Yves here. Sadly, the most desperate are regularly the subject of the most intense financial grifting, be it loan sharks or the more-respectable seeming versions, like credit cards that very quickly reach interest rates of 34% when payments are late. Payday loans have long been one of those abuses, to the degree that the Department of Defense moved in as a banking regulator of sorts to limit their use and rates on operations located near military bases. From one of our very first posts, in January 2007, The Pentagon as Financial Regulator:

When the Pentagon is sticking its nose in an area this far from its native (and very large) sphere of influence, you know something is up. From Reuters:

The Pentagon is writing a rule to keep the minds of U.S. troops on their missions by shielding them from debt, but the prospect of the Defense Department as a regulator frightens the financial industry….

The rule will limit how much lenders can charge military personnel, and it could affect banks, credit unions, mortgage providers and payday lenders, among others.

The Pentagon is especially concerned about payday loans, which are typically two-week extensions of credit to cover quick cash needs between paychecks. They can have interest rates of 300 percent a year or more, pushing troops so deep into debt that they cannot focus on fighting.

Defense officials and some lawmakers argue that young, financially unsophisticated service members are particularly vulnerable to shady financial practices and deep debt, especially when lenders offering high rates and quick cash set up shop outside the gates of military bases.

The push against payday loans is part of a bigger effort to clamp down on financial practices the Pentagon sees as predatory. It follows efforts to boost standards for insurance sales after reports found the insurance industry had spent years offering unsuitable and expensive products to soldiers.

The limit on loan rates would be set at 36 percent — a number meant to drive the payday loan industry out of military lending….

It also may make the industry subject to penalties that include prison. That risk could stop many lenders from doing business with military personnel and their families.

It’s appalling that anyone can attempt to defend loans at an annual interest rate of 300% (since when aren’t soldiers creditworthy? Their paychecks come from the US government, so they are a full faith and credit obligation of the US Treasury, and soldiers can’t even quit if they want to. They have to get a discharge. I’d say that’s about as good as it gets). But this isn’t really about the DOD’s alleged incompetence as a financial regulator (let’s face it, it isn’t hard to craft an interest rate ceiling, but any broadly worded provision will likely incorporate fees, which can drive de facto interest rates into the stratopshere). It’s that the Pentagon’s strike against overweening creditors, if permitted to stand, may lead Congress to take interest in the question of the fairness of lending practices, and perhaps even to overturn the federal exemption of national banks (ones chartered by the Fed), federally chartered savings and loans, installment sale sellers, and chartered loan companies from state usury laws.

A bit of background: federal usury laws were in place until the Great Depression, and states had usury laws of their own. In 1978, the Supreme Court ruled in Marquette versus First Omaha Services Corp. that a national bank could charge the highest interest rate permitted in its home state to customers living anywhere in the United States, irrespective of any state interest rate caps.

In 1980, short term funding rates were over 20% and Citibank was losing boatloads on its credit card portfolio. Unable to obtain legislative relief from a New York interest rate ceiling of 12%, Citibank went jurisdiction-shopping (this wasn’t as easy as it might sound, since in those days, federal banking regulations stipulated that before a national bank could set up operations outside its home state, it needed to be issued an invitation from the legislature of the state they wanted to enter).

Citi forged a deal with South Dakota that kept the local banking interests at bay and actually wrote the emergency legislation that permitted them to set up shop in 1981. Other states swiftly followed suit with credit-card-friendly laws.

Credit cards have gone from a loss leader to one of the most profitable, if not the most profitable, banking product. And it is due entirely to a change in the regulatory climate (another Supreme Court decision, in 1996, lifted limits on late fees, which in 2003 contributed $12 billion in revenues).

And let us not forget the new bankruptcy law, enacted in 2004, which severely limits consumer access to Chapter 7 bankruptcies (the kind that let you erase your debts) and imposed tough standards for payback plans under Chapter 13 (the version most consumers now must use). A relative who is a bankruptcy lawyer himself, and one would think would favor such a bill, has called it draconian, unfair, and a clear sop to the credit card industry.

