Mr. Market falling out of bed due significantly to the Trump tariff whiplash has freed the business media to go with both barrels after Trump economic policies. Some headlines in the last two days:

Wall Street Fears Trump Will Wreck the Soft Landing Wall Street Journal

Is Trump Taking a ‘Liquidationist’ Approach to the Economy? Wall Street Journal

CEOs Don’t Plan to Openly Question Trump. Ask Again If the Market Crashes 20%. Wall Street Journal. Subhead: “Behind closed doors, business leaders air plenty of concerns about the administration and its policies.”

US CEOs Need to Find Their Missing Backbones Bloomberg

Trump’s $1.4 Trillion Tariff Threat Spurs Companies to Seek Cover Bloomberg

How Do You Sell America on a Recession? Bloomberg

U.S. markets tumble as Trump dismisses economic fears CNBC

Trump ‘an agent of chaos and confusion, economists warn CNBC — but a U.S. recession isn’t in the cards yet CNBC. Note the part after the dash does not appear in a search.

Musk’s cuts fail to stop US federal spending hitting new record Financial Times

Wall Street loses hope in a ‘Trump put’ for markets Financial Times

Trump’s tariffs are starting to bite American builders Business Insider

I’m a Canadian mom who frequently traveled to the States. Now I’m avoiding the US and boycotting American products. Business Insider

For the first time, a majority of Americans don’t like Trump’s economic policies Business Insider

And yes, not only is this selection not unrepresentative, but there is more where that came from.

Even libertarians are turning on Trump:

Nobody is pulling punches on Trump’s handling of the economy in the White House briefing room … not even Fox News. pic.twitter.com/jYN7ubMYxs

— The Recount (@therecount) March 11, 2025

The DOGE Tracker Shows DOGE Savings Only 8.2 Percent of the Claim Michael Shedlock

How Do We Lower the Trade Tensions Between the U.S. and Canada? Michael Shedlock

And even though the economy is softening (as we’ll see below, at a quickening pace due to consumers cutting back on spending), inflation pressures have yet to meaningfully abate:

Price of Natural Gas Futures Up 140% Year-over-Year: One More Reason for Inflation to Not Back off Easily Wolf Richter

Inflation eased in February, but trade war threatens higher prices Washington Post

On the one hand, eggs are only eggs. On the other, they have come to symbolize the Biden and now Trump Administration’s inability to curb inflation:

The cost of eggs in the U.S. jumped 10.4% last month, the Consumer Price Index shows. Eggs are nearly 60% more expensive than a year ago. https://t.co/p9kcmzK384

— The Associated Press (@AP) March 12, 2025

Mind you, not all business/economic tsuris is Trump’s fault:

How things got so bad for airlines seemingly overnight Business Insider

We’ll briefly turn to two new stories on Trumponomics, which go beyond Mr. Market’s misery and tariff freakout. One is the lead item in the Wall Street Journal, Consumer Angst Is Striking All Income Levels. The story describes clearly how the rate of decline in confidence and spending accelerated in February as compared to January. And this is before Musk started threatening bulwarks of many Americans finances, Social Security and Medicare. Remember it isn’t just retirees who get whacked. Those within 10 to 15 years of retirement who expected Social Security to be a significant part of their retirement funding are likely to hunker down further on spending to try to bulk up their nest eggs. From a reader by e-mail:

I am slated to start getting my SS in September after waiting until the end of the window. The promised amount will be a substantial part of my retirement income. Ditto for my better half who will retire at the end of June. It better be there. I have paid into the system with every paycheck since I was 15 years old in the summer of 1971.

Those who made Bernie Sanders impossible, twice, made Donald Trump inevitable, twice.

The opener from from the Journal’s account:

American consumers have had a lot to fret about so far this year, between never-ending tariff headlines, stubborn inflation and most recently, fresh fears about a recession. These concerns seem to be hitting spending by both rich and poor, across necessities and luxuries, all at once.

Take low-income consumers: At an interview at the Economic Club of Chicago in late February, Walmart Chief Executive Doug McMillon said “budget-pressured” customers are showing stressed behaviors: They are buying smaller pack sizes at the end of the month because their “money runs out before the month is gone.” McDonald’s said in its most recent earnings call that the fast-food industry has had a “sluggish start” to the year, in part because of weak demand from low-income consumers. Across the U.S. fast-food industry, sales to low-income guests were down by a double-digit percentage in the fourth quarter compared with a year earlier, according to McDonald’s.

Things don’t look much better on the higher end. American consumers’ spending on the luxury market, which includes high-end department stores and online platforms, fell 9.3% in February from a year earlier, worse than the 5.9% decline in January, according to Citi’s analysis of its credit-card transactions data.

Costco whose membership-fee-paying customer base skews higher-income, said last week that demand has shifted toward lower-cost proteins such as ground beef and poultry. Its members are still spending but are being “very choiceful” about where they spend, Chief Financial Officer Gary Millerchip said. He said consumers could become even pickier if they see more inflation from tariffs.

