The Trump tariffs, announced on April 2, are so wantonly stupid and destructive that I can barely stand to discuss them. But because their impact will be so far ranging, I can’t not.

Amusingly, Russia, which is already super sanctioned, is a big relative winner by already having adapted by reoriented its trade to the Global South and becoming even more of an autarky. But it will still experience second-hand consequences as its trade partners start limping.

However, even thought the US is set to reap the harvest Trump is sowing, the US probably will not be the earlier big victim. Odds favor emerging economy crises first. Remember that Jomo has been warning for at least a year and a half of the rising odds of financial upheaval in developing countries, due among other thing to a continued high dollar and slow growth globally. Even though the business pointed to the dollar falling in a global currency index, that is weighted towards big economies. As we’ll discuss further, Southeast Asian currencies declined against the greenback. Some countries in this region were already see as at risk of a crisis, not due to foreign debt exposures but excessive domestic debt. Trump’s kick in the head could push them into the danger zone.

Another area at risk, with which I am less familiar, is Central America. Their economies depend in a big way upon remittances from the US, which Trump is working very hard to reduce. The US runs a trade surplus with Central America but its member states will still face the “base tariff” of 10%. Not that Trump cares much about niceties like treaties (see for instance the JCPOA), but per Reuters, Guatemala has already complained that the new tariffs violate the DR-CAFTA trade pact. Mexico, which does run a large surplus with the US, is somewhat financial crisis (as opposed to just plain super bad recession) protected by virtue of having large FX reserves.

The point about emerging markets is contagion. When (not if) a not-trivial emerging economy goes into a meltdown, investors reflexively run for cover. Any country that is colorably similar to the one having a seizure will be shunned. That means among other things the value of their currency will fall.

Now that we have some actual numbers, we can expect to see some stabs at analysis over the coming weeks. Some experts tried claiming that China would not be much affected because its export to the US were only 3% of GDP. First, that is not a de minimus number. Second, for reasons of cost and/or reduction of controversy, China has moved some production to Southeast Asia, particularly Vietnam, and Mexico. Third, Trump has also targeted every country except Russia and North Korea. At a minimum, they will see a reduction in their economic activity, which will blow back to trade with China.

If readers have any early sightings from manufactures, exporters, or middlemen, please pipe up.

Some overviews. Here is the White House Fact Sheet. Note Trump ritually invokes a national emergency when he is the one causing one. In a separate Fact Sheet, he eliminated the de minimus exemptions starting May 5. It is not well drafted but it seems to cover only goods from China and Hong Kong.

U.S. stock markets were poised to open sharply lower. The U.S. dollar sank more than 2% against the euro, Japanese yen and Swiss franc. Oil and gold both fell and investors dashed for the safety of Treasurys, a response to fears that the tariffs will tip the economy toward recession.

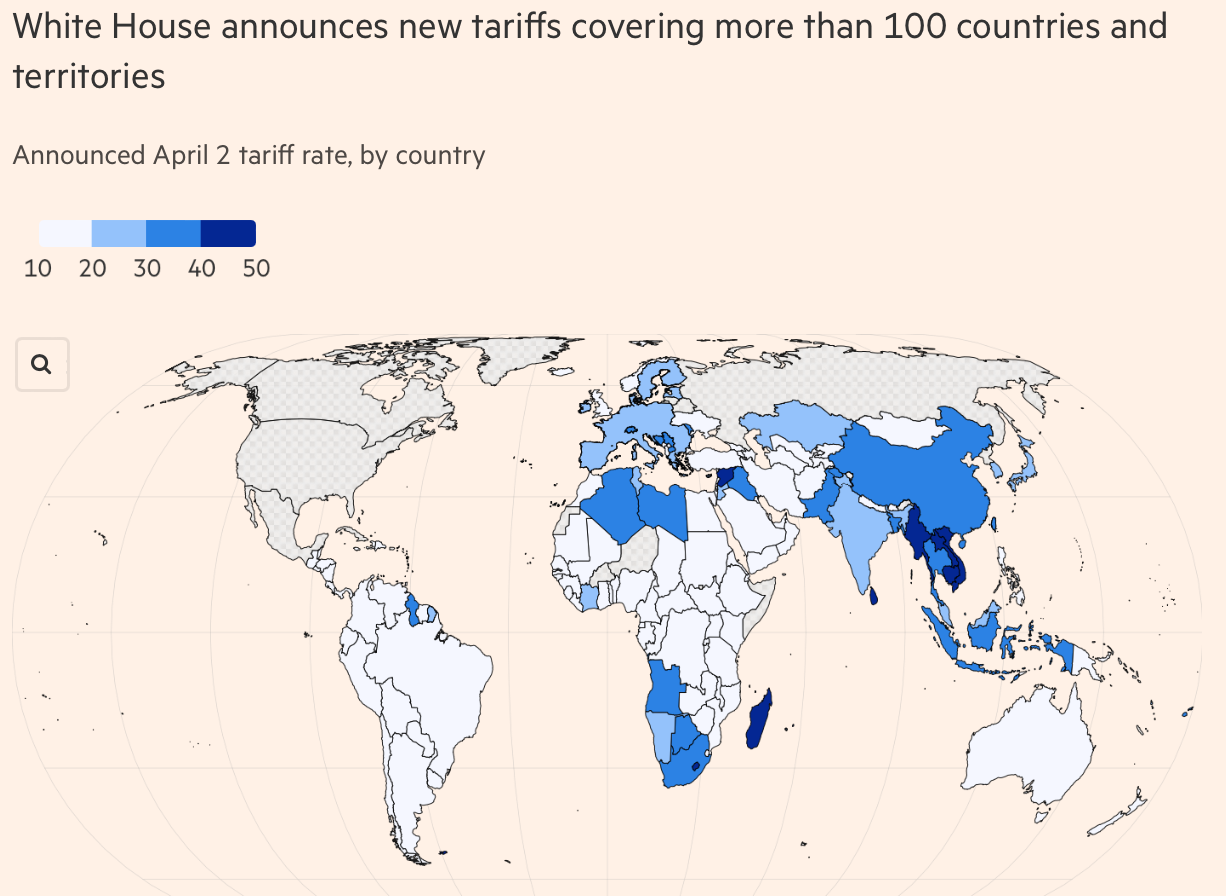

All U.S. imports will be subject to a 10% tariff, effective April 5.

Trump will impose even higher rates on some nations that the White House considers bad actors on trade. For example, Japan faces a 24% duty and the European Union faces a 20% levy, effective April 9.

China will be hit with a new 34% tariff, adding to previous duties, like the 20% tariff Trump imposed over fentanyl. That means the base tariff rate on Chinese imports will be 54%, before adding pre-existing levies.

The tariffs are pegged to amounts Trump says other countries impose on the U.S. Here’s the math behind the levies.

Some global leaders are vowing to retaliate, while others are hopeful there is still time to strike a deal with the U.S.

Canada and Mexico are excluded from the reciprocal tariff regime.They are still subject to plans to impose 25% tariffs on most imports to the U.S., though the administration has given an exemption for autos and many other goods. Here’s a list of the products and countries exempted from the tariffs.

Trump’s 25% tariffs on foreign-made autos and parts took effect at 12:01 a.m. ET.

Custom tariffs for ‘worst offenders’

