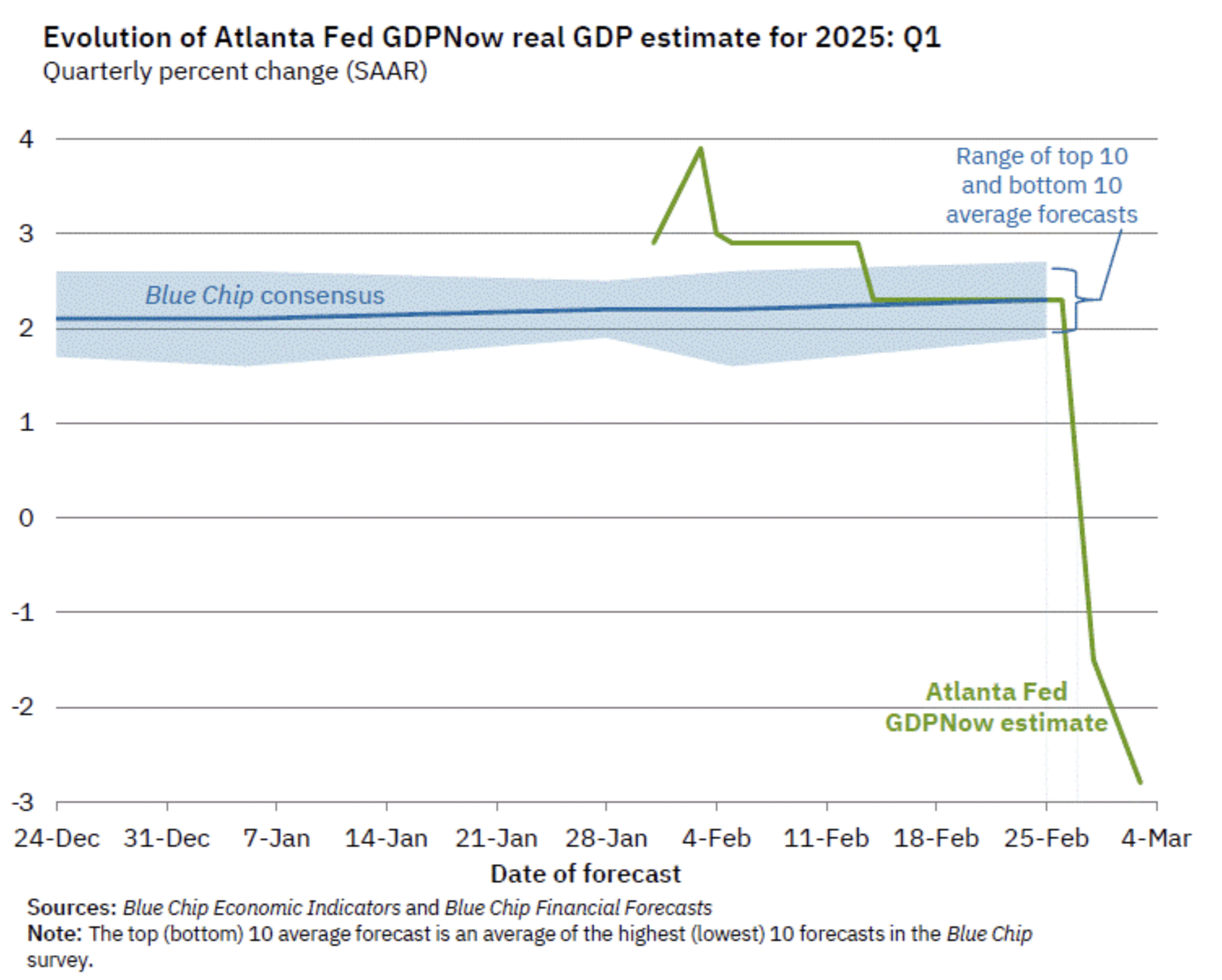

Yves here. While alarmism is entertaining, it can also be fully warranted. We’d seen some economic oriented sites comment on how the Atlanta Fed’s typically pretty accurate NowCast was sending recession warnings. But until we say the chart in the post below, we had no idea how severe the downward reading was. Yikes!

The chart below also makes clear that the Atlanta Fed forecast is an outlier. But consensus views are often wrong at inflection points. Remember the how finance talking heads were saying in 2007 that we were in a Goldilocks economy? That the Fed was engineering a soft landing?

Keep in mind that this result is entirely plausible given how Trump is creating radical uncertainty and job insecurity. It’s not just those directly defenestrated by DOGE but also those concerns and individuals that benefited from programs being whacked or cut back. And it may not be direct cash but depending on program services. So not only to we have volatility, which businessmen who are not professional financial speculators hate, but be also have demand reduction. That does normally equate to some degree of slowdown.

