It is perverse but predictable that the media is fixated on the drama of a global equity and risk assets rout, and is less attentive to the likely depth of the coming real economy damage. We will shortly turn to the fact that the freakout of late last week intensified after Treasury Secretary Scott Bessent doubled down on how the Trump Administration was not retreating from its shock and awe tariffs, throwing in the insult to intelligence of trying to depict the US as victim of so-called free trade deals and a liberalized trade regime it had promoted.

The bad substantive part of Bessent’s blather was that even if other countries made trade concessions that the US found acceptable, it would take months (at best) to iron out details. Trump did his version of Nero fiddling by playing golf and posting to Truth Social.

The same way the meal is not the menu, even more so, securities markets are not the economy. But you’d never know that looking at the lead headline at the New York Times:

And as reader spud pointed out in comments, even putative defenders of workers seem to have over time been brainwashed:

gee i wonder if it has anything to do with bill clinton sending americas real wealth offshore so that the stock market could end up being the largest economic bubble in the history of the world, you gotta wonder.

and during trumps first term nancy pelosi stood up in front of america and declared democrats are free traders to their core.

so now a tiny few own more than the rest of us combined, control americas political system, and what do we hear out of the whiners, gee look at all of those losses in the stock market.

“The US would need 5 years of the income from tariffs at this new level to equal the $2 trillion wiped out in today’s stock market loss.

US only has $4.1 trillion in annual imports.”

even jimmy dore and jamie galbraith are whining about stock market losses.

read the comments, it tells the story.

lori wallach,

comments mostly great.

One of the disturbing developments has been central bank obsession, fostered by Alan Greenspan, with stock price levels. That in turn produced the famed Greenspan, and later Bernanke and Yellen puts, the way the Fed would run in to engage in aggressive rate cuts to boost stock prices. The predictability of that behavior reduced the riskiness of stock market investment by truncating the downside, encouraging investors to be more complacent about equity market risk than they ought to be.

On top of that, stock prices have become more and more unmoored from the real economy. We described long form in 2005 (yes, 20 years ago) in the Conference Board Review how public corporations in the US had, on the whole, moved to the unnatural and economically counter-productive behavior of net saving, as in slowly liquidating. A savvy friend remarked around that time, “Why should I invest in a stock when its management isn’t investing in the business?” Yet investors have been conditioned to do just that via stock buybacks and short-termist cost fixation. The end of that road is the wrecking of once great companies like Boeing and Intel.

