Yves here. US popular mythology puts taxation without representation as the driving force behind the American rebellion against England. This article contends that high and uneven taxes, particularly imposed without consent, were central to the French Revolution. Trump’s tariffs are the poster child for arbitrary taxes imposed without citizen or legislative approval. And the US’ level of inequality is higher than that of pre-Revolutionary France.

By Tommaso Giommoni, Gabriel Loumeau, and Marco Tabellini. Originally published at VoxEU

Extractive taxation is considered one of the main causes of the French Revolution. This column exploits regional variations in the French salt tax, which accounted for 22% of royal revenues in 1780, to document that areas of France burdened by a higher tax rate experienced more revolts in the years leading up to the Revolution. These effects were amplified by droughts that increased food prices and activated latent discontent. It suggests that when taxation is imposed without representation, it can become a catalyst for popular unrest, especially after negative economic shocks.

The French Revolution dismantled the Ancien Regime and ushered in a new political order, redefining state power and institutional structures. Its transformations – from the abolition of feudal privileges to the creation of modern bureaucratic and legal frameworks – extended far beyond France, shaping institutions across the world. Although the causes of the French Revolution are complex and multifaceted, one widely recognised factor is extractive taxation (Norberg 1994). However, despite its prominence, to the best of our knowledge, no systematic evidence exists on the hypothesis that extractive fiscal institutions were an important determinant of the French Revolution.

Our recent paper (Giommoni et al. 2025) seeks to fill this gap, exploiting geographic variation in the incidence of the salt tax – considered one of the most “iniquitous institutions of the Ancien Regime” (Sands and Highby 1949). First introduced as a temporary measure in the mid-13th century and then made permanent one century later, the salt tax in 1780 accounted for 22% of royal revenues (Touzery 2024). The salt tax varied across regions, along multiple tax borders – creating large discontinuities in tax rates, which we can exploit in our analysis. Because public goods provision was minimal and centred around royal prerogatives, such as national defence and justice, a higher tax burden did not correspond to higher redistribution.

