Your humble blogger does not like having to discuss lame proposals because giving them any attention has the effect of legitimating them. However, since the Trump 50 year mortgage proposal can’t be put back in the toothpaste tube, let us contribute to the chorus of well-warranted criticism by adding some issues that don’t yet seem to have been aired.

Let’s first turn to the obvious negatives. The Trump idea is an admission that he and pretty much everyone are unserious about addressing the housing unaffordability problem because too many powerful players benefit from it. The most obvious remedy is to build more middle/lower middle class residences in high cost areas. But right away, that runs hard into NIMBYism: all those well off with their tony houses don’t want the servant classes or even dull normals living nearby and possibly harming their property prices.

A confirmation of that notion: the last time I heard about 50 year mortgages was in the 1980s in Japan during its bubble years. To give an idea of how badly overpriced residential real estate was (along with the more famous commercial real estate bubble), I visited a prime 3 bedroom, where a bedroom was barely bigger than a tatami mat, with a gallery kitchen, one bath, and a small combined dining and living room, owned by a board member at Sumitomo Bank. It was about 900 square feet. The price in 1989 was $5 million, or in current dollars, $13.4 million.

A search on Japan’s 50 year mortgages reminded me:

As the bubble progressed, lender expectations improved, leading to excessively loose credit standards. New 100-year, three-generation mortgages popped up. Grandkids would be paying off their parent’s parent’s mortgage.

Another measure would be to reverse rules that made what were formerly called single-resident occupancy apartments illegal. My understanding is that what killed this type of cheap housing, which kept many from being homeless, was barring shared bathrooms. Funny how we are just fine with them in student dorms and military barracks….and homeless shelters.

We’ll turn to points many have already raised, that the 50 year mortgage would preserve and promote unaffordability by loading up borrowers with mortgages they could probably never pay off (assuming they never moved) and would saddle them with more interest over the loan life. So it’s another “help the FIRE sector at the expense of the citizenry” plan.

But the popular freely-refinancable (as in no prepayment penalty) 30 year fixed rate mortgage is a very unnatural product and is found in comparatively few advanced. economies. On paper, it puts the interest rate risk on the lender. If rates drop, borrowers refinance, taking the loan away from creditors just when taking the risk of longer-dated loans is paying off. There are many ways to better share the interest rate risk, such as barring refis for the first five to seven years of a mortgage, or having interest rates float subject to a floor and ceiling. I had that sort of product in the early 1980s and was very happy with it. You can pencil out what your worst-case mortgage costs might be and benefit with no expenditure of effort if interest rates fall.

So why is this supposedly borrower-favoring feature, of the “freely refinancable” fixed rate mortgage, actually not good for borrowers? Because that option is NOT free! Not only do borrowers pay fees when they refinanace, but lenders have succeeded in structuring refis so that roughly 2/3 of the economic benefit of the refi is captured by financiers, not by the homeowner.

A related bad feature of the refinancable 30 year mortgage is that it increases systemic risk. Mortgage guarantors Fannie and Freddie have to hedge the refi risk. That hedging is pro-cyclical on a systemically disrupting scale. From a 2012 post:1

Both Freddie and Fannie have a long standing practice of hedging their prepayment risk. Their hedging activities are so massive as to have macroeconomic impact. They are “pro cyclical” meaning they tend exaggerate interest rate moves, pushing them down faster when they are falling and forcing the higher when they are rising. Greenspan was concerned about the distortions caused by the GSE’s hedging in 2003 and was relieved when the Freddie and Fannie accounting scandals led to them having their loan growth restricted, since it kept a big problem from getting even bigger. John Dizard of the Financial Times discussed this problem in early 2008:

The core problem for the housing GSEs is, and has been, the prepayment option embedded in US fixed-rate mortgages. That has meant that the term of the GSE assets extends or contracts depending on whether homeowners can refinance at an advantageous rate. However, most of the long-term debt on the liability side of the GSE balance sheets has a fixed term. So the GSEs must more or less continually offset this imbalance between the average maturity of their assets and liabilities through the derivatives market, specifically the interest rate swap market. Otherwise the mark-to-market losses would overwhelm their small equity bases.