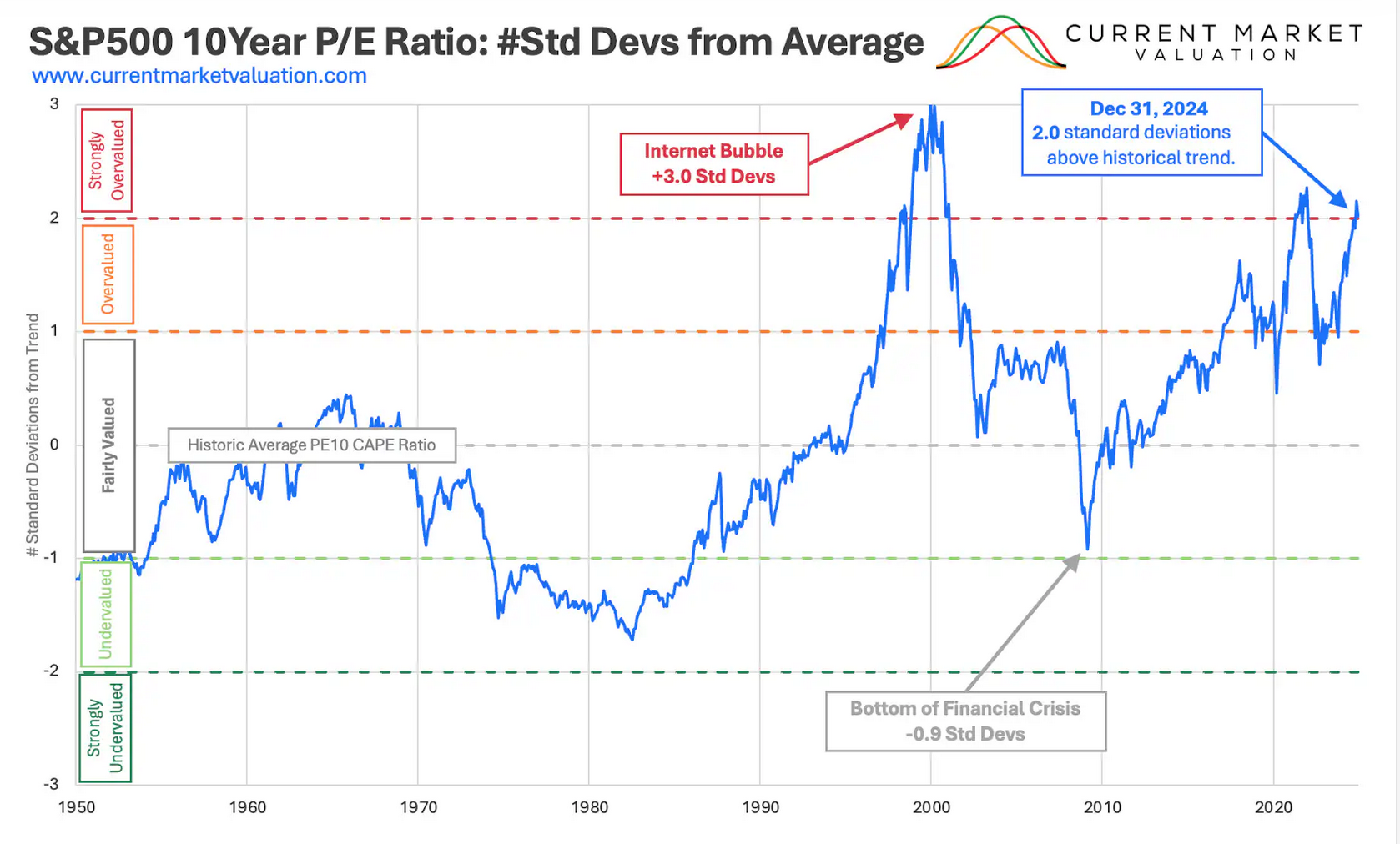

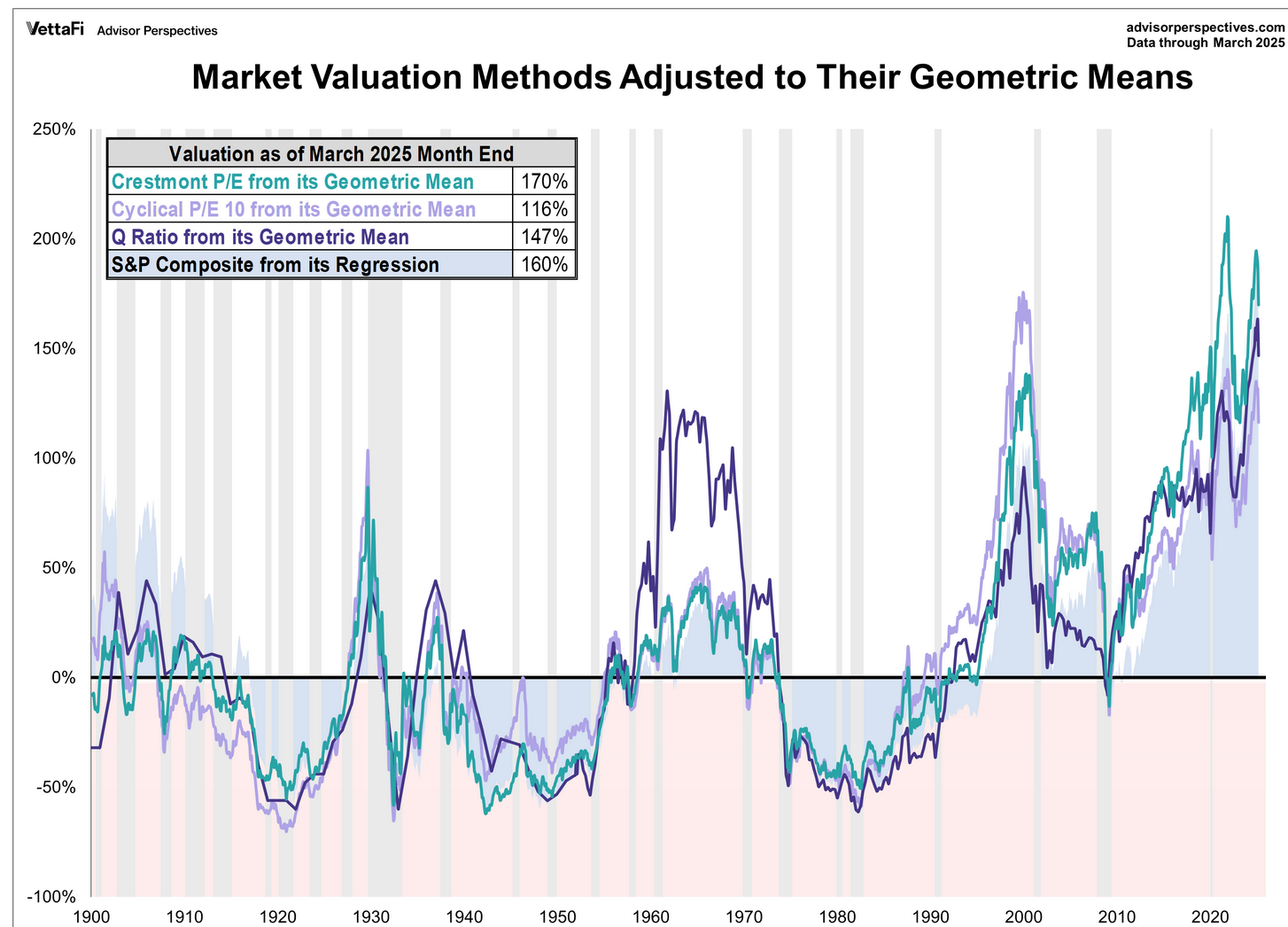

As you can see from the valuation charts below, the Fed getting out of ZIRP did not lead to a major reset, when investors ought to require higher returns from stocks in a higher interest rate regime. See:

GuruFocus (series ends at October 1, 2024; its value in February reached 1.97):

Cison on March 25, argued the market was considerably overvalued:

The Buffett Indicator, which compares the total market value to U.S. GDP, currently sits at 211%. This ratio is calculated by dividing the Total Value of the stock market $62.29 Trillion by the total GDP $29.55 Trillion. This indictor currently sits art approximately 66.99% above the historical trend line, indicating the stock market may be “strongly overvalued” relative to the size of the U.S. economy.

That is not to say that the investments swan dive won’t hurt the Confidence Fairy and so also have real economy effects. But the Fed has been attentive to the wealth effect, and has concluded that it’s about 3 times as large for housing as it is for stocks.