On top of that, the Trump tariffs look set to increase inflation. So we could wind up in serious stagflationary terrain.

The other issue is that if things turn out to be this bad, you can be sure the Trump Administration will do everything it can to massage the data to hide that (much easier to do when the graybeards have been DOGE-defenestrated and those left are afraid of being next). The first place to look would be the GDP deflator, but there are plenty of other tricks.

I recall one quarter, no long after the dot-bomb hit, that the initial GDP release was something like 2.2%. That was so out of whack with everything that I was reading and hearing that I must have called 20 people across the US and different industries (including investors who also did a lot of real economy tire-kicking) sputtering about where did this figure come from? Were they seeing any meaningful growth? No one reported on any hidden sectors or even pockets of strength.

The final GDP print for that quarter was 0.4%. So there is a proud tradition for this sort of thing even in a nominally growing economy.

By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Fund the Future

I am grateful to Dr Tim Rideout for drawing my attention to the GDP Now forecast run by the Atlanta Fed in the USA.

The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.

GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter.

This is their latest forecast:

They say of this:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.8 percent on March 3, down from -1.5 percent on February 28. After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.

The obvious question to ask in response is, might the US be about to fall off an economic cliff? It would seem it is entirely possible that this is the case. So much for Making America Great Again. It would seem that the plan is about Making American Chaos Again.

The Trump team wants to cause a sharp recession. They intend to pop the everything bubble. It is quite risky.

My cynical side also thinks that “they” then want to pick up the pieces on the cheap.

Trump’s first hundred days will be known as the Time of Moving Fast and Breaking Things.

“My cynical side also thinks that “they” then want to pick up the pieces on the cheap.”

Most likely result. Because the hope is the sharp enough recession returns the Fed to easy money interest rate policy for the loans for such a spree. Will it be as “ZIRPY” as before? Sure will be interesting to see how low they will go this time around.

I was wondering when it would get close to this point ever since Powell’s Jackson Hole pain speech of 2022 with the other Central Bankers.

Bust Out Economics, a la Tony Soprano…

That’s why they are playing dead right now. / ;)

Adding: Ed Dowd saw a deep recession coming last spring for the summer 2024. He surmised the B admin was doing everything in its power to keep the stock market aloft until the election.

I’ve been reading about a recession for quite some time. Many have predicted one coming and it seems some of the data suggest this. The MAGS (mag 7) hit it’s all time high in mid-December when it was around $58. Now trading at $48. The S&P hit all time high on 2/19/2025 and has drifted lower since (up nicely today as I type this).

I won’t try to predict what the market will do, but I don’t think I’m alone thinking this market, the one some call the “everything bubble” is prime for a pull back, and has been for quite some time.

If you look at a chart of the main indexes going back before the dot-com bubble burst until now – I don’t think it looks normal. For context, on 10/1/07 the S&P was at 1576, which was the all time high at the time. March 1 2009 it hit the intraday low of 666 only to hit 6147 on 2/19/25. That’s quite a run. As Ralph Kramden would say – to the moon Alice.

this is most likely correct. i saw my revenues plunge last febuary, and only ticked back up close to the election, and a bit after in january 2025, to see them plunge again in febuary 2025.

Biden did away with everything that was done under the pandemic to help the average person. he completely restored bill clintons economy, and here we are.

the tariffs alone are bad policy, we need more of course, but free trade was and still is, the number one deflater of wages.

i am with Hudson, the U.S. entered a depression in 2008, and have never fully recovered. what Biden did was to restore what caused the depression in the 1st place.

now trump has unleashed oligarchs on the federal bureaucracy, turning america over to Ayn Rand quacks, and exploding unemployment, that is, if they can get it.

How about calling it, The Great Trump Theft, or simply, The Great Theft? To quote a line from Bob Dylan’s song, Like a Rolling Stone, ‘After they took from you everything they could steal, how does it feel…?’ And to quote, and to answer that question, about just how we should feel, from the Fantastic Four’s the Thing, ‘It’s clobbering time!’

“They” are in fact Mellonites. ( Mellon was President Coolidge’s Secretary of the Treasury). They hope to cause an actual Great Depression. And here’s why, in Mellon’s own words . . .

” Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

Here is the link to that quote, to show that I found it rather than just made it up.

https://www.azquotes.com/quote/747203

It’s a perfect recipe for creating a desperate labor pool anxious to work any job in all those new factories so they keep current on their car loan….the car they are sleeping in.

I have come across that quote many times. You read his words and you see that it is the words of an ideologue at work. Much like Musk and his DOGE boys. Both Mellon and people like Musk have a moral philosophy and will force it through no matter the facts of the situation. They are true believers.

