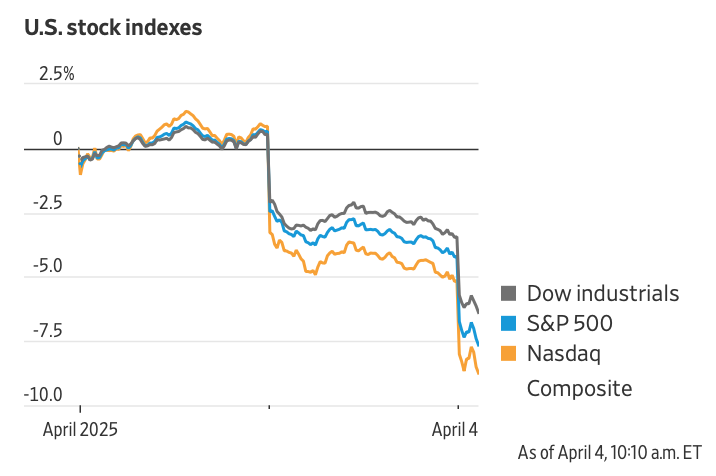

As China announced 34% retaliatory tariffs overnight, triggering a further swoon in European stocks and US equity futures, experts are grappling with which sectors and companies will be hit particularly hard. Even though this post focuses on private equity, we would be remiss in overlooking the continuing bloodbath. From the Wall Street Journal in Market Turmoil Deepens as China Sets 34% Tariffs on U.S.: Dow falls over 1,000 points; S&P 500, Nasdaq shed more than 3%:

China lashed back at President Trump’s tariffs, applying 34% levies on all imported goods from the U.S. Beijing said the levies would come into effect next Thursday, the day after a big part of Trump’s promised tariffs go live. “China played it wrong, they panicked,” Trump retorted.

The market selloff continued Friday, with the China retaliation and recession fears pushing investors to sell stocks and hide in the safety of government bonds.

Markets took little comfort from President Trump’s willingness to negotiate over the tariffs. The levies announced late Wednesday were deeper and more aggressive than the business world expected. And even as Trump left the door open to making deals, he vowed new tariffs on drugs and microchips.

Marco Rubio, Trump’s secretary of state, acknowledged that “markets are crashing” but said economies weren’t, and that global businesses would adjust to the new environment. Trump said investors were pouring money into the U.S., saying in a social-media post it was a “great time to get rich.”

Clearly, pretty much no one is buying what Trump is selling. The old Wall Street adage is “Don’t try to catch a falling safe.”

Admittedly this post is speculative since pretty much no one (except specific manufacturers themselves) has granular data on the amount and country mix of foreign elements in their cost of goods sold. And it’s remotely possible that some nations will get relief via sufficiently large acts of prostration.

