Yves here. The Trump executive order of March 26, mandating a near-total end of the use of checks by the Treasury Department, including for receipt of tax payments by September 30, has gotten little attention in the flurry of other Trump actions.

This is yet another example of the saying attributed to that great American philosopher, Yogi Berra: “In theory, there is no difference between theory and practice. In practice, there is.”

In theory, it’s a good idea to get rid of checks, at least if you are in the habit of processing a lot of them. There’s an arguable secondary benefit to consumers, since check fraud has allegedly increased in recent years.

However, an article in PMTS describes in gory detail that no way, no how can Treasury achieve this goal by September 30. In fact, given the intractability of the underlying payment processor systems, one wonders how many years it will take for the Feds to realize any net savings from this initiative. $650 million to process checks across all Treasury expenditures and receipts is couch lint.

And this change-over is going to be made more difficult given the DOGE obsession with firing Federal employees.

We’ll later turn to the question of the potential for more costs to consumers for payment processing.

I wish I could embed the 18 minute video from the PMTS site. Its writeup does not fully capture the bemused dismissiveness of Ingo Payments CEO Drew Edward, who has apparently spoken directly to the IRS from time to time about these issues. From PMTS:

As Ingo Payments CEO Drew Edwards pointed out in conversation with Karen Webster recently, the bigger problem runs deeper than the paper check’s stubborn persistence. Edwards contended the real issue is that the treasury simply does not have the digital data required to make instant, accurate electronic payments to millions of Americans by the Sept. 30 mandated end of paper checks….

The executive order’s goal of modernizing the system is hindered by a data deficit. Edwards cited the Internal Revenue Service (IRS) as one of many federal agencies working from outdated frameworks that lean on physical addresses rather than digital identifiers…

Traditionally, Edwards noted, the treasury has either mailed out paper checks or processed direct deposits via Automated Clearing House (ACH) files — both reliant on data the IRS gathers through tax returns. While some taxpayers opt to enter routing and account numbers for direct deposit, large swaths of recipients continue to receive treasury checks by mail. And if the government aims to eliminate checks entirely, it must update everything from how it collects consumer information to how it verifies recipients’ identities.

“The biggest challenge is how do they get contact information from everybody that’s receiving money from the federal government other than that name and address,” Edwards explained. “Then how do you make sure the contact you have is actually the person you think it is?”

Authentication Issues

Even if authorities identify a viable digital payment system, Edwards warned that the next obstacle lies in ensuring secure, authenticated transactions. In other sectors — such as insurance, where Ingo Money works with firms to shift from checks to digital payments — companies often tap into non-public data to confirm an individual’s identity. With government agencies disbursing everything from tax refunds to veterans’ benefits, the verification puzzle becomes even more complex.

Additionally, many Americans neither have established relationships with traditional financial institutions nor keep a standard checking account. Others use digital-first services — PayPal, Cash App, Chime — as their primary “banking” relationship. That lack of uniformity makes a one-size-fits-all approach unworkable. Edwards stressed the government should recognize consumer preferences and extend multiple digital payment options….

But fraud isn’t limited to paper. Transitioning to digital payment rails, especially those promising faster or real-time transfers, poses its own risks, he said. A direct deposit can be instantly final, leaving the government with fewer levers to pull if the payment was made in error or under fraudulent pretenses.

