Yves here. I have retitled the post by John Ruehl because I regard the original title, which reflects the positioning of the piece to be misleading. Ruehl, playing on xenophobia, had declared: Foreign Companies Are Driving the Global Privatization of Domestic Infrastructure.

In reality, this is pure and simple class warfare. Here, capitalists, mainly in the form of big fund managers and their investors, profit at the expense of the broader citizenry. A popular vote on these matters (with accurate briefs) would almost certainly lead to rejection of the economic proposal, “Sell the family china and rent it back at inflated prices.”

Admittedly, Sydney-based Macquarie Bank was a pioneer and early leader in infrastructure finance, which grew out of its expertise in project finance, particularly big mining deals. Macquarie’s initial move to the pole position reflected the fact that infrastructure deals were technically difficult due to the many moving parts and there were less taxing ways in investment banking to make similar amounts of money (another way the pattern of big dogs pursuing easy money is that complex products like mortgage securitizations had disproportionate female representation at high levels of the industry).

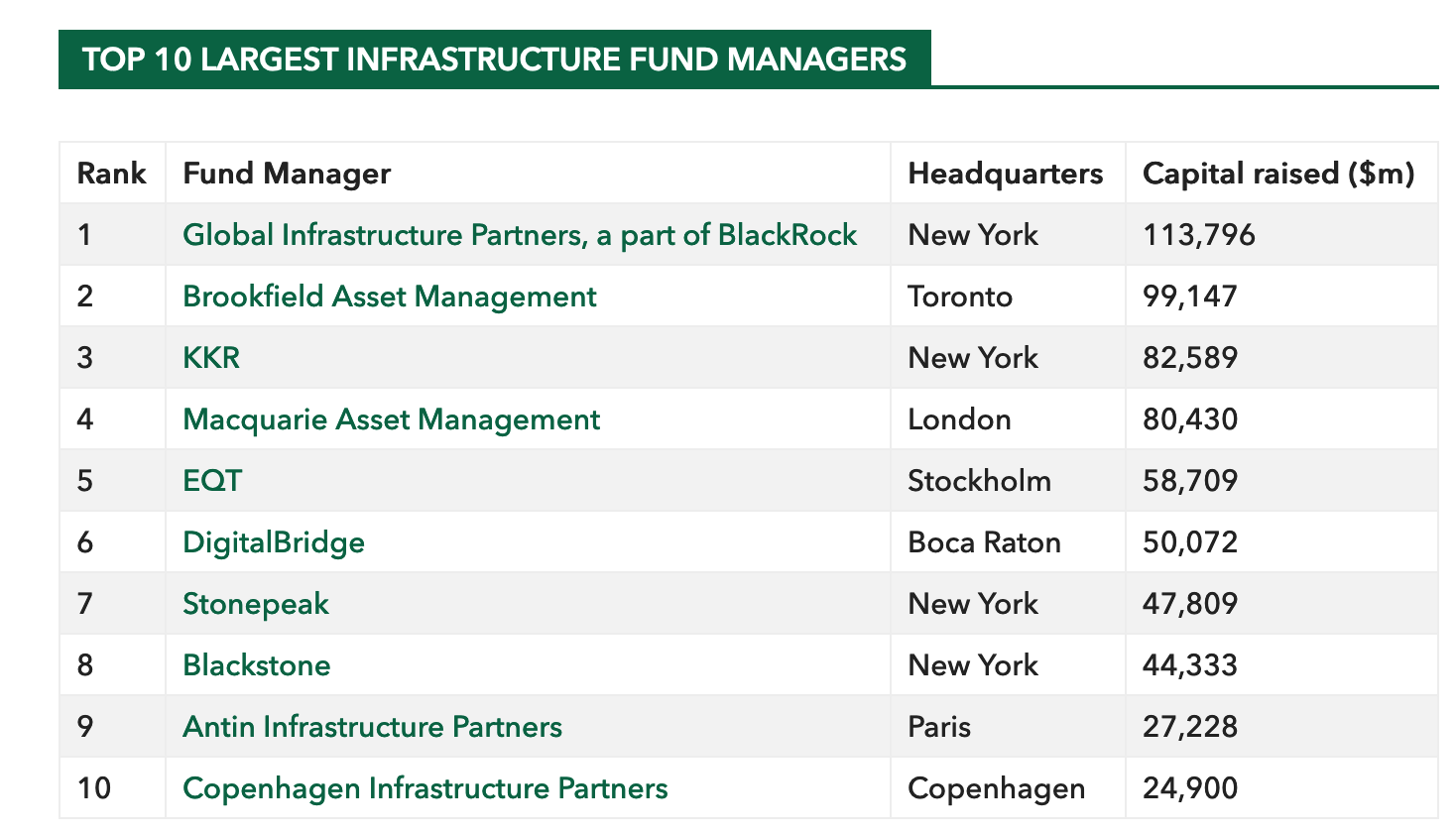

But as you can see, half of the biggest infrastructure funds are American, including the biggest, a BlackRock entity.,US concerns also represent more than half the funds raised in this top echelon. From Infrastructure Investor 100:

Ruehl starts by showcasing the infamous sale of Chicago’s parking meters, a deal we lambasted in detail close to when it was first inked. Ruehl goes though hoops to depict the city as abused by furrniers because it was largely foreign investors who picked up the equity in the deal…after Morgan Stanley, who structured the original deal, defaulted. Ruehl does not understand or acknowledge that the continued extraction from Chicago results from the original, one-sided terms Morgan Stanley got the clueless city to agree to. This blaming foreigners for the very successful and durable predation by Morgan Stanley is seriously off base.

Similarly, Ruehl points to the fact that the US is the major market for sale of government owned assets. The US runs chronic trade deficits. That means we import capital. We do that via sales of securities and other assets. If the US was not running such large and persistent trade deficits, we’d have a lot less in the way of this property-hawking (not that we are fans of the Trump tariffs, but indifference to our yawning trade deficits is part of how we wound up here).

