Yves here. Satyajit Das looks at the conundrum of the recent peppy performance of European stock markets and its currencies versus terribly longer-term prospects. He concludes the only way to achieve not-really-terrible outcomes is to kiss and make up with Russia and China. But can European leaders eat enough crow to be able to do that?

By Satyajit Das, a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011) and A Banquet of Consequence – Reloaded (2021). ). His latest book is on ecotourism – Wild Quests: Journeys into Ecotourism and the Future for Animals (2024). This is a revised and extended version of an earlier article, Dysfunction, debt, drag on efficiency, European decline, published at New Indian Express.

European Renaissance?

Since the Trump ascension, European stock markets have outpaced US stocks for the first time in a quarter of a century. Assuming that stock prices actually mean something, the implication is that an European economic renaissance is imminent. It is a mirage.

Fast money is moving in an overdue rebalancing into European, Chinese and emerging markets At peak, the US constituted over 60 percent of global equity indices well above its share of global GDP of around 26 percent (by nominal GDP) and 16 percent (adjusted for purchasing power). Concentration is exacerbated by 26 stocks accounting for half the entire value of the S&P 500 index and the domination of technology stocks. ‘FAANGs’ morphed into the ‘Magnificent 7’ and narrowed into a single stock NVIDIA, on which investors globally have unwittingly bet their life savings and retirement funds.

