Yves here. The highly kinetic conduct of the Trump Administration, despite dominating news coverage, is unlikely to divert the attention of most Americans to day to day household budget realities. Inflation has still not been tamed. Consumers face the visible sign of ever-levitating egg prices along with pressure in many other expenditure categories, even with energy prices not presently being a big contributor. Tariffs are set to make matters worse. On top of that, we have Musk Federal employment and program whackage directly damaging many, plus creating broader anxieties.

Below, Tom Ferguson and Sevaas Storm describe a big and not sufficiently acknowledged driver: strong spending at the very top of the income distribution. The well off party on as most of the rest feel the wallet squeeze.

By Thomas Ferguson, Research Director, Professor Emeritus, University of Massachusetts, Boston, and Servaas StormSenior Lecturer of Economics, Delft University of Technology. Originally published at the Institute for New Economic Thinking website

Here we are again.

First the IMF, then the Fed belatedly tiptoed to the conclusion that we reached almost two years ago: that the bubbling consumer demand that has sustained US inflation in the face of Fed interest rate hikes is driven principally by the spending of affluent Americans whose wealth has soared thanks to the Fed’s doubling down on quantitative easing during the pandemic. Due to surging house prices and stock market prices, the net worth of the wealthiest 10% of US households has increased by more than 50% in nominal terms, or $36.3 trillion, during the first quarter of 2020 and the third quarter of 2024. This, in turn, has unleashed a powerful wealth effect on consumer spending, as we have repeatedly pointed out (Ferguson and Storm 2023; Ferguson and Storm 2024a; Ferguson and Storm 2024b).

Now comes Moody’s Analytics with more of the same. A Wall Street Journal article interviews that institution’s chief economist, Mark Zandi, and cites data and charts from the institution in support of the claim that “Many Americans are pinching pennies, exhausted by high prices and stubborn inflation.”