Recall that Greenspan advocated floating mortgages then too, again to try to reduce the needed level of interest rate hedging.

50 year mortgages will make both these problems more severe. 50 year mortgages, compared to a 30 year obligation have more of their payments over their life in interest. That means in a refi more total interest savings. That means even more in fee extraction by middlemen! More critically, it also means much greater pro-cyclical hedging action, and thus an even bigger increase in systemic risk, assuming that there actually was consumer receptivity to this bad idea.

Let us turn the microphone to others who have derided this Trump mortgage plan. From Michael Shedlock, who documentshow much more a borrower will wind up paying in interest:

The FHA head said the proposal is a “complete game changer.” Yeah right.

This is the stupidest thing I have ever heard. Imagine a 50 year mortgage, spending almost a million in interest for a 400k home. Fuck no https://t.co/x4x9sP8L1i pic.twitter.com/BFcBxiqKQl

— Kerry (@k3rrytrad3s) November 8, 2025

Complete Game Changer – Not

- 50-Year mortgages won’t help with the down payment. For many, that is a huge obstacle.

- Home prices are starting to decline. Anyone who needs to sell their home within a few years would be upside down. We don’t nee more people trapped in their homes.

- Prices need to fall and fall dramatically. To the extent the product would create demand, it would help keep prices higher.

- The average age of the first-time home buyer is over 30. Congrats. They would own their home at age 80+, assuming they were still alive. If not, heirs would own the mortgage.

- 30-year mortgage rate are higher than 15-year rates. 50-year rates would be higher still. The higher rate would eat up some of the alleged “savings”.

- People are already in trouble because they do not understand property taxes or maintenance……

Addendum

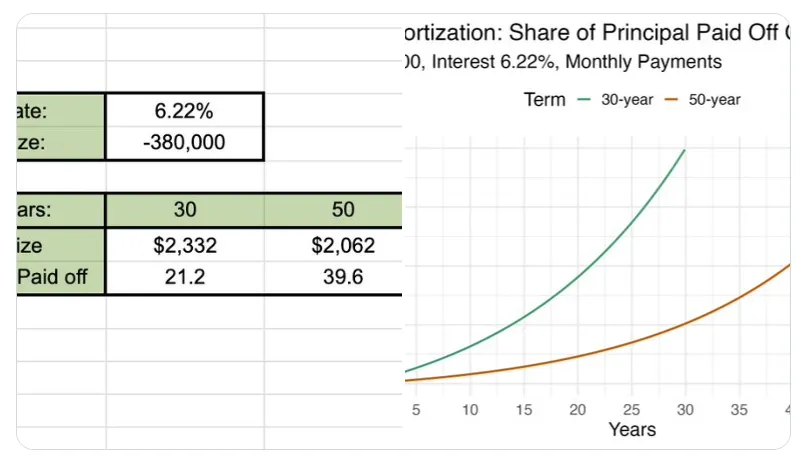

After 12 years of payments on a 50-year mortgage very little principle will have been paid back.

Here’s the exact comparison for a $400,000 loan at 6% fixed rate after exactly 12 years (144 monthly payments) on 15-year, 30-year, and 50-year mortgages.

And Supermoney in 5 Reasons Why Trump’s 50 Year Mortgage Proposal Is a Horrible Idea:

1. Little effect on affordability

With home prices and mortgage rates both high, a new idea is gaining traction—the 50-year mortgage….

