By Matthias Kaldorf, Research Economist Deutsche Bundesbank, and Matthias Rottner, an economist at the Monetary and Economic Department at the Bank for International Settlements. Originally published at VoxEU.

Climate policies could affect financial stability if they lead to large changes in asset returns. This column studies the financial stability and welfare effects of such ‘climate Minsky moments’ using a novel quantitative macroeconomic model with carbon taxes and endogenous financial crises. An accelerated net zero transition aligned with the Paris Agreement temporarily increases the probability of a financial crisis, before resulting in a lower long-run crisis probability. However, the welfare losses are small relative to the real costs and benefits of the net zero transition. Therefore, ‘climate Minsky moments’ do not warrant delaying ambitious climate policy.

Mitigating climate change is one of the greatest challenges facing economic policy over the coming decades. Achieving a path of carbon emissions that is consistent with the Paris Agreement of keeping the global temperature increase below 2°C requires a large-scale shift to emission-free technologies. Since many of these technologies are either less productive than their fossil-dependent alternatives or involve substantial adoption costs, the net zero transition is characterised by a reduction in aggregate asset returns. If the resulting losses of the financial sector are substantial enough, they might trigger a systemic financial crisis – a ‘climate Minsky moment’ in the words of Mark Carney (2015).

Assessing the financial stability implications of climate policy is necessary to appropriately account for all benefits and costs of the net zero transition. However, the current debate on the financial sector’s role during the net zero transition largely focuses on banks’ credit supply (Sastry et al. 2024, Hale et al. 2024) and the stress-testing of individual institutions (Alessi et al. 2023, Reinders et al. 2023). Thus, the discussions overlook the wider systemic dimension embodied by climate Minsky moments. Against this background, in a recent paper (Kaldorf and Rottner 2024) we develop a nonlinear quantitative macroeconomic model with endogenous financial crises and climate policy. Employing our novel framework, we evaluate how climate policy consistent with the Paris Agreement affects financial stability, macroeconomic aggregates, and welfare, both in the short and long run.

Financial stability decreases in the short run when the economy shifts unexpectedly to an ambitious carbon tax path aligned with the Paris Agreement. In response to such a negative shock, financial intermediaries face deleveraging pressure which induces them to sell assets quickly, potentially at fire sale prices. The likelihood of a systemic financial crisis increases. However, climate policy is not detrimental to financial stability in the long run. Climate policy reduces long-run capital accumulation and the accumulation of excessive financial sector leverage, which makes systemic financial crises less likely. Thus, the net financial stability effect depends on the social discount rate.

Importantly, our framework also speaks to the quantitative relevance of climate Minsky moments in comparison to the real costs and benefits of a transition to net zero. Specifically, we demonstrate that the welfare losses associated with climate Minsky moments are at most second-order when compared with the welfare cost of adopting clean technologies. Our results suggest that financial stability considerations do not decisively alter the basic climate policy trade-off: productivity losses due to stringent carbon taxes versus gains from reducing global surface temperatures.

Financial Stability along the Transition to Net Zero

We develop a nonlinear quantitative macroeconomic model with two key features. First, the financial sector is run-prone in the spirit of Diamond and Dybvig (1983). Specifically, the possibility of a systemic run on the financial system is fully endogenous and depends on the macro-financial environment. Based on the seminal work by Nordhaus (2008), the production sector generates carbon dioxide emissions, which are subject to carbon taxes, and can invest into emission abatement. We then evaluate how climate policy consistent with the Paris Agreement affects financial stability, macroeconomic aggregates, and welfare, both in the short and long run.

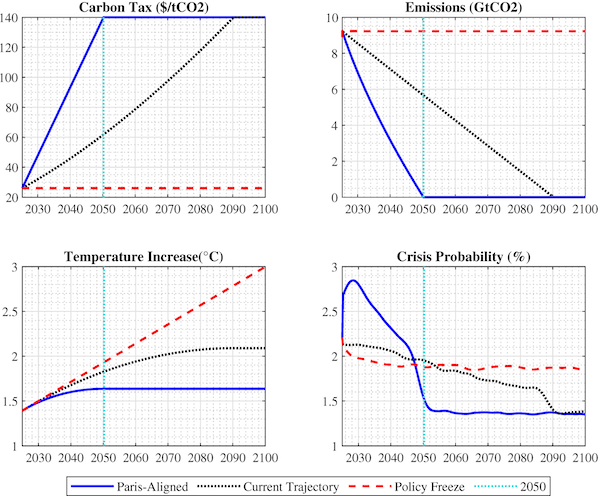

To quantify the financial stability effects of the transition, we compare the current climate policy trajectory to a stringent scenario aligned with the Paris Agreement. The current trajectory extrapolates the historical reduction in global emission intensities observed between 1990 and 2023. Under this trajectory, net zero would be reached in 2090 with a carbon tax of around $140 per ton of carbon dioxide ($/tCO2) and global temperatures would exceed 2°C by the end of the century. In contrast, the Paris-aligned transition assumes that climate policy suddenly shifts in 2025 to a steep tax path that reaches the full abatement carbon tax of 140 $/tCO2 already in 2050. As an additional reference point, we also consider a scenario in which the tax is frozen at its current level. These different carbon paths have substantial implications for emissions and temperature increases (Figure 1). The Paris-aligned path limits the temperature increase to 1.6°C, while they would increase by 2.1°C and 3.0°C on the current trajectory and the policy freeze, respectively.