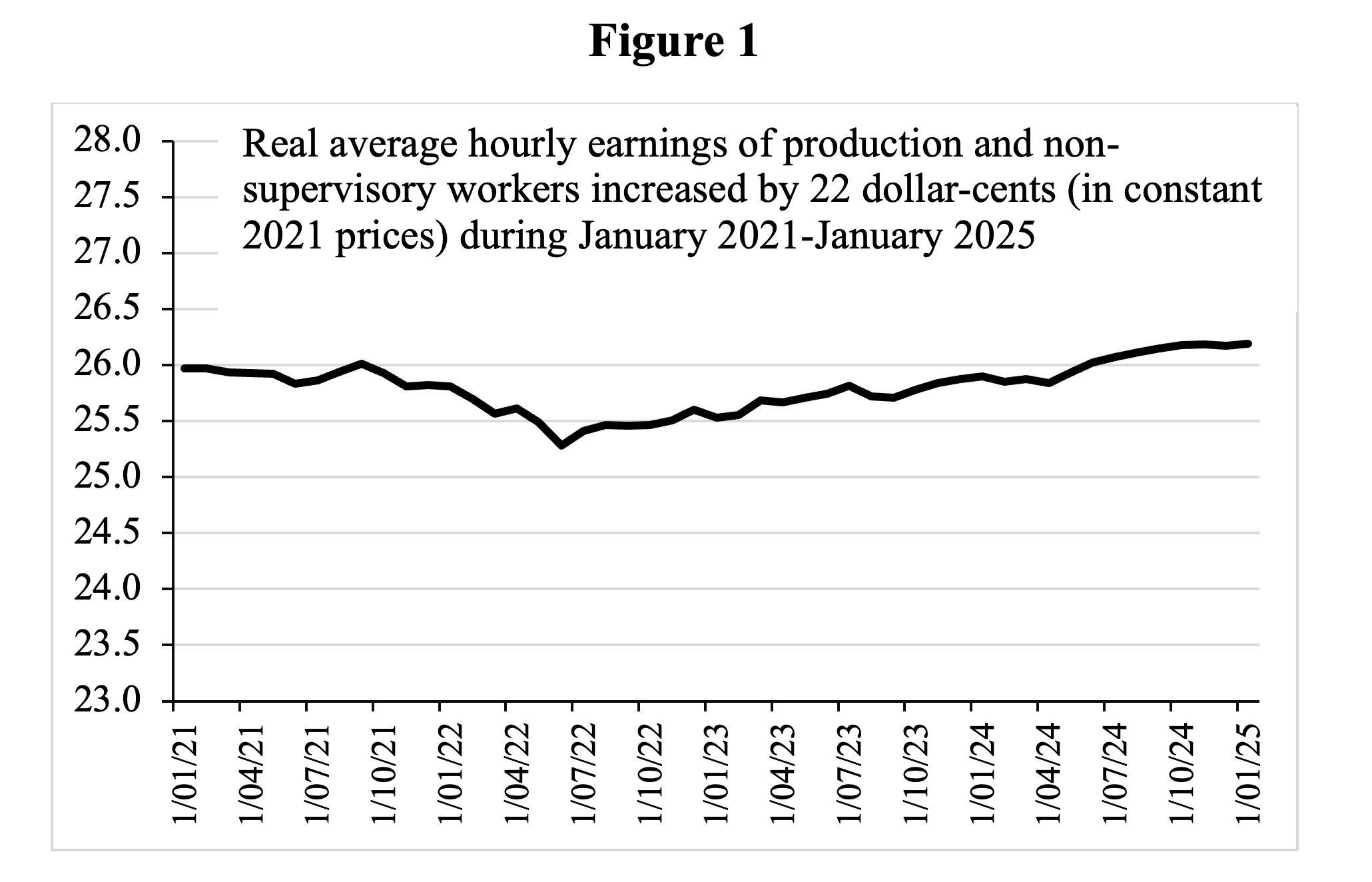

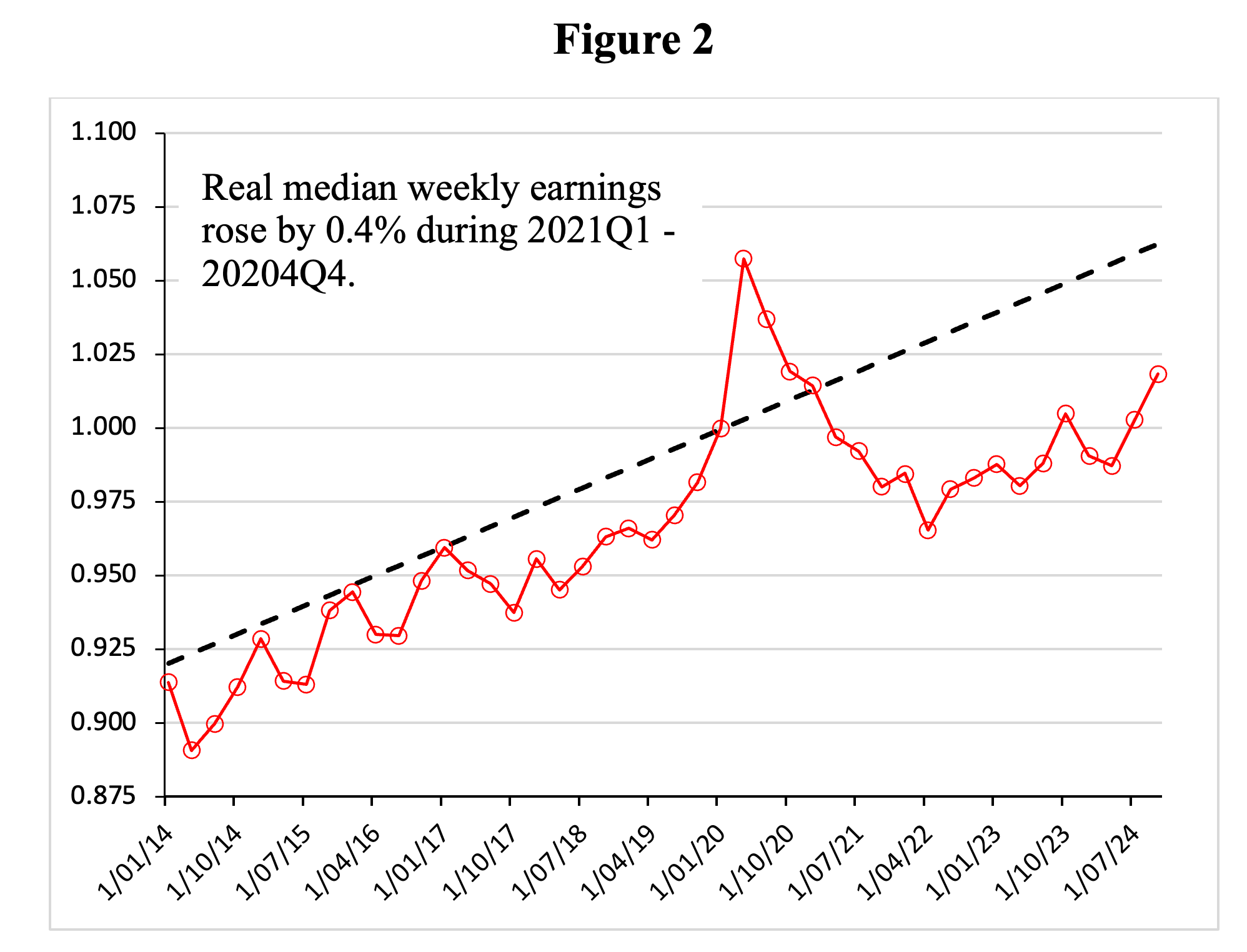

This is underscored by Figure 1, which plots the monthly change in real hourly earnings of American production and non-supervisory employees during January 2021 to January 2025. Higher prices did eat up almost all of the nominal pay raises of American workers, whose real hourly earnings rose by a pitiful 22 dollar-cents during these four years. Similarly, real median weekly earnings of American workers hardly increased during 2021Q4-2024Q4 (see Figure 2), even as prominent economic commentators trumpeted claims that the US labor market was extremely tight. The clamor about the looming threat of an imaginary wage-price spiral (Ferguson and Storm 2024a) diverted attention from the real action: astonishing increases in home values, the stock market, and the net wealth of the top 10%. Between January 2021 and December 2024, the S&P CoreLogic Case-Shiller U.S. National Home Price Index rose by almost 17% (in real terms), while the S&P Stock Market Index increased by a whopping 31% (also adjusted for inflation). In contrast, real weekly earnings of American workers grew by a grand total of just 0.4% during this period.

In America’s ever deepening dual economy, most citizens struggle to afford more than the basics and feel exhausted by the persisting financial stress. But, as the WSJ writes, “the well-off are spending with abandon. The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate, and other assets. Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%.”

A separate Moody’s Analytics report that Zandi himself issued at virtually the same moment echoes the importance of the wealth effect in explaining the strength of consumer demand and economic growth but cites statistics on spending by the top 20% of the income quintile instead. We have minor reservations about details