Yves here. While I appreciate the purity of Rob Urie’s argument, the prevalence of financiers as oligarchs depends on whether the economy is financialized. Trump hearts the robber baron era of the late 1800, where fur traders, whalers, and steel magnates. Even in the 1930s, electrification and the rise of related consumer goods, the growth of the auto industry, oil exploration and developments, and the rise of multinational companies were the main businesses of the top wealthy, and not banking.

As Simon Johnson described in his classic article, The Quiet Coup, in 1980, average pay for bankers was virtually identical to average pay all across the economy. It started its spectacular relative rise shortly thereafter.

By Rob Urie, author of Zen Economics, artist, and musician who publishes The Journal of Belligerent Pontification on Substack

The recently elected Trump administration is the most conspicuously oligarch-laden in recent history. Most of Mr. Trump’s senior advisors are oligarchs, which means that they have limited knowledge of the world that the rest of us inhabit. To suggestions that American democracy provided an alternative in 2024, Kamala Harris’s first stop on her way to the Democratic party nomination was to bend the knee to the oligarchs who control the Democratic party.

That the outgoing Biden administration thought that attacking oligarchs rhetorically would benefit the Democrats politically demonstrates a pathological incapacity for introspection. As argued below, most of the current crop of oligarchs owe their status to the resurrection of Wall Street carried out by Barack Obama and his administration. To the charge that there was no alternative, banking crises are as old as banks. There were lots of alternatives.

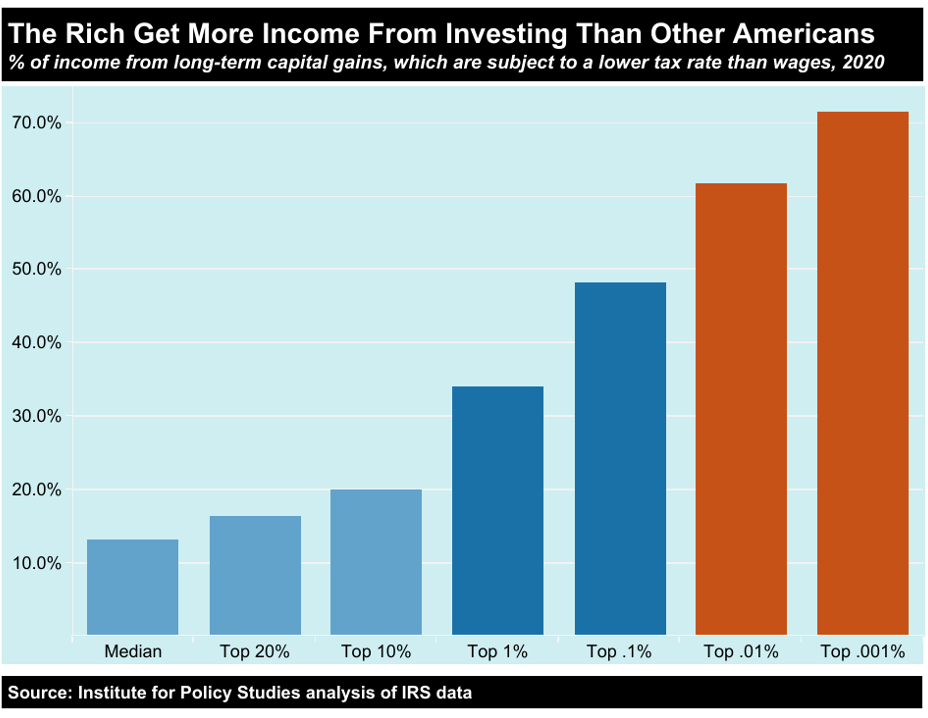

Graph: the link between finance capitalism and oligarchy is straightforward. Through theft, inheritance, and chance, oligarchs have tended to be those ensconced in the right chairs during epochs of finance capitalism. In the US, the proportion of wealth derived from financial markets perfectly rank-orders the wealth of today’s oligarchs. This renders the bipartisan American project to levitate stock prices in perpetuity the only ‘labor’ that the oligarchs perform. Source: inequality.org.

For instance, Sweden experienced a banking crisis in the early 1990s that was caused by self-dealing by Swedish bankers. The Swedish state assumed control of the banks, fired the culpable bankers, and segregated bank assets into good banks that were to survive and bad banks that weren’t. In contrast, the Obama administration restored the fortunes of culpable bankers, and even used bailout funds to pay banker bonuses. Mr. Obama saved his donors, not the ‘system.’

The social consequences of Mr. Obama’s actions go far toward explaining why Donald Trump is president. Between bailing out Wall Street and the Federal subsidies of the technology industry that flowed from doing so, urban economies recovered relatively quickly from the Great Recession, while the deindustrialized heartland was handed over to opioid addiction and suicide. The Federally subsidized distinction between urban and regional economies had the Democrats floating tech and Wall Street while leaving the heartland to rot. This is the very division that re-elected Donald Trump in 2024.

