Yves here. One thing Federal officials (or Friends of the Administration who give hot takes on business TV) have taken far too often to doing is refraining from “Just the facts, ma’am” updates to trying to spin the latest set of releases so as to sound better than they are. Often you see Mr. Market make a fast move that takes up the positioning, only to pretty quickly retreat and recalibrate. Other times, the prettying-up sticks for longer than it ought to. Inflation is a particularly charged issue, since consumers correctly perceive it is still very much with them.

Wolf Richter explains below that that latest hope-fanning, that PCE inflation might be relenting, is contradicted by other readings of the same data. Ooopsie!

And that’s before the fact that Trump tariffs will increase prices, by design, so as to try to shift purchases away from the tariffed foreign wares. But that of course assumes that first, reasonably close US substitutes exist and are or can soon be produced in sufficient quantity so that their prices don’t rise a lot. Otherwise, higher prices and/or shortages are baked in.

To put it another way, this outcome is so obvious that my US-educated Southeast Asian dentist asked me during a recent checkup: “I’m not an economist, but I don’t see how these tariffs make any sense” and rattled off how they’d be sure to increase prices and generate supply chain problems…so what was the point, exactly? In other words, when parties who have no reason to be interested in this topic can still see on a very quick assessment that it looks like bad policy, you have to wonder if the Trumpies are blinded by ideology or have a cunning plan to benefit from the resulting dislocation.

Some other observations on the inflation beat before we turn to the main event.

When you’ve lost the Peterson Institute…

25% tariffs on Canada & Mexico would cause lower GDP & higher inflation than otherwise in all three countries, including the US—& the damage would be even worse if Canada & Mexico retaliate.

Learn more: https://t.co/XuSWijqlfX pic.twitter.com/HdCURdv3Lj— Peterson Institute (@PIIE) March 3, 2025

Lutnick just said, “You can’t have inflation with a balanced budget.” Government budget was in surplus from 1998-2001. Inflation accelerated. pic.twitter.com/U9dAWrcVAF

— Stephanie Kelton (@StephanieKelton) March 4, 2025

Supply chain bottlenecks are about to be reinvigorated, due to the gross fatuity of Dump’s tariffs. As a consequence, cost-push-markup inflation will be revived, and because of the hegemony of neoliberal central banking, monetary austerity will not wane.

