Yves here. We’ve mentioned in passing how the spike in city center commercial vacancy rates was a crisis in the making for urban budgets. First, at some point, the new market reality of lower occupancy equating to lower values would cycle through to tax assessments and tax receipts, particularly in cases where owners turned over the properties to creditors. Second, many cities have their own sales taxes on top of state sales taxes; these will be down due to fewer people in downtown areas during the work day and a resulting fall in retail business. Third, the fall in in-person activity and habituation to Zoom meetings has almost certainly cut into business travel, and with it, those juicy hotel-specific sales taxes, as well as meals and entertainment while on the road.

This article usefully walks through the elements of the already-in-process squeeze, from a cost as well as revenue perspective.

By John Rennie Short, Professor Emeritus of Public Policy, University of Maryland, Baltimore County. Originally published at The Conversation

Five years after the start of the COVID-19 pandemic, many U.S. cities are still adjusting to a new normal, with more people working remotely and less economic activity in city centers. Other factors, such as underfunded pension plansfor municipal employees, are pushing many city budgets into the red.

Urban fiscal struggles are not new, but historically they have mainly affected U.S. cities that are small, poor or saddled with incompetent managers. Today, however, even large cities, including Chicago, Houston and San Francisco, are under serious financial stress.

This is a looming nationwide threat, driven by factors that include climate change, declining downtown activity, loss of federal funds and large pension and retirement commitments.

Why Cities Struggle

Many U.S. cities have faced fiscal crises over the past century, for diverse reasons. Most commonly, stress occurs after an economic downturn or sharp fall in tax revenues.

Florida municipalities began to default in 1926 after the collapse of a land boom. Municipal defaults were common across the nation in the 1930s during the Great Depression: As unemployment rose, relief burdens swelled and tax collections dwindled.

In 1934 Congress amended the U.S. bankruptcy code to allow municipalities to file formally for bankruptcy. Subsequently, 27 states enacted laws that authorized cities to become debtors and seek bankruptcy protection.

Declaring bankruptcy was not a cure-all. It allowed cities to refinance debt or stretch out payment schedules, but it also could lead to higher taxes and fees for residents, and lower pay and benefits for city employees. And it could stigmatize a city for many years afterward.

In the 1960s and 1970s, many urban residents and businesses left cities for adjoining suburbs. Many cities, including New York, Cleveland and Philadelphia, found it difficult to repay debts as their tax bases shrank.

In the wake of the 2008-2009 housing market collapse, cities including Detroit, San Bernardino, California, and Stockton, California, filed for bankruptcy. Other cities faced similar difficulties but were located in states that did not allow municipalities to declare bankruptcy.

Even large, affluent jurisdictions could go off the financial rails. For example, Orange County, California, went bankrupt in 2002 after its treasurer, Robert Citron, pursued a risky investment strategy of complex leveraging deals, losing some $1.65 billion in taxpayer funds.

Today, cities face a convergence of rising costs and decreasing revenues in many places. As I see it, the urban fiscal crisis is now a pervasive national challenge.

Climate-Driven Disasters

Climate change and its attendant increase in major disasters are putting financial pressure on municipalities across the country.

Events like wildfires and flooding have twofold effects on city finances. First, money has to be spent on rebuilding damaged infrastructure, such as roads, water lines and public buildings. Second, after the disaster, cities may either act on their own or be required under state or federal law to make expensive investments in preparation for the next storm or wildfire.

In Houston, for example, court rulings after multiple years of severe flooding are forcing the city to spend $100 million on street repairs and drainage by mid-2025. This requirement will expand the deficit in Houston’s annual budget to $330 million.

In Massachusetts, towns on Cape Cod are spending millions of dollars to switch from septic systems to public sewer lines and upgrade wastewater treatment plants. Population growth has sharply increased water pollution on the Cape, and climate change is promoting blooms of toxic algae that feed on nutrients in wastewater.

Increasing uncertainty about the total costs of mitigating and adapting to climate change will inevitably lead rating agencies to downgrade municipal credit ratings. This raises cities’ costs to borrow money for climate-related projects like protecting shorelines and improving wastewater treatment.

Underfunded Pensions

Cities also spend a lot of money on employees, and many large cities are struggling to fund pensions and health benefits for their workforces. As municipal retirees live longer and require more health care, the costs are mounting.