FDR (Franklin Delano Roosevelt), who created the New Deal in response to the Great Depression, was also born an oligarch. Following implementation of the New Deal, FDR was widely regarded as a class traitor by his fellow oligarchs. But a more constructive view of his reforms is between long and short-term planning. Europe succumbed to fascism as the Great Depression wore on. Adolf Hitler was appointed Chancellor of Germany in 1933, in the very pit of the Great Depression.

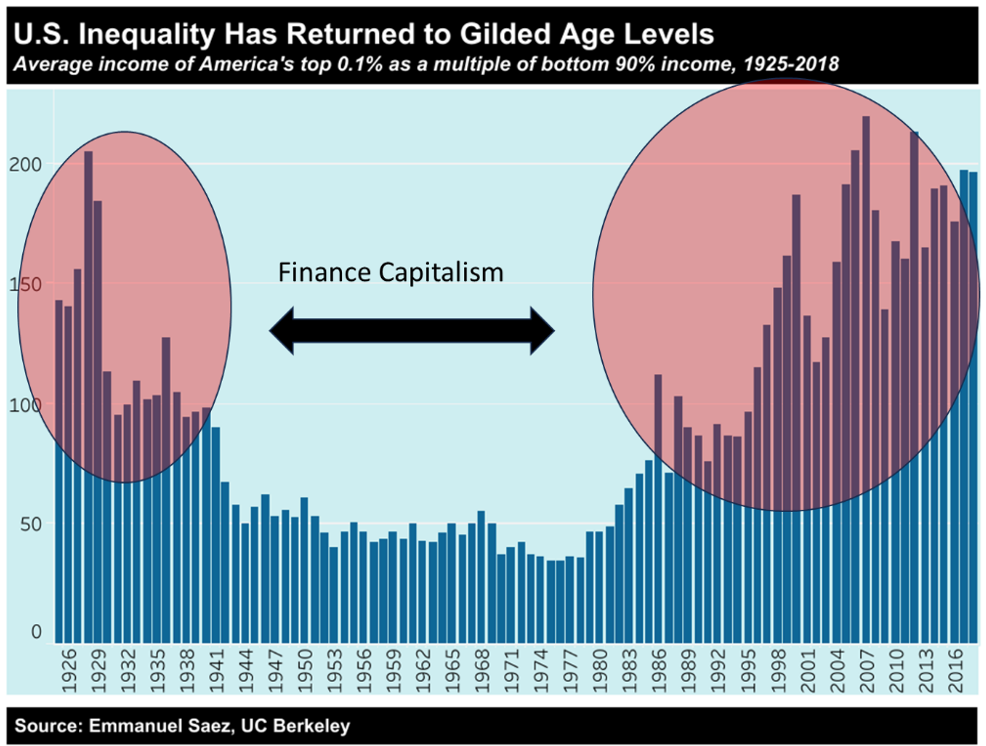

Graph: the two epochs of finance capitalism in the US ended in tears. The epoch of the 1920s ended with the Great Depression, the rise of European fascism, and WWII. The current epoch is still unwinding. Apparent ignorance of this history, or government capture by the oligarchs, led liberal technocrat Barack Obama to rebuild ‘the system’ after 2008. The result has been two elections of the only candidate promising to blow ‘the system’ up, with a full-blown racist genocide committed by liberal Democrats in between. Source: inequality.org, urie.

The US spent the subsequent decades allying with fascists, with the CIA hiring as much of the deposed Nazi leadership as it could accommodate (see here, here, here), while sending the rest to labor for American industry. Ex-Nazis taught torture to the US military and traveled with US-allied death squads to assassinate political leaders considered inconvenient to the interests of American oligarchs. Both of the wars that the US is currently engaged in (Russia and Israel) date to the end of WWII.

With oligarchs once again openly running the US, FDR neither redistributed the wealth of the robber barons (oligarchs) nor impinged on the tendency of American capitalism toward oligarchy. In other words, he saved the nation so that oligarchs could rule again. However, FDR’s time presented a very different set of historical circumstances. That the US was allied with the Soviets in WWII, and that they won the war, left the US with the only intact industrial base in the world.

With 70% of the wealth of the very rich coming from financial asset price gains (graph above), and most of the wealth of the lesser oligarchs coming from the same, the stock market bubble that has been fed and nurtured by the Federal government since the 1980s has stretched valuations to approximately 4x their starting point. What this means is that the financialized present is priced for perfection in circumstances that guarantee major disruptions.