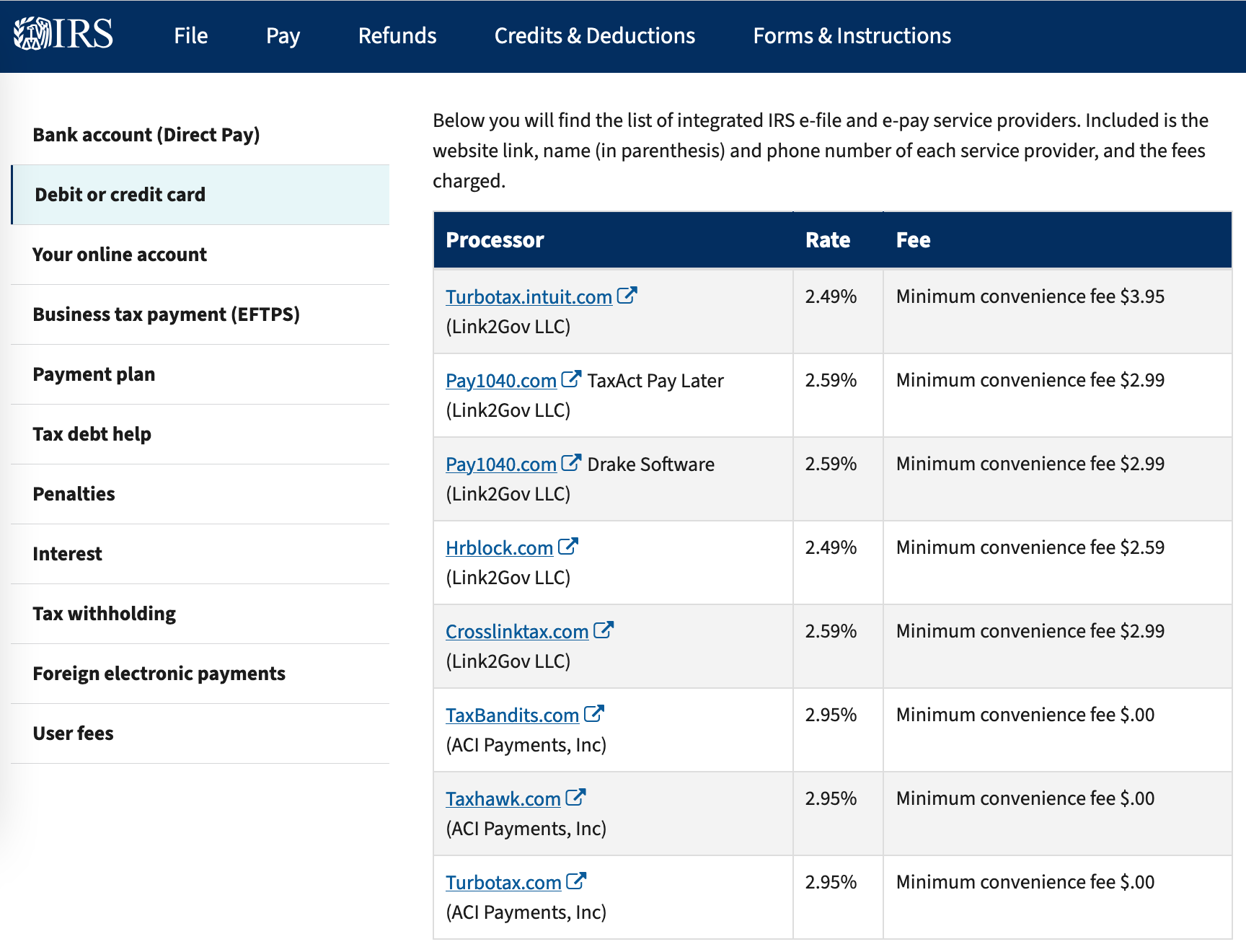

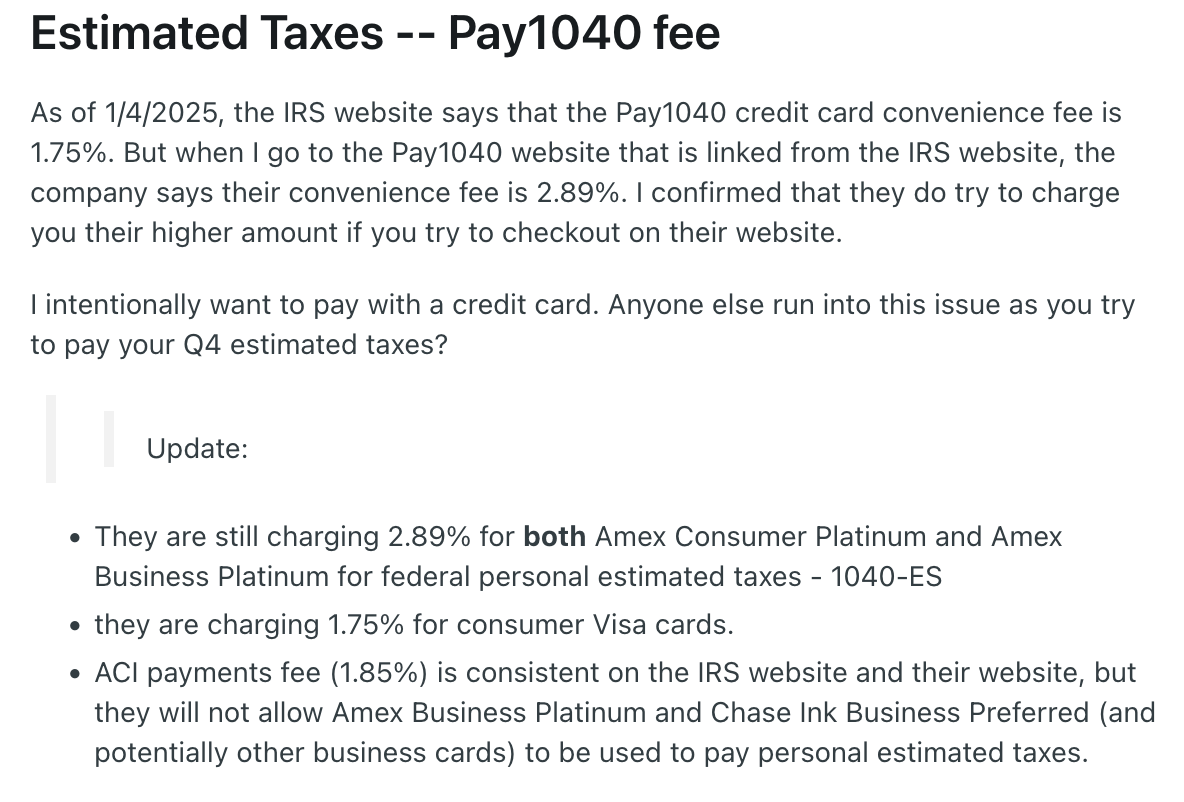

For my corporate tax deposits, the IRS makes what I believe is an ACH debit at no charge to me. This is not the case for retail customers who use debit or credit cards:

A recent complaint on Reddit confirms the “convenience fees” are not chump change:

Needless to say, this will be more of a moving target than Team Trump pretends. Stay tuned.

_________

Text of Executive Order, Modernizing Payments To and From America’s Bank Account. Attentive reader may notice that it includes vague language that could include accepting crypto: “digital wallets and real-time payment systems,” and “other modern electronic payment options.”

Perhaps “digital wallets” stands for PayPal and “real-time payment systems,” “Zelle”. But if “other modern electronic payment options” means crypto, good luck with that. Treasury is going to find it very hard to get rid of checks. Pray tell, how will it value all these crypto, let alone connect to every more idiosyncratic wallet providers?

By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered:

Section 1. Purpose. The continued use of paper-based payments by the Federal Government, including checks and money orders, flowing into and out of the United States General Fund, which might be thought of as America’s bank account, imposes unnecessary costs; delays; and risks of fraud, lost payments, theft, and inefficiencies. Mail theft complaints have increased substantially since the COVID-19 pandemic. Historically, Department of the Treasury checks are 16 times more likely to be reported