— David Fields (@ProfDavidFields) March 4, 2025

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

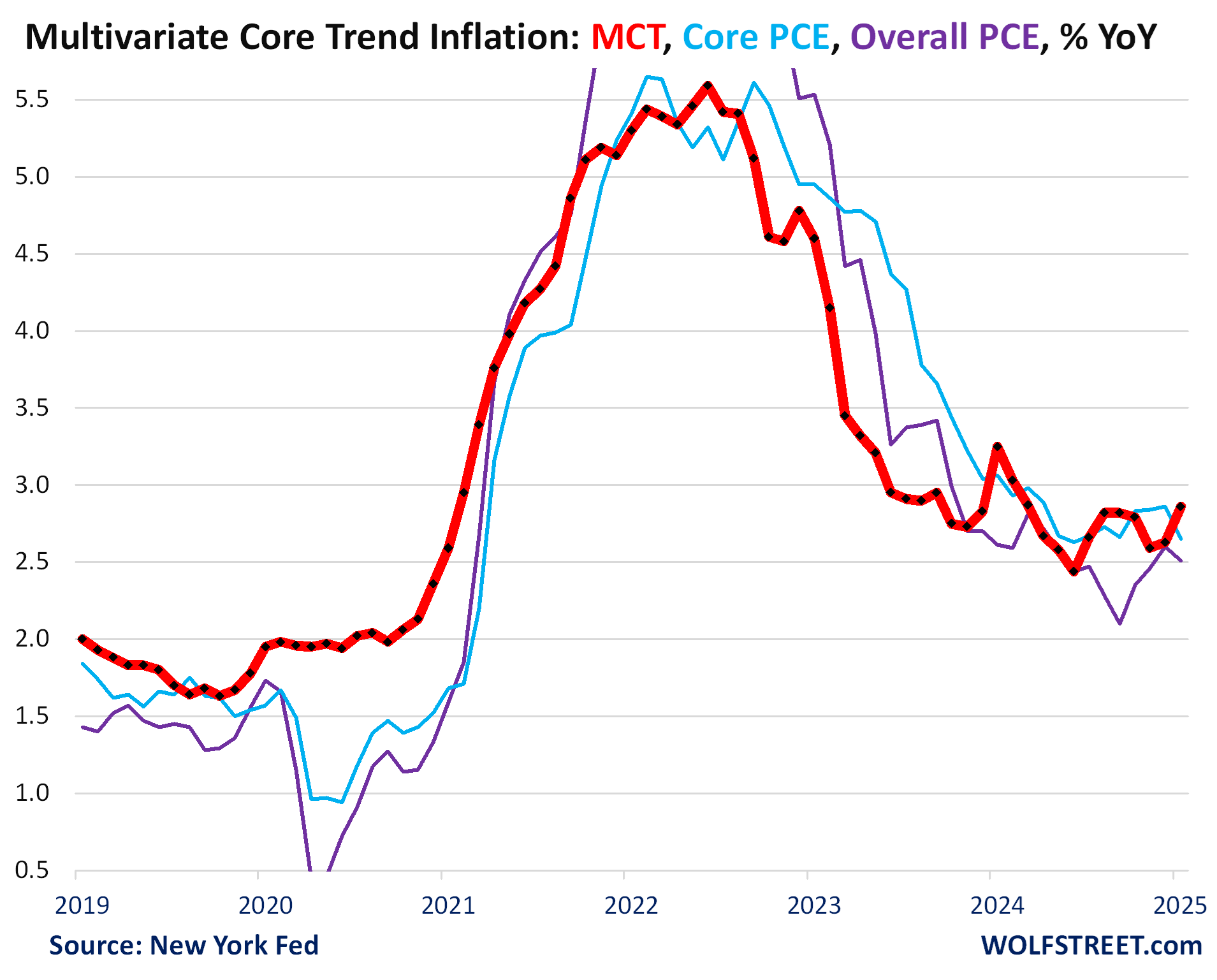

Just briefly here because it’s an interesting twist by the New York Fed on Friday’s PCE inflation reading: it nixes the idea that year-over-year PCE inflation is cooling.

Back in April 2022, when the Fed’s favored inflation measure, the PCE price index, was surging towards its June 2022 high of 7.2% year-over-year, researchers at the New York Fed came out with a new inflation measure that’s based on the data in the PCE price index, but tries to show inflation’s “persistence.” They did this by aggregating the PCE components differently. And they called it Multivariate Core Trend inflation (MCT inflation).

The idea was perhaps to show that inflation wasn’t quite as bad beneath the surface, and that it was less persistent and on its way out, as for most of the time since its invention, MCT inflation has run well below the core and headline PCE price indices.

Today, they released the MCT for January. Oh boy! The PCE price index for January was released on Friday. What the media jumped on was that year-over-year inflation readings cooled a little. What I pointed out was that the month-to-month increase, the three-month increase, and the six-month increase all showed the worst inflation since the spring of 2024, after accelerating relentlessly for months, but that the massive base-effect in services cooled the year-over-year increases in services, and thereby in the core PCE price index and the headline PCE price index (my discussion of PCE inflation for January).

So now here is the MCT for January, which attempts to show “persistence” of inflation, using the same underlying data but dividing it up differently. “Persistence” has become a huge concept after “transitory” was retired by Powell himself.

The year-over-year MCT accelerated to 2.86% in January, from 2.63% in December, the worst increase since March 2024 (red), driven largely by “services ex-housing” and to a lesser extent by “core goods” (excluding food and energy goods).

In other words, housing is no longer the driver of this inflation at the moment. In this game of inflation Whack-A-Mole, price pressures have shifted to non-housing services, and to core goods.

Also shown in the chart are Friday’s figures: The headline PCE price index decelerated to +2.51% (purple) and core PCE price index decelerated to 2.65% (light blue).

Interesting, especial the Peterson Institute.

If their modelling is correct, the effect on US GDP is within the statistical error on any economic model! Whereas the effect on Canada and Mexico is stinging! With an asymmetry like that, why wouldn’t Trump do it?