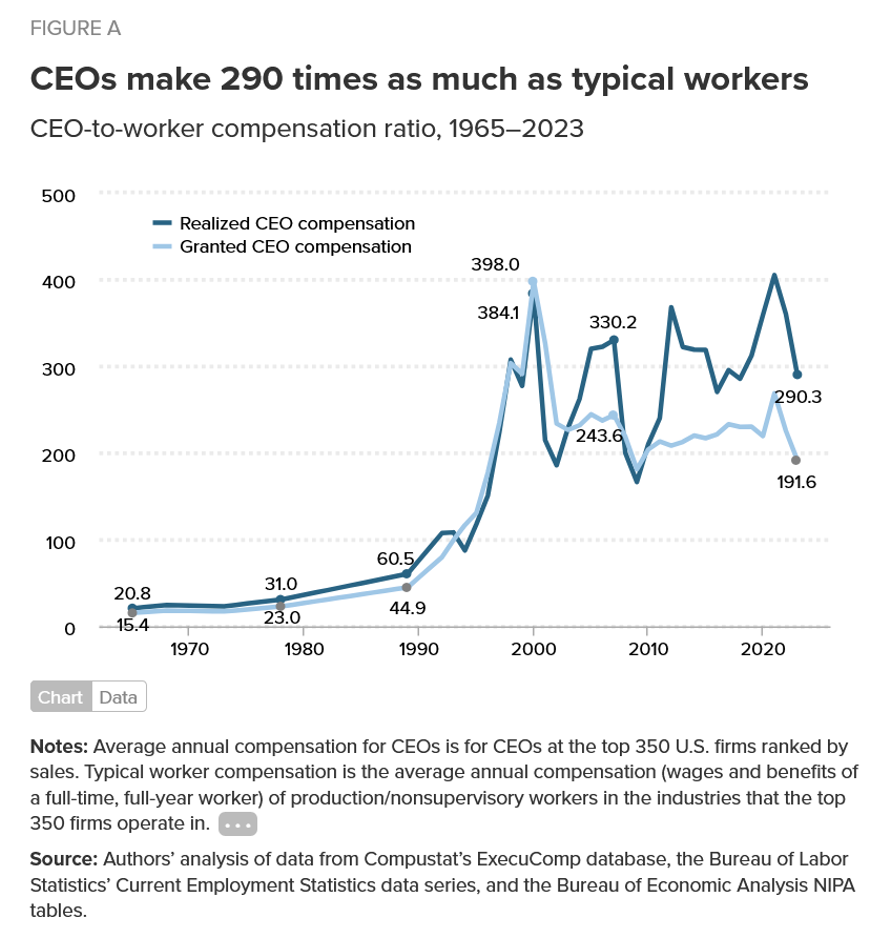

Conceived in the 1990s to give executives stakes in the companies that they manage; stock options were believed to align their objectives with those of shareholders— and against those of workers. For most of the 1990s and early 2000s, mass firings lifted stock prices, thereby rewarding executives who had granted themselves stock options. This was an impetus for outsourcing as well. Executives made themselves rich by making ‘their’ workers poor.

Mainstream economists, long taught that economic distribution is none of their business, are also taught that money is neutral and that financial asset valuations are stationary, as in only temporarily affected by Federal policies intended to support financial asset prices. This makes the epochal nature of finance capitalism difficult to explain. The cyclicality of financial asset valuations is proof of non-stationarity. The point: history matters.

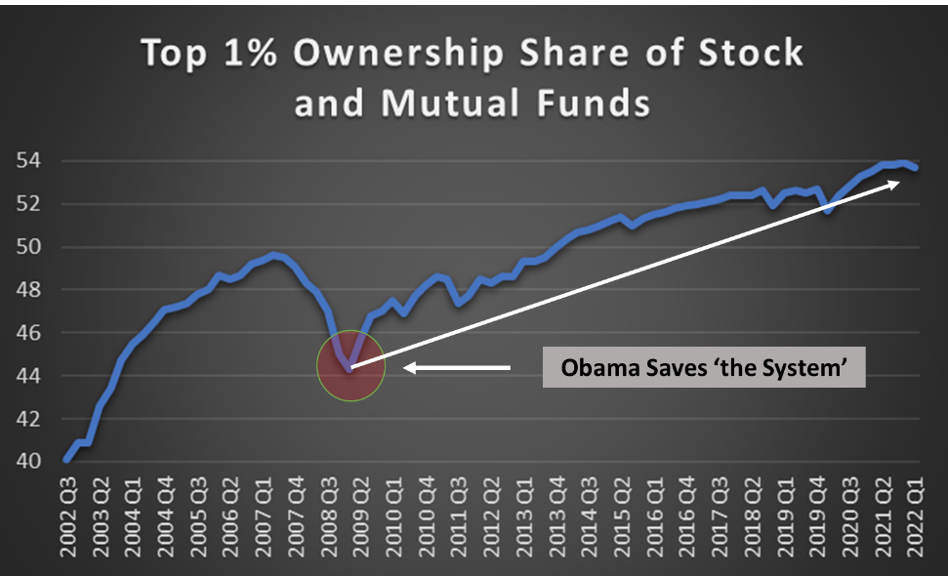

Graph: the panic to reinvigorate Wall Street during the GFC (Global Financial Crisis) ranged from rich to poor, for opposite reasons. Rank-and-file workers needed jobs, while the neoliberal leadership of the Democratic party needed campaign contributions and the restoration of Wall Street’s neoliberal vision of the American economy. The graph illustrates who benefited from this cross-class alliance— the rich today own 10% more of total financial assets than they did in 2009. Source: inequality.org, St. Louis Federal Reserve.