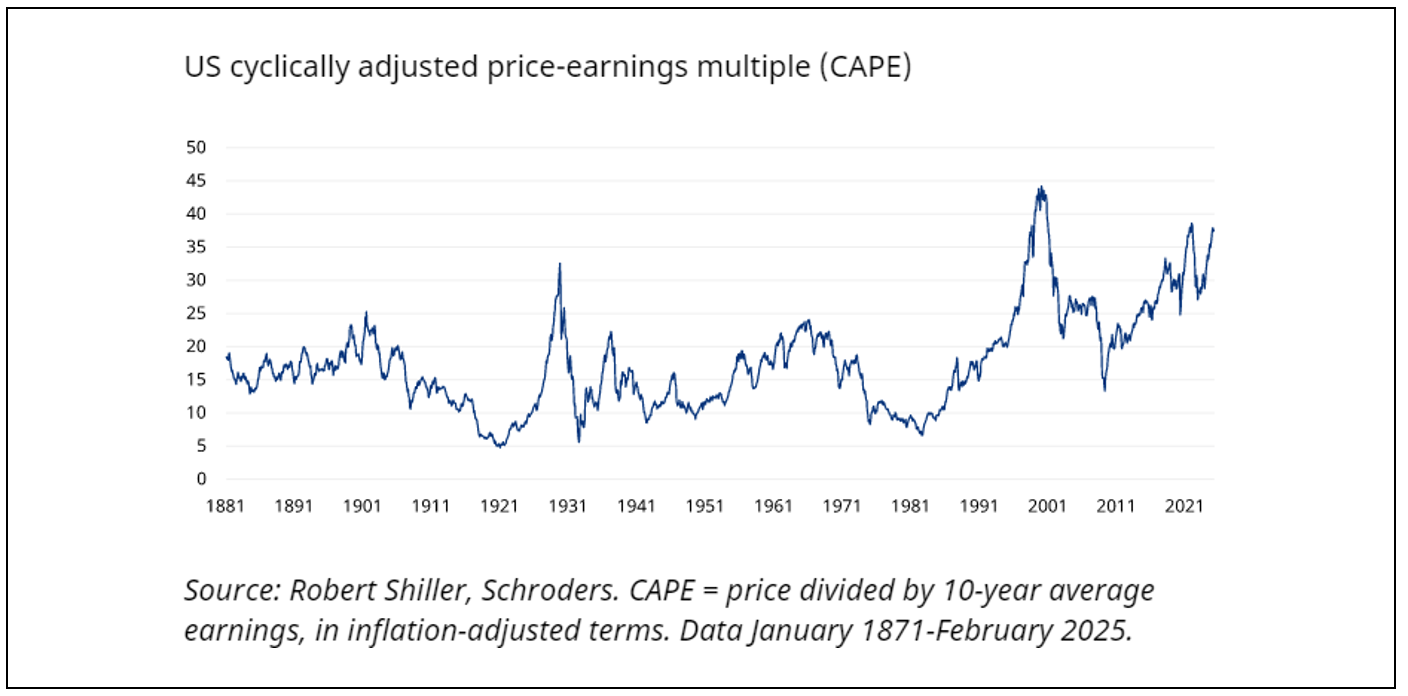

Other markets now simply offer better value. There is concern about uncomfortably high US valuations (close to their most expensive in the past 143 years). Assumed superior US economic growth was never much more than the result of high government spending under the 2022 Inflation Reduction Act and the CHIPS and Science Act which resulted in unsustainable budget deficits of 6 per cent and rising debt. China’s Deep Seek’s low cost AI models raised uncomfortable questions about America’s technological advantage. As US technology stock prices have fallen, Goldman Sachs lowered its S&P targets. The underperformance of the ‘Magnificent’ US mega-cap tech stocks led the investment bank to dub them the ‘Maleficent 7’.

The Bazooka

The only real economy development has been the hasty announcement of spending plans on defence and infrastructure. ‘Pathetic Europeans’ (to use the description favoured by the US Administration) have realised continued US security support is not a given. Having worked themselves into a frenzy over the invading Russian hordes without substantive evidence of the threat, Eurocrats have been forced to act or, to be more accurate, make announcements.

Facing a choice between increasing their own spending on security and paying the US protection money, they have agreed a €800 billion ($860 billion) plan to increase European defence spending. It includes a €150 billion loan scheme secured against unused funds in the European Union (EU) budget and a loosening of EU’s fiscal rules to unlock €650 billion in new spending. The basis of the calculation of the amount is not clear.

In parallel, Germany, under future Chancellor Merz who has transformed from a ‘fiscal hawk’ into a plain raptor, will exclude defence spending from the calculation of the debt brake (which limits annual deficits to 0.35 percent of GDP). As part of negotiations to gain the Green’s support for the constitutional amendment, Merz promised a €500 billion fund for infrastructure and climate transition over the next 12 years.

Markets are giddy at the prospect of European reflation but there are reasons for caution. It is unclear if governments will make use of the scheme or the full financial flexibility afforded. The proposed sum of €650 billion will be over several years and compares to member states total defence spending of €324 billion in 2024. The US spends around €780 billion annually. How the spending will be financed remains unknown with German resistance ruling out common debt at least for the moment.

To ensure self-sufficiency and independence from the ‘dastardly’ US, the EU will exclude American, British and Turkish suppliers from weapons procurement. But European defence industries remain capacity constrained and fragmented along national lines. Given that the US currently supplies between 50 and 60 percent of European weaponry, there is a high risk that the funds won’t be deployed or leak outside Europe.

As usual in Europe, there is no strategy or details. Each member wants to maximise their own benefit. The French and Germans believe that these funds will benefit their manufacturers. VW which struggles to make cars competitively may convert its plants to produce tanks- a new version of guns versus butter. There is the vexed issue of nuclear weapons which only France amongst EU members possesses. Even the perception of risk is different based on the distance from the Russian border. The European Commission will see the plan as way to increase its powers. Traditional conflicts of European integration will surface over procurement and financing.