How a 50-year mortgage works:

The longer term reduces monthly payments, helping buyers meet debt-to-income (DTI) ratios.Illustrative example at the same 6.30% rate on a $500,000 loan:

- 30-year loan: ~$3,103/month

- 50-year loan: ~$2,801/month

- Monthly savings if rates were identical: ~$302

Longer terms have higher interest rates

>Reality check: 50-year loans would carry higher rates (+0.7% to +1.0% or more) because they expose lenders to decades of extra risk. At a realistic 7.00%, the 50-year payment rises to ~$2,907, cutting savings to just $196/month. At 7.30%, savings shrink to $146/month.

2. Explodes the long-term cost

| SCENARIO | RATE | MONTHLY PAYMENT | TOTAL INTEREST |

|---|---|---|---|

| 30-year standard | 6.30% | $3,103 | $617,080 |

| 50-year — Same rate (unrealistic) | 6.30% | $2,801 | $1,180,600 |

| 50-year — Realistic rate +0.70% | 7.00% | $2,907 | $1,244,200 |

| 50-year — Conservative +1.00% | 7.30% | $2,957 | $1,274,200 |

Bottom line: The longer term guarantees a higher rate. Once that penalty is added, the monthly “savings” become tiny, but the lifetime cost explodes past $600,000 extra interest.

3. Retirement risk

A borrower who buys a home in their early 30s could still be making payments well into their 80s….it blurs the line between owning and renting — you may technically own your home, but you’re still making payments for most of your life.

Entering retirement with a mortgage means a large, fixed expense at precisely the time income typically drops. …What seems like affordability in the short term could become a generational form of debt…

4. Will lead to housing inflation

Longer terms let buyers qualify for bigger loans, which pushes prices higher in supply-constrained markets. Canada (40-year loans pre-2008) and the UK (35–40-year terms) saw similar demand spikes followed by tighter rules. Extending terms doesn’t add homes, lower land costs, or raise wages, it just inflates another bubble.

5. Slows equity growth

After a decade, the 50-year borrower has less than half the equity despite paying only ~$196 less per month.

More disses courtesy Twitter. The first focuses on a critical issue, that just about no one would keep a home for the life of the mortgage, and the impact of the longer maturity and higher interest on typical ownership terms. This is similar to the point we made at the top, that a longer-term mortgage with a refi will result in more money going to middlemen, and also means more money will have gone to interest if you sell the house before maturity, so less in principal recovery and gains if any:

Everyone's debating 50-year mortgages like you'll actually pay them off.

You won't.

The reality:

Average homeowner moves every 9-10 years

Most refinance 2-3 times before thatAlmost nobody pays off a mortgage by making 360 payments

Your mortgage is a temporary financing…

— Chris Smith (@Chris_Smth) November 10, 2025

The "50-year mortgage" is a disgusting insult. We are Americans. We are not slaves. We are not slaves to the plantation owner. We are not slaves to China. And we are not slaves to Wall Street. This 50-year mortgage idea is a spit in the face. It is an insult. We did not vote for… pic.twitter.com/2EG74pYRqe

— James Fishback (@j_fishback) November 9, 2025

How is

“here, enjoy this 50 year mortgage”

different from

“you will own nothing and you will like it”

— Thomas Massie (@RepThomasMassie) November 9, 2025

And last but from the least, just in from The Hill:

Lower monthly costs could also tempt prospective homeowners to buy more expensive homes, which, Realtor.com senior economist Joel Berner told CBS News, could further drive up prices, eliminating any benefit from lower monthly payments.

“This is not the best way to solve housing affordability,” he told the network.

The Mortgage Bankers Association (MBA) also expressed skepticism about the feasibility of a 50-year mortgage.An MBA spokesperson told The Hill the “mortgage lending industry welcomes efforts to make homeownership more affordable and attainable for more Americans,” but “our concern is that any affordability benefit derived from expanding the mortgage term to 50 years would be offset by increased borrower risk and slower borrower equity growth resulting from the extended amortization period, especially given the expected slowing of home price growth.”