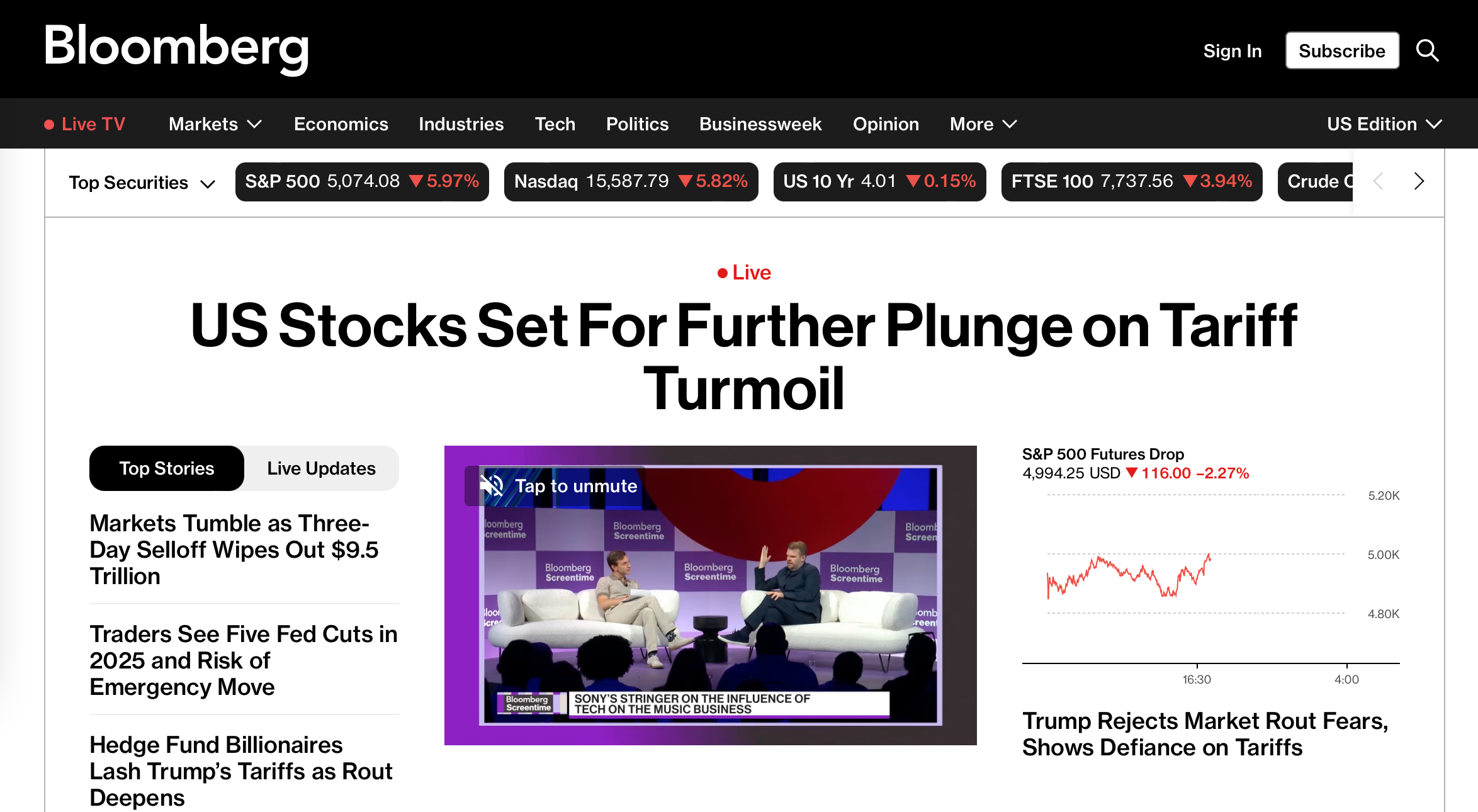

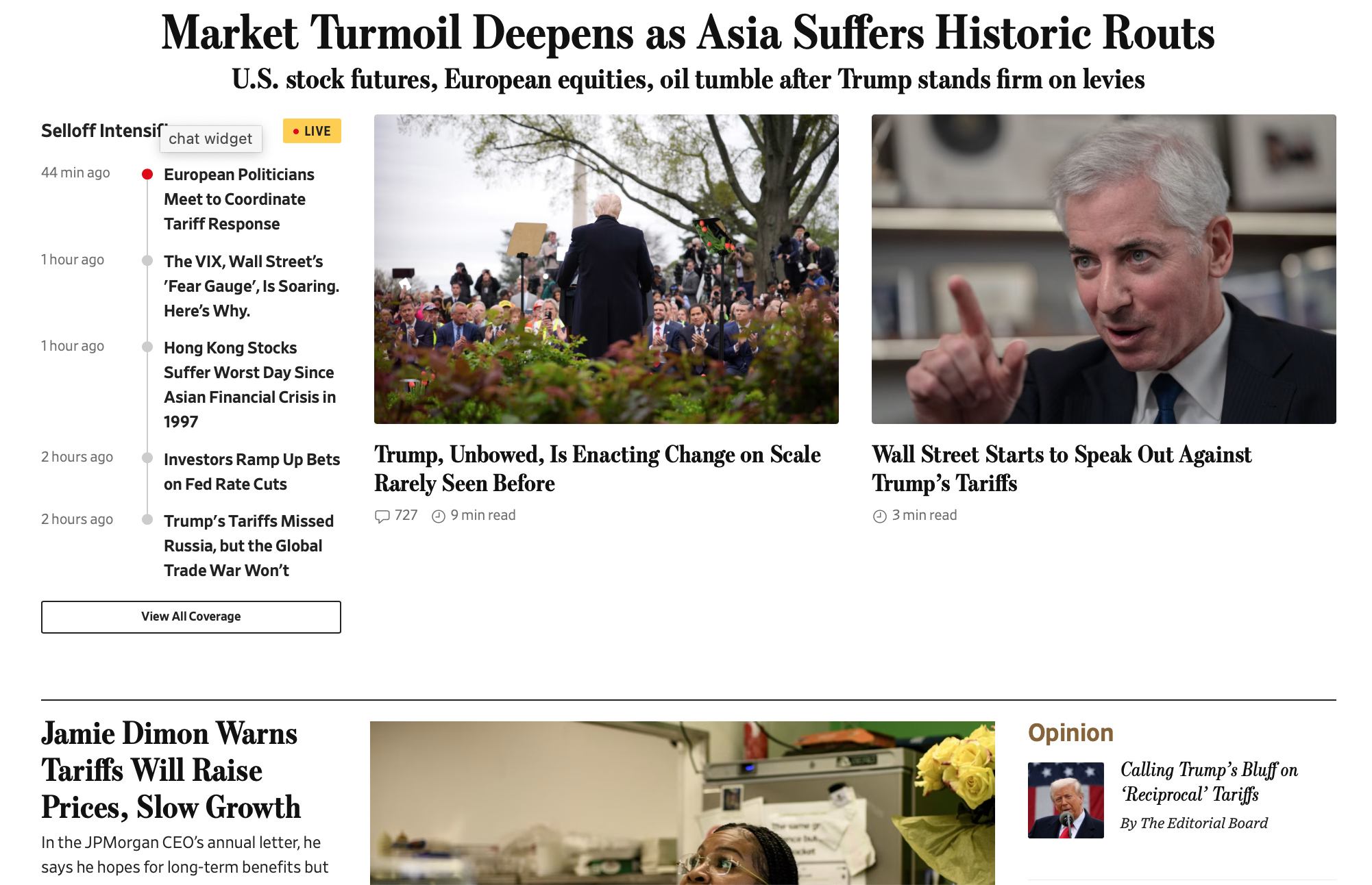

Since a lot more will happen as the US markets open and the business day begins, we thought headlines would give a good snapshot of the current state of play:

FT Alphaville has an excellent chart series on action, or more accurately, heart attacks, in various markets.

This overly dynamic situation is giving cover to the DOGE teardown at Social Security, which will do enormous damage to individuals and the economy. This pillage will directly lead to Russia-in-the-1990s level outcomes, like the elderly begging outside churches as the froze or starved to death. A critically important point is Social Security is well on its way to being wrecked now, even before getting the DOGE plan to finish the job via the pretext of re-doing a perfectly functional massive database and related systems. From the Guardian in Doge’s attack on social security causing ‘complete, utter chaos’, staff says:

Office closures, staffing and service cuts, and policy changes at the Social Security Administration (SSA) have caused “complete, utter chaos” and are threatening to send the agency into a “death spiral”, according to workers at the agency…

“They have these ‘concepts of plans’ that they’re hoping are sticking but in reality, are really hurting American people,” said a longtime SSA employee and military veteran who requested to remain anonymous for fear of retaliation. “No one knows what’s going on. They’re just coming up with ideas at the top of their head.”

The SSA website has crashed several times this month. Wired reported Doge staff want to migrate all social security data and rewrite code in months, which could cause system collapse and further outages.

The agency plans to eliminate the jobs of 7,000 workers at the agency through voluntary buyouts, resignations or firings, though the union representing SSA employees anticipate even more firings beyond cutting staff to 50,000 workers…

“It’s just been a lot of craziness, a lot of foolishness. Until they get rid of Doge and the person in office right now, and the Republicans actually get a backbone and stand up for something for once in their lives, things are just going to be complete chaos. That’s really the best word to describe SSA right now, just complete, utter chaos,” the worker added. “They couldn’t understand the coding, so everything they said SSA was doing illegally, they weren’t. Common sense is something they lack. They don’t know what they’re doing.”

Rich Couture, a spokesman for the American Federation of Government Employees’ Social Security Administration general committee, the union representing roughly 42,000 social security workers, said Doge’s public targets for cuts make no sense.