As Monty Python might have put it:

“No one ever expects the Economic Inquisition! Chairman Biggles! Poke them with the Puffy Balance Sheet!”

Who was it who commented recently about an elderly friend whose grandmother worked as a cook for a branch of the Rockerfeller family and also as a spy for a Swedish political party? The grandmother told her son that she overheard someone in that family say:

“Depressions are how we harvest the wealth accumulated by the lower classes.”

And things like depressions are how revolts, revolutions, and wars start and end states, empires, and civilizations.

IIRC, that cook was working during just before the Great Depression and the concurrent rise of fascism.

Restating this, elites are often walking a fine line between success or death.

Buffet has already positioned himself with a sizeable warchest to make some heavily discounted buys.

“My loss is your gain.”

https://youtu.be/fij_ixfjiZE?t=382

Is there a “secret” plan or is this just faffing about and hoping that things work out?

Ideologues are notorious for ignoring reality right up until the guillotines start to fall.

I’m hunkering down and prepping for hard times. I hope our former Docent from Maine has his rat line to Frederickton still open.

Another chaos factor involved in all this is the ‘Fort Knox Mystery.’ By bringing up the existence or non-existence of the gold reserves at Fort Knox, Kentucky, the DOGE crowd has bought the “full faith and credit of the US Government” into question. World financial markets must really love that.

DOGE=Elite Wrecking Crew.

Stay safe.

You as well.

Well . . . If DOGE hopes to abolish the Dollar and make various cryptos the new Official Currency And Money of the United States, this might be a clever way to start.

Remember when the Clintonites’ favorite President of Russia super-crashed the Ruble? In order to pauperize millions of Russians in order to destabilize Russian society/economy enough to be able to privatise all public parts of it? Same here.

Nathan Tankus has a theory about the Fort Knox adventure. (Spoiler alert: it’s not a comforting story)

https://www.crisesnotes.com/a-scam-built-atop-an-accounting-gimmick-wrapped-in-bullshit-why-visiting-fort-knox-is-not-about-selling-gold-but-is-about-buying-bitcoin/

Yves and all at NC

Might you note that my biography needs changing? I am now Emeritus Professor of Accounting at Sheffield University Management School, director of Tax Research LLP and author of the Funding the Future blog.

Thanks.

Sounds like a nice promotion, congratulations.

Are you the Richard Murphy who had a small video-cast about how the Trump Administration is very carefully engineering a recession deliberately and on purpose? ( And if you are, did I over-interpret the video-cast?)

Congratulations on Emeritus status. That’s an honor which comes with significant uni perqs. Few retiring US profs are granted the honor at their uni.

Um, nope. Most if not all US professors are granted emeritus status at retirement, as was I. No “significant uni perqs [sic],” alas. Far as I can tell, no perks at all.

Um, you may be in a different uni comp. In my uni comp, only retiring profs with a long history of important contributions to their field with many and important publications in important science journals are granted Emeritus status. Maybe that’s just my uni and its uni comp.

In my uni several important perqs are granted upon receiving Emeritus standing.

adding: “perqs” per “perquisite.” I know that term is now often shorthanded to “perks.” / ;)

edit: “… in important science or other fields’ journals are granted Emeritus status.”

Wolf Richter provides useful background:

https://wolfstreet.com/2025/02/28/no-consumer-spending-didnt-plunge-in-january-and-auto-sales-didnt-collapse-or-whatever-but-the-huge-seasonal-adjustments-might-have-gone-awry/

There may be going on with cars than meets the eye. The car business is in a total mess right now. There are dealers with 2022 vehicle on their lots that they are begging the manufactures to take back or give them incentive for new cars. Remember, the dealer buys cars from the manufacturer. The only way they can move such overpriced old cars is to sell them at auction….often to other dealers…at a loss. Those writedowns should be treated as an offset to sales.

I doubt they are large enough to explain the big bad auto #. But they may have something to do with it.

There is also the issue of the “Floorplan”.

New car inventories are financed by a bank, you only pay the interest on the loan, up until the vehicle is 365 days in inventory, at which point you must pay off the full cost of the unit.

This system is called the Floorplan, and the bank is constantly checking to see that there is no fooling around about it, including having their guy walk your lot.

There is also “Lot-Rot’ the term that describes the damage done to things like brake rotors that rust and batteries that fail while the car is sitting there, this will cost you time and money just to be able to show it to a customer.

Repossessions also result in the banks clawing back funds lent to buyers, banked by dealers, so the record high repossessions of late are having a bad impact on dealers bottom lines.

