Amid widespread economic weakening, due in no small measure to destructive Trump policies such as slashing and burning of Federal agencies that provide important public and business-boosting services, and supply-chain-cracking and inflation inducing tariff increases, it should hardly be a surprise that consumer and business confidence is sagging, as are Trump policy approval ratings. As we’ll review posthaste, a new naysayer, albeit in economese, is the Fed.

Donald Trump's approval ratings are underwater across the board.

Americans don't support how he is handling the economy, the federal work force, foreign policy, or trade.

Which, is basically everything a President does. pic.twitter.com/tKzqcAIUIJ

— Jessica Tarlov (@JessicaTarlov) March 13, 2025

BREAKING: In a stunning announcement, CNN Senior Data Analyst Harry Enten just announced Donald Trump has the lowest approval rating on handling the economy at this point in his Presidency. This is huge.pic.twitter.com/UrLUMjFmjj

— Democratic Wins Media (@DemocraticWins) March 19, 2025

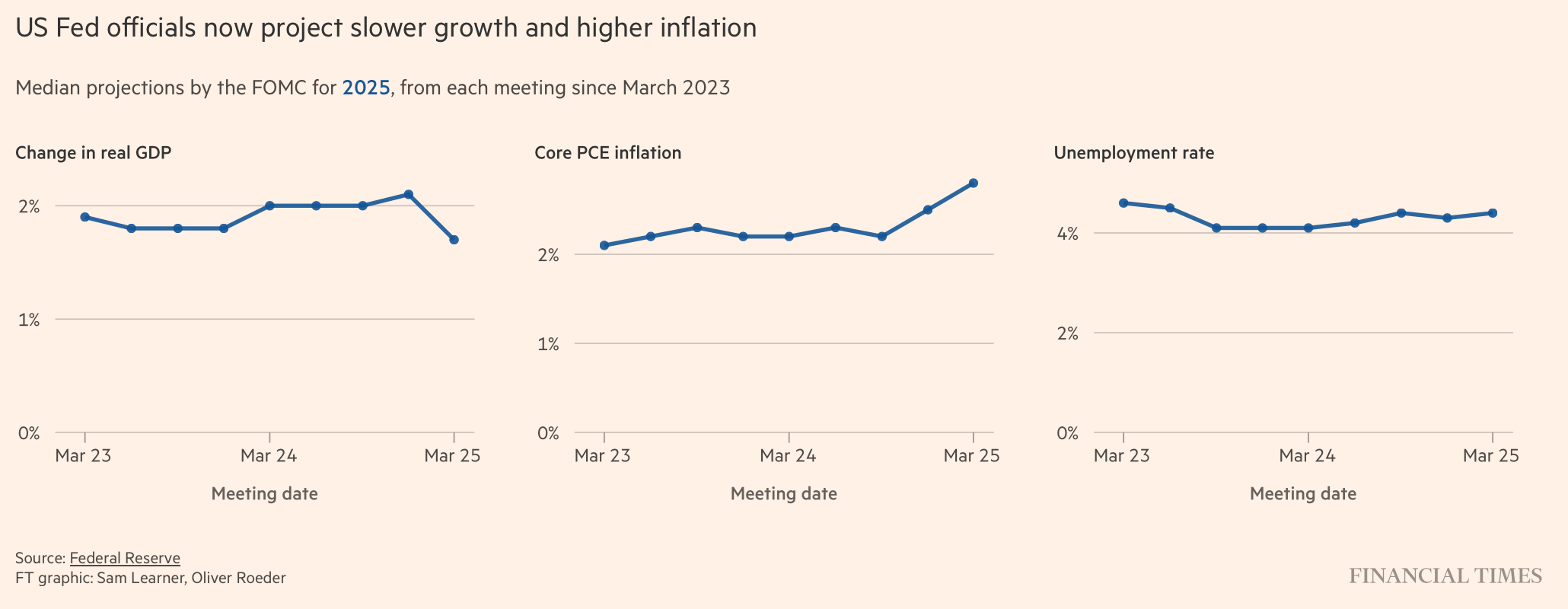

The lead story in the Wall Street Journal is Fed Projections See an Economy Dramatically Reset by Trump’s Election. The corresponding headline at the Financial Times is more direct, Federal Reserve cuts US growth forecast as Trump’s policies weigh on outlook, but the Wall Street Journal does a through job of unpacking the central bank’s, erm, reservations.