Because Barack Obama was perceived to be a representative of the people’s interests, he was initially given the benefit of the doubt when he bailed out Wall Street while ignoring the plight of the rest of the nation. Workers needed jobs and the oligarchs wanted their wealth back, creating broad political support for resurrecting Wall Street.

In this endeavor, one side knew what they were doing politically, while desperate workers had no idea. Wall Street had been one of the most enthusiastic supporters of NAFTA. Federal support for financial asset prices, through which Trump administration officials took Federal largesse by imagining that they deserved it, ‘lifted their boats’ while leaving the nation to rot.

As the graph above illustrates, not only was the wealth of the oligarchs recovered by Mr. Obama’s policies, but their ownership shares of financial wealth increased from 44% at the start of the bailouts to the 54% that it stands at today. In theory, financial assets represent claims on the underlying companies. And through capitalist property rights, ownership conveys control. Taken together, the results of Mr. Obama’s revivification of Wall Street transferred ownership control to the oligarchs at the same time that it made those ownership shares worth more.

Donald Trump understands the economic mechanisms at work here. His Covid-19 pandemic relief bill specifically targeted financial asset prices to be rescued by the Federal government. Why was doing so important to him? Because stock market wealth is the source of his political power. How plausible would his economic theories be to his constituents if he had been born rich, but ended up not-rich? Left unchecked, market forces would have left Trump with far less wealth three times (1987, 2008, 2020), had the Federal government not subsidized its resurrection.

Graph: before neoliberalism was made the reigning ethos of the West, corporate executives earned on average 20x what the average worker earned. By the time that Bill Clinton entered office, this ratio had risen to 60x, reflecting the growing economic power of corporate executives. From Clinton forward, this ratio has ranged from 200x to 400x average worker pay. This is what happens when executives are given the power to decide their own pay. It is a form of looting. The corporations are on the hook for repaying borrowed money while the proceeds go into the pockets of corrupt executives. Source: epi.org.

While the graph above is likely old news to most readers, it helps illustrate the epochal (cyclical) nature of US oligarchy. The current epoch of financial capitalism started in the US in the early 1980s. At that time, the ratio of CEO-to-worker pay was 31x. By the time that Bill Clinton ‘freed’ the banks to create the Great Recession and GFC, it was 60x. From the moment that Clinton’s financial deregulation was implemented to today, this value has ranged between 200x and 400x.

But the point here isn’t the levels of CEO-to-worker pay per se, but rather the epochal nature of the process by which this was accomplished. While politicians from Reagan to Clinton to Trump participated in financializing Western economies, critical mass was reached in the 1990s whereby the wealth of the oligarchs was increased to the point where it bought explicit political control. In American mythology, wealth is the product of skill attached to hard work. Question: skill at what?

