It seems more than a little short-sighted for Team Trump to profess so much desire to bring production and manufacturing to the US, without apparently talking to many, let alone any, people who make things. The Trump tariffs will deliver a crippling blow to an already reeling ex-China auto industry, with little in the way of prospects that much manufacturing will be brought home. Trump’s tariffs and his hostility to electronic vehicles are inimical to industry success, or even merely regaining its footing.

The car industry matters because outside housing, vehicles are the biggest and most important purchase most households make. It was once the engine, pun intended, of US industry, as witness GM president Charles E. Wilson, saying during confirmation hearings to become Secretary of Defense:

I thought what was good for our country was good for General Motors, and vice versa. The difference did not exist. Our company is too big. It goes with the welfare of the country. Our contribution to the Nation is quite considerable.

As Big Serge wrote in a magisterial article on World War II, US dominance in vehicles played a critical role in the war, as it produced vast volumes of tanks and transport equipment. The auto business drove the demand for other key sectors: steel and tire factories, oil production, and of course made possible America’s infamous urban sprawl. Carmakers’ status then as defense contractors and private sector masters of logistics and manpower (albeit not of the rapid implementation sort required in war) made their top execs logical picks to lead the Defense Department.

As most readers know, US carmakers started losing ground to German and Japanese manufactures in the 1970s, with the business press and academics criticizing sclerotic US managements. But even after decades of market share loss, the US car industry was still an important enough economic flywheel to get its own bailout in the wake of the global financial crisis.

Trump, mired in his romantic view of the 1890s, is looking forward to the world when Ford’s River Rouge factory employed over 100,000 people. But the future of production is one stripped of workers:

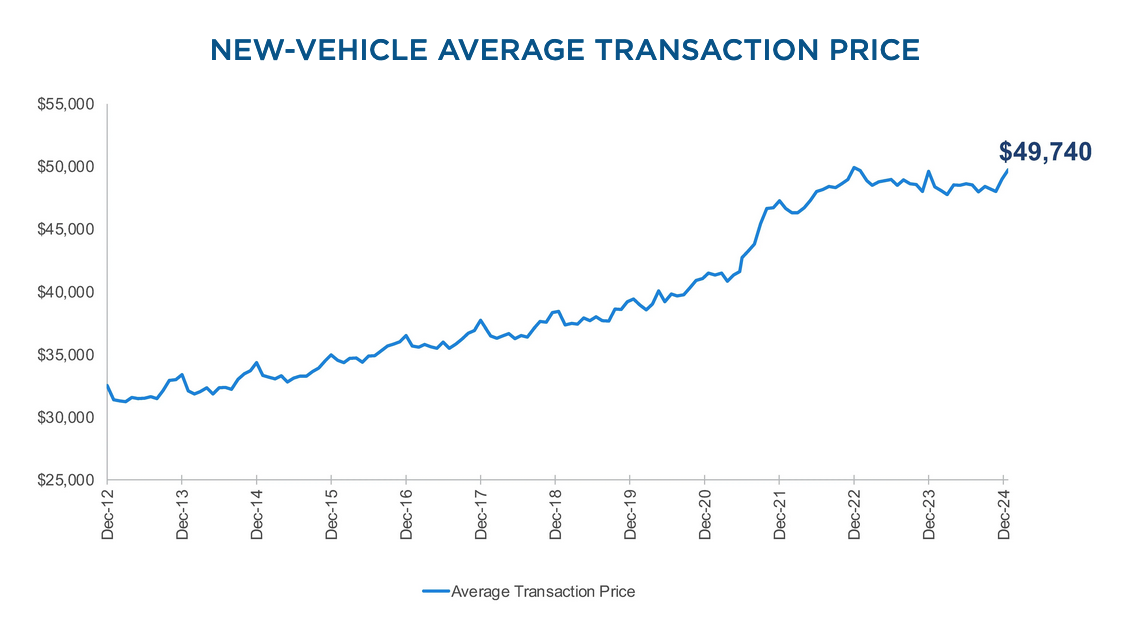

And factories like that require confidence in demand for output, something sure to be surely wanting in most US industry and even more so for cars. The trend among the incumbents for decades has been to lard up the vehicles with features, some admittedly mandated like air bags, but most of which turned cars into feature-bloated computers on wheels: ever more lavish entertainment centers, embedded GPS (drivers here simply use their phones, keyless starting and locking (inferior to and more costly than keys) and rear-vision cameras. The reason we lamented the slow-motion demise of Nissan is that it is the last maker of relatively inexpensive vehicles, which is, or ought to be, a critically important segment, particularly given the price trends Paul Greenwood described in comments:

ou do realise car prices have doubled inntjevpadt decade ? In 2016 a Ford Fiesta kn U.K. cost £10,345 and in 2023 it cost £19,350

Nissan Qashqai from £18,545 to £30,135

Incomes in U.K. stagnated after 2008

Cheapest VW Golf in Germany €31,145

2021 it cost €20,70050 years ago average car price Germany was 38% annual average salary today 2024?it is 10 months average salary Yet Nissan quality took a dive due to its alliance with Renault.

The US version of this story, using data from Kelley Blue Book:

As Newsweek pointed out in January 2024:

In 2023—a year during which inflation slowed down to the point that the Federal Reserve decided to stop hiking rates—new car prices rose by 1 percent to an average of $50,364, while used car prices fell by only 2 percent to an average of $31,030.

But as things stand, cars are still really expensive for many Americans. Just 10 percent of new car listings are currently priced below $30,000, according to CoPilot. Things are not much better in the used car market, where only 28 percent of listings are currently priced below $20,000.

According to an October report by Market Watch, Americans needed an annual income of at least $100,000 to afford a car, at least if they’re following standard budgeting advice, which says you shouldn’t spend more than 10 percent of your monthly income on car-related expenses.