However, there’s a huge failing at the heart of the Journal story, which is not even mentioning what the actual forecasts were. For that, we have to go to the Financial Times, which appropriately puts them in the second paragraph:

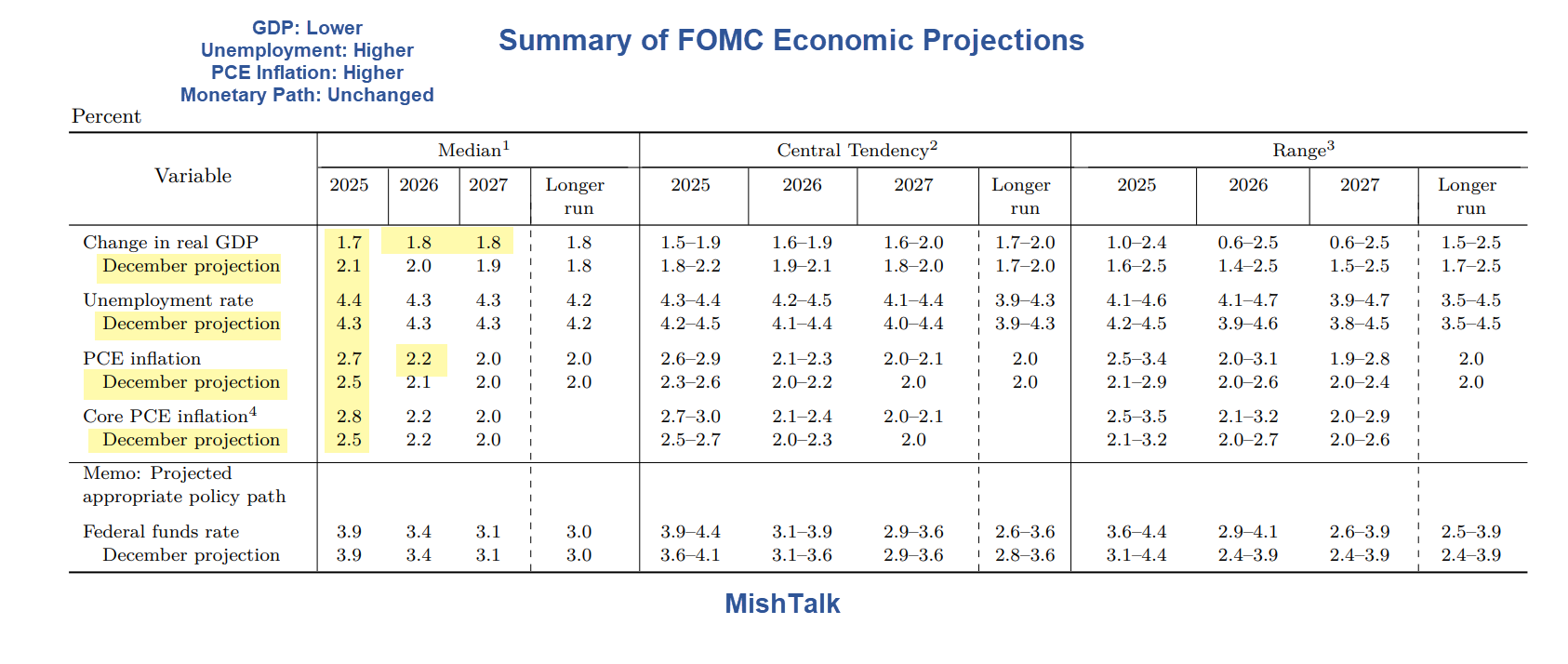

The Fed’s latest projections showed officials expected GDP to expand by 1.7 per cent this year, with prices forecast to rise by 2.7 per cent. Policymakers kept the central bank’s main interest rate on hold at the end of a two-day meeting on Wednesday.

