But what could it mean for China’s trade relations with Latin America, in particular the US’ largest trade partner Mexico?

Midway through last week, as the economic reverberations from Trump’s latest round of tariffs spread around the world, the Hong Kong-based (and Cayman Islands-registered) conglomerate CK Hutchison Holdings caught global markets off guard. Straight out of the blue, the company announced that it was selling 80% of its subsidiary Hutchison Port Holdings, including its 90% stake in the Balboa and Cristobal docks at either end of the Panama Canal, to a consortium led by BlackRock, the world’s largest investment manager.

An Associated Press article reported that the sale effectively puts “the ports under American control after President Donald Trump [had] alleged Chinese interference with the operations of the critical shipping lane.” In a speech to the US Congress on March 4, Donald Trump bragged:

To further enhance our national security, my administration will be reclaiming the Panama Canal. And we’ve already started doing it.

Just today, a large American company announced they are buying both ports around the Panama Canal, and lots of other things having to do with the Panama Canal, and a couple of other canals.

CK Hutchison’s decision to sell up its port holdings company in a deal valued at nearly $23 billion, including $5 billion in debt, gives the BlackRock consortium control over dozens of ports in more than 20 countries. They include the Panamanian ports of Balboa and Cristobal, four ports in Mexico, 13 in Europe, 12 in the Middle East and Africa, and 11 in East Asia and the Pacific. Unsurprisingly, Hutchison will retain control of its 10 docks in China, including two in Hong Kong.

It is debatable just how good a financial deal this was for the BlackRock-led consortium. As Yves points out in the comments below, participation in the Panama Canal could prove to be more of a curse than a blessing, especially given Panama’s ongoing water crisis. The canal already experienced a 29% drop in ship transits during fiscal year 2024 due to severe drought conditions, according to the Panama Canal Authority (ACP).

The decision to sell the canal was driven primarily by geopolitical concerns, as reports the South China Morning Post:

CK Hutchison Holdings’ decision to sell its port operations in the Panama Canal and elsewhere is to mitigate against geopolitical risks even though it framed it as a purely commercial move, analysts and sources said, urging Hong Kong’s other major companies to also prepare for unparalleled global uncertainties.

From a geopolitical perspective, the deal represents a victory for the Trump administration and a setback for China’s belt-and-road ambitions given that some 6% of global trade passes through the Panama Canal.

There could be alternative express trade routes connecting the Atlantic and Pacific oceans some time in the not-too-distant future, however. Nicaragua, a close ally of China and Russia, has recently revived plans to build its own canal, though it will take years to complete, assuming it ever is.

There is also Mexico’s Interoceanic Corridor of the Isthmus of Tehuantepec (CIIT), a multibillion-dollar project that connects the port of Salina Cruz, on Oaxaca’s Pacific coast, with Coatzacoalcos, on the Gulf of Mexico with both freight and passenger rail travel (h/t upstater). As we reported in 2023, the project, if well-executed, could hold the key to hedging the global economy’s dependence on the drought-hit Panama Canal.

And the good news is that the project is relatively close to completion. Money has been pouring in from all sides, including up to $2.8 billion from the Inter-American Investment Bank.

The south-eastern region of Mexico across which the CIIT will eventually criss-cross is one of Mexico’s poorest, but both the AMLO and Sheinbaum governments have prioritised its economic development. The region has also been receiving significant Chinese investments over the past decade while US companies have largely neglected it, preferring to focus on Mexico’s northern border regions, according to a 2023 report by Mexico Business News. Whether that trend continues time will soon tell.

Back in Panama, China will presumably continue to have sway over the economy. But there’s no denying that the BlackRock-led consortium’s takeover of the canal’s two main ports signifies a clear shift toward closer realignment of Panama with Washington’s interests. It also represents a major milestone for BlackRock’s global infrastructure ambitions, as Benjamin Norton notes in his Geopolitical Economy Report:

BlackRock is the world’s biggest investment company. It managed a record high of $11.6 trillion in assets in the fourth quarter of 2024. (The top 500 investment managers on Earth together held $128 trillion in assets at the end of 2023.)