That means that more than 60 percent of American households currently cannot afford to buy a new car, based on Census data. For individuals, the numbers are even worse, with 82 percent of people below the $100,000 line.

A Bain industry overview from January 2025 (as in before the idea of harsh tariffs were in play) described how automakers were focusing on upper-income buyers, and seemingly abandoned most prospective buyer. This is even Chinese cheap and cheerful electronic vehicles having been kept out of the US and EU by 100% tariffs, which would give them some cover in offering more basic, and therefore cheaper, cars. It also describes how suppliers have been so stressed that they might seek support from carmakers, like two drowning people desperately grabbing each other to try to keep their heads above water. Amusingly, this overview promotes a related brief How Auto Suppliers Can Navigate the Industry’s Perfect Storm:

As volatility has become the norm for the automotive industry, it has upended traditional profit margin dynamics. For two decades leading up to 2019, automotive suppliers’ EBIT margins were on average 1 to 2 percentage points higher than those of original equipment manufacturers (OEMs). Then came massive supply chain disruptions with the Covid-19 pandemic and global chip shortage, plus higher raw material and energy prices, and now rising borrowing costs and wage bills due to inflation. Automotive OEMs were able to ride out the supply shortage by focusing production on the highest-margin models and raising prices, but suppliers had no such strategic options…

Here are some of the key takeaways through the third quarter of 2024:

- The third quarter of 2024 marked a turning point. Supplier margins exceeded those of OEMs for the first time since the pandemic upended global markets in 2020, reversing a trend that had stretched 17 quarters. OEMs’ average profit margin fell to 6.2% in the third quarter, down more than 2 percentage points from the 2023 average. Meanwhile, suppliers recovered slightly to a 7.0% average profit margin.

- Decreasing margins for OEMs indicate softening customer demand and increased downward pressure on prices. OEM margins may get squeezed further in 2025 and beyond by persistent inflation and high interest rates causing subdued demand, rising costs, and falling prices. In addition, growing uncertainty around the pace of electric vehicle (EV) adoption will likely force OEMs to shoulder the dual burden of producing both combustion engine vehicles and EVs for an extended period, further pressuring margins. Many OEMs have already announced efficiency and performance improvement programs, including a reduction of material costs, that will likely put additional pressure on suppliers.

- Despite improving margins in the third quarter, a two-fold challenge for many suppliers remains: They’re still suffering from higher input costs (even though material costs have receded from all-time highs) while OEMs increase cost pressure even further. A growing number of suppliers face liquidity challenges that will likely require special support, including from OEMs, to prevent insolvency.

We have skipped over the elephant in the room of electric vehicles, which represent an even more difficult challenge to established car makers than the shift to smaller, more fuel efficient, and cheaper cars did in the 1970s and 1980s.

To simplify, EVs have vastly fewer parts than traditional internal combustion engine powered vehicles and of course also require developing competitiveness in battery performance, particularly charging speed and driving distance per charge. And as a result, cheap and cheerful low end Chinese EVs are reportedly popular in some non-tariffed markets like Mexico.1 And the Chinese EV makers have been going from strength to strength in their home market. Upper end buyers used to prefer European and Japanese brands. No so much now.2

Despite the rapid growth of EV uptake, some experts contend that the ICE can’t be eliminated due to user needs (such as charging stations in the still significantly low-population-density US will never be sufficiently distributed). Toyota, for instance, maintains that the market will top out at a much lower level than is widely assumed. From Forbes in 2024:

Akio Toyoda, the man who led Toyota as its CEO for 13 years, and now holds the chairman spot, believes that battery electric vehicles (BEVs) are not the final answer. No matter what the auto industry undertakes to promote growth, Toyoda says the electric car segment will only ever account for a maximum of 30% of the market. The fact of the matter is that several markets have already cleared that percentage, some significantly.

Notice the terrible position that results for traditional car makers. They have big installed production bases but are faced with a big fall in volumes. Like managing a retreat in war, managing in an industry in fundamental decline is something MBAs and shareholders don’t adapt to well. On top of that, if Toyoda is correct that the future is not an awkward long-term exit, but having to operate in a shrunken industry so as to best harvest not-exactly-legacy assets, and keep ICE customers happy (consider the problem of parts)….when the other incumbents will fight ever harder over the shrunken pool of customers.

And the European and UK player were in even more pain due to the sanctions blowback of persistently higher energy prices, which makes them structurally less competitive. Recall the shock across Germany last fall when Volkswagen announced plans to close at least three plants and downsize others.

Now with that sorry background, to the impact of tariffs on the car biz. Keep in mind a key point often made both with respect to the US reindustrializing and Europe building an arms industry: it would take at least ten years, with substantial government support. But advanced economies became allergic to formal industrial policy, while doing a lot on the sly to curry favor with powerful interests, and even more so under our current libertarian state-smashing exercise.

Benzinga confirms that this general view applies to the US auto industry: “Reshoring auto parts is “essentially impossible” due to high U.S. labor costs and lack of skilled workers.”

As we’ll see soon, parts are the key part of this equation even for cars nominally made in the US. For instance, Mercedes assembles German parts in its factory in Alabama. Ditto for BMW’s facility in Spartansburg. Japanese makers, along with Ford and GM, bet big on Mexican production.

Nearly half of all vehicles sold in the United States are imported, as well as nearly 60 percent of the parts in vehicles assembled in the United States. That means the tariffs could push up car prices significantly when inflation has already made cars and trucks more expensive for American consumers….

Mr. Trump argues that the tariffs will increase domestic auto production, but it’s not clear how fast he can accomplish that goal. Tariffs can encourage companies to use more products from the United States and expand production, but new factories typically take several years and can cost billions of dollars to construct.

The additional costs that tariffs will introduce could also backfire economically, harming the U.S. auto industry by squeezing its profits and slowing its sales….