lost or stolen, returned undeliverable, or altered than an electronic funds transfer (EFT). Maintaining the physical infrastructure and specialized technology for digitizing paper records cost the American taxpayer over $657 million in Fiscal Year 2024 alone.

This order promotes operational efficiency by mandating the transition to electronic payments for all Federal disbursements and receipts by digitizing payments to the extent permissible under applicable law (but not, for avoidance of doubt, to establish a Central Bank Digital Currency).

Sec. 2. Policy. It is the policy of the United States to defend against financial fraud and improper payments, increase efficiency, reduce costs, and enhance the security of Federal payments.

Sec. 3. Phase Out of Paper Check Disbursements and Receipts. (a) Effective September 30, 2025, and to the extent permitted by law, the Secretary of the Treasury shall cease issuing paper checks for all Federal disbursements inclusive of intragovernmental payments, benefits payments, vendor payments, and tax refunds, except as specified in section 4 of this order.

(b) All executive departments and agencies (agencies) shall comply with this directive by transitioning to EFT methods, including direct deposit, prepaid card accounts, and other digital payment options, and take all steps necessary to enroll recipients in EFT payments, except as specified in section 4 of this order.

(c) As soon as practicable, and to the extent permitted by law, all payments made to the Federal Government shall be processed electronically, except as specified in section 4 of this order.