Why are they cutting 7,000 jobs, asked Couture….

“I don’t think they’re going to stop at 7,000 people lost. If they lose 10,000 or 12,000, they’re running up their high score. They’re able to brag about it.”

Departments at the agency have been closed and reorganized, with workers forced to take reassignments or risk firings, and all workers have been ordered to return to the office five days a week…

“There is no safe office in this country,” added Couture. “It’s a concerted attack on the legitimacy of social security itself. The promise that this country has made to the public with respect to income security is being broken.”…

Couture noted the operating overhead of the agency, as a share of benefits paid out, has shrunk by 20% over the last ten years and is now less than 1%…..claiming the agency is already a model of efficiency and as effective as possible under its fiscal and staffing constraints.

He said he was concerned the situation was creating a “negative feedback loop” where, as more employees leave, more work is put on those remaining, depressing morale and inducing more to leave “until the agency ends up in a death spiral with staffing, inducing office closures”.

We are doing our part in trying to keep the focus on real economy effects, such as with our companion article today on how the Trump tariffs will harm auto industry production and employment and greatly raise costs without producing meaningful US reindustralization.

When Pinochet implemented the Chicago Boys’ radical neoliberal program, Chile at least got an initial asset bubble before the train wreck started. Pinochet not only abandoned most of his reforms but engaged in Keynesian backpedaling and restored union rights.

Even though there’s no evidence of upside here (say unless you were a hedgie or currency trader who got advanced wind of the severity of Trump action), even if Trump were to reverse course quickly, it’s not clear how much of his DOGE and tariff destruction could be unwound. Which no doubt is the point.

I agree wth everything said above and then some. I would also add a too infrequently discussed structural point. The markets of today and those when I worked in asset management are totally different animals. First, they are dominated by passive investors, namely index funds and ETFs. These have become the domain of retail fund investors — including in 401ks. So long as defined contribution flows continue, these funds have to buy something. Yet, at the same time the number of listed securities has dramatically declined, largely due to PE taking them private and to a lesser extent the protracted reduced flow of IPOs.

As a result, when money flows into the stock market there are just fewer things to buy and much more concentration in a small number of stocks due to both their index weightings and liquidity. The opposite is also true.

Good luck with all this.

I shut off my 401 almost completely when Orange took over. Seemed the only sensible thing to do was stuff cash into high yield savings and treasuries and pray. Buffett seemed to agree, BH holding more cash than ever I believe…

Maybe the demise of company pensions decades ago explains, at least in part, the disproportionate focus on market outcomes in the contemporary press, given the class of persons who produce and consume it? Combine that with the relentless neoliberal campaign to deny the existence of “the public” (Thatcher’s “there is no such thing as society”) which implies therefore no such thing as public goods (the better to privatize them) and you create an environment where Musk’s vandalism gets less attention than equity market ructions.

The ultimate goal of capitalism is to make all of us capitalists.

That would be the good equilibirum to reach.

The bad equilibrium is to make all of us commodities….

Somebody has to be on the menu, am I right…?

What will be the knock-on effects in the mortgage industry? Asking for a friend…

If this friend were trying to sell a house for example, I assume they would be totally screwed right now. I assume holders of leveraged assets like RE are maybe in an ok position if they can hold through the inflationary spiral and then sell on the other side in a few years?

Somebody set me straight

Im aware of a cash sale in December that fell through last week. My gut is the buyer, an institutional buyer, needs the cash whether due to air bandb types cutting back or localities experiencing cash crunches and not messing around with property assessments.

Even without the tariff mess, its the blood from a stone problem. We can’t have post modern feudalism, just feudalism.

The tariffs are deranged, but the complaints about egg prices were real as they were representative of problems everywhere.

We really do need to take an honest inventory. Time was when the surging boomer population created the mirage of endless wealth creation and housing and jobs and everything under the sun was “good for business.” Not so much now. The mistake Trump is making is not offering a viable alternative to this great slowing. With a true alternative all the deprivation could be absorbed in a new industrialization. Of Course Trump is too brash to adopt the Inflation Reduction Act itself, but he could rename it and do his classic fudge routine and call it a re-industrialization. Instead of all that housing being a millstone, it could become a new focal point for self sufficient local economies, sort of turning suburbs into eco-farms and etc. But not nearly glamorous enough for the Donald probably.

Thank you for refocusing on the real impacts which many of us are either facing now or worrying about. Several people I know who work in healthcare are living through what I’m calling the non-profit apocalypse, as their federal grants get pulled, or layoffs happen pre-emptively in anticipation of that. Some were part time, so no unemployment.

Yves, I read a newsletter of Larry Johnson’s last night in which he suggested that the imposition of these tariffs had to with the short-term debt position of the government with respect to bondholders. I’m a bit rusty on the bond market; what are your thoughts on Larry’s take?

I left my non-profit job at an HIV/AIDS group in early January because I was at the leadership tables when cuts were discussed. (I’m in marketing so saw myself as expendable if they needed to tighten the belt)

Since then, all I’ve heard is how they are probably going to be cutting testing and prevention because the government grants that funded it are at risk.

The death blow to those specific nonprofits will be if the trump admin guts Ryan White funding – which pays for the treatment of most low income individuals living with HIV.

So many lives are going to be lost and we will see an uptick on HIV here soon as the government completely guts all the funding that went to prevention.

Jesus, Antifaxer! I hope you’ve landed on your feet. Could be that you saved someone else’s income in the process -for now, of course.

Getting our (collective societal) treatment of HIV to the where people living with it (who are properly connected and treated) can get back to undetectable status was an accomplishment; someone I know worked in that world for decades; that person and I hope we aren’t, through either denialsm, ignorance or pure contempt going back to when it was a death sentence, people were just gone.

PEs and ATHs Apparently too quaint.

And Uncle Buffy has been sitting on almost $400,000,000,000 cash for how long?

On Saturday a friend texted to ask if we were going to “the protest”. There was in fact a quite large turnout not far away from here in Boston. We weren’t sure what it was about. My wife and I scratched our heads about what might have finally motivated large-scale political protest. She said it wasn’t genocide and war but the prospect of higher prices for imported goods. I said it was their tax-deferred savings funds are down.

“In 2023, $192,084 was the median household net worth in the United States. This is up from $121,411 in 2020.” https://dqydj.com/net-worth-percentiles/ and a lot of that (correct me if I’m wrong) will be in equities.

The politics of that many people feeling that their life savings are being wiped out by Trump is going to be interesting.

Indeed. Nobody cared when Biden’s “sanctions” did in my family’s farm – those s*itkicker farmers aren’t PMCs after all. But suddenly these “tariffs” have got all the PMC knickers in a twist as their 401Ks take a hit. And judging by appearances at least, the protestor crowd I saw over the weekend was heavily PMC – older and white.