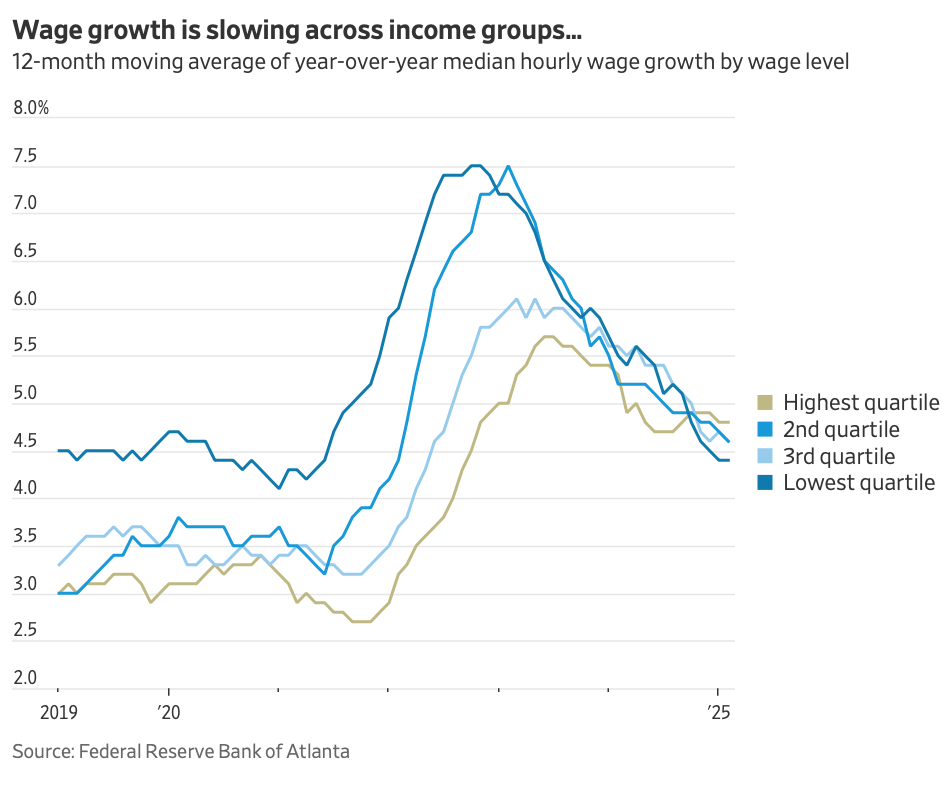

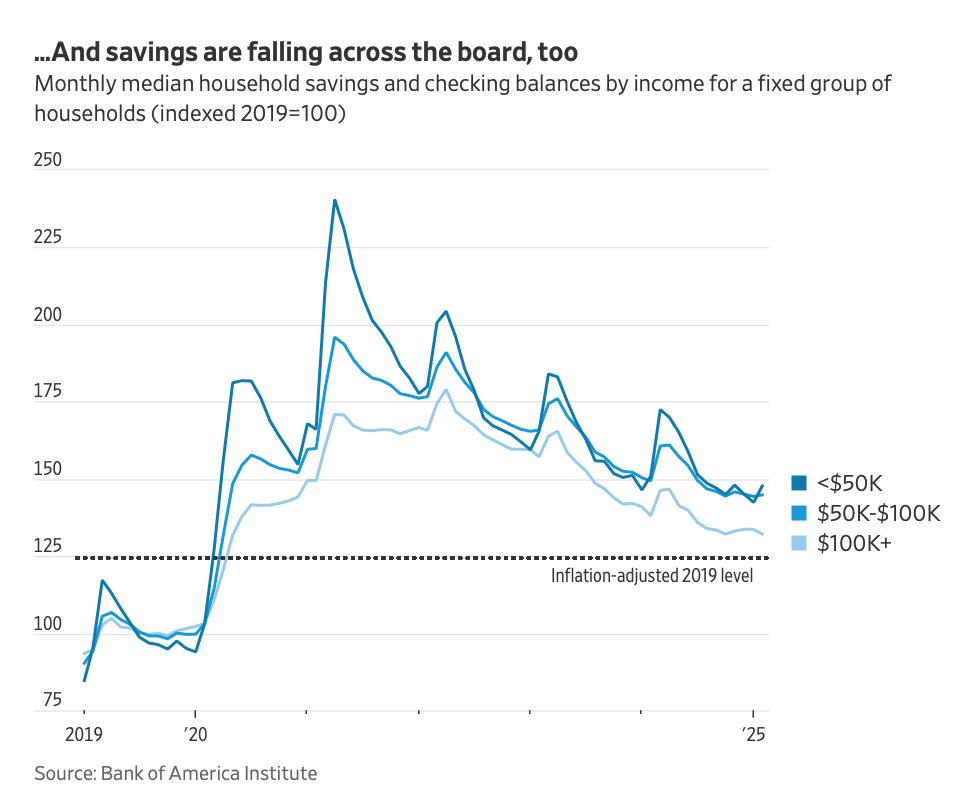

The Journal helpfully provides charts that show that the big Biden deficits did not translate into fatter wages:

Later in the Journal’s discussion:

The economy has seen pockets of weakness in recent years, but nothing that suggests such widespread weakness…. Several years of inflation—particularly on necessities such as groceries, rents and utility bills—have hit poorer Americans hard. But a strong stock market, buoyed by artificial-intelligence hype, kept wealthier folks spending.

Recall how we have repeatedly featured analyses by Tom Ferguson and Servaas Storm that showed how depending groaf has become on the outlays of the richest cohort, to the degree that it was a big factor in stoking inflation. The Journal later took up this thesis.