Ruehl raises the specter of evil funniners using ISDS to enforce their rights. Again, see the Morgan Stanley example. The contracts for infrastructure sales are exceedingly investor-favorable. It is hard to see a scenario where a government entity in the US (where precedents are well-set) could wriggle out of one in US courts. And that’s before getting to the fact that the big private equity and fund management firms are far and away (as a group) the biggest buyers of sophisticated legal services. Not only would it be hard to find a firm with decent expertise that was not conflicted out and/or was unwilling to make it impossible to ever be engaged by the big financiers by opposing them. A government entity suing a general partner is a one off. That also makes it a less attractive legal matter.

Moreover, as far as I can tell (again given the pre-existing investor-friendly legal climate in the US), ISDS cases against US government entities are rare (I can’t recall ever hearing of one but knowledgeable readers please pipe up). I suspect to the extent they happen, they relate to state environmental or labor laws. Consistent with that:

The United States is the most frequent home state of investors litigating ISDS cases, which have brought 174 cases against other states to date.

Finally, Ruehl is unduly concerned with the general partner(s) in these investments and not the limited partners. As with private equity, public pension funds, as in managing money for government employees, are top participants, along with private pension funds, sovereign wealth funds, endowments, family offices, and life insurers. Admittedly, Canadian and Australian public pension fund managers were early to this party. But fixating on the national angle obscures the fact that this is yet another facet of how rentiers pinch the public purse.

By John P. Ruehl, an Australian-American journalist living in Washington, D.C., and a world affairs correspondent for the Independent Media Institute. He is a contributor to several foreign affairs publications, and his book, Budget Superpower: How Russia Challenges the West With an Economy Smaller Than Texas’, was published in December 2022. Produced by Economy for All, a project of the Independent Media Institute

On February 4, 2025, Chicago’s business community pushed back against Mayor Brandon Johnson’s proposal to raise real estate transfer taxes, adding to the city’s ongoing economic struggles.

Besides a struggling pension fund, high home prices, and other factors, a significant contributor to the city’s woes lies in the controversial privatization initiatives from the 2000s, known as the “Great Chicago Sell-Off.” Over the past two decades, these decisions have siphoned an estimated $3 to $4 billion from Chicago.

The privatization trend began under former Mayor Richard M. Daley, starting with the Chicago Skyway. In 2005, the 7.8-mile toll road was leased to a consortium led by Spain’s Ferrovial and Australia’s Macquarie Group for $1.83 billion. Tolls were raised immediately, and in 2016, the 99-year lease was sold to “a trio of Canadian pension funds” (the Ontario Municipal Employees Retirement System (OMERS), the Canada Pension Plan Investment Board (CPPIB), and the Ontario Teachers’ Pension Plan (OTPP)) for $2.8 billion. Australia’s Atlas Arteria Ltd. then acquired a two-thirds stake for $2 billion in 2022, while OTTP retained the remainder.