So you can see the banks have every reason to fear a powerful organization like the Pentagon standing up against the God-given (well, Supreme Court given) right of financial services companies to engage in predatory pricing. Who knows where such a radical line of thinking might take us? But no one should be surprised that a lack of restraint could lead to a pushback, albeit from a very unexpected source.

Switching these services over to apps has allowed them to financially strip-mine borrowers more efficiently, even in states like New York that have imposed strict usury laws. Just charge egregious fees in place of egregious interest and all is good.

And from a 2021 post, on an upsurge of payday lending because apps:

Payday loans’ prevalence declined the past couple of decades due to regulation and pressure from consumer advocates. Why regulation and pressure? The loans are obscene: a study by the Consumer Financial Protection Bureau revealed that most borrowers paid more in fees than the loan itself. Meaning, if you borrow $200 for medicine, you may owe more than $400 by the time you’re through fulfilling your loan obligation in much less than a year’s time.

Despite payday loans evaporating, the addressable market isn’t:

- 18.7% of households are underbanked (“household had an account at an insured institution but also obtained financial products or services outside of the banking system”.)

- 5.4% of households are unbanked.

- 1 in 3 adults report “having difficulty covering basic expenses.”

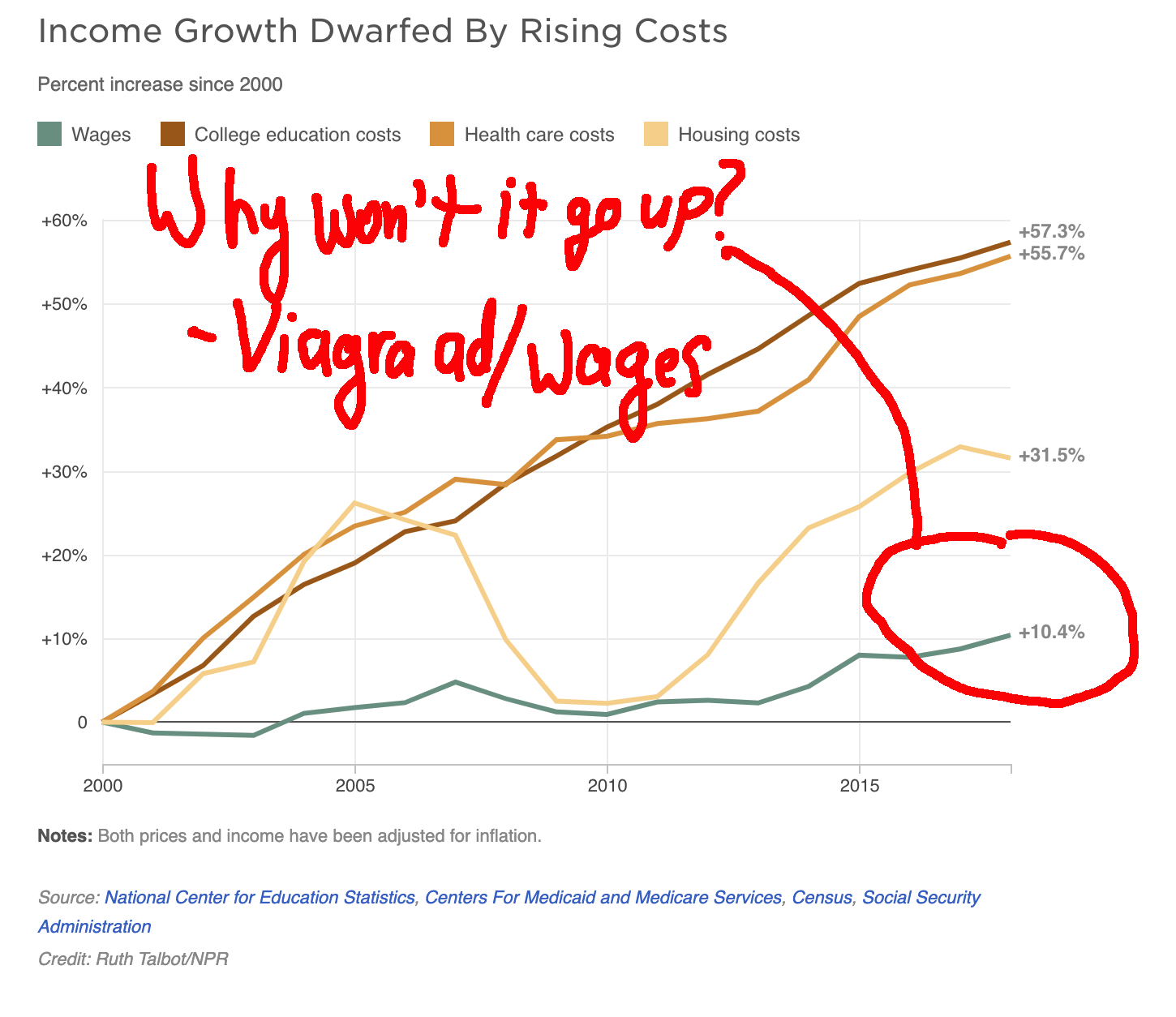

0% loans on labor, years of flat wage growth, and disproportionate costs in other major areas, has ensured the market has stayed ripe.

Source: National Center for Education Statistics, Centers For Medicaid and Medicare Services, Census, Social Security Administration Credit: Credit: Ruth Talbot/NPR

Notwithstanding their decline, the ethos of payday loans lives on in applications that allow people to access their paychecks in advance of payday: charge exorbitant amounts to those who can least afford it so that they may access their own wages in a timeframe that’s more reflective of reality. Apps such as Earnin, Dave, DailyPay, and many others give users access to their paychecks early. Each early-access app has its nuances around how paychecks are accessed and how each makes money; however, the effective interest rates charged by each mirror their payday loan forebears quite closely. Equally obscene APRs, repackaged in brightly-hued homescreen apps.