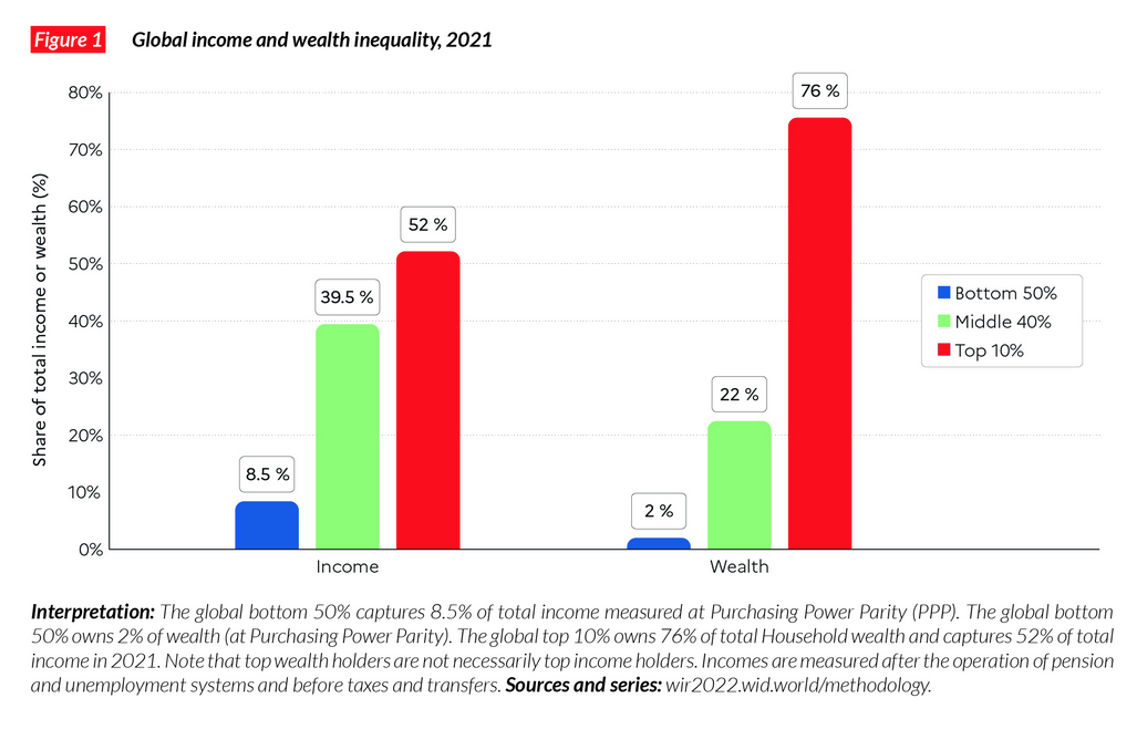

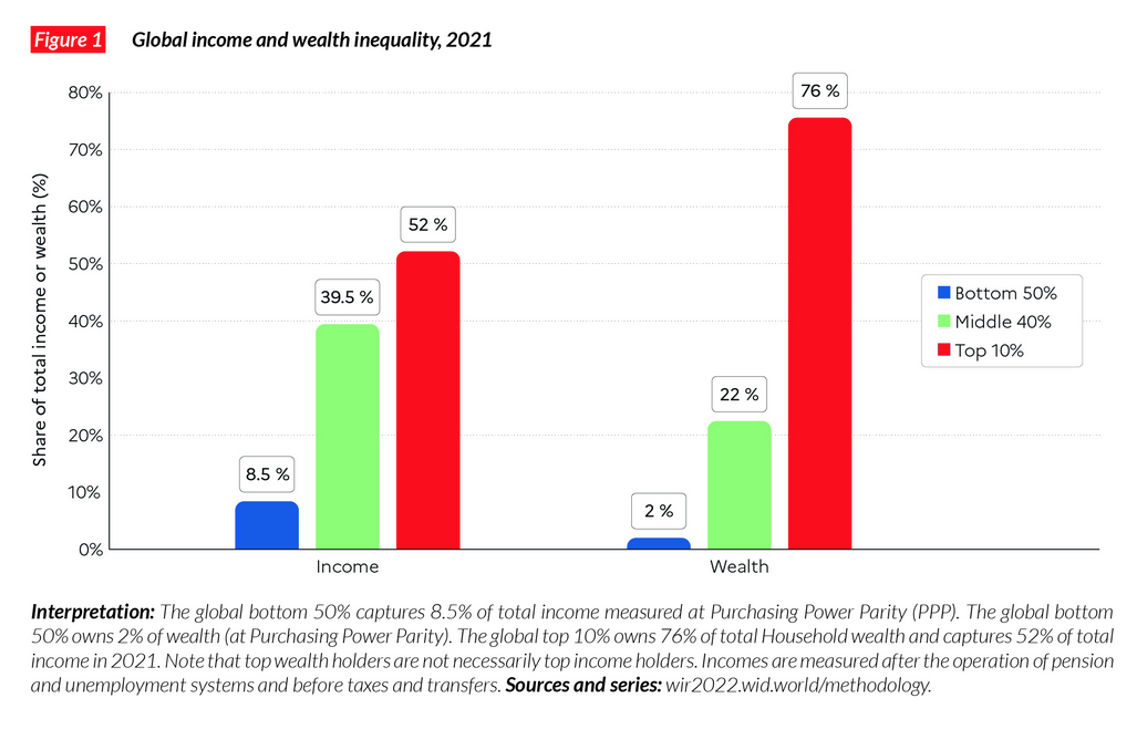

In earlier decades, the large size of the US economy skewed global measures of income and wealth concentration. With the economic rise of China and BRICS, this US centric skew is today less pronounced. What is illustrated in the graph below is the rise in global income and wealth concentration. Within a mainstream economic frame, income is a flow and wealth is a stock. But what this framing misses is that saved income is wealth. The distribution of wealth is directly affected by the distribution of income.

Graph: in economics-speak, income is a flow and wealth a stock. What ties incomes to wealth is that incomes that are saved, as opposed to spent, become wealth. Because the rich save and the poor borrow, higher incomes produce higher wealth. And because ownership confers control, having higher wealth means that the rich control Western societies. This is called oligarchy. Source: wid.world.

In terms of wealth, meaning ownership control, the richest 10% globally owns 76% of the world’s wealth, while the bottom half owns (controls) 2%. With a political system like the US has, where political donations confer control of Federal decision making, the US is clearly an oligarchy. By the evidence, so is the rest of the world. The term ‘Davos man’ was coined to describe the top-down governance structures of Western ‘democracies,’ where hucksters and thieves with institutional support decide what is best for America’s future.

With a brief detour into the value of Davos Man’s insights, the Biden administration went all-in on AI (artificial intelligence), expecting something like fifteen percent of US GDP to come from AI investment directly and from ‘efficiencies’ created by it. Two years ago, I spoke with a senior developer from Google about AI. Having created and coded predictive ‘error-correction’ models myself, AI is a brute force method of error-correction. A goal is defined, and AI organizes existing information until a solution is produced. There is no magic to it.

