“Is Too Much Significance Given to U.S. Credit Rating?”

A useful discussion with Marshall Auerback on Fox News on the debt ceiling deal and the implications of a possible downgrade of US Treasuries. Enjoy!

Read more...A useful discussion with Marshall Auerback on Fox News on the debt ceiling deal and the implications of a possible downgrade of US Treasuries. Enjoy!

Read more...By Randy Wray, Professor of Economics at the University of Missouri-Kansas City and Senior Scholar at the Levy Economics Institute of Bard College. Cross posted from EconoMonitor

Don’t you feel relieved? After weeks of threats, hostage-taking, and other forms of deficit terrorism, our two political parties have finally “compromised” on what was always a foregone conclusion. (As I write, we still await the Senate vote—but it looks like a done deal.)

Washington got what it wanted—a down payment on destruction of the last remnants of progressive policy. Soon, it will be 1929 all over again. We can make believe that the New Deal and Great Society programs never existed, and go back to the good old days when it was every “man” for himself.

Read more...By Delusional Economics, who is unhappy with the current dumbed-down vested interest economic reporting. Cross posted from MacroBusiness

With the economic world firmly focussed on the US debt debacle this week it is likely that Europe will slip off the radar a little. I suspect, as many people do, that for the US there will be an eleventh hour resolution followed by a short lived bounce in the world markets. Once that bounce heads back to earth again it is likely that the world’s eyes will turn back to Europe. There is much to see.

Read more...By Scarecrow and Jane Hamsher. Cross posted from FireDogLake

The Politico headline says it all: U.S. credit downgrade worries Obama, Congress more than default

It’s not the default that strikes the most fear in the White House and Congress these days. It’s the downgrade

As Robert Reich notes, Standard and Poors is the “biggest driver in the deficit battle.” Why would anyone care what the corrupt and disgraced organizations who quite nearly brought down the world economy think about anything at this point? And yet, that is where elite opinion is focused right now:

[W]hat really haunts the administration is the very real prospect, stoked two weeks ago by Standard & Poor’s, that Barack Obama could go down in history as the president who presided over his country’s loss of its gold-plated, triple-A bond rating.

[]

Financial analysts say such a move would hit Americans with more than $100 billion a year in higher borrowing costs, but it’s not just that. It would be a psychic blow to a nation that already looks over its shoulder at rising economic powers like China and wonders, what’s gone wrong? And it would give the president’s Republican rivals a ready-made line of attack that he’s dragging the country in the wrong direction.

This rumbling has been coming from Capitol Hill for a while, which made us start asking questions about what was really going on with Standard and Poors. It felt like there’s a story-behind-the-story driving S&P’s actions in the debt ceiling debate, which appear inexplicable at face value and go way beyond what Moody’s or Fitch have done. And the more we looked at the timeline of events, the more we wondered how the intertwining dramas of a) S&P downgrade threats, b) the liability that the ratings agencies may have for their role in the 2008 financial meltdown, and c) the GOP’s attempts to insulate the ratings agencies from b) are all impacting each other.

Read more...Cross-posted from Credit Writedowns Looking up the term procyclical on the Internet, I see the Wikipedia entry defines it as: Procyclical is a term used in economics to describe how an economic quantity is related to economic fluctuations. It is the opposite of countercyclical… In business cycle theory and finance, any economic quantity that is […]

Read more...Cross-posted from Credit Writedowns I have stopped reporting the quarterly GDP numbers but this last reading bears mentioning. The US Bureau of Economic Analysis reported the following at 830AM ET: Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an […]

Read more...It is one thing to suspect that something is rotten in Denmark, quite another to have proof. Ever since Obama appointed his Rubinite economics team, it was blindingly obvious that he was aligning himself with Wall Street. The strength of the connection became even more evident in March 2009, when Team Obama embarked on its “stress test” charade and bank stock cheerleading. Rather than bring vested banking interests to heel, the administration instead chose to reconstitute, as much as possible, the very same industry whose reckless pursuit of profit had thrown the world economy off the cliff.

But now we see evidence in a new paper by the think tank Third Way of an even deeper commitment to pro-financier policies. The Democratic party has made clear that it supports institutionalized looting by banks, via the innocuous-seemeing device of rejecting the idea of writedowns on bonds they hold.

Read more...Cross-posted from Credit Writedowns Below is a video of Lakshman Achuthan, co-founder and chief operations officer of the Economic Cycle Research Institute (ECRI), talking about the economic outlook for the US. I profiled Achuthan’s views on a broad US slowdown when I wrote in May about why a global slowdown will hit by summer. Now […]

Read more...By David Apgar, the founder of ApgarPartners LLC, a firm that helps companies and development organizations learn by treating goals as assumptions to be tested by performance results. He blogs at www.relevancegap.blogspot.com.

Speaker Boehner made three points in his surprisingly combative reply to President Obama on debt ceiling legislation Monday night. Readers of this blog can help determine whether, as I believe, all three were lies despite the seriousness of the impasse on federal authority to continue borrowing.

Read more...Hope you enjoy this chat. I’m pretty sure I corrected saying “House” rather than “Senate” at the time but that appeared not to have made the edits. The peril of this medium is low/no tolerance for flubs.