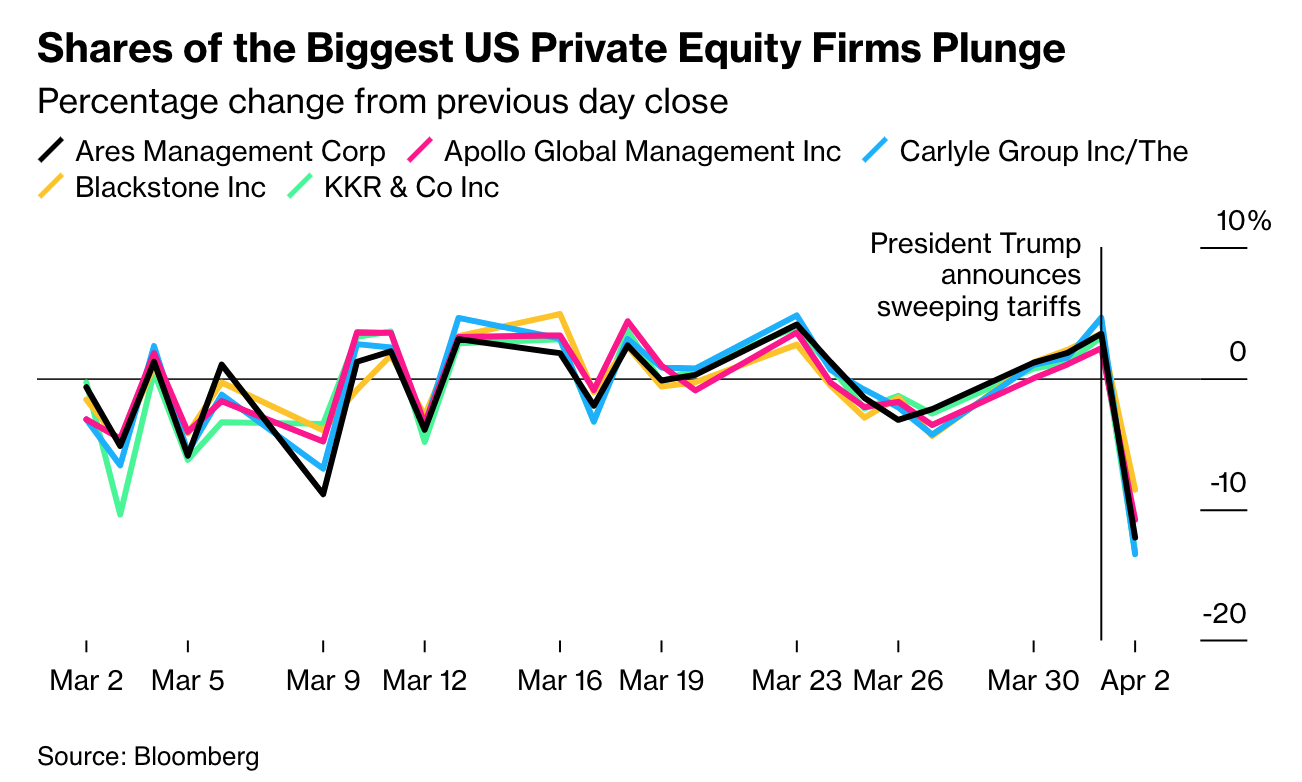

However, Mr. Market worked out that Apple and Nvidia looked seriously exposed, and punished them suitably. Oddly, the press took less note of the bloodbath among big private equity stocks. This swan dive strong suggest that private equity fund limited partners like public pension funds (as in investors in the funds, as opposed to buyers of the public stocks) are in an even more perilous position. Remember, roughly 2/3 of the income at private equity funds comes from fees that have nothing to do with how well the investment does, like transaction fees, management fees, “fees for doing nothing” aka monitoring fees. By contrast, for fund investors, a simple way of thinking about private equity is to view it as levered equity.1 Leverage amplifies gains and losses. So a levered portfolio will do worse in a bear market than one with no borrowings.

And remember, private credit, which are debt funds, often managed by big private equity firms, have private equity debt (“leveraged loans”) as a substantial portion of their assets. Private equity firms already have a wee problem with bankruptcies among their portfolio companies. Unless there is a big U turn on the Trump tariffs, defaults and bankruptcies look set to rise, which have the potential to deliver losses to credit fund investors….who again have public pension funds, life insurers, private pension funds, foundations and endowments, and sovereign wealth funds as their big holders.

In addition, the blowback of more distress among private-equity-owned companies will be serious. Most are unaware of how significant private equity fund holdings are relative to the real economy. For instance, in its initial S-1 filing in 2007, KKR said the total staffing among all of its portfolio companies put it at the 5th biggest employer in the US. If anything, its share is likely to be larger now.

First to Bloomberg yesterday on the hit to private equity stocks:

Shares of the biggest US private equity firms plunged on Thursday, some by the most since the early days of the pandemic, as US President Donald Trump’s sweeping tariffs shocked global markets.

Apollo Global Management Inc., Blackstone Inc., Ares Management Corp., Carlyle Group Inc. and KKR & Co. all tumbled at least 10% during the session after Trump announced the steepest tariffs in more than a century, threatening to wreak havoc on supply chains and crush economic growth.

As of 1 p.m. in New York, KKR and Apollo were the second- and third-worst performers in the 73-company S&P 500 Financials Index.

The big reason for the share slump was that tariffs will make a difficult fundraising environment worse. As the Financial Times reported last month, in Private equity industry shrinks for the first time in decades:

Private equity assets under management fell last year for the first time in decades as investors confronting a $3tn backlog of ageing and unsold deals pulled back from committing new funds to the sector.