But now:

This week alone, consumers have had plenty of new developments to digest. President Trump on Sunday declined to rule out a U.S. recession as a result of his economic policies, causing stocks to plummet. This was followed by yet another roller coaster of tariff threats, counter-tariffs and reversals. While Wednesday’s inflation data showed price increases slowing down slightly in February, that is cold comfort because it is too early to reflect the effects of Trump’s tariffs…

Many also have less cold hard cash on hand. Checking and savings deposit balances across all income levels have declined over the 12-month period through February and are getting closer to inflation-adjusted 2019 levels…

What this means is that consumers generally are less able to absorb shocks, just as uncertainty is soaring. It is hard to blame them for turning cautious, even if that means the economy suffers.

So shorter: Mr. Market and the Confidence Fairy were keeping the economy chugging along, even if it was not widely recognized as a two tier enterprise. Now Trump has managed to whack them both, hard. Remember, a surprising trend since the crisis is the degree to which even the moderately to very wealthy would borrow against assets. Falls in asset prices put a hard brake on that as an additional booster.

A new Axios story, Voters disapprove of Trump’s economic policies, polls show, explains why the public view of Trump’s schemes has soured:

The big picture: The ramifications of Trump’s policies are already rippling outwards and impacting businesses and communities.

- The National Federation of Independent Business’s uncertainty index for small businesses rose to it’s second-highest reading ever last month since the 1980s, and many small businesses report raising prices, MarketWatchreported.

- In fact, a slew of small business owners have spoken out about the detrimental impacts Trump’s tariffs will have on their ability to maintain their businesses.

- Delta, Southwest and American airlines all warned this week that their first-quarter revenue or earnings forecasts will fall below expectations due to weaker consumer demand.

Our thought bubble, from Axios’ Ben Berkowitz: Investors are beginning to realize the first-term “Trump put” — the notion that he’d change policy if markets reacted negatively — isn’t in evidence this time around.

- There’s a greater willingness by his team to let whatever happens happen, which is an adjustment to past Trump economic practice that’s coming as a shock to some people.

Recall that the mother of all shock doctrines, Pinochet’s 1975-1975 program, which unlike the Trump program, did produce some initial promising results, eventually led to damage so severe as to lead Pinochet to go hard into reverse.1 As we have seen repeatedly (particular tariff threats, the Ukraine negotiations, Trump ritually beating up on Bibi before shoring him up, Iran) Trump seems to relish making radical reversals simply because he can. But how much ego investment does he have in his tariff and Federal institution destruction program? He’s rhapsodsized so much about how wonderful it was in the great pre-electricity, barely-any-indoor plumbing Gilded Era that one can expect him to be far less responsive than he has on his other pet project. I’d like to see we’ll see soon enough, but we may not.

______

1 From ECONNED:

Chile has been widely, and falsely, cited as a successful “free markets” experiment. Even though Chilean dictator Augusto Pinochet’s aggressive implementation of reforms that were devised by followers of the Chicago School of Economics led to speculation and looting followed by a bust, it was touted in the United States as a triumph. Friedman claimed in 1982 that Pinochet “has supported a fully free-market economy as a matter of principle. Chile is an economic miracle.” The State Department deemed Chile to be “a casebook study in sound economic management.”

Those assertions do not stand up to the most cursory examination. Even the temporary gains scored by Chile relied on heavy-handed government intervention….

The “Chicago boys,” a group of thirty Chileans who had become followers of Friedman as students at the University of Chicago, assumed control of most economic policy roles. In 1975, the finance minister announced the new program: opening of trade, deregulation, privatization, and deep cuts in public spending.

The economy initially appeared to respond well to these changes as foreign money flowed in and inflation fell. But this seeming prosperity was largely a speculative bubble and an export boom. The newly liberalized economy went heavily into debt, with the funds going mainly to real estate, business acquisitions, and consumer spending rather than productive investment. Some state assets were sold at huge discounts to insiders. For instance, industrial combines, or grupos, acquired banks at a 40% discount to book value, and then used them to provide loans to the grupos to buy up manufacturers.

In 1979, when the government set a currency peg too high, it set the stage for what Nobel Prize winner George Akerlof and Stanford’s Paul Romer call “looting” (we discuss this syndrome in chapter 7). Entrepreneurs, rather than taking risk in the normal fashion, by gambling on success, instead engage in bankruptcy fraud. They borrow against their companies and find ways to siphon funds to themselves and affiliates, either by overpaying themselves, extracting too much in dividends, or moving funds to related parties.

The bubble worsened as banks gave low-interest-rate foreign currency loans, knowing full when the peso fell. But it permitted them to use the proceeds to seize more assets at preferential prices, thanks to artificially cheap borrowing and the eventual subsidy of default.

And the export boom, the other engine of growth, was, contrary to stateside propaganda, not the result of “free market” reforms either. The Pinochet regime did not reverse the Allende land reforms and return farms to their former owners. Instead, it practiced what amounted to industrial policy and gave the farms to middle-class entrepreneurs, who built fruit and wine businesses that became successful exporters. The other major export was copper, which remained in government hands.

And even in this growth period, the gains were concentrated among the wealthy. Unemployment rose to 16% and the distribution of income became more regressive. The Catholic Church’s soup kitchens became a vital stopgap.