For example, Chicago currently faces a budget deficit of nearly $1 billion, which stems partly from underfunded retirement benefits for nearly 30,000 public employees. The city has $35 billion in unfunded pension liabilities and almost $2 billion in unfunded retiree health benefits. Chicago’s teachers are owed $14 billion in unfunded benefits.

Policy studies have shown for years that politicians tend to underfund retirement and pension benefits for public employees. This approach offloads the real cost of providing police, fire protection and education onto future taxpayers.

Struggling Downtowns and Less Federal Support

Cities aren’t just facing rising costs – they’re also losing revenues. In many U.S. cities, retail and commercial office economies are declining. Developers have overbuilt commercial properties, creating an excess supply. More unleased properties will mean lower tax revenues.

At the same time, pandemic-related federal aid that cushioned municipal finances from 2020 through 2024 is dwindling.

State and local governments received $150 billion through the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act and an additional $130 billion through the 2021 American Rescue Plan Act. Now, however, this federal largesse – which some cities used to fill mounting fiscal cracks – is at an end.

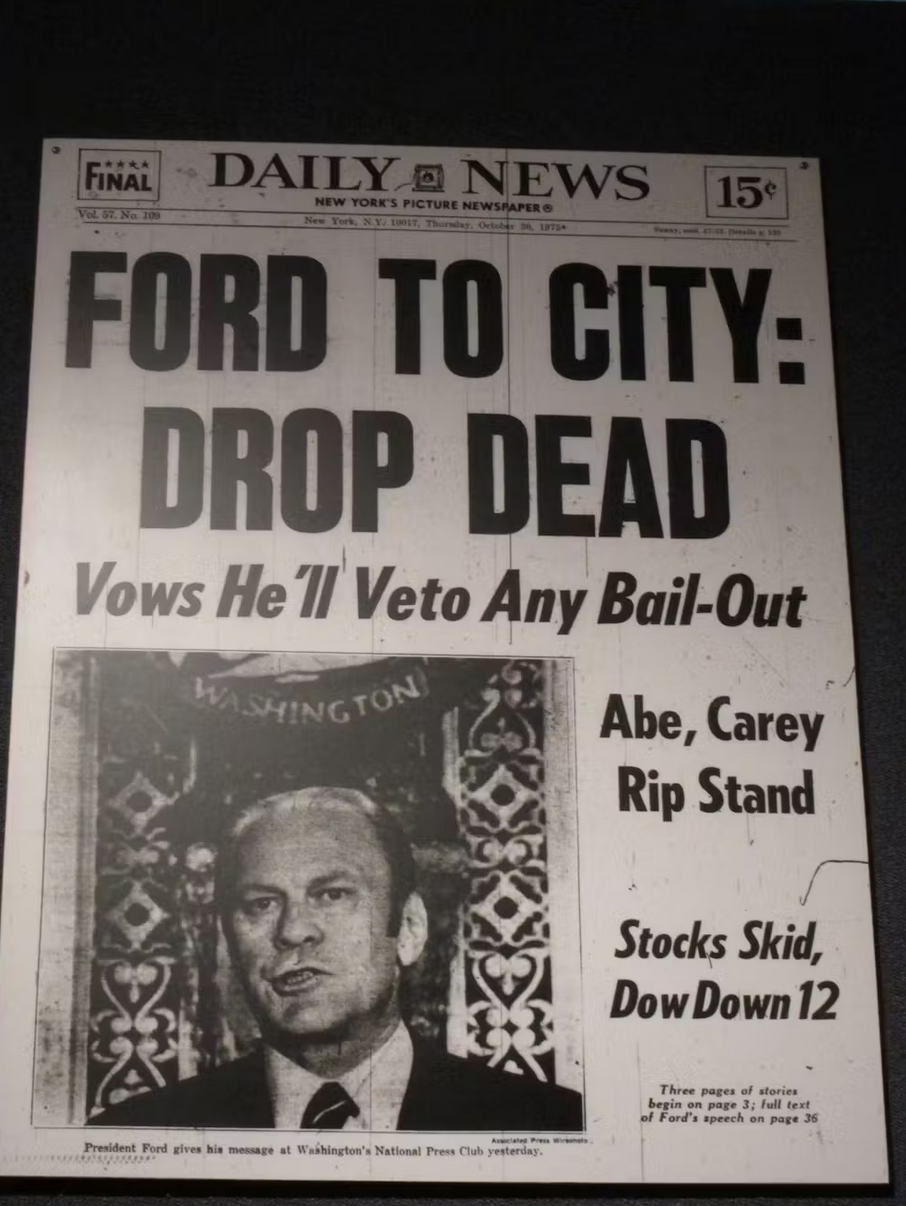

In my view, President Donald Trump’s administration is highly unlikely to bail out urban areas – especially more liberal cities like Detroit, Philadelphia and San Francisco. Trump has portrayed large cities governed by Democrats in the darkest terms – for example, calling Baltimore a “rodent-infested mess” and Washington, D.C., a “dirty, crime-ridden death trap.” I expect that Trump’s animus against big cities, which was a staple of his 2024 campaign, could become a hallmark of his second term.

Resistance to New Taxes

Cities can generate revenue from taxes on sales, businesses, property and utilities. However, increasing municipal taxes – particularly property taxes – can be very difficult.

In 1978, California adopted Proposition 13 – a ballot measure that limited property tax increases to the rate of inflation or 2% per year, whichever is lower. This high-profile campaign created a widespread narrative that property taxes were out of control and made it very hard for local officials to support property tax increases.

Thanks to caps like Prop 13, a persistent public view that taxes are too high and political resistance, property taxes have tended to lag behind inflation in many parts of the country.

The Crunch

Taking these factors together, I see a fiscal crunch coming for U.S. cities. Small cities with low budgets are particularly vulnerable. But so are larger, more affluent cities, such as San Francisco with its collapsing downtown office market, or Houston, New York and Miami, which face growing costs from climate change.

Pacific Northwest told me thatnthese difficult circumstances, politicians need to be more frank and open with their constituents and explain convincingly and compellingly how and why taxpayer money is being spent.