In 2006, four downtown parking garages with more than 9,000 spaces were leased for 99 years to Morgan Stanley for $563 million. After Morgan Stanley defaulted on its debt tied to the lease agreement, control was transferred in 2014 to lenders, including France’s Societe Generale, the German government, and Italy’s UniCredit S.p.A. In 2016, Australia’s AMP Capital and Canada’s Northleaf Capital Partners acquired the garages.

Abu Dhabi came into the picture in 2008. In a $1.16 billion deal, 36,000 parking meters were sold to Chicago Parking Meters (CPM) LLC for 75 years, a consortium led by Morgan Stanley. Morgan Stanley’s Infrastructure group soon restructured CPM’s ownership, transferring major stakes to the Abu Dhabi Investment Authority and Germany’s Allianz through complex investment vehicles. Over the next five years, parking fees more than doubled. By 2022, CPM recovered its entire $1.16 billion investment, while the city had spent $78.8 million buying back parking spots to cover the revenue it would have generated until 2084. As of 2024, the investment has returned $700 million, with 60 years left on the lease.

Daley’s goal was to balance the city’s budget without raising property taxes before leaving office. However, the one-time payments resulted in long-term consequences. In addition to financial losses, the privatization deals have hindered Chicago’s ability to modernize infrastructure by limiting efforts to build bike lanes and reduce car dependence downtown, and people even need to get permission or make payments to companies thousands of miles away for local street parades.

Growing Privatization

Profit-driven entities argue that privatizing public infrastructure leads to greater efficiency through expertise and investment. However, their focus is on profit maximization, not service improvement, leading to long-term rent-seeking behavior. Furthermore, in contracts with limited liability companies, the government assumes the losses, while private companies reap the profits. Companies can walk away or demand renegotiations, while governments are left to maintain services, absorb long-term revenue losses, and burden the public with higher costs.

As Chicago’s experience shows, privatization has extended beyond domestic markets to become an international phenomenon. Starting in the 1980s, the International Monetary Fund (IMF) and World Bank reforms encouraged the privatization of public infrastructure to attract investment, leading to its internationalization. “A 2006 study by the Norwegian government of IMF conditionality revealed that 23 out of 40 poor countries still have privatization and liberalization conditions attached to their IMF loans,” stated an Oxfam Briefing Paper.

By 2000, sovereign wealth funds, pension funds, and multinational corporations began treating infrastructure as a global asset class, involving extended leases that frequently change hands.

Foreign companies operate under bilateral investment treaties or trade agreements, allowing them to bypass local courts. Disputes are often mediated in foreign courts or through international arbitration, such as Investor-State Dispute Settlement (ISDS) and the World Trade Organization. By exploiting legal loopholes like offshore subsidiaries and tax havens, companies can also shield profits while facing little public scrutiny. Despite these issues, domestic infrastructure continues to be increasingly available on international markets.

United States

While Chicago remains the most prominent American example, similar deals are widespread across the country, primarily involving companies from allied or dependent nations.

In 1998, Atlanta became one of the first cities to enter into an international privatization deal over public services, signing a 20-year and $428 million contract with United Water, a subsidiary of France’s corporate conglomerate Suez, to operate the city’s water system. Celebrated as the biggest privatization contract in the U.S. at the time, it led to claims of quality decline, delays, and other mismanagement before the contract was terminated, leading to the infrastructure being returned to public control in 2003.

Nonetheless, the trend continued. By 2006, foreign companies were leasing and operating 80 percent of U.S. port terminals along with a smaller share of the nation’s airports. The UK’s National Grid owns and operates electric transmission networks in the northeastern U.S.

Indiana has since become a prominent example of experimenting with international privatization. France’s Veolia entered a 20-year contract to manage Indianapolis’s waterworks in 2002. The deal was, however, eventually canceled in 2010. Meanwhile, its airport was managed by Britain’s BAA from 1994 to 2007. In 2006, the Indiana Toll Road was leased to a foreign consortium led by Spanish and Australian companies for 75 years for $3.8 billion. It was later sold for $5.7 billion to Australia’s IFM Investors in 2015.

United States entities have purchased some infrastructure abroad, such as in 1999, when a subsidiary of Bechtel privatized Cochabamba’s water system in Bolivia before controversy forced its exit. But for a major economy, the U.S. owns surprisingly little foreign infrastructure. It has few state-owned enterprises for overseas infrastructure investment, though some private entities like Blackstone’s Infrastructure Partners division and Corsair Capital are active. Instead, extensive domestic privatization opportunities have made U.S. infrastructure a prime target for American and foreign investors.

