to fund and build the company, and its success so far. That was a huge accomplishment.

As Tesla became a profitable global automaker that now sits on $33 billion in cash, it shook up the legacy automakers, forced the entire industry to invest huge amounts in developing and manufacturing EVs and batteries for EVs, many of them in the US, which has entailed a boom in factory construction in the US, etc. etc. So this was all good and very hard to do, and Tesla managed to do it.

But now Tesla is just another mid-sized automaker with stagnating vehicle sales amid EV competitors that are eating its lunch. So it should trade like an automaker.

Dear Yves,

I see the intuitive logic of your claim “that higher-than-necessary transportation costs translate into uncompetitive labor costs.” But do you have a source for this mechanism?

I ask because this is never mentioned in the discussions of Finnish competitiveness – we just assume we’re an island and transport from here is expensive (by ship I suppose it doesn’t have to) – especially now that the Russian market is once more closed. But more importantly, it connects the housing issue with labour market relations (and therefore collective agreements etc.)

So I’d be very grateful if you (or any other NC reader) has a source for this.

I believe she is talking about workers’ cost to commute to work from home, not international shipping costs. In the US, with such poor public transportation, that means the cost of private automobiles and their fuel and maintenance.

And yes, commute costs do affect labor competitiveness because it affects how many jobs the typical worker can apply to (closer or farther from home), especially since moving house is so onerous in the US.

No, I mean the cost of cars as an asset. Most Americans either lease them or finance the purchase, so there is an ongoing cost. Even in 2022, the average price for a new car had hit $47,000. For 2025 models, the ONLY one below $20,000 is the Nissan Versa, and readers warned in an earlier post that Nissans were very much to be avoided for their poor quality.

By contrast, the cheapest Chinese EV sells for $8,000:

So this is yet another way Americans have a higher cost base than workers in other countries.

Thank you for this clarification! This is still significant, in Finland the average car age is said to be like 12 years, because new cars are so expensive.

Average US car age is 12.6 years. What’s your point?

Mine’s 14, so I am doing my part to bring up the average (in Canada) …

14 years is very impressive for Canada! Mine is 20, but… I’m a flatland Californian, and the combination of affluence, desert climate, and lack of road salt means that we operate a large-scale car museum.

Cuba thinks that your large-scale car museum is cute.

To the extent labor must cover transportation cost (among other necessities), labor must demand wages to also cover. Thus, were these costs public, labor could be had for lower wage. See Hudson in numerous places.

“higher than necessary transportation costs translate into uncompetitive labor costs”

To that add all costs required for a living (house renting, health care, food…). The price of having high GDP is being uncompetitive. The only exceptions being monopoly business which one day will also crash.

It does look to me that the function of tariffs is only to try to keep the fiction of GDP numbers and overvalued stocks, land, etc.

Not the only. For Trump, there is one other very valuable function of tariffs. They enable him to self-deal by granting exemptions to individual importers who wet his beak.

Most places on the internet would see the comments section of a post like this quickly descend into a virtual bare-knuckle brawl. The fanboys and sycophants would come out swinging in defence of Tesla, armed not so much with data but mouthfuls of buzzphrases and tropes like “tesla is a tech company not an automaker, never bet against Elon, the Chinese are far behind and can’t innovate anyway, try FSD then come back to us” etc. Not even facts would sway the intransigent horde (eg forget other automakers, why is Tesla trading at a forward P/E so much higher than other magnificent 7 stocks, even pureplay tech stocks?) and trying to coax them out of the cultish echo chamber to have their strongly held beliefs weighed against reality would be an impossible task. Fortunately, the risk of such a bare knuckle brawl happening here is extremely low because NC operates, for the most part, above the fray of hype and emotion that saturate most corners of the open internet.

The reality is for a long time Tesla’s overvaluation was propped up by the assumption that the company would both create the EV wave (which it accomplished successfully) and be so far ahead (with a moat so impenetrable) no peer level competitors would appear to surf that wave with them (or knock them off that wave). That assumption has disintegrated spectacularly with the emergence of BYD and others, but instead of a downward correction in valuation, the marketing waffle about Tesla grows louder. To be clear, Tesla is a successful company, but it’s also one coasting on hype.

That PE ratio really is an eye opener. For comparison’s sake, I just looked up Amazon’s PE ratio – to me the way that stock trades is the epitome of the old saw that markets can remain irrational longer than you can remain solvent. Amazon’s PE us currently at about 46. Alphabet is at 25.5.