of both sets of estimates. But none of our reservations add up to anything material. The latest data in the longer Moody’s piece extend to the same period as our last investigation. While neither Moody’s nor the Wall Street Journal ever directly make the crucial final conclusion, the linkage is clear: Yes, consumer demand by America’s most affluent citizens is indeed driving consumer spending, and consumer spending, in turn, is the main force keeping inflation so high.

The CPI inflation jumped in January 2025 — rising by 3% during the 12 months that ended in January and drifting away from the Federal Reserve’s inflation target of 2%. The Fed finds itself in a fix. On the one hand, it cannot lower the interest rate (as President Trump would like it to do), because the wealth bonanza enjoyed by the richest 10% is still fueling spending and inflation, while the majority of Americans have a hard time scraping by. It is perhaps oddly appropriate that a regime so intertwined with unelected billionaires is kept afloat by the spending of the super-affluent.

On the other hand, monetary tightening or any other shock that leads to a stock market selloff or decline in home values would rattle the confidence of the top 10%, cause them to cut back spending and hurt the economy. This may bring down inflation, but the collateral damage would be substantial.

The implication is that the Trump administration has a tiger by the tail. Waiving some qualifications, since after all, unilateral tariffs by the US would be one offs, unless they lead to escalating tariff wars, it is easy to understand why fears of still higher inflation are so pervasive. The Moody’s data provide further confirmation that wealth-price inflation, not any phantom wage-price spiral, is a powerful force running in the background as the administration sorts out its policies on tariffs and other issues.