The Associated Press reported that the BlackRock-led consortium now controls at least 43 ports in 23 countries. The Wall Street giant’s subsidiary Global Infrastructure Partners was central to the US government-sponsored Partnership on Global Infrastructure and Investment (PGI), which was launched by the Joe Biden administration and the G7.

BlackRock’s billionaire CEO Larry Fink was invited to sit with Western heads of state at the G7 summit in Italy in 2024, where he called for “public-private partnerships” to help Wall Street firms buy up global infrastructure, especially in poor, formerly colonized countries.

BlackRock has enjoyed a very close relationship with the US government, under both Democrats and Republicans. Fink said before the US presidential election in November 2024 that it “really doesn’t matter” who wins, because both parties would benefit Wall Street.

Bloomberg reported that Fink personally called Trump and asked him to help BlackRock purchase the Panama Canal ports. The financial media outlet noted that the billionaire CEO bragged of BlackRock’s deep links with governments worldwide, stating, “We are increasingly the first call”.

Trying to Halt a 25-year Trend

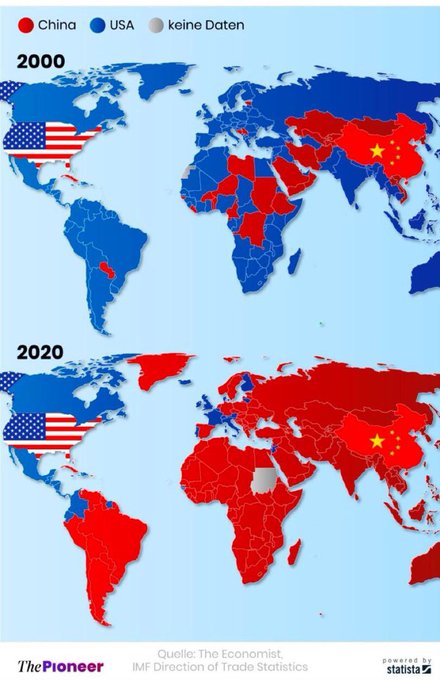

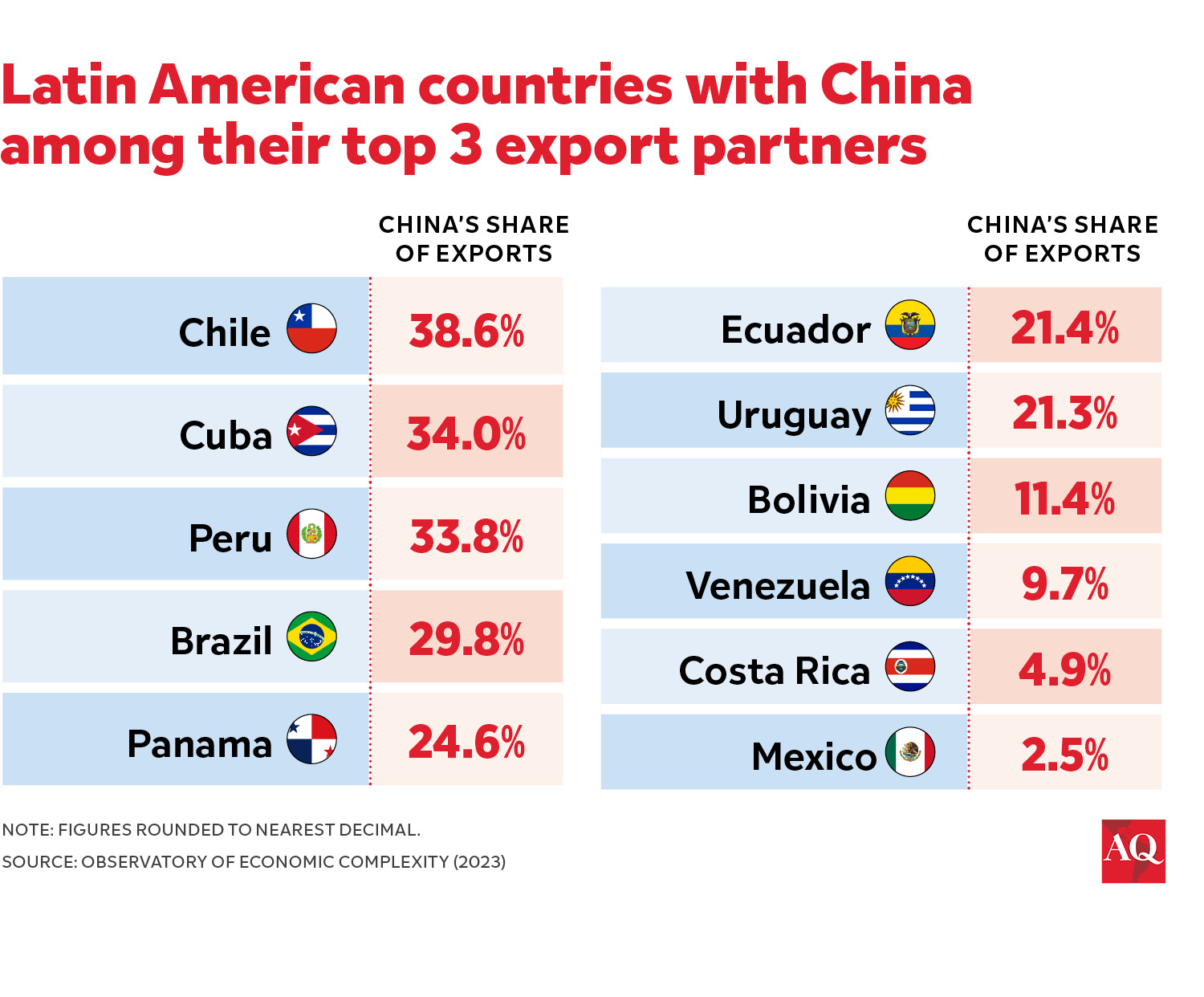

As we have documented in numerous posts since the summer of 2021, the US’ apex strategic rival, China, has not only gained a foothold in the US’ backyard in the past three decades but has even begun to win the race for economic supremacy in the region. China is already South America’s largest trade partner, and as we saw with the recent opening of the Chinese-funded and controlled mega-port in Chancay, Peru, its Belt and Road Initiative promises to further cement that position.

Besides Hutchinson’s controlling stake of Panama’s two main ports since 2015, the Trump administration’s main bone of contention with the Central American nation was the fact that its government, like most governments in Latin America, had signed the Belt and Road Initiative. In fact, Panama was the first Latin America country to do so, in 2017. Since then, 20 other countries in the region have signed the initiative, including Venezuela, Chile, Uruguay, Ecuador, Bolivia, Costa Rica, Cuba, Perú, Nicaragua and Argentina.