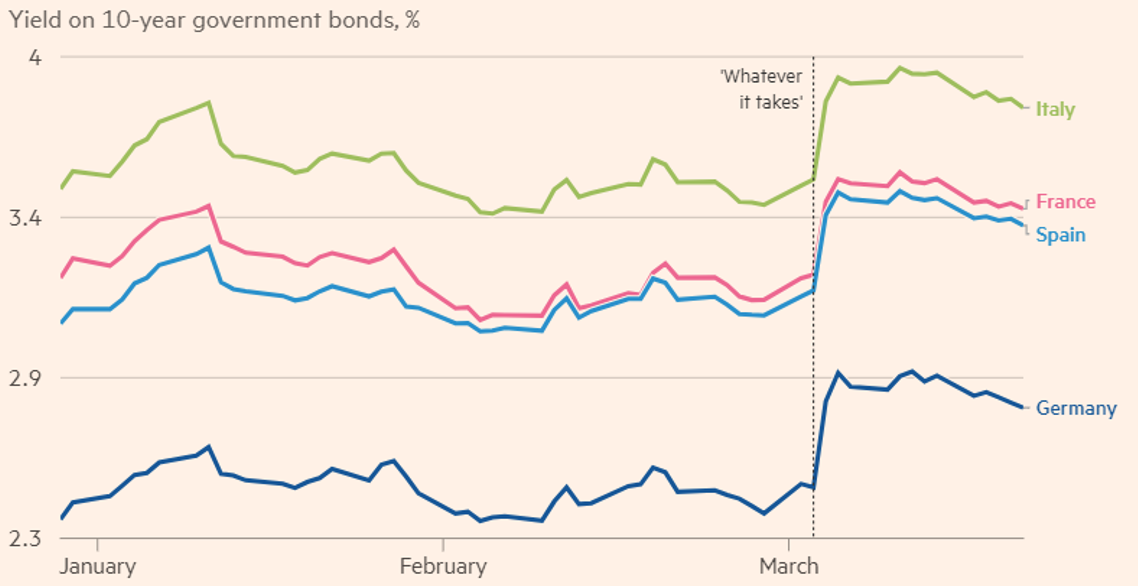

The only point of consensus was that a big announcement that Europe will do “whatever it takes” was necessary. All else will follow.

The Sad Truth

In any case, these measures even in implemented will not change Europe’s fundamental trajectory.