My all time favorite business name, from Myrtle Beach, SC, is ‘Tippy Toe Repo.’

If you take out the trade picture the final real sales, which is the real determinate of expansion in a consumer society are just above stall speed now, so still just moving. I find Econbrowser and Bonddad good on figures, however both are madly Democrat. The sales deflator recently moved from 2% to 3% so slightly more realistic.

The proposed changes to Medicaid are the sleeper, these are worse than the tarrifs and more immediate. The CR coming up soon will clarify a lot.

Unsurprisingly the subcomponent contributions driving this are 1) Net exports 2) Government spending and 3) Residential investment.

Certainly Trump is happy to see inflation increase the value of his assets in relation to his debts but the real power behind the curtain is the PayPal Mafia — Thiel, Musk, their tool Vance, and Curtis Yarvin’s Dark Enlightenment, ironically the ugly denouement of Inverted Totalitarianism as conjured-up by the Clintonites. Cratering the economy will be their Shock Doctrine “Hard Reset.”

The only problem that these often foreign-born or foreign-raised crackpots can’t seem to fathom is the impact of this chaos on a well-armed American society. BLM and Jan. 6 on steroids is just as likely to come for them as it is for the libs…

We Are Luigi

But will “we” pick the correct targets?

The Musk Administration can very easily get its Trump to instruct its well-armed fanbase that the Democrat Voters caused the crash and are the people who deserve to be shot.

I’m not sure there is an incorrect target among the Beltway Parasites regardless of party.

God will sort them out.

We Are Muppets.

Muppets will kill each other in defense of their lords. The fact they are well armed just means the fight would not last long. Remaining muppets will live in shantytowns modeled after San Francisco Tenderloin District.

Seems like only yesterday the pump was on with the “soft landing”, “no landing”, “Knots Landing”…whatever the hell the financial press was making up.

The Austerity/Destroy the Economy thing is the precursor to full blown 1930’s German style fascism. Create grounds for martial law after engendering social unrest. The SCOTUS has delivered the US equivalent of the Nazi’s Enabling Act.

See ya at Bergen-Belsen Comrades…

No, this is not classic Fascism. We can label the unfolding dystopia with terms like “inverted totalitarianism”, “plutocracy”, “oligarchy” “kleptocrat-oligarchy” , “Techno-totalitarian neo Feudalism” or whatever but this is definitely not Fascism. It might be even worse as the Janus Face of technology enables the few to create their own “reality” and convince others its true via the electronic mass media oligopoly

If I remember correctly Marxist interpretations, fascism refers to the fusion of state/government with Big Capital and corporate oligopolies that is sought in times of deep and protracted capitalist crisis, when the contradictions of the system do not allow for resolution, and the ruling classes take the iron fist out of the velvet glove. I find that the definition fits perfectly the current historical moment.

So far, everything we’ve lived through matches the steps that lead to WWII: global financial crisis initiated on Wall Street check, protracted recession and austerity for the masses check, formation of trade blocs as a defense to deflationary forces embedded in the global economy check, destruction of democratic institution and decay of the public sphere check, arm races and assiduous preparation for war in the core states of the capitalist system check, charismatic sociopaths taking the rein of militarized states check… Did I miss anything?

Sorry, that is a bit of a stretch and in a way far too optimistic. I just don’t quite see the world of 1930s as the same as now. History does rhyme, but it does not repeat.

The EU/NATO states, especially Germany, are vassals of the US. The USSR does not exist. The “crisis of capitalism” is nothing new. Geopolitical power centers are quite different now.

We have China as the rival of US dominance, not Germany, not the USSR. So, we are headed for another world war? Is nuclear war with China inevitable?

Firstly, you haven’t addressed the political economy explanation which lies at the core of my view of contemporary fascism. This is what started the conversation.

Secondly, I never stated that we will get the same cast of actors, only that certain parts of the play are disturbingly similar, and I thought I made it clear that this is so because capitalism has its own defining dynamic, not because history is mechanically repeating itself.

Thirdly, yes, if you ask me nuclear war is inevitable, because of the intractable mess in the political economy of global capitalism, not because of China.

So, given that the West is actively preparing for war, this is my prognosis: there will be global war within 5-10 years, most likely developing simultaneously on three fronts (Russia, China, Middle East), and the conflict will devolve to nuclear war because of the sunken costs fallacy, and because our overlords have built fancy bunkers for themselves and their purebred horses, and feel pretty safe in them.

FAFO? I seriously doubt those bunkers will keep their denizens safe for long. 6 months likely, 6 years maybe. Their short-term planning horizon will be the death of them. And maybe us all.