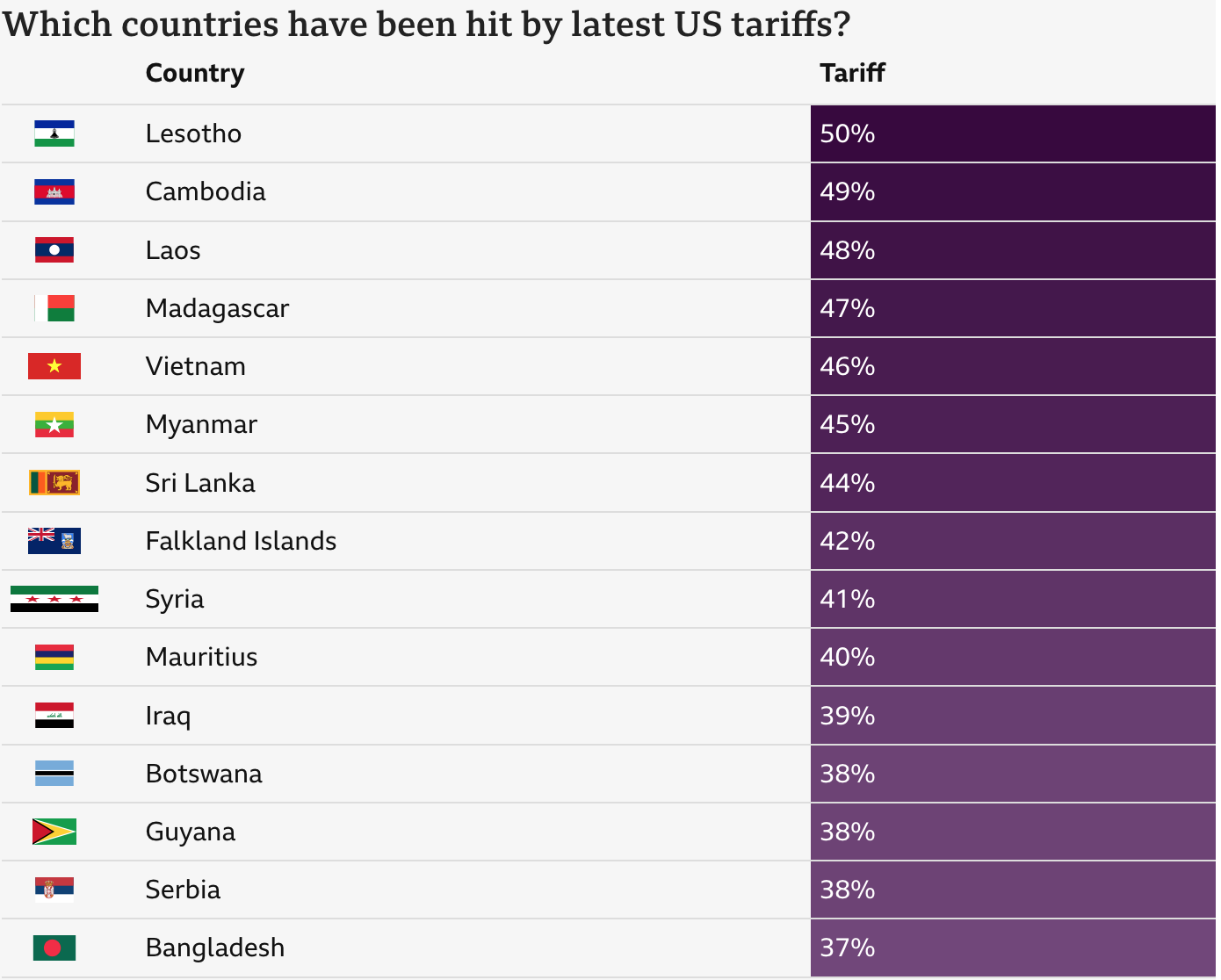

White House officials also said that they would impose what they describe as specific reciprocal tariffs on roughly 60 of the “worst offenders”.

These will go into effect on 9 April.

Trump’s officials say these countries charge higher tariffs on US goods, impose “non-tariff” barriers to US trade or have otherwise acted in ways they feel undermine American economic goals.

The key trading partners subject to these customised tariff rates include:

- European Union: 20%

- China: 54% (which includes earlier tariffs)

- Vietnam: 46%

- Thailand: 36%

- Japan: 24%

- Cambodia: 49%

- South Africa: 30%

- Taiwan: 32%

The Financial Times weighed in with Donald Trump baffles economists with tariff formula:

The formula used to calculate the tariffs, released by the US trade representative, took the US’s trade deficit in goods with each country as a proxy for alleged unfair practices, then divided it by the amount of goods imported into the US from that country.

The resulting tariff equals half the ratio between the two, resulting in countries such as Vietnam and Cambodia — which send large amounts of manufactured goods to the US but import only small quantities from the US — attracting punitive tariffs of 46 and 49 per cent respectively.

By contrast the UK, with which the US had an annual surplus in goods trade last year, will be hit only by the baseline 10 per cent tariff that applies to all countries barring Canada and Mexico.

Economists argued the USTR methodology was deeply flawed economically and would not succeed in its stated aim of “driving bilateral trade deficits to zero”. They added that, despite the White House’s claims that “tariffs work”, trade balances are driven by a host of economic factors, not simply tariff levels….

Economists also attacked Trump’s obsession with reducing bilateral trade deficits to zero as economically illiterate, since there will always be items that it is impossible or economically unviable for countries to grow or make themselves — for example, the US cannot grow its own bananas on any meaningful scale.

Some hope this is just a Trump opening bid and relief might be possible. But the Administration is making confused noises. From NBC:

Trump surrgoates were sending mixed messages in the wake of his shock tariffs announcement yesterday.

On X, Eric Trump, the president’s second-oldest son and the principal of The Trump Organization, predicted talks would commence.

“I wouldn’t want to be the last country that tries to negotiate a trade deal with @realDonaldTrump,” he wrote. “The first to negotiate will win — the last will absolutely lose. I have seen this movie my entire life … ”

But on CNN, White House Press Secretary Karoline Leavitt said there would be no negotiations. She urged Wall Street to “trust in President Trump” and rejected the idea that Trump would pull back on tariffs before they go into effect.

Pharmaceutical companies breathed a sigh of relief Wednesday after U.S. President Donald Trump revealed that they would not be subject to reciprocal tariffs — but that reprieve could prove fleeting as the White House moves ahead with plans for the sector.

The Trump administration is considering launching a so-called 232 investigation into pharmaceuticals, among other industries, which could lead to import duties under the Trade Expansion Act, Bloomberg cited a senior administration official as saying on Wednesday.

But also from CNBC, evocative of Annie Lennox, “Some of them want to be abused”:

The latest U.S. tariffs could cost the Polish economy 0.4% of gross domestic product or roughly 10 billion zlotys ($2.64 billion), according to a preliminary estimate shared by Polish Prime Minister Donald Tusk.

“A severe and unpleasant blow, because it comes from the closest ally, but we will survive it. Our friendship must also survive this test,” he said

Bloomberg clears its throat and points out that so far, US investors are the biggest losers (not clear this is true outside big and advanced economies; Southeast Asian currencies fell versus the dollar):

Donald Trump’s shake-up of the global trading system is hurting US assets more than those in many of the big economies he has just slapped with additional tariffs.

US equity index futures tumbled more than 4% after the US President announced a sweeping series of tariffs following the market close on Wednesday, and a gauge of the dollar slumped. But the impact elsewhere was less extreme. The Stoxx Europe 600 was down 1.3% in morning trading while the euro was up 1.3% against the dollar, hitting its highest level since October. A broad gauge of Asian stocks fell as much as 1.7%

For what may seem a parochial take, from the Bangkok Post:

Southeast Asian stocks and currencies fell after Asian emerging nations were given some of the biggest tariff increases by US President Donald Trump. Vietnamese shares tumbled.

Vietnam’s main stock index slid as much as 6.2%, heading for its biggest one-day drop in more than four years, while equities in Thailand, the Philippines, Malaysia and Singapore also declined. The Thai baht weakened as much as 0.8% against the dollar, and the Vietnamese dong and Malaysian ringgit also dropped.

Southeast Asian assets slipped after the region was hit particularly hard by the reciprocal tariffs announced by Trump on Wednesday. He said the US would place a 46% tariff on Vietnam’s exports, 36% on Thailand’s, and 32% on Indonesia’s. The region’s largest trading partner — China — was heavily targeted, with Beijing now facing a cumulative 54% tariff….

‘It’s not surprising to see panic selling as local investors only expected 10%-to-15% tariffs,” said Nguyen Anh Duc, head of institutional brokerage and investment advisory at SBB Securities Corp. “Margin lending balances of brokers is quite high and can make things worse. If stock prices plunge another 10%, we may see margin call pressures.”…

The cost to insure Southeast Asian countries’ sovereign debt also climbed. Credit-default swaps tracking emerging Asia bonds widened by the most in 19 months, according to traders…

A further uptick in trade tensions may heap additional pressure on Asian currencies. The Indonesian rupiah has slumped 2.8% this year and last month fell to the weakest level since the Asian financial crisis in 1998.

We’ll need to wait for other shoes to drop, particularly reciprocal tariffs. But it’s hard to adequately express how this is an ignorant and savage act of destruction.

Trump appears to be uniting the world, against the US, that is.

It could be seen as a positive by some: the DT2 regime is putting the decline of the US into high gear.

The only thing the US can do is threaten economic warfare, bombing campaigns, or nuclear war. Is this the Samson Option of the USA?

Trump is applying exactly the remedies Goldsmith proposed in this prophetic interview in 1994 when tariffs were abolished.

It’s hard to disagree with Goldsmith, his main point being that companies delocalizing to china should sell their products in China only. Posterity has definitely proven him right as to the social consequences of GATT policies for the West , it remains to be seen if Trump tariffs will redress the situation….if he has the nerve to see them through as screaming gets louder and louder from intrenched interests.

https://youtu.be/wwmOkaKh3-s?si=sHVOJ7WgxWfoOrG5

The perfectly predictable tragedy for Trump, it that he could’ve gotten 85% of what he wanted even with a small universal tariff like 3%.

Trump is channel the very Amrrican trope of “Go ugly early”

I would of been okay with small incremental tarrifs along with industrial policy to rebuild some industries, like making our own medicine again.

This?

This is the product of a crack cocaine government. He’s really speed running the collapse of the empire and will go down as the greatest anarchist in American history (no offense to the anarchists).

blessing or curse? seems hard to know.

I’m in my early 30’s, I doubt I’ll ever really have a career or get married at this point.