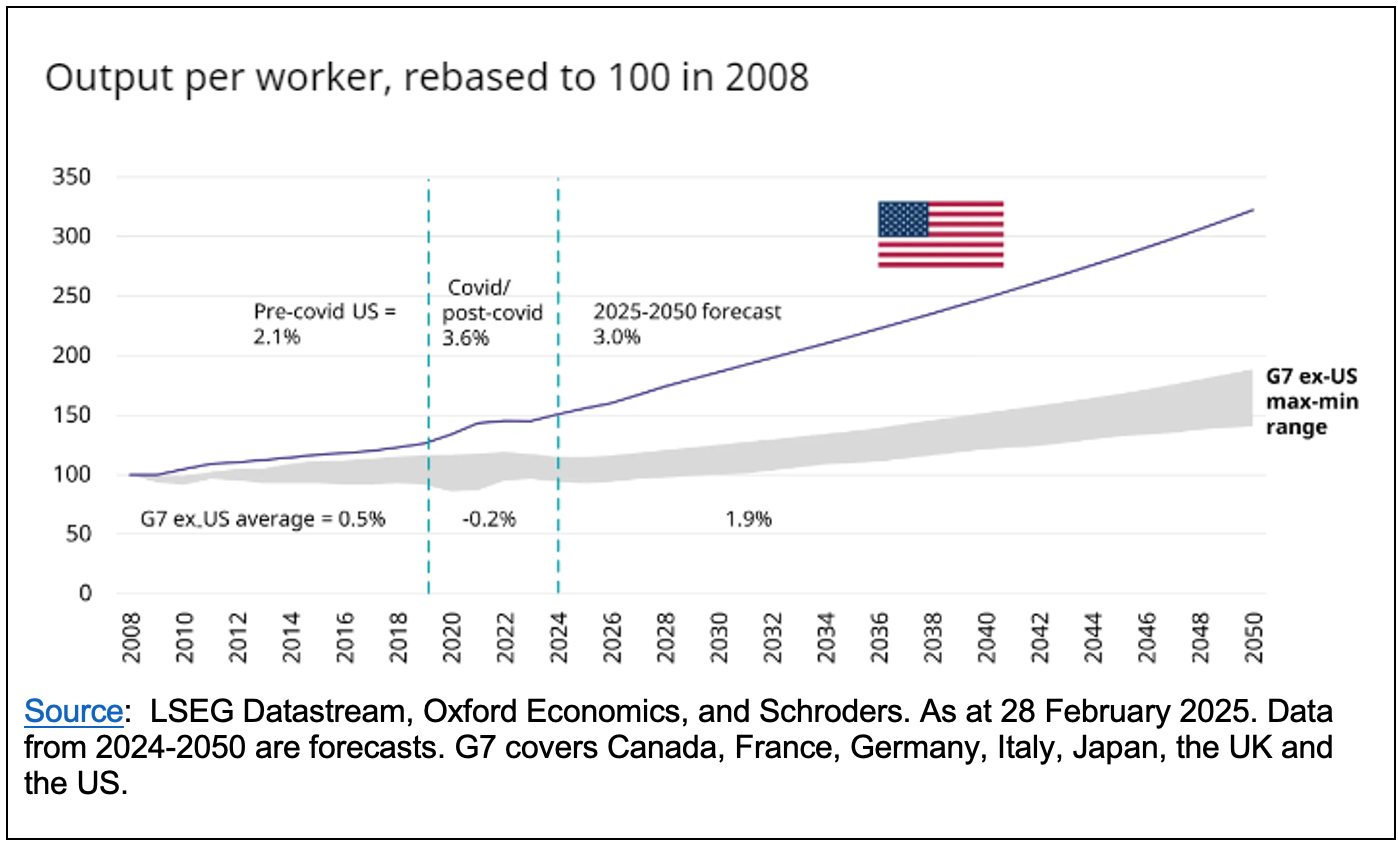

European growth is lack lustre. Between 2010 and 2023, European GDP grew cumulatively by 21 percent, compared to America’s 34 percent. Current forecasts project medium term annual real growth of around 1-1.5 percent. Causes include low investment in infrastructure, new technologies and research and development and poor productivity improvements. Weak consumption and high saving rates reflect low consumer confidence.

US productivity currently outstrips the rest of the world. American demographics are more favourable with the working age population forecast to increase, in part through immigration, supporting economic growth. US businesses are more profitable and growing faster. Even with the likely reversals due to the Trump administration’s regressive trade and immigration policies, it is difficult to see Europe economically outperforming the US.

Source: LSEG Datastream, Oxford Economics, and Schroders. As at 28 February 2025. Data from 2024-2050 are forecasts. G7 covers Canada, France, Germany, Italy, Japan, the UK and the US.

Europe’s current economic model is unworkable. Post-war success was based on rebuilding shattered economies, the generous Marshall plan, low labour costs and a strong technical and manufacturing base. The common market reinforced by the single currency since 1999 facilitated trade amongst members. The expansion of the EU and the reunification of Germany created new pools of cheap labour and new markets. More recently, China provided new markets for automobiles, machinery and industrial technologies underpinning growth.

The position is now different. Dependence on exports to compensate for anaemic domestic consumption and associated mercantilist policies create problems.

Intra-European trade relies on recycling of German savings and trade surpluses to net importing Mediterranean and Eastern European nations to finance purchases of Germany’s exports. The substantial internal financial imbalances were exacerbated by the European Central Bank (ECB) bailouts of crisis-afflicted Greece, Cyprus, Italy, Portugal, Spain and Ireland in 2012. Germany is now owed over Euro 1 trillion (around 22 percent of GDP) mainly by Italy, France, Spain, Portugal and Greece.

In 2024, EU trade with the US showed a €198 billion trade surplus partially offset by a services deficit of billion.Proposed US tariffs, especially on automobiles, medicines and pharmaceuticals, will be damaging. There is significant reliance on China, which is the EU’s third largest export market and the largest source of imports. Europe now runs trade deficits with China (€305 billion in 2024). Having moved up the value chain, the Middle Kingdom is a potent competitor with significantly lower cost in semiconductors, white goods, consumer electronics and automotive. The ongoing trade conflict over electric vehicles evidences these tensions.

Several factors underlie Europe’s lack of competitiveness. Energy costs have increased by 30-40 percent with the replacement of Russian gas imports via pipelines with more expensive shipped US and Gulf LNG. It has replaced one geostrategic dependency with another.

Declines in the working age population and increasing resistance to immigration to supplement the workforce places pressure on labour markets. Non-wage items, such as social, unemployment and medical insurance, adds up to 40 percent to labour costs. Europe’s unfunded overgenerous welfare state, including relatively early retirement and generous pensions, is unsustainable and seemingly unreformable. France has struggled to make modest changes to its pension arrangements.

Despite decades of talk, integration of its capital markets remains incomplete.

Over-zealous, complex overlapping regulations are a drag on efficiency. Brussels’ intervention adheres to the principle of all extraneous bureaucracies – self perpetuation and mission creep.