Bloomberg gave a its TL;DR version:

The Federal Reserve left interest rates unchanged, buying time to assess how President Donald Trump’s policies impact an economy facing both lingering inflationary pressures and mounting growth concerns https://t.co/Sp5efWSkin pic.twitter.com/56OPsGnOnt

— Bloomberg TV (@BloombergTV) March 19, 2025

Michael Shedlock provided the relevant data table:

The Journal describes a sudden, hard Trump economic gear-shift, to the degree that a lot of vulnerable travelers have gotten whiplash:

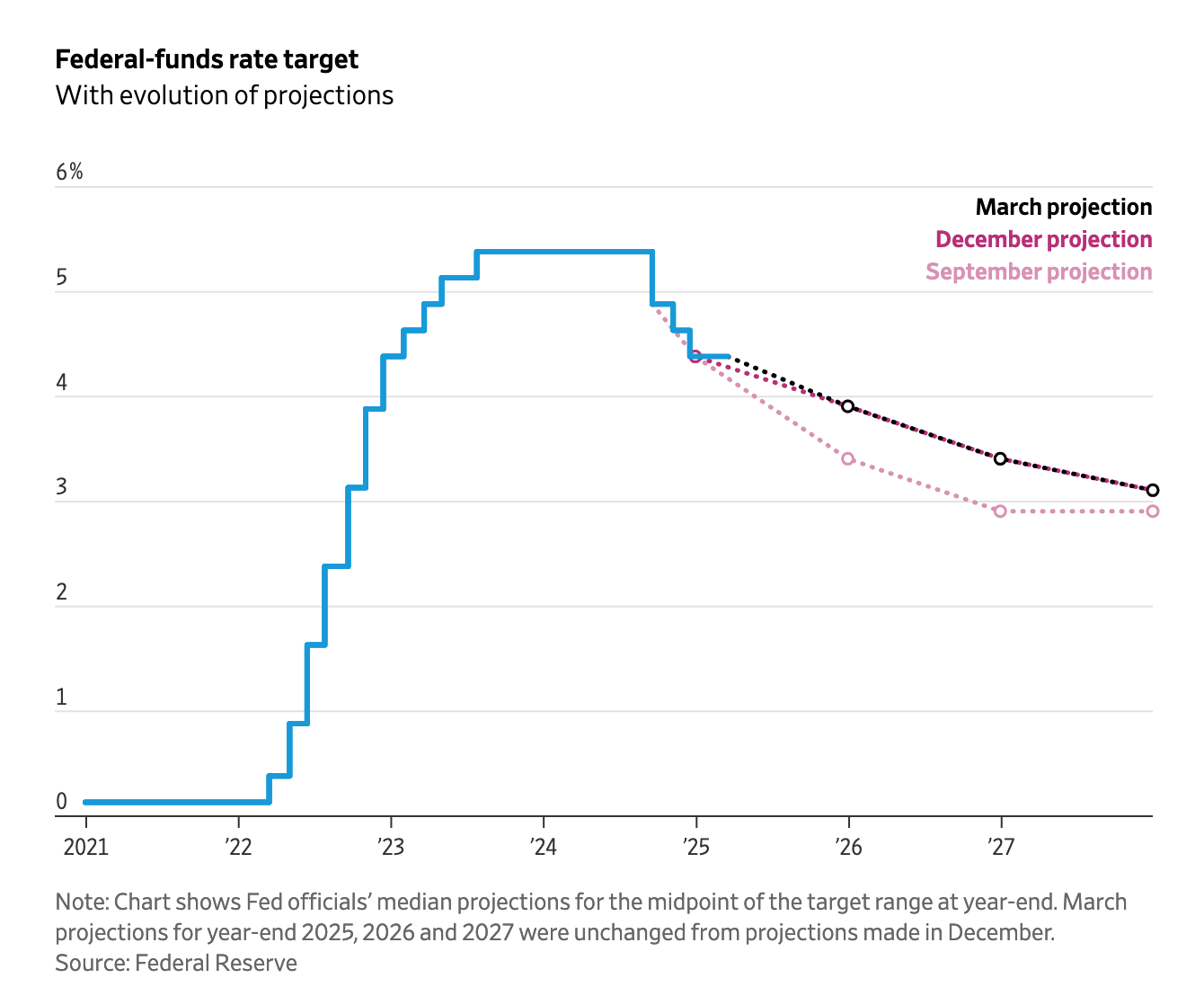

The Federal Reserve’s first set of projections since Donald Trump’s inauguration underscored—in the central bank’s understated and technocratic fashion—just how much the president’s plans to press ahead with widespread tariffs have turned the economic outlook on its head.