(d) The Secretary of State, the Secretary of the Treasury, the Secretary of Health and Human Services, the Secretary of Education, the Secretary of Veterans Affairs, and the Secretary of Homeland Security shall take appropriate action to eliminate the need for the Department of the Treasury’s physical lockbox services and expedite requirements to receive the payment of Federal receipts, including fees, fines, loans, and taxes, through electronic means except as specified in section 4 of this order.

(e) The Secretary of the Treasury shall support agencies’ transition to digital payment methods, including by providing access through the Department of the Treasury’s centralized payment systems to:

(i) direct deposits;

(ii) debit and credit card payments;

(iii) digital wallets and real-time payment systems; and

(iv) other modern electronic payment options.

Sec. 4. Exceptions and Accommodations for the Phase Out of Paper Check Disbursements and Receipts. (a) The Secretary of the Treasury, shall review and, as appropriate, revise procedures for granting limited exceptions where electronic payment and collection methods are not feasible, including exceptions for:

(i) individuals who do not have access to banking services or electronic payment systems;

(ii) certain emergency payments where electronic disbursement would cause undue hardship, as contemplated in 31 C.F.R. Part 208;

(iii) national security- or law enforcement-related activities where non-EFT transactions are necessary or desirable; and

(iv) other circumstances as determined by the Secretary of the Treasury, as reflected in regulations or other guidance.

(b) Individuals or entities qualifying for an exception under this section or other applicable law shall be provided alternative payment options.

Sec. 5. Implementation and Compliance of Electronic Transactions. (a) The Secretary of the Treasury, in coordination with the heads of agencies, shall develop and implement a comprehensive public awareness campaign to inform Federal payment recipients of the transition to electronic payments, including guidance on accessing and setting up digital payment options.

(b) Agencies shall coordinate with the Department of the Treasury to facilitate a smooth transition to digital payments, ensuring that affected individuals and entities receive adequate support.

(c) The Secretary of the Treasury shall work with financial institutions, consumer groups, and other stakeholders to address financial access for unbanked and underbanked populations.

(d) The Secretary of the Treasury and the heads of agencies shall take all necessary steps to protect classified information and systems, as well as personally identifiable information and tax return information, through the implementation of this order.

Sec. 6. Reporting Requirements. (a) The heads of agencies shall submit a compliance plan to the Director of the Office of Management and Budget within 90 days of the date of this order detailing their strategy for eliminating paper-based transactions.

(b) The Secretary of the Treasury shall submit an implementation report to the President through the Assistant to the President for Economic Policy within 180 days of the date of this order detailing progress on the matters set forth in this order.

Sec. 7. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

Let’s put an end to these scumbuckets who are safely out of reach of overdraft fees and other costs of banking!

From your lips to FEDs ears!

ironically, having every American with a valid SSN being able to open a free bank açcount at the USPS *and* getting any balance automatically sweep into a Vanguard-like 90-day T-bill fund would go a long way in moving into a post-check world.

Heck…one could theoretically do this on the state-level, with branches at the local DMV. Paging Vermont or DC.

not holding my breath obviously.

A great idea!

This is the way to deal with the unbanked and help the USPS fight off the privatizers. Everyone would benefit except those that want to get rid of and privatize the USPS.

The USPS bank could also issue debit cards (not credit cards) and take cash deposits, which would help the banked and unbanked. Withdrawals would only be by debit card.

State banks would be nice too!!!!

Not that the Constitution stands in the way of trump or the banksters, but USPS is the only department specifically required by the founding document.

Stating the bleedin’ obvious, this sounds like a precursor to outright privatization of a major Treasury function.

Private entity receives a list of recipients and a big bag of money, plus a percentage. Problems raised in the article regarding move away from paper become someone’s problem. Now, customer is no longer individual citizen that can complain to their congressman but the USG, that only cares about total cost. Increase in fraud or errors and decrease in efficiency is the only outcome.

Can replacing the IRS with tax farmers be that far away?

(this doesn’t change the overall tenor of the article)…

Individuals can use ACH for free, too. (but that doesn’t negate the usefulness of checks)

And the debit-credit card fees that the IRS charges are essentially “at cost”.

Blame Visa (CA)-Mastercard (NY) and the Democratic senators who help to protect them

Luke 19:1-10 (New International Version)

Zacchaeus the Tax Collector

19 Jesus entered Jericho and was passing through. 2 A man was there by the name of Zacchaeus; he was a chief tax collector and was wealthy. 3 He wanted to see who Jesus was, but because he was short he could not see over the crowd. 4 So he ran ahead and climbed a sycamore-fig tree to see him, since Jesus was coming that way.

