Yves here. This post unintentionally is a telling snapshot of where leading edge conventional wisdom is in terms of adapting to climate change and the inability of insurance to serve as an adequate remedy as losses keep rising. Admittedly, this post reports on a conference organized by an insurer-affiliated NGO, so it is arguable unduly focused on the insurance part of the problem. Even so, that reflects the popular and political bias to hang on to the status quo even when it is clearly breaking down, and to use an unduly fashionable term, no longer sustainable.

As a result, there’s a bizarre unwillingness to confront that the coming levels of damage will be beyond the ability of any financial scheme, including government provided/backstopped ones, to cover. There is some indirect acknowledgment of the physical world issues, like having local governments invest more in protective measures (but what are those? Better levees?) and having insurers give incentives to property owners in high risk areas to reduce their exposure. But there’s no consideration of the fact that many people will engage in retreat, whether managed retreat or not. For instance, as of late January 2025, nearly a year and a half after the Maui fire, only three of roughly 2000 burned out homes had been rebuilt.

To put this more simply: climate change responses need to focus less on better insurance and more on better coping.

By Ulrike Decoene, Group Head of Communication, Brand and Sustainability AXA, and Beatrice Weder di Mauro, President Centre for Economic Policy Research; President Professor of Global Economics, Climate and Nature Finance Geneva Graduate Institute (iheid); Visiting Professor Hoffmann Global Institute for Business and Society INSEAD. Originally published at VoxEU

Intensifying climate extremes are exposing growing gaps in insurance coverage and threatening financial resilience. Drawing on a recent panel hosted at the Collège de France, this column examines how escalating disaster costs, market failures, and the need for better prevention urge to redefine societies’ risk management mechanisms in an increasingly uncertain climate landscape. The discussion highlighted the tension between risk-based pricing and solidarity-based schemes, underlining the necessity of prevention efforts and more equitable risk-sharing arrangements. As climate hazards intensify, striking a sustainable balance between affordability and fiscal viability emerges as a pressing challenge for policymakers, insurers, and society alike.

Los Angeles is burning, Valencia is flooded, Mayotte has been devastated. The shock of seeing people lose everything highlights a stark, ever more frequent reality: climate risks are increasing, and most of the vulnerable, as well as some of the wealthy, remain uninsured.

As climate change intensifies, the role of insurance in providing resilience and financial protection is under growing scrutiny. Climate-related disasters are becoming more frequent and severe, yet insurance coverage has not kept pace in some geographies, leaving significant protection gaps.

In this context, what are the levers to address the challenges ahead and foster a holistic approach that brings together the various stakeholders? The AXA Research Fund is a key partner of CEPR in Paris and, in September 2024, they jointly organised a conference fostering exchange between academics, policymakers and business practitioners at the Collège de France. At the conference, a panel of experts convened to discuss the future of insurability in the face of escalating climate risks.

The discussion, summarised in this column, highlighted three main themes: the rising cost of climate disasters and the insurance protection gap, market failures and the role of the state, and the need for better prevention and risk-sharing mechanisms.

The Rising Cost of Climate Disasters and the Insurance Protection Gap

Over the past 30 years, the cost of natural catastrophe claims has increased significantly, with global economic losses from extreme weather events reaching approximately $320 billion in 2024, compared to $268 billion in 2023 (adjusted for inflation) and considerably lower figures in the early 1990s (Munich Re 2025). This rise is driven by both the increasing frequency and severity of climate-related disasters and the growing value of exposed assets. In addition to dramatic social distress for the impacted population, this escalation has profound macroeconomic and financial effects, disrupting economic activity across labour, production, consumption, investment, and housing sectors (Eickmeier 2024).