Debt Debt Everywhere

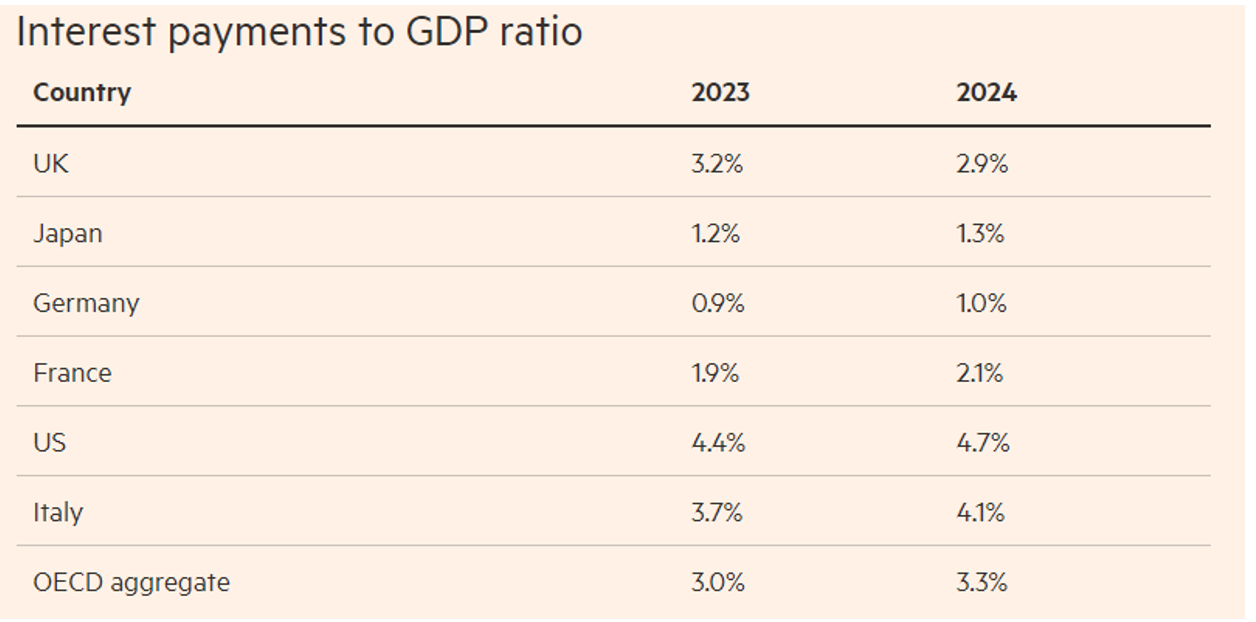

The EU’s government gross debt is near 88 percent of GDP. The highest debt levels are Greece (164 percent), Italy (137 percent), France (112 percent), Belgium (108 percent), Spain (105 percent), and Portugal (101 percent). Germany’s debt to GDP is a more modest 62 percent but likely to rise under its new spending plans. In addition, like some other member states, it has substantial unfunded pension liabilities (estimated at anywhere between 31 and 58 percent of GDP). Adding the most probably unrecoverable amounts owed by other EU members, Germany’s debt position looks less comfortable. The EU’s own separate debt is expected to reach €900 billion by the end of 2026 to fund coronavirus recovery programmes and support for Ukraine. Debt services costs are steadily rising and now constitute an increasing portion of GDP and government revenues despite relatively modest Euro interest rates.

Source: Financial Times based on OECD Data.

The EU plan for increased spending resulted in a sharp rise in European interest rates. Benchmark 10-year Bund yield rose about 0.25 percent, the most in decades. Quickly rationalised by apologists as being the result of optimism about growth and not debt concerns, it will nonetheless place increasing pressure on borrowers.

The debt problems are steadily moving from the periphery (smaller states) to the EU core (Germany, France, Italy). They will become problematic, especially if markets lose confidence and interest costs rise. France’s debt costs recently exceeded that of Greece! There is no plan to restore public finances which will deteriorate if the spending proposals are implemented. A new European debt crisis is a non-trivial risk.

Source: Financial Times based on LSEG Data.

The structural flaws of the Euro remain unaddressed. The inability to devalue or set individual monetary policy limits the flexibility of members with different requirements. At the same time, there is no common fiscal policy because of German reluctance to de facto underwrite EU common debt. An incomplete union, a currency without a country and states without a sovereign currency severely restricts policy options.

Geo-strategic Paralysis

In the post World War 2 period, the EU benefitted from modest defence spending using the US umbrella enshrined in NATO to guarantee its security. After 1989 and the collapse of the Soviet Union, it gained from a large peace dividend diverting funds from defence to more productive sectors which is now being unwound.