Efforts to balance city budgets are opportunities to build consensus with the public about what municipalities can do, and at what cost. The coming months will show whether politicians and city residents are ready for these hard conversations.

Another reason for the problems seems to parallel the UK experience. Years ago “unitary authorities” were created, allowing cities like Nottingham to effectively secede from their parent county (in that case Nottinghamshire). The stated reason was “better democracy” (yeah right), because supposedly people didn’t know whether particular services were provided by the city council or the county council etc.

In practice it created the problem that schemes like insurance are meant to solve (risk pooling or in this case a new lack of it). Nottingham city boundaries are wayyyyy too restrictive anyway (about half of metropolitan nottingham lives outside Nottingham proper and in one of the borough councils of Nottinghamshire). Nottingham city residents are poorer and in greater need of state-funded services. Thus it was no surprise when Nottingham was recently one of the cities that effectively went bankrupt.

Flight from the city has now finally become flight from the suburbs and even some of the local borough councils (which form a ring donut around Nottingham city) are getting into trouble. The latest kerfuffle around here is whether the borough councils should be abolished and risk pooling be restored via a “super council” of effectively all of Nottingham that isn’t officially Nottingham. Of course this is bogged down in calculations about which party would end up in the majority since some sections of the donut are still Tory, some are solidly Labour and others could very easily end up Remain (since we’ve watched in fascinated horror the mess that has happened in Ashfield, whose MP, Lee “30p” Anderson, and his mates have demonstrably ruined the borough via mismanagement with half of the councillors ending up in court and the leader’s trial to begin on Monday.

Correction: Reform not Remain.

Nottingham went bankrupt because of a crazy green power scheme, plus the council is full of incompetent workers who need doging.

References please. Nottingham has been turning from blue to red since the high water mark of Thatcherism in the mid 1980s, massively predating any energy changes. I remember a mid-point point at which Labour and the Conservatives had equal number of seats on Nottm city council around 1987; the casting vote was held by OUR local councillor, a guy who unashamedly got elected as a Communist (then as a Green when the Wall fell). He told Labour they should never count on his vote, he was interested in improving the city and would vote according to conscience. Best period of Nottm governance in yonks.

Then neo-liberalism went into overdrive, formerly respectable suburbs went down the toilet due to reduced central govt funding – do NOT accuse local councillors of being the sole antagonists when a HUGE proportion of local govt spending came from CENTRAL govt, making the ability of councils to raise money (via the 25% ish amount they had control over via council tax very difficult to adjust when people can’t pay).