Historically speaking, it’s not the poor who upturn the current order (although they do get enlisted to do the necessary dying) – it’s that top 10% or so who have gotten used to their relatively luxurious lifestyles who get real testy when their own fortunes are threatened. Sam Adams owned the brewery – he wasn’t in the vats cleaning out the lees.

” Nobody cared when Biden’s “sanctions” did in my family’s farm – those s*itkicker farmers aren’t PMCs after all.”

I am so very sorry you lost your family farm, lyman alpha blob. There’s a special place in my heart for the small family farms who sell locally in my area, whom I support as much as I can.

Equally egregious is the disregard for people who lost their small businesses/farms during the financial crisis, myself included, after which we got to watch bankers get bailed out with ourselves left to twist in the wind. There are thousands of people who lost their jobs and businesses and homes who have never recovered. I certainly haven’t, and we are now seeing the same kinds of things disrupting a new group of people, while sweeping up again many of those devastated by GFC.

Solidarity.

An all too common tale here in Vermont, playing out since the eighties and with several driving forces. The PMC going off dairy is a recent one, (oat milk lattes being an insult to coffee is delicious irony).

Unfortunately due to the doge cuts in small family farmer infrastructure (Big AG gets fully reimbursed for commodity products’ losses that are the result of government stupidity programs – MAGATURD tariffs), the family farm that tries to earn a living will disappear completely. This will especially hit the organic farming industry hard.

Unfortunately for DOGE, previous Congresses beat them to it. I don’t know where you’re from, but in my neck of the woods there are pretty much zero family farms left to be affected by any DOGE cuts. Congressional farm policy has deliberately favored industrial factory farms over the little guy for many decades now, and it worked.

And son I’m just sorry theres no legacy for you now

John Cougar Mellencamp

Rain on the Scarecrow

1985

This from the lp Scarecrow.

Earl Butz: get big or get out.

Yes, it goes back to New England in the mid-1800s, when the new phonomenon of “factories” needed labor to tend their f’ing machines. The only source was farmers, who wanted nothing to do with factories and bossy labor. The cure was for the wealthy factory owners to buy up the farmland and force the former owners and farmhands to move to the cities and work in their factories. Well, it’s ever that way, isn’t it. It was the UK’s strategy in Africa, etc.

Is it the strategy underlying DOGE and the tariffs?

The people I know who were protesting were angry about DOGE viciously tearing up our federal agencies such as the National Parks, and threatening others like NOAA, Medicaid, the Education Department,and Medicaid, etc. After the protests were already planned, the draconian attacks came at Social Security. Conservatives drive by laughing at these protestors, they think it’s funny.

As with Yves, I’m staggered and outraged that the press and people in general are only upset about losing their ballooned gains from the Mag 7 runup. While we’re all going to sit by and let some unelected wrecking ball sabotage the Social Security system, which is so important to hundreds of millions of people. For what? Why is this okay?

I’m all for protesting DOGE and attacks on Social Security, but why the self-yoking to imperialism and the War State? I’ve been marching against war on my own since I was twelve years old, and this kind of political incoherence drives me nuts.

Don’t these people see that part of Trump’s appeal is his successful manipulation of himself as the “peace” candidate?

Hands Off NATO? As Lambert used to say, the stupid, it burns…

Because Hands Off 2025 is run by Indivisible, a team blue fundraiser. From their website,

© 2025Indivisible Project. Indivisible.org is a joint website of Indivisible Project and Indivisible Action. Indivisible Project is a registered 501(c)(4). Indivisible Action is a Hybrid Political Action Committee. They are separate organizations.

I read that MoveOn was also a sponsor: another kiss of death.

Thank you, mrsyk. The Spokane County democrats were major organizers of the local Hands Off event here in Spokane. In addition, they were promoting an April 1st* ZOOM call, organized by Indivisible, which invited one to “join movement leaders, experts, and more for a mass call on Tuesday, April 1, to make sense of the Trump administration’s unprecedented power grab, efforts to remove limits to its power, and what we can do to confront it on April 5 and beyond.”

“movement leaders, experts, and more” – because they’ve been so successful in stopping this themselves and want to show us how to do it?

*I find the date ironic, but that’s just me.

Lol, thanks. I wager it was strategy to “improve messaging”. Elections are a business sector first and foremost.

And presidential candidates are products to sell.

Someone always has to take the lead, take responsibility for making something happen. Otherwise, most of us won’t do a damn thing except wait.

So whats wrong with some austerity for Federal works who have skated by every downturn in my lifetime? Couldn’t we at least go back to 2022 staffing levels? Drive thru some of the rustbelt cities and open your eyes.

not the most effective way to cut federal spending.

they give 20% in income and payroll taxes days after the spend.

they increase the private labor market, driving down wages.

they are customers and borrowers that stimulate local economies.

this isn’t being done to save tax money, it is being done to drive down wages.

we will see what kind of effective it has in the next 12 months. if ‘noone wants to work anymore’ and these people can fill job opening in the private sector, it maybe a net benefit.

Richard Wolff observed recently in a video with Michael Hudson on Dialogue Works that Federal Government staffing remains similar to what it was in the 1960s, despite an increase in US population in the order of 100 million in the interim.

The rust belt cities you rightly identify as a priority for rehabilitation are a function primarily of unconstrained neoliberal policy over the course of 50 years, not the Federal workforce.

I’ve maintained that the plan is and always has been to threaten to kill social security in order to privatize it… until now. They really want to kill it. Further, as much as I want to think that they couldn’t care less about consequences of killing it, I now think that they intensely care about the consequences- they want to cause as much pain and suffering as possible, and invent new ways to cause even more.

Thanks for this post.

I read a long, interesting twt yesterday analyzing the stock market as 2 different markets: stocks issues for companies themselves and stocks issued as bets on a companies performance – puts and calls and also derivatives and derivatives on derivatives. Those things Buffett once called ” financial weapons of mass destruction.” I wonder if it’s the bets stocks that are taking the worst hit at the moment.

Arguably “Russia-in-the-1990s level outcomes” are already happening — the “deaths of despair” and the recent fall in overall life expectancy, along with what looks to my eye to be more homelessness than at any time other than the Great Depression being perhaps the most obvious examples.

I have not read him in years, but I recall Dmitry Orlov (the author, not the hockey player) predicting a Soviet-style collapse in the USA. Looks like it took a bit longer than expected but…

I just did a quick query,

https://en.wikipedia.org/wiki/Dmitry_Orlov_(writer)

“…By 2019, Orlov felt[17] that most of the ingredients precipitating collapse of the United States were in place, and that the one single ingredient still missing–a humiliating military defeat–was under way…”

“Project Ukraine has entered the chat …”

As I recall Orlov thought the USA decline would have a far different character than Russia’s due to the speed of Russia’s decline versus the USA’s slow, multi-decade decline.

A fast decline leaves factories and experienced people available to be brought back on line.

That was Russia.

The long, slow decline of the USA has left decrepit, empty factories with their equipment destroyed or moved overseas.

The experienced USA workers may be aged out and never were engaged to train younger USA workers as that training happened overseas.

