By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

The DOGE people in the Trump administration are considering shedding a big portion of the massive office space that the government owns or leases nationwide, managed by the General Services Administration (GSA), including selling two-thirds of the office space the government owns and terminating three-quarters of the leased office space, according to the WSJ.

Much of this office space is vacant or underused and poorly maintained due to lack of funding, according to GSA testimony before Congress in 2023, cited by the WSJ, which further noted:

“A recent report from Sen. Joni Ernst, a Republican from Iowa who chairs the Senate DOGE caucus, found that not one of the headquarters for any major agency or department in Washington is more than half full. GSA-owned buildings in Washington, D.C., average about a 12% occupancy rate. The government owns more than 7,500 vacant buildings across the country, and more than 2,200 that are partially empty.”

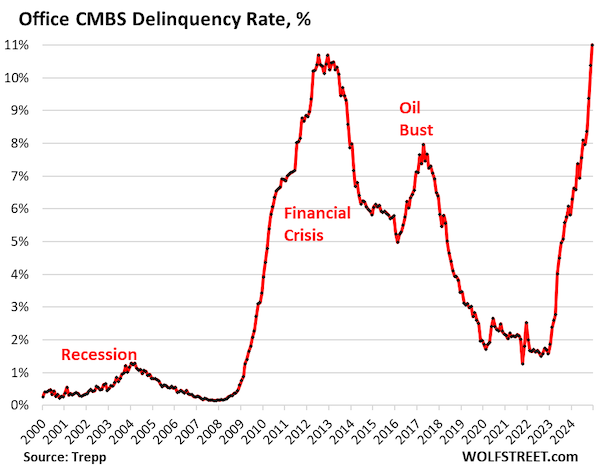

The office sector is already in a depression, with default rates that exceed those during the worst moments of the Financial Crisis. Putting this inventory on the market for sale is going to weigh on the already collapsed prices of older office buildings – prices of 50-70% below the last sale before the pandemic are now common.

And terminating leases is going to stress office buildings, their landlords, and their lenders even more, likely entailing more defaults and foreclosure sales. This is a much needed but very bitter medicine to alleviate government waste.

What Office Landlords and Their Lenders Are Facing

Here we look at the leased office space, where those buildings are, and what portion of the leased space the GSA has the right to terminate in 2025, and also through 2028 (Trump 2.0), based on an analysis from Trepp, which tracks commercial real estate debt and CMBS.

- GSA leases 149 million square feet (msf) of office space around the US.

- GSA pays $5.2 billion in annual rent to private-sector landlords.

- Through 2028, GSA has the right to terminate 53.1 msf of leases, or 35.5% of its leased space, spread over 2,532 properties.

- In 2025, GSA has termination rights on 21.2 msf spread over more than 1,000 properties,

- If GSA terminates all possible leases during Trump 2.0, it would save the government $1.87 billion in annual rent after 2028.

- In the vast Washington DC metro, GSA leases nearly 10% of the entire office market, 35.8 msf in 446 buildings, and can terminate 9.6 msf of that in 2025.

- In the Washington D.C. metro, GSA currently pays $1.47 billion in annual rent.

- GSA leases nearly 6% of the office space in the Kansas City metro (DoD, USPS, Treasury, VA, and USDA), 4.3 msf, of which it can terminate 1.0 msf in 2025.

Here are the top 10 metros in terms of government office space. GSA leases 66.3 msf of office space in them and has termination rights in 2025 on 18.9 msf (28.5%):

| Metropolitan area | Number of buildings | Office space msf |

% of total market | Annual Rent, Million $ | Space with termination rights in 2025, msf |

| Washington DC | 446 | 35.8 | 9.7% | $1,470 | 9.59 |

| New York City | 223 | 5.0 | 0.7% | $249 | 1.53 |

| Hagerstown-Martinsburg | 60 | 4.8 | N/A | $210 | 1.58 |

| Kansas City | 78 | 4.3 | 5.8% | $99 | 1.03 |

| Philadelphia | 124 | 3.0 | 2.9% | $97 | 0.71 |

| Atlanta | 90 | 3.0 | 1.9% | $68 | 1.35 |

| Los Angeles | 168 | 3.0 | 1.0% | $134 | 1.04 |

| Dallas-Fort Worth | 86 | 2.8 | 1.4% | $82 | 0.57 |

| Chicago | 113 | 2.4 | 1.0% | $92 | 0.93 |

| Denver | 74 | 2.3 | 2.3% | $77 | 0.58 |

| Total | 1,462 | 66.3 | $2,576 | 18.9 |

Office CRE Would Be Stressed Enough Without This

The office sector of commercial real estate is in a depression, and office debt just keeps getting worse: The delinquency rate of office mortgages across the US that have been securitized into commercial mortgage-backed securities (CMBS) spiked to a record 11% at the end of 2024, blowing by the Financial Crisis peak, having exploded over the past 24 months from an everything-is-just-fine 1.6% at the end of 2022, to a disastrous 11.0% at the end of 2024.