Freddie and Fannie nevertheless will spend money devising standard mortgages at these 50 year terms and promoting them to lenders. And DOGE will peculiarly fail to head this wasteful expenditure off at the pass.

––––

1 Nerdy detail for the curious, from the same post:

The structuring of Freddie and Fannie bonds is to deal with interest rate risk (remember, there is no credit risk since the bonds are guaranteed by the GSEs). This is well established technology, dating back to the early 1980s.

The undesirable feature of mortgages is their prepayment risk. Every country ex the US has features in mortgages that restrict or prohibit prepayment risk (the most common is having mortgages be floating rather than fixed rate). Prepayments are very unattractive to bond investors, since the time you are happiest as a fixed income investor is when interest rates fall, since your bonds go up in value. But if you hold a simple mortgage pass-through, the bond will disappear due to prepayments.

So the structuring of a CMO (collaterlialized mortgage obligation) creates a series of normal looking bonds from the cash flows from mortgage securities: some fixed interest rate bonds of various maturities (created at a lower interest rate than the yield on the mortgages) and one medium-term maturity fixed rate bond which is then decomposed into a floating rate bond and an “inverse floater” which consists only of the inverse of the interest rate payments on the floating rate note (for instance, if the coupon on the bond from which it was decomposed was 6% and the rate on the floater is Libor + 8 basis points, or .08%, the inverse floater would pay at 6% – (Libor + .08%).

There are some dirty little secrets of inverse floaters. The first is that because the other parts of the deal are very to extremely easy to sell, various features of the deal structure are tweaked to favor the inverse floater, plus the other components are often sold at premiums, meaning some additional cash flow can be diverted to the inverse floater. This is useful because the inverse floater is colloquially called “toxic waste.” It is very difficult to sell and usually retained by the originator because it is hard to explain, hard to model, and has widely divergent payouts depending on what interest rates and prepayments do.

The second dirty secret is that all the feature tweaking makes inverse floaters a good bet on average. On a $100 million bond deal, you might expect $2 million of the value to be in the inverse floater. All the eagerness of the other buyers for the other pieces means you can probably rejigger terms during the deal structuring for it to be expected to be worth $3 million. If you are smart and disciplined, you book it at $2 million, so that if things work out, you look like a hero. and if events pan out otherwise, you look like less of a goat.

End-stage neoliberal asset inflation and financial extraction.

America isn’t a country, but a business — a plantation. Mr. Fishback is in the denial stage of the Kubler-Ross cycle of accepting this.

{I was doing 30 years to life in the big house, when they decided to extend my sentence another 20 years…}

How much longer are we going to survive all the cockamamie air-brained hair furor schemes, thought out on a whim on a suggestion from a most interested party?

My immediate reaction: This is the problem with our public education system that teaches nothing about money, money creation, finance, mortgages and amortization in schools. Not just our public education system, but the system in virtually all western countries. My 16 year old daughter is good at math. She gets the concept of compound interest and exponential functions. But when I showed her an amortization schedule for a sample 30 year mortgage, she was dumbfounded. She needs to learn this at home, because none of her teachers will ever explain this to her.

Ever since SAAS companies realized that reoccurring monthly payments (I.e. we never own anything) is a literal gold mine, everyone is jumping on that boat.

I’m interested in finding out more about the refinancing capture of 2/3 of the economic benefit. That seems like an underreported issue.

Where do I find out more details? Thanks.

I am pretty sure I have a more specific source in my archives, but this will give you the drift of the gist:

https://www.nakedcapitalism.com/2013/08/a-very-profitable-part-of-banking-goes-totally-to-heck.html

How does passing your mortgage onto your children even work? They may have not even been born when that original 50 year mortgage was signed. Do they even get a say? So no debt without representation? Or is it more a case of an STD – a sexually transmitted debt.

The children don’t personally owe the money. When someone dies, their debts are paid out of their estate; any debts left over are canceled.