To placate Washington’s demands, the Panamanian President José Raúl Mulino said he would not renew Panama’s Belt-and-Road membership when it comes up for review, becoming the first country in the region to leave Beijing’s global infrastructure initiative. He also mentioned the possibility of his government reconsidering the concession granted to Hutchinson Ports. The move sparked an unusually sharp rebuke from Beijing slamming Washington’s “Cold War mentality” in Latin America.

From Al Jazeera:

A spokesperson for the Ministry of Foreign Affairs of the People’s Republic of China on Friday hit out at the United States for sabotaging the global infrastructure programme.

Beijing “firmly opposes the United States using pressure and coercion to smear and undermine Belt and Road cooperation,” said Lin Jian in a statement. “The US side’s attacks … once again expose its hegemonic nature.”

Referring to a visit this week to the region by Marco Rubio, Lin said the US Secretary of State’s comments “unjustly accuse China, deliberately sow discord between China and relevant Latin American countries, interfere in China’s internal affairs, and undermine China’s legitimate rights and interests”.

A Different Vision of Multipolarity

With Trump back in power, the US may have finally accepted the multipolar reality of today’s world but, as Conor noted in his recent post, The Empire Rebrands: Foreign Policy Under Trump 2.0, the Washington’s vision of multipolarity differs markedly from the one envisioned by China, Russia and other countries in the so-called “Global South”:

As many have pointed out, the US seeks win-lose transactions, and this is nothing new under Trump. As Glenn Diesen states:

In a multipolar world, security is enhanced by reducing the security competition between the great powers, while a mutually beneficial peace can exist under a balance of power and acceptance of the status quo. Even small- and medium-sized states can obtain more political autonomy from the great powers by cooperating with all great powers to diversify their economic connectivity. However, the US appears to be attempting to defeat China as its main rival, and coerce small and medium states into spheres of influence to ensure political and economic obedience.