The bust came in late 1981. Banks, on the verge of collapse thanks to dodgy loans, cut lending. GDP contracted sharply in 1982 and 1983. Manufacturing output fell by 28% and unemployment rose to 20%. The neoliberal regime suddenly resorted to Keynesian backpedaling to quell violent protests. The state seized a majority of the banks and implemented tougher banking laws. Pinochet restored the minimum wage, the rights of unions to bargain, and launched a program to create 500,000 jobs.

Just like they brand Health care act under Obama as Obamacare, they need to brand this economy on Trump and coin a word-Trumponics sounds good. People need to know and more importantly make the connection of their collapsing 401K to Trump.

Actually, Obama initially hated the term “Obamacare”. He later embraced it when the Dem-friendly media took to touting how it had reduced the number of Americans without health insurance…omitting that many found Obamacare policies to be so skimpy and costly as to make it a coin toss as to whether to stump up for them or not.

Very true, what a racket. It should have been called RomneyCare, but no matter, the so-called ACA was another gift for the insurance oligopoly and could be considered a form of kleptocracy.

https://www.npr.org/sections/itsallpolitics/2015/10/23/451200436/mitt-romney-finally-takes-credit-for-obamacare

Massachusetts still has a health insurance mandate with tax penalties for those who don’t have insurance. It has a religious objection exception which I have used every single year, to not pay the penalty.

The form is entitled Healthcare Information and is pages long making it the majority of pages of the “simplified” tax form (epic political fail) and requires input of very long policy account numbers and company identification numbers and number of months carried.

I just completed my LAST Massachusetts income tax form and mailed to Massachusetts dept of Revenue. On it, I circled the “Healthcare Information” title on the form and wrote at the side of the page “You call this a Healthcare form but all your questions pertain not to healthcare, but insurance. Insurance is not care, and healthcare insurance is not healthcare. You should remove this title from this form and stop deceiving taxpayers.”

Equally bad, as Stoller has pointed out, Obamacare caused massive consolidation as insurers worked around the medical loss ratios by simply buying hospitals and physician practices en mass.

Fun times!

Obamacare has truly been a complete debacle.

Not for the insurance oligopoly. It is a gift that keeps on giving! So-called health care in the USA is a giant extortion racket. A great example of Kleptocratic Oligarchy

Trumponomics . . . Trumpinflation . . . yes, it would be good to repeat those words millions of times in millions of places to get them into the general public brainfield.

Maybe cute little trolls could make ” I did that” stickers featuring Trump’s face instead of Biden’s face, and go around sticking millions of them onto millions of packages of eggs. If it achieves nothing else, it would create jobs in the sticker industry.

Saw a video news clip of Trump a few days ago where he stated America was going to be rolling in money from all the income derived from tariffs, would not know what to do with it all – rim shot ….

And there will be rainbows, unicorns and cotton candy for everyone! We can always believe the promises of politicians, con-men, and snake-oil salesmen. It’s an American tradition

Here is the instant rimshot sound effect button its very own self, in case anyone wants to use it.

Of mafia dons , Trump is more Madonna ( US) rather than Mogilevich ( grand don of world crime syndicates, Russia). Out of his depth all round?

Trump 720 degress round and round we go, reminds me of a scene in Flawless 2008. Michael Caine plays London Diamond’s janitor being interrogated by the insurance investigator (Lambert Wilson) of entire diamond inventory gone missing as Demi Moore (the only female company Manager repeatedly passed over in promotion) looks on. Growing exasperated with the investigator’s endless minutia questions, Janitor asks investigator in English understatement: “You sound like someone who’s looking for something. Perhaps if you tell me what it is, I could help you find it.”

Well that was quick. Trump only had his Inauguration Day about 7 weeks ago and he has already succeeded into steering the US economy towards a ditch with the press shouting ‘Woop! Woop! Terrain. Terrain. Pull up! Pull up!’ Makes you wonder what he will do for the next 200 or so weeks.

Trump has certainly done tremendous damage and created a lot of uncertainty but there are a lot of signs that the wheels were starting to come off the economy in November, December, and January.

Hiring was slowing and inflation was being way too persistent. Trump has now thrown his brand of chaos into the mix and nobody knows what is going to happen next.

The stock market is at an inflection point and might come back really strong if he gets his tax cuts passed cleanly. If he doesn’t , look out below and it’s going to be an ugly ride.

The economy was looking a bit wobbly in the fall, but it looked in much worse shape back in 2022, yet no recession occurred. And most of the “persistent inflation” has been the housing index, which for various reasons the U.S. measures in such a way that it’s a lagging indicator. My understanding is if we measured housing costs like the EU, inflation would have officially been like half a percent lower – much closer to the 2% target.

Gosh! I feel so much better knowing that things are not so bad if only we measured housing costs like the EU. By the way, how is the EU doing these days?

Hooray, more tax cuts for oligarchy! That will surely boost the economy.

We agree with Matt L. In essence, the “wheels have fallen off” in the US.

Today, Ben Norton on X said, it looks as though Trump might be seeking a Reagan re-do with “The Plaza Accord.”

Big item on the list “devaluing the dollar.” Back in the 80s, other countries agreed with Reagan to follow suit, but today, nations/investors think very differently.