Buyout firms managed $4.7tn in assets as of June last year — down about 2 per cent from 2023, according to a report from consultancy Bain & Co.

The decline in assets was the first since Bain began tracking industry assets in 2005.

Even during the 2008 financial crisis, the private equity industry recorded modest asset growth, underscoring the magnitude of the challenges currently facing buyout groups.

Fundraising has slowed sharply as private equity groups have struggled to sell assets and return cash to investors, causing large pension funds and endowments to retrench, said Hugh MacArthur, chair of Bain’s global private equity practice….

The proportion of a fund’s net asset value that buyout managers return to their investors as cash has fallen to about half the historical average in recent years.

The lack of distributions has squeezed pension funds, which need regular cash payouts to fund their commitments to retired workers.

In 2024, the distributions from the private equity industry as a percentage of net assets fell to their lowest in more than a decade at just 11 per cent, Bain found.

Mind you, it’s not that these companies can’t be sold, but that they can’t be sold at prices that are peppy enough to provide decent-looking returns. But the distortions of IRR mean that selling a company relatively early in a fund’s life provides more of a goose to apparent returns than the true apples-to-apples of “public market equivalent“.

Keep in mind also, unbeknownst to most outside the industry, private equity has increased the leverage of its strategy over time. Two of the big devices:

Leverage on leverage, via borrowing at the fund level as well as the investee company level. These loans are called “subscription lines”. And guess what the source of the funding is? The yet-to-be-spent commitments of the limited partners! As in say, Apollo can hit up CalPERS if a fund in which CalPERS has invested and which Apollo has drawn down on its subscription line has a liquidity problem severe enough that Apollo can’t meet the subscription line obligations.

Increased operating leverage. One might also call it asset stripping. For entities that owned their real estate, such as retailers, hospitals, and restaurants, private equity firms will sell the real estate to investors and lease the property back to the former owner. The price of the rental payments is set high so as to assure a hefty sales price for the real estate. Needless to say, the burden of the new high rent payments makes the business even more likely to fail. And particularly for retailers and restaurants, the reason they had owned their premises in the first place was that their industry was cyclical and they wanted to keep fixed obligations low so as to be able to ride out bad time.

So imagine what happens when these companies face both a cost squeeze and a big fall in demand due to the Trump tariffs. They will be failure-prone. And unlike in the private equity bloodbath of the late 1980s-early 1990s, private equity collectively is important enough to the economy that the scale of private equity business failures could intensify a downturn.

Now let’s consider what this mean for investors, particularly public pension funds. Private equity will under duress as stock prices as swooning. Private equity accounts for 14% of fund allocations, but some public pension funds like CalPERS are short of their targets. While private equity funds engage in a lot of fakery in their valuations (they are the only asset class not required to get independent valuations), pension funds, irrespective of what the valuations say, will feel even more squeezed due to private equity not returning anywhere near as much cash as expected via sales of portfolio companies.

And what about private credit funds? They are a new form of shadow banking. A recent Yale Law Journal article estimated their total size as $1.5 trillion (by contrast, private equity weighs in at about $5 trillion). Note that the authors of the article worry about the secrecy as well as the concentrated power:

First, as the corporate debt markets follow the equity markets in going dark, information about many large firms will be lost to the investing public. For better or worse, these firms will act with unprecedented discretion—having been shielded from the discipline and scrutiny of regulators, the trading markets, and the general public. Second, corporate debt—like corporate equity—will become the dominion of investment funds, some of which are already unimaginably large. These funds will influence everything from firm operations and strategy to corporate distress, with uncertain consequences.

Remember that private equity, like investment management generally, is a “heads I win, tails you lose” business. While they do obscenely well if their funds perform well, they make a very handsome living regardless (witness their use of private jets as a matter of right). If private equity owned companies start falling over, it will hit both private equity and private credit results. Quite a few public pension funds, from the Kentucky Public Pensions Authority to the aforementioned CalPERS, have government guarantees of pension obligations. So if these funds hit the wall, taxpayers will be on the hit for the shortfall. That is unlikely to show up in the form of an overt bailout or special assessment, but in intended-to-be-less-visible form of budget, as in service, cuts elsewhere.