This is now playing out in Latin America. It is no coincidence that the US’ new Secretary of State Marco Rubio’s first international tour was to the five Central American countries of Panama, El Salvador, Guatemala, the Dominican Republic and Costa Rica. Officially speaking, Rubio was visiting these countries for three main reasons: to stop mass illegal immigration to the US; to fight the “scourge of transnational criminal organizations and drug traffickers”; and “to counter China, and deepen economic partnerships to enhance prosperity in our hemisphere.”

As a trading power, the US continues to holds significant sway over Central America. Pound for pound, it is still Latin America and the Caribbean’s largest trading partner. But that is predominantly due to its huge trade flows with Mexico, which account for a whopping 71% of all US-LatAm trade. As Reuters reported in 2022, if you take Mexico out of the equation, China has already overtaken the US as Latin America’s largest trading partner.

Meanwhile, China’s trade with Mexico, as with most parts of Central America, is growing fast, or at least was. And it is this trend that the Trump administration wants to halt, or even reverse. In order to achieve that, Trump 2.0 is, according to the Washington Post, “reviving” the two-centuries old Monroe Doctrine:

Long-attuned to U.S. slights both perceived and real, few [policy makers in the region] missed Trump’s throwaway line during his signing of executive orders just hours after his inauguration. Relations with Latin America “should be great,” he told reporters in the Oval Office. “They need us much more than we need them. We don’t need them.”

“What is the point of saying that?” asked the senior South American official, who spoke on the condition of anonymity to avoid drawing unwanted attention to his country. “It’s destroying trust. … Instead of inviting us to a new vision, he doesn’t invite anybody. There are only threats.”

Of course, the Monroe Doctrine never went away, it has just waxed and waned. During the first two decades of this century, it took a back seat as Washington focused on executing its War on Terror in the Middle East. As it squandered trillions of dollars spreading mayhem and death and breeding a whole new generation of terrorists, China began snapping up Latin American resources, in particular food, petroleum and strategic minerals like lithium.

But even during this time Washington was able to organise a failed coup d’état against Hugo Chavez’s government in Venezuela (2002) and a successful coup against Manuel Zelaya’s government in Honduras (2009). There was another unsuccessful coup against Venezuela’s Chavista government in 2019 as well as a successful one in Bolivia. The partly self-inflicted downfall of Peru’s socialist leader Pedro Castillo in 2022 also got the prior blessing from Washington’s ambassador in Lima and former CIA agent, Lisa Kenna .

By the early 2020s, it was clear that Washington had begun rejigging the Monroe Doctrine, a 202-year old US foreign policy position that opposed European colonialism on the American continent, in order to apply it to its most important strategic rivals of today, including China, Russia, Iran and even Hezbollah. Just this past week, a bipartisan bill titled the “No Hezbollah in Our Hemisphere Act” was introduced to the US Congress seeking to counter the Lebanese terrorist group’s influence in the region.

But it is China’s rapid rise in the US’ own “backyard” that is of greatest concern in Washington. Unlike the US, Beijing offers win-win trade and investment deals to national governments in the region. It also does not tend to meddle in internal politics, or at least hasn’t until now, preferring to let the money do the talking. As the former US Treasury Secretary Laurence Summers once admitted, “When a Latin American head of state asked me for something, I lectured them. While I was preaching, the Chinese were building airports.”

When it comes to international trade, win-win strategies tend to work far better than the zero sum games pursued by Washington. As China’s influence in the region has grown, it is the US military that has done a lot of the talking. In January 2023, General Laura Richardson, the then-Commander of US Southern Command (USSOUTHCOM), reminded the Atlantic Council of just how important Latin America’s resources are as well as the need to “box out” China and Russia from them.

In other words, despite what the Washington Post may claim, the Trump Administration’s attempted shakedown of small and mid-sized Latin American countries does not represent the revival of the Monroe Doctrine. That said, it does represent a significant escalation in that trend, and one that many countries in the region and beyond will be keeping a close eye on — including, of course, China.