The motto in 2024 was “survive till 2025” via extend-and-pretend. But now it’s 2025, and here comes the government’s vacant office space.

In the early to middle 1990’s, the US government went about closing military bases and or decommissioned military installations across the country. This looks to be a highly comparable moment in time, but for this current era the deficit is much worse while the national debt has only ever gone higher ( no matter what the out of power party says on the matter )…

Closing up under utilized office buildings, whether that space is owned or leased seems like pretty low hanging fruit. I’m sure the lenders can appropriately adjust with the times.

Adding in that absent any best approach ( banks, or lenders and fixed income investment portfolios ) there can be put into play the bust out move ala from Goodfellas…\Sarc

The other day Trump ordered every Federal worker to go back to the office in person, pandemic be damned. Did he do this to offset even by a little the effect of all those rentals coming onto the market by having those workers back in their offices?

The “back to the office” order seems to be at odds with the ” selling two-thirds of the office space the government owns and terminating three-quarters of the leased office space”. Maybe Musk wants to market the office space as “fully staffed”?

The titans of PE woke up with twisted knickers this morning, heh heh.

Back to the office is to get feds to bend the knee and/or quit.

Perhaps after the purge they’ll allow telework for those feds that remain or consolidate them into fewer buildings.

Good point. All stick, no carrot.

They’ll be replaced by Murikan AI chat bots (serviced on the back end by Indian engineers).

Fewer than a fifth of the workers in [the Office of Personnel Management]’s database – about 449,500 – “ work in DC, MD, and VA. A comparable number work for the VA – presumably all across the country (though I think property management is within the VA, not part of the GSA numbers referenced in this post). In any case there will be some challenges consolidating the “feds” in fewer buildings.

https://www.pewresearch.org/short-reads/2025/01/07/what-the-data-says-about-federal-workers/

How many office buildings are in pension or insurance company portfolios? The fallout could be widespread.

I suspect that the more senior you are in the new Administration, the less time you will spend in your office. That’s probably been true for decades, if not since the days of George Washington. So why shouldn’t others be able to work from wherever they have a good wifi connection?

Technically of course the President’s office travels with him. Trump will continue to play a lot of golf, if his first term is any indication, and will spend time at Mar-a-largo. It would still be interesting if someone could track how much time he spends in his White House office.

The mandates of neoliberalism and crony capitalism are in play. Terminate the leases to crash property values. Cronies buy the properties at fire sale prices (if they haven’t already done so). Federal workers are forced back to the offices creating artificial demand by presidential proclamation. Lucrative new long-term lease agreements are signed with the cronies. Ah, the wondrous workings of the free market, in response to the unpredictable changes in economic conditions.

These aren’t good old Edifice Wrecks, they are Fedifice Wrecks.

That’s a dad joke, a mom joke, AND a grandmom joke.

Throw in the Pentagon and it’s also a Dod joke.

You can’t have everything, where would you put it all?

DOGE might consider requiring all vacant buildings remove their entrance doors, in a nod to the homeless crisis. With NYC at the 2nd top of the vacancy list, that might put us closer to a real “Escape from New York” in real time.

Perhaps p diddy could have his sentence commuted to assume the office of ‘duke of new york’?

Won’t somebody think of the rentiers? /sarc

Look at those annual rent savings!

$56 million

$39 million

We’re gonna close that $35 trillion deficit in only a couple centuries.

PT Barnum is just distracting you again.

Here’s the Trump Revolution in three steps:

1) Gulf of America

2) a tax cut for Jeff Bezos

3) That’s it.

Closing office space has an advantage in that if the employees’ new location is in the commuting area they have to either suck it up and accept that or resign. If outside, the gov’t may need to PCS them, but again a percentage won’t be willing to move.

How do the lines of power and command work and flow? Does DOGE have any real power here? Is President Musk indeed the true real President?

If he decrees that X-amount of office base be shed, can he give the order and ‘make it so’? Perhaps President Musk’s brain-control engineers are even now working on a meme featuring Captain Picard with the face of President Musk saying ” Make it So.”

A naive question: Why are what appear to be important problems in the real estate market not reflected in the values of REIT indexes?

S&P United States REIT

https://www.spglobal.com/spdji/en/indices/equity/sp-united-states-reit/?currency=USD&returntype=T-#overview

Well, federal buildings are a relatively small part of REIT holdings?

Can you imagine the dent we could make in the housing crisis if we had an actual government that cared?

I know office buildings usually don’t convert to apartment buildings very well, but the feds have infinite resources. Just knock it down and hand it off to housing developers as greenfields.

Lots of continuing talk by both parties about the inefficiencies of government but never any actual figures that prove it.

The government provides service and if you look at how the private sector provides services, it doesn’t the creator of the problem then passes the service to a third party that generally does a botched job.

In transport, just look at the airline industry compared to other transport from the cities