I know. But they have enjoyed impunity over the course of their whole lives, and I have a feeling they think themselves indestructible. We shouldn’t underestimate the God complex of the plutocrats.

“Thirdly, yes, if you ask me nuclear war is inevitable”

Kinda underselling that point all the way down at number 3….

“So, given that the West is actively preparing for war, this is my prognosis: there will be global war within 5-10 years, most likely developing simultaneously on three fronts (Russia, China, Middle East)”

The west has been actively preparing for war for decades, and also trying to fight wars on 3 or more fronts. This is a weather report.

The fancy bunkers won’t stop a Russian Oreshnik missile, unstopable, heading to the Ukranian undeground manufactoring plant at Mach 11, this missile has six MIRV/MARV warheads for longer bunkers. It was used in Dnipro. All the rescuers found was dust. Houses up to a mile away cracked, as if an earthquake had struck. And no, the US of A has nothing like it. The US of A is tops in Financialisation but its ability to build stuff where STEM qualification is needed, not so much. No Rosie the riveters around any more.

“Did I miss anything?”

1) Explicit ideology that drives and justifies the policies, including a well-formulated corporatist legal framework: nope.

2) Systematic organization of mass movements, including setting up or taking over trade unions, professional and trade associations, sports clubs, youth or women organizations — all besides a political party — so as to control society tightly: nope.

3) Assuming that armed violence is not the “ultima ratio” but a legitimate, normal measure, and ensuring that it can be resorted to by creating an armed militia (staffed with lots of veterans from previous wars) commanded directly by the (fascist) party and not by the State (i.e. not the police of the military): nope.

4) An ethno-nationalist conception of the world, based on a variety of cultural, historical, and biological arguments, leading to the determination of who are the genuine citizens, and of those who must be excluded: nope.

5) A relentless cult of personality of the leader, viewed as the incarnation of the national virtues: nope.

6) Gleichschaltung, i.e. all social and economic entities have to adopt the ideology and implement the governmental directives — since the entire nation must work toward a common goal; political parties and competing political programmes are prohibited; regional particularisms are frowned upon and even repressed in favour of a supposedly unique national spirit: nope.

So there are quite some important things missing.

In a real fascist regime, Elon Musk would never had all the power he has been given — he would be deadly afraid of Trump. The department of education would not be disbanded — on the contrary, it would be reinforced to impose the regime’s ideology. The powers and symbolism of constituent states would be severely curtailed in favour of a centralized state, like in Germany, or in Brazil (the fascist leader there even had the flags of the individual states of the federation burnt in an official ceremony, and their governors designated by himself — it goes that far).

I see the current developments as a free-for-all of the plutocrats. Fascism may still come, but I do not believe Trump (or Musk) has the calibre to make it happen.

Primo, I have to quote myself, which is an unpardonable sin, but here it is: ‘a fusion of state/government with Big Capital and corporate oligopolies, that is sought in times of deep and protracted capitalist crisis, when the contradictions of the system do not allow for resolution, and the ruling classes take the iron fist out of the velvet glove.” In Marxist terms, this is the essence of fascism, and the unholy marriage of Trump and Musk encapsulated this dynamic splendidly.

Also, fascism doesn’t happen overnight; a society has to traverse what sociologists call a period of fascization. It takes time until the social polarization begets political assasinations, and the cancellation campaigns become terror. We are not there yet, but the directions are clear.

Segundo, the cult of the leader is unavoidable in this kind of systemic crisis because politicians have no resolution for the convulsions of capitalism. It’s a chain reaction: the population is disgusted with the political class, the party system is broken, and the charismatic opportunist who will claim to be above parties, to represent the suffering nation, and who will usurp power in the name of this much abused nation, will be embraced by the plutocrats. The world is filled with little Zelenskys eager to play their part.

Tertio, I was honestly surprised by your ‘nope’ directed at ethno-nationalism, with its divide between genuine citizens and those who must be excluded. I would think that the bitter fight over immigration that has become ubiquitous in the West qualifies. Or you could google Trump’s Fortress America. It might not take the same shape and form as interwar ethno-nationalism, but nobody should expect that it would.

I’m not going to address the rest of your comment for two reasons. First, it seems to me that to you fascism means the wholesale repeat of the interwar phenomenon, but this is not my definition, so we are possibly talking in parallel. Secondly, I noticed that this is a blog for morning people, almost nobody reads it after 6pm, and I feel like a crazy person talking to herself in an empty city square. And thank you for taking the time to write such a substantial reply. It gave me food for thought.

Primo, secundo, tertio… Sorry, my rudiments of Spanish vitiated my rudiments of Latin.

“First, Second, and Third.”

I think we get it. / ;)

But then Dida wouldn’t be so delightfully florid in prose.