This time around, China’s government is taking a much harder line against Trump’s aggressive foreign and trade policy, including on the American continent. Last month, the country’s foreign minister Wang Yi warned that Latin America is not the “backyard” of any country amid attempts by the Trump administration to browbeat reengage with countries in the region.

“Latin America is the home of the Latin American people, not the backyard of any country,” Wang told Sosa, according to a statement released by Beijing. “China supports Latin American countries in defending their sovereignty, independence, and national dignity.”

If anything, China is seeking to intensify its strategic relations with countries in the region, particularly in South America. As the Mexican expert in international relations Brenda Estefan recently wrote last month for American Quarterly, the US may have notched up an early victory in Panama but convincing other countries, particularly in South America, to leave China’s orbit is likely to be more challenging:

Beijing currently maintains “strategic partnerships” with 10 of the 11 South American nations it engages with, with Guyana being the only exception, as it maintains only standard bilateral relations…

In January, during a visit to Beijing, I met with Chinese business leaders whose inclination to deepen their investments in Latin America, particularly in Mexico, was unmistakable. Our discussions revealed China no longer perceives Latin America as a resource supplier but as a pivotal part of its ambitious global economic agenda…

… Brazil—Latin America’s largest economy—is largely a lost cause for Washington, as it has significantly deepened its ties with Beijing. Chinese firms have invested in major infrastructure projects ranging from ports and railways to power grids. China is now Brazil’s largest trading partner, absorbing most of its exports, including soy, beef, coffee, and iron. In 2023, bilateral trade reached a record $181 billion. Moreover, Brazil and China have strengthened their geopolitical ties through BRICS, further complicating Washington’s ability to exert influence.

Of all the countries in the region, Peru draws the highest level of Chinese investment relative to GDP. The most significant of these investments was the recently inaugurated deep-water port at Chancay, which is intended to serve as a direct trade link between China and South America. After Trump’s electoral triumph, one of his advisors even proposed imposing tariffs on goods passing through Chancay.

Argentina is another interesting case. Before coming to power in late 2023, President Javier Milei talked openly about cutting all ties with China’s “murderous” dictatorship, only to backtrack once in office. There was a simple reason for this: since 2009 Argentina has had a currency swap arrangement with Beijing which has helped to ensure some degree of exchange rate stability for Argentina while also deepening trade between the two countries.

Given the sorry state of Argentina’s finances, Milei was in no position to turn his nose up at any outside financing. Indeed, by October 2024, almost exactly a year after telling Tucker Carlson that he would never trade with China due to its government’s left-wing, authoritarian proclivities, Javier Milei had nothing but fond words for the US’ main strategic rival today.

“China is a very interesting trading partner,” said Javier Milei, who just a year earlier had described the Chinese government as as “assassin.” They “do not make demands, the only thing they ask is that they not be bothered.”

Mexico, Between a Rock and a Hard Place

There can be no doubt that the US’s main priority is to drive a very large wedge between Mexico, its largest trade partner, and China, its second largest. According to Norwegian logistics firm Xeneta, the Mexico-China trade route is now the fastest-growing in the world, as China has sought to use Mexico’s fast-growing industrial base as a stepping stone for the US market. Given the extent of economic integration between the US and Mexico, Washington is determined to put an end to this trend.

And so far, Mexico has buckled each time the US has applied pressure. Last April, the AMLO government announced hundreds of “temporary” tariffs on imports from countries with whom it does not have a trade agreement. The tariffs were imposed on 544 imported products, including footwear, wood, plastic, electrical material, musical instruments, furniture, and steel, and ranged from 5% to 50% in size. They had one clear target in mind: imports from China though the word “China” was not mentioned once in the decree.

While the growing deployment of protectionist measures in Mexico, largely at the behest of the US, has elicited rare criticism in the Mexican business press, it seems that the Claudia Sheinbaum government is poised to continue this policy. From Bloomberg:

Mexican President Claudia Sheinbaum said her country would review tariffs on Chinese shipments, a move that could give the Trump administration a win in its push to build a “Fortress North America” that blocks shipments from the Asian nation.