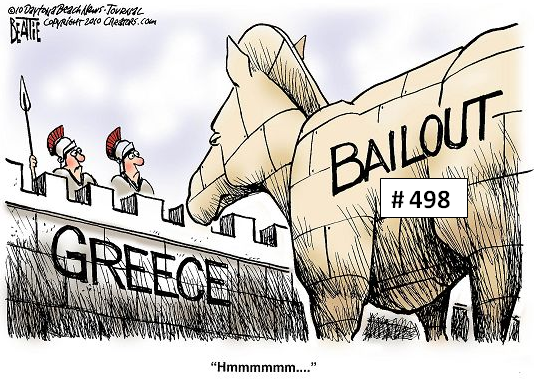

Read more...Yves here. Quite a few readers in comments expressed confusion over the announcement of the latest Greek bailout, and some of the details were admittedly a bit murky. This piece will hopefully help clear matters up.

By Alexander Gloy of Lighthouse Investment Management

Here we go again. Another bail-out. [Sigh.]

I’ll try to make this as entertaining and easily readable as possible – but first the details of the bail-out agreed on July 21st:

Read more...We commented last night on the parallels between the pressure tactics used to railroad the passage of the TARP and our current contrived debt ceiling crisis. The similarities have increased in a predictably bad way. Even worse than the economic toll radical budget cutting will impose on ordinary Americans is the continued undermining of basic democratic processes.

Read more...Washington DC appears to be readying itself for a repeat of the TARP, namely, the passage of unpopular legislation to appease the Market Gods (and transfer even more income from ordinary Americans to the Masters of the Universe). It isn’t yet clear whether this drama will be played out via generating bona fide financial market upheaval or mere threat-mongering (the Treasury market seems pretty confident that well-trained Congresscritters will fall into line). But unlike the TARP, which was a classic example of well-placed interests finding opportunity in the midst of upheaval, this reprise is a far more calculated affair.

Read more...Via e-mail, a reading of public sentiment in Greece from reader Scott S, who is a TV/movie industry professional and did the trailer for ECONNED. I have gotten similar. albeit more brief accounts from other readers. One reader with contacts in Greece did stress that the protests, at least as of the end of June, were overwhelmingly peaceful and added:

Read more...So they are now motivated to get something done.

A lot of Democrats, by contrast, are fiercely opposed to the pact under discussion, which consists of $3 trillion of cuts and no tax increases, or more accurately, an immediate commitment to cuts, and tax increases possibly coming via a to-be-brokered tax reform. The Democrats see the trap being laid for them; reform/increases later is likely to be no reform. (Separately, this package will kill the economy, a consideration that pretty much everyone is ignoring, proving Keynes correct: “Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.”).

The latest update at the Wall Street Journal was cautious:

With prospects of a government default looming in early August, leaders on both sides denied Thursday that a deal was close…Both sides warned that an agreement is not near. “There is no deal,” Mr. Boehner told radio host Rush Limbaugh. White House spokesman Jay Carney used similar language. And White House officials said Mr. Obama has never considered an agreement that did not include revenue increases.

A good deal can change in the next few days, but the window of opportunity narrows as time passes. And that is why the Treasury’s apparent refusal to consider options for working around the debt ceiling looks colossally irresponsible. This is similar to the behavior of the financial regulators pre-Lehman: they placed all their chips on one outcome, that of a private sector bailout, and failed even to find out what a bankruptcy would look like (at a minimum, if Lehman had prepared a longer-form filing, the implosion would have been less disruptive).

But this “all in” strategy is by design. Obama has long wanted entitlement “reform,” as in gutting; Paul Jay of Real News Network pointed out to me today that Obama told conservatives at a dinner hosted by George Will in the first week after his inauguration that he planned to turn to it once he got the economy in better shape. So this is a variant of a negotiating strategy famously used by J.P. Morgan: lock people in a room until they come up with a deal. But the J.P. Morgan approach used time to his advantage; here the fixed time frame makes this more like a form of Russian roulette with more than one cylinder loaded.

It is also worth noting that what starts happening on August 3, assuming no deal, is “selective” default. It isn’t clear if and when Treasuries would be at risk of having payments skipped, and I would assume Social Security would also get high priority. But with Treasuries, the bigger risk is not a missed payment (which would certainly be made up later) but a downgrade, which is expected to force certain types of investors who are limited to AAA securities to dump their holdings.

A useful article in the Economist describes how Wall Street, which had heretofore assumed that there was no way the US would (effectively) voluntarily skip some interest payment, is now scrambling to figure out how to position themselves should such an event come to pass. Many observers had assumed that the repo market, on which dealers depend to fund themselves and collateralize derivatives positions, would go into chaos (the belief was that counterparties would demand bigger haircuts). But the Economist argues that does not appear to be the case:

SIFMA, a trade group for large banks and fund managers, recently gathered members together to discuss issues like how to rewire their systems to pass IOUs rather than actual interest payments to investors, should a default occur. “It’s one of those Murphy’s Law things. If we do it, it won’t prove necessary. If we don’t, we’ll be scrambling like crazy with a day to go,” says one participant.