Further, and unlike humans, it recreates only variations on what has already been created. Take away the ‘training sets’ to understand how AI output is a function of AI input. My acquaintance from Google agreed with this basic explanation. The literary results that I have seen have been workaday, what a reasonably intelligent and hard-working 11th grader would produce once trained in how to conduct research on the internet. What it isn’t is (artist) Jackson Pollack cobbled to (musician) John Coltrane.

As related metaphor, it was recently revealed that Amazon’s AI driven grocery stores require large rooms filled with humans to function. The idea was that AI would monitor customers in a way that allowed them to put items into bags and walk out of the store without standing in line at checkout. The problem is that AI only does what it is coded to do. The contingencies of being human don’t fit very well into this rules-based logic. Therefore, Amazon’s techno-fraud was created to give the illusion that its technology works when it doesn’t. This is AI.

Much has been written by economic historians regarding the global nature of the Great Depression. Charles Kindleberger wrote The World in Depression to explain the global nature of that crisis. Global views tend to be very different from the localized explanations that Western economists conjure. For instance, the American idealist discourse around fascism 2016 – today focused on personalities, not unemployment and capital flows.

The GFC and Great Recession left the EU with a second-wave crisis around 2013 that elevated the European right. This refers to bankers in suits, not European ‘deplorables’ trading sieg heils. Race and class loathing were expressed through who got bailed out (EU bankers), and who didn’t (the humans of the European periphery). That Europe has been destroyed economically since joining the US in war against Russia is a surprise only to Europeans.

The number of natural limits that the US is currently up against should give concern. Efforts by the Federal government to keep the stock market afloat have created the most generalized financial bubble in known history. Stock market valuations are currently 4x the level considered excessive when the current epoch of finance capitalism was launched in the 1980s. House prices, adjusted for inflation, are currently 11% above the peak of the greatest housing bubble in history. And Donald Trump’s proposed tariffs are structured as regressive taxes. They will impact the poor far more than the rich.

And Mr. Trump’s newly planned tax cuts for the rich will exacerbate future economic woes. The economic logic that is motivating the cuts, known as capital accumulation, misses that capital markets, and to a lesser extent banks, fund capital investment today. Not only does the West not need the savings of oligarchs to fund capitalism, it doesn’t need oligarchs at all except possibly for human companionship.

Economic production in the US is currently funded in capital markets and by banks. What this means is that tax cuts are a pure gift to the rich, intended to serve no economic purpose other than t

Type in Rob’s name in the title.

“The contingencies of being human don’t fit very well into this rules-based logic.”

As the Soviets learned. Over-enthusiastic (to put it diplomatically) scientific management contributed to its dissolution. IMO.

“Europe has been destroyed economically since joining the US in war against Russia is a surprise only to Europeans.”

If the USA stays involved in Europe’s centuries old grievances, the favor will be returned.,

Increased productivity can either be taken out as time or as money. Time cannot be hoarded but money can be hoarded. What we’re seeing is how (supposed) representatives for workers/citizens traded power in the long term for money in the short term. Reduced working-hours would maintain the scarcity and thereby maintain the bargaining-power of the worker while choosing to take money instead led to increased competition for paid working hours and thereby weakened the bargaining-power/position.

The outcome so far has been that capital have used their increased power in negotiations to get the biggest part (close to 100%) of the improvements in productivity.

& the ones who got to manage the hoarded benefits of increased productivity chose to pay themselves a lot and the reason why they chose to do was simple – they could and they will continue to do so as long as productivity increases is taken out as money instead of time.

Inequality is likely to continue to grow as long as productivity gains are diverted into finance instead of time.

So what you are saying is the general strike is the only answer, right?

Well…Lenin had it righr even if Stalin went a bit overboard. You don’t get rid of a cancer by cutting aroumd the edges.

Grandpa Jacob was a Menshevik. They advocated for a bloodless / limited revolution. He emigrated during the failed revoltion of 1905.

One of my few long talks with him when I was of age (my father was the youngest of six sons) was his recounting of the tumultuos time and his arranging to bring his family over. They are counted in the 1910 census. Great-grandpa, great-grandma and a couple of his brothers and family.

>>>Increased productivity can either be taken out as time or as money.

While in high school I read a magazine article in the school library that where the writers explicitly said that due to increased productivity people would, not could, experience a shrinking workweek. I vaguely remember the hours given was twenty or so, maybe even less. I remember being skeptical of it being too good to be true, but then being convinced by the argument that it was at least likely. I also remember this happening before St. Ronald Reagan of Blessed Memory became president and started the Reagan Revolution. The shift from time to money was not accidental especially as inflation was double digits for a while as Paul Volcker used interest rates to destroy unions using the excuse of fighting inflation. If inflation is almost fifteen percent, a person might prefer to take his increase in income instead of reduced hours.