“We have to review the tariffs that we have with China,” Sheinbaum said at a press conference Thursday.She pointed to Mexico’s problems in textile and shoe production, saying: “Much of the entry of Chinese products into Mexico caused this industry to fall in our country.”

The comments come after President Donald Trump offered major reprieves to Mexico and Canada, the US’s two largest trading partners, by exempting goods from those nations that are covered by the North American trade agreement known as USMCA from his 25% tariffs.

There’s a clear logic behind this. For a start, the economies of Mexico and the US are already so intertwined that trying to disentangle them will be an ungodly task. A staggering 83% of Mexico’s exports, many of which are goods assembled by US manufacturers in Mexican maquiladoras, go to the US. If a large part of those supply chains was threatened, the result for Mexico would be a deep economic crisis with millions losing their jobs, which in turn would endanger the ruling party MORENA’s entire economic project.

As I’ve noted in previous pieces, Mexico is caught in the middle of a titanic duel between the world’s two rival economic superpowers. While Brazil’s Lula may have invited Claudia Sheinbaum to the next BRICS meeting, the chances of Mexico becoming a BRICS nation any time soon is still razor thin, even as the Trump administration does everything it can to dynamite the USMCA trade deal, and its constituent economies.

For one thing, it will take years for Mexico to pivot its economy away from the US. Also, as AMLO said last year, Mexico’s geographic reality simply means it has little choice in the matter:

We cannot shut ourselves off, we cannot break up, we cannot isolate ourselves. It is a fact that we have 3,800 kilometres of shared border, for reasons of geopolitics (presumably in reference to the US’ invasion, occupation and appropriation of more than half of Mexico’s territory in the mid-19th century). With all due respect, we are not a European country, nor are we Brazil. We have this neighbourhood and, furthermore, if we agree on things, as we have done, we can help each other out…

However, helping out the US essentially means hitching Mexico’s economy to a declining superpower that appears to be on the verge of inflicting upon itself — and by extension, large parts of the world — a severe economic crisis while at the same time adopting an increasingly belligerent approach to adversaries and allies alike.

This time around, however, China is adopting a tougher response to US and broader Western provocations. Just a few days ago, Beijing imposed a 100% tariff on Canadian rapeseed oil, oilcake and peas and a 25% tariff on aquatic products and pork from Canada as a retaliation for Ottawa’s escalating tariffs on Chinese-made electric cars and other products.

While Mexico’s exports to China are negligible, representing just over 2% of the total, a chill on diplomatic and commercial relations with China will mean even greater dependence on the big neighbour to the North as well as loss of influence in the Global South, which is just how Washington wants it.

BlackRock’s Takeover of Panama Canal Is First Major Victory for Trump’s “Americas First” Policy, It is also a major victory for Wall Street.

So the obvious, to me, is to ask the question victory for whom? “America First” you say, Wall Street? Are the two the same or divergent? That There can be no denying it: the deal is a major geopolitical victory for the Trump administration… I’m ready to concede if it is the U.S. flexing its military/financial/ political influence in this hemisphere viz-a-viz China. A victory for those Americans on Soc. Sec. and under a insufferable burden of debt, living precariously from day-to-day, victory? ah…not so much.

Woodrow Wison wrote: “Since trade ignores national boundaries and the manufacturer insists on having the world as a market, the flag of his nation must follow him, and the doors of the nations which are closed against him must be battered down. Concessions obtained by financiers must be safeguarded by ministers of state, even if the sovereignty of unwilling nations be outraged in the process. Colonies must be obtained or planted, in order that no useful corner of the world may be overlooked or left unused.”

It is, in much the same terms, Lenin’s theory of imperialism. In whatever terms, both Trump and Xi understand this.

Yes, and of course the most notorious period of Latin American intervention was the post WW2 Cold War when our FP elites were allegedly fighting communism–a mere idea–rather than a trading rival. Many of us thought back then that Reagan was doing in Latin America what he and the MIC would do in this country if they could get away with it.

Perhaps one explanation for today’s world wide elite tolerance of massacres in the ME and Africa is that they keep the colonialist dream alive in the spirit of Pizarro and Cortes and even Columbus. As Madeleine Albright said, “why do we have this giant military if we aren’t going to use it?” Why indeed.