‘the well-off are spending with abandon. The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate, and other assets. Those consumers now account for 49.7% of all spending’

And this is exactly why Biden and the Democrats never saw the red wave coming to hit them – everybody they knew, including their consultants, said the economy was going great which is why Biden said in public the economy is going great. Of course the argument may have been made in private behind closed doors that it was not possible to hit the 10% with extra taxes instead of the bottom 90% to re-balance the economy. If they did, the economy would suffer too much as those rich people would stop spending!

Yah, I’m not sure things were rosy even at the top 10 percent before January 20th. The tech job market has really cooled down and people are coming down from the post-COVID YOLO travel and purchases. Maybe my friends and family in this tier were still spending but they’re not exuberant about it. I did see quite a few people finally break down and buy a house in the last 5 years, after decades of renting. I wonder if that kicked a lot of consumer spending up as they’re buying furnishings and appliances and getting trades people in to help them fix up the house.

Now DOGE is taking aim at a lot of gold plated rice bowls at government contracting and perhaps the finance sector (DOGE taking heavy early strikes at the various financial regulators, who have typically worked hand in glove with large financial institutions, is interesting), is going to be far more economically impactful than the firing of 75 percent of federal workers threatened by Project 2025.

The biggest shocker so far is that DOGE forced the Veterans Administration to cancel a huge number of contracts because they were described as consultant contracts, keeping in mind that basically anytime the US government procures services from the private sector, the word “consultant” gets thrown around to get around the ” inherently governmental function” concern about hiring non-feds to fill in work that federal workers are not staffed to do. Apparently this was done without any prior notice to the contracting officers or government program managers. Norms and decades of carefully crafted regulations and procedures completely out the window.

Ditto forcing the General Services Administration (the federal government body responsible for managing government building leases, a lot of routine building maintenance work, government credit cards, and a lot of routine “commercial” goods and services like monitors and software licenses) to cancel leases on government buildings and selling government owned buildings, again without prior notice to the program managers and contracting officers responsible for the leases – who may sin be unemployed as DOGE asked for a 50 percent cut in head count at GSA). This stuff is pretty much impossible to reverse at a large scale. This is at least one previously very cozy corner of the world where decades are happening every week.

Also apparently most government credit cards used by federal employees to travel and pay for small dollar purchases has been reset to a limit of $1.

Anti-DEI means the deference that American government contracting has given to “small” businesses for almost a century, is getting smashed to bits and preparing the ground for those with deeper pockets to come in. A lot of the dwellers of very nice houses in DMV (DC/Maryland/Virginia) suburbs must be laying awake at night wondering when their number is going to be up.

It’s going to be an interesting couple years, possibly decades, possibly forever, for some people who were at the top of the current American economic pyramid.

Luxury spending slowed in 2024:

https://www.fashiondive.com/news/bain-luxury-spending-flat-worst-2024/733451/

https://www.mckinsey.com/industries/retail/our-insights/state-of-luxury

https://institute.bankofamerica.com/economic-insights/luxury-spending.html

If consumers are feeling the squeeze, then where is the crisis?

https://wolfstreet.com/2025/02/19/our-drunken-sailors-and-their-credit-cards-delinquencies-balances-burden-and-available-credit-in-q4-2024/

https://wolfstreet.com/2025/02/18/auto-debts-auto-loan-to-income-ratio-serious-delinquencies-for-prime-subprime-our-drunken-sailors-and-their-auto-loans-leases/

Muppets only have themselves to blame. As has been well documented by Wolf Street, incomes are outpacing inflation and muppets have been spending like drunken sailors.

https://www.spglobal.com/spdji/en/indices/equity/sp-global-luxury-index/#overview

Luxury stock index has gone nowhere the past year, so no, the rich have not been splurging on luxury handbags.

Thanks for this. Though honestly better than I thought.

I bought a lot of my protein from D’Artagnan (high end online meat seller that sell a lot to mid to upper end of American restaurants but also direct to consumer) and their prices haven’t gone up much after an initial COVID spike. Ditto Costco where a lot of prices actually are going down because of dollar strength.