Considering that productivity has increased around forty percent, and has likely been slowed down by the increasing wealth and income inequality, which is a pretty universal phenomenon, and that the wealth generated by the increase has captured by the top, I would think that the article was correct; however, the elites intervened to rig the system. Even at the time of the article productivity had started to be shifted almost entirely away from the middle class and below, but it likely not either noticed or seen as a permanent shift.

I wish I could remember the magazine, but it was likely Time, Newsweek, or US News & World Report.

In the 1990s they also changed how inflation was calculated lower than it actually is, which is about thirty years of the official inflation increases in the cost-of-living being too low. That why the social security payments are worth less every year.

All that wealth being taken from the majority of Americans and given to the top is a good example of theft.

Here’s the productivity vs pay gap graph over time:

https://www.epi.org/productivity-pay-gap/

https://fred.stlouisfed.org/graph/?g=1jczi

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2000-2024

(Indexed to 2000)

Decline in labor share of income:

86.0 – 100 = – 14.0%

Increase in real profits:

281.1 – 100 = 181.1%

Thank you. To nitpick, assigning causation creates thin spots.

His Covid-19 pandemic relief bill specifically targeted financial asset prices to be rescued by the Federal government. Why was doing so important to him? Because stock market wealth is the source of his political power

Wouldn’t there be some other plausible reasons related to keeping the whole enchilada from going tits up? Not that this matters much to the overall argument, but Trumps our man in charge now, so it does matter when attempting to assess the current shitstorm.

Given the skewed impact that a crashing stock market would have had, causing pain to the rich who own the stock market quite out of proportion to that of the 90% who own little if any stock, only a piece of the enchilada would have bitten the dust had the stock market not been ‘saved.’

The rich doubled their wealth in Mr. Trump’s first term. That was quite out of proportion with how the rest of us fared.

https://truthout.org/articles/us-billionaires-have-doubled-their-wealth-since-2017-trump-tax-overhaul/

Yeah, I agree. That and your point it defends make sense. I get jumpy over pinning causation. The post-Obama signal to noise ratio has ben effective at distorting realities on the ground. Thanks for your reply.

Edit, I enjoyed your essay.

https://fred.stlouisfed.org/graph/?g=PGTe

January 30, 2020

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2020-2024

(Indexed to 2020)

Decline in labor share of income:

94.9 – 100 = – 5.1%

Increase in real profits:

129.3 – 100 = 29.3%

“As Simon Johnson described in his classic article, The Quiet Coup, in 1980, average pay for bankers was virtually identical to average pay all across the economy…”

https://emeritus.er.ethz.ch/media/inspirin_articles/quiet_coup.html

May, 2009

The Quiet Coup

By Simon Johnson

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.

The conventional wisdom among the elite is still that the current slump “cannot be as bad as the Great Depression.” This view is wrong. What we face now could, in fact, be worse than the Great Depression—because the world is now so much more interconnected and because the banking sector is now so big. We face a synchronized downturn in almost all countries, a weakening of confidence among individuals and firms, and major problems for government finances. If our leadership wakes up to the potential consequences, we may yet see dramatic action on the banking system and a breaking of the old elite. Let us hope it is not then too late…

In my opinion there are today other kinds of oligarchs in different sectors mostly because monopolies: clearly IT is one (Google Microsoft…), the owners of power transport and distribution grids, the owners of railway grids, the owners of water distribution systems (as long as they are privately owned).

Urie is worth reading in any case.

Notice that all of your examples obtain of network effects and enjoy economic rents — they need to be taxed into oblivion.

A funny thing (general observation, not specific to the Urie piece) is the widespread idea that “capitalism” is necessarily good for capitalists (and that Adam Smith liked capitalists–I know I saw a comment along these lines by Terry F the other day, but I can’t seem to find it.) Smith’s argument in the Wealth of Nations (not even talking about Moral Sentiments) indicates that not only he didn’t like capitalists, but he liked big market capitalism because they were not good for capitalists. Big markets force capitalists to be price takers as they cannot exert excessive influence over how the market functions. By extending markets beyond political boundaries, capitalists cannot manipulate politics to their advantage. Many and diverse competitors makes it likely that they cannot easily collude (quoth Smith, “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public.”). In fact, Marx’s argument follows naturally from Smith’s, once you take into account increasing returns to scale brought about by the Industrial Revolution–it forces the number of firms downward and makes both undue political influence and conspiracy against competition increasingly likely if not inevitable. Thus, capitalists destroying the foundation capitalism, or the inherent internal contradiction of capitalism.

Thanks for shout out. My secondary school was big on prizes. One I achieved allowed me to get the Wealth of Nations and I actually read it. It was interesting. I’m just annoyed I didn’t read the Theory of Moral Sentiments with same degree of critical analysis, though I certainly spotted the general difference in tone.

I’m pretty sure there are lots of Classical economists who’d be horrified by modern society. Reform UK is just waiting for 2029 here. It has nasty elements. Don’t simply take my word for it….you just have to look up the fascist BNP vote in the 1990s in my constituency to see the nasty and internally contradictory capitalist/populist group here. They did not go away. Thanks to Starmer Labour are about to score an own goal.