5 When Jesus reached the spot, he looked up and said to him, “Zacchaeus, come down immediately. I must stay at your house today.” 6 So he came down at once and welcomed him gladly.

7 All the people saw this and began to mutter, “He has gone to be the guest of a sinner.”

8 But Zacchaeus stood up and said to the Lord, “Look, Lord! Here and now I give half of my possessions to the poor, and if I have cheated anybody out of anything, I will pay back four times the amount.”

9 Jesus said to him, “Today salvation has come to this house, because this man, too, is a son of Abraham. 10 For the Son of Man came to seek and to save the lost.”

The New American Version (in preparation) will leave out the eighth verse.

There is already a New American Bible, used by Roman Catholics. Might also be worth considering the parable that follows in Luke’s Gospel as well.

Many American “Christians” that I know, many of them close family members, think that Jesus whipped prostitutes and tax collectors while dining with money lenders. Pointing out which scripture passages they have backwards only pisses them off (even more than normal).

Maybe the DOGE should take on some costly government programs first, the USA sugar price support program and the alternative fuels ethanol and biomass support programs come to mind.

And save money by ending the Cuban embargo that has been in place for 60+ years. Then shut down Guantanamo.

These actions should be far less disruptive than taking on the USA payments system.

And far fewer people will be affected.

and maybe cutting off Israel as well. Stealing resources from the US public and giving it away to a foreign country to mass murder women and children is not very “productive” nor “patriotic”. Cutting some of the notoriuous fraud and waste in the DoD might be a good idea as well. But that will never happen, of course, the idea is to asset strip and privatize, not to be more “efficient”

Regarding attempts to privatize tax collection, reminds one of tax farming, “Farmers Generale” in pre-revolution France. Entrepreneurs bid for the franchise. They were aggressive keeping big percentages of moneys collected. They had uniformed enforcers and could enter your premises at will and seize your assets. Post revolution the Jacobins did provide many of the farmers, for example, Lavoisier the discoverer of oxygen complementary shaves. Most of DOGE seems to be unproven “couch lint.”.

I always under pay taxes (including Massachusetts when I lived their) and send a check each year with my return. This will be another reason why. Them holding my $$ not a good idea. Someday someone will write an insider book regarding this decision – Trump/Doge mentality may be soon to along the lines “We can just use QuickBooks for the peasantrie’s returns. The budget version. How hard can it be?” You know, easy. Like doing a truce with Ukraine and Russia.

Beware the government you flush down the toilet- it may be hanging on to you during the flush.

When did “withholding” become a “thing”? WWII ? Sounds downright patriotic!

It all started with a 3% tax on tea. Dump the whole income tax and IRS overboard, no need to dress in costumes.

Problem here is, the Tax System is the most efficient social engineering tool the State has. America did it right during the New Deal days. Once a society passes a threshold of complexity, some “oversight” and “guidance” is needed, just to keep the system running. If the New Deal style tax system were still in force, the top tax rates would be much higher, just to equalize the wealth imbalances enough to preserve social harmony. Now, we are heading for Disharmony, an exclusive, upscale outpost of Dystopia LLC.

America is not at the level of the Bonus Army days, yet. Remember that to quell the original Bonus Army march, Hoover called out the Army. Blood flowed in the streets. Right after that, America elected the scion of an Old Wealth family, the Roosevelts. Luckily for America, he was farsighted enough and honest enough to carry out the reforms he had campaigned on. Compare his record with that of any of the last three Presidents. (I’ll give Bush Jr. a pass because he did not pretend to be a reformer.) Even Bush Sr. falls short. Remember “read my lips?”

Anyway, we’re entering Jackpot Enhancement Days. Grab your ankles!

Don’t see how this works. After retirement my Dad moved to New Orleans west bank and opened a small classic auto repair business, sort of as a hobby. Everything done in that area was cash except for government paper check. The local Regions bank branch had a separate line for government check cashing for non-customers that seemed to get plenty of use.

It will work because once they figure out the data and coding, there will be no government payment by check. You want to pay taxes or receive funds, you need to make the required electronic arrangements.

And imagine the extra complexities involved in trying to “Firewall” your financial flows from your other data.