Has that occurred because more countries/investors are buying into Gold rather than using T-bills.

We’re shootin’ in the dark here.

Perhaps Yves could explain if and why there might be a new Plaza Accord, or is it too late for the US to do that??

Most Americans living through the second Gilded Age don’t remember, but the first one was replete with violence. Labor actions and protests were met with armed strike breakers and corporate militia massacres. The Pinkerton Detective Agency targeted labor organizers and fought pitched battles with strikers. Workers and Anarchists responded with bombings and assassinations.

It’s ironic that Trump idolizes President McKinley, who was president during the first Gilded Age, and the beginning of the American empire, while Trump presides over the second Gilded Age and final chapter of the American empire.

McKinley was assassinated by an anarchist. And while history doesn’t repeat, perhaps it rhymes?

“Managed recession”, a phrase heard Tuesday from a true believer, lol.

I’m waiting for “managed industrial collapse” lol

A boy can dream 🥲

It won’t be managed.

Oh, they may well manage it…. ;-)

Manage to make it unmanageable?

Pull the pit props and let the mine collapse.

Meanwhile, Mark Cuban (a democrat and Trump critic, I believe) prepares to feast on the carcass of government agencies destroyed by DOGE:

Oligarchs will feast, and they’ll feast, and they’ll feast, feast, feast, feast!

It’ll be the US’s Yeltsin era.

I don’t think Russians or anybody else will feel much pity. Indeed, dual-nationality carpetbaggers from across the world will likely going be flying in to get a piece of the privatization action.

How ironic would it be if the Chinese and Russians got in on the action?

Pretty sure dual-nationality Americans would be flying out of the country at the same with their looted fortunes to places safe from lynch mobs. Zuckerburg already has that mansion with the bunkers waiting for him in Hawaii and Thiel has New Zealand citizenship after spending only 12 days in the country-

https://www.theguardian.com/world/2017/jun/29/new-zealand-gave-peter-thiel-citizenship-after-spending-just-12-days-there

Its all good in Hawaii until they decide to eat the zukes ala Cook.

Did you ever have the Tall Poppy Syndrome in Aussie?

It seemed really pronounced in NZ when I traveled there quite a bit in the 80’s.

Thiel would be one mighty tall Poppy.

Hawaii is not out of the country. Hawaii is a U.S. State.

Maybe unhappy Hawaiians could start building and putting up huge official-looking signs: . . .

” Welcome to Hawaii! America’s Baltic State.”

Well, the lege is looking to make Independence Day (Nov 28) a state holiday (SB 614).

Ua Mau ke Ea o ka ʻĀina i ka Pono

Eggs. That foodstuff so symbolic in so many ways. Besides the economy, which I’ll muse about, Easter is coming up. Eggs at Easter are a thoroughly nonbiblical sign of lavishness, fertility, and renewal (along with bunnies, in the US of A).

On BookFace after the election, a number of liberals were posting memes along the lines of, “Hah, the MAGAts sold their civil rights for a dozen eggs!” One immediately notices just how out of touch liberals are. No wonder the Democrats can’t win and can’t operate as an opposition.

The egg represents several things that are now being pointed up in U.S. culture. Notice the guy at the refrigerator in the TwiXt? Here in Italy (and as I recall, in France), eggs are not refrigerated. The refrigeration is a clue that there is a problem in the U.S. food distribution system, one more foodstuff that is being abused. Recall the salmonella outbreaks. Recall that USonions can’t get a caesar salad with its traditional ingredient: a raw egg.

I am not a big consumer of eggs: I use them to make savory tarts, quick breads, and cakes. But many of our fellow commenters mention that they eat the traditional U.S. breakfast: two eggs, sunny-side up.

Italian eggs come in fourpacks and sixpacks. In the U.S., if you are going to eat the traditional breakfast, you’ll require a dozen. Price becomes a political issue. The U.S. Constitution indicates that the federal government is supposed to encourage manufactures and trade and productivity. One wonders what is coming apart in the pursuit of happiness.

Hence: Eggs as a sign of deterioration in one’s standard of living, in the quality of food, and in availability of basics (like a doctor’s appointment).

An egg shortage? In the land of amber waves of grain and fruited plains? It’s a symptom that I keep monitoring. Just as I monitored prices in Chicago in September 2024, when I went to a nice (but not fancy-shmancy) café that I once frequented only to find that an espresso coffee and plain croissant had risen to USD 9.18 $.

That’s when I knew that Kamala Harris would lose. Eggs? Trump had better keep his eye on the egg.

The reason eggs in the US are refrigerated is our bizarre production system. Eggs are somehow washed to remove a thin membrane….which keeps them from going bad faster! So in places with sensible practice, like Italy, Australia, and Southeast Asia, eggs in stores are not refrigerated and are good for about 3 weeks.

Farmer & homesteader tip: if you don’t wash your eggs, they keep in the fridge for a couple months!

However my hens produce so many my fridge would fill up entirely if I didn’t distribute them.

When the collapsenik neighbor gives you free eggs during eggflation, you are more amenable to his crazy ideas… I am winning hearts and minds out here you wouldn’t believe

Successful survivalism bestows personal credibility.

And I think they’re good for longer too, if someone regularly flips them, or if waxed, or if coated in butter.