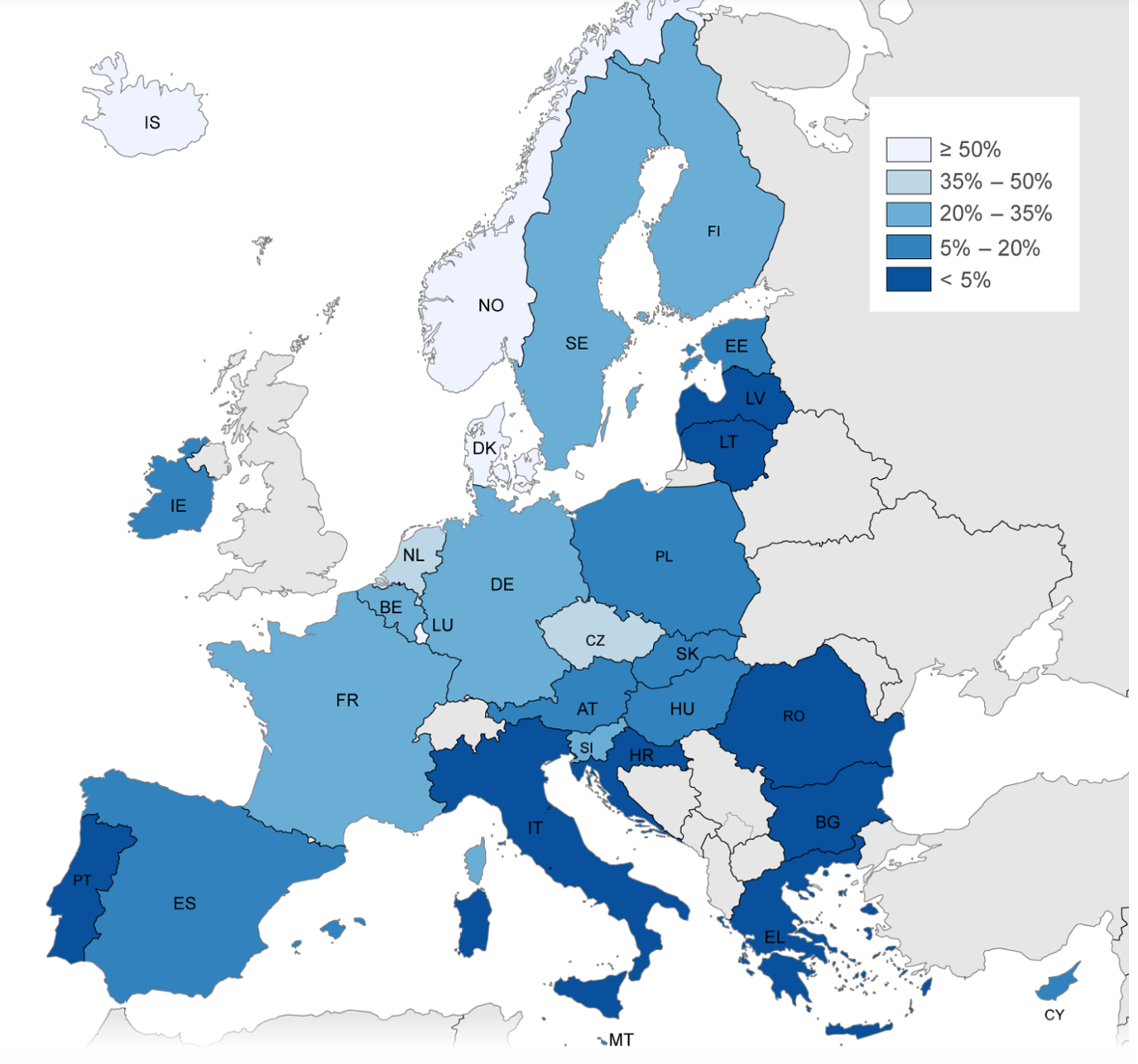

Yet, the coverage gap remains vast. In Europe, only about 25% of economic losses from extreme weather events are insured, leaving a 75% insurance protection gap, with some EU member states insuring as little as 5% of losses, as shown in Figure 1 (ECB 2024). Outside Europe, the numbers are only better in North America and Oceania, with around 43%; Latin America and Asia range around 80%, while there are no comparable numbers for the African continent (Swiss Re 2023). This shortfall places increasing pressure on public disaster relief funds – where they exist – and raises concerns about long-term financial sustainability. Despite insurance being a fundamental tool for risk management, it remains underutilised in many high-risk areas. Improved risk-sharing mechanisms and prevention measures are crucial to mitigating the long-term impacts of climate disasters on both economies and communities (Vives et al. 2021). It is also about setting the right price and promoting partnerships between public institutions and private companies.