But a mortgage is on the property the children inherit, which is still burdened by the lien. By the time they inherit, a noticeable amount of principal may have been repaid, leaving equity in the property. If they want to keep the property, they have to pay the mortgage, by refinancing it or otherwise. (That’s why it’s called a mortgage = “dead hand.”)

Also, their parents benefited from the cash they received in the mortgage (if it was a cash–out refi) or simply by being able to buy the property that the children are now inheriting. Either way, the payment (or property) the parents received in exchange for the mortgage increases the value of the estate that passes to the children.

That doesn’t make a 50-year mortgage a good idea. It’s a very bad one. For all the reasons stated in the post.

The children don’t personally owe the money. When someone dies, their debts are paid out of their estate; any debts left over are canceled.

Porcine maquillage

When someone dies, their debts are paid out of their estate; any debts left over are canceled.

Perhaps in the USA, but not elsewhere (basically, where the Roman-Germanic legal system rules): the residual debt passes on to the inheritors. If they do not want to be burdened by debt inherited from their parents, they must repudiate the entire inheritance.

If “debts left over” exist it implies there are no assets remaining in the estate to inherit. But here I think the question is the terms of the note, since in case of default etc the lender has recourse to the security instrument, Deed of Trust or Mortgage typically in the US.

Yes, this occurs for instance when after evaluation of the legacy, the real-estate to be inherited appears to be severely underwater wrt mortgages (it can happen, there are such things as real-estate busts), and pledges to cover nursing home costs.

Then the descendents may simply repudiate the inheritance and let the banks and other creditors deal with the mess.

Assumable mortgages were a big deal back in the Carter/Reagan era.

What I don’t like is that the TIL form amortizes up-front origination fees over the loan term expressed as interest rate, so on a 50 that is going to be small. If instead they had to show it over the 7 year average life the imputed interest rate would be much higher.

The interesting (well, in a morbid sortuv way) thing about the three main economic proposals from Trumplandia and the Republican reactionary mainstream is that that none of them is a serious economic proposal. (I won’t mention fantastical supply-side economics, which is part of the continuing disaster of the U.S. political economy and accepted by the MonoParty of Property.)

—I’m so old that I recall the “no taxes on tips” proposal. This proposal would entrench all of the bad U.S. habits of the U.S. tip economy, which is borderline slavery. The proposal also undermines FICA / Social Security. Not so amazingly, people were lapping it — servility is never out of style.

—The tariffs as revenue raiser and political pressure are going to distort an already distorted U.S. economy. Naked Capitalism has been all over their ill effects.

—Now we have the fifty-year mortgage. Eternal interest payments. I don’t even want to think about the mentions in this article of inheritable mortgages — which would be an economic absurdity.

The Democrats will do anything not to govern and not to rescue the social state. The Republican mainstream / Trumpists seem to live in a world of economic fantasy and foreign-policy sock ‘em / pow comic books. What could possibly go wrong?

The idea/PPT slide directly came from Bill Pulte, a literal nepo-baby—grandson of the founder of Pulte Homes.

Then intellectually unserious Trump, presumably impressed that he can be the next FDR, instructed his team to retweet the slide, lmao

Can we please bring back the oligarch hyper-tier for the federal estate tax? not holding my breath

Kinda like the company store. Debt slaves forever.

Sure seems like that.

At which point I leaned into it and was wonder what would be the term of a loan that gets a $500K house price to $50 per month? 200 years? 2000 years? 10,000 years? I mean who cares at this point, make it a million years and see if we can get the monthly payment below a buck.

So yeah, it’s a bad idea, but in my opinion even a thirty year term seems very long. Longer term home loans came about as a New Deal program:

Homeowners Refinancing Act https://en.wikipedia.org/wiki/Homeowners_Refinancing_Act

At that time 15 year home loans became the most popular (prior was 5 to 7 years). 30 year home loans didn’t become popular until later in the 1950’s but that also was when most people could get career length employment with one employer that also included good retirement pensions, and a healthcare system that didn’t bankrupt you with one emergency. A fifty year loan in the AI powered gig economy with a Russian roulette healthcare system? That’s just a completely unserious solution to a very real problem.