I don’t see that the world will rush in to help the USA after all the ill will our government has created around the world.

As in election seasons where we focus on the horse race instead of the issues, here we are commenting, discussing our finances instead of this outrageous attack on SS. If even the commentariat is facing the wrong way…

Yves, I am so grateful for NC’s consistent focus on the real economy. It has made me a faithful reader (and because so far, I have been able, a regular donor) for over 15 years. Sincere thanks.

NC: Fearless commentary on finance, economics, politics and power. Indeed. This evening i will be talking seriously with my wife and my son about finance and savings. One of them has a saving portfolio which relies excessively on US stocks (I believe about 70% of the fund invests there) and has got a dive these days. Not that i didn’t tell them something wrong was coming a few days before the dive. But yes, we have to watch the real economy, and here I couldn’t anticipate how the rot is now growing at speed and have come to the realisation that one has to be prepared for that. How, I haven’t figured it out, but we can no longer believe this is business as usual. To this excellent overview add “distraction by destruction” as the current wisdom in foreign policy. Explosive mixture here. Compared to humans, viruses are gentle entities.

I’m just wondering how many of the billionaires in Trump’s cabinet managed to greatly increase their net worth by front running this engineered market plunge.

Looks like Mr. Market is taking a bath in Trump’s toilet. Waiting for him to get off the seat and flush. Whatever floats following flush will not be fungible, except in-kind.

I don’t know why so many people are worried about a stock market crash. Neoliberalism is investor first, so the market will absolutely be bailed out by the government and the central bank, as it has been many times in the past.

Yes, and the PMC crowd will cheer it on, just like they did in 2008. I remember pointing out then that the banks needed to be allowed to fail, and found that those whose retirements depended on their 401Ks did not share my sentiments.

If it’s a choice between baling out Mr. Market and shoring up SS, you know which one the powers that be will pick. In fact, they may be killing off SS precisely so all that money can be routed straight to Mr. Market. That is, if they have any semblance of an actual plan at all, and I haven’t seen any evidence of that yet.

People really have been brainwashed about all of this. Speaking to a friend over the weekend, I mentioned that in theory at least (because I see zero political will to actually do so), we could start paying grandma double or more of the average $1,200.00 monthly SS payment, and grandma would go out and spend that rather than spending most of her time at home eating cheap mac and cheese, which would boost the economy. Prime the pump. No, I was told from a very liberal fried, this would crater the economy, because somehow it’s grandma having a little extra scratch to spend that causes inflation, not shoveling trillions at bankers and/or price gouging by monopolists.

Of course the mass media cartel focus on the wealthy, and the drama while largely ignoring the majority of the population – that’s what they are paid to do. It reminds me of a soap opera where everyone is beautiful and rich.

There is no requirement or provision to report about the important issues that affect the majority, or critique the overall (corrupt) system. They may have to report on a big event, but they focus on the details, and ignore the underlying structural problems. The system works, just a few bad apples.

Their job is also to distract and divide the public, and get ratings to sell products. They are a big factor in shaping public opinion – they frame what issues are to be discussed, and determine what will be ignored or obfuscated. At worst, they repeat bald-faced lies like Saddam has WMD, or Putin shot down the plane, Chavez was an un-elected brutal dictator etc. the list is long.

They are employed and relatively well-paid by the corporate oligarchy to be good sycophant-stenographers, and they are good at it.

The most sophisticated and pervasive system of social conditioning in history has produced people who will often act against their own interests. They will “vote” for charlatans, conmen, demagogues (aka politicians) who tell them what they want to hear, or what they BELIEVE they want to hear. Much of the public has been “electronically lobotomized”. Couple that with a piss-poor, poorly-resourced, administration-heavy, education system and we have a “dumbed-down” emotionally manipulated population. (conditioned Collective Stockholm Syndrome?)

It will be tragic yet interesting to see at what point do the R faithful and DT supporters turn against the DT2 regime, when they are dumpster diving and lining up at the food bank?

Thank you, JonnyJames. It’s going to be even more interesting to me to see if d faithful will turn against the Dem party. I’m not holding my breath, though.

Thank you, yes of course this all applies to the D faithful as well. But then again at what point will all voters boycott the polls due to lack of meaningful choice? When will the D/R faithful figure out that we are getting played? As my old friends in Oakland used to say “they runnin game on us”

And meanwhile, Yemen gets bombed, the Genocide of Palestine continues, sanctions, siege warfare etc, foreign policy has not changed, only the blah blah blah

‘”When will the D/R faithful figure out that we are getting played? As my old friends in Oakland used to say “they runnin game on us”’

Yes they is, JonnyJames. I sometimes wonder how it is that I starting figuring things out when Bill Clinton was president while almost no one else that I know in my boomer age group has. I was quite comfortable, financially speaking, so theoretically, I was disinclined to notice the policies designed to undermine the social safety net for working class people whose jobs were being shipped overseas. I smelled a rat, and the stench has only gotten greater with each passing year.

aye. i was in my early 20’s…once again livin outta the car(this time in austin, with a wife in tow)…when Billary happened.

we were door hanging for some outfit or another, drivin around in our ancient datsun b210, switching between npr, rush limburg and sveral other am radio news type stations(yes, once there were more than one option for radio news).

and this is long before i took up the independent study of oeconomica.

what Billo was up to, starting with nafta, just “felt” stupid to me, back then.

and i have seen zero evidence to the contrary in the intervening 30+ years.

ergo, ive been adding datapoints to my narrative framework of decline and fall ever since.

ie: ive been expecting something very close to whats happening right now since around 1992…and getting ready as best i have been able.

the details of How it would happen are whats amazing…not That its happening.

i’m really kinda surprised that it took this long.

Thank you, amfortas. I haven’t been nearly as prescient as you, although I knew deep down that abandoning working class people was never going to work out well – for anyone not PMC or adjacent. It seems likely now that lower rung PMCs are going to take a significant hit. As I think Greer advised, I collapsed early (not by choice) and avoided the rush. That said, I most likely still will be caught up for a second round if I can’t manage to get out of this country.

I have a lot of admiration for what you are doing down in your neck of the woods, amfortas, and I’ve enjoyed following along via your comments.