Earnin users, for instance, are prompted to pay a default 10% ‘tip’ on the amount of money they access. If they opt not to tip, they’re limited in the amount they’re able to withdraw. If a user tips $5 on a $100 advance, that comes out to a 130% APR. Earnin has received $190 million in VC funding. The ethos lives on….

The existence of these apps isn’t any more sane than shoving a chicken bone down someone’s throat every couple of weeks, then gouging them for their CPR. They exist only because someone breathing is restricted by someone else.

To give a sense of the scale of these charges, New York has just under 13 million adults, so using the low estimate in the New Economy Project study of $500 million, the total charges per adult are $40. If you assume as many as 10% use these apps (clearly high), that gets you to $400 per person per year, which is substantial in relation to a low-income individual’s budget.

Do readers know anyone caught up on a payday loan treadmill, or similar exploitative products?

By Claudia Irizarry Aponte. Originally published at THE CITY on March 27, 2025

Cash advance apps like Dave and EarnIn have charged New York consumers more than $500 million in hidden fees and “tips” since 2019, a new report estimates — allowing the loan platforms to thrive despite New York’s strict limits on consumer interest rates.

The report from the New Economy Project concludes that borrowers in New York City account for nearly half of that amount, with an estimated $217 million siphoned from their paychecks during that period. It cites the company’s use of “deceptive” processing and expedition fees, even prompts to tip lenders, that inflate costs and trap borrowers into debt.

These payday loan apps provide high-cost, short-term loans — some as small as $25 — and automatically deduct repayment from the borrower’s next paycheck.

The findings by the New Economy Project, which published the report on Thursday, are based on a 2024 analysis of industry data from the Consumer Financial Protection Bureau, applied to New York State’s working-age population, and focuses on direct-to-consumer cash advance platforms.

President Donald Trump is in the process of dismantling the bureau, which was formed in response to the late-2000s financial crisis.

While many of those same companies claim their advances are free and are not loans at all, the NEP writes, the CFPB determined last year that their cash advances are loans subject to federal lending laws.

In New York, charging more than 25% annual percentage rate (APR) on a loan is a felony. But estimates from California’s top financial regulator determined that the fees and other charges imposed by the cash-advance or “Earned Wage Access” apps on borrowers amount to effective average interest rates of 330% APR.