Who knows what tariffs will mean? Perhaps domestic producers will raise prices if they were price takers from imported competitors? Or perhaps they will lower their prices (and there will be minimal change in the overall market price structure) because increased volumes will enable production efficiencies and competition for addressable market share is again worthwhile?

Goods with high capital intensity manufacturing can be made either place and prices should be similar already so the tariff knocks the rekative advantage of these imports hard. Whereas light, easily shipped goods with a high labour component, have a big price advantage vs USA and may still be competitive afterwards. So prices will rise in cheap goods for the poor because the lowest cost producer is still foreign but costs 25% more (and US competitors can raise prices) whereas foreign exporters of capital goods / intermediate goods will either suffer margin losses to maintain share or will move their production to the USA and US mnfrs may be able to cut margins to make up on volume (or just go for gouging because its easier).

This all assumes untariffed competitors don’t step in!

Who knows? Maybe… possibly…, or perhaps we are engaged in wishful thinking and hopeful speculation?

My bet is on higher prices baked in, as the intro explains. I don’t expect to see any rainbows or unicorns

A lot depends on how much redundancy and flexibility there is in the main supply chains. Trade is rarely truly bilateral, there is a near certainty of unexpected alterations in supply chain patterns as each country or block responds.

If there is one thing that the history of trade conflict tells us, it is that deficit countries suffer less in trade wars than surplus countries. Its something I think Trump understands better than many of his critics. The problem is that he may not realise just how big a stress test he is putting the worlds economy through.

Of course, with China responding by putting high tariffs on US food products, you may want to hold on to UK farmland….

Lol, PK – it’s not sold until it’s sold, the farm! :-) Certainly we’ve always hung on to it out of a memory of WW2. But frankly, bunker mentality is no good. Better to sit it out with financial assets in a non-combatant country. Plus the EU as a whole can feed itself.

And I just looked at the UK tax rises that kick in in April and it is horrific. The economy is already flatlining and the blood harvesting has barely begun…. Plus the EU 900bn for rearmament. Are you kidding me…? And doubtless Starmer’s going to keep up with the Joneses….

I think we’ll be off to Asia (Thailand, Singapore, HK), there’s no hope for Europe….

The secondary effects of tariffs could do more to undermine US financial markets than any direct effects. IIRC, last week Cory Doctorow postulated that since tariffs will violate WTO and NAFTA terms, those treaties are effectively null.

Doctorow then observed the entire IT/IP rent stream of US licensed and traded companies is based on the Digital Millennium Act (DMA) extended abroad by those treaty structures, among others.

So, the US unilaterally voiding these treaties, by nullifying the export of DMA, opens the door to reverse engineering and optimizing every US licensed app in use outside our borders and capturing those rent streams for our erstwhile trading partners. The Chinese seem to be early out the gate with DeepSeek and some of the open source initiatives linked to here recently.

To your first point, with 10% of the population doing over 50% of the spending, that “within the statistical error” may be true but irrelevant.

For the 90% of the population doing the other 40somthing% of spending, that spending will ratchet down in direct proportion to real consumer price inflation.

It seems to me like that’s a first step for a deflationary spiral I doubt Peterson has factored in their model.

…or have a cunning plan to benefit from the resulting dislocation.

With this crowd the first question I always ask is Cui bono? I was once the chief illegal substances prosecutor in the 18th largest county in the country and let me assure you, this isn’t about stemming the flow of fentanyl.

They clearly want to stoke inflation after seeing their asset “values” and profits soar during Covid greedflation. To these clowns it’s free money, never mind the cruelty and suffering inflicted on everybody else. I think that it’s that simple…

“…And that’s before the fact that Trump tariffs will increase prices, by design, so as to try to shift purchases away from the tariffed foreign wares. But that of course assumes that first, reasonably close US substitutes exist and are or can soon be produced in sufficient quantity so that their prices don’t rise a lot. Otherwise, higher prices and/or shortages are baked in…”