To me this is a big one. Where supply is constrained, the monthly cost people can afford sets the price. Supply can be constrained by population growth, high cost of construction, lack of land in the only places where there are jobs under neoliberalism, homes taken of the market to be illegal hotels or empty assets. Anyway more “generous” lending means higher prices because everyone needs a roof over their head.

And hey, maybe that is the goal, pump some more air into the everything bubble by increasing home prices! Higher asset prices is after all growth and doesn’t generally count as inflation even as life gets less affordable.

I worked at a large bank back in 2003-2006 selling mortgages. Towards the end of my time there the bank brought out a 40-year loan. I sold zero of these things, because anytime I covered the option they would be at a higher rate, likely 3/8 to 1/2 percent higher. Comparing payments with a 30 year the difference in payment was not material, thus they never took off. I imagine that will be the case today with a 50-year loan, the higher interest rates that will be required for a higher loan/refi risk will offset most of a reduction from a longer term.

From my vantage point a 50 year mortgage looks an unbreakable 50 year lease.

Plus the landlord gets to pawn off the taxes, insurance and upkeep onto the tenant! Whats not to like?

Here in Hawaii, the big idea was to lease the ground for 50-75 years and only buy the improvements. Worked OK for while but IMO home prices didn’t sufficiently account for the fee interest. But then when the lease was getting down to 10-15 years people found they could no longer get loans. So a crisis resulting in laws forcing lease conversions for residential real property. Of course you needed a new loan to buy the fee.

Since the lessors tended to be the Hawaiian “ali’i trusts” (third generation of chiefs since title in real property was instituted tended to leave their estates in land to trusts to benefit Hawaiians) this became a cultural issue as well.

Yes, what was the phrase from 2008? You are a renter with debt.

Maybe a dumb question; why not take the 50 year to keep the monthly payment as low as possible, then pay as much as you would have with a 30 year loan (or more if you can) in order to pay it off way early?

I did this with a 30. They were offering 15 and 30. I took the 30 and paid it off in 11.

A sagacious act that I trust has set you up to prosper. But also, I would imagine, a winning gamble on your rising income at that stage in your career, your own foresight in not ‘living up’ to your increasing income, and your being spared some random misfortune that would have scrambled your calculations. Not a game suitable for everyone to play.

Because the shorter loan will almost always have a lower interest rate, which means even though the difference between your monthly payment and your overpayment is smaller, more of that overpayment is going to the principle, which means you’ll pay off the shorter loan sooner.

Example. $400,000 loan financed for 30 years at 6.98% interest continuously compounded. Your base monthly payment without insurance or taxes will be $2659.14 Over the course of those 30 years, you’ll pay about $534587 in interest. To pay off the loan in 11 years instead, you pay $4331.96 each month, reducing the amount of interest you paid to about $176125.

Now take the $400,000 loan financed for 15 years at 6.48% interest continuously compounded. Using the same $4331.96 over payment, you end up paying off the loan at month 128, or 10 years and 8 months instead of 11 years. Furthermore, you end up only paying about $155996 in interest instead of the $176k.

If you can afford a higher monthly payment of a shorter term loan when you first buy a house, and are highly job secure, you should take the shorter term loan because of what I described.

Correct. But in the US the FIRE sector encourages folks to purchase the biggest hou$e they can. Purportedly to capture the future rise in home prices (while the FIRE sector captures the most money now).

Let me add, that it is not just maintenance and property tax costs that new homeowners don’t seem to understand in their excitement to have a “home of their own”. Utility costs rarely decline. As some have learned with new data centers nearby, monthly electricity bills are going through the roof. Home insurance is rising due to new climate calamity, as well. Buying the bigge$t home possible can portend a personal financial disaster.