All I’m doing at this point is wondering when this nonsense ends. If Trump’s suicidal actions lead to revolution, fine! I want to see the start of a socialist America before I’m in my 60’s. That’s my retirement plan. Even being born some-what secure isn’t that safe anymore in America.

I really, really don’t want to be fighting in a trench in my 40’s. Let’s this get this started sooner rather than later.

i’m curious where you believe that trench may be located. and if its an internal/civil action or foreign incursion. or both perhaps?

i am likewise curious at the stock market “surprise” over something thats been telegraphed and telephoned in for months.

i appreciate your concern and hesitency. being older has its advantages i suppose.

let chaos reign?

The answer to your last question is not hard to guess. Most investors don’t really understand anything about politics at a deep level. They have grown up sheltered in a system where it has never been necessary. So they write off anything totally catastrophic as “obviously that would never happen. It’s crazy!”

Good points. Virtually everyone I’m acquainted with seems to have a weak grasp of reality. Baseball season just started, and “March Madness” (a very appropriate name, not just for the games) is around again. Most of the citizenry here neither knows nor cares about the wider world, or the nearby world of politics and culture that affects them. But once they start getting hit, then what?

I am not sure how a 3% tariff will get you reindustrialization.

In fact even 300% is unlikely to do it.

Because the fundamental problem is that it costs many times more to produce inside the US. Not percentages, multiples. Thus the current tariffs are doomed too.

The solution is to bring costs down in the US. But to do that you need to do some combination of:

1) Lower labor costs

2) Automation

The problem with 2) is that China is multiple generation cycles ahead in manufacturing automation, and now it is reaching escape velocity where the process of efficiency improvement is accelerating exponentially, so good luck catching up with them.

So we go back to labor costs. You can get rid of all residual unions and gut all regulations mandating minimal pay, benefits, etc. And that will likely be done indeed. But it will not be enough, because those workers still need to physically survive somehow, and that means you have to pay them enough to cover food, rent, utilities, education for kids, and some medical bills.

And there is the real fundamental problem — those expenses are extremely high because those are all right now private taxation domains used to extract real wealth from the general population towards the sub-1%. If anything, the trend is in the opposite direction. And Trump coming from real estate is not exactly the kind of person I would want in charge of having to solve that problem.

Notice what happened in China a couple years ago. Xi publicly came out and said “housing is for living in, not for speculation”, and then the government proceeded to dismantle the nascent rent extraction industry there.

You want truly low production costs in the US? You need to get rid of all the rent extraction parasites. But that is the whole power structure.

This is not a problem you solve with a Trump imposing tariffs externally, it is the kind of problem that requires a Lenin-Dzerzhinsky-Stalin combo applying the classic Lenin-Dzerzhinsky-Stalin methods of physical elimination of the problem. Trump included.

P.S. Trump’s actions are absolutely idiotic also because he just slapped tariffs with the vague goal of “reindustrialization”, but there is no actual activity towards real reindustrialization. That would mean the government investing heavily in technical education, in ramping out things like machine tooling productions, robotics and automation at scale, etc. But technical education is the most important prerequisite for everything. Have you seen many billions earmarked for that and a massive program to orchestrate the process? No. Quite the opposite — the Department of Education was dismantled.

I guess they truly believe in the mythical power of the free market to solve all problems in the current administration.

Too bad for them the Chinese believe in just doing things instead.

P.S. This impossibility of internal US change also means WWIII is likely inevitable. Because right now the extremely inefficient internal US structure of siphoning off wealth to the top while maintaining some kind of standard for the masses to stave off revolution (but keeping all the absurd physical inefficiencies such as suburbia, the car culture, the aviation industry, “healthcare”, etc.) depends on the rest of the world being a colony of the US. Problem is it also depends on perpetual growth, and the list of places in the world that are not yet colonies actively being looted has shrunk to the absolute minimum now. Meaning that the US has to go after the remaining very tough to crack nuts.

Thus the ongoing cannibalization of Europe, the war against Russia, the looming one against Iran, and eventually China’s turn will come too. And there will be no detente with Russia unless Russian elites sell the country out once again as they did in the 1980s…

We could lower labor cost the way Germany did in its better days: assure low housing costs via very tenant-favorable rent rules (I had a rent stabilized apt. in NYC where I had substantial property rights, with the landlord having to give a lease renewal and regulated rent increases, which more or less tracked inflation; many with similar leases renovated their apartments) and move to a basic (as in more than bare bones) government paid health care. But the US will never go there.

That’s exactly what I was saying too — low housing costs means eliminating one of the key pillars rent extraction.

Can’t have that.

Why just tariffs to get jobs back to the U.S.? It would seem to me that removing the business expense tax write offs for work sent off shore and the product (whether physical or service) returned to this country would do the job. That would help companies that have not off-shored jobs get back some of their competitive advantage and force the companies that did to move the work back here.

Yes but what about the notorious crumbling infrastructure? What about the huge capital-intensive projects that are necessary to rebuilt mfg capacity? What about the huge overhead costs in the US? Reversing decades of financialization and de-industrialization, even if conditions were perfect, would take many years and many trillions.

As far as “comparative advantage”, where exactly is that in the US? The US does have a heavily-subsidized BigAg sector, and is an net exporter of Ag

Another headwind is having a deficit of “know-how” as our population with manufacturing experience ages out.

The US used to be a net exporter of ag, but now we are a net importer as of a year or two ago.

You are right, I’m behind the times. Even worse than I thought.

I might be mistaken, but I believe that’s a dollar amount based on expensive imported foods like berries and avocados. In terms of calories produced, even factoring in the blasphemous waste of food on things like ethanol, I have a hard time believing the US isn’t still a net calorie exporter.

Man does not live by corn alone

Where did the James Goldsmiths of the world go? Rich people don’t talk that way nowadays. He nails so much of what the US and world are suffering.

I need more evidence to believe Trumñp has in mind anything approaching what Goldsmith advocated: infrastructure, deindustrialized ag, regional markets, civil stability, a productive economy that serves the nation’s needs rather bloat low-wage, financialized profits

>>>Where did the James Goldsmiths of the world go?

Partly because he also said stuff like “”Tolerance is a tremendous virtue, but the immediate neighbors of tolerance are apathy and weakness.” (documented in a video interview with a journalist, don’t have the citation, but it appeared in one of Adam Curtis’s documentaries….maybe it’s buried in that Charlie Rose interview or one with David Frost.

If Goldsmith were alive and said that today, he’d get cancelled immediately—because the Cancel Mob can’t process subtlety, having one’s extant worldview’s rigorously challenged, viewing XYZ as both a tool of good and bad.

James Goldsmith …you should have seen what he was up to in the 60s, 70s, and 80s.

Check out Adam Curtis’s The Mayfair Set.

4 parts on Youtube. He enters in part 2.

I had never seen this interview- right. On. The. Money.

About 6 months ago I needed some stuff @ Home Depot, and every last item of the $423 I spent was made in China.

The prior rounds of Trump’s tariffist attacks in his first term, killed profitability in almonds-do the retaliating tariffs this go round make selling almond firewood a viable prospect?

If power tools become unobtanium, will forearms start looking like Popeye’s?

Make America Brawny Again

Despite my best intentions, the 1-time-use power tools I bought on the cheap at Harbor Freight, all continue to perform years later.

Pawnshops fill up with tools every recession. I imagine the underground/ black market trade will grow with cheaper tools just across the border in Canada and Mexico.

I’m willing to play my part and smuggle a trunk-load of Makita and Milwaukee tools across the Rainbow bridge. Bonus – better beer on the other side of the Niagara River.

Who’s with me?

Maybe peeps will finally realize that 90 years of bipartisan imperial presidency mission-creep was a bad idea.

Not holding my breath.

Not holding my breath either.

The Brennan Center has been pointing out for years that “emergency” is an undefined term in both the National Emergencies Act and the International Emergency Economic Powers Act. https://www.brennancenter.org/our-work/analysis-opinion/trumps-hidden-powers

This is all simply Trump’s ignorant and uneducated response to the global labor arbitrage enabled by a world population that has exploded four-fold from 2 billion to 8 billion in his lifetime. Outsourcing really has created an army of the homeless and immigrants really are suppressing wages.

Who knows? Maybe crashing the globalized economy is the only way to combat population-induced climate change. There’s no legal means to contravene a presidential emergency declaration, so I’m looking for silver linings…

How would combating population-induced climate change square with Trump the “Fertility President”? It’s an ill needle to thread.

Combatting climate change is my silver lining — certainly not Trump’s intent!

Eric Trump reminds us that Trump actually believes that acting like a madman recklessly crashing the global economy is a brilliant negotiating strategy to miraculously resurrect the Rust Belt.

Looks like they have temporarily at least found their spines – https://thehill.com/homenews/senate/5230192-chuck-grassley-maria-cantwell-bipartisan-legislation-tariff-power/

This stuck out –

“Grassley said in the release that Congress has “for too long” delegated its “clear authority” to regulate interstate and foreign commerce to the executive.”