The administration said the 25 percent tariff would apply to both cars and car parts made in Canada and Mexico, despite the U.S. trade agreement signed with those nations. It created a small exception to those levies, saying any content or materials that originated in the United States but were incorporated into cars finished in Canada and Mexico would be exempt.

Otherwise, White House officials indicated that there would be no exemptions, and Mr. Trump said Wednesday that he expected the tariffs to be permanent.

While we are focusing mainly on Trump’s misguided attempt to increase US production by punishing car buyers and makers, the impact on foreign marks is dire. For instance, Jaguar Land Rover has “paused” exports to the US for a month. The BBC notes that the US is the British car industry’s second biggest export market after the EU. The Japanese didn’t just bet big on Mexico for parts; they also export “foreign” cars from there. 3 Volkswagen has similarly halted rail shipments of its cars from Mexico and its “tariff affected vehicles” will stay in US ports until the German manufacturer figures out what to do.

The Wall Street Journal gave an in-depth account of the expected cost to the American industry and its workers. It opens with Ford, which depicts 80% of its vehicles as made in the US. Except not:

But a look under the F-150’s hood reveals a key vulnerability for the company in Trump’s new tariff regime: There are thousands of parts that cross the border from Mexico and elsewhere. More than half the value of the truck’s components comes from outside the U.S.—at least two dozen countries, including alternators and wheels from Mexico and tires from South Korea.

Starting next month, each one of those parts could face a fresh 25% tax. So even though Ford’s trucks are built in the American heartland, import tariffs could jack up the average price by thousands of dollars. Tariffs on parts could cost Ford 6% of its revenue, according to an analysis from financial firm Bernstein.

The Journal continues by describing how GM is even worse situated and points out:

But after three decades of setting up supply chains and factory networks under free-trade rules, automakers now find themselves peering into a funhouse mirror of tariff scenarios: a 25% duty on vehicle imports, higher steel and aluminum costs, a 20% tariff on anything from China and a potentially catastrophic levy on auto components that is still being hashed out.

Observers inside and outside the industry believe that the tariffs could deal a heavy blow to the two storied giants of American car manufacturing. One U.S. auto-industry executive described three potential outcomes: “OK, bad and Chernobyl”…The tariffs on car parts alone would cost the U.S. industry around $26 billion, which translates to more than $3,000 per vehicle, Bank of America analyst John Murphy said. “The supply base is where there is the greatest risk of disruption to North American production,” he said in a research note on Wednesday.

And perversely, domestic auto parts companies would take it on the chin:

The auto-parts sector serving U.S. carmakers is massive and includes everything from global companies like Canada’s Magna and Germany’s Bosch to small mom-and-pop auto suppliers concentrated in states such as Michigan, Ohio and Indiana. The sector employs over 930,000 people and contributes 2.5% of the U.S. gross domestic product, according to MEMA, the vehicle suppliers industry group.

“Most of the supply base looks like us,” said Gary Grigowski, vice president of an 80-worker supplier of plastic components like switches, based in Michigan. “It’s a lot of smallish manufacturers in little towns like we are,” he said.

The piece includes examples of components that are not amenable to being made in the US:

Automakers commonly get many cheaper components—brake pads, seat upholstery, fasteners—from overseas. Such commodity items are difficult to make in the U.S. at a profit, executives say.

One example is wiring harnesses, the sheaths of wire and cables that distribute electricity through a car. They are painstaking to make and require a great deal of manual labor, which is why production of them has moved to Mexico, Central America and other lower-wage countries.

And how about upholstery? Tell me under what scenario that would ever be made domestically.

Some manufactures plan to effectively kill their suppliers (recall Bain saying above that many were in bad shape and would need, erm, assistance, including from their customers):

In a letter last week to a supplier, GM said that worsening market conditions as a result of higher costs doesn’t change a supplier’s responsibility to uphold a contract. GM has “no obligation” to pay a supplier increased prices on a contract as a result of tariffs, said the letter, seen by the Journal.

Expect Americans to have more motorbikes in their future.

___

1 Even cheap Chinese EVs are pricey in Southeast Asia, and charging stations are an issue. From Bangkok Post in March:

While Southeast Asia’s upwardly mobile population may aspire to own EVs, the still-pricey cars are beyond the reach of many. Access to a reliable electricity source isn’t always a given and even if it were, EV charging infrastructure across many countries is spotty. And in some places like Vietnam, consumers prefer a brand more immediately familiar….

EV sales in Indonesia were just 43,188 units last year, more than the mere 125 in 2020 but still only a fraction of the around 860,000 passenger cars sold in total, according to industry association Gaikindo. At those levels, it’s hard to see how the government’s target of 2 million EVs on Indonesia’s roads by 2030 can be met.

“Maybe the rich are more aware about EVs but not everyday people,” said Hairayani, a school teacher based in Jakarta who like many Indonesians only goes by one name. “Plus there’s the price factor and the extra hassle of finding a charging station.” Hairayani said he doesn’t plan on moving away from his gas-powered car anytime soon.

In Thailand, where buyers benefit from a government subsidy of 100,000 baht per vehicle, EV sales dropped 9.3% to 66,732 units in 2024 from a year earlier, short of the Electric Vehicle Association of Thailand’s target of 80,000. Thailand has the highest level of household debt in Southeast Asia and many consumers are now subject to stricter bank loan approvals.

Things didn’t improve in January, when sales of battery-powered EVs slipped almost 8% year-on-year, Federation of Thai Industries data show.

The article also describes how Vietnamese EV makers are giving the Chinese a run for their money.