Trump of course is waxing nostalgic for the even older McKinley period when the Philippines gained our benevolent attention. But American imperialism was always a mere me too version of what Europe had been doing. After all it was Spain and Portugal who created all those Latin American countries.

With luck buying a few ports will satisfy Trump’s urge for territorial glory. Multipolarity is a rational and desirable thing but it is not the historical trend.

We couldn’t hardly wait to grant independence to the Philippines just after WW2, that’s how important it was to us, Puerto Rico (‘Rich Door’ in Spanish) is somewhat of a basket case, Cuba has been our sworn enemy going on 65 years now, leaving us with Guam for the win, of our circa 1898 territorial conquests.

We weren’t very good at colonialism as it turns out.

Europe, on the other hand…

You’re forgetting the 1898 imperial-colonial elephant in the room — the annexation of Hawaii.

https://www.qwant.com/?q=hawaiian+pear+is+fully+ripe+golden+hour+pluck+it

Not for nothing has Woodrow Wilson been called one of America’s most evil Presidents. Right down there with Clinton, Cheney (bush) and Obama.

Yes, but give Wilson his due. Wisdom resides in changing the things we can change, accepting the things we can’t change, and making money off of the rest.

While reading this post, one line stuck out which said ‘the BlackRock consortium control over 43 ports in 23 countries.’ I have read this before but I am now wondering how far back that Blackrock has been acquiring ports. Thing is, as soon as Trump got in he was talking about the US seizing places that had shipping lanes go through them (Panama) or had vital shipping lanes go by them (Greenland) and of course the US is setting up bases on places like the Galapagos Islands which also have trade routes go by them. So when you think about it, if you have the government trying to seize control of the world’s shipping routes while at the same time you had US Blackrock buying up strategic ports, it seems that the new strategy of the deep state government is to control the world’s shipping routes to strangle any country that they did not like. So this must be one of those public-private partnerships that you keep on hearing about. /sarc

Please stop the hyperventilating. China has been buying up ports. So now the US is catching up?

The only difference it is the Trump noisemaking.

CK Hutchison Holding is probably laughing all the way to the bank. Panama is in the midst of a crisis over water. Not enough for the canal and local farms, to the degree that it was causing local unrest. So now America which I believe also has a base there gets to be the bad guy water hog.

Sure China is buying up ports if not building them and perhaps that reflects the number of engineers in their National People’s Congress. They are all about infrastructure after all. But the point I was trying to make was the combination of controlling trade routes and controlling the ports that they stop off at. Trump wants Greenland for control of shipping routes coming out of the Arctic. All those mineral resources to be mined there would be just to pay for it all. I doubt that this is all a Trump idea but somebody for years now has been feeding him such plans about controlling the world’s shipping routes and ports.

If global warming turns the Panama Canal into a dry empty ditch, it won’t even be a shipping route anymore.

A railway, perhaps?

control as in managing or actual ownership. The ownership can be much murkier and less transparent than this. Read somewhere that from the 11 Trill managed by BlackRock only a fraction is in fact owned by the company. Is it true?

CK Hutchinson Holdings is owned by the influential Li family. The patriarch, Li Ka-Shing, who is now retired was once known as the Superman of Asia and had deep links to the Communist Party of China. The Holdings company also still has a very substantial presence in Hong Kong (for example the ubiquitous Watsons shops) and Mainland China. I have a hard time reading this one, because the family knows that it has to stay on the right side of the Communist Party and if the later really wanted these ports, they could have one of the State Owned Companies gobble them ports up, so I think this sale was actually approved by the Chinese government and the next obvious question is to what purpose?

To make some money before global warming makes the Panama Canal dry and worthless?

( Dumm Trump doesn’t ” believe in global warming ” so Dumm Trump could never imagine the Panama Canal running out of water).

The “Fortress North America” reference really struck a cord. Apparently the US reputation is so damaged that countries can no longer be convinced to be a vassal state anymore. Apparently the BRICS offer is a better one. The economic war drums are beating. Luxuries like education, healthcare, environmental protection, and what remains of the social safety net programs, in both the US and in the US’s vassal states, are quickly being defunded, dismantled, and privatized for profit. The elites who run our private government are building up their financial war chests in a variety of ways. We all know who profits from war. As for the remaining 95-99% of us, well, we all know who bears the burden of sacrifice in war.