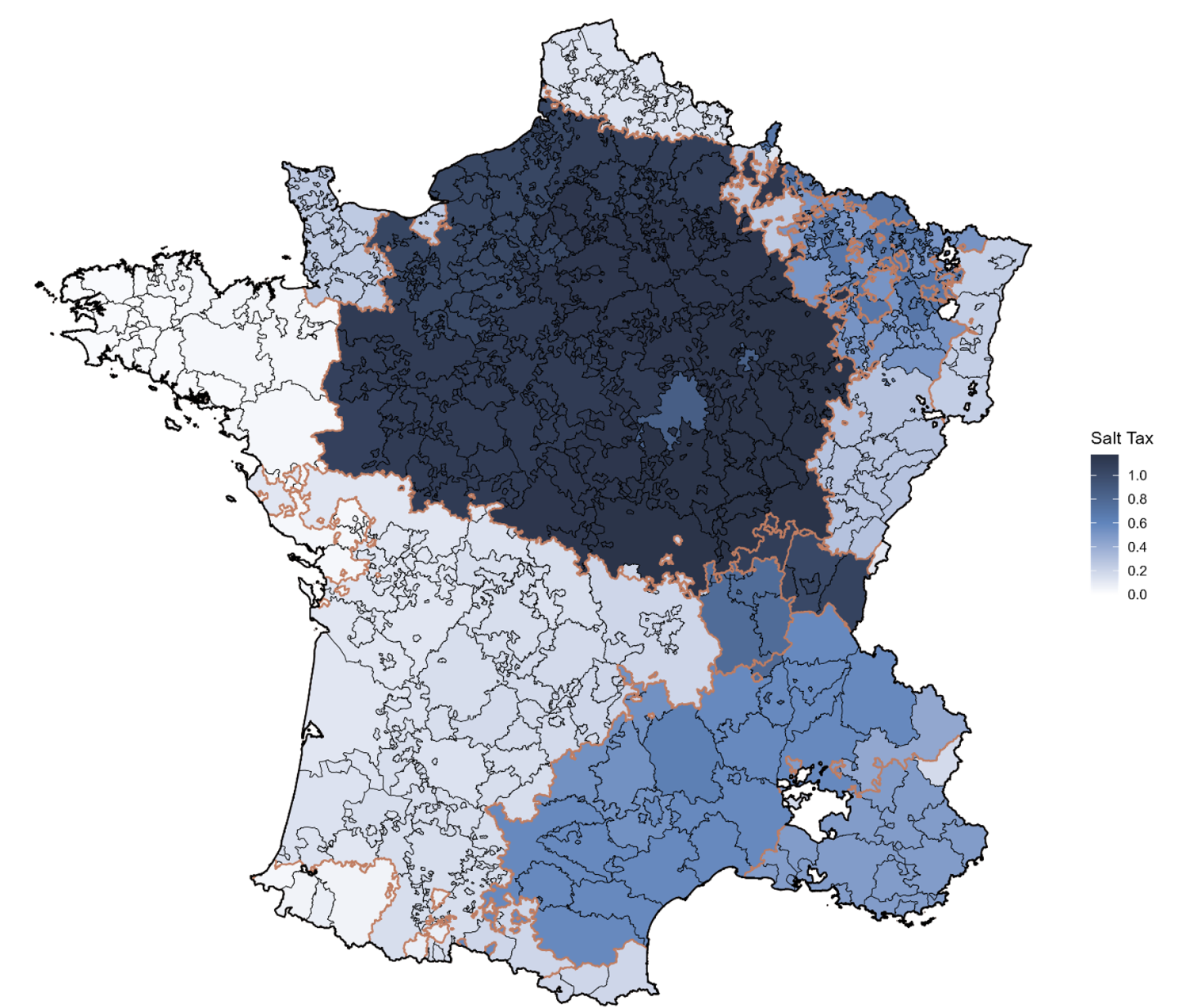

We retrieved and geolocalised data on all historical salt-tax borders from the digital archives of the National Library of France, which we cross-referenced with newly hand-collected information on the salt tax rate prevailing in each jurisdiction on the eve of the French Revolution. The resulting map is plotted in Figure 1 (darker shades of blue correspond to higher salt tax rates). We combine these data with a comprehensive dataset assembled by Chambru (2019) that provides a fine-grained localisation of uprising events before, during, and after the French Revolution.

Figure 1 Salt tax map

Notes: The figure plots the salt tax, expressed in pounds per litre, at the bailliage level, together with the salt-tax border highlighted in orange.