My first copy of the Wealth of Nations had just vol 1-3. Alas, as I found out much later, vol 4 is where most of the interesting stuff are!

https://www.marxists.org/reference/archive/smith-adam/works/wealth-of-nations/book01/ch10b.htm

1776

Book I: On the Causes of Improvement in the Productive Powers. On Labour, and on the Order According to Which its’ Produce is Naturally Distributed Among the Different Ranks of the People.

By Adam Smith

Chapter X: On Wages and Profit in the different Employments of Labour and Stock

Part II: Inequalities by the Policy of Europe

As a long time leftist I recognized long ago that the vast majority of the working class do not care about income/wealth inequality or programs to reduce that inequality at this point in history. So even if there was a way to get out from under finance capitalism in theory, as a practical matter there is no support for it. What people do care about is maintaining a sence of relative freedom at least outside the PMC class. We will have to accept the System as it is and work through it in some way by changing the culture of narcissism and radical materialism to one where love and compassion are value at least as much as materialism.

They care about not being exploited.

And TPTB know that people care about whether or not they are exploited…hence all the lying.

Part of the point of the piece is to reveal the mechanisms by which the rich are made rich. I discuss this with my working class friends, and I receive thanks for doing so more often than you might think. People are interested, but they don’t know who to trust.

When the Democrats failed to govern effectively, the Right had people and a plan in place to replace them. When Wall Street crapped the bed in 2008, there was no relevant Left to do the same.

While I’m not holding my breath, 1) a crisis is coming and 2) it will represent an opportunity to shift the political dynamic. Organize and prepare if you have an interest in governing.

How is the two-party system in the US going to change? Politicians on both sides rise in the system by following party policy, not challenging it. They get election funding through the party system that sheppards them to victory. I don’t see how any outside, organized group can peacefully disrupt this system. Unless there is a full collapse and subsequent chaos. That would get ugly.

Did you ever come across the affine wealth theory?

https://www.scientificamerican.com/article/is-inequality-inevitable/

It would be quite simple for AI to create a Jackson Pollock, since said oeuvre is a random application of coloured paint on canvas. Mad magazine hired an ape named J. Fred Muggs to do the same thing, years ago.

Yes good point. If AI could paint an original better than Rubens that would be something.

Pollack went through a number of phases before he got to the drip paintings, none of which involved the random application of paint to canvas.

He was a student of American figurative painter, Thomas Hart Benton, and brought Benton’s lyricism into his early work.

His later drip paintings were supported in real time by art critic Clement Greenberg, who claimed that they advanced art. While I don’t necessarily agree, one needs to understand the argument to have an opinion one way or the other.

And even then, the drip paintings were in no way random. The lyricism of his earlier work is still there.

And algorithmic randomness is never random in the sense conveyed. Why? Because it is algorithmic. It is rules based instructions that converts inputs into outputs according to the rules.

The actual term is Pseudorandomness, if anyone is interested. Pseudorandom numbers can be useful in many cases, and there are ways of creating “better randomness” if needed (for example, RANDOM.ORG uses radio receivers to pick up atmospheric noise, which is then used to generate random numbers).

Not random as much as subconscious (including the ape too). Generating random stuff and selecting what looks good is the old monkeys-and-typewriters thingy (which is close to what current brute-force AI boils down to). A chessmaster can play a good move subconsciously (aka intuitively), but that requires getting the chessmaster knowledge in the brain first. Regular people can play a good chess move randomly, but can not randomly play multiple good moves in a row.

Minor quibble— Obama, once in place, could have stopped what Bush 2 and Hank Paulson started.

He did not.

BUT, it did start with the Lehman moment, Paulson’s scribblin’s on the legal tablet, and the no-holds barred actions in the autumn of 2008, that preceded Obama’s win. Much happened in the eight years of Bush 2 under the shock doctrine moment that was 9-11.

No doubt that Obama had the golden triad of Judiciary, House, and Senate, and he willfully did NOT chose a different path.

I agree with the sentiments expressed here by Urie and the NC commentariat. Since Adam Smith and Wealth of Nations has been invoked multiple times, I thought I’d add that Smith, in what is possibly the most famous section of the WoN, the pin maker example as a measure of the importance of division of labor and its role in modern economies, is almost certainly not factual and certainly not based on empirical research. The example was taken from Diderot’s Encyclopedie, and the French Encyclopedists were often guilty of ‘just so’ explanations for ideas they thought were obvious. This was also true in mathematics from before Newton and Leibniz until the early 19th century, when another Frenchman, Augustin Cauchy, challenged many of these and introduced rigor into mathematical analysis. If you examine the increase in productivity that Smith cites for the pin making operation, it’s completely implausible. But it helped sell the WoN as a whole, and there is no question division of labor is essential to the material progress we’ve made since 10,000 BC when the last Ice Age ended. Another instance of ‘it ain’t necessarily so’. ;-)