That’s an alarming reference, coming after the latest piece by Nathan Tankus on potential Trump/DOGE attempts to secure control of ACH:

It also answers the ‘why’. If paper payments are disallowed, ACH becomes the only payment mechanism, creating a convenient central point of control and removing the main potential opt-out option.

Accuse me of being cynical, but on the IRS paying people, this seems like an excuse to not pay them and then blame them. On the IRS getting paid this sounds like see how screwed-up things are, even if me made it that way, we need a tech-bro company to fix it for a fee.

Don’t know how the US systems work but up North in Quebec, I receive my monthly federal government Old Age Security in the mail by cheque. Every cheque I receive is accompanied by a request to go digital. I decline because I’m happy to have a postal service that can deliver my cheques and I don’t like everything being digital and subject to system failure and surveillance.

On the other hand I receive my monthly Quebec Pension Plan payments electronically. I don’t think I was given a choice for that one.

All of.this makes the life of the “little guys” harder and more complex. Last year I had to deal with the whole new system for filing W-2’s for my father who has 1-2 caregivers in any year. He pays them directly and files for their withholding etc as part of his 1040. We used to be able to file W-2’s thru a business social security site if you had an Employer Tax ID. Now we have to go thru a personal social security account tied to his Employer account. It took several months and sitting thru 2 hours of on-line help calls to figure out the new system. Don’t get me started on the State of California or State Fund Workers Compensation insurance. This is for currently 1 employee.

Now I’ll have to figure out electronic quarterly deposits since he is retired and has multiple income streams instead of sitting down with my spreadsheet and writing a check with a 1040-ES and just mailing it in.

Everything keeps getting harder to do the correct and legal way…

They really do want to push you into either using “services” which cost money like temp agencies, payroll companies, or tax preparers, or push you into going to “off the books” which gives governments an easy opening to prosecute you if they ever decide you are a problem.

That last bit might be tin hat territory, but given all the stuff we’ve been finding out about, who knows.

Hey Yves, you’ve got some major changes on here. What’s up? Where’s Lamont? I haven’t been on here in quite a while.

I think you mean Lambert Strether, who has gone on to a well-earned retirement. Others have stepped forward to fill some of the considerable void he has left. Be kind.

Noting the “to the extent permissible under law”, I anticipate this executive order will run up against the fact many Americans, especially seniors, don’t do online banking and meanwhile, the government, being a government, is legally obligated to provide services to all citizens including those without digital connectivity.

If it’s anything like Canada it’ll take the form of you can opt-out of paper and/or opt-in to digital and the government encourages everyone to do both, but must also continue to provide paper to those who don’t.

Also, in order to do this the Canadian government needed to set up a secure website where every citizen can log in to check on their tax stuff. For obvious reasons setting up an account is not as easy as just creating a login and coming up with a password, 2FA is involved, and a higher order of encryption, and Canadian banks also provide authentication. Do Americans have the same?

The next EO that Trump will write after this one is an EO to make all Government and Taxpayer payments to be issued in $Trump coin.

Now . . . is that satire? Or prophecy?

Holy mackerel!

I was reviewing the US Treasury’s Daily Statement trying to get a picture of tax inflows from tariffs from a before perspective. While I was reviewing it I came across 2 line items that when viewed together shocked me… (fiscal year to date numbers)… inflows/deposits to the Treasury…

Taxes – Non Withheld Ind/SECA Electronic $164,358M

Taxes – Non Withheld Ind/SECA Other $126,061M

These line items relate to taxes paid by individuals that were not withheld from payroll or collected in advance for other reasons… the money owed after you complete your return if you did not receive a refund.

While I’m not 100% confident I have identified the best/fullest answer, but from what I’ve been able to glean the difference between Electronic and Other is tied to whether you filed your return electronically of via paper where “Other” is primarily paper filed returns. I’d suspect they call it Other because it likely also includes legal judgements regardless of your original type of filing.

While it is technically possible to file on paper and pay electronically via the IRS web portal, I would highly suspect the correlation is that paper filings include a paper check!

At least at the dollar level, the ratio is 1 : .75. That’s a lot of paper checks (or their dollar equivalent) to force to electronic payment in the next 6 months or so! While I do suspect some of those paper returns & checks are very high dollar value, I still think it directionally points to a significant volume of people who are paying their taxes in paper check form (or equivalent such as a money order).