I definitely haven’t seen it in my upper middle class circles. They’re still spending but it’s on things they perceive as necessities (insanely expensive child care and child enrichment activities, “sanity” vacations, smaller home updates but reluctance for taking on bigger projects). I imagine that Gaza, Ukraine, and saber rattling against China aren’t opening a lot of Muslim, Chinese, or Russian pocketbooks either.

The biggest individual price jump at Costco is for their 24 pack Cup Noodle ramen. I think it used to be $5 in 2019 and now it’s $14. The next biggest might be canned corn and beans, I feel like they doubled in price. The other price creeps were not too visible.

Though somewhat elliptical to the thread of your comments I have noticed Costco’s tendency to lean into selling to high end consumers. Consider the wine packages on offer — for example six bottles of wine for $2000. I guess like Willie Sutton’s fondness for banks, Costco is catering more and more to its high end customers. I have also noticed that fewer Costco sales include items I put into my cart when I shop there, purchases which include items like canned corn and beans.

I know people who had memberships for their wine (and they were serious wine aficionados) and the steaks.

I grew up in California and strongly prefer wine to other alcohol. I buy the Costco wines whenever I can, the Kirkland Brand box wines and I sometimes try some of the blended reds Costco sells at a small subset of their warehouses. I doubt I will ever buy one of the wine packages available from costco.com … and unfortunately they are the only wines available from costco.com. [The only Costco warehouse near me I know of that sells wines is a five-hour drive.] Is wine drinking instead of beer drinking still considered a class marker in this age of boutique beer?

I may have missed the costco.com wine package sales in the past but I do not remember seeing them until recently. I also feel that fewer plain-old food items are available for delivery. The last time I tried to send some food items to my daughter I remember having trouble finding items I thought I saw when I ordered in the past.

Also, out of curiosity — do serious wine aficionados really pay $300 for a single 750 ml bottle of wine? If so, I am seriously out of touch with the amount of money my betters have to spend on things like a bottle of wine. Does $300 per bottle win really taste that much better than a $20 – $30 bottle of wine?

Spending appears to continue in my neighborhood. New Teslas including a Cybertruck on my street. Also seeing a lot of home improvement work, a mix of people preparing for sale (the RE market has boomed here after the LA fires) and those updating in preparation for retiring in place. Seeing a fair number of restaurant closures however.

They have boosted sales elsewhere:

https://www.cnbc.com/2025/02/19/walmart-earnings-wealthy-shoppers-boost-sales.html/

Drunken sailors paying their co=pays, rent, car insurance and interest on credit cards!

Let the good times roll!!

You do realize that almost 30% of USians have no credit cards? And the bottom half that do are most likely making purchases that reflect the growing inflation-not spending like drunken sailors as the gold bug Wolf is alluding in his regularly parroted articles. Shaming those that are just trying to stay afloat is a bad look.

I see Wolf as more of a chart bug, loves those squiggly lines running akimbo. A numbers man.

Averages hide a multitude of sins.

I keep trying to make that point when I comment over there — Wolf is not interested in hearing it.

I see Wolf as a “Quant”. He loves statistics, and is really good at quantitative analysis.

But I think Gary Stevenson is way better at explaining our asset economy and putting what it means into perspective. Economics used to be called “political-economy” for a reason.

Michael Hudson has an interesting perspective too.

The premise of the article is “The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate, and other assets.” . I’ve included links that show that luxury spending has moved pretty much nowhere i.e. the premise of the article is quite false. Whether 30% of the US population have credit cards or not is besides the point, because the 70% who do are clearly holding up spending and so far the credit card market has not been showing any visible stresses.

I’ve realized that the NC commentariat does have a blind spot when it comes to articles like this. Just take Netflix which is like the epitome of discretionary spending, the company has been increasing subscription prices, but has that resulted in subscriber numbers going down because people simply could not afford it? No, https://www.statista.com/statistics/250937/quarterly-number-of-netflix-streaming-subscribers-in-the-us/. Instead we get comments like “Wolf does not understand averages”, etc, etc. The rich do have way more money than the rest of us, but there’s only 24 hours in a day, so no, it’s physically impossible for even the rich to consume more content than the rest of us.