If history is any guide, at some point in the not too distant future Elon is going to get [family blog]ed right in the face.

Yes, Elon and Tesla rode the initial EV wave. But the early Model S (expensive) were being purchased by wealthy buyers. These people had homes where they could install powerful chargers to fill the large Tesla battery and drive longer highway distance. As the Tesla cult grew, Elon set up banks of quick chargers in public locations (useable only by Tesla owners). Eventually, the Model S and the winged-door Model X were deemed overkill by future buyers and the smaller Model Y was introduced for this new cadre of buyers. Unfortunately, many of these new buyers created lineups at the public chargers and the achillies heal of the EV was exposed. Charging infrastructure.

While BYD has developed a smaller vehicle with a smaller (rapid charge) battery that fits with urban use patterns, the majority US driver likely lives in a rental unit that does NOT have charging capability. And most public chargers are rather slow (taking many hours) requiring owners to leave their car out in the elements for long periods of time. The EV requires a lifestyle change.

And finally, Tesla is not a technology company. It is an auto maker that implemented “stamped metal” to the car manufacturing process. (It did not invent the process.) Tesla’s may look sleek, but have durability issues—and of course are unsafe when crashed. The software technology that they did develop, AutoPilot, has proven to be ‘unsafe at any speed’.

So, the stock price for Tesla is like StarLInk; beyond elevated—it is in low earth orbit.

(Nice to see Thuto in Comments again.}

Correction: the smaller Tesla is the Model 3, not the Model Y.

China has at least one vendor using swappable batteries (Nio?), so the urban charging argument is not a permanent negative. There are delivery guys in China who start the day with a fresh battery, drive around all morning, spend 5-30 minutes waiting for a swap at lunchtime, and drive around all afternoon.

One giant problem here is liability: if the battery design is a firebomb, I don’t think it is possible to make swappable batteries a viable business in the US. You would have to sign away your rights to sue every time you did a swap.

A punster has quipped that the stainless-steel Tesla pickup could be called the Deplorean in reference to a previous vehicle with a stainless-steel body.

Carvana is another high stock value stock that may be headed for a steep correction. Carvana is the subject of a lengthy report by short selling firm Hindenburg https://hindenburgresearch.com/carvana/ Carvana is an online seller of used cars that has been called the Amazon of used cars. The report is fascinating reading. The report characterizes the business model as a loan originator that sells subprime and deep subprime loans to investors. Ally Bank is a major buyer of Carvana’s loans, but recently there is an undisclosed loan buyer. Hindenburg suggests that this may be a trust fund of Cerberus Capital. Related to the GM bankruptcy, Cerberus acquired GMAC. As Musk is involved in politics, so too are Carvana and Cerberus. Former Vice-president Dan Qualye is a Director of Carvana and is Chair of Cerberus’ Global Investments. Mr. Steven Steinberg is CEO of Cerberus. Like Musk, he is a heavy contributor to candidate Trump, contributing $985,000 in 2016 and 1$M in 2020. President Trump has designated Mr. Steinberg for appointment to be the Undersecretary of Defense in his upcoming administration.

ZOMG, love “Deplorean”!

And thanks for the pointer re Carvana. Saw LOTS of ads for it on old people TV when I was taking care of my mother, which is generally not a good sign. It typically means “looking for suckers”.

Slightly off-topic, but likely heralding a change for 2025 – the “old people TV” ads I’m seeing are now beginning to tour Medicare Part C, not Medicare Advantage. Perhaps that misleading title is becoming too toxic, as people’s eyes are opened to the scam, via the death of Brian Thompson?

It is surprising that, after all the billions of net worth of powerful individuals, that a “heavy contributor” contributes only $985k and $1million.

Maybe the implied promise of more to follow, or that friends will kick in?

Or the amount is not as important as the signaling?

Maybe there is one important but relatively low priced product in the USA with great ROI and value.

That being political influence/legalized bribery.

The trouble with trying to price Tesla’s stock is that Musk’s name is riveted onto it and Musk himself has become a sort of brand name in much the same way that Trump has managed to do with his own name. If Musk sold Tesla then that stock would be much more realistically valued. The problem for Musk is that the Chinese are fully capable of eating his lunch with much cheaper and more reliable EVs that I believe have superior features. That BVD Seagull that was released that hugely would undersell his own Teslas must have been a wake-up call to him. So perhaps that is why he has dedicated himself to becoming part of Trump’s government. So that he can push Trump to levy punishing costs on those Chinese EVs so that they are not such a threat to his Teslas in the US. He does not strike me as the altruistic sort to become part of the government without there being something in it for himself.