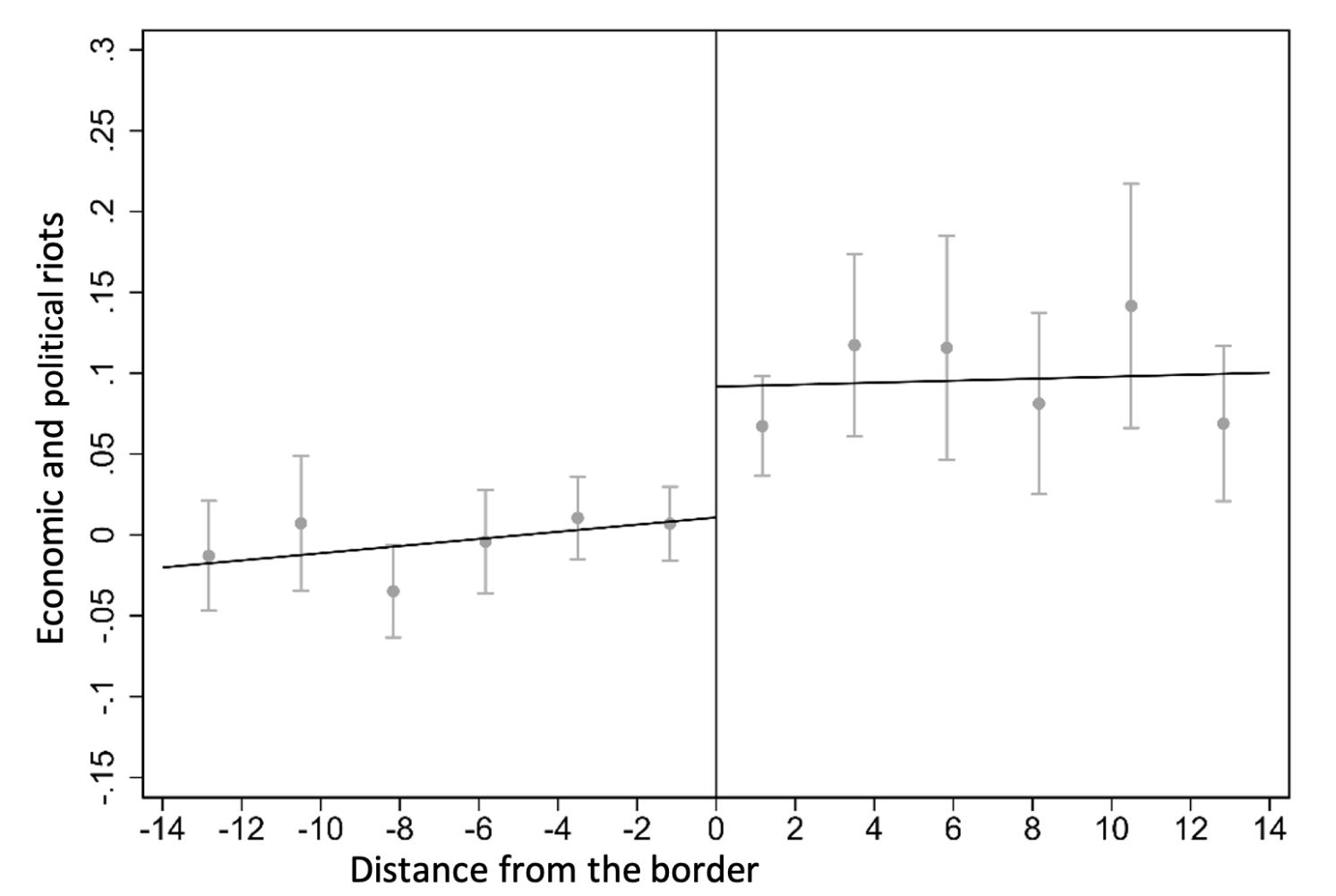

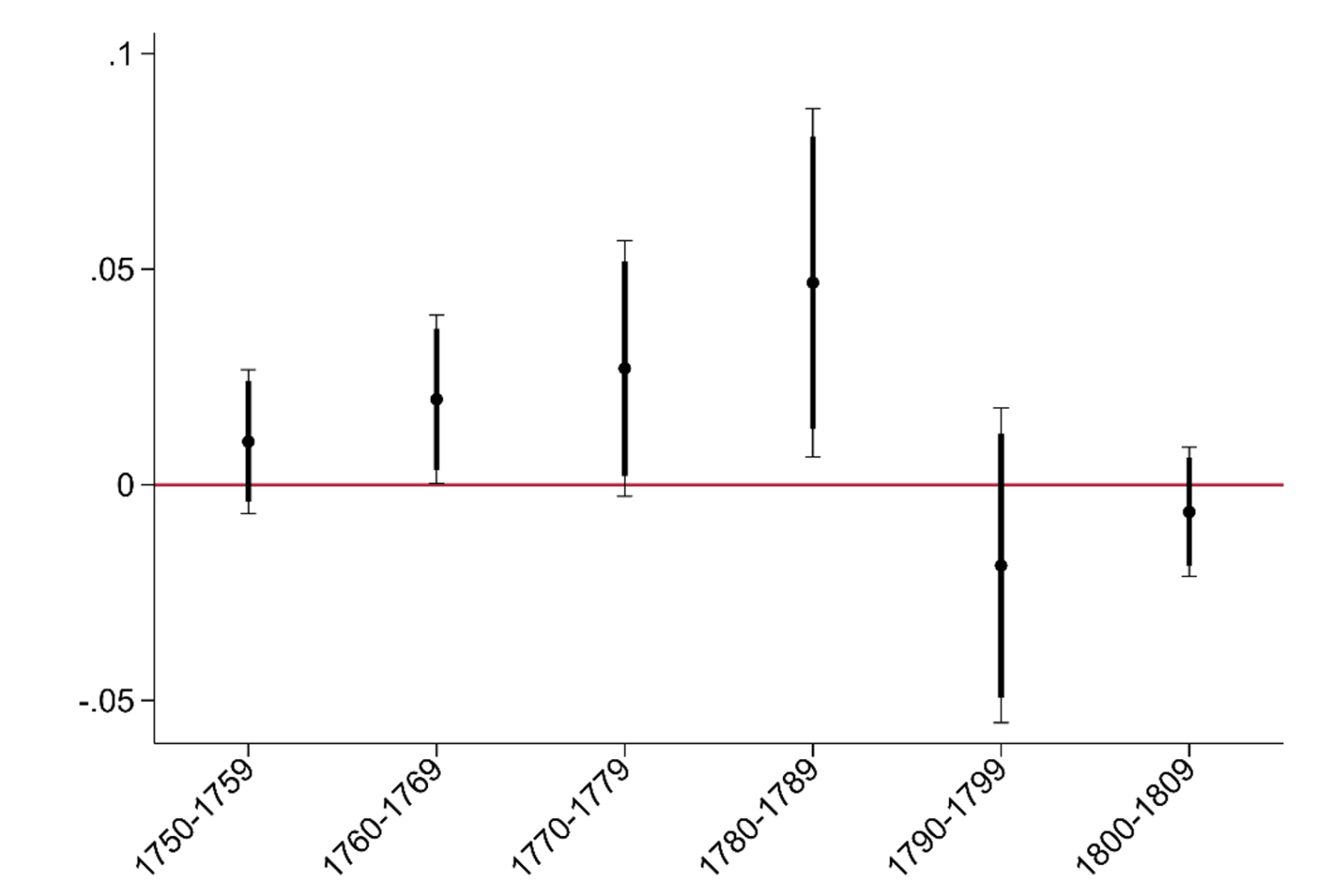

We deploy a non-parametric regression-discontinuity approach with optimal bandwidth and polynomial order selection following Calonico et al. (2014) around the salt tax borders. We find that crossing the salt-tax border leads to a discontinuous increase in the number of riots (Figure 2, Panel A). The effects of the salt tax begin to appear in the 1760s and grow over time, peaking in the 1780s (Figure 2, Panel B). According to our estimates, crossing the border from a low- to a high-tax municipality increases riots over the 1780–1789 decade by 73% relative to the sample mean. These effects are due to both the intensive (more riots in a given location) and the extensive (more locations experiencing at least one riot) margin.

Figure 2 Riots around the tax border

a) Number of riots, 1750-1789

Notes: The plot shows non-parametric regression-discontinuity estimates following Calonico et al. (2014) under optimal bandwidth and polynomial order selection. The dependent variable is the number of economic and political riots between 1750 and 1789. The treatment equals one for municipalities in the area with a higher rate. The specification includes border fixed effects as well as a set of municipal controls (population in 1780, coordinates, and soil fertility). The sample includes all municipalities in contiguous France, except those in the bottom quartile of the tax gap distribution. The coefficient is 0.104, and standard errors, clustered at the bailliage level, are 0.045.

b) Regression-discontinuity estimate, by decade

Notes: The plot shows non-parametric regression-discontinuity estimates following Calonico et al. (2014) under optimal bandwidth and polynomial order selection. The dependent variable is the number of economic and political riots for different periods of time (bins of 10 years). The treatment equals one for municipalities in the area with a higher rate. The specification includes border fixed effects as well as a set of municipal controls (population in 1780, coordinates, and soil fertility). The sample includes all municipalities in contiguous France, except those in the bottom quartile of the tax gap distribution. Standard errors are clustered at bailliage level.