Ya think Chuck? While you’re at it, maybe re-arrogate the power to declare wars, and any number of other things Congress has allowed the executive branch to do. There were some of us who warned decades ago that allowing the executive to call all the shots was a bad idea because maybe someday there might be a president people don’t like very much.

What?

You mean govern?

That would get in the way of dialing for dollars.

It’s maddening alright, every year (day) seems more surreal.

“…Economists also attacked Trump’s obsession with reducing bilateral trade deficits to zero as economically illiterate…”

I can’t think of any policy area where this isn’t true. The unhinged emperor gets nuttier by the week. At this rate, I shudder to think what it will be like in a few years time.

The “market” is plummeting, S&P down 4% now.

And buckle up because many retaliatory measures from various countries still have yet to hit the news.

Kwik Kwiz Kidz! (multiple guess)

“There is a place, like no place on earth. A land full of wonder, mystery, and danger. Some say, to survive it, you need to be as mad as a hatter. Which, luckily, I am.”

This quote is attributable to

a. Lewis Caroll, Alice in Wonderland

b. Donald Trump, Inaugural Address as the 47th US President

The correct answer is of course Lewis Carroll, but for the sake of good order here is the full video of Trump’s inaugural speech (warning: viewer discretion advised):

https://www.youtube.com/watch?v=IFvLorAL5-8

I’ve occasionally joked that the USA is no longer a reality-based society, but I’m not sure it’s a joke anymore. We live in interesting times. The prediction of a Fourth Turning starts to look increasingly accurate.

Not plummeting really. Surprisingly orderly. Doesn’t look like we will even hit a circuit breaker today.

Makes me wonder what levels actually start to cause palpable fear.

We need a “naked swimmer.” You know the guy, he was all in on frolicking in the waves, until the tide went out revealing his lack of a bathing suit (along with a bloated gut and, er, shrinkage.)

Look for our friends the edifice wrecks. Empty office towers sitting on someone’s balance sheet. It was all good pretending they were worth something, until Mr. Margin came a calling.

I expect a slow steady decline in stocks.

I expect panic when the credit market freezes or goes into crisis.

when the private debt market gets into trouble and the assets securing the loans go on the market, then the crash begins.

Not surprising really.

Nations have not responded yet. In other words, Mr. Market is waiting for the other shoe to drop.

I made a comment this past week, that it’s growing more likely that the US military will intervene and remove the trump syndicate. Consider syndicate to mean most of those affixed to trump. Any thoughts?

Only Jim “Mad dog” Mattis could get that level of support.

That’s called a coup, and is not something to be rooting for.

Looks like globalization is officially dead, the international rules-based order is also dead after serving its purpose and Trump has decided to do a controlled demolition of the world’s economic order with some countries getting more pancaked than others. I can only think that a major reason is so that they can crush lots of country’s economies allowing favoured US investors like Blackrock to swoop in and buy assets on the cheap. Of course Trump is thinking of all this as a business person would and ignores other factors as not being important. But when you have China, Japan and South Korea coming together you know that there is major slippage going on. The consequences? For a start I would expect Chinese trade missions around the world having their phones ring off the hook as they offer predictability and rationality. Business around the world would be looking at the US with a suspicious look as they appreciate predictability but Trump is delivering chaos. Who is to say that a country that is hit with a 10% tariff might not suddenly be hit with a 40% tariff on a White House whim? Some tweets that I have seen show his MAGA base cheering him on and being gleeful about all the chaos. But you have to hand it to Trump. He told his base that America which is the richest country in the world, uses more resources than any other country in the world and mints more billionaires than any country in the world is being hard done by – and they believe him.

True, I know some otherwise well-informed people who just plain REFUSE to acknowledge basic facts, because The Orange Saviour said blah blah blah. The pathetic, contradictory excuses they offer are, as usual, tragically ridiculous. It looks like a huge percentage of the US population has serious mental health problems. They will cheer-lead their own destruction. Mass Stockholm Syndrome? Nihilism? Is there a psychologist in the house?

Not Jordan Peterson. Please.

People are gathering into tribes because they properly perceive they live in a society without direction or purpose. It’s true across the West. “Woke” was one pretty laughable attempt to provide that purpose as that Old Tyme religion has lost its appeal to many and “the one who dies with the most toys wins” is pretty thin as a telos either from the standpoint of the individual or society.

The irony is that there is a purpose out there, one that is perhaps greater than any humanity has ever had. We’ve really screwed up the planet, and all hands are required to minimize the damage for the future while caring for the victims of our boundary breaching energy party. Standing in the way is a crumbling system based on consumerism, colonialism and extractivism that is taking us to 3 degrees of warming unless it collapses first.

We’re all trained to compete to consume rather than cooperating to conserve. We knew how to do the latter as recently as a generation or two ago. My grandparents had an acre’s worth of garden and orchard on their farm, and all of it was eaten by the extended family, put up for the winter or given to needy neighbors. It was an approach that they had learned from their parents, and that frugality got them through the Depression with two kids. We will have to re-learn what our grandparents knew and what much of the Global South still knows: how precious are the gifts we receive from the Earth.

Preach it, Brother Henry! My grandparents were the same, then my parents bought into the post-war American Dream ™, left the farms, moved to the city, and did everything they were told to do. They both died believing it was the right choice. Mistake, as it turns out.

we “somehow” have new definitions of success. as sustainability and sufficiency has given way to cheap and easy, and justice and liberty FOR ALL has succumbed to for SOME… we shall, as a society, suffer for this – are suffuring. until we reasses our assumptions and look at systems theory to build a society that takes human nature more fully into account and addresses mass psychological manipulation by those seeking control – and ultimately remove compliance and complicity, will we achieve different results? most just want to be left alone to pursue their own non-violent or non-harmful ends. human needs remain quite constant. and some are content to treat others as things, which we collectively allow. courage and bravery, anyone?

It is the unfailing fall of rain that sustains this world

Rain is the nectar of life

Rain produces your every meal

And is part of each meal besides

Though oceans surround it, this world will drown

From hunger if the drifting clouds deny us

When clouds withhold their wealth

Farmers cease to pull their plows

For it is rain that ruins, and it is rain

That raises up those it has ruined

Unless rain falls from the sky

Not even green grass will rise from the dust

Even the oceans will diminish

If clouds cease to take up water and give back rain

If the sky dries up, worship of the divine

In festivals and daily rites will wither

Unless it rains neither kindness

Nor holiness will grace this world

There is no life without water

And all these endless flows of water come from rain

~ Thirukkural

Nice to see you again. I missed you.

Thank you. Compelling words of an all together too foreseeable future.

I have missed your poetry as well.

As the saying goes:

Use it up;

Wear it out;

Make it do;

Or do without.

You got a good laugh outta me when I saw Jordan Peterson, cheers Henry!

I remember my grandfather as well (also grew up during the hard times of the 1930s) who hunted, fished and grew huge veg gardens with every kind of produce that would grow. The freezer was always full of salmon, ducks, venison etc. He even had a still for making his own moonshine.

As somebody who is on the right, but not a Trump supporter, it is extremely frustrating. My prediction is he will destroy the economy like 1929, and ensure another FDR rises. Then the conservative movement will be crushed for a generation.

He was handed the answer on a silver platter with the reversal of the Chevron deference. He could be suing the regulatory agencies out of existence. I’m sure as leader of the executive agency he could actually leverage a proper executive order around that. He pretends that if he sows chaos and lays of the workers, the rules and regs magically go away, when really they are just put on pause for the next admin to utilize. This is would reduce costs for domestic manufacturers.

It’s looking like the formula for these “tariffs” are trade deficit/total imports/2. The good news is the formula will self correct, when the total imports go down because no one will want to do business with us! It’s genius, oh wait!! lol

My tinfoil hat tells me that at least if there is a controlled demolition of the world’s economic order, then the globalist financiers will know to position themselves around BRICS so they control it rather than an organic development in the host countries.

Raymond Williams made a quip that the middle class or the petite-bourgeoisie always see the world in stark black and white colors. In other words, “this is the end of….” or “this is a new beginning” or “a point of no return”. All of which has never been the case. I believe it is not the end globalization and the rules based order, only that these current iterations may well be simply modified or transformed into more effective versions – as the marxists would say, for another round of capital accumulation, like the one that began in 1945 and has been in crisis since the US destroyed the gold standard. Perhaps the dirigisme of the post-war period but on a global scale will take hold. If so, the new political leaders will have to deal with a “capital strike” which has been effective in rolling back any taming of the market since 1945. But China has done something new: China has gone beyond the Lenin’s NEP and using state power controls Chinese capital quite effectively. They are not stupid and have put safety valves in place to rein when capital gets a little too “uppity”.

Minting millionaires makes a rich country poor. Most Americans are poor or poorish. Their America is not “the richest country in the world”.