Changed US foreign policy means that European countries will have to increase defence spending substantially and bear the bulk of the cost of support for Ukraine. The peace dividend is reversing with the onset of a second cold war. Unless the conflict is resolved, the EU’s continued support Ukraine, both in combat and reconstruction, will strain its finances and industrial capacity. An additional constraint will be the need to support large numbers of refugees from Ukraine (estimated at over 6 million at a cost of around €120 billion). Continued instability in the Middle East and Africa will result in a steady flow of displaced people into Europe further pressuring resources. Unlike America, Europe lacks the protection of a “beautiful ocean”.

Political dysfunction means that Europe is incapable of enacting the policies and reforms needed to manage these pressures. France is barely governable with drawn-out dramas over the formation of a government. The righteous deal between the Centre and the Left to deny the Far Right a greater role sets a dangerous precedent and may rebound on major parties at the next election. France President Macron, the self-proclaimed ‘Jupiter’, is now largely an impotent figurehead.

Germany’ main political parties may come to regret their cynical horse-trading to use the existing parliament to change the constitution despite its successor having been elected and due to take office in weeks. Backroom deals to freeze out the AFD, the second most popular party, risk antagonising restive voters. The refusal, subsequently overturned by courts, by members of the German Bundestag to allow elected AFD politicians to join the football side on the grounds that they did not want to “shower with Nazis” was farcical.

The European electorate has fragmented into far right, far left and centrist groupings, often of roughly equal size. Voters, many of whom share pathological dislike of governments and elite politicians and bureaucrats, have shifted support from traditional parties to more extreme populist movements. Central concerns include sovereignty, immigration and border security and disagreements on social issues around diversity and inclusion. Economic disagreements are around costs of living, housing, public finances and expansion or preservation of existing welfare benefits. Even where these populist parties are not part of governments they now dictate the political agenda. Lack of governing majorities means unwieldy and unstable coalitions, with contradictory political positions. Victor tyranny and lack of loser’s consent leads to continuous trench warfare preventing action.

New entrants, primarily small former Eastern European nations, have exacerbated the EU’s problems. Having only joined to secure Brussel’s largesse, their frequently narrow concerns, parochial worldview, paranoias and different relationship to great powers like the US, China and Russia prevent agreement on a considered continental position. At a transnational level, the EU, where decisions require unanimity or consensus, is paralysed by two divides: North-South (a fiscally conservation Northern Europe against a spendthrift Latin group) and East-West (a liberal West matched by a socially conservative East). This means backroom deals, over simplification of complex issues, and inchoate decisions which are presented to an unconvinced public with appropriate platitudes.

Three Chances Saloon

Europe’s only realistic choice involves three steps.

The first is a comprehensive security agreement with Russia. As Prince Otto von Bismarck advised: “The secret of politics? Make a good treaty with Russia.”

European equivocation between prostrate supplication before or defiance of the current US administration suggests that its weak leaders are unsure that Europe can defend itself. In practice, it probably does not have the necessary military capability without America’s uncertain and increasingly costly nuclear shield.

Any agreement will entail withdrawing military assets, most of which is American in any case, from Eastern Europe providing a buffer zone. This was President George Bush and Secretary of State James Baker’s commitment to Mikhail Gorbachev which the West never adhered to.

Europe’s support for Ukraine will have to modulated around practical battlefield verities. It will entail loss of territory and other concessions. President Trump is right in that Ukraine’s position is weak. Claptrap about the rule of laws, which all great powers evoke or ignore according to realpolitik, will not prevent partition. The choice will gradually become one between complete destruction or survival as a rump state.

If reached, the agreement would restore Russian gas supplies and lower European energy costs. It would reduce the planned build-up of defence capabilities and the cost of sustaining Ukraine and war refugees freeing up funding for other purposes

The second requires reaching an equitable trade agreement with China allowing European firms access and controlling unfair dumping of cheap Chinese goods. The large and growing market in China and its appetite for technology and investment presents significant opportunities.

Building strong relationships with Russia and China may help Europe navigate a complex geopolitical landscape and counter potential US trade and geo-political pressure. They may actually prove more reliable long-term future partners than an increasingly isolationist and volatile US who treats allies and agreements with contempt. Europe needs to prioritise its interests over ideological and sentimental concerns.

The third is to direct spending to productive areas to rebuild now-aged infrastructure, accelerate digitalisation, move beyond the middle-technology trap and rethink its dirigiste state. Mario Draghi’s voluminous report on Europe’s lack of competitiveness provides a starting point. There is an unprecedented opportunity to attract talent that would have once drifted to the US to kickstart the process.