Figure 1 Proportion of economic losses from natural disasters covered by insurance across Europe

Source: ECB (2024).

Richer regions are not immune either. Fiscal vulnerabilities can also be exacerbated: EU countries could experience significant increases in public debt burdens after natural disasters (Gagliardi et al. 2022).

Market Failures and the Role of the State

One of the key challenges is ensuring that insurance remains accessible and effective. Research on crop insurance uptake among farmers has shown that many small farmers, despite facing significant climate risks, remain uninsured. Administrative complexity and excessive paperwork have been identified as major barriers, particularly for smaller farms that lack the resources to navigate insurance contracts (Nshakira-Rukundo et al. 2021, Grislain-Letrémy et al. 2024).

The panel discussion then focused on whether insurance should be mandatory in high-risk areas. In developed countries, the insurance market is already far from liberal because people usually expect government intervention after disasters. This creates a moral hazard problem: if households and municipalities anticipate state compensation, they may be less willing to purchase insurance or invest in preventive measures. Some argue for risk-based pricing as a way to discourage development in flood-prone areas, while acknowledging that the most extreme risks – about 3% of cases – may require government intervention.

In contrast, others emphasise that purely market-driven insurance leads to undercoverage. A solidarity-based approach, where mandatory insurance schemes and cross-subsidisation help distribute risk more evenly, has been advocated as a possible solution. France’s CatNat regime was cited as a successful model, where state-backed reinsurance ensures insurers remain engaged in high-risk areas while keeping premiums manageable. However, even the Caisse Centrale de Réassurance (CCR), which provides state-backed reinsurance, is facing rising costs as climate risks escalate.

Hybrid models may need to be developed further. While market mechanisms encourage efficiency, certain catastrophic risks may require public–private partnerships to ensure broad coverage. Stronger governmental coordination in prevention efforts, pricing regulations, and targeted subsidies could help strike the right balance between affordability and sustainability. Switzerland offers a key example of such a hybrid public–private model that ensures broad coverage. Insurance against natural hazards is mandatory for most buildings and premiums are uniform, regardless of individual risk exposure, thus fostering affordability and risk sharing. Further research into the Swiss model, which operates on a dual framework of cantonal insurers in most cantons and private insurers in the remaining ones, could shed light on how similar principles might be adapted to other regions facing escalating climate risks. A critical question would be to see if uniform pricing would also work in regions and countries with extreme exposure such as sea level risk.

Prevention, Risk-Sharing, and the Path Forward

A recurring theme of the discussion was the need for greater investment in prevention. Initiatives such as local municipal risk assessments have been highlighted as promising approaches to helping small municipalities assess and mitigate local climate risks. Insurers also now work strategically with small and medium-sized enterprises to help them asses their risk and implement preventive measures. The challenge is ensuring that prevention efforts are actively implemented.

Another approach is impact underwriting, where insurers incentivise policyholders to adopt risk-reducing measures in exchange for lower premiums. However, many businesses and individuals fail to follow through on prevention commitments, even when financial incentives are offered. Greater coordination between insurers, governments, and consumers is necessary to ensure preventive measures are taken seriously.

A major point of contention was whether cross-subsidisation should replace risk-based pricing. Risk-based pricing encourages efficient allocation of resources but can make insurance unaffordable for high-risk areas. Some argue that solidarity-based systems allow for broader coverage, while others counter that removing price signals could lead to inefficient rebuilding in high-risk zones.

Public education on climate risk and the need for prevention is also key. Many households underestimate their exposure and fail to take advantage of available risk mitigation measures. Without stronger risk awareness campaigns, both insurance uptake and preventive actions will remain insufficient.

Conclusion

As climate risks grow, ensuring the affordability and availability of insurance will require a mix of private market solutions, public interventions, and stronger prevention efforts. The challenge is balancing risk-based pricing with solidarity mechanisms to ensure that insurance remains both fair and sustainable. Governments and insurers will need to work together to close the protection gap while incentivising investments in resilience.

The debate over the future of insurance is not just about who pays, but also how societies manage risk in an increasingly uncertain climate landscape. Without action, the current gaps in coverage will only widen, leaving the most vulnerable populations even more exposed to the devastating financial consequences of climate change.