Rev Kev: So that he can push Trump to levy punishing costs on those Chinese EVs so that they are not such a threat to his Teslas in the US.

It’s an existential matter of survival for Musk, no? So of course.

The question then becomes how Musk squares the circle with Beijing, because Tesla’s Gigafactory Shanghai, aka Giga Shanghai, is Tesla’s primary production site for its Model 3 and Model Y, annually producing 950,000 vehicles. Indeed, half of all Tesla electric vehicles are now made in China.

https://en.wikipedia.org/wiki/Gigafactory_Shanghai

Given China’s key role in the global battery supply chain, crucial for Tesla’s EVs, Musk needs the Chinese more than they need him.

Which means the question also becomes: How does Musk square the circle in Washington?

Elon Musk’s Business Ties to China—What to Know as MAGA Turns on Trump Ally

https://www.newsweek.com/elon-musk-business-ties-china-2006722

We’re possibly seeing Peak Elon — thank God! — unless he does something remarkable with SpaceX/TwitterX, like giving away Twitter services with added AI via Starlink.

Add to this Trump wanting to aim a kill shot at the head of German industry via throttling Russian energy exports to the EU even further. Remember Tesla has a gigafactory in Berlin whose competitiveness will be hobbled by rising energy costs. Under the Orwellian guise of targeting Russia, Trump has the EU in general, and Germany in particular, in his crosshairs. He’s also salivating at the prospect of picking up where he left off with his anti China crusade, yet both China and Germany deliver more output for Tesla than US based production. Me thinks co-president Musk is in a pickle…

Slightly tongue in cheek, the way Nazi Germany did this was import/export matching (in the context of foreign currency controls).

You could imagine some similar tariff system where Tesla can import its Chinese production business as usual but bar BYD, by claiming a tariff offset off the export value of Tesla IP (design, software, patents) to the China factory. It’s a totally neutral mechanism and BYD or BMW for that matter can access it too, at the expense of exporting their IP profit-base permanently to the USA.

Bannon or Vance might figure this out for themselves, as a way to monetise USA’s buyer-of-last resort status.

Actually reshoring production and reduce costs through Bismarckian state provision of shelter and transport and healthcare would be an alternative but where’s the vig…?

Wouldn’t it be just as legal for the Chinese EVcar makers to invest in plants making their EVcars here in America in the same way that German and Japanese car companies have invested in making cars here in America?

And if they decided to try doing that, would President Musk be able to order Trump to try stopping them?

Trumpmusk will try to stop them by not allowing them to utilize H-1B visas. Chinese EV car factories in USA would have US workforce, and still pay the tariffs.

There are a few other strikes against Tesla from what I read on my car blogs.

They are extremely expensive to repair.

Which makes them expensive to insure

They have poor build quality reputation.

just this am saw a report that the cybertruck sales are crashing even with big discounts.

I was waiting at a red light the other day, behind a tesla. It appeared fairly new, undamaged.

I was adjacent / behind a nissan altima in the next lane.

The gap of the rear hatch-to-main-body on the nissan was visually consistent. The tesla visually varied by an observable 1/4 ” to 1/2″ . This from a distance of several feet. Shoddy workmanship / finish on tesla.

Seems the production standards for space x and tesla vary greatly. the rabble, the plebes– no lives matter.

I truly wish Musk would head off to Mars .

Jefemt, The other day I watched a you-tube video where a man showed how the sharp edges on a Tesla could be used to peel a cucumber. Then he sliced carrots using the hatchback.,

Nvidia is another stock which I think is massively overvalued, but that’s because they supply the chips for the AI “revolution” (or hype train).

Deepseek V3 is a Chinese AI model that just came out that is not only competitive with the latest models from OpenAI, Google and Meta but outperforms them in certain benchmarks. Here’s the kicker, it was trained at a cost of just $5,6m (vs the 100s of millions to train peer models in the west) on last generation Nvidia H 800 GPUs because the much coveted H 100s are restricted from being sold to China. Nvidia shot to the moon fuelled by exuberance stemming from the massive capex spending by Big Tech hyperscalers looking to gooble up every GPU in sight to throw ever increasing amounts of compute at model training. With deepseek proving that model performance isn’t necessarily a function of training cost, the gig may be up for Nvidia with a valuation correction more or less inevitable.