In its report, the NEP makes the case that the companies sidestep New York’s usury laws by charging users hidden fees for immediate access to their money, among other costs.

“We’re one of 20 states that has a strong usury law, and in states where they don’t have strong usury laws, you see this kind of massive wealth extraction particularly from low-income communities,” said Andy Morrison, associate director of the New Economy Project. “So we’re just seeing this same thing, it’s just morphed into this tech version.”

Paycheck or cash advance apps have exploded in popularity in recent years, primarily among borrowers earning less than $50,000 annually. A representative of EarnIn, one of the largest payday loan apps, told lawmakers at a state Assembly meeting last year that the company had 80,000 users in New York alone in 2023.

The companies lure in borrowers with allegedly “fee-free” loans but use other means to profit from consumers, Morrison said, either by hitting them with costly expedite charges before payday or by charging monthly subscription fees on top of loan charges.

Some companies even prompt borrowers to “tip” their lender or employer, increasing costs for consumers.

As a result of these practices, a majority of the New York borrowers surveyed by NEP described being trapped in an “impossible cycle” of debt.

Deshawn, a user from the South Bronx who asked that his last name not be published, said he’s used “all of them” to pay for necessities like groceries and meals. He has slowly stopped using them, but still has an outstanding $300 debt from EarnIn on a $100 loan that had a two-week repayment period; the outstanding payment includes a $50 fee he paid to expedite the cash, he said.

“I feel like they get you to sign up for their services because you’re not aware of the different things that they charge on the back end,” he said about the EWA services, which he called “cash advance scams.”

Efforts in New York to regulate the financial technology industry, or fintech, have stalled. A bill introduced earlier this year by Queens Assemblymember Steven Raga that would strengthen state usury laws and prevent fintech companies and loan sharks from charging exorbitant rates only has nine co-sponsors. Meanwhile the chairman of the chamber’s banks committee, Assemblymember Clyde Vanel of Queens, re-introduced legislation this year that advocates say would carve out payday loan apps from state usury laws entirely.

Adrienne Harris, the state’s top financial regulator, has deep ties to the fintech sector and deregulation efforts. Between 2020 and 2021, Harris worked as an advisor to Brigit, a payday loan app that was subpoenaed in 2019 by the state Department of Financial Services — the agency she now leads — over concerns that the interest rates on its loans violated state anti-usury laws, New York Focus reported. Efforts by progressive lawmakers to thwart her 2022 nomination failed.

The DFS under previous leaders has taken a more aggressive approach towards the fintech sector. When federal banking regulators sought to override state usury laws on behalf of the industry during the first Trump administration, then-DFS superintendent Maria Vullo sued and won.

In 2019, Vullo’s successor, Linda Lacewell, announced the agency was leading a multi-state effort to probe the payday loan app industry, but that report was quietly shelved and its findings never made public, Morrison said.

“If you go to the Department of Financial Services’ website, it has a whole page about how payday loans are illegal in New York, and the Department of Financial Services has in the past been very aggressive in going after illegal online payday lending,” Morrison said. “So it really raises a question for us as to why not now, given that the department did open an investigation in 2019 into the industry and we New Yorkers never heard the results of that investigation.”

A spokesperson for the Department of Financial Services did not answer questions about the New Economy Project’s findings and said the agency cannot comment on potential or ongoing investigations.

Representatives for Vanel and Raga did not respond to requests for comment.

The head of the trade group representing the fintech industry insisted that EWA’s are not loans and should not be regulated as such — and said the products provide an alternative to payday loans.

“Responsible earned wage access is not a loan, has none of the characteristics of loan, and should not be treated or regulated as such,” said Phil Goldfeder, CEO of the American Fintech Council and a former Assembly member from Queens. “Responsible earned wage access is utilized by millions of American workers and serves as a safe, transparent, affordable and important alternative to high-cost predatory and payday loans.”

“The misguided views and recommendations promulgated by those who clearly do not understand earned wage access products are fruit from a poisoned tree and not in the best interest of consumers,” he added.