Thank you Yves, I might be crazy, but I don’t think I’ve gone totally insane: I’ve tried to explain that to some friends and colleagues for a long time, but apparently their emotional attachments and wishful thinking have overridden their critical thinking skills. I still can’t get over how many otherwise intelligent and informed people can become so irrational and delusional. The psychological conditioning, convincing people to act against their own interests is both frightening and amazing at the same time.

https://www.yahoo.com/news/even-trump-admits-just-made-143823084.html

When prices start to rise dramatically, will the hopium-addicted folks be shocked into sobriety?

but prices have risen steadily since bill clinton, yet wages have not. lots of graphs proving this is so. in fact, millions upon millions of lost high wage jobs lost due to free trade. that is why we are here at this point.

vast area’s of america now look like third world countries, homelessness even though they are working, the jobs are all low wage part time service jobs.

so how can free trade be for our best self interests?

Why Free Trade Isn’t Efficient

By Ian Welsh

On June 26, 2018

Comments

For the past few weeks, I’ve been reading a raft of literature by lawyers, economists, and bureaucrats involved with the World Trade Organization (WTO) and other free traders. It’s been a fascinating journey into an alternate world, one in which frictionless trade and money flows, and unified regulations and laws are considered to be a good thing.

————————–

https://wolfstreet.com/2025/02/05/trade-deficit-in-goods-worsens-to-all-time-worst-in-2024-small-surplus-in-services-improves-overall-trade-deficit-worsens-by-17/

Three decades of connivance by the US government – which bridged with ease any political divide – and Corporate America, under the failed doctrine of globalization, have destroyed much of the manufacturing base so that corporate profit margins could fatten by chasing cheap labor, lax environmental laws, and preferential treatments in US and foreign tax codes.

In return, they sacrificed the most important economic sector – manufacturing – with its huge primary, secondary, and tertiary impact on employment, on household incomes, on federal, state, and local tax receipts, on knowhow in automation and manufacturing technology, on engineering and engineering education, and on infrastructure. In the process, they shifted much of this activity and expertise to other countries.

The US is still the second largest manufacturing country by output in the world, with a share of 15.9% of global manufacturing output, and larger than the next three combined – Japan 6.5%, Germany 4.8%, and India 2.9%. But China’s manufacturing output is nearly twice that of the US, with a share of 31.6% of global output (World Bank data).

That this mess was encouraged to happen over the past three-plus decades under the doctrine of “globalization” and “free trade” is a huge scandal that spanned the political parties. And those globalization-mongers are still at it today, preaching the same failed doctrine.

and there is no more discussion possible after that.

1. Back then, the US was the largest exporter in the world; and now it is the largest importer. 180-degree different, the opposite. If countries want to retaliate, fine, let them, and they should. Everyone should use tariffs to raise some taxes, and nearly all countries already do, particularly China.

2. Tariffs are already widely in use by all countries, and have been in use forever. Tariffs are very high in China against protected products. Lots of tariffs in the EU against US products, including cars.

3. The Great Depression wasn’t caused by tariffs. People who say that propagate anti-tariff BS. It was caused by a mix of factors, including the collapse of massive speculation on everything, entailing the total collapse of the stock market, and the collapse of the banking system where money in bank accounts just vanished when the bank collapsed, and companies couldn’t make payroll anymore because their money was gone, triggering huge unemployment, but without unemployment insurance, and so people stopped spending because they ran out of money even if their bank hadn’t collapsed, and it turned into a vicious self-propagating cycle.

That’s why we have backstops today, such as backstops for banks (deposit insurance, the Fed’s liquidity tools, strict regulations, etc.), unemployment insurance, a retirement system, etc. Most of these things came out of lessons learned from the Great Depression.”

—————————–

https://www.ianwelsh.net/quick-takes-tariffs-the-zelensky-blowup-more/

Sometimes I want to comment on topics without doing a full piece.

According to Trump tariffs on Canada and Mexico, at 25% except on energy, which will be 10%, start tomorrow. Along with the 20% tariff on China, the cost to the US is likely to about 1% of GDP. Canada could lose as much as six percent.