Decades of Clintonite-Sh!tobamacrat perfidy and double-triple crossing helped create the vacuum which sucked MAGA into existence and Trump into power.

I don’t think Trump will care about a lot of the economy( he did say we would have to possibly experience some short term pain), until real estate, specifically his and his families, start taking in the backside.

Gee, if only there existed an elegant, robust and eminently fair method to accomplish such..

Wait!

There DID exist such a comprehensive system, and it was the KEYNES’-designed one, which the US summarily rejected at Bretton Woods.

One can only wonder how much different, peaceful and more prosperous (sustainably so) the last 80 years could have been.

I don’t think Trump will care about a lot of the economy( he did say we would have to possibly experience some short term pain), until real estate, specifically his and his families, start taking in the backside.

But meanwhile, buckle up.

https://www.reuters.com/markets/us/trump-says-he-would-like-see-federal-reserve-lower-interest-rates-2025-03-24/

Trump says he would like to see the Federal Reserve lower interest rates

So the Fed has to choose between possibilities: inflation that allegedly is supposed to mean raise interest rates and recession which is allegedly supposed to mean lower interest rates.

I just keep thinking that easy money for the well-connected is kind of like the hair of the dog that bit me.

And I’m wary of any phrases like “the inflation is transitory”.

Hearing a lot of jokes about the same people who are still complaining about lockdowns and asking people to wear a mask in the grocery store now cheering on the idea groceries will be unaffordable “for a while” for our long term good.

>Participants were asked to perform an innovative online cognitive assessment on the Cognitron platform, which comprises tasks that can detect subtle changes in different aspects of their brain function, such as memory, reasoning, executive function, attention and impulsivity.

The above from the earlier post about Covid brain and Cognitive Impairment.

Perhaps his advisors should have administered this to Trump before he pulled the trigger on tariffs…

But Trump said we won’t have to pay taxes anymore because tariffs will give us trillions. I saw it on the TV in between commercials for drugs that dont tell you what they are for while taking care of my elderly client. So everything is going to be great again.

By we/us he meant they/them.

900 people in the auto industry have already been laid off in Indiana due to down stream effects (they work on things that require parts from Mexico)

But Trump has said this pain is to be expected, wonder how long his base will accept this “pain” before they turn

They will learn they have to get poorer before they get poorer.

It’s gonna hurt so good!

This is worth reading regarding the tariffs. Essay by his chief economics advisor.

https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

Jeffrey Sachs: Trump’s Impoverishing Tariffs

The rest of the world isn’t ripping off the U.S. The American trade deficit is the result of chronically large budget deficits resulting from tax cuts for the rich combined with trillions of dollars wasted on useless wars.

https://consortiumnews.com/2025/04/03/jeffrey-sachs-trumps-impoverishing-tariffs/

p.s. German Mercedes Benz Group considers to move production of their SUV completely to the US

Mercedes Weighs Moving Some Car Production to US Over Tariffs

https://www.bloomberg.com/news/articles/2025-04-03/mercedes-weighs-moving-some-car-production-to-us-over-tariffs

https://archive.is/wtQlT

“(…)

Mercedes’ most popular imported model is the GLC. The German luxury-car maker sold 64,163 units of the SUV in the country last year, an increase of 58% compared to the prior year.

Starting at just under $50,000, the GLC has smaller margins and faces stiffer competition than more expensive models such as the S-Class sedan and G-Wagon, meaning tariffs are more likely to weigh on its profitability.

(…)”

Youtube

It’s rather stunning that, although Tariff theory and practice is well understood, the successful implementations found within US history, has not been publicly discussed at all, nor is it being adhered to.

Indeed, not a SINGLE PENNY of the $170 Billion in Section 301 Tariffs, collected since 2019, were ever segregated or appropriated, in targeted fashion, to rebuild or aid US industry.

Perhaps they should focus on more manageable Tasks, such as remedying our EGG deficit.

>Indeed, not a SINGLE PENNY of the $170 Billion in Section 301 Tariffs, collected since 2019, were ever segregated or appropriated, in targeted fashion, to rebuild or aid US industry.

Just imagine if the Nation had a forward thinking industrial policy, how much those funds could have accomplished if dedicated to growing a manufacturing base.

Forget even growing a manufacturing base, consider if it was just pushed into properly funding scientific research and PhD grants.

The NSF has typically gotten $9 billion a year since 2019.

Imagine tripling that number to $30 billion a year.

Or for something more impactful in our current era, boosting the NIH’s budget by a little over 50% from 48 billion to $75 billion a year.

Each $ spent on research returns over $2 in newly generated economic activity. Why can’t we have that kind of self-licking ice-cream cone instead of the US war machine?

A big increase in funding will not automatically increase the number of qualified researchers, so the law of diminishing returns could apply. Then again, after mopping the last shred of resistance at Columbia where they had a cheek to make temporary president strongly connected to Democratic party (even if totally ready to repress students to Trumpian satisfaction), so she was defenestrated, now they wrack their brains to find a Trumpian with amicable disposition, it will take some time. This model will be presumably applied to other universities, so funding streams will be chaotic.

Imagine next target: Tufts. Yes, a black sheep was stripped of visa, but what about citizens who allowed her to publish her op-ed? Why they are not expelled from Tufts yet? So far, grants to Tufts researchers are not frozen… Inquisitors in DoJ have a backlog of denunciations that they not acted upon yet (from “activist” organizations like Betar).

Ian Welsh:

“Trump’s Liberation Day: This Boy Could Fuck Up Boiling Water”

https://www.ianwelsh.net/trumps-liberation-day-this-boy-could-fuck-up-boiling-water/

I suspect this will cause a generalized wave of bankruptcies on the emerging economies. If US imports from other countries really drop on account of the tariffs, this would lead to a generalized shortage of dollars which would drive its value against other currencies. Given the disastrous finances of many countries (many of which borrowed through eurobonds, making dollar exposure particularly dangerous; though Servaas Storm and Andrew Fischer argue in a 2023 paper that even countries that only borrowed in their local currency are still greatly exposed to dollar fluctuations (p. 963)) even the slightest shock could be dangerous; this is verging (or perhaps even worse!) than a Volcker shock level of catastrophe.

If bankruptcies do happen I suspect we’ll see some major financial instability as bondholders find that their holdings have become worthless; and if they have done so on margin trading through Yen swap, then we’re in for a bumpy ride. Buckle up!

Theoretically, is it possible for all nations to simply not trade with the US, thus avoiding the tariffs altogether?

Yes, it would probably take a while to restructure the world economy away from this global interdependency on the US market, but does the move toward that restructuring begin as of now?

Do we begin to see more countries viewing BRICS in a new light? Do we begin to see Canada, Mexico, the EU, etc., by necessity needing to explore alternatives, no longer having a choice?

Not if the US has control of the sea.

I think the era of cheap drones makes that a non-starter (US controlling the sea.)

Sure, we can still project force regionally, like in the Middle East. But globally? I think the sun has set on that. China can build a swarm of naval drones, and Russia can too. Heck, Ansar Allah has for all intents and purposes, chased the US Navy out of the area and now we’re reduced to long range bombing runs from Diego Garcia.

You will be proved right by the first demonstration.

Right now the well informed believe as you suggest but no one is willing to break heard and act on it. This has been theorized for going on two decades.

A couple of Nimitz Class reef starters and it’s a whole new ballgame. But we’re still in the old one…

How long will the US have control of the sea? Can it replenish its stocks fast enough, man its ships, build more ships?

Oh shucks. Do you think they would literally use force to prevent this? That really scares me.

Great observation by Richard D. Wolff:

The context being that those 3 nations with a history of tension and conflict (indeed, Pacific NATO was centered around Australia, Japan, S. Korea, Philippines)

Stunning turn of events.

It takes real genius to inspire such unity!

Yes, if these three actually work together and with ASEAN, the tariff gambit is doomed.

The problem we all have then is that the only age old remedy the US has left is war, and a big one.

I do not think the US will be content to retreat into fortress America ( north and south). How many mob bosses went out without guns blazing?

I own a small business in the wholesale specialty food, spices, etc. We distribute nationwide into grocery, specialty markets, e-commerce. Much of what we import is under the larger tariffs. I don’t know how this will shake out but this will hurt a lot of people. Most small businesses just don’t have the resources and the runway to make it long with this kind of disruption.

But I wanted to reiterate something from the article about this lunatic obsession with trade deficits, since I am in the food business:

Think about something like coffee and demand for it in the US. What, are we going to turn all of Hawaii into a coffee plantation? Still wouldn’t be able to meet demand. Raw sugars? We could never meet that demand either. What about all the spices that make our food good and delicious and interesting? A lot of them can only grow in the tropics and the sub tropics. I think people don’t really think through and visualize the scope and of trade.

How can one man cause so much intentional damage? Where are our Senators and Reps?

Indeed.

I share your frustration with this wholly-illogical fixation of Washington.

The Trade Deficit is the direct result of the (deliberate) De-industrialization Policy (of 40 years)!!