On Wednesday, NEP and more than two dozen labor unions, credit unions and advocate organizations sent a joint letter to Gov. Kathy Hochul urging her to direct DFS to enforce usury laws against payday loan apps and to partner with state Attorney General Letitia James to rein in the industry, among other recommendations.

Thank you, Yves.

Further to yesterday and last week’s budgetary measures announced in the UK, pay day lenders can expect to make a comeback.

As part of making Britain competitive and boosting growth, regulators are under pressure to ease rules on such lending.

Among the most egregious of predatory usurers is H&R Block. It offers “clients” ( = suckers) to obtain their refund right now, with a small ( 400% ffs) interest charge. It’s risk-free lending, it’s deeply exploitive of poor people, it’s filthy usury and it should be illegal again.

Good for the DND for putting a dent in this criminal industry.

Who is getting that money and where do they live?

Ask Chuck Schumer.

Welcome to the world of “left hand = i am socially liberal and pro-whales and brown people; right hand = i let my donors fleece your pockets

The most insidious part (and distasteful if one had financial decency) is that Amazon, Target, etc. have icons/links for the buy-now-pay-later (BNPL) lenders like Klarna, Paypal embedded right into the checkout process.

And I imagine with better data, better data mining, and simple trial-and-error, both credit cards and BNPL lenders have much models than 20 years ago about just how much parasitic debt to squeeze out of a rock to keep the host alive.

This clearly ought to be banned—even much of MAGA would agree, especially the Huey Long-wing of MAGA.

Every, single day I take heat from some members of my auto repair trade group for refusing to offer predatory financing options to our clients. I am told of all the money I am missing, and asked “who are YOU to so arrogantly make these decisions for your customer base”? My reply? “A man who can sleep at night, and look himself in the mirror the next morning.” There are several financial options that have actually skirted weak usury laws by allowing you to “lease” your auto repairs!! In other news, the over/under for the number of times I think “I have lived too long” has tripled in the past few months./sarc

Bravo! Good on you.

“Lease” auto repairs? wtf? What’s next, collateralize auto repair bonds, aka CAR bonds? / sheesh

Everything is rent.

Thanks for this post.

In related news Jack Dorsey is laying off nearly 1000 folks at Block – which includes AfterPay (the differed payment piece of CashApp. Block also houses Square so this is all FinTech with game-ified apps and weak controls. At a guess AfterPay is worth more than CashApp but this stuff all chains together.

https://techcrunch.com/2025/03/25/read-the-email-jack-dorsey-sent-when-he-cut-931-of-blocks-staff/

Back in my active service days, the common thing outside the main gate was the used car lot “E-3s and up financed”.

But Pentagon interest in this sort of thing is not new or surprising. From the 1830 Articles of War:

“Art. 29. No sutler shall be permitted to sell any kind of liquors or victuals, or keep their houses or shops open for any entertainment of soldiers, after nine at night, or before the beating of the reveille, or upon Sundays, during divine service or sermon, on the penalty of being dismissed from all future sutling.

” Art. 30. All officers commanding in the field, forts, barracks, or garrisons of the United States, are hereby required to see that the persons permitted to suttle shall supply the soldiers with good and wholesome provisions or other articles, at a reasonable price, as they shall be answerable for their neglect.”

When the pentagon steps in to (rightfully) address things outside its domain, something is horribly wrong.

I served just prior to Nixon’s establishment of the All-Volunteer force in the 1970’s. Pay was miserably low, but for many of my fellow Marines it was the first time they ever had a steady paycheck. If you ate your meals in the mess hall, didn’t go nuts buying stuff at the PX, and didn’t gamble, you could get by.

Needless to say, many couldn’t resist the temptations of having real money in their pockets–some for the first time in their lives. So, back in the day, by the end of the pay period the going rate was $5 for $7. In other words, you could lend someone $5 for a week or so and get $7 back on payday. I think I only lent cash like this a couple times but I knew enough that it was a pretty good rate of return. Sad to see its become big business.