____

1 This take is actually flattering to private equity, which as we have been documenting for many years, has not outperformed public stocks since 2006. Long-standing rules of thumb held that private equity should outperform public stocks by 300 basis points (3%) to compensate for the greater risks of leverage plus illiquidity.

The proportion of a fund’s net asset value that buyout managers return to their investors as cash has fallen to about half the historical average in recent years. That is quite the canary. I’m looking forward to the verbal gymnastics accompanying an enormous bailout.

Additionally, a return to ZIRP seems likely, how else can the systemic risk margin pools present be contained?

Most likely a redux of Bernanke’s smorgasbord (on steroids) of TARP and PDCF (frees up Primary Dealer balance sheets), all at Par or 100% valuations, coupled with an immediate ZIRP.

Effectively Mark to Market will be suspended.

Like I said the other day, it’s “the hair of the dog that bit me” remedy.

Oh, ZIRP is coming back, it’s just a matter of when. My baseline expectation for how the Trump 2nd term would turn out for quite a while has been tariffs then lower rates then rampant inflation. I do not think early 80s levels of inflation are too far fetched before all this is over with.

When things get ugly, they’ll turn on the firehose and start blasting liquidity into the marketplace. The bond market seems to think lower rates are in our future, as yields have declined in tandem with the stock market. The only silver lining I can find in this whole sad, own-goal circus put on courtesy of the Trump administration is that if fortune smiles on me and I keep my job I can refinance my way out of the ugly mortgage rate we got in 2024.

Big question in my mind is, will ZIRP work? If not, what about a great big totally not approved by Congress unconstitional spending spree by the Federal Reserve of QE? Personally if the Fed wants to spend money to stimulate the economy I’d prefer they buy eggs instead of financial assets and distribute it to us peasants.

Good question and certainly not a given on a society wide basis. But who cares (amongst the political class) about society? Both bailout and ZIRP have real risk in a fiscal system where most investment is in the financial sector and not in infrastructure/manufacturing/public welfare sectors.

I have a substantial US Treasury due to mature in under 2 weeks. I’ve been rolling it over every 30 days. I have to make a decision soon to rollover, or mature. If I rollover and then the Fed acts to help it’s rich friends, I could get stuck with dramatically lower interest….not that there would any comparable alternatives. A good part of my income is determined by how and how much the Fed helps their rich friends (and themselves).

Like any good company does when projects and prospects are bleak, they’ll flood the quarter with all the bad debt that has been hidden, and predict anything bad (unreasonable loans and the like) and shove it into this quarter so that the next will look better. Only then can they pass out the gravy to their friends and hide it again, but not before.

ZIRP would be the wrong tool for the job. Tariffs mean higher prices, and lower demand for basic consumer goods, along with higher end stuff (but not the real high end – our oligarchs will still want designer shoes and yachts.)

If Trump really wants to transition to a “made in America” economy and away from a consumer economy, ZIRP would be at cross-purposes. Plus the Fed doesn’t really set short-term rates, anyways.

If prices make their stuff unobtanium, why would France, Germany, etc. continue to export to us? They’ll tell us to pound sand (someone translate that to French for me …) and find other trading partners.

The Fed cannot do much about supply issues, as we saw in the post-COVID inflationary shock. As far as demand, yes they can try to stimulate demand but for big ticket items, like homes, cars, and maybe appliances … nobody is taking out a zero-percent interest loan to buy eggs, at least we hope not.

This all reasonably accurate, but the survival of PE (in my estimation) is tied to ZIRP policy for their “leverage on leverage” strategies. Leverage don’t work when interest rates are anything but very low.

PE blowing chunks doesn’t threaten the system. If private investors get wiped out, tough luck.

The Fed will act to protect the system. That would require a larger credit crisis. Definitely something to watch out for, but as of now, I don’t see one.

What of CalPERS, etc?

Way beyond my ability to say … Yves covers them.

Keeping with the theme “because markets … just die” I would guess that a major pension fund imploding would not get any bailout beyond what the PBGC would offer.

I think the Trumpies would be delighted to see state and local government workers take pension haircuts, or alternatively, see California in a credit crisis.

Agreed ,but will they let a the opportunity of a crisis go to waste? I wager team trump will find a way to have their cake and eat it too.

The price for quickly moving out of Illinois is only a modest toll on I-294 or I-88. The state and local government public servants can cannibalize themselves for their pensions after that. Absolutely nothing to do with Trump. Exponents and Ponzies.