It’s the logical conclusion and is working as intended!!

Pure madness and schizophrenia.

Senators? Reps? They are busy soliciting bribes (aka “dialing for dollars”). My D rep. is busy exploiting the disgruntled plebs by saying he can’t do anything unless they have majorities in Congress, so they need more money. Elections Inc. are very expensive

There’s an organic spice place I still order from in Somerville, from my time there, I guess they’re gonna get absolutely scorched on this. That sucks. Small locally owned business. Friendly people. There’s a confectionary almost right next door. They’re smoked too I suppose. Order Christmas chocolates there every year.

Sigh.

You may notice that Colombia and Brazil, the main exporters of coffee to the United States, are only getting the minimum. This is despite the absolutely draconian tariffs Brazil has placed on imported goods for generations. The administration does not want another spike in a breakfast staple just as people are getting used to the price of eggs (which we are also planning to start importing from Brazil).

We already have a trade surplus with Brazil.

The Pentagon used to invade countries so that they could steal their oil. After Trump, the Pentagon will be invading countries so that they can steal their coffee and sugar plantations

True, Rev Kev, but they also invaded to steal bananas many moons hence.

Clearly we’re going to send secret trade missions by sail to find the passage to the land of spice in the east! We’ll commission privateers to bring us silk and strange things from the orient, it will fire the imagination and be gloriously inefficient. I can’t wait to see pirate wear and breaches come back into fashion. Where is my spyglass? I must needs make to my ship, the TDS Destroyer…

As for where our congressional representatives are, they’re where the dry powder is kept. Safe and unused.

First, we all need to rewatch the movie “Idiocracy.”

That said, I also believe that Trump’s idea of re-shoring US manufacturing industry is equally misguided. The US has de-industrialized, so expanding an existing plant for many types of industry is a non-starter. Establishing a new US manufacturing plant takes years, even if the economic payback is nearly certain, and ‘certainty’ is not a word in today’s US political/economy.

Citing and building a plant or taking over an abandoned one is a major investment. Then one must import the machine tools, since we no longer make them in the US. Then we must import design engineers, production engineers, and other experienced manufacturing personnel since we no longer have been educating folks in these fields. (Plenty of financial engineers, however.) Then we must establish supply chains, hopefully domestically, to source the necessary raw materials to produce a product. Then you must hire and train a work force that can operate the new machinery, and do so efficiently, in order to keep costs to a minimum, and so hope to make a profit.

I’m sure others could add to these problems, but in short, as Yves would say, na ga happen.

For re-industrialization to work we would need to start with affordable housing, affordable education, healthy, affordable food, and health care in deed, not just name, to hope to have the workforce with which to first build and then innovate manufacturing, hell, even to keep imported Chinese robots running.

The spreadsheet generations spawned by the Business School proliferation post Reagan have lost all contact with the real world and have become accustomed to forcing various realities to conform to their spreadsheets. Which was possible with all the redundancy integrated into the multiple layers of the New Deal.

Once that redundancy was consumed, as it was largely by the .Com Crash, funny money was the only thing that could keep the spreadsheet charade going. These people have been insulated from real world consequences for a full generation now and have lost touch with reality to a degree beyond even the late Soviets, who at least still understood what good food, health and education were. Putin had an easier time picking up the pieces than whoever our rye catcher turns out to be, these children are falling off the clif.

It took an effort of about two centuries, including over a century of a deliberate federal policy called the American System, from the time of the American Colonies to the imposition of Neoliberalism in 1972 to create the autarchic industrial superpower that was American. We do still have the dregs of it including a few septuagenarians who remember who to manage industrial production, but the dregs are rapidly disappearing.

You mean the ones that the DOGE bois see as useless encumbrances?

Yep.

Not just that, but we can safely assume that most, if not all modern manufacturing facilities will be mechanised, requiring minimal human employees. So even if you onshore *some* American manufacturing, you’re not necessarily going to bring manufacturing jobs back.

The whole tariffs fandango is a “Ponzi scheme,” to quote that great statesman, the Wizard of Subsidies, Elon Musk. I encourage all of youse (Chicago dialect) to read the Fact Sheet: President Trump Declares National Emergency, Golden Age, and Dog Food for Citizens for Lunch.”

The headline is incorrectly styled — semiliterate. The Fact Sheet is a long list of snivelling. If you would like to witness how far the U S of A has declined, the Fact Sheet is a good gauge. Keep in mind that this Fact Sheet is no isolated incident — all one has to do is listen to Nancy “Stock Tips” Pelosi or Kamala “Premier Lethal Force” Harris for similar resentment, grievance, and illogic.

But the Fact Sheet slips up: “Countries including China, Germany, Japan, and South Korea have pursued policies that suppress the domestic consumption power of their own citizens to artificially boost the competitiveness of their export products. Such policies include regressive tax systems, low or unenforced penalties for environmental degradation, and policies intended to suppress worker wages relative to productivity.”

Pot, meet kettle.

Further, if you look at the Newsweek “Reciprocal Tariff” chart, you will see more amateurishness, along with this quote from Trump: ‘ “This is Liberation Day,” Trump said during a Rose Garden ceremony, holding up a printed chart of countries and their new tariff rates. “For decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike.” ‘

He makes Scarlet O’Hara look like an intellectual.

The base tariff for the EU is 20 percent. But the U S of A is the land of “don’t know much about geography.” This means that there are 10 percent tariffs for San Marino, which is functionally part of Italy and uses the euro. So all of the Italian economy can now filter through the Serenissima Repubblica Piccola. Likewise, Andorra is listed at 10 percent. But the heads of state of Andorra are the president of France and the bishop of Urgell in Catalunya. Hmmm. Martinique is listed — but Martinique is a départment of France. Like a state, only smaller.

Just as DOGE is marked by ineptitude, so is this tariff regime.

I find the fact sheet and Trump quote to be what amounts to candyassery from some so-called tough guys. You know, Pete Hegseth and the tattoos. J.D. Vance and his Tartuffian clerics. Elise Stefanik beating up Palestinians for the greater glory of Jesus.

The U.S. economy is hollowed out. So is the U.S. elite. The inability of U.S. elites to make a meaty argument is long gone — Ukraine is the war of memes and pantsuits. The understanding of actions and consequences has vanished — just as one would expect from the children of the U.S. upper-middle class used to crashing cars and cheating on exams.

As Yves Smith and Lambert Strether have reminded the readership, power is lying in the street ready to be picked up. The current AOC-Bernie roadshow is an attempt to deflect attention from how rickety the structure is.

What is to be done? The tariffs aren’t an issue of economics. The tariffs are an issue of power.

Do I have to quote Patti Smith?

> Do I have to quote Patti Smith?

‘Jesus died for somebody’s sins .. but not mine’ ???

“Freedom is…the right to write the wrong words.” ~Patti Smith

or perhaps the preference is:

“People have the power to redeem the work of fools” ~Patti Smith

Surely not “people have the power!?”

Do I have to quote Patti Smith?

Pissing in a river watching it rise

There’s a little trick you can use when reading most anything supplied by the USG (or their presstitutes) that will make perfect sense to the sane:

Just reverse the subjects of the article.

Example from above:

“For decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike.”

Voila! it is now accurate….

“For decades, nations near and far has been looted, pillaged, raped and plundered by our country, both friend and foe alike.”

True, but you didn’t mention the bottom eighty percent of the American nation that is also plundered. If you want enemies, then the American elites and their lackeys, the elites of other countries, are truly ones.

Why San Marino? There are no tariffs on the Holy See….

Horses, horses…

“Because the night belongs to lovers”?

Gung Ho?

Something, something, “one more turn of the wheel”?

Power is lying in the street ready to be picked up? Too late. The Triple Nazi Revolutionaries ( Republicanazi/Silicon technazi/Christianazi) have already picked it up and are running with it.

Would anything short of a megadeath civil war be able to take that power away from them at this point?

Ai ! …and there it is. Presume some best of all possibly worlds in the worst of times, and somehow the April 5th Marches turn also into the April 6th and 7th and 8th Marches and Sit-Ins, and the Occupations of Mid-April/May. Unlike the revolutions given cute colors throughout the world in the past, there will be no US Congressional DemocracyDemocracy funding supporting dissidents. (One wonders if Musk was prescient instead of just trying to placate China when he closed NED/NDI.)

Which of all the things trump’s puppet masters have done will be the line crossed? What great plans will who have when the 1%-lickers criminals march themselves into prison, ceding power to the _______. Will “Homes and Jobs for All” break through as the #1 focus? Will “Medicare for All” get added to the chant? Will “A Future Fund to handle the climate crisis of 50 years hence from what we are burning today” be added?

Yeah; well, American’s don’t do multi-day marches, or storming of the capital…oh, wait…Uhm, Fact-based American’s don’t do multi-day marches or storming of the capital…but I was just wondering what the end game might be if it did.

What is the “financial crisis (as opposed to just plain super bad recession)” doing in the middle of the following sentence?