The spatially challenged German Foreign Minister Annalena Baerbock thinks that Russian President should execute a 360 degree turn in policy. Europe needs to complete just half such as manoeuvre. But change is unlikely with Europe gormless leaders content with complacent mediocrity and the lack of clear direction. Deep divisions within the EU mean that agreement on the necessary policies is doubtful.

Without change, Europe risks irrelevance. It is already politically extraneous. America’s contemptuous treatment, bypassing its repeatedly on foreign policy on matters material to its future. highlights its marginalisation. No number of meetings, summits and declarations will change that. Its industrial prowess is waning. It is sustained by accumulated but shrinking wealth and legacies. Great powers like China and Russia and rising emerging markets increasingly view it as a curiosity – someone you trade with, a tourist destination filled with the relics of a once vibrant civilisation which you holiday in. Without a clear strategy, Europe risks steady decline punctuated by successive crises.

Recent events do not presage an European revival. It is a mirage which keeps moving away from you as you approach.

© 2025 Satyajit Das All Rights Reserved

This piece is a revised and extended version of an earlier piece Dysfunction, debt, drag on efficiency, European decline published at New Indian Express.

To successfully navigate the present and future as described in this article requires a level of leadership acumen that the EU political elite, in Brussels in particular, demonstrably does not possess. Trump is simply a wild card but dull, incompetent and self-serving political elites have become the standard throughout the collective West. It’s hard to imagine them doing anything that will actually improve the situation. For that, they would have to take the welfare of their publics, rather than just themselves, seriously.

Thank you, Yves.

I would like to highlight these three sentences and add personal context:

“Building strong relationships with Russia and China may help Europe navigate a complex geopolitical landscape and counter potential US trade and geo-political pressure.” CS: That will require an enormous amount of humble pie and personal / professional move from courting the US as a sponsor, employer and money manager. Much of Europe’s elite is invested in the US beyond a coincidence of neoliberal and neocon views. Some of the reaction to Russia, including its military prowess, can only be explained by racism, although Russia embodies views that Europe’s modern elite cares little for. That racism extends beyond Russia. Pre-video calls, it was interesting to take part in calls where attendees who have yet to meet me make certain assumptions from what I talk about and sound like.

“There is an unprecedented opportunity to attract talent that would have once drifted to the US to kickstart the process.” CS: In “hostile environments” (copyright Theresa May) like the UK and even France? Even the Franco-Mauritian elite is giving up on France, a trend that goes back a dozen years. Last year, a thousand French, without local connections, took up permanent residence in Mauritius, an increasing trend. In recent years, the families behind Lucien Barriere (hotels & casinos), Norbert Dentressangle (haulage), Peugeot (automotive) and Rothschild (finance, mining and agriculture) have invested in Mauritius as a bridge between Africa and Asia. Rishi Sunak and his family, too.

“But change is unlikely with Europe gormless leaders content with complacent mediocrity and the lack of clear direction.” CS: Please see above. There’s more to come from that production line, especially in the UK and from the European Parliament.

This reality is seriously depressing.

Talk of democracy has always been merely a figure of speech.

But the complete lack of any alternative to take shape must be the most depressing moment in German history in the last 80 years.

You know exactly what´s gonna happen and you also know nobody will resist it.

Thanks, Colonel Smithers. I think that Das is trying to critique effectively, but on many details, he just plain gets it wrong, which means recalibrating some thinking. Your pulling out sentences and critiquing them helps.

The piece is worth reading for Das’s diagnosis: “Having worked themselves into a frenzy over the invading Russian hordes without substantive evidence of the threat, Eurocrats have been forced to act or, to be more accurate, make announcements.”

This is succinct and insightful.

Yet “spendthrift Latins”? Would that be us PIIGS again? Porca miseria! We just can’t help ourselves.

Too bad that Italian hesitancy about money, reliance on cash, and tendency toward thrift mean that the habits I see in Italy are much more sustaining financially than what I saw in the U S of A, credit-card heaven.

See comment by vao below and my response about the social state.

I agree with your first sentence, however you seem to forget the EU and some US elites are so smitten with exceptionalism of themselves and their nations all the while preaching multiculturism and Woke cultures for the rest of the population. It is like asking a Cat to become and behave like a Dog. Unfortunately these elites have dug their own graves which they dug for Pesky Rooskies. They may try but it is not going to work. Thanks

Excellent piece.