The salt tax had been in place for centuries. Why, then, did its effects peak after 1780? Historians have pointed to several structural factors that heightened tensions during this period, such as the spread of Enlightenment ideas and the rising indebtedness of the French government. Historians and economists have also stressed how a series of droughts that hit France in the 1780s destroyed the harvest, increased wheat prices, and fuelled revolts throughout the country (Lefebvre et al. 1947, Waldinger 2024).

We conjecture that the eruption of discontent was stronger in places historically burdened by a higher salt tax, where weather shocks activated citizens’ frustration and opposition to the state. Combining our baseline regression-discontinuity analysis with temporal and spatial variation in growing-season temperatures, we confirm this hypothesis and show that droughts amplify the effects of the salt tax on revolts.

We then more directly connect our analysis to the French Revolution. We first test whether the salt tax favoured the spread of revolts across space and over time. We focus on the wave of riots that swept through France shortly after the storming of the Bastille, also known as the Great Fear. Between mid-July and early August 1789, rumours that the king sought to suppress the Third Estate triggered widespread violence that caused panic and led to the abolition of feudal privileges on 4 August 1789 (Lefebvre 1973). Exploiting newly geo-referenced data, we document that high-tax areas are more likely to host an initial revolt that was subsequently followed by many other riots. We also show that, during the Great Fear, revolts propagate more in high-tax areas.