I still see hardly any on the road and have gotten one only 2x in my nearly two years of calling for rideshare transport. This impression is confirmed by Kpler:

Since EVs are still a nascent phenomenon in the region, with only a 0.6% share in the total passenger car fleet, the projected gasoline displacement in 2024 was 13 kbd, approximately less than 1% of demand. 2024 was a pivotal year for the big car markets in the region as EV sales skyrocketed. Malaysia, which has a passenger car fleet nearly equal to its population, saw EV sales soar by approximately 70%. A similar trend was observed in Vietnam, but Indonesia led the race with a 164% jump, according to estimates. Although this growth is expected to continue, EVs are projected to account for just 6% of the regional passenger car fleet by the decade’s end due to the dominance of gasoline-powered vehicles and a substantial two-wheeler market.

2 From a new Financial Times story, The relentless innovation fuelling China’s ‘brutal’ car wars:

However sales in China, the world’s biggest EV market, are forecast to rise about 20 per cent to 12.5mn cars this year. As EVs start to outsell cars with internal combustion engines, 78 per cent of those sales are being soaked up by just 10 companies, including 27 per cent solely by BYD, according to HSBC data….

With a new car model released on average every two days in China, keeping pace with cutting-edge technology — such as assisted driving functions and the latest infotainment systems — has become crucial for survival as the market inevitably consolidates.

Ding said it had become “binary”, split between companies with “smart EV” capabilities and those without. She added that with the market for fuel-powered cars further deteriorating, the sector was entering a period of “the most brutal competition” in its history….

Foreign automakers’ market share hit a record low of 31 per cent in the first two months of 2025, a loss of one-third of the market since 2020.

UBS analyst Paul Gong said a $20bn average annual profit enjoyed by foreign carmakers in China over the past decade was at risk. If their market share fell to 20 per cent, they could be stranded with excess production capacity of 10mn units, he calculated.

Germany’s Volkswagen and Japan’s Toyota, two of the world’s largest car groups, are fighting back by investing heavily in local production and technology partnerships with Chinese companies. In recent weeks, BMW has announced tie-ups with Alibaba and Huawei, as foreign companies turn to Chinese-made software for a chance of survival.

3 From Reuters:

Last year, major Japanese carmakers exported almost 880,000 vehicles to the United States from Mexico, according to data from Mexico’s national statistics agency. While Toyota’s Tacoma pick-up was the most exported model, Nissan had the biggest share of any automaker, accounting for more than a third, with 327,000 vehicles, the data showed.

Thanks for this wide-ranging round-up.

(1) another important strategic blunder…..Detroit automakers GM-Ford-Stellantis (Chrysler), in the tradition of 50 years of continually “fighting the last war”, no longer sell cheap entry-level sedans (see Toyota Corolla) or even relatively affordable mid-sized family sedans (see cancelled Chevy Malibu, Ford Fusion).

Because their entire product portfolios pivoted to higher margin pick-up trucks, full-size SUV, and crossovers….and higher-end electric cars; because of course you take the current trajectory and extrapolate it as a straight line that goes on forever, just like 1972, 2007….that’s just basic intelligence, right??!!!??

(2)….and look at GM’s fundamental profit center: full-size SUVs and pickups. Only 35% of a new Chevy Tahoe has parts made in the USA. Take a guess wear the rest are from. and shifting to even 66%-USA parts isn’t as easy as just giving existing workers overtime.

(3) GM/Ford/Stellantis (IMO) are just awfully run companies at the Mary Barra/(forgot the name of the horrendus Stellantis CEO who resigned last year)….Detroit’s bench is not ready for this…..but they are/were great at diverting free cash flow to stock buybacks-dividends!

(4) you know who’s ready (or at least least-flat-footed) for this…..the Japanese and Korean carmakers; if we get a standard recession, they are going to eat Detroit + Stellantis’s lunch.

we are on the verge of a f______ing dumpster fire that could have been 100% avoided if someone bothered to talk to any sufficiently informed “car guy”

apologies for the rant. the state of the US carmaking industry is a triggering topic for me, lol

(forgot the name of the horrendus Stellantis CEO who resigned last year)

Unironic Pangloss: Carlos Tavares, from Portugal. Who ended up with a golden parachute (in Italian “buonuscita” “great exit”) of 12 million euro.

https://www.ilgiornaleditalia.it/news/economia/686484/stellantis-a-tavares-maxi-assegno-da-35-mln-di-cui-12-mln-di-buonuscita-e-23-mln-di-compenso-per-il-2024-350-volte-il-salario-di-un-lavoratore-medio-dell-azienda.html

Stellantis is nothing but a shell company.

–The one advantage is that FIAT still has some “starter’ cars, so their line of offerings isn’t completely carjacked by upper-end vehicles. The FIAT 500 is still around, and a new FIAT city car, the Topolino, an electric vehicle, is in production.

–That written, nothing exonerates Stellantis and the Elkann Family and their shell companies and interlocking directorates such as Exor and Dicembre.

–The holding companies have been publicly exposed because of a rather strange but telling lawsuit by daughter (of Gianni Agnelli) Margherita, mother of some eight heirs and heiresses, who is contesting her own mother’s will (Marella Caracciolo), on the grounds that the Elkanns helped mamma defraud the Italian state by claiming that mamma lived in Switzerland. That would have made the estate transfer subject to Swiss law. There is plenty of evidence that Marella Caracciolo, who suffered from a bad case of Parkinson’s, was up in the rich hills above Torino at the family compound.

–And, excellent point, as you mention below, Stellantis and Exor are involved in all kinds of weird stock buy-back schemes, which have even come to the attention of the Italian Parliament, which hasn’t done much. Elkann’s testimony was mainly bromides and cazzate.

this is correct,

“Reshoring auto parts is “essentially impossible” due to high U.S. labor costs and lack of skilled workers.”

but whats over looked is, Detroit could care less about cars, or market share. all they care about is their stock price.

if they cared, they would not have canceled besides the fusion, the volt, the impala and the cruz.

this is a dumpster fire brought on by bill clintons disastrous policies of gutting the new deal and Gatt, and allowing a free market that is populated by clever, cunning, and manipulative creatures, who have no real intelligence.

it was going to implode anyways.