Moving forward, policymakers and academics must address three fundamental questions:

- What are the necessary conditions for insurance to remain financially viable while providing broad coverage?

- What role should governments play in bridging the most severe protection gaps?

- How can prevention be better integrated into insurance models and public policy making to reduce overall risk?

Solving these challenges will require new thinking and bold policy action. The cost of inaction is too high.

See original post for references

Whenever I look at the economics of climate change, really the economics of energy, I tell people you can have two out of three, but not all three. (1) plentiful energy, (2) cheap energy, and/or (3) green energy.

When it comes to private market insurance, a similar logic applies. (1) relatively low-costs, (2) comprehensive coverages, and/or (3) ready availability. In the short run we are seeing a reduction in availability in personal lines insurance as the pricing is politically influenced (whereas commercial lines rates are negotiated). But, rates for commercial property have more than once shown significant issues for insureds; e.g., tier 1 counties in coastal U.S. (e.g., Houston).

The almost certain outcome is that we will get the major event and have mass failures of private insurers. When it happens it will be irrelevant if it is attributed to climate change. It will devastate a community, cause economic hardship, massive financial losses, etc.

It is a question of when, not if.

As climate change intensifies…

Not directly related to the economic aspect of climate change but related nonetheless, is the formation of various groups forming to sponsor/support legislate against geoengineering.. I believe Arizona will join Florida and other states in introducing a bill prohibiting the dispersal of any chemicals into the atmosphere intended to control/modify the climate.

Recently, Nicole Shanahan, RFK jr’s running mate posted the Tweet/X below which garnered many views. Of course if you believe it is all a fringe conspiracy theory, you have Mother Jones and the majority of news outlets, and people, on your side. For those of us, and it’s a growing group, who watch/study the sky overhead, it’s gratifying to see various groups start to gain traction.

Mike Wendling

@mwendling

Nicole Shanahan has seen a chemtrail and would like to talk to the manager please

https://x.com/mwendling/status/1894912381404254615

https://www.jacksonville.com/story/news/columns/mark-woods/2025/02/19/chemtrail-bill-part-of-2025-florida-legislative-session/78877200007/

https://azmirror.com/2025/01/28/chemtrail-believers-sway-gop-lawmakers-to-support-geoengineering-ban/

https://www.motherjones.com/politics/2024/12/chemtrail-conspiracy-theories-heres-why-rfk-jr-is-watching-the-skies/

One answer to the three questions posed would be the nationalisation of insurance. The authors applaud state intervention for such things as mandatory insurance and back-stopping high risk areas. Reinsurance does not, in and of itself, make premiums more affordable – it just reduces the proportionate risk to the original underwriter for a commensurate reduction in premium, allowing him to drop the premium for the same risk on the grounds that if disaster happens he won’t be wiped out and if all is OK he still gets a proportion of the reduced premium. In other words, the reinsurance mechanism is being used here to shuffle off only high-risk to the state and increase underwriter profitability.

However, if taken to the logical conclusion from the point of view of ensuring everyone is properly insured against climate-related disasters then each state should make insurance mandatory (aka tax) and put all premiums into a National Sinking Fund to compensate insured citizens in the event of disaster. At least in theory premiums would be cheaper as risks would be completely shared (the authors would approve this greater solidarity and wide-spread insurance uptake) and also no need for premiums to carry the burden of excess profits demanded by private insurers (probably not cheered so loudly by the authors).

My cousin Tom —nothing was left of his house in Pacific Palisades; and I was in Hawaii when Lahaina burned.

I live in Hawaii half the year. These islands are filled with tight communities. People know each other, people talk. It’s a very intimate place.

And a good friend of mine lives near Valencia. So what do you call this? A trifecta for exposure? My information is personal, admittedly anecdotal. But close to the bone.

Isn’t it a coincidence that two destroyed, prime pieces of property listed in this article: Lahaina and Pacific Palisades, Los Angeles are the results of —on the one hand —being located in dry and Windy regions, prone to fire hazard: and, on the other hand, absolute carelessness in (non) anticipation/ preparation of these risks.

I speak more for Lahaina— and given the theme of this article I am suffering personally with astronomical insurance increases from my condominium common charges in the last year —and this insurance increase has become the number one political issue in Hawaii— rising condominium insurance walloping people. IT IS UNSUSTAINABLE for the middle-class here. You will have rich and poor soon. Recent annual increases of 25% are expected to continue and accumulate over the next few years.