However, even renters have to pay the higher electric costs too, I rarely ever see rental units with utilities included anymore. Most owners will, in turn, jack up rates with rising insurance/taxes costs as well.

About the only thing renters don’t have to worry about is the appliance, flooring and structure repairs/replacements.

If the owner of a rental intends to flip in a few years and is counting on 7%-10% price appreciation then sure, he can eat the property tax and insurance for a couple years and still come out ahead. But for a long term owner the ROI won’t justify the investment.

We own a rental in Cali that we owned when Prop 13 went into effect. Due to that we can keep rents $800 or so below market and still get a decent return. Not so if we sold that house tomorrow and the tax went up to current value.

The heuristic I learned was that one extra principal payment (loan amount/360) annually cuts about 7 years off a 30 year mortgage. We added enough extra principal to every monthly payment to make two months worth at the end of the year, essentially cutting the mortgage in half. About 8 years in we did a refi with a 15 year mortgage, made the same extra principal payments again, and paid off the 15 year in about 8 years. Even taking out some cash for repairs in the refi, we paid off the house in about 17 years.

When we were looking for the house, it was in the pre-crash boom times, when everybody was getting pre-approval letters in the mail for astronomical amounts of money. Whoever sent these out determined that we could afford about twice the amount that was actually affordable for us. Had we trusted this “advice”, we would have grossly overpaid for a house and probably lost it.

My unsolicited advice – always try to pay extra principal on a monthly basis [and be sure to note the extra is just for principal] to drastically cut down the interest you pay to the bank. If you go for financing and you can’t pay a few hundred extra dollars extra per month on top of the figure the bank gives you, then you can’t really afford the mortgage. If the regular payment maxes you out every month and then you lose a job, you are at much greater risk of losing the house. Paying extra principal also gives you some cushion to make lower payments if your financial situation changes for the worse.

All that being said, nobody should ever be saddled with 50 years worth of debt, for all the reasons others have mentioned here. Thirty years is already too long.

Wait a minute. Aren’t banks very fond of imposing additional fees and lump charges to punish those borrowers who reimburse their loans in advance? How does this change the calculation?

When I did mine in 2000, I made sure the loan didn’t penalize for early payoff. I paid as much as I could every month up until I paid off a big chunk at the end to pay it off completely (money I had saved – saved – what is saving Kemosabie :-)).

When I did that, I also demanded the original wet ink note I signed (just to be an ass) since it had been resold a few times it appeared. Best I can tell that’s what I got. I think it was called a note.

Same here. I asked about any pre-payment penalties ahead of time and only signed the loan once I learned there weren’t any. The mortgage also came from a credit union and not a bank – not sure if that makes any difference as far as terms and fees go.

Re-fied plenty of loans over the years (bought a house in 87 when interest was around 14%). Never had any special fee, but the servicers do tend to add on a few things ($50 to compute payoff amount, $50 in recordation fees, etc). You pay that sort of thing even if you keep the note full term.

Thanks for this post.

For some reason or other, this looks to me like another bailout of Wall St. and the big banks. (Sort of like the ‘student loan’ business. / ;)

Trump probably believes that people take out mortgages not because they lack the cash to buy a house outright, but because they prefer lower monthly payments, even if it means paying more interest over time.

A 30 year mortgage was all I could afford, but I’ll be long dead (or destitute and repoed is the other possibility) before that term is up. Nothing about the housing market makes sense to me. A home that was sold for $140,000 in 1990 should not be selling for $575,000 now, that’s just absurdly stupid. My wages didn’t quadruple during that interval. If we had a government that actually worked for the people I would say make 25 years the longest legal mortgage term and only allow interest to compound during the first half of any mortgage term (then go to simple interest for the remainder of the term). But can’t have that, market roolz!