But the moneymen hardly have all the bases covered. “I really thought I understood this market, until I tried to map all of the possible consequences of a breakdown,” sighs a bond-market veteran. That is hardly surprising, given that Treasury prices are used as the reference rate for most other credit markets. Moreover, some $4 trillion of Treasury debt—nearly half of the total—is used as collateral in futures, over-the-counter derivatives and the repurchase (repo) markets, a crucial source of short-term loans for financial firms, according to analysts at JPMorgan Chase.

Some fear that a default could cause a 2008-style crunch in repo markets, with the raising of “haircuts” on Treasuries leading to margin calls. The reality would be more complicated. For one thing, it’s not clear that there is a viable alternative as the “risk-free” benchmark. One banker jokes that AAA-rated Johnson & Johnson is “not quite as liquid”. In a flight to safety triggered by a default, much of the money bailing out of risky assets could end up in Treasury debt. Increased demand for collateral to secure loans could even push up its price.

Then there is the impact of a ratings downgrade. Money-market funds, which hold $684 billion of government and agency securities, are allowed to hold government paper that has been downgraded a notch. Other investors, such as some insurers, can only hold top-rated securities but their investment boards are likely to approve requests to rewrite their covenants, especially if a lower rating looks temporary. “It would be a full-employment act for lawyers,” says Lou Crandall of Wrightson ICAP, a research firm. There’s a surprise.

In other words, this event is focusing enough minds that a lot of parties are looking at ways to get waivers or other variances to allow them to continue to hold Treasuries even in the event of a downgrade or delayed payment. But a report from Reuters on the Fed’s contingency planning makes them sound markedly less creative than their private sector counterparts (but it is important to note that Charles Plosser of the Philadelphia Fed, the key source for his story, has been a critic of the Fed’s fancy footwork in the crisis. In fact, the New York Fed is the key actor, and it has been notably, um accommodating in the past).

In addition, the New York Times reported yesterday that some hedge funds are moving into cash to buy up Treasuries in case other investors dump them. I’ve even heard of retail investors planning the same move. That does not mean the volume of buyers will be enough to offset forced sales, but it does say that fundamentally oriented investors would see this event as an opportunity, not a cause for panic.

The financial system is so tightly coupled and there are so many potential points of failure that I’m hesitant to say that the consequences of a default may be far less serious than are widely imagined. But in the Y2K scare, the considerable panic about potential catastrophic outcomes led to a tremendous amount of remediation, which served to limit problems to a few hiccups. Unlike Y2K, the remediation efforts have started very late in the game, so their is a lot more potential for disruption.

But even so, why is the Administration so willing to engage in brinksmanship? S&P expects a 50 basis point rise on the short end of the Treasury yield curve and 100 basis points on the long end, which they expect to reverberate through dollar funding markets and cause all sorts of hell. Remember, we have both Geithner and Bernanke again in powerful positions, and both went to extreme efforts to prevent damage to the financial system. Why are they merely handwringing at such a critical juncture? Might they have a trick or two up their sleeve?

I can think of at least one. I was working for Sumitomo Bank (and the only gaijin hired into the Japanese hierarchy) and was in Japan during and shortly after the 1987 crash. Initially, the reaction in Japan was one of horrified fascination, of watching a neighbor’s house burn down. It then began to occur to them that their house might burn down too.

The volume of margin calls on Black Monday and Tuesday were putting serious pressure on the Treasury market, which was beginning to seize up. On top of that, bank were understandably loath to extend credit to clearinghouses and exchanges (as we’ve discussed elsewhere, the Merc almost failed to open and would have collapsed if the head of Continental Illinois had not approved an emergency extension of credit after a $400 million failure to pay by a major customer. Had the Merc failed, the NYSE would not have opened, and its then CEO John Phelan has said it too might have failed). So keeping the Treasury markets liquid was a key priority in stabilizing the markets.

Japan is a military protectorate of the US. The Fed called the Bank of Japan and told it to support the Treasury market. The BoJ called the Japanese banks and told them to buy Treasuries. Sumitomo and the other Japanese banks complied.

I could see the same phone call being made again in the event of a default or downgrade. First, the yen is already at 78 and change, which is nosebleed territory from the Japanese perspective. The BoJ intervened once in the recent past when the yen got slightly above this level. Purchases of Treasuries is a purchase of dollars, and done on big enough scale would help lower the yen. Second, if you buy the hedgie view, buying in the face of forced (as in AAA mandate driven) and not economically motivated selling means this trade would have near term upside.

Is this scenario likely? I have no idea. Is it possible? Absolutely.

Again, I would not bet on happy outcomes. As Cate Blanchette muttered in the movie Elizabeth, “I do not like wars. They have uncertain outcomes.” And while the negotiators finally seem to have awakened to the risk of entering uncharted territory, the old rule of dealmaking is if one side’s bid is below the other side’s offer, you can’t get to a resolution. That’s where the two sides appear to be now, and even though it would be rational for both to give a bit of ground, rationality has been missing in action on this front for quite some time.

Read more...