TBH you don’t sound like someone who knows the city at all. We re-introduced trams, have consistently had the best independent bus service in the UK for years (thanks to resisting Tory Stagecoach and FirstBus) and though I do indeed find the Labour super-majority on the Labour city council worrying, Nottingham was indisputably on the up until very recently when major Tory-sponsored companies looking for quick buck (look up Intu) pulled out.

Your comment reads like exactly the type of comment Yves wanted rid of during the comment hiatus. 2 minutes will establish the INTU fiasco, how public transport in Nottingham is still brilliant etc. Dont make shit up. Plus how on earth can you claim crazy green power schemes when I’ve already told people that Nottm is fractured: the ridicuously small city Council plus overly powerful borough councils mean you’re gonna have to do a LOT better in backing up your point than a random comment.

If you want to legitimately criticise what is going on in “proper nottingham” how’s about asking how TEN barbers/nailshops survive on the main entry point to the city centre. They have virtually NO custom and there is NO way a single one is economically viable. Look up YouTube videos about “money laundering” to understand how these companies can possibly be surviving. My favourite barber more or less admitted to me misdeeds and asked “Why did the EU allow us Eastern Europeans enter the EU with our corruption?” before his (much cleverer) wife told him to STFU. Personally I liked him cause he he took time to give a good cut but I knew his fee was uneconomic.

Try again.

Terry, don’t feed the trolls. Yves and company do a great job keeping them out, but they still occasionally get through.

Not from the UK but appreciate your description of Nottingham’s problems regarding the many layers of government. Reminds my of my city, St. Louis, Missouri, which divorced from its county in 1875 and now operates parallel City and County offices within the same 66sq miles. St. Louis County later split into ~85 different municipalities post-WWII (mainly to keep out black folks that migrated North to the city post-Civil War, some still have racial covenant in their articles of incorporate).

This ridiculous system of non-governance incentivizes these little fiefdoms to cannibalize each other for economic development while preventing any significant regional reform or coordination. Many of the smaller Munis will eventually be forced to merge and/or disincorporate per the forces described in the article, but I think our fair City-proper will make it through. When times are good in the rest of the US, they’re never as good in St. Louis, and vice versa during bad times. I suppose this is the value in municipal mediocrity.

Should it be plunge in occupancy rates, or explosion of vacancy rates?

Aiees, yes, I had not wanted the word “vacancy’ in two sentences running and didn’t fix the rest of the sentence after the revision.

The article fails to mention how bad city government and bad policy choices/decisions influence the current city fiscal crises. Disappointing.

Not like they, insert favorite s**thole city here, haven’t had decades to figure out that they are the problem! There are many factors, and an overarching one of political malfeasance and incompetence.

Add in a recession, too (the number of small business people – restaurant owners, small furniture store owners, certain craftsman – I’ve talked to in the last six months who’ve told me that business has been seriously declining for the last six months is alarming – and you’ll have a general slow down across the board for cities and states alike.

It’s an issue in small towns, too. I live in an “exurb” of Athens, Georgia (a University town if there ever was) and the county and town have been in a boom for 20 years (one of the poorest in the state 50 years ago) as folks realized they could work from home more, the university faculty decided to move away from the problems of Athens, Georgia for their school age kids, and our school system became one of the best in the state (whether by admin/teachers or self selecting populace for two parent, highly invested in parenting, and wealthy families is not a subject that makes me popular with the county school board, sigh). I am sure developers looked at the county based on a spreadsheet of average income and school statistics and flooded the county. As a result we have multiple car washes, storage facilities, fast food locals, office developments (1/2 full it seems despite more coming in each year), and strip malls / urban town centers that have been developed. The city government (population 3,000) went on a spending spree, taking a city coffer from approximately $6 million saved up (over decades of stewardship by the previous generation of farmers who ran it) and an operating budget of like $500,000 annually to an operating budget of almost $3 million annually and $7 million in long term debt (in less than 8 years!) to pay for new city buildings and parks.

Worst part is almost all of the financing for this development has come from one local bank. I do NOT see this ending well for either the town citizens or the local bank if this down turn continues.

Ah, yes, I know the place well! And well remember riding my bicycle in that peaceful countryside in the 1970s and 1980s, now the perfect example of suburban sprawl and white flight that will eventually collapse in on itself. I currently live in a similar medium size city with the same problems, except the surrounding public school systems only think they are superior.