Ditching the sedans and all other low-margin vehicles was the inevitable consequence of the US system of paying CEO’s based on the value of the stock THIS QUARTER. Who cares about getting a customer at the start of their life cycle when you’ll be retired by the time they can afford the high-profit iron?

Most of Jakarta has odd-even license plate restrictions on ICE automobiles while EVs have no restrictions. Some Grab drivers are using the Vietnamese EVs; the small SUV types cost equivalent of $15,000 US. While ICE vehicles predominate, I felt the percentage of EVs was higher or at least equal to central NYS. Of course the majority of transportation is scooters. Air quality was horrendous. I’d expect the 2M target is hoped for in Jakarta. The most pedestrian-unfriendly place I’ve ever been.

On Trump tariffs topic, my brother-in-law is a honcho at an industrial equipment manufacturer. 3 years ago he was charged with bringing back lab and testing functions to the US from China. Industrial labs require both expensive, sophisticated equipment and highly trained staff. It was STILL a work in progress last I heard. Reshoring is easier said than done! This weekend he said big layoffs of US engineering staff happen this week. I guess the executives never let a crisis go to waste!

Supposedly the Greeks tried odd and even day controls on Athens at one point and the enterprising locals modified licence plates with 9’s and 6’s to be reversible….

“To simplify, traditional internal combustion engine powered vehicles have vastly fewer parts than EVs […]”

Oops. The converse is true.

elaboration (as you likely will get flamed)…an electric motor is incredibly “simple” and been around for >100 years.

what is not simple is temperature control of the motor and battery to extend life,and assure effiency, and make sure 100kwH of battery doesn’t blow up.

then add the thermodynamics jujitsu needed so that the interior is 22c/75f regardless of the temperature outside (it is not as simple as adding an electric heater, and wiping your hands of it)…while minimally hitting car range.

and all this is before we get to “right to repair”

Any pundit that says, it is an EV…it’s so simple, is a dolt

If you read the full sentence, you’ll see I flipped the order in a drafting error; the clause about the need to improve batteries points to ICE, not EVs.

Don’t EVs have less parts than ICE cars?

Sorry, bad drafting. Fixing…

But, but share repurchases. Ugh.

Stellantis (Chrysler)and GM are the worst with that respect!

Assuming that the big, beautiful car tariffs wall Trump is erecting is permanent, would that not lead to US car manufacturers to get lazy and not bother that much with innovation. I mean, they would have a captive consumer market so why not just do the minimum – and charge high prices to boot.

Of course if you are a car manufacturer, before you send the billions to tool up factories to churn out car parts and cars, you would have to be assured that Trump is not just going to mess with the car tariff rate from week to week. Who would take that bet?

Wasn’t competition a core part (heh) of capitalism that leads to constantly improved products? /sarc

So, being dependent on a car for everything does look increasingly problematic. More so in the US than in Europe. Motorbikes can be a daily solution, even electric bikes if commuting is not too long. Car industries in the CW poised to shrink. The contrary with main battle tanks if one believes some plans will go forward. Commuting in tanks? ;)

I did more or less say that but some of us will never never never ride a motorbike. My brother would have died had he landed differently in a bad bicycle accident; I broke a cheekbone in one and had I landed a little differently, I would have lost an eye.

I’ve considered that electric powered tricycles could work in smaller cities with a functional downtown.

The rider is on a more stable vehicle, has room to store packages and can be more visible to automobile drivers.

The tricycle could be fairly light, so a lot less energy would be consumed in operation.

And the tricycle could have a simple top for inclement weather,

In the USA, we have 4000lb vehicles moving 150lb people around.

Imagine how the package delivery industry would be decimated if a 15lb Amazon package were shipped in a 400lb protective package.

Rickshaws. You don’t need fancy engineering on those, and they can be powered by kids!

As my cycling days begin to wind down, I’ve always thought (hoped) that something like the Renault Twizy would be in my future (if I lived somewhere where they were available for purchase).

Think about an eBike. I just gave away my beloved Woodrup 21-speed to a deserving kid and bought a Type-2…46 mile range, weighs in around 50 lbs., a throttle with optional pedal-assist and a 20-mph top-end speed. Around $1,400 delivered prior to Trump’s tip. With a little luck I won’t get run over by the entitled summer knuckle-heads in their BMWs.

what you imagine is reality in modern day China,

Well, yes, my comment was not intended as the solution for everyone but and option. One that I see being chosen by more and more people. My son, for instance, commutes by motorbike, even if I don’t like it very much. Besides daily work commuting, one does all sorts of things that require moving around in the city. Visiting friends, weekly/daily food purchases, meeting in all kinds of places. With good public transport one can do most of it but not always. So you might need a car from time to time. At home we have a car but we use it the less we can. We are 3 drivers at home and I fill the deposit about every 3-4 weeks so we do not abuse the car and it will hopefully last for long. Yet, I find cars increasingly unaffordable.

You wrote something which IMO is true: the leadership cannot come up with industrial policies because neoliberalism. Another problem with Neoliberals is that they are unable to come up with other sensible solutions because these are out of their ideological bounds. Car sharing is a mess because free markets, but, as a public utility, it would work far better. I have seen this with electric bikes in Madrid, there are the public ones and once upon a time there were private companies flooding the city with bikes. This didn’t work. Yet, the public bikes not only survived but thrived and these are being used by many these days. My guess is that with car sharing it would be the same.

Ignacio: See Yves Smith’s comment directly above. I had a relative aged eighteen killed in a motorcycle accident in Chicago, so I am highly unlikely to use a motorcycle.

Scooters (what the Italians call motorini) and monopattini (those things on little wheels that are dangerous toys and are scattered all over the sidewalks in European cities) also have their drawbacks. Monopattini are accidents waiting to happen.