I hate to be harsh, but this is elite handwave thinking.

Most people even in towns and cities very much damaged by deindustrialization stay. Please tell me the cost and difficulty of getting a job in new city where you have few/no contacts. It’s hard enough for locals to change jobs and they almost without exception will land the better ones first. You have to move or go back and forth a lot to troll for employment. If you have a house, pray tell how do you sell it for a decent price in a declining community? Housing is sure to cost more in a new place. How do you even have enough for a rent deposit when one in four don’t even have $1,000? The average rent in the US for a one BR is nearly $1,600, which means a rental deposit of >$3,100.

That’s before the cost of losing informal support networks of family, friends, churches.

CALPERS is backstopped by the California taxpayers.

The Calpers investment portfolio returns could drop tremendously but the pensions Calpers covers would be backstop funded by assessments to many cities, counties, and special districts in CA

That’s an angle I hadn’t considered. Private pension funds (think corporations like Bethlehem Steel) are at the mercy of the PBGC. States are public so it makes sense that there would be a taxpayer backstop.

Socialization of losses, on deck!

Heh heh, of course, thanks. This allows for direct public money spigot at the state level as well.

“…nobody is taking out a zero-percent interest loan to buy eggs, at least we hope not.”

Mr. Market has it covered already, for a price: Payday Loans.

The generally unspoken corollary to “Too Big To Fail” is “Too Small To Survive.”

I know which camp I fall into. Curses.

Sans ZIRP (or maybe in addition to), what these finance folk need is another place where there is loads of money that they can extract fees and rents from.

WSIB (which manages my wife’s WA state pension) is invested at around 25-30% in PE.If there is a 25% haircut, I’m hoping that there would be an increase in contribution requirements for future beneficiaries rather than distribution cuts. Can anyone with more knowledge of how these things work offer any insights?

There is likely to be both. The distribution cuts to existing retirees comes in the way of reduced services (medical/dental offsets). As Yves noted, existing retiree contracts are backed by the taxing ability of each sovereign state. ( in your case WA.)

Thanks. Appreciate this.

Just an amazingly casual and juvenile aloofness being projected here, despite the implementation of perhaps the most hasty, ill-conceived, illogical and wantonly destructive Policy to ever come out of Washington (and that’s saying something)

We have yet to see a single “Roadmap” as to exactly how Tariff Revenues will be segregated and earmarked for appropriation by Congress, so as to aid in the rebuilding of Industry.

As I mentioned yesterday, $170 Billion in Section 301 revenues wound up in the Treasury General account, and I could find no evidence of targeted application / spending.

@Yves

What’s your supposition as to the Depth of the “Wargaming” that the administration engaged in, prior to pulling the trigger on this Trainwreck?

Is it conceivable that they actually DID NOT perform any Modeling here, or include such scenarios?

Criminal Negligence at BEST.

I am guessing as everyone is, but the odds of modeling are close to nada. This Administration works first and foremost on Trump’s ego needs, above all his need to dominate, no matter what the cost. Secondarily, he is surrounded by ideologues trying to use the Trump prime directive to their advantage. Ideologues do not do models.

I would proffer that just like weather/climate models are having a bad hair day, its even worse for economic models. Here in Qld/OZ there are huge blind spots in the radar coverage in the outback, hence no data to draw conclusions off. This has contributed to decisions by people and towns in staying to long, not getting trapped and livestock dramas.

So like the speed in the change in climate so it is for econ models.

Personally I don’t see stock prices and currency as the main issue, its contracts, because they proceed everything else and insure the flow of funds from them. lf they all start going poof I would stay very far away from the resulting mess …

Addendum … what I am saying is models are built on normative data, so like some have noted, when built up risks via models meet fat tails humans panic. So all the stored potential via attempts be it Fed or computational power in smoothing out markets just hit the proverbial wall.

Just because some ideologues want to force their world view on everyone else, bonus of it all is the fight for the holy lands and crusades for everyone.

Predictable headlines from the usual suspects…”Feels Like an End of History Moment”, “Emergency” for the Fed. Meanwhile news says egg prices to go up still more. But that’s not an emergency nor does it warrant a Fed cut in interest rates.