The government has been spending like drunken sailors (crisis level spending), nominal interest rates are still below real interest rates, consumers likewise are also spending like drunken sailors so you have inflation. It’s as simple as that.

“Walmart is drawing more online sales from higher-income shoppers, as it expands its online assortment, remodels stores and grows its membership program, Walmart+.

Households earning more than $100,000 made up 75% of the company’s market share gains in the fiscal third quarter,…”

More affluent households are increasing their spending at places where the non-affluent shop.

This article clearly says ““The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate, and other assets.”

Also households making $100,000 are higher middle income (“higher income” does not mean high). You want prices to drop, how about doing something like this: https://www.france24.com/en/live-news/20250124-croatians-boycott-shopping-to-protest-high-prices? Supposedly a similar movement was supposed to happen a couple of days ago, https://time.com/7262444/why-consumers-are-planning-economic-blackout-february-28/, so we’ll see if muppets could do anything else but shop. Somehow I doubt it, since we are talking about people who are too happy to punch each other out over a good Black Friday deal.

Americans have always had a spending problem, this is not new, not sure why this is such a big deal.

Late to this. The part of the luxury spending market that fell was among aspirational shoppers (not part of the 10% but who buy a really nice bag or shoes or a scarf to make a statement, which is actually pretty significant in total) and to your point, also some in the 10%. The 1% spent like bandits.

>Eggs & You

It’s the name of a restaurant in Ft Lauderdale on the south bound corner of Federal and 26th. I drove by it last week and thought to myself that I haven’t had an egg in a long time. So back in Central rural PA this week and I decided to buy some eggs, they were $7.95. The shelf was only 40% filled and I wondered if it was the price or availability. It started me wondering about maybe getting a chicken coup, but I realized it wouldn’t work until I retire in a couple of years.

I don’t think the politicians really care or not on what my thoughts are on the price of eggs at the grocery store, they are too busy lining their pockets, most of them, with exceptions I surmise. Will Trump feel the heat? I hope so, it will mark how he will act viz the Fed and what influence he can exert on monetary policy. Maybe the market will self-correct, I’m not buying eggs at this price, I’ll skip breakfast altogether and have a bigger lunch. I need to lose 10 pounds anyway.

Since avian flu is spreading and killing lots of Canadian Geese right now, I wouldn’t recommend establishing your flock at this time unless you keep them very carefully confined.

Costco is selling 18 eggs for $7 and the supplies didn’t look too bad. I do think maybe we’re all being a little overdramatic here. Even if eggs cost $1 each now, a 4 egg omelette is going to cost less than most other protein options and only slightly more than making a tofu scramble (tofu costs about $2.50 a box around me). So I think we can still afford to indulge in a few eggs here and there, for now

So go for it😁

My sister and her husband are pretty much the polar opposite of me in spending, they will splash out serious simoleons on a cruise getting top end digs and fly at least business class if not first class everywhere they go.

They seem to get off on paying more, as crazy as it sounds. I know nobody else like them in terms of hey big spenders! in my life.

The only avenue i’m likely to see the moneyed class is at a ski resort, and i’m only there to ski with my motley crew of golden years ski bums-not buy a couple million $ ski out-ski in chalet on the mountain.

Aside from skis/snowboard and clothing, there isn’t much else you need nor would want, and on account of everybody wearing a helmet these days (in my observations over the years, I’d guess its around 97% helmet wearers on the slopes now) and reflective goggles, everybody looks like Jeff Goldblum after metamorphosis in the remake of The Fly, so much for individuality.

I pretty much buy the same food all the time, and have watched inflation in not just prices, but shrinkflation too. WinCo has these wonderful premade salads which used to be $3.29 on the way to the present $4.99, and you used to get 2 boiled egg halves in each one, but now you’ll get a half, and like it!

My house insurance went up nearly 30% this year over last year’s cost.

It isn’t all bad news, marijuana now costs 1/6th of the price it was at the turn of the century.

Possibly Mosler’s interest rate contribution to inflation by way of bondholder’s interest income.