Next, we verify that parts of France burdened by a higher salt tax express more complaints against the salt tax in the list of grievances collected by the king in the spring of 1789, ahead of the General Estates (Shapiro et al. 1998). We also collect data on newly elected members of the National Assembly (the legislature of the Kingdom of France from 1 October 1791 to 20 September 1792) and document that legislators representing areas subject to a higher salt tax are more likely to support the abolition of the monarchy.

Using newly digitised data on the votes cast in January 1793 by members of the Convention Nationale, 1 we further document that legislators originating from high-salt-tax regions are more likely to vote for the death penalty for the king. Comparing two legislators representing high- and low-tax areas, respectively, the former is 50 percentage points (or 79.5% relative to the mean) more likely than the latter to vote for the death penalty for the king.

The notion that extractive taxation was one of the main causes of the French Revolution is widely recognised in the historical literature (Marion 1921, Sands 1949, Touzery 2024). However, our paper is the first to provide systematic evidence in support of this idea. More broadly, our findings shed light on the relationship between taxes and revolutions and resonate with the well-known maxim ‘no taxation without representation’. While Angelucci et al. (2022) have documented how fiscal autonomy and local tax collection enabled medieval English towns to gain representation, our findings emphasise the risks of political exclusion: when taxation is imposed without representation, it can become a catalyst for popular unrest and regime change, especially following negative economic shocks.

See original post for references

It may have been the French taxation system that brought on the French Revolution as they simply could not get it together. For a contrast, the British reformed their tax system, fought several major wars and managed to pay their debts. The French were never able to do so, fought several wars and went broke. They knew about the British system but could never get in introduced into France. The French taxation system was extractive but only selectively so. The Nobles never had to pay any taxes and would oppose the thought of doing so. And it got worse. Under Louis XVI the rate at which certain people were being added to the Pension List grew at a rate faster than defense. And it wasn’t poor people being added to the Pension List.

That Salt Tax map may need another factor to be considered. The darker colours look like the old French heartlands including up to the coast where they fought the British for control over the centuries. But as one paper explained-

‘More “recently” absorbed territories such as Brittany, Burgundy, Provence, Artois (fifteenth century), Bearn, Foix, Bigorre (sixteenth century), Franche-Comte, and Flanders (seventeenth century) negotiated their global tax dues with the king through the provincial Estates, which met regularly and were charged with collecting tax monies.’

Macroeconomic Features of the French Revolution

http://piketty.pse.ens.fr/files/capitalisback/CountryData/France/Other/PublicDebtFR/SargentVelde95.pdf

So perhaps that salt Tax map should also be mapped against these ‘recent’ acquisitions over time.

OP: The notion that extractive taxation was one of the main causes of the French Revolution is widely recognised in the historical literature (Marion 1921, Sands 1949, Touzery 2024). However, our paper is the first to provide systematic evidence in support of this idea.

I’m not sure systematic evidence was necessary, though this data is interesting. How systemic was tax farming — parasitic taxation by elites — in Pre-Revolutionary France? This systemic —

Wall of the Ferme générale

https://en.wikipedia.org/wiki/Wall_of_the_Ferme_g%C3%A9n%C3%A9rale

…Unlike earlier walls, the Farmers-General Wall was not intended to defend Paris from invaders but to enforce payment of a toll on goods entering Paris (“octroi”). It was commissioned by the nobleman and scientist Antoine Lavoisier on behalf of the Ferme générale (General Farm), a tax farming corporation that paid the French State for the right to collect (and keep) certain taxes. Lavoisier was a shareholder and Administrator of the Ferme générale and determined that the cost of building, staffing, and maintaining the wall would be compensated by better revenue collection. The wall’s tax-collection function made it very unpopular: a play on words of the time went “Le mur murant Paris rend Paris murmurant” (“The wall walling Paris keeps Paris murmuring”)There was also an epigram:

Pour augmenter son numéraire (To increase its cash)

Et raccourcir notre horizon (And to shorten our horizon),

La Ferme a jugé nécessaire (The Ferme générale judges it necessary)

De mettre Paris en prison (To put Paris in prison).

The Wall was five meters high and 24 km long, following the then-boundaries of the city of Paris. No buildings could be erected within 98 meters of its exterior or within 11 meters of its interior. The outside of the wall was flanked by boulevards….

Me: It was a big, beautiful tariff, in short.