Canadian and Australian Companies

Canadian and Australian pension funds and other entities, driven by well-funded systems, consolidation, government support, and early privatization experience, have become major infrastructure investors in the U.S. and elsewhere. The CPPIB owns toll roads worldwide, the OTPP holds stakes in airports across Europe, along with the Channel Tunnel, while the Canadian company Brookfield Infrastructure Partners owns telecom infrastructure across Europe.

Roughly half of Australia’s pension pool is invested outside the country. But Australia’s Macquarie Group, in particular, has seen its assets surge, emerging as the “world’s largest infrastructure asset manager.” Since the 1990s, Macquarie Group has focused on identifying underperforming or undervalued public assets to acquire and restructure, and it established its Global Infrastructure Fund in 2001 “to invest in infrastructure financing opportunities in the U.S., Canada, UK, and the European Union,” according to its website. In addition to Chicago’s Skyway, Macquarie holds long-term operational licenses for the Dulles Greenway toll road in Virginia and the Foley Beach Expressway in Alabama, among others.

Macquarie’s toll road portfolio in India is worth an estimated $2 billion, and it took a 49 percent stake in Greece’s largest utility, Public Power Corporation (PPC) in 2021. It also led the push for privatizing the UK’s Bristol Airport in 2001, while Britain’s largest water utility was sold to an international consortium led by Macquarie Group from 2006 to 2017. Macquarie also took full ownership of the UK’s National Gas Network in 2023.

According to a July 2023 Guardian article, “Macquarie is well known for taking advantage of volatile markets. In the aftermath of the global financial crisis, it bet big on non-investment grade loans, known as junk debt. The debt was cheap, but the quality was decent and the returns turned out to be excellent.”

Europe

The UK has been a major market for infrastructure investors since the global wave of privatization in the 1980s. Beyond Macquarie’s infrastructure holdings, the UK’s largest electricity generation company was privatized and acquired by France’s EDF in 2009. Foreign investors have continued to diversify, with Saudi Arabia’s Public Investment Fund (PIF) poised to take over Newcastle Airport, after acquiring a 37.6 percent stake in Heathrow with French co-investor Ardian in 2024.

Europe’s collective experience with infrastructure privatization has been marked by controversy, largely due to Western European corporate dominance. As the EU expanded, some Western EU companies bought control of critical infrastructure in Eastern EU member states. In 2015, Greece privatized 14 regional airports handing them over to a consortium led by the German company Fraport. This move was unpopular in Greece, especially following the austerity measures imposed by the EU and Germany during Greece’s economic crisis. However, the EU also provides safeguards in such deals, including profit sharing and economic support to member states.

Outside the EU, resolving disputes is even more challenging. French water companies like Veolia and Suez are leaders in global privatization efforts but have ended up in court over dealings with Argentina in the 1990s, Egypt in the 2000s, and Gabon in the 2010s. Argentina renationalized its oil company from Spanish company Repsol in 2012 after domestic backlash, damaging relations between the two countries. Such cases can be particularly sensitive when they involve former colonial powers and their former colonies, as economic disputes risk being seen as extensions of past dominance, with former ruling states accused of leveraging privatization to maintain influence.

China

China’s Belt and Road Initiative (BRI) predominantly focuses on building infrastructure in non-Western countries, though the 2020 takeover of Laos’ electric grid shows an exception. In contrast, Europe’s existing infrastructure has proven attractive for Chinese investment. Greece sold a 51 percent stake in its Piraeus Port Authority in 2016 to China’s COSCO shipping, which later increased to 67 percent in 2021.

China’s competitive pricing, substantial financial and productive resources, and strategic interests have extended its infrastructure influence to countries with their own expansive foreign infrastructure portfolios. Chinese firms hold stakes in Belgian, Dutch, German, Spanish, and Italian ports, as well as European energy and telecommunications infrastructure.

In Australia, the Port of Darwin was leased for 99 years in 2015 to China’s Landbridge Group, with the Australian government resisting pressure to cancel the deal. The State Grid Corporation of China and its subsidiaries, meanwhile, hold large stakes in Australia’s electricity and gas infrastructure, raising national security concerns due to its close ties to Chinese military and intelligence agencies. Furthermore, China’s control over Australian agricultural land has granted it valuable water rights.