So, I believe, with 800 billion euro going to rearmament, I will drive a tank.

Parking will be a problem, but I will be ready to drive to Estonia to protect Kaja Kallas!

I understand very well those reserves about motorbikes, bikes, scooters and the bloody monopatines. There was an accident in Madrid because some people learnt to trick the engines to run the monopattine faster. As a result one overheated engine exploded in a suburban train. Now it is forbidden to take those inside public transport vehicles.

Maybe scooters? I lived in Taiwan for close to two years where most everyone rides scooters, and man, those things would take up all sorts of public space because you still have to park them somewhere. It’s one of the less pleasant aspect of living in Taiwan.

The proliferation of alternatives is greatly complicated the transition away from car based transport systems. Neither transport planning nor regulations are close to keeping up with the huge speed that new EV systems are being adopted – everything from scooters, folding EV bikes, regular EV bikes, souped up motorbikes, delivery systems (robot ones to come soon) and so on. The speed these are being adopted has meant that even high quality schemes of just a few years ago (such as separated bike lanes) are now being overwhelmed with vehicles they were never designed for.

In theory this is great – we’ll get a vehicle for every need, from the little scooter you can bring on a bus to travel the ‘last mile’, to cheap quadricycles, either owned or app based. But at the moment its something of a free for all and its hard to see what the final outcome will look like.

For what it’s worth – Knoxville where I live has extremely limited public transportation, buses. If this is typical of mid sized Southern cities with but a handful of downtown skyscrapers pretending to be a biggish city, cars are essential. The flip side is there are no rush hours to get downtown and back, and free parking is plentiful (Knowville converts space underneath expressways into enclosed free public parking. It’s quite a joy of convenience for what it is. Sometimes local Republicans can have so much common sense).

in the quadrennial race to see who can implode first, Trump may have finally snatched defeat from the jaws of victory. unless the Dems. nominate AOC for president in 2028

at the course that we are headed on, it is seemly inevitable that this turns into Carter’s °Delta One

https://search.brave.com/search?q=delta+one+iran+1990

Trump may be following a corporate model of “taking a bath this quarter” to move the goal posts with enough time to show economic improvement before the next election.

Collapsing the economy, leaving more hydrocarbons in the ground, makes Trump an accidental environmentalist.

I don’t find much (any) wisdom in the USA political scene.

And there are no rising stars in any political party.

It’s like a professional baseball league without a decent farm system.

Trump’s party may elect the next president, if the economy is in improvement mode in 2028.

The good thing about buses is that efficient bus transit systems can, with the will, be implemented relatively quickly and cheaply. Its not all about expensive rail systems.

Much depends on urban form – grid systems are ideal, lots of housing areas linked by highways less so – but by giving over a lane to express bus use and another lane to non-car traffic, most cities can be adopted to mass transit very quickly. Unfortunately, the opposition to it is not just from people not wanting to be shifted from their cars – its also the perception that ‘real’ public transport is about glossy rail projects.

Had the US not allowed and facilitated the monopolization of its auto industry, then who knows how well the industry might have adjusted to the changing winds of technology, economics and trade?

>>>monopolization

there is blame on all sides, one can blame the traditional right-wing and traditional left-wing, and stupidity on all sides.

buybacks, legitimately dumb executive class. complying w/crash and environmental regulations is not cheap. the extreme mis-allocation of public subsidies in the name of being green. “liberal” jurisdictions are blatant hypocrites via zoning and other public policy that subsidize the worst aspects of American vehicle consumption.

Better make room for the junkyards, too. This will be a cutting edge demonstration of John Greer’s catabolic collapse as motorheads in the US come back into their own. They used to laugh at us in flyover for our rustbuckets on blocks, well, that bet might finally pay off.

the problem is….with the conscious design choice made by most automakers in the past 10 years, it is literally more likely that a relatively new car by-passes the junkyard and just gets sent to the smelter and landfill because the auto manufacturer doesn’t support all the parts anymore and/or you can’t physically fix it. (compare/contrast a primitive cast iron engine from 30 years ago versus very advanced aluminum engines today)

“planned obsolescence” to the extreme.

Fortunately for the motorheads, the cars in their yards are mostly 30+ years old (my cars are 30+ years old, but they worked all along and never needed to be parked in the yard).

Some of us are already planning our Continuing Education trips to Cuba . . .

I think much of the problems within the car industry, and in particular the source of their antipathy to electric car, is the fear of modern manufacturing technology commodifying car prices in the way that happened with consumer electronics and white goods, or basic computers. The widespread availability of all the components of all those problems at very low prices, more or less fixed worldwide. Unless you are very lucky or far sighted (e.g. an Apple or Miele or Dyson), you end up in a very high volume, low profit industry. EV’s promise to do this to car manufacture – once battery packs and drivetrains are produced in very large volumes, the potential is there for pretty much anyone with sufficient capital to make them. Notably, the only car that is for sale for the same price as 10 years ago in most markets is the Nissan Leaf – 25K in the UK in 2011, and still more or less that price 10 years later – now up to around 28K.

So pretty much every manufacturer is desperately trying to increase profit margins – the only brands fighting it out for value are usually the ‘value’ brands of bigger groups (such as Dacia in Europe), or brands trying to break into markets. But even the Chinese brands now seem very reluctant to compete on price – BYD’s and Polestars, etc., may be offering good value compared to incomers, but nobody could call them cheap compared to cars of a few decades ago. Its noticeable that with the possible exception of MG, Chinese cars are loaded up with all the goodies that have more to do with boosting new car value rather than giving consumers what they need.

I think we are now seeing the endgame of this, whereby pretty much every established brand in the market, and most of the incomers, are trying to be Apple. Something has got to give. There is enormous overcapacity in the world car industry – most of it in China, but not all – a sharp recession, especially one in which the tariffs may encourage buyers to shift to other products, will result in a huge clearout.