“Only rampant price increases and going forever upscale have allowed automakers to increase their dollar-revenues, even as unit sales stagnated and fell. In fact, because they kept pushing up prices of their models to increase their profit margins and dollars sales, their unit sales have fallen because their models have gotten too expensive.”

Perhaps it’s time to admit that in America cars are yet another example of society existing to support industry rather than vice versa. I once owned one of the original Volkswagens–a tin can that struggled to get above 60 mph–and while it may not have been much of a car the philosophy behind the “people’s car” was sound.

And so these monster pickup trucks that crowd our roads exist because Detroit–and also its unions–must be saved as a vestige of the country’s industrial peak. Whereas if the green new deal people were in charge and really serious we’d be selling those Chinese EVs like hotcakes. Back in the day a new VW cost under $2000. In our own day the much nicer Chinese electrics are selling in China for $12000. This will be doom for Tesla in the short term or the long.

And for all the complaints about computers in cars the cheap EV will be the logical end result of bringing transport into the digital age. Half the cost of an ICE car or truck is the very complicated engine and emissions controls. Electric motors will be even simpler and far more reliable than those old VW air cooled jobs. It’s time to go back to the future.

Telsa’s P/E is really worse than the current 106, as Tesla took a huge one time accounting benefit in Q4 of 2023. Once they announce Q4 2024 results that will be dropped for P/E calculations and the P/E will shoot up to close to 200.

The financials by quarter showing the big one off spike in Q4 2023, a US$5.75 billion income tax benefit.

https://www.marketwatch.com/investing/stock/tsla/financials/income/quarter

My understanding is that Tesla is struggling in China and is losing ground to Chinese brands, for a variety of reasons. Perhaps Tesla can learn to compete is that market and bring the lessons home? Their cars seem so overpriced…

On another note, I believe that Ford was dealt a setback when their partnership with Chinese battery-maker CATL was scuttled by a few screeching congress-critter China hawks, but this “partnership” has been recently reworded into something not a partnership. Watching to see what may evolve there.

The Chinese EV market grew by about 36% in 2024 y-o-y, while Tesla Chinese sales only grew by 8.5%; and that after Tesla started offering zero down 5-year 0% financing early in the year. In Q4 Tesla’s share of the EV market (BEVs and PHEVs) went from about 6.5% (2023) to about 5.3% (2024). For the full year it fell from 7.5% (2023) to about 6% (2024). Troy Teslike estimates that Tesla makes next to no profit in China.

The refreshed model 3 has been inundated with much better competition (i.e. actual new sedan models), including of course the Xiaomi SU7. But it is not just Xiaomi but many others. In Q4 2024 there were also a number of competitor new models / major refreshes that compete with the Model Y. We have to see when the facelift is coming in 2025, but the competitor Xiaomi XU7 will be coming out only months later and the production/sales of the other competitor models is ramping up.

The basic problem for Tesla is that it lags far, far behind the Chinese competition in producing new models and substantial refreshes. The Chinese are now in the overtaking lane. There are many, many “Model 2s” in China, just not from Tesla, plus a whole bunch of “Model 1s”. In addition, Tesla has no position in the PHEV market which BYD especially has driven with its super-efficient PHEV technology (e.g. 2,000km range on a full tank and battery) at prices equal to ICE only/HEV models. The utter waste of the huge resources directed to the CyberTruck, Semi etc. is now really being felt by Tesla, as it still does not have the cheaper models needed for a bigger presence in China and Europe and the Model 3 and Y fall further behind the competition; even after their refreshes.

In the US Market others have caught up.

The Model 3/Y (same platform with car & CUV sizes) have strong competition from multiple Hyundai/Kia products and the Ford Mach-e.

The Hummer is a much better prestige Bro-Dozer that the Cybertruck. F150 Lightning and the Silverado EV are much better 1/2 ton pickups.

Tesla has been losing market share in the US BEV market for years now; 2019 85%, 2020 79.5%, 2021 72.5%, 2022 64%, 2023 55%, 2024 about 47%. About 8% market share loss per year for the past few years. Tesla’s market share loss accelerated into year end, with Q4 BEV market share around 43.5%.

As Tesla’s market share gets lower, that loss of market share represents a bigger and bigger chunk of their sales. For example 64 divided by 8 is 8 (12.5% drop), while 55 divided by 8 is 6.875 (14.5% drop). Another loss of 8% market share in 2025 would represent a 17% drop. Tesla’s drop in market share has been offset by a growth in the BEV market, until 2024 when its US sales dropped about 6% y-o-y (4% in Q4 y-o-y). In 2025 the market share loss impact becomes even greater. If Trump does remove US federal fiscal support for EVs, then the overall market may flat-line or even shrink with Tesla’s sales falling by more than the overall market.