The geopolitical implications of these foreign investments in infrastructure are undeniable, with national security concerns forcing China to sell its stake in the U.S. Port of Long Beach in 2019. Yet such investments are only becoming more common globally. While they may strengthen economic ties between countries, they reduce accountability, risk undermining sovereignty, and disconnect public services from local oversight, sidelining effective public planning in favor of enriching foreign entities.

This trend appears likely to continue, requiring more responsible approaches to maintaining a healthy balance between the necessity for infrastructure investment and public needs. Shorter contracts, profit-sharing models, and performance-based agreements could help countries and companies showcase their development models and expertise—potentially even at lower costs than local providers. However, profit maximization remains the driving force, particularly when financial entities dominate the field.

The question that should always be asked when looking at privatizing infrastructure is “can it be allowed to fail?” If it’s a no, then do not privatize or seek third party private investment.

Speaking from the UK, where everything not bolted to the floor has been privatized.

Brits forgot their history…: https://en.wikipedia.org/wiki/Rebecca_Riots

Our “conservatives” of all political parties appeal to tradition but find it convenient to ignore or forget history.

Hello Yves, could you please explain this part “another way the pattern of big dogs pursuing easy money is that complex products like mortgage securitizations had disproportionate female representation at high levels of the industry).” did not quite get it.

Thank you

Female dominated professions and roles are less well paid and prestigious. This is particularly true in finance.

Well, it’s a well known fact, isn’t it, that men go into lucrative professions like male lawyers, male engineers, male doctors, and so forth, whereas women go into less remunerative women’s professions like female lawyers, female engineers, and female doctors?

FER SHER!

The article is useful if one thinks of the problems of allowing capital to flow freely without regulation — which is more or less what is going on. These unbridled movements of capital are one of the sources of the current assertion of oligarchy in the U S of A.

Having lived through the give-away in Chicago, I appreciate Yves Smith’s skepticism up top. The problem was *not* that foreigners and the Spanish peril were swooping in to take Chicago’s assets. The problem was that the entrenched Daley / Obama / Rahm Emanuel Democrats were only too happy to give away pieces of the public sphere. It was / is part of their fantasy of “reinventing” government. At the time of the parking-meter scamola, there was no reason given why the city couldn’t manage its own parking meters. Meanwhile, scads of bucks were / are flowing into Chicago’s swamp of tax-increment finance districts, better known as TIFs and slush funds.

Here in Italy, there are plenty of U.S. entities showing up to loot the public space at the invitation of Fratelli d’Italia and the Lega (believe it or not). TIM, the Italian phone company, is now owned by KKR investment bank, although there are rumors of a buyout by an EU company.

The Italian government keeps threatening to offer pieces of the FFSS, the Italian state railway system. I can hardly wait for U.S. companies to buy a slice of the FFSS and then offer lessons on how to turn the Italian railway system, which is of the highest quality, into AMTRAK.

Yes, this idea that foreigners swooped in is nonsense. As you noted, powers that be were only too happy to sell out, citizens be damned.

This from the article was quite the handwave –

“…Europe’s existing infrastructure has proven attractive for Chinese investment. Greece sold a 51 percent stake in its Piraeus Port Authority in 2016 to China’s COSCO shipping, which later increased to 67 percent in 2021.”

The author fails to mention that it was the European Troika who forced the sale of this public asset as a condition of Greece being bailed out. I don’t remember the exact timeline, but at some point Greece held a referendum on austerity policies and citizens voted ‘no’, only to be overruled by technocrats and have austerity measures imposed on them.

Yanis Varoufakis explained that the initial deal was very bad for Greece so the Chinese agreed to renegotiate, giving Greece much better terms. Pretty good rundown of that situation here.

I think that the author is on the wrong track here. They are obsessed with all those foreign corporations buying up everything but they should be looking at who is running those corporations and not which countries those corporations come from. On that level, those executives do not really care which passport – or passports – they hold and they have much more in common with executives running other foreign corporations rather than with people from the country that they actually come from. Probably the only time they wave the flag of the country that they come from is to impress the hicks in their home country but truth be told, find it more comfortable mixing with executives from other countries even if they are direct competitors. After all, this is truly their people.