I’m sure you see the appeal ;)

Thanks for the explanations.

When it comes to the “fusion of state/government with Big Capital and corporate oligopolies”, it depends highly on how the fusion takes place. Fascism always put big capital and oligopolies on a privileged, but ultimately subordinate position to a strong (and de facto and often de jure all powerful, totalitarian) state. Nowadays we see big capital and oligopolies reducing the state to be their servant, weak and without initiative for anything that does not concern the legal defense of the “market”.

After all, there are enough countries in Africa and Arab states where the governmental and political leaders are also the owners and the leaders of those oligopolies, monopolies, and big capital — to the point that firm funds are state funds are personal funds. No deeper fusion possible — but nobody claims that Equatorial Guinea or Kuwait are fascist regimes.

“a society has to traverse what sociologists call a period of fascization.”

I agree, but, historically, an essential element of that fascization is the constitution of mass organizations. I doubt fascization can succeed without them, and I do not see this happening in the USA — contrast this to the efforts that Azov & co in Ukraine devoted to setting up political parties, armed militias, youth organizations, and infiltrating existing organizations.

“I would think that the bitter fight over immigration that has become ubiquitous in the West qualifies.”

That has been the case for ever; see what happened in the USA regarding Chinese immigrants in the 19th, and Central European Jews in the early 20th century. Had fascism taken over the USA? No. Does the 50-years long hostility regarding Northern Africans in France and Turks in Germany mean those countries have been fascist all that time? No.

The real question is, indeed, “the divide between genuine citizens and those who must be excluded” — and that means excluding existing citizens, just like Jews and Gypsies were ultimately considered to be foreign, no matter how many centuries they had lived as German, French, Italian, Hungarian, etc, people, and deprived of their citizenship.

There I have difficulties to see how the USA, a country built upon immigration and whose only “genuine sons of the soil” are the tiny minority of native amerindians will do to elaborate an explicit ethno-nationalist ideology that excludes some of the existing communities. Alternatively, it could go the way Brazil, which faced a similar conundrum, went during its fascist period. Then, the official ideology was that the country was creating a “new man” based on the harmonious fusion of the “three races” (white, black, amerindian).

“to you fascism means the wholesale repeat of the interwar phenomenon”

Historically, that was the only period during which fascist regimes existed. In the mid-1950s, previously staunchly fascist regimes in Spain and Portugal had shed most of their fascist trappings to become personal dictatorships (by 1958 fascism was completely gone as ideology of those regimes), while the fascistoid regime of Peron in Argentina had been overthrown. The numerous authoritarian regimes in Latin America (Chile, Argentina, Brazil, Uruguay, Nicaragua…), Greece, Pakistan, Egypt, etc, were/are bog-standard military dictatorships — and how are business and government fused via those sprawling military-controlled corporations in Pakistan, Egypt, Burma, oh, and Iran too…

I am unconvinced that what is taking place in the USA is fascism on the march. To me, it appears that Trump, a businessman, took over the government and opened wide the doors to let other businessmen weaken the state, plunder what is there to plunder, and disable all legal/administrative locks that prevent them to loot the public at large. This is neoliberal plutocracy, led by a demagogue (that is what Trump is — not a populist or a fascist), running amok. It more akin to what Milei (and previously Menem) is doing in Argentina, and Yeltsin did in Russia; but time will tell.

To what extent can we say that they are emulating Pinochet-level Chi School Friedmanesque “Shock Doctrine” economics here? Because Chile, arguably, has never recovered (god help them they’re trying now). Milei is driving Argentina into a ditch. Bukele. . .

One of the lessons I think we might yoink from a history of the last 50 years/neoliberalism is that the thin edge in wealth that colonialism supplied the colonizing countries–while maintained for the very wealthy by monopoly capital and financialization, by automation and out-sourcing–has narrowed to nothing for the lower and middle classes, for what Lenin called ‘the aristocracy of labor.’ (Worth a read, that.)

And one way to see what the white working class hoped for in Trump was a restoration of that aristocracy of labor. (With some willing to have it be less than 100 percent white.)

But Steve Bannon is getting out-maneuvered. Badly. These days he just looks like a sycophant. His choices were to revolt or submit, and it looks like he’s already made them.

The Bernie Sanders of the Right, then.

Wait, wait, wait. Are you suggesting that Sr. Sanders is of the Left? In America?

I’ll believe it when I see him supporting the Maple Syrup Army Faction in its fight against Oligarchy and Robber Barons. (The other Tapestista Army.)