The story continues by discussing how the soft landing scenario is out the window as tariffs will raise prices while whacking investment, the Confidence Fairy, and groaf. Moreover, the risks all look to be on the downside.

The Fed Chair just said what every credible economist, every economics textbook, and every empirical study shows: Tariffs reduce output and raise prices.

This is quite uncontroversial stuff, folks. (Also, depressing.) pic.twitter.com/h0dj05STMQ

— Justin Wolfers (@JustinWolfers) March 19, 2025

Despite all that, the central bank stuck with anticipating two rate cuts this year, which led to a bit of a stock market bounce. That came despite Fed chair Powell pointing out that there was a “level of inertia” among investors about the odds that their hoped-for rate cuts might come up short.

However, the “inertia” remark is more than a bit of projection. The Fed takes the view that any tariff-induced price increases are a temporary shock and then prices will stabilize. But the central bank’s time frames are different from those of consumers and one imagines, many businesses. Even after the prices of eggs has stabilized at an arguable new normal, buyers still remembered well when they had been cheaper, even if prices had not risen further in, say, the last six months. Keep further in mind that this phenomenon suggests that how the Fed thinks about inflation expectations (as reflected in bond market yields) are based on investor behavior, not consumer behavior, and thus could seriously misread real economy reactions.

The Journal describes that Fed officials do recognize that their usual approaches might fail given the tariffs shock:

Officials could be hard-pressed to declare price increases from tariffs as temporary if they set in motion a reordering of global production processes that takes years to play out.

On top of that, Fed officials are nervous that the postpandemic inflation might have given businesses and consumers more acceptance of higher inflation. Policymakers pay close attention to expectations of future inflation because they think those expectations can be self-fulfilling.

The Journal did use the dreaded word “stagflation” but depicted that as a possibility as opposed to a given, and further argued that even if it happened, it would not be as bad as the 1970s version.

Now to the pink paper, which provided a more urgent take:

The Federal Reserve has slashed its US growth forecast and lifted its inflation outlook, underscoring concerns that Donald Trump’s tariffs will knock the world’s biggest economy….

Progress on inflation was “probably delayed for the time being”, Powell said. The Fed has been battling to push inflation back to its 2 per cent goal and halt the most severe bout of price pressures in decades.

The Fed also announced that it was slowing down the pace of its quantitative tightening programme, lowering the amount of US Treasury debt it allows to roll off its balance sheet each month from $25bn to $5bn beginning in April.

With Trump a chaos generator, the prospects are so much in flux that one might as well throw darts….except for quickly rising alarm and widespread signs of deterioration. Readers have reported big falloffs in traffic in local stores. The Journal reported on belt-tightening at every level of the income scale. These are not portents for happy citizens or a healthy economy.

The lower interest rates help the hyper-financialized economies misrepresent easy money as productivity. The playbook of this century.

One wonders if the thought has crossed Powell’s mind that the AI bubble may be about to pop.

I just read a headline that all of the ‘AI premium’ in the Nasdaq has been wiped out. Anecdotally, I am seeing more and more F.U.D. tactics being used to sell AI based on LinkedIn being taken over by marketing shills. It goes something like, “if your business doesn’t immediately fire all the software devs and replace them with ‘vibe coders’ then you’re going to be left behind!”

The herding and lemming-like behavior doesn’t bode well.

I’m usually way to early to call the end of the bubble game, but I suspect we’re in the late innings.

I’ll change my title on LinkedIn to ‘vibe coder’ immediately thank you.