“Mexico, which does run a large surplus with the US, is somewhat financial crisis (as opposed to just plain super bad recession) protected by virtue of having large FX reserves.”

If you read it without the parenthetical interruption part it makes sense.

I tripped over this too, but if you remove the parenthesized part, it looks OK (or at least to my non-native speaker eyes).

My selfish silver lining: I’m a youngish guy and haven’t had an opportunity in my adult life to buy stocks cheap. 2008 crisis and dot com bubble we’re both before my time. If the SPY does a real dive I might have to sell some gold and gold miners to gobble it up.

Young people should be celebrating today. Not to do the inter-generational warfare thing, but boomers with bloated portfolios and overpriced homes have been a bug in search of a windshield for quite some time.

Also, some of the companies getting sold off the hardest are the ones that screwed us all the worst.

NVDA, Broadcom – building chips so our tech 0verl0rds can build an AI hellscape.

Apple – gave us the iPhone which led to social media addiction, attention span deficits. Relies on China for labor and evades environmental laws.

Boeing – builds weapons to kill brown folks. Kills with shoddy MAX planes that fall from the sky and doors blow off midair. Down 8%. Just die!

Frankly, if the price of seeing these suckers go down is watching my 401k shrink, I’ll gladly pay it.

What percent of boomers have bloated portfolios? And what percent of boomers have overpriced homes? And what percent of those boomers who have overpriced homes are “house-rich/ survival poor”? If they are forced to sell their overpriced home, and every house on the market costs two overpriced homes, and every apartment has overpriced rent?

” Not to do the inter-generational warfare thing” . . . . oh, no. you wouldn’t do that . . .

Piece of work you are. A financial crisis benefits no one except a few saavy individuals which no generational label can be affixed. You actually think the generations succeeding the Boomers are waiting for them to be crippled financially so that they will be able to pick up the hot commodities and the only reason they couldn’t was because the oldies had an extra 100k in their 401s? Face it, if the over 60 set loses everything, the younger generation’s chief driver of wealth (inheritance) goes down with ’em.

having lived through it…. November 2008, buying the financials hand over first….was the only time I ever had heart palpitations as I was keying in the orders. And holy __*#*@#__ was my heart pounding.

It won’t be a real bottom unless you are physically ill while entering a buy order, lol.

Right on cue, Scam Altman hands out crack like a drug-dealer at a school:

Free AI kids, just in time to cheat on finals!

Restated, they want our kids (and us) stupid. Hey kids! Don’t think as that’s so hard! Use AI instead!

I kinda, sorta see that ultimately this AI bezzle might become our overlord, but I also remember the phrase that algorithms are biases in code.

And thus the wheel turns. Guy who could be thinking about building community, innovating useful things for society as a whole, protecting the vulnerable just does what any guy with a few spare bucks would surely do — buy the dip baby, buy the dip. Even from the carcass of all those who did the same thing before. And no one learns, and nothing changes. ‘Cept for some money money money changing hands. Hey maybe that 10 will make babies with me and our super mega alpha offspring will survive the coming climate apocalypse with their godgiven genius genetics, catch a ride to Mars, and if not all the way to the moon!

Annie Lennox, Yves, that’s merciless. But don’t forget the full lyric, which is even more applicable to Pharma:

– some of them to abuse you

– some of them want to be abused.

https://www.youtube.com/watch?v=Zq9gy6MFrl4/

Bears Dance to Sweet Dreams (Remastered)

Thank you for that. It’s springtime, bears are waking up from their long winter’s hibernation.

And they’re hungry …

Michael Roberts included this in his take on our liberation, it’s an angle I hadn’t seen addressed elsewhere:

Boy, I thought the way Biden was handling re-shoring industry was bad, but at least it was identifiable as a re-shoring effort.

The Trump re-shoring effort – is this even a real policy? The way they calculated them is crazy.

This looks like a way to wreck America so that the billionaires can buy it for nothing. Pair that with the random firings of Federal workers, and about all I can make of this is billionaires win, everybody else – rule two:

1) Because markets.

2) Go die.

Some shows are reporting this “policy” was created using ChatGPT. Well, makes sense I guess.

Yes, https://www.theverge.com/news/642620/trump-tariffs-formula-ai-chatgpt-gemini-claude-grok

I believe Laffer did the Laffer Curve on the back of a bar napkin.

Ha, we need an acronym for AI in, fantasy out.

freakshow, man.

this will not end well.

I had a flashback to a very bad “acid trip” (called the SARS Coronavirus – 2,) I had in 2020.

Are we going to have “runs” (no pun intended,) on toilet paper at the shops soon? A decently large part of Americas toilet paper is imported.

See: https://housefixmaster.com/is-toilet-paper-made-in-the-usa/

Also of concern is the nature of the Administrations policy towards foreign made generic drugs. I can see this lot exempting precursor substances for Brand Name drugs made in America and steep tariffs imposed on the cheaper versions of said high priced drugs. Watch this space.

Time to put on the body armour and head on down to the Bigg Boxx store.

Upcoming Zeitgeist Reports, no matter the source, should be ‘interesting,’ just like the times, to say the least.

Panic now and avoid the rush!

Stay safe.

I already bought my Costco paper products for the year, so the rest of you can feel free to panic or not as you see fit.

I have a Thailand-style bum gun, so I’m not worried about that. But I might make a Costo run to load on coffee beans. And olive oil…and maple syrup, and…

Hmmm… “bum gun.”

Is that some sort of “Pucker Sahib” term from the days of the Raj?

I think it’s 90s backpacker lingo.

I’m a huge fan of the bum gun and have come to view toilet paper as a barbaric relic.

A point — if someone throws feces in your face, what do you go for first, water or a paper towel. I’ve never looked at the toilet paper vs water debate the same way since.

Interview with Ha-Joon Chang on Trump’s tariffs: https://youtu.be/Shz3mSMqW04?si=ElpsZSX5VWxz4K13

It’s not just numbers; There is the loss of consumer and investor confidence. Both prefer some sort of stability. Trump forgot to sell his vision to the ‘people’: “This is where we are going. This is how we are going to get there. These are the sacrifices that need to be made.” So on and so forth. People will follow leaders who are resolute and methodical. Jittery people are prone to panic ; and if the latter sets in, it’s every individual for his or her self. The US is like a drug addict high on debt. Trump seems to think he can bludgeon others into investing in a corpse in need of life support.

Aurelien’s latest has an excellent take on just this “every individual” event.

Analysis in Spain is as bad as you can get. It will have direct effects on wine, olive oil exports, machinery, electric equipment and auto parts. More difficult is to predict effects on longer supply chains which go through other countries, for instance via Germany. It is expected a 0,2% impact on GDP and it is said that Spain is among the less affected European countries. Some fear invasion of Chinese products but without real analysis behind.

When i was living in California i bought Spanish wine, not because i was trying to be patriotic, but for its excellent quality/price ratio compared with any other wine.

>>> but for its excellent quality/price ratio compared with any other wine.

That is what irks me the most about the Trump tariffs; frictionless international trade is not desirable but neither is the American consumer subsidizing awful decisions made by American MBAs.

IMO, the stereotype of a “Made in Japan” car being better than an “Assembled in USA” car is proven more often wright than wrong—-even if the car is “Assembled in the USA” by Toyota. (Usually due to design/financial choices made by someone in an office versus due to an act by a factory worker)

Yves has said before that tariffs on raw material imports don’t even make sense

Happened across CNBC’s page, banner headline, breaking news that Trump says the rollout is going well, yada, yada.

Has me thinking of a scene from The Naked Gun: nothing to see here…

https://www.youtube.com/watch?v=aKnX5wci404&pp=ygUdbm90aGluZyB0byBzZWUgaGVyZSBuYWtlZCBndW7SBwkJYgAGCjn09Vw%3D

Nothing to see here, move along. Mr. Margin probably showed up around 3:15 and cleared his throat.

Plunge Protection Team – you are hereby notified to report for duty. This is not a drill!

Mr. Margin?

I think the dreaded words: Margin Call, is going to be hitting quite a few in the face going forward. And let’s mot forget the markdowns coming in banks among all their holdings.

https://www.youtube.com/watch?v=j4SRsGn14PI&pp=ygUaVHJhZGluZyBwbGFjZXMgbWFyZ2luIGNhbGw%3D

Oh yeah, regional banks stuffed to the gills with zombie office towers are no. 1 on my bingo card.

Then there are the unknowns … who is swimming with no trunks on?

Problem is, unlike 2008 we don’t have enough detectives on the beat to figure out who the victims are. We have to wait for a bank to blow chunks like some frat kid who overdid it at a kegger.

Musical accompaniment for the next 20 mins of trading … or the next couple of years:

[When the levee breaks/Led Zeppelin]

https://www.youtube.com/watch?v=JM3fodiK9rY

That there’s yet another insurance industry damaging weather event at scale happening in real time is irony of the first order. How long before the wheels fall off?