Figure 1 Transition dynamics: Carbon taxes and crisis probability

Importantly, the different paths have a distinct impact on financial stability (lower right panel of Figure 1). The Paris-aligned transition comes with an elevated crisis probability in the early stages of the transition. The gradual but permanent increase in carbon taxes can render the initial financial sector leverage and size unsustainable. Specifically, the annualised crisis probability initially rises to slightly more than 2.8% in the Paris-aligned transition, up from 2.1% on the current trajectory. Thus, we observe a substantial increase in financial fragility at the outset.

The crisis probability then gradually declines to its new long-run level around 2050 for the Paris-aligned scenario, while the current trajectory converges around 2090. When assessing the implications for the long run, we show that permanently higher carbon taxes enhance financial stability. The reason behind this perhaps surprising result is that there is less capital accumulation in the long-run due to the carbon taxes. The financial sector is smaller overall and accumulates less excessive leverage, reflecting a positive relationship between capital accumulation and the demand for financial intermediation services.

Net Financial Stability Effect

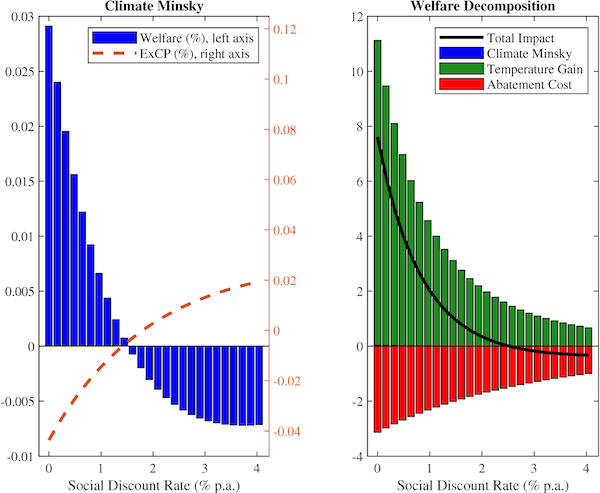

To determine the net financial stability effect of these opposing mechanisms, we introduce a metric of financial stability that summarises the crisis probability along different transition paths. The excess crisis probability is defined as the discounted difference between the crisis probability under the Paris-aligned transition and the current trajectory. As customary in the evaluation of climate policies, we allow for different social discount rates. The possibility of discounting future financial stability gains via the social discount factor puts different weights on the elevated crises probability at the outset versus the long-run stability gains.

The excess crisis probability is positive for sufficiently high social discount rates, as the elevated crisis probability in the short run triggered by increased carbon taxes dominates (see left panel of Figure 2). The turning point, where the excess crisis probability turns negative, occurs at a social discount rate of around 1.5% per annum. We identify a trade-off between climate policy and financial stability only for relatively impatient policymakers. Put differently, our analysis rejects the notion of an unambiguous trade-off between financial stability and climate policy objectives.

Figure 2 Welfare

Our non-linear model further reveals that the financial cycle is a crucial driver for climate Minsky moments. The build-up of macroprudential space or the implementation of climate policies during a period of strong financial fundamentals allows policymakers to substantially mitigate the risk of climate Minsky moments. The reason is that a resilient financial sector is better equipped to absorb the impact of a sudden shift to an ambitious climate policy path. This result informs the ongoing debate on macroprudential policy (Hiebert 2024) and bank capital regulation (Van Tilburg et al. 2022) in the context of transition risk.

The Welfare Relevance of Climate Minsky Moments

Using our structural model, we assess the welfare relevance of climate Minsky moments in comparison to the welfare effects associated with abatement costs and temperature increases. Note that the welfare gains of climate Minsky moments are inversely related to the excess crisis probability: a larger crisis probability is associated with welfare losses (left panel of Figure 2). However, our model suggests that the welfare effects of climate Minsky moments are dwarfed by the costs of switching to emission-free technologies and the benefits of curbing global warming. The right panel of Figure 2 highlights that the basic climate policy trade-off between short-run productivity losses associated with stringent carbon taxes (red bars) and long-run gains from a reduction of global surface temperatures (green bars) dominates. The welfare effects of climate Minsky moments (blue bars) are barely visible due to their small impact.

The effect of Paris-consistent climate policy on financial stability and welfare is robust across various modifications and extensions of our baseline model. These include technological change, alterations in the design of climate policy, and different assumptions regarding welfare losses from global warming.

Conclusion

In this column, we argue that climate policy is not necessarily detrimental to financial stability. Using a quantitative nonlinear macroeconomic model, we show that climate policy consistent with the Paris Agreement increases financial fragility in the short run but has a positive effect on financial stability in the longer run. Furthermore, the welfare effects of climate Minsky moments are at most second-order relative to the real costs and benefits of an accelerated transition. Our results challenge the notion that financial stability concerns justify delaying the net zero transition.