I tried out github/Microsoft’s copilot coding bot. Gee whizz it can sure write a lot of entirely predictable boilerplate for you!

lo and behold students (of all calibers and a wide spectrum of universities) are using LLMs to do homework and takehome-exams.

And when it comes to troubleshooting coding, that form of “learning” essentially makes you useless.

Colleges need to go back to paper-pencil exams……..or use locked-down examination Chromebooks for exams. But paper-pencil exams costs $$$$$…but I imagine someone will tout an OCR, LLM-powered exam grader.

Trump/Musk: “We don’t need no stinkin’ students.”

“Gee whizz it can sure write a lot of entirely predictable boilerplate for you!”

Yes, that’s exactly it. It’s as if all you need is a little boilerplate for any specific solution you are looking for and bim, bam, boom done! I think it would be charitable to say this technology needs a lot more time in order to mature, but I think that’s giving it too much. An algorithm can replicate a readable sentence but it can’t replicate understanding.

FED dot plot – “We have to reduce interest rates before we reduce interest rates.” Or as Lily Thomlin put it “Things are going to get worse before they get worse”

Would any economics ‘experts’ correct my intuition that interest rates directly cause inflation? I don’t mean giving away free money for speculation, but the actual interest that people pay for loans and doing business.

yes and no. Yes. in the sense obviously, paying 7.9% for 60-month car loan versus 1.9% raises prices for your standard middle-class car shopping.

*BUT* headline CPI is not based on your installment payment for a new/used car, rather the actual transaction price.

Then you have the effect of higher interest rates causing demand destruction—-see the market for $80,000 pick-up trucks and full-size SUVs.

I can’t correct it because I think you are right. The Fed fights inflation by raising the price of money, which is an input to just about everything.

This is Warren Mosler’s insight — that the prevailing economic orthodoxy has the influence of interest rates (as set by the Fed; he’s not talking about the secondary market) precisely backwards. He sees the injection of funds from the public sector into the private sector via the interest income channel as stimulative. It helps to understand Wynne Godley’s sectoral balances analysis to appreciate how this works. Unfortunately it is a wildly regressive stimulus, because bonds are overwhelmingly owned by the rich — so a higher interest rate essentially rewards rich people for already being rich in proportion to how rich they already are! I have heard him crack that a non-zero interest rate policy is “welfare for rich people” …

While Trump is not helping, I think the AI bubble unwind is a huge hit to groaf numbers.

Seems like every week Google puts a new button on my development dashboards with a big flare saying “PLEASE USE GEMINI!!1”

My answer continues to be shoooo go away. But they have been getting quite persistent. The ‘real world examples’ they throw out are underwhelming to say the least. Out of the gate:

“Gemini is still under development and may give inaccurate information that doesn’t represent Google’s views. Test any code it generates before using it in your apps.”

Use cases listed in Google’s own documentation do not require any kind of “AI”:

1. Interpret voice commands: Create functions that correspond with in-vehicle tasks. For example, you can create functions that turn on the radio or activate the air conditioning. Send audio files of the user’s voice commands to the model, and ask the model to convert the audio into text and identify the function that the user wants to call.

2. Automate workflows based on environmental triggers: Create functions to represent processes that can be automated. Provide the model with data from environmental sensors and ask it to parse and process the data to determine whether one or more of the workflows should be activated. For example, a model could process temperature data in a warehouse and choose to activate a sprinkler function.

3. Automate the assignment of support tickets: Provide the model with support tickets, logs, and context-aware rules. Ask the model to process all of this information to determine who the ticket should be assigned to. Call a function to assign the ticket to the person suggested by the model.

4. Retrieve information from a knowledge base: Create functions that retrieve academic articles on a given subject and summarize them. Enable the model to answer questions about academic subjects and provide citations for its answers.

There isn’t a single one of these that can’t be done with a simple decision tree and NLP from a decade ago. Gemini is a mirage, worse than that it is an excuse to prop up commercial real estate, drain the aquifers, and crash the grid.

Is this AI? I’ll let #1 explain

The idea is to push the first hit of the AI crack for free, then, when you get addicted, jack the price.