Latest on the tornado outbreak:

https://weather.com/news/weather/news/2025-04-03-live-updates-tornado-outbreak-arkansas-indiana-missouri

Yeah, one of those F4s could take down a faulty tower or two, timberrr!

>Yeah, one of those F4s could take down a faulty tower or two, timberrr!

Timgerrr…

We’ll let that commenter speak for themselves …LOL

4:04 as I type this. Square those accounts…

Spare a thought for Mr Powell in all this. He is the one who will have to decide who to bailout. The mess is too big this time to bailout everyone a la Covid. Hopefully PE will not be on the list

Though I think that this is just another initial bargaining bid by Mr Trump and they wish to redo trade with most countries on an adhoc basis one by one.

And to think the bailout basically ended up in billionaire pockets by the end. So maybe they are counting on a massive bailout..

Thanks for that last part about the Asian markets. We just a had an Asian customer tell us today that they didn’t want to send payment yet, and were going to wait a week or two in the hopes that the exchange rate was better. Now I know why.

On the discretionary spending front

https://www.43rumors.com/trumps-tariffs-will-drastically-increase-the-usa-prices-of-om-lumix-gear-om-3-price-could-go-up-by-45/

A blast from the past. Fitting for today.

https://www.youtube.com/watch?v=cOrLasoStes/

WTO 1999 Seattle protest footage

Indeed and wait until the protests are about lack of food, medicine, jobs, you name it. Coming soon to a city near you if I’m being pessimistic about it all.

Get your victory garden ready to go. Or find a friend with exra space. Or community gardens. We need to help each other nowadays.

Ahhhh – a trip down memory lane. I remember the tear gas wafting up the Pike/Pine corridor well. Lots of cops all over the place yet somehow none of them could stop those “anarchists” or “renegade protesters” (aka cops) from carrying out their vandalism.

The whole thing started if I remember right with a righteous labor march, which wasn’t covered much. Then black bloc types showed up which allowed the protest to be discredited – imagine that.

Musical accompaniment

I remember the “riot” at the 1972 Republican convention on Miami Beach. The “Forces of Law and Order” started it. I saw that part first hand.

Be prepared to “liquidate” agents provocateurs and various sorts of “stealth police agents” during the height of the chaos. They are killing us. Time to return the favour.

Stay safe. Go grey.

I believe Laffer did the Laffer Curve on the back of a bar napkin.

With a swizzle stick?

Viewing Trump as the “Joker” from “Dark Knight”, I suppose this clip from the movie might be more fitting:

The Dark Knight – Alfred explains the Joker: Some Men Just Want to Watch the World Burn Scene

https://www.youtube.com/watch?v=uC3rWcP_TVU

The Joker in the Dark Knight was never seriously challenged by the Gotham’s crime bosses. I can suspend disbelief for a movie. I find difficulty believing the Elites running the u.s. are unable to challenge Trump. That leaves me very suspicious of the inaction of congress and the u.s. Elites in the face of Trump’s seeming leap into chaos. I cannot believe there is not much more going on than meets my eye. I have no idea what, and grow frightened at what may come.

The elites in the US have a scale problem.

In the case of elected elites, you have two incredibly unpopular parties, the GOP is a Trump vehicle. Then state governments piggyback off of federal structures and are heavily dependent on federal dispersal of dollars.

The financialization of the elites is an issue. They aren’t controllers of steel mills. I think the Knights Templar are a good example. They gave up their old power for finance. Then they went poof. There is no Duke of York. There isn’t a sub government.

Obama’s popularity and Team Blue’s absence from the scene helped the 2008 bailouts get through and continue into the Obama years.

I’m reminded of the assurances that Shrub’s daddy’s friends would be handling everything. We aren’t dealing with the offspring of those dolts. The elites don’t have a clue.

Here is an example — https://www.desmoinesregister.com/story/money/business/2025/04/01/whirlpool-layoffs-amana-iowa-plant-losing-one-third-of-workforce/82757127007/

Donald Tusk said “A severe and unpleasant blow, because it comes from the closest ally, but we will survive it. Our friendship must also survive this test.” Radosław Sikorski said “Thank you, USA”, probably.

“Thank you sir, may I have another”

The effectiveness of the treatment will only be decided by future backward looking glances, as is the usual case. In the meantime “there will be weeping and gnashing of teeth” and there will be winners and losers. Differentiating between the two classes in a capitalist style economy is clearly self-evident.

And pain, ‘there will be pain’. For the losers, great pain, no doubt, but it is the economic game and its myths and dreams that mostly everyone is currently addicted to. So, play on.

“Access to cheap goods is not the essence of the American dream,” Bessent said during a speech to the Economic Club of New York. “The American Dream is rooted in the concept that any citizen can achieve prosperity, upward mobility, and economic security.” “. . . and Trump has acknowledged the tariffs could cause American consumers “some pain.””

We survived COVID-19, we can survive Trump. Not overreacting to Trump should be standard meditation. That said, I hope to hear something from the winners. How are small producers faring? With so much volatility, I doubt these businesses will make any long-term investments until these tariffs start to feel permanent. The Trump administration will have to offer interest-free loans to domestic producers if he fails to see immediate economic results. The man may eventually trip and stumble into some sort of industrial policy, a far smaller one after he is forced to roll back all his grand pronouncements. I don’t doubt he is reenacting the lockdown economy and the wasted opportunities of that crisis.

When was COVID survived, exactly? This is not past tense. The virus continues to disable and kill. The American elite failed to rise to the challenge, preferring stochastic eugenics instead. Biden and liberal Democrats allowed whatever material benefits from the early stages of the Pandemic to expire.

Survive, perhaps, in so far as society hasn’t yet collapsed from this ongoing debacle. But public health is effectively dead. And that’s going to continue to bear rotten fruit.

You cannot have public health in a neoliberal regime so utterly committed to social atomization that it doesn’t recognize a public, let alone public goods.

The wages of neoliberalism are death …

No/ low interest for domestic producers/ employers and high interest on everything else to curb inflation and (critically) the rampant financial SPECULATION we have in lieu of real economy investment.

But if things stand as they are, global recession/ depression.

So I was bored and looked at the exclusions of for the tariffs….https://www.whitehouse.gov/wp-content/uploads/2025/04/Annex-II.pdf

https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

there are a lot, too many to shift through as a hobby. some that stood out….

children’s books = excluded.

globes, yes globes! = excluded;

certain electronics = excluded;

certain plywood = excluded;

wood pulp? as I was curious about that as someone above talked about toilet paper = ?????? (dunno the exact term for toilet paper feedstock)

So don’t go to Mega-Lo Mart to hoard without checking that list, lol

and that was one thing that I noticed once the kids appeared…..the US has no children’s book printing industry anymore. everything is printed in you-know-where.

versus all of the 70s/80s-era “Little Golden” or Richard Scarry books that we have.

>and that was one thing that I noticed once the kids appeared…..the US has no children’s book printing industry anymore. everything is printed in you-know-where.

Who needs books when you can just shove a screen in from of little jimmy and Julie’s face and get them hooked on electronics for the rest of their lives?

Novara Live UK on American Liberation Day

Donald Trump’s Tariffs Spark Global Turmoil

What cards does Vietnam have in tariff negotiation as US slaps 46%? (VN Express News)

46% is causing quite the consternation here, despite The Party’s positive-sounding words about “8% growth remains the target’. Vietnam had already cut import tariffs in US goods and appears to have limited space for negotiation.

Round-up here with some relevant nuggets:

—-

“The impact will be devastating,” a business owner told me.

—-

The Trump administration was floating the idea of reciprocal tariffs for months, and experts’ opinions about this ranged from pessimistic to optimistic. But few expected a rate as high as 46%.

Set to take effect on April 9, the tariff will apply broadly to Vietnamese exports to the U.S.

“The impact will be devastating,” a business owner told me.

To grasp the scale of this impact, consider this: If Vietnam’s exports to the U.S. remain at $119 billion annually and most goods face a 46% tariff, the total tax burden will be around $54.74 billion or over 10% of Vietnam’s GDP.

Some argue that Vietnam will not be at any great disadvantage since other countries also face tariffs. But that is not the case since competing nations have lower rates.

The tariffs are 36% for Thailand, 26% for India, 32% for Indonesia, 24% for Malaysia, 37% for Bangladesh, 17% for the Philippines, and 29% for Pakistan.

Vietnam’s rate is matched only by those of Cambodia, Laos, Sri Lanka, and China, which puts its goods at a 10-20% cost disadvantage against key competitors.

The most severely affected industries will be electronics, textiles, footwear, and furniture.

Over the long term, multinational companies may rethink their production and investment in Vietnam, which could slow the country’s economic growth.

So what will Vietnam do over the next week?

At a meeting this morning Prime Minister Pham Minh Chinh addressed the issue.

What options does Vietnam have?

One option is cutting tariffs on U.S. goods. Vietnam has already taken steps in this direction, lowering most favored nation import duties on various American products on March 31.