All roads lead to Rome, as it were. My evil multinational had a serious slice of shares acquired by both Blackrock and Vanguard over the past few years and now it’s one set of RIFs after another and “AI” pushed like it’s magically going to replace HR, Research, Application Development and of course, Legal, because lawyers have always been the biggest bottleneck to doing business. Like DOGE, I see this as a current of immature thinking about superstructure and systems. When it all breaks down, I guess there will be no further bottlenecks to business doing whatever the heck it wants. So long as they’ve got the bagmen and enforcers to keep the princes in line.

Thank you, Yves.

I recognise the first five and BlackStone from workshops with Labour in opposition.

Labour has prioritised these giants in government, much to the private chagrin of UK investors, but no one dares complain in public.

US firms pay better than peers from elsewhere. In addition and on current polling, Labour is unlikely to form the next government, so Labour politicians and even officials in Whitehall are prioritising their nest eggs after 2029. It feels terminal in Blighty, so one may as well sell everything to Wall Street. Plus, when BlackRock visits Downing Street, Angela Rayner can get handsy with Larry Fink.

The NC community can read these and weep for Blighty: https://www.taxresearch.org.uk/Blog/2025/02/18/treasury-incompetence/ and https://www.taxresearch.org.uk/Blog/2025/02/18/streeting-rotten-to-the-core/.

Not unrelated: https://www.gov.uk/government/speeches/defence-secretarys-speech-on-defence-reform–2.

What is it about these politicians, many of whom have not “worked” outside politics, but think the government is a business? Pat McFadden is another.

The biggest con in so called privatization deals is the chronic lie that private investors will bring in all sorts of new investment funds and drive efficiency in whatever is being sold off. This is all aided and abetted by the mainstream economics professions which chronically fails to even apply its own basic and foundational principles to properly critique these situations.

The driver of this is that mainstream economics has long since abandon the discussion of monopolies or monopoly economics.

You see in micro economics 101 we all learn that in a competitive market, price is where the demand curve and the supply curve meet. However, if you venture further up the ladder of economic theory you will learn that the supply curve discussed in econ 101 is the upward sloping portion of a firms marginal cost curve.

Here’s where the problem is… every economic study that has tried to understand what the real world shape of real world businesses marginal cost curves are keeps coming back with the same answer… only a small minority of entities actually have a business where their margin costs are rising as output increases. The majority of businesses face a downward sloping margin cost curve.

Conveniently the majority of mainstream economics just keeps on ignoring this even though in that same econ 101 class there is probably at least a brief discussion about firms that do face downward sloping marginal cost curves. They are called natural monopolies.

The real-world implication of this is that most businesses will act like a real monopoly if they are allowed to. So it should be no surprise to anyone (including economists who shamefully ignore this reality) that when you privatize what is invariably a fairly large entity with few, if any competitors, that they maximize their rent extractions at the expense of their customers and even the business they are supposed to be running.

It’s never better, is it?

You and I understand ‘efficiency’ in terms of how well our tools work, how far our car drives per tank. That’s the wrong meaning of the word; when a capitalist says ‘efficiency’, the only thing meant is more profit per $ of revenue, so anything that cuts cost is by definition ‘efficient’.

Hi Yves,

In response to your question about ISDS cases against the US, they did happen under NAFTA Chapter 11, but never succeeded, which is probably why you never heard about them. Some of the bigger ones (Methanex, 1999, brought against California for phasing out the gasoline additive MTBE, and Glamis Gold, 2003, also brought against California, this time for a law requiring restoration of open-pit mines) related to state environmental laws, as you suggested. A number of them concerned the softwood lumber disputes and were terminated with the new softwood lumber agreement in 2006. By contrast, as of 2018 (before the renegotiation of NAFTA under Trump), Canada had lost 8 cases and Mexico 5. Many of the ISDS provisions under Chapter 11 were removed from the USMCA, which was a win for Canada and Mexico.

Sacramento did a similar sell off of parking meter & garages 10ish years ago then used the money to build a new downtown arena for the NBA franchise.

Bonus! The City owns the stadium, so the NBA team can threaten to move and extort even more money from the City–or leave it with a money-losing white elephant.

The Oakland Raiders did this in Oakland, Anaheim, Oakland again and now Las Vegas.

George W. Bush practiced something similar in Arlington, TX, persuading the public to fund a stadium for the (money losing) MLB Texas Rangers. W. then sold his stake in the team (which he purchased with borrowed money), and that sale accounts for 75% of his net worth.

Sacramento has a large and growing homeless population, but while it can afford a quarter-billion-dollar stadium, somehow help for the homeless is just too darn expensive.