IMO….if I was a technocratic, omnipotent dictator….

I would just let the US languish with mix of 100% petrol cars, hybrids, full EVs as an anachronistic backwater, must like left-hand drive, or imperial measurements, lol….until EV tech truly reaches parity with the simplicity of petrol.

The population density is too low outside of very specific states, the temperate range is too vast (during continental European winters 50% of Americans would be wearing shorts at home, including me), and too many gross mis-allocations have been made with subsidies…..(giving $7,500 a white-collar type who drives 8,000 miles a year to buy a $70,000 Tesla X while the hyper-commuter in a Toyota Corolla gets $0.00 is insane; relying on a “supercharger” model versus charging at home, etc)

YMMV.

To support your comment please see this post from 4/2/25 by Matt Stoller. There is an excellent interview of the CEO of Ford embedded. He makes your point and lays our Ford’s strategy moving forward. This post by Matt is worth reading!

https://www.thebignewsletter.com/p/monopoly-round-up-tariffs-abundance

Trump tariffs based on massive error, conservative think tank says

https://www.axios.com/2025/04/06/trump-tariffs-error-aei

“For example: Corinth and Veuger write that if the tariffs had been calculated correctly, with the same ultimate goals in mind but using the right kind of elasticity figure, the levy on a country like Vietnam would have been 12.2% and not 46%.”

“Ditto for BMW’s facility in Spartansburg, Tennessee.”

Please correct

https://en.wikipedia.org/wiki/BMW_Plant_Spartanburg

“As of 2019 the BMW Spartanburg manufacturing plant in Greer, South Carolina, had the highest production volume of the BMW plants worldwide,[7] producing approximately 1,500 vehicles per day.[8] The models produced at the Spartanburg plant are the X3, X4, X5, X6, X7, and XM SUV models.”

This factory, which very visibly sits next to interstate 85, just expanded and given the devoted luxury car clientele seems so far impervious to the above at least going by local news. Unclear whether the Trump tariffs will affect the imported engines.

I think the history of the American car industry is highly relevant to Trump’s alleged intentions. After all a big driver of offshoring in the latter 20th was Detroit’s initial dismissal of foreign cars like the Volkswagen and the Japanese subcompacts followed by Detroit’s near conquest by the Japanese–signified by Toyota rather than GM becoming the world leader in car output volume. The turn to the pernicious SUVs and monster pickups was how Detroit saved themselves as initially the off shore competitors didn’t make these. Favorable government regulations along with consumer nostalgia for their land yachts helped with this. Spoiled Americans, it turned out, didn’t want to wear Jimmy Carter’s energy saving sweater.

All of which is to say that our manufacturing heyday had become as decadent as our now financialization heyday because a country where even the workers are middle class lacked the motivation to be what China now is or America pre WW2 was. Plus as mentioned above the plutocrats don’t really want workers of any description if they can replace them with robots. The America that Trump wants to remake no longer exists and probably can’t without overturning every other arrangement and most especially rentiers like him. The fish after all does indeed rot from the head.

Response to Lost in OR, 11:23 AM:

Thanks for the link from BIG. It makes quite a bit of sense. If Trump had read that piece he’d have realized that instead of a willy nilly tariff implementation a much better to way to do it would have been staging each market and giving it a minimum of 5 years to adapt (say using 10%, 20% etc) until it reached 100% in the fifth years and providing subsidies to the companies rebuilding their facilities. At the same time he should’ve levied significant penalties on companies buying their own stock and manipulating their stock prices.

Response to John Wright, 9:13 AM:

Knowing the dwindling support for the duopoly. it would seem an excellent time and opportunity to start a third party that would NOT take $$$ from big donors and would work toward the goal of making the US more self sufficient with no domestic/foreign interference – no wars, no political maneuvering and an economy towards helping the average joe. It probably would take several cycles (3 x 5 years) to get a grip on the political situation.

Yup, it’s true. As if the global car manufacturing industry wasn’t in enough turmoil already. And then along comes Orange Man and spices it up with his tariffs.

There is no chance in this world and the next that Orange Man, or anyone else in the US for that matter, will succeed now or in the future in bringing back the glory days of the once-upon-a-time US car industry. Much too late for that. You would need a first-class industrial policy, by definition impossible in the neoliberal world of the US today. The less government, the better. Furthermore, who would prepare and execute such a sophisticated, high-level policy. Sorry, the US does not have such experts. Moreover, you would need to educate and train literally hordes of new workers, in German/Swiss/Japanese style vocational schools. Nope, vocational schools don’t exist in the US anymore. Then you would need to employ these workers in first class companies and practically guarantee them jobs for life. Otherwise, they would look for other more “safe havens”. You would need to treat them well like the Germans, Swiss and Japanese still treat their workers. Nope, impossible. That would be pure anathema to the neoliberal owners, managers, investors. I could go on and on and on. So, while one could debate whether Orange Man is being disingenuous or not with his MAGA claims, his stated goal will just never happen.

Regardless of Orange Man and his tariffs, the car manufacturing industry indeed finds itself in the biggest turmoil since its inception due to the onset of Electric Vehicles (EV). Whereas the entrance barriers to making first class Internal Combustion Engines (ICEs) were and still are high, this is not true for EVs. This applies particularly to modern turbodiesel engines, which are still quite popular in many European countries. They are practically ubiquitous on all trucks and buses. An ICE has about 4,500 individual parts. And the associated know-how needed to design very efficient, reliable, smooth-running and long-lasting ICE engines is quite formidable. Not so with EVs. A modern electric motor used to power EVs today has about 50 individual parts. No more. So that’s 4,500 versus 50. Let that sink in. The required know-how associated with electric motors is no big deal. Any serious manufacturer of electric components has them. So, the entrenched German makers of world-class cars and ICE engines are currently in a state of utter confusion and panic. Furthermore, the main real differentiator in EVs is the battery. Maximizing the car’s range and battery lifetime while at the same time minimizing the charging time are design goals that are extremely difficult to achieve. And of course, the Chinese with their giga factories and giga economies of scale are a difficult, if not altogether impossible act to emulate. So, not looking good for Mercedes Benz, BMW and Audi.