Filthy US industrial agricultural practices, which also includes mistreatment of the animals, is the reason US eggs get washed, raw chicken carcasses are washed in bleach, dairy has to be pasteurized, and all the warnings about thorough cooking.

Caged chickens lay eggs and poop in the same tiny confined place.

Potatoes also last much long if they are NOT washed.

In Mexican supermarkets, eggs are sold by the dozen, not refrigerated, but in smaller shops and the public markets they are sold by weight, again, unrefrigerated, and you can buy as many or few as you need. They are not inexpensive, and are at least as popular for breakfast as they are in Canada. Shells are very fragile and thin — and they taste better!

I don’t know how to post a link here (and am a little wary of breaking the rules), but BIG by Matt Stoller has posted an amazing piece of the global control of the egg industry: Fowl Play: How Chicken Genetics Barons Created the Egg Crisis: https://www.thebignewsletter.com/p/fowl-play-how-chicken-genetics-barons?utm_campaign=email-half-post&r=15fy5x&utm_source=substack&utm_medium=email

That’s a great article for understanding what is/has happened to the egg industry fairly recently. I had never heard of egg barons before and having only two giant companies (not USA based) controlling the vast majority of egg/chicken production through sketchy genetic engineering practices was a revelation.

Here on Oahu, Hawaii, most of our eggs come from California. There was a period of 3-4 weeks where they were pretty much unavailable but lately I see no shortage. Local Hawaii eggs are about $4 a dozen more expensive than mainland eggs typically.

In 2016 I was lucky enough to visit Kauai. At the time the island was being overrun by feral chickens; we were told this was because there were no mongooses unlike there were on other Hawaii islands. Maybe the crafty little so and sos are better at hiding their eggs too.

Easter egg hunt anyone? Maybe all year round.

Does Kauai also retain more of its traditional legacy species of animals than the other Islands which have mongooses on them? If so, “feral chickens” might be a price worth paying to have more native species survival due to no mongooses.

Eggs, rent and gasoline, all are easily cited as markers of runaway inflation forcing prices higher and many citizens of America to adapt into a less than optimal ( or sub-optimal, to quote CNBC anchor Jim Cramer ) spending and consumption for an overall healthy economy. At the very least, my latest rent renewal had a modest price increase, so the monthly rent is not increasing at the same pace from prior years. I’ll take a win where I can find it.

Headlines a few weeks back were discussing if or how Disney might adjust or review their pricing packages for their park guests. These problems met the new administration when they walked in the door. And as referenced above it won’t be long until those ubiquitous stickers on gas pumps are perhaps showing up on egg cartons with a face switched out.

Just as a general point, in parliamentary democracies on a 4-5 year cycle of elections, the notion of ‘getting the cuts in’ first is quite common – almost standard procedure. While actually engineering a domestic recession is unusual (although not unknown), its standard practice to dampen economic expectations for the first 2 years or so in the hope/expectation that there will be a later upswing – most politicians are well aware that most people don’t vote on the basis of absolute economic conditions, but on expectations – i.e. if people feel ‘things are getting better’ they will be more likely to stick to an incumbent, hence its rare for a government to lose out during an upswing (even if they were responsible for the ‘dip’ – people have short memories). This is probably what UK Labour is trying to do, albeit incompetently.

This generally doesn’t happen in the US system because of the non-synchronous cycle of elections. But if you have a President who doesn’t really care about the mid terms, then this approach can make a certain amount of sense, especially if he is seeking rapid structural change. It doesn’t have to be a Pinochet type ideologically change – it may just be a calculation that there is a lot of deadwood and bubble in the system, and better to flush it out quickly, then use the following upswing to build in whatever new economic system you want. I suspect that Trump doesn’t really want a tariff based tax system, its just a short term way for him to shock the international trade system into the form he wants – i.e. one in which there is US onshoring and the US industry (not Wall Street) calls the shots.

Also, worth pointing out that Isabella Kaminski is speculating that a recession is part of an implied deal with the tech oligarchs – an initial cutting down to size in favour of a longer term accommodation – exactly what we’ve seen in Russia and China. I don’t particularly agree with this, but it is an idea worth holding in mind.

Some tech oligarchs seem to think this is what they’ll be getting: “Industrial Greatness Requires Economic Depressions” from Palladium, a Thiel mouthpiece.

Thanks for the link. Some real doozies in there – I think everyone here will have a laugh at the assumptions. E.g.

Who comes up with this stuff? As if “the poor” ever see a dollar of this money.

People still don’t fathom that the rich, such as Thiel and Musk, don’t want more- they want it all.

They think if we all live in Grafton, New Hampshire it will be a good thing.

this is a deeply fascinating link. i’ve felt for a while that musk, thiel, and co are going to use the trump admin to sieze power, but i was expecting something a little more obvious, like government contracts suddenly switching from boeing to spacex. this article agrees with that, but implies that the trump admin is first purging their enemies via forced economic depression.

purge then replace could be the overall strategy. but i dont know how good the implementation is going to be. the us would be in a very vunerable place during the transition time, and there could be consequences to that. ie, climate catastrophe coming in, and there being too much chaos to effectively deal with it.

also. the article makes the big assumption that optimizing for innovation is a good thing. which, i am sure is true for some people. but plenty of people want to optimize for stability. what your values are determines what world you consider to be better. so like, eh. as a mere mortal i feel uncomfortable claiming what the ultimate best thing to optimize for is. instability is definitely good if you’re looking to seize power tho.