Also, use “bundling” to force feed AI slop down our throats. See fellow commenter Jason Boxman’s notes about Google Workspace.

Either:

1. They won’t give you the option of opting out of AI for Developer Tools, Outlook, Excel, etc.

2. They might give you the option, but the non-AI version gets enshittified to point of uselessness.

Coworker was encouraged to use copilot to help with scheduling. She immediately discovered that it’s useless unless people are meticulously updating their calendars, which is exactly the same problem with just using outlook.

We are seeing a drop off in ‘working’ storefront businesses around here in the benighted North American Deep South – Economic Zone. The latest sighting is the closure of a storefront EZ Clinic. This in a high traffic street adjacent to the State University Preserve. Also, two “boutique” fast food outlets are showing signs of stress, as in not getting their annual Spring Makeover. Finally, the most serious sign is the sudden closure of a “local” liquor store, situated in a functioning strip mall. My inside source at the booze shop says that the “word on the street” in that sector is that there is a drop off in liquor purchases. People aren’t suddenly becoming moral and sober, they are running out of money.

This is what “Move fast and break things” looks like at a societal level.

Stay safe.

I noticed a wave of small businesses closing right after the New Year. A local one I frequented mentioned that they were closing due to the landlord refusing to negotiate a reasonable rent, so upon lease expiry, they shut down rather than try to keep doing business with increased costs.

Actually Ambrit…

I have noticed people becoming sober in my US based friend group. Two heavy drinking boomer friends did a dry January and they’re still at it. My son and his girlfriend, both in their early thirties, are planning to do a dry April, probably the first time for them. My son said other friends were cutting back on drinking as well.

It does seem like an odd thing to do when times are getting tougher, I agree. But I myself have decided to quit drinking. The stress has caused me to drink so much last year it really got out of control, even though I was trying to cut back. So now I’m quit, with the goal to be sober for life. I think a lot of people started drinking more heavily during the pandemic, and now they’re pulling back from it.

The administration of the US government has been taken over by a PE firm headed by Mr Trump. The Fed will be reduced to the financier of this PE firm.

All this talk of revaluing under-appreciated assets ( Gold holdings ) to engage in new pursuits ( Bitcoin Reserve ) is typical of PE thinking. Then there is the Mar A Lago Accord talk based on converting large parts of the National Debt to Century Bonds ( non interest paying ) to give the finances time to let tariff’s do their work. Debt reconstruction is a PE specialty.

Overseas activities show the same emphasis with distressed assets ( distressed by US actions ) being picked up for pennies on the dollar. Again a PE staple. Wiil be wonderful to see how they intend to revalue the US dollar because they need it lower. The US just intends to take the resources it needs and will never have again in the US from overseas and pay what it wants, not what the owners of those resources want. Think of it as one big United Fruit Company.

…The US, for the resources it needs but no longer has, or never had, intends to go overseas and pay what it wants, not what the owners of those resources want. Think of it as one big United Fruit Company.

hmm… Well, there has already been a trend.

Clearly the Donald should have built some sort of Strategic Approval Rating Reserves prior to unleashing DOGE and his other hair brained schemes.

I don’t know much about macroeconomics but am looking to learn. What does it mean when the Fed “rolls debt off its books” as was mentioned towards the end of the article?

“…when the Fed “rolls debt off its books”

Quincy, The simplest way to explain it is that the securities the Federal Reserve had in inventory, had, in effect, been sold to someone else,

Thank you!

To “roll off” means to not re-purchase new securities as existing securities mature.

From 2022:

The Fed Is Shrinking Its Balance Sheet. What Does That Mean?

I’ll check out the article. Much thanks.

A municipal well construction project that I’m involved with just went out for bid last week. Bids are 50% higher than both my and the engineer’s estimates. Steel and grout prices are as high as I’ve seen them on a bid tab, and the low-bid driller is pushing for (and just received as I’m writing this) a notice to proceed now so he can order the materials today. Seeing that nearly all well pumps and motors are imported (specifically Japan, China, Spain, Italy), I’m dreading how much more expensive the pumping system is going to cost since we can’t order the pumping system now, before we know the yield of the wells. This is ridiculous.