Expect retaliation from both countries. Some of it will be sub-Federal, the Ontario Prime Minister has said he’ll raise prices for electricity sent to New York state, for example. Sorry folks, I know most of you didn’t vote for Trump, but…

As I’ve written before I think tariffs are good for Canada. We’ll take a substantial hit, but moving to manufacturing in Canada, buying Canadian and diversifying our export partners are all things we should have done years ago. Hopefully we’ll cancel NAFTA/USMCA: there’s no point in having treaties with the US, since they never obey them.

———————

i have the same view that welsh has with this.

https://www.ianwelsh.net/category/economics/trade/

he transition period will be ugly. Beyond ugly. Quite likely “economic collapse” level ugly.

There was a way to use tariffs and industrial strategy, but starting a trade war with half the world all at almost the same time was not the way to do it. You pick sectors (start with machine tools and basic electronic and machine parts), tariff that, put in subsidies and restructure the market for those goods. Once that’s going, you move back up the chain.

That’s how you use tariffs and industrial policy to reindustrialize.

Dunno what you’re on about mate. I never advocated for blanket “free trade”.

Your argument is largely straw man.

The US will not re industrialize, the US has no real industrial policy.

You contradict yourself, how can the US “reindustrialize” if the economy collapses, the population is in ill health and ill-educated, the infrastructure is crumbling and the overhead costs are ridiculously high? Not gonna happen. You can wish all you want.

Yet more ham-fisted hopium and wishful thinking.

sorry, prices have gone up under free trade, because in actuality wages have never kept up to even minor inflation since 1993.

i have always said what bill clinton did to us, i doubt can be reversed. but as Keen and others have pointed out, we have no other choice but to do tariffs, and more than just industrial policy, with a new deal like last time.

the youtube on the canadians is so so educational, one side gets it correct.

i do not expect to be able to reverse what bill clinton did. he managed to turn a first world nation into a third world nation, quite the feat.

A theory (and just that, could be completely off the mark):

1) Precipitate a recession

2) Blame your predecessor for generating the conditions conducive to a recession

3) Implement otherwise desired policies (tax cuts) or achieve otherwise desired external policy results (interest rate reduction — Trump has on at least one recent occasion declared that interest rates were too high) which can be considered as stimulative

4) When (if) the economic situation improves, declare yourself the hero

5) In the meantime, position yourself/benefactors/cronies to benefit — in every crisis, opportunity (and opportunism)

I believe this somewhat dovetails with the FT article comment by one “The Muppet Strikes Back” embedded in yesterday’s post regarding the proposed crypto strategic reserve, but I am eternally naive in such matters.

Too cynical or off the wall?

A mild recession will not be enough to induce deflation. It will have to be close to a major depression, and then what? Trump will surely be blamed for it, but this is his last term, so his focus might be positioning himself to loot the country when his term is over.

Tax cuts might indeed be an easier sell when the economy is in the dumpsters, but at the same time it could also backfire as in the masses might demand higher taxes on the rich, but we all know that won’t happen.

I see your cynicism and raise you…

What about

step 6) wait for uprisings and declare martial law

7) stay in power (third term, delayed election)

8) manufacture international conflict to justify more erosion of rights at home

9) oligarchy + state religion make a pact (like Saudis, like Russia, Israel…)

10) wall off the poor from the rich and prepare for climate crisis

11) use just enough human workers to buy time for fully automated work force

12) exterminate the leftovers Palestine-style

The fascist fever dream

Shadowstats site calculates inflation the way the US once did in 1990, which I think includes energy costs and food, unlike the current methodology. Their figures are much higher as you might imagine. https://www.shadowstats.com/alternate_data/inflation-charts

I read that New England energy prices doubled overnight as a result the of heating oil being imported from Canada.

I wonder if the plan is to inflate away some of the national debt?

we have lived under the crank theory of free trade for so long, people are unable to distinguished whats in their own best self interests,

here is a nice youtube explaining both sides. one side understands it, the other side lives in fear because they never experienced stability.

https://www.youtube.com/watch?v=mRSt2bTJLWs

here is stability,

https://dairyfarmersofcanada.ca/en/dairy-in-canada/dairy-at-work/food-security

Keen has it right on tariffs.

https://www.youtube.com/watch?v=bW8HH8FECr0

“Is Trump Wrong on Tariffs?” Top Economist Warns the US