Solidarity.

some setbacks, of late…mostly due to my mom’s insanity: killed the front pasture in pursuit of her hatred of mesquites…as well as a burning desire to make me wrong(now, there is no native grass that i planted established up there,lol…well done! you win!)

add this to the 4 years ago plowing under of the back pasture, where there was a much less robust ecosphere of various natives growing…plus the grayzon she had sprayed by a moron(walking in ellipses) to kill the mesquites.

so 30 years of me patiently and in spite of her collecting seed from roadsides, planting when god plants, and thus building topsoil and a resilient and robust and drought tolerant pasture ecosystem…undone over a weekend in february.

while we have 43 sheeps(about 4 times what our 20 acres can handle, given that only 11 was actual pasture.

she’s, i finally determined, what the hot shrink lady calls a covert narcissist, and i play the role of Scapegoat…so i have zero influence in any of these things, because i am evil and always wrong by default.

its to the point that if i cannot avoid her, on my way away from her place(doing her animals, etc…key man=unacknowledged), i sometimes go on and provoke a psychotic rage event(in deadpan, with studied lack of affect) in the hopes that she’ll stroke out…so that i can begin, at last, the remediation protocols for all her bullshit.

when i was over there feeding sheeps the other day, she pointed to the front pasture:”man, look at all that green grass…see?”

me: yeah. thats stickerburrs….(stickerburrs love “disturbed ground”…and i predicted a bumpercrop as the hired guy was out there scraping the topsoil(and my grass) away,in feb)

but whatever.

i focus on my 5 acre part of the place…which is coming along.

planting extra beans and squash and such today…due to trump’s chaos machine.

funny karma thing: last spring, her yard…like all 2 acres of it…suddenly sprouted like a million baby mesquite trees. likely from the sheeps and then extant goats’ droppings(i swear i didnt plant them,lol).

but she got rid of the goats(who eat such things)…because she regarded them as my goats.

and thus malign.

hot shrink lady over yonder hill(who text treated me as a favor to Tam) said that the usual recommendation when someone is confronted with a covert narcissist parent is to walk away and never come back….which i had arrived at myself,lol.

but i reckon ive put up with such craziness for so long, that i consider it paying th mortgage.

i earned this place, now in a Trust, managed by my eldest…and it aint like i got the body or money to go anywhere else anyways.

(perhaps this will serve as a distraction from the current worldly newsfeed,lol)

God, amfortas – you have far more fortitude than I do in regard to your mother’s successful (dammit!) attempts to undermine you. I myself would have stroked out if I had to face that kind of cruelty.

Even more solidarity!

my most valuable talent: I endure.

ive had a difficult, but remarkable, life.

and endurance is the main thing its taught me.

i’ve a really hard head, too.

added: in this conflict, spite also drives me.

i will outlive her, because i loathe the idea of her writing the narrative of me.

her ashes will go into a feedsack, to go to the landfill…replaced with cat litter, to be buried here….down there with Tam and Don , in our little graveyard in the oak copse in the front pasture.

my hate will die with her.

ive already secreted the red corn kernel in the threshold of her room, and admonished the boys to never cross it.

old school hedgewitchery at its finest,lol.

with Don Juan curanderoism tossed in for the american flavour.

theres jars of ancient rusty nails and ancient broken glass and piss from wife, boys and me buried under every egress point on my side of the place, as well as under the cattleguard leading into here, and the gate to the cemetery.

also a medicine bundle wrapped in a thunderbird blanket buried in a shallow cave up there on the mountain, to protect us from storms.(that was 28 years ago, and i cant find it, now)

we’ve had no storm damage(touch wood), and mom hasnt come over here to pop out of the bushes and accost me for almost 4 years(i hang signs:”naked day, keep out” to deter such intrusions..she is a puritan, after all,lol…and she knows its not an idle threat…im nekkid all the time…somewhat to deter her thus.)

Thanks for this post.

I suspect what we’re going to find out if SS is wiped out is that it was a larger driver in the real economy than the stock market. Just take a quick look at WalMart:

Walmart’s average customer is a suburban baby boomer who spent $3,578 there last year

https://www.businessinsider.com/walmart-typical-customer-demographics-shopper-profile-numerator?op=1

All of the SS payments go directly into supporting the Main St economy across the country.

I’m very grateful to Yves and front pagers like Conor who focus on the real economy. I’m especially thankful that poverty is discussed here. Over the years I have been on the internet, very few sites mention poverty at all. It’s treated like a disease or something: “Don’t talk about it! It might be contagious!”

Thank you for caring about the poor and vulnerable. Thank you for treating us with dignity.

“They couldn’t understand the coding, so everything they said SSA was doing illegally, they weren’t. Common sense is something they lack. They don’t know what they’re doing.”

When they aren’t being deliberately cruel, this is the case.

Thinking also about things like the door handles (or lack thereof) on some cars currently being designed as demonstrative of lack of common sense.

Also this (it’s the Atlantic, I know, but related to the issue raised above)

What the Comfort Class Doesn’t Get

People with generational wealth control a society that they don’t understand.

https://www.theatlantic.com/ideas/archive/2025/04/class-money-finances/682301/

The opening:

“I recently, I accidentally overdrew my checking account. That hadn’t happened to me in years—the last time was in 2008, when I was running a small business with no safety net in the middle of a financial crisis. Back then, an overdrawn account meant eating canned soup and borrowing cash from friends only slightly better off than me. This time, I didn’t need to worry—I was able to move money from a different account. And yet all the old feelings—heart palpitations, the seizure of reason in my brain—came right back again.

I have one of those wearable devices that monitors my heart rate, sleep quality, activity level, and calories burned. Mine is called an Oura ring, and at the end of the day, it told me what I already knew: I had been “unusually stressed.” When this happens, the device asks you to log the source of your stress. I scrolled through the wide array of options—diarrhea, difficulty concentrating, erectile dysfunction, emergency contraceptives. I could not find “financial issues,” or anything remotely related to money, listed…”

SPX cliff diving:

https://ycharts.com/indices/%5ESPX

But to the point of the thread, we only lost 1 year of gains (April 2024).

For real thrill seekers, check out an office REIT loaded up with zombie buildings. Orion Properties, Inc.

https://ycharts.com/companies/ONL

Now that’s a splatty cat! Capital destruction at work.

Such a pessimist. Hey, now that it’s down to a buck sixty nine per share, with its 2 cent dividend, that a whopping 1.3% cap rate!!! Jump on it!

Share price is the only thing that matters. Just ask Milton Friedman. Oh wait, he’s dead.

https://www.forbes.com/sites/stevedenning/2013/06/26/the-origin-of-the-worlds-dumbest-idea-milton-friedman/

61% of US households are in the stock market. S&P can easily trade down to 4,000. Tariffs on soybeans into China are 44% and 49% from US origins. PNC bank found the check fraud! Yay, now how long to get my money back? 45 days to complete the investigation, months to refund, ouch!

Good for you. Really.

“Commenting on developments in Chile, the conservative British journal The Economist observed, ‘Chile, under the stern eye of President Pinochet, has provided laboratory conditions for a prolonged experiment by Mr. Milton Friedman’s disciples…Chile is another economic disaster. The ‘Chicago boys’ have gone grey watching their achievements…slowly wasting away.'” – p.70 Not So Free To Choose , by Friedman’s student, Elton Rayack.

“Contrary to Friedman’s claim that Chile’s free-market experiment is an economic miracle, the overwhelming evidence indicates that the experiment has been an economic disaster. In eight of the nine years under the Chicago model, the unemployment rate was in the double-digit range, three to four times greater than the average of annual employment rates in the decade prior to the takeover by the junta, and in 1982 and 1983 soared to well over 20 percent. Throughout most of those nine years, real wages were significantly less than what they were in 1970 and in 1983 they fell below the 1970 level by 13 percent.