However, the real purpose of Orange Man’s tariffs is the most interesting. With his entourage, he realizes that the glory days and strength of the old US economy is long gone. Above 40% of the US GDP falls in the so-called “rent” department. “Rent” as in Finances, Insurance and Real Estate (FIRE). “Rent” as in you don’t have to produce it and you don’t have to work for it. “Rent” revenues and profits as in they’re generated while you sleep. Most importantly, “rent” doesn’t create new value. Furthermore, on the order of magnitude of 90% of all things that are sold in the US are “Made in China”. So Orange Man is trying to bully, force and submarine everyone else into making concessions to Uncle Sam of one kind or another in the hope that the sum of these concessions will give the US a prolonged lease on life. So, the US under Orange Man’s leadership is stooping to the level of Mafia-like behavior. What’s new is that this is being done out in the open and in broad daylight, so to speak. No attempts at concealment. This is where we are now. However, the main point of the tariffs is to bring the fight against China to the next level. Trump has insisted that tariffs are necessary to rebalance global trade and rebuild domestic manufacturing—singling out China as “the biggest abuser of them all”.

The world will continue to run on turbo diesel engines for the indefinite future (lorries, trains, cargo ships) because only railways are easily electrified (and not with batteries).

The loss of ICE engines for passenger cars may result in the engineering talent pool shrinking in a way that raised costs or simply removes capability for these industrial transport sectors….

The urbanism stuff being in my wheelhouse, I do want to point out that the notion that the US being a big country is somehow detrimental to the proliferation of transport infrastructure (whether EV’s or transit) really isn’t true. Transport infrastructure development shouldn’t be measured by land area coverage, but by destination coverage.

This has some interesting implications about how we think about “density”. You have to be clear when defining what kind of density you are talking about. Usually people only consider residential population density, which in itself is more complicated than you might consider. But even just looking at that, US residential population density (weighted by local population) is actually quite high, not particularly different from other developed countries.

On top of that, I’d argue that commercial density is much more important for transport infrastructure (especially transit) anyway, simply because commercial destinations inherently attract more trips per uniy area then residential. But that’s a different discussion

Indeed – many aspects of US urbanism are actually ideal for public transport, especially grid cities, and very wide roads (providing plenty of scope for dedicated bus/light rail/bike transit. The big problem is a pattern of exurbs clustered like Brussels sprouts along highways – these are very problematic in terms of layout and density.

This is why I think the arguments about HSR in the US are moot. In reality, only a few corridors in the US are suitable for HSR. Denser overlapping patterns of public transit (with a particular focus on buses) are potentially much more cost effective. Smaller EV’s of all sorts are probably the best way to address the last mile problem.

The chart shows an avg 3.6% increase/year over a 12-yr period. Doesn’t seem extreme given recent inflation trends. plus my wife considers the shift towards added safety features such as blind spot monitoring, lane change warning, auto braking, and the mentioned backup warning – which I find invaluable – quite worthwhile.

Consumer Reports thought the replacement for my 2013 Nissan made product inferior to the one it replaced, so I continue to drive a 2013. My own view is Nissan lost its way in an increasingly competitive market.

Also, cards are better built, and last much longer than they did once upon a time. As a result, to maintain a nearly fixed number of cars on the road, annual production will fall.

If you compare to the 1970, but compared to the early 2000s? I doubt it. All the electronics are designed for obsolescence.

Correct. Up until the early 1990s, cars were designed with fairly high design margins. Since cars in those days had little or no electronics, this pertained to the mechanical systems, above all to the engine. In the meantime, due primarily to competitive cost pressure, these high design margins (in those days they were called “comfortable” design margins) have been eliminated. Another reason for eliminating them was feedback from the owners and drivers about the extremely long lifetimes these cars were able to achieve. So as a result, the lifetime of cars from the 2000s onwards has decreased. It must be pointed out that this pertains to cars with internal combustion engines.

Particularly long lifetimes were a common feature of cars with diesel engines. Due to their much higher compression ratios than gasoline-powered cars, diesel engines had to have a particularly robust design. This then translated into extra-long lifetimes.

Those who are old enough will remember the ubiquitous excellent diesel-powered Mercedes and Peugeot cars that were used as taxis in almost all European cities, often easily achieving lifetimes of 500,000 km (312,500 miles). Of course, assuming good maintenance. At the end of their “European lifetime” these cars were then sold to taxi drivers from cities in Northern Africa and the Middle East where they had a second life again as taxis, being driven for yet another 500,000 km. They were indeed masterpieces of excellent engineering.

From the perspective of lifetime, electric cars are very different. Electric motors have about 50 parts compared to about 4,500 parts in an internal combustion engine (ICE). Furthermore, ICEs are subject to very high operating temperatures exceeding 1,500°C (2,732°F) and high pressures of 10-11 bar (145-159.5 psi) for gasoline-powered engines and up to 20 bar (290 psi) or more for modern turbocharged diesel engines. Such operating conditions act as limits on the engine’s lifetimes. In comparison there is no combustion in an electric motor. The lifetime of electric motors is therefore longer. If it wasn’t for the battery, electric cars would last significantly longer than traditional cars with ICEs and would also require very little or no maintenance. The critical part in an electric car is its battery. As an example, the battery in a 2–3-year-old good electric car will have degraded to the point that its range will be between 200-300 km (125-187.5 miles). And the cost of the battery is about 50% of the value of the new car. This is the main reason why the price of second-hand electric cars is extremely low, significantly decreasing the benefits of owning an electric car.