Meanwhile, there is not a person in Hawaii where I live doesn’t believe that the Lahaina fire could’ve been avoided. (More believe it was a setup than don’t believe this. That land is worth a fortune.)

I live in a building with people who owned businesses there. I have many friends and acquaintances that intimately understand that location— the geography, the local corrupt political scene—and above all the complete neglect with which the people in charge failed to address the dangerous risks that were highlighted by previous fires in recent years.

You can find videos on YouTube of the Lahaina environs burning during the last few years before the big fire that wiped it out —people watching and filming from vantage points as the fires came down the hills at night, and spread close to the village. and yet nothing was done to fix the dangerous electric lines or to plant intelligently in fields that had been given over to neglect and become fuel/wind tunnels—not to mention the mayor disappearing; and the emergency management chief who was at a hotel on Oahu, ironically, meeting, ironically, with FEMA.

To everybody on Maui it was an accident waiting to happen—and they let it happen!!!!!

the people who were supposed to be in charge were nowhere to be found. It just goes on and on once you dig into the details.

Were people under insured? of course! there were a lot of everyday hard-working people living in Lahaina? many of them worked in the hotels in Wailea. there were about 1200 Mexicans that vanished afterwards. They had sketchy working papers. It’s not clear what happened to them.

the corruption was and is prodigious . Hawaii is known as being the most corrupt state in the union —so change climate change… or change neglect, change corruption?

Let’s see who owns and rebuilds there in the next decade or so.

But on the insurance issue, if you want a condo here, the condo has to be insured, otherwise banks won’t write mortgages. and there is a neat little network now between the insurance companies, the lawyers, and the management companies like “Hawaiiana” — you can read about it in “civil beat”the local newspaper here on Oahu.

https://www.civilbeat.org/2024/07/condos-high-rising-insurance-premiums-are-a-top-issue-in-these-legislative-races/

Look to corruption above all —I would look there first, and naked capitalism has a long history of not letting people off the hook.

from the article: “A recurring theme of the discussion was the need for greater investment in prevention. Initiatives such as local municipal risk assessments have been highlighted as promising approaches to helping small municipalities assess and mitigate local climate risks. Insurers also now work strategically with small and medium-sized enterprises to help them asses their risk and implement preventive measures. The challenge is ensuring that prevention efforts are actively implemented.”

Yes. But you need honest government. And you don’t need local or bigger insurance companies in cahoots with property management companies and lawyers on a local level milking the situation to make a bad thing even worse.

Climate change: I listen to someone like Denis Rancourt. Or Javier Vinos.

These people have long careers in science and scientific method and they’re brilliant, and the way they handle and choose data is exceptional. I get the impression that for NC the science is more settled on this issue, but I find myself learning and exploring new pathways every year on this subject.

Maurice “Hank” Greenberg will turn 100 years old in a couple of months and still goes into the office every day. Would be interested in his take on insurability of climate change risk. Or would the insurance underwriters simply attach a Climate Change Exclusion to every policy?

Insurance is a bandage. Climate change is the wound. I see no willingness to address the causes of the wound. How about another metaphor? The cost of insuring the deck chairs on the Titanic is rising. What to do? Secure the deck chairs … as the deck slips from beneath you.

I know that these insurance companies are pushing to have more coverage to mitigate their costs but I think that you can say that the insurance companies are the canaries in the coal mine as far as climate change are concerned. When those insurance company’s books start bleeding red, that is the same as when in a coal mine the canary falls off its perch. You ignore both at your own peril.

Thanks for the post.

One could posit that adequate Insurance Coverage is an enabler for denying a man made Climate Crises.

I am affiliated with Organizations that see Insurance, along with Finance, as pressure points for changing Energy policy, sources, and usages.

Cogs in the wheels of status quo thinking.

The cost of inaction is too high.

imo—If Rising Insurance Costs are rattling your world you need to rattle your politicians world and engage in actions focused on stopping the multiple human causes of the Climate Crises.

Insured entities are a huge-but silent-cohort.

As JMH points out above: change the bandaid or cure the wound??