I just wonder about how much the increase in US output per worker comes from deficit spending? Since 2018, the US has pumped about $16 trillion into their economy through deficit spending. That surely increases GDP and productivity from what it would be without the deficit spending, leading to wondering what the statistics would look like without the massive influxes.

The composition of US GDP (almost never discussed) does not inspire confidence — much of it is economic rents, which by definition are unproductive

GDP has no distribution vectors so whats the point, could be hollowing out the nation, accruing in the top and everyone applauds …. ???? … same goes – for as you note – productivity via over financialization [see rents] again to the top.

Some have opined here on NC back in the day that Capital leased out some of its wealth via the commie/socialist scare, once neoliberalism became dominate, have been taking it back. I fully expect the unwashed in the US to get the same treatment as they are experiencing in the EU soon.

“Between 2010 and 2023, European GDP grew cumulatively by 21 percent, compared to America’s 34 percent.”Really, Satyjait, I know that you are only doing standard macro, but this kind of analysis is increasingly meaningless…in fact its been meaningless for years. Why don’t you use the Gini Coefficient. From what I can see all this “economic growth” in the US has been channeled to the upper echelons. Europe still has a better Gini than the US. Good thing that they have had the debt-brake, otherwise the Euro elites would have stolen even more money…all in the good name of “economic growth.”

There is also this:

“Europe’s unfunded overgenerous welfare state, including relatively early retirement and generous pensions, is unsustainable and seemingly unreformable.”

First of all, there is no “Europe’s welfare state”; each country has its own system, and as far as I know, social security, pensions, etc, are not even in the realm of competences of the EU.

Second, he should have a look at what the “overgenerous welfare state” concretely means in countries such as, say, Greece, Portugal, or Romania.

And then he should consider how that “seemingly unreformable” welfare state has evolved in the last couple of decades, say in Germany, the UK, or Sweden. Does “Hartz IV” ring a bell? And finally he should look at what the plans are for that welfare state in various European countries. Hint: dismantlement.

vao: Thanks for this. As I mention above in response to Colonel Smithers, the piece by Das does try to analyze the situation in Europe, but some prejudices slip through and I recommend that Das do some recalibration of thinking.

I just check: Italy’s retirement age is 67. So much for the overly generous retirements and social state.

Italy hasn’t gone as far as northern Europe in outright wrecking the social state — although France seems to have retained its wonderful health-care system — but your last paragraph truly should be read in contrast to the article for the sake of balance.

In Greece, where I live, the median pension is ~750 euros. Pensions in Germany are at ~1500 euros. In Germany, people with low pensions receive social help that in Greece is lacking or is rudimentary. So I can’t agree with the comparison, where the South has a generous welfare state as opposed to the North.

This quote:

Interesting conclusion, another possible conclusion is that it indicates low confidence in social safety nets. For some reason people are expecting cuts in social safety nets.

Why would people ever think that? Is that because the cuts have been happening for years, are still happening now and politicians are saying they will cut them more in the future?

This quote:

That seems to indicate that by removing public insurance deducted at source by payroll then that kind of insurance will not need to be paid by anyone?

Or is it indicating that private insurance paid by individuals is better? People who look at the healthcare costs driven by private healthcare in the US and might come to different conclusion.

Then this quote:

Why care? Is the cost/benefit of having influence in/over other continents always a net positive? Who in Europe cares about Europe losing influence in/over other continents?

And this quote:

I thought Russia and China were doomed due to poor demographics?

I thought people living in the ’emerging markets’ have so little confidence in that their home-countries would ever overtake Europe that they are willing to risk life and limb to get into (the supposedly declining) Europe?

Or is it maybe only the ‘curiosity’ view of the wealthy in China and Russia and emerging markets?

““Europe’s unfunded overgenerous welfare state, including relatively early retirement and generous pensions, is unsustainable and seemingly unreformable.”

That one sentence immediately told me where the author’s viewpoint was anchored, colouring every other releflection, statement and conclusion, vis: the population must meet and serve the requirements of the economy, rather than the economy serving the needs of the people.

To DJG’s comment above.

Umm, is there a misunderstanding about “spendthrift”? It means to spend money carelessly, without regard to the future.

I know, I know, weird. It is one of those words whose real meaning is opposite of its appearance.