“The US has no functioning democracy… an oligarchy with unlimited political bribery”

When oligarchs openly call the shots, and free speech is legally equated with $$, how can one speak of “democracy” with a straight face? How obvious does it have to get?

I think the outline of their idea is firming up. It is not an internal recession but an external one they seek. Seeing that the world is drifting away from the US they seek to transmit through the consumption channel a shock that will enable the US to regain a bit of its comparative advantage that it is losing.

Ideas of re-industrialising the US will take decades and necessarily start with the technical education system which has dwindled away. These people have no patience and will not personally gain from such actions so seek to force overseas winners into the US in a manner they can personally profit from.

First must come a change to budget making so that finances come before the spending not the other way around, otherwise deficits will continue. National infrastructure spending is the usual spur to industrial strength.

And of course the ever present danger of GFC 2 requiring a $ 10 trillion dollar bailout with these valuations and extent of speculative activity.

I think Trump and Bessent aren’t really afraid of an early recession (yet).

It seems like Bessent may think the best way to draw down interest rates is a good ol’ recession. If you look at the amount of maturing government debt in the next 1-2 years, it’s a bit scary, and they may want to refi with better rates.

Even though Reagan didn’t really “engineer” a recession, his administration suffered a bad one in 81-82, but by 84, it was “morning in America”.

Hi PK. I suspect this is what Trump’s team is attempting. And you are right that usually in a 4-year political cycle it’s a very risky strategy. But I think they’re willing to run the risk. I can also cite two previous Administrations, both Republican, who did the same with success: Nixon and Reagan.

Nixon was a political loner and didn’t care about his party in Congress, which were a distinct minority in 1969-70 anyway. Nixon as President basically made a deal with the Democrats who led Congress: I’ll sign your domestic agenda into law, you give me free reign and your support in foreign affairs. (That’s how we got the EPA, the Clean Air Act, the Clean Water Act, etc., etc., etc.). I don’t recall offhand what happened in the 1970 midterms but the result wouldn’t have made much difference to Nixon’s presidency.

Reagan certainly cared about his party in Congress, but like Nixon, they were far from a majority, although they did have a great deal of political organization and energy. Hindsight tells us that Reagan did have a knack for getting what he wanted out of the Democrats in Congress. On the economy, he had Nixon’s example from the previous decade, and a lot of Nixon’s key people (e.g. George Schultz) around him who knew just how to do it. They did it so smoothly that their timing was perfect for the “recovery” scenario you outlined in Reagan’s re-election campaign. I was in my teens at the time, but I do recall public perceptions about the economy shifting in early 1983.

This strategy has become one Republican template. They don’t all use it, but as a party, it’s in their culture and some of them have learned how and when to try it. Trump is not only a businessman with a natural feel for big economic trends, he’s basically a lame duck. This compromises his political leverage somewhat, but in other ways gives him more range and freedom of action, not having any electoral consequences of his own to fear.

Trump is following in the other non consecutive terms footsteps, in that the Panic of 1893 got going just before Grover Cleveland was inaugurated, and the years 1893, 1894 and 1895 are the rarest for US silver coins-as not many were minted on account of lack of demand in commerce when money was mostly silver.

We’re gonna get there by other means to be determined, by our determined teetotalitarian leader.

And a lot of the post election spending and maybe some of the debt accumulated, was perhaps from Americans who anticipated the tarrifs and were buying before those went into effect. Anecdote is not data, but several friends and relatives bought large ticket items just in case. Cars, cell phones, etc.

I can confirm, anecdotally. that my sister is planning her spending on large ticket items and goods stockpiling in anticipation of the negative impacts of tariffs.

As bad as the ‘70s economy was supposed to be there was never a shortage of eggs being flung at windows now and then.

I still see some finance types saying that the master plan to manage the deficit is on track (lower rates, weaker dollar, and another goal that I forget) but even if true, the mid terms have to be at risk. Wait until the Trump promised elimination of taxes on tips and social security are “deferred” to a later bill while the Trump tax cuts are extended (I’ve seen early whispers about this).

Just saw an email from my congress critter asking for constituents affected by federal cuts to contact his office. Signs of life in the Democratic party!

I have been assuming that the midterm risk will be managed by not having free and fair elections. The SAVE act, armed thugs at polling places, etc.

When squillionaires choose and fund the candidates, they don’t need to prevent the unwashed masses from voting.

US elections are already neither free nor fair.

Fighting Aliens in Aliens II:

“What the hell are we supposed to use man? Harsh language?”

Response of “constituents affected by federal cuts” … “Harsh language”?

I believe that is what your congress critter might apply to counter Trump’s efforts toward economic collapse.

I always assume the goal is fund raising.

Thank you for this extremely convenient round up, Yves.

I wondered if this might finally lead to a much needed separation of business and state, similar to separation of church and state. It would be nice, but I’m not getting my hopes up.

An Amendment that establishes that money is in no way speech and that corporations are not people with any inherent rights would be a game changer.

Amendment not required, and politicians who say otherwise are just trying to construct political cover. The spending=speech doctrine stands only absent any legislative or executive action. Faced with a strong enough challenge from either or both of the other two branches, the judiciary is checked. But they don’t even have to be checked if the legislature acts decisively on its own. Neither party in Congress has any intention of challenging the notion that spending=speech. It works to their distinct material advantage, so they prefer to make people think their hands are tied.