Nice round-up Yves.

Here is an interactive from the FT on the web of lending and leverage in the PE/banking/private credit world. You might think that the TBTF banks undergo some scrutiny in this regard…not so.

Great links, thanks.

Seems like it’s worth a bit of ANTI TRUST scrutiny, but call me crazy….

.

PE is a literal wrecking ball to sovereignty of any kind, at any level.

The interactive (which I have referred to before) does show the different types of leverage but also makes clear nobody knows re how much. It’s a fancy chart that belies the level of actual information, which is not much. This is very distressing since in the runup to the GFC, there was data on the size of the subprime market, CDOs, CDS, admittedly rough and marked variations in the estimates, but much less fuzzy than here, when the instruments are simpler. Not your fault but another proof of the severity of the opacity.

I wonder if the larger impacted countries will raise tariffs on USA provided services, especially since that’s what we sell the most (beyond entertainment).

T. Carlson interview with Lighthizer the US Trade Representative.

https://www.realclearpolitics.com/video/2025/04/03/robert_lighthizer_trump_is_right_to_fix_our_broken_trade_system.html

Unbelievable, if this is the level of thought in the White House. It makes no sense.

I have not yet watched but Lighthizer was in Trump 1.0 one of his only sensible guys. So now he has drunk the Kool-Aid.

Yale Law Journal, not Review. They are kinda insistent about the terminology.

Oopsie, fixing!

This i didn’t understand (the mechanics explained):

The part I don’t understand is “cuts elsewhere”. — So, private equity funds stop paying back returns to investors and if these are funds and collapse, instead of fund bailouts, there will be budgetary cuts in services ( public services?) elsewhere… because federal income shrinks as a result of funds collapsing?

My intuition is that the crisis will provide the libertarians with a tool for cuts in government budgets and scope of government services but, silly me, I don’t get the mechanics and cannot understand how will this go less noticed than bailouts.

I regret to be so financially incompetent.

No, these public pension funds are all at the state and municipal level. Some are employee-specific, like state teachers’ funds (CalSTRS) or even for state or county policemen. They don’t have the reserve currency. Over time, they have to balance their budgets. And if those pensions are 1. defined benefit (particular payment level promised based on pay and time in service) and 2. government guaranteed (and many are, see CalPERS), the government has to make up any gap if investment returns fall short.

Thank you. I forgot you were referring to CalPERS and the like. I think I now understand better.

For a lot of people, the BlackRocks and the BlackStones are black boxes, so thanks for an insightful piece, Yves, and for deconstructing and demystifying the private equity industry in the present macroeconomic climate. Over the years, the two large California pension funds have felt pressurized to go in for more risky investments, and looks like a reckoning is coming for all participants, especially given the credit rationing that will squeeze the PE bros and their leverage gravy train.

BlackRock has virtually nothing to do with this post. BlackRock is third tier wannabe in private equity. They manage huge portfolios of PUBLIC stocks, vastly lower and well-disclosed fees on much bigger total assets.

https://www.marketwatch.com/livecoverage/stock-market-today-dow-s-p-and-nasdaq-set-for-further-losses-after-1-679-point-blue-chip-tumble?mod=home_lead/

Trump urges Powell to cut interest rates minutes before Fed chair speaks

Just minutes before Federal Reserve Chair Jerome Powell was set to speak on Friday, President Donald Trump urged him to cut interest rates, saying it would be a “perfect time” to do so.

Trump, who appointed Powell during his first term in the White House, has been a frequent critic of the Fed chief’s monetary-policy decisions. “He is always ‘late,’ but he could now change his image, and quickly,” Trump said in a post on Truth Social….”

It would be more than revealing if after the tax cuts for the wealthy and more easy money for insiders, there are even fewer moves by corps to re-shore manufacturing. That would make all this chaos from tariffs about bailouts.

PE down and going further? Couldn’t happen to a nicer group of people. Too bad the public pension funds (run by morons, apparently) are going down with them. Cockroach capitalism strikes again- all these parasites know how to do is extract wealth and destroy healthy companies. Nice to see the market recognition of this.

Looks like Blighty takes the first bullet for Trump’s tariffs:

https://www.telegraph.co.uk/business/2025/03/27/british-steels-chinese-owners-reject-500m-go-green/