“The record on economic growth is equally deplorable. In the decade of the 1970s, while Latin America’s (19 countries) per capita gross domestic product increased by 40 percent, Chile’s rose by a mere 8 percent. By 1982, Chile’s per capita GDP, as a result of a severe depression, was actually 5 percent lower than it was in 1970.” (Ibid p. 72)

Not to mention the murders, torture, and folks being thrown out of helicopters, to get rid of any opposition. The “free-market” neoclassical/neoliberal economic order must be enforced with brutal violence. “Free” market Orwellianism. No wonder Maggie loved Pinochet.

I am told by a Chilean neighbor (who wasn’t born at the time) that Salvador Allende didn’t know how to govern and that’s why he was overthrown by Pinochet. He doesn’t mention anything about the horrors you describe nor the u.s. meddling in Chile’s internal affairs. My neighbor’s American wife has told me she’s capitalist to the bone because it’s the only system that works. Works for whom, I ask?

Allende wasn’t allowed to govern: the US, as Kissinger boasted “made the Chilean economy scream,” funded a strike by truckers and caused overall chaos.

aye. the old lefty antiimperialist archive, Third World Traveler has a whole section of forgotten memories(and documents) on all that mess.

one of the main impediments to reaching people on the street…especially out here…is that they simply do not know our own history.

when i first got ahold of the intertubes, i went straight for FOIA Docs, and such,lol.

they waited until faceborg, and jumped on whatever bandwagon made them feel good, at the time.(mostly teabilly madness wagons)

Thanks, Michael. I knew about the ‘make Chilean economy scream’ bit. Makes me sick.

Fed having a closed meeting tonight US time. S&P500 defended the 5000 line today ( with a little help ? ) Treasuries being sold to raise dollars. Rumours that gold lease rates are 12% already. Florida real estate blowing up already.

Will China stand or fold is the big question, if they stand shortages of vital goods will appear in the US quickly. No leader will want to come to the US and be ritually humiliated by Mr Trump and his press sycophants so any contacts will not be in public.

Co-incident indicators are the ones to watch here, but discount capital gains tax incoming, the selling will boost them for bad reasons.

I always look for “flies in the ointment” and silver being up all day caught my attention.

When silver goes full bull-ride, it tends to be explosive. Like a Russell Wilson “moon-ball” deep to George Pickens.

It also has a habit of blowing up somebody on margin.

Silver was breaking out last time when it crossed 34, but since then, it’s gone nowhere. I said last week that this week there’s likely going to be a dead cat bounce because no market goes to hell on a straight line. Trump’s fellow billionaires have also started making noises left and right, heck perhaps they are now looking for Lee Harvey Oswald 2.0 to protect their portfolios.

ive had the vix on a separate tab all day,lol.

keep checking and refreshing.

likely need to run the crap cleaner, soon.

charts make my eyes hurt, so i usually avoid them(save for the clean Fed ones)…and my approach to econ has been strictly political-economy, and mostly narrative…since ive never had the maths for anything besides divvying up my meager funds.

and the occasional windfall.(I’m a Humanities Guy)

so…assigning homework, i suppose,lol…if Yves, et alia could provide a narrative primer for what the f^^k is goin on, that would be great.

as with Physics…Narrative only gets you so far…and Imagination/Visualisation gets ya a lil farther…but i know i’ll never really appreciate the Universe without High Math…and its the same socratic conundrum with econ, since it went all physics envy, long ago.

looks for all the world to me like trump/musk are blundering into a catastrophe, while thinking that they’re rejiggering the world to their benefit.

i’m planting extra stuff, tout suite, regardless.

i foresee a local demand for local food in the near future.

How much longer before Trump & Co. start dangling a Social Security buyout plan?

Take $100k now and be done with it, before maybe it’s too late…

I don’t know if you are being sarcastic or serious, and honestly, with our current “leadership” it could be easily, but IIRC, the average social security payment is around $1,900 or $22,800 per year. That hundred thousand dollar buyout would cover four years and three months. How many years or even decades does the average person live on social security? And how much of this buyout would be taxed by what remains of the IRS?

1) Because Markets.

2) Go Die!

Trump just made another offer to NPS employees to quit and get severance pay after 1,000 took him up on it the first go round.

He’s pretty predictable, and screwing people out of their money is what he’s quite keen at.

Current law would not allow the government to buy out social security accounts, but I wonder if it would require any new legislation to allow private speculators to buy peoples’ social security rights, the same way they can buy life insurance policies? That seems like a more plausible candidate for doing by executive order.

at this moment, i’d take it.

i can do a whole hellovalot with 100k.

finish my great work,etc.

i’d want it in krugerrands,junk silver, or something, in case they crash the dollar the next day.

i still need reliable solar/wind for the freezers and especially the well pump.(10 -15k last i looked)

and a roofing team to cover the big greenhouse.(guessing around 7k)

and then i’m set enough to weather just about anything short of nukewinter.

residuals go to bulking seedbank, and a million little labor chores.

As part of the MAGA-Left in the U.S., I tend to agree with Musa Al-Gharbi when he notes that you can’t understand the system of power that exists in our country by focusing only on the super-rich in your economic analysis.

As he observes, the top 1 percent do indeed hold a large, disproportionate and growing percentage of resources in the US. He notes that, by 2022, the top 1 percent controlled 26 percent of all of America’s wealth. However, he also notes that the top 1 percent do not control a majority of America’s wealth.

Consequently, if you just focus on the top 1 percent you are actually missing the overwhelming majority of that wealth.

He believes you must look at both the billionaires as well as what he labels as the upper middle class (especially the managerial/professional strata). When you zoom out to this upper quintile, we are suddenly talking about a grouping which together controls 71 percent of America’s wealth. Or, put another way, the bottom 80% of Americans make do with roughly one-quarter of American wealth because the super-elite billionaires and the upper middle class gobble up the rest.

Those individuals in the top 2-20 percentiles are generally eager to get ahead and ingratiate themselves with those above. They also tend to hold moral and political views which are out of step with most working-class Americans.

It may just be that there is plenty of silent cheering among a large percentage of average Americans as the stock-market wealth of the upper middle class is damaged. It also just may be that that they are happy to see this new populist right government challenge Wall Street finance directly along with the bloated asset valuations of the insurance and real estate industries.

Long time listener, first time caller. I just wanted to say thank you. This is the kind of thing that has kept me coming back for nearly a decade. I expected there to be a dense fog of confusion in the early days of fascism so how important it is to be able to come here to get the real picture.

Greenwald adds to the question as to why the left is defending wall street.

https://www.youtube.com/watch?v=utZ1gm9oaF8

“Stupid is as stupid does”

It looks as if the administration or it’s AI calculations F’ed up the formula as well. You can’t make this sh*t up.

https://www.axios.com/2025/04/06/trump-tariffs-error-aei