The headline is acrid male bovine faeces of the ilk agent orange loves spouting. BlackRock has not taken over the Panama Canal(s), it only purchased two out of the five port terminals in the country

In order to do this BlackRock had to purchase 43 port terminals in a score of countries and seems to have overpaid for a package it cannot even operate because it lacks the expertise. Swiss based MSC will operate these terminals.

BTW 38.000 US citizens did not die building the first Panama Canal, only a few hundred. Most were probably mormons who refused to live pissed on gin tonic.

Point taken, Mangy Cat, and it’s an important one. Title has been changed. Thanks for the eloquent feedback.

Thank you!

Yellow fever – the major killer in Panama – is not listed as a disease treated by quinine at drugs.com.

I don’t know if it has any such efficacy equivalent to that of malaria.

Unlike its effect on plasmodium malariae, the parasite causing malaria, you are correct that quinine is not a treatment for yellow fever. However, like caffeine, quinine is a mosquito repellent, these critters being the vectors of both diseases.

I have no data on the epidemiology while the US built the canal but during the De Lesseps venture both malaria and yellow fever were severe problems.

In the generation between the French and US ventures the mosquito was found to be the vector. Together with the decision to build lacks rather than at sea level contributed to the success of the canal.

Thank you, Nick.

The Partnership on Global Infrastructure and Investment (PGI) link caught my attention. Some, but not all, of the private sector attendees are involved with the British government’s attempt to reboot, really privatise, the UK. Sometimes, a storied UK firm is invited as a token, like Schroders a fortnight or so ago, but these US giants are in the driving seat.

This is why I think the UK will continue to triangulate between the EU and US.

In addition, with an election defeat not unlikely in 2029, Labour politicians will need a golden parachute. They have to suck up to US big finance.

There is no doubt in my mind that CK Hutchinson believe the have sold Blackrock a pig in a poke. I doubt they would have been allowed to make the sale by the CCP if the latter believed it was AT WORST geopolitically neutral.

As Yves pointed out above, Panama is hurting badly for water, and China is better positioned to operate without the Canal. Expect to see more >Panamax ships sliding out of Chinese shipyards soon.

Mexico launches Interoceanic Train service Trains

More recently Sheinbaum dramatically increased funding:

Double tracking the line and running double stack container trains could easily handle several million containers a year with efficient sorting at either end. With Panama’s water problems, increased transit tolls and Blackstone running the ports, this project may have promise for Mexico.

Thanks for bringing this up, upstater. We actually covered this story back in 2023. Have added a couple of additional paragraphs to this piece on the issue as well as a wee hat-tip in your direction.

Since it is acknowledged that most of the fenanyl comes in by ship, does this mean Blackrock will face 25% tariffs unless they get it under control?

In the medium and long run, if Chinese ships use the North East Route to reach the North Atlantic and then go down the eastern seabord of Americas, do theyyy even need the Panama Canal. What are the distances involved, and the dangers for chocking for one traditional route (passing the island chains around China into Pacific and then the Pacific into Panama and Atlantic) compared to the other (NER under Russian security umbrella then down to North Atlantic and so on?

I have the feeling that Yves is quite right and Hutchinson Holdings is laughing on their way to the bank…

re: There can be no doubt that the US’s main priority is to drive a very large wedge between Mexico, its largest trade partner, and China, its second largest.

Until Canada actually becomes the 51st state, I believe it’s the USA’s largest trading partner, before Mexico.

Nick Corbishley – thanks for a very informative article.

One also wonders if Blackrock will manage the Ports for trading efficiency, or strip mine the port’s value and assets while neglecting maintenance – the typical VC maximizing profit approach, eventually leading to much higher costs for the nation’s (and loss of competitiveness) that sold them the ports.

You can’t make this up, Blackrock CEO Larry Fink sounds the alarm on the economy

After buying a couple of lemons he’s just realized that he would not be able to turn them into lemonades. Time to Learn to Code?