6yrs ago they had the market to EV market more or less to themselves with the only real competition being the Nissan Leaf.

The Leaf is a ok econobox replacement if you can run it within the limits of its range and practically nonexistent DC Fast charge support.

If Tesla’s fortunes turn sour and the press starts piling on him, I don’t trust he’s stable enough to handle it. I would bet money that he’ll blow his brains out. Or at least go a little too heavy on the recreational pharmaceuticals he’s so fond of, leading to an unpleasant discovery for his poor housekeeper. I don’t know how the weird internet nerds he seems to attract would handle it, but it would be insufferable for the rest of us.

In all seriousness, though, TrueAnon had a rather interesting dive on him a while back, which certainly illuminated some of his financial trickery and how deeply involved his companies are with government contracts. While it should have been obvious, TA pointed out how precarious the company finances were, depending on his cult of (repellant) personality to gin up revenue.

Didn’t occur to me until they stated it – when TSLA was listed (the worm turned) by one of the big financial indexes (S&P? NASDAQ?), a whole bunch of funds mirroring those indexes HAD to buy a bunch of TSLA, no matter how shitty or overvalued. So the incentive to talk a boatload of shit to keep the price up only increases.

I wish he would stick to his weird EA / E-Acc garbage and breeding farms, but no.

when i was in auto repair in the 1970’s, this was before bill clinton had fully unleashed hedge funds and free trade onto the world. the automakers made a good share of their own parts and components.

they owned factories with hi-tech machinery and well trained workers that made all sorts of things, not only for their own internal use, but sold to other car manufactures, even other manufacturers.

thus they made money doing it.

as we saw with boeing shedding all sorts of its own internal manufacturing and becoming just a final assembly company, that is what our car manufacturers became from 1993 onwards, just a final assembly destination.

hardy the stuff of innovation.

that is why all of the talk of a industrial policy is mostly by people who are neo-liberals, befuddled as to why free trade and markets are not working.

china makes every, that is a industrial policy that has created robust supply chains.

what china can do is turn off the spigot of parts to western financialized auto makers. and the WHINE will be so loud, it will echo out to pluto.

then china gets the u.s. markets, tariffs, or no tariffs.

Dr Evil Airquotes “Full Self Driving” is a bunch of smoke, mirrors & hype in no particular order.

The Semi tractor was promised quite awhile back and they are now just building the line to make them in a new building in Sparks NV. The early accounts of the Alpha build trucks in service PepsiCo/FritoLay in central California are promising. I’m watching closely to see how they perform in regular full high intensity use versus the competition. Even if it’s a solid product they will have to fight hard for market share vs Volvo, Freightliner and Paccar. Volvo and Freightliner already have thousands of their large truck EVs running in regular service.

Only real unknown in the valuation of Tesla is the supercharger network.

The

FSD, whether we believe it or not, is one technological advantage Tesla has over Chinese EV’s. Tesla has years of driving data and R&D on this, at least a decade of lead time and competitors are starting from scratch, have maybe 5 years I would guess.

The first automaker to achieve full FSD will take a big slice of market share for that feature. And clearly for the automakers the stakes are very high – it’s get there or die. American hostility to EVs (and in particular to Tesla and/or Musk) might mean China gets there first. This is one key advantage Chinese EV makers have over Tesla, that general Chinese cultural embrace of new technology vs American inbred fossilism.

At the moment we have no reason to believe Tesla is not in the lead, is not edging toward it, won’t get there first, nor that it’s technologically impossible. Tesla owners can see with their own eyes what their cars are sensing and doing, for them its within reach, they’re not putting air quotes around it.

I do wonder, though, if that China tech embrace against American fossilism and EV hostility makes China look like a path of least resistance and also the surest path to FSD success. Could Tesla pull out of the US and move to China? How feasible is this?

(And it’s rather looking like a dream homeland for any kind of tech corp.)

However, FSD is potential or intrinsic value, not actual or projected. Correct me if I’m wrong, but that P/E is saying Tesla can dramatically lower its prices and still be quite profitable? Its looking at production, materials and manufacturing costs versus profits. Take $10k-20K off the prices and the P/E is still in quite positive territory, right?

Musk is an idiot about most things outside his wheelhouse (which is most things) but his particular undeniable genius is in systems design and process efficiency, which means the fundamentals will be good and analysts want the fundamentals.