It makes sense, inequality has just increased. Look at Canada where wages have increased an average of 0.5% per year, average house price has increased 2.1% per year, but national net worth has increased 6.9% per year. If wages actually increased proportionally house prices would still be affordable

Another item, after 50 years, will there even be a house as collateral given climate change-induced disasters? Will today’s houses even be standing (no one builds with that timeline anymore)?

I am massively impressed with Naked Capitalism and Strong Towns. I Remember trying to shoutout ST in the comments years ago, it didnt end well. Its only been mentioned sparingly since around here.

Strong Towns calls it a ‘trap’ with the horrors of extreme financing and speculation. The 30 year mortgage was a major escalation of risk in itself. There’s no incentive in this country to drop housing prices, unless there is a true crash.

To see both Naked Capitalism and ST year after year arrive at the same conclusion is fascinating.

To offer an alternative view, a long mortgage, e.g. fifty years, is not such a terrible product for certain people and purposes so it should not be banned, just regulated. The same applies to very short term borrowing, equally.

Example 1:

– we took out a forty year repayment mortgage on our farm when we inherited it from my grandmother, with a ten year fixed rate. This bought us certainty while we tried to turn the farm around (and waited out a sitting tenant who leaves this year).

– we just refinanced, to expand the farming once the lease falls in… with a one year term, floating, interest only overdraft facility! From the sublime to the ridiculous! But we are betting that the interest rate cycle has turned so the floating nature does not worry us for the moment and the overdraft is from a private bank that lends to landowners etc. so their business model is Bagehotian – be patient, lend liberally and expensively against the best collateral – and the overdraft will in practice just be rolled forward. The annual refinance gives them fees and leverage with wayward clients. We doubled the borrowing in the refi and are still at only 16-20% LTV if we maxed out the facility, 8-10% LTV at the current borrowing. We plan to pay the interest and keep the headroom but if rates start rising or cashflow stumbles we would have plenty of “fiscal space” to allow interest to roll up and seek a new harbour in the storm.

Example 2:

In the UK, tenants get a very mixed deal. There has been a lot of flexibility in the forty years since the assured short hold lease was created in 1986 and a small time, buy-to-let landlord boom ensued. This is because the assurance was that the landlord could get his property back! There is no security of tenure with an AST. (We had residential sitting tenants into the 1990’s and we had to wait for them to die and the rent tribunal would not raise their rent to market). But rents are high and amateur landlords and parasitic rental management companies have bad reputations for slow, poor and expensive repairs and non-existent refurbishments and outrageous restrictions like bans on pets and children.

The commenter above who said a 50 year mortgage was like an unbreakable lease may have been joking but it is a real benefit. Renting in the UK is a mug’s game once you’re no longer a student and have stable employment, especially with a family, but you could just buy a property in a 50 year mortgage, pay less than renting and have security of tenure, freedom to choose your wall colours etc. Admittedly your deposit is at risk if the market falls but the UK is run by rentiers who will do their best to prevent that and any capital gain is tax free….

Clearly I am not arguing that it improves affordability – any increase in credit supply just bids up the price of land. But by that token, get in quick if it is created because land is going to get a booster rocket….

Also, to pick up a comment above, in countries other than the USA, mortgages are often portable, so you could take the fifty year loan and move house in its remaining time. You might well pay it off, especially if you built equity climbing the housing ladder and then downsized….

Just a defense of the 30 year mortgage. Primarily, it’s the monthly payment that makes it cheaper than a 15 year or other mortgage. When money is tight, the monthly payment may be doable, but when you get an Xmas bonus or a raise or other money, you can make an overpayment, and the money above the normal amount goes directly against the principal. We did this with our house, always putting in a few hundred more a month over the regular payment. At some point we got the principal down enough that we refinanced into a 15 year mortgage. (This is all in the 90s and early 2000s.)

Yes, an enormous amount of money is given to interest, especially in the early years, but if you work it right, it can be easier to handle than a shorter mortgage. And obviously you get more equity than if you just rented a place.