Lore is the University of Georgia was established in Athens because your little town had a tavern as early as the 1790s, now preserved as a landmark.

such as San Francisco with its collapsing downtown office market, the Millennium Tower should collect royalties for being a real time metaphor.

First sentence after “Yves here” is suffering a sort of double negative muddle.

Covid-induced work-from-home should’ve been addressed more.

Same w/regional tourism hit by the double whammy of Covid lockdowns and post-Floyd riot fall-outs.

When people didn’t/couldn’t drive 2 hours to Chicago or St Louis for a weekend, they found other things to do and those alternatives stuck.

All hail the “Edifice Wrecks” as fellow commenter Wukchumni coined as a term of art.

I still observe too much optimism (hopium) here in the sun belt. Evidence exhibit A – an AJC article that interviews local brokers who think that the past 5 years were just a fever dream, and everyone is going to just go back to the office like it’s 2019.

De-paywalled link

I have a friend who works for EPA, and didn’t take the buyout … it’s back to the 5-day a week grind starting next month. The problem for the real estate jockeys is that the Federl presence here overall is pretty small … it may help locally right around Georgia State U. But overall, these guys have hit the hopium pipe pretty hard.

Looks like back to limited operating hours for the MLK and Sam Nunn skatepark. Here’s some fun and impressive skate video shot at Hot-Lanta’s 4 and 5 block.

From what I can see in the video, Atlanta parks dept.must have a huge budget contingency for injury lawsuits. (No warning signs declaring appropriate injury protection required.)

I believe “unsanctioned” is the liability defense.

I haven’t been back to Atlanta for awhile but by most accounts it is now even more of a traffic nightmare as the “new urbanism” has drawn more residents into the core area while options for expanding the already giant freeways are limited. My own small city is part of this trend as the downtown–emptied out in the late 20th–is now revived via younger people seeking an urban lifestyle amid zealous city govt efforts to encourage this. Some of us question whether these efforts are ultimately likely to succeed.

All of which is to say that this “crisis of the cities” is, as the article says, not at all new and the coming of the digital age may be a new excuse to flee the crowding just as malls and big box stores (and white flight without a doubt) did fifty years ago.

Perhaps all the empty office towers can house the homeless. Isn’t NYC already trying this?

Traffic has been really awful lately … adding some more federal workers commuting 5 days a week to the Sam Nunn building won’t help; possibly offset by the CDC firings, though.

I drive downtown 3 nights a week, against the heaviest flow and it can take over an hour (with no traffic, 20-30 mins.)

This analysis rather needs to be differentiated between old cities and “new” Sunbelt cities. Many Sunbelt cities have significant suburban sprawl contained within the titular municipal limits and much office development in suburb municipalities. Think Dallas (lots of sprawl) vs. Plano (lots of HQs) and Arlington (even has its own HQs), and so on. Heck, property taxes don’t even fund city government in every state’s fiscal structure (being instead tied to school and county government). Can the article’s predictions of doom really apply to Sunbelt cities like Atlanta and Phoenix with equal force as Chicago?

Um, Atlanta is in the process of losing a large portion of 32,000 well paid jobs due to CDC whackage.

And this projection was before Trump took office:

https://civicatlanta.org/blog/2024-12-15-projected-city-budget-deficit

Atlanta’s vacancy rate for office is 33% – source Wolfstreet.com

No, being in the sunbelt isn’t going to save you. I notice that there are pockets of higher occupancy in the newest, fanciest “LEED certified” type of construction, mostly in mid-town and near the Braves Stadium (Cobb County.) This is what the brokers are placing hopes on – Trophy class “A” office space.

But the older stuff is a complete train wreck. There are dozens and dozens of vacant older stock office parks in the northern ‘burbs, with “For lease” signs that have been up since before COVID. I suspect these will need to be bulldozed or re-purposed to stop the negative absorption.

Local governments around here don’t seem fiscally stressed, yet, Keep in mind that CARES act funding only dried up last year, and tax assessments could be using “mark to fantasy” values.

Correction – by local governments I mean Cobb County. I pay attention to the local board of commissioners meetings and am active in some local groups watching the funds.