I had heard and read bits and pieces of Bannon over the years but never got his comprehensive world-view. Recently, he sat for an interview with Ross Douthat of the NYT. I watched the interview in its entirety. Before long I’m thinking, “Is this guy a Marxist?” Class antagonism, alienation, oligarch plundering, working- class battering, historical materialism…it’s all here. What’s really weird is that he comes to precisely the wrong conclusion.

I sent him a courteous e-mail explaining my thoughts about his analysis, and asked him if anybody else had ever mentioned to him that his political philosophy bordered on Marxism. He never replied.

He was military intelligence. Marxist analysis, if they are serious about their craft, is one of their tools.

My dad studied Marxism as a member of the Counter Intelligence Corps, forerunner of the CIA, in post-war Germany; I have stared at his notes. While they ran to just a couple of pages, as I recall, it looked like his instructor(s) took it seriously, that there wasn’t a great deal of proselytizing but a serious attempt to get inside the works and see what made Marxism tick. The emphasis, as I noted in watching the new version of The Ipcress File last night, was on the lack of spiritual or idealistic qualities in the search for a Marxist “science,” which is–interestingly (and minus the humanism that someone like Francis Wheen says drove Marx)–also part of what Marxists see as its appeal.

If you had called it ” National Marxism”, that might have gotten his attention.

That graph looks like a comical AI hallucination which the AI proof-readers missed while hallucinating!!

And I always wonder how “GDP” growth is accounted for. The devil is in the details.

Parasitical activities, extortion, oligopoly/monopoly rents etc. are all considered productive activities in the US national income and product accounts. These activities might be considered to detract from real economic productivity. Of course, the rentier class claims that they are the most “productive” members of society.

To be crude: we are told that the activities of the rentier-oligarch class is necessary and productive, not extortionate or parasitical. We are instructed by the mass media oligopoly to worship celebrity-oligarchs uncritically and blame all of our problems on the powerless and on foreign countries – but never ever look behind the thin curtain. The frame is: which celebrity-oligarch do you identify with? Instead of “why do we have oligarchy?”

Even when oligarchy is in our faces, we are not supposed to notice.

If you download the spreadsheet you’ll notice a massive surge in Imports and a very large negative net change in net exports. Those are they data points driving the -2.8% forecast. I’ve read elsewhere that much of this is likely driven by massive inventory builds trying to get ahead of tariffs.

As an aside, it also signals how worried some manufacturing companies are about what those tariffs might do to their business margins and competitiveness.

I drilled into the numbers a bit further down the thread and they seem to support your view. The import/export changes aren’t the only thing going on though – personal net spending is down quite a bit as well.

Some of the source data is up to 2 months old, so I’m not sure how much of a leading indicator it is. The pessimistic import/export data through December was released on 5 Feb, so you’d expect it to have been accounted for in the Feb numbers, but perhaps they don’t update regularly or it took time for it to be posted or something.

This happened the last time around as well, end of 2017, and here we are with muppets still spending like drunken sailors.

Never underestimate Americas’ willingness to spend beyond their means.

look for products that are almost, or all made in the U.S.A. not easy or impossible in many cases, but i have found some daily usage ones, that are cheaper than those that say made with global components.

Any links to where this info/sources may be found? Could be useful to may.

unfortunately it requires a lot of leg work, and reading labels.

Thanks, didn’t know if there is a clearing house of some sort on this.

Made in the USA has certainly affected our purchasing decisions, especially if the parts are made in the country should repairs be needed. Supply chains and all.

Observation from my small corner of the American marketplace but been talking with other creatives in the advertising world. All of them mention how slow it is and usually we all have projects and plans through the summer by this point but it’s crickets. Companies are holding out due to uncertainty and not committing to spends on ad production at the moment. They’ve all talked about how it’s giving them 2008 flashbacks.

I was in that industry in 2008. Everybody went jobless for six months (including me). Agency owners were all talking openly with each other about whether they’d all have to close their doors.

Marketing is one of those activities that companies figure they can postpone indefinitely as non-core. The saying I’ve heard is, “When corporate America gets the sniffles, the agency business gets pneumonia.”

Imo, the 2008 GFC was never resolved, only papered over for as long as possible.

This 2009 Atlantic Magazine article is now mostly paywalled. It used to be open. The intro and first couple of paras give the flavor.

‘The Quiet Coup’, by Simon Johnson.

https://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/307364/

A brief review of the article’s main point.

https://www.ericgardner.net/classic-reads-simon-johnsons-quiet-coup/

Is Trump trying to destroy the US economy on purpose, for shock doctrine types of reasons? A quick web search didn’t find anyone flat-out saying so, but it’s a plausible theory as far as I can see. Any thoughts?

Or, is Musk?