They are not.

The passage of an Act of Congress nullifying cases like Buckley and Citizen’s United would probably be enough by itself to overturn those decisions. And if the President were to sign it into law? The judiciary’s natural inclination is to defer to the legislative power, especially when joined in common cause with the executive.

In other words, those Supreme Court decisions are only still relevant because of a policy vacuum which both parties in Congress help to maintain as beneficial to their own selfish interests.

But what about all the campaign promises?

https://www.cnn.com/2025/01/28/economy/trump-inflation-price-promises/index.html

Now, the message is SFTU and get over it. That was fast

https://www.the-independent.com/news/world/americas/us-politics/trump-egg-prices-shut-up-b2712527.html

“Even libertarians are turning on Trump”: Trump’s Trade War With America’s Neighbors Is All Cost and No Benefit

What did we learn from yet another escalation in the North American trade war? Not to do it again. (What Did We Learn? – Burn After Reading https://www.youtube.com/watch?v=J6VjPM5CeWs)

https://reason.com/2025/03/07/trumps-trade-war-with-americas-neighbors-is-all-cost-and-no-benefit/?utm_medium=reason_email&utm_source=new_at_reason&utm_campaign=reason_brand&utm_content=Trump%27s%20Trade%20War%20With%20America%27s%20Neighbors%20Is%20All%20Cost%20and%20No%20Benefit&utm_term=&time=March%207th,%202025&mpid=49358&mpweb=2534-5999-49358

As Markets Whipsaw, Conservative Media Shrugs – NY Times

Those “shrugging” probably bought puts.

While retirees and close to retirees bite their nails at the state of their 401k, the casino goes “wheeeee” (from 3/11):

https://www.marketwatch.com/story/tariff-fueled-stock-market-panic-sparks-options-trading-frenzy-as-investors-favor-riskier-contracts-706fe86c?mod=home_lead/

Volume in S&P 500-linked contracts hit a record on Monday. Activity has been particularly intense in ‘0DTE’ options, which some have likened to ‘lottery tickets.’

Trump will be 82 years old and constitutionally barred from running again when the next presidential election comes around — he doesn’t give a rat’s a$$ what Mr. Market or the WSJ think, let alone the suckers who voted him into office.

This is nothing but a self-interested Shock Doctrine play. Trump made a fortune buying up distressed property in the 1970’s NYC malaise/bankruptcy and he’s been laundering money for oligarchs minted during the collapse of the USSR. He just loves the idea of leveling places like Gaza and the West Bank, driving off the people in order to snap-up their real estate to flip to settlers. In his psychopathy, recessions and depressions are nothing but buying opportunities at distressed prices.

Expect more of the same.

Trump Slump

Trump Pump, Dump and Slump…

And we’re the Chumps.

if you read the ecconned piece, its exactly as bill clinton crafted his disastrous economic policies, and we got the same results as chile.

i used to post that piece religiously in the days of free speech.

till we bite the bullet and tell the truth as to how we got here, a sanders type will always fail, and there will be no real opposition party.

We must destroy the Country in order to save the Country!

We learned that in Vietnam…

So much talk of the price of eggs but no mention of the over 100 million chickens slaughtered because of the faulty (for the purpose of documenting infection) PCR test . Also the desire for the next fake pandemic of bird flu.

If bird flu becomes Spanish Flu 2.0, the pandemic won’t be fake.

But people who would consider such a pandemic to be fake are invited to go maskless, boycott flu vaccinations, etc.

NASDAQ down over 2.2 %; S&P 500 down over 1.5% so far today.

The “plunge protection team” might have to get to work.

“Those who made Bernie Sanders impossible, twice, made Donald Trump inevitable, twice.”

That quote by Yves should be sent to every Dem politician.

They are impervious, I guarantee you.

The Clintobama Dem Politicians would merely sneer: ” another bernie bro heard from”.

https://www.crisesnotes.com/can-the-trump-administration-arbitrarily-take-money-from-anyones-bank-account/

New post by Nathan Tankus. Raises lots of big issues: is $1 in a us bank still worth $1 if it can be grabbed from any bank account at any time and what are the implications for the global financial system?

“…the Trump administration was in the process of successfully claiming for itself the power to arbitrarily reverse any government payment or even, in the worst case scenarios, arbitrarily confiscate the funds in any person’s bank account without due process of law.” Certainty if true this will lead to full blown dictatorship in months to maybe a couple years.

Tankus summarizes: “The pattern across my previous reporting, my current reporting, the reporting of others and this late-breaking FBI-EPA-Citibank situation suggest that the Trump administration is testing the waters in order to gain far greater control of the United States entire payments infrastructure- control great enough to bend Donald Trump and Elon Musk’s enemies to their will at a speed far faster than courts could ever conceivably contain. We are entering waters beyond the scale of constitutional crises and nearly every expert in this shallow pool feels ill-equipped to speak about it publicly for a variety of reasons. I’m having trouble imagining circumstances more dangerous.”

Looks like stormy waters just ahead!

Thanks for the link (I think). My warning to fellow commenters is that this article is not safe for reading just before bedtime. Maybe it’s just me, though. :(