I can’t speak for Gwinnett County or other suburbs, but note Yves data on the city of Atlanta. I would guess that they are suffering more from downtown being hollowed out.

What did Cobb County “contribute” to the new Braves stadium in some of the ugliest suburban sprawl in the nation? I seem to remember $400M…and an apocalypse of sorts for the politicians who went all-in on that ridiculosity for the team that should now be known as the Cobb County Crackers.

Oh surely not that ugly. I used to live across the freeway from Smyrna.

Although I believe Smyrna girl Julia Roberts has said she never wants to go back.

Here in SC somebody is spending a bundle on a new minor league baseball venue. Hope it doesn’t flop and get dumped on the city.

There are some big differences in LEED for buildings. Yes, it’s the same standard for all, but some buildings get their cert credits by having modern building systems that work efficiently and others get their credits by installing a bike rack and having education programs. This is a case where not all buildings with the same advertised qualities are the same. Which is going to make price discovery in the market more difficult.

Speaking of Texas, didn’t that state offer incentives and credits to two enterprises led by Elon Musk, the world’s twitchiest man?

Isn’t the Texas Space X site an environmental nightmare with fires and garbage falling from the sky and no plans for clean-up. Makes you average stadium deal look like a bargain.

Don’t forget Nixon’s MMT-friendly “revenue sharing”, where federal money went to municipal governments.

Another factor that is common in many Canadian cities and I would assume American cities is aging infrastructure. A lot of places have vast amounts of old infrastructure that haven’t been maintained well or replaced due to fiscal restraints.

If it is anything like Australia the one that is flying under the radar is the water mains. Here the central ones are all about 100 years old and due for replacement but the funds and reserves were used to build traffic tunnels to hand off to people like Transurban, neo-liberalism in action.

We get regular huge leaks and sink-holes. Another one is the old dams which get stressed because they are held back in floods to protect houses built on floodplains and have to be run at 80% capacity afterwards with no remedial plan 10 years later. Next drought will sort out our cities bigly.

In addition to the above issues discussed, I am curious about the muni bonds, debt overhead and bond repayments putting a further squeeze on cities and towns. I recall reading some years ago about the controversial issue of “capital appreciation bonds” or “serial bonds” that have large balloon payments at the end of term.

As a result of this and the other factors, will we see even more bankrupt municipalities (and counties) in the coming years?

Back end loaded repayment is the current proposal in Chicago.

Critics stall final vote on Mayor Brandon Johnson’s $830 million bond issue for infrastructure projects

Here in Honolulu circumstances are a bit different as we don’t have “cities”. The state is divided into 5 counties (one of which, for historical reasons is run by the state Dept of Health). The current trend in downtown is to allow residential use and also a couple properties are being converted into hotels — this is new for us as for the longest time all hotels were forced into resort-zoned portions of the county.

When the county has budget issues the plan is always to have tourists pay the difference. Historically counties had to rely on property tax and a portion of excise (sales) tax from the state. That was broken a couple years ago as counties now have their own hotel room tax. So since the 90s the room tax has gone from 7.25% to 13.25%. We also have a “temporary” 0.5% addition to the state general excise tax for rail capital spending. The practice has been to keep residential property tax rate fixed, and allow increased appraisals to increase the tax.

Note that in Hawaii, public education is a state responsibility and the counties have no role in it. Much of the transportation infrastructure is also state (all harbors and airports and a good portion of the roads). Our biggest fiscal problem is a consent agreement entered into with EPA to upgrade the county sewage treatment system. That plus EPA mandates to remove all cesspools (this affects the other counties too).

There’s not much to do except predict which parts of the city will be hit the least in an extended budget crisis, lasting perhaps more than two decades. I picked an old street-car suburb close to the downtown with some old corner stores still remaining and some-what walkable historic business areas in biking range. This includes multiple grocery stores including a little Eastern European grocery.

So I got interesting places to visit, shop for food even if one or two groceries go bankrupt, and enjoy mostly ‘civilized’ life.

The upper middle class and wealthy that bought McMansions on the edge of the city are going to get struck down. Their homes are extremely impractical and will be hard to resell. They will be expensive to heat and cool. There will be zero public transportation and no walkability to fall back on. Once their roads begin to fall apart, the city will not repave them, if ever.

So, a reverse Detroit with outer neighborhoods collapsing first, with abandoned skyscrapers in the center.