Personally I find it quite plausible that Musk, being many times richer than Trump and having bought him the office, is really calling the shots. In 2017-2020, we heard all about how Trump had cowed congressional Republicans into submission with threats of primarying them. Now we’re hearing that congressional Republicans are being cowed into submission with threats of MUSK funding primary challengers to them.

I think Musk has likely peaked and Republicans, particularly in the Senate, are going to start to assert their authority. But it’s early days.

re: “having bought him the office”

FB,

Can you provide some proof for this assertion? An explanation of how this purchase took place, with substantiation, would be helpful.

Thanks.

I’m not FB, but Musk spent over a quarter of a billion on Trump’s reelection:

https://www.reuters.com/world/us/musk-spent-over-quarter-billion-dollars-help-elect-trump-2024-12-06/

Your source, Reuters, states that Musk gave the money, about 270 million, to a PAC for advertisements, etc. Given this, is calling this action “buying the office for Trump” justified? One might as well say Kamala Harris spent 15+ billion and could not “buy” said office. Looks like Musk won with a low bid.

The theory I’ve heard from long time follows on financial X, mainly currency speculators and hedgies, is that the Bessent plan is to rebalance the economy to slow the acceleration of the deficits, through deregulation and lowering the long end of the curve while crushing demand through tariffs and recession. Looters are gonna loot regardless but if true, looting is a side effect rather than the goal.

Some of those same people have been saying that the recession is already underway.

He’s going to slow the deficits through a huge tax cut on the rich? Good luck with that.:(

Added: The above theory is interesting and of course it also involves crushing labor and wages, by creating massive unemployment, I expect.

Has anyone asked how Trump was able to get the Soros guy to run the treasury?

“Looters are gonna loot regardless but if true, looting is a side effect rather than the goal.”

Feature or a bug? Depends on who you’re talking to. In practical terms, there is no difference. You’re still not part of the group that matters.

That’s a sufficiently large dive that I wondered if it was a data artifact. They do (kind of) show their work if you click the ‘Subcomponent Contribution Charts’ tab. If you do that then you can see that by far the biggest contributor to the dive is Net Exports, which they have dropping from -0.41 to -3.70. They’re also forecasting big drops in consumer spending and residential/nonresidential fixed investment, all dropping from positive amounts to near zero or negative in some cases. The FAQ page links through to data sources including the FT900 report, which does seem to show a large recent spike in imports (in December, though the report wasn’t released until February). The vast majority of this increase, about 80% of it, was in ‘finished metal shapes’.

January numbers for Personal Income and Outlays (released end of Feb) also showed a big increase in saving and drop in personal outlays. The biggest movers were vehicles and parts (down 40%!) with spending on housing and utilities increasing by 29% at the other end. Nearly all the increases were in nondiscretionary expenses (gasoline and energy also went up) with the declines in discretionary expenses.

To me this paints a picture of manufacturing businesses stockpiling to mitigate against possible tariffs, and consumers responding to price increases for essentials by cutting discretionary spending. I’d expect the former to be temporary, but the latter might not be.

The Wolf Richter article linked above mentioned seasonality, which is worth investigating – the changes I noted are month on month, and perhaps that’s normal for Dec/Jan?

Finding the prior year equivalents of the same docs proved to be more work than I cared to do (they don’t save them in the same format and getting an apples to apples comparison is tough). I was able to find the year prior version of the consumer spending/income analysis, and while it wasn’t broken out individually it mentioned big drops in automotive spending and increases in housing and utilities. So perhaps that is a seasonal pattern that happens every year.

I am in Europe. And I am hiring, IT department. The number of candidates on vacancies has jumped up recently. I used to be happy to have one decent candidate. Now I have 15. I have never seen this, in 15 years.

Most candidates are freelancers looking for an internal position. Or younger, with only a few years experience. These are the positions companies cut first, and can cut fast. I look at it as a leading indicator.

A data point for this post – ‘American businesses are getting nervous about hiring more workers’–

https://edition.cnn.com/2025/03/05/economy/adp-private-sector-jobs-february/index.html

Which snowflake will cause the avalanche?

If one adds up the various expenditures of Keynes’ “state money” into the economy targeted to be cut back, and then the cost inflation due to tariffs and re-shoring in a high cost of living country, the squeeze could be considerable, and that’s before “bank money” shrinks. At least no one seems to be talking about Treasury stopping payments for obligations. I’m not sure what to call a situation with rising costs and falling incomes and savings.

Stagflation? I’m not sure.

US GDP is formed primarily with non-productive sectors like services and finance….total sham…you want to see GDP, fly from Shanghai to Guangzhou and look at the limitless miles of factories, warehouses, distribution centers and ports….same thing for Tokyo to Osaka….and Seoul to Inchon…nothing but “production”….