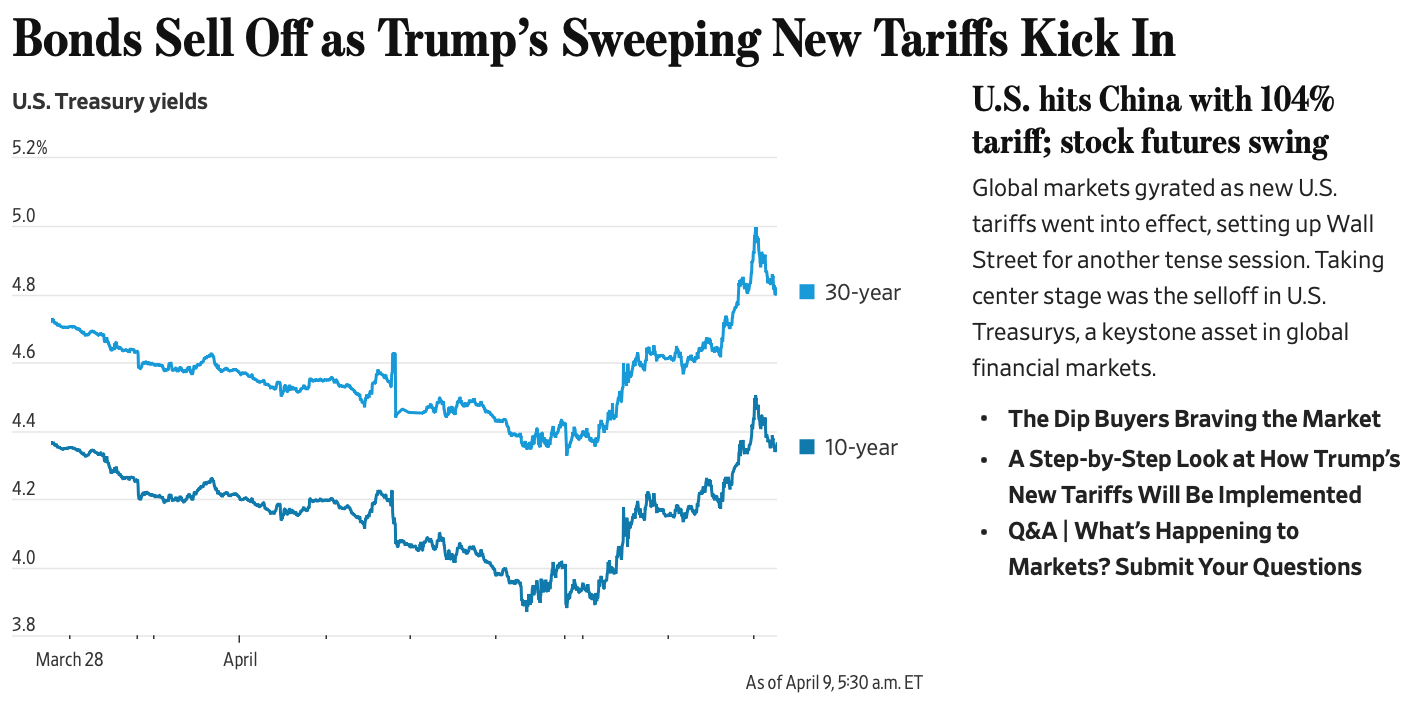

Yves here. The Trump tariff blowtorch is now whacking the Treasury market. Even before this massive own goal, Trump was complaining about the Fed having interest rates that in his mind were too high was bad for business and (somehow) making inflation worse. Some commentators have argued that an (the?) objective of the tariffs was to lower interest rates, particularly on Treasuries, so as to lower the interest cost burden. That’s proving to be a backfire too. See the banner headline at the Wall Street Journal as of 5:30 AM EDT:

The story explains that the Treasury market is about to face new fundings at those longer maturitiees:

For bond investors, the sharp rise in yields is uncomfortably similar to a brief selloff that occurred at the depth of the Covid meltdown, when traders sold whatever they could to raise cash. Further increases in Treasury yields could add to pressure on economies already hit by rising prices and slowing trade due to tariffs.

Investors say there is broad nervousness about holding longer-term Treasurys ahead of government auctions of 10-year notes Wednesday and 30-year bonds Thursday. That anxiety contributed to a global stock selloff overnight, with Japanese stocks falling 3.9% and European stocks down 2% in Europe’s morning. U.S. stock futures were volatile and recently stood modestly lower.

Japan’s top currency diplomat pledged to ensure stability in the global financial system, saying Tokyo will coordinate with other nations on U.S. trade policy changes.

Keep in mind that a reason for Japan and other countries to help prop up Treasuries is to lower the value of their currencies. Buying Treasuries for Japan means buying dollars and selling yen. China, which runs a dirty float, lowered the value of the renminbi a bit when it announced its retaliatory 34% tariffs. Japan, by contrast, has seen the yen rise as an alternative safe haven. It will want to contain and better yet somewhat reverse that increase so as not to have its price competitiveness worsen. Recall that competitive devaluations were a feature of the Great Depression.

I was in Japan during the 1987 crash, when I worked for Sumitomo Bank, then the largest by market cap. At first, the sentiment was akin to watching someone else’s house burn. Then it shifted to the concern that one’s own house might catch on fire. Treasuries started getting wobbly. The Fed called the Bank of Japan and told it to buy Treasuries. The Bank of Japan called the Japanese “city banks” (the equivalent of what were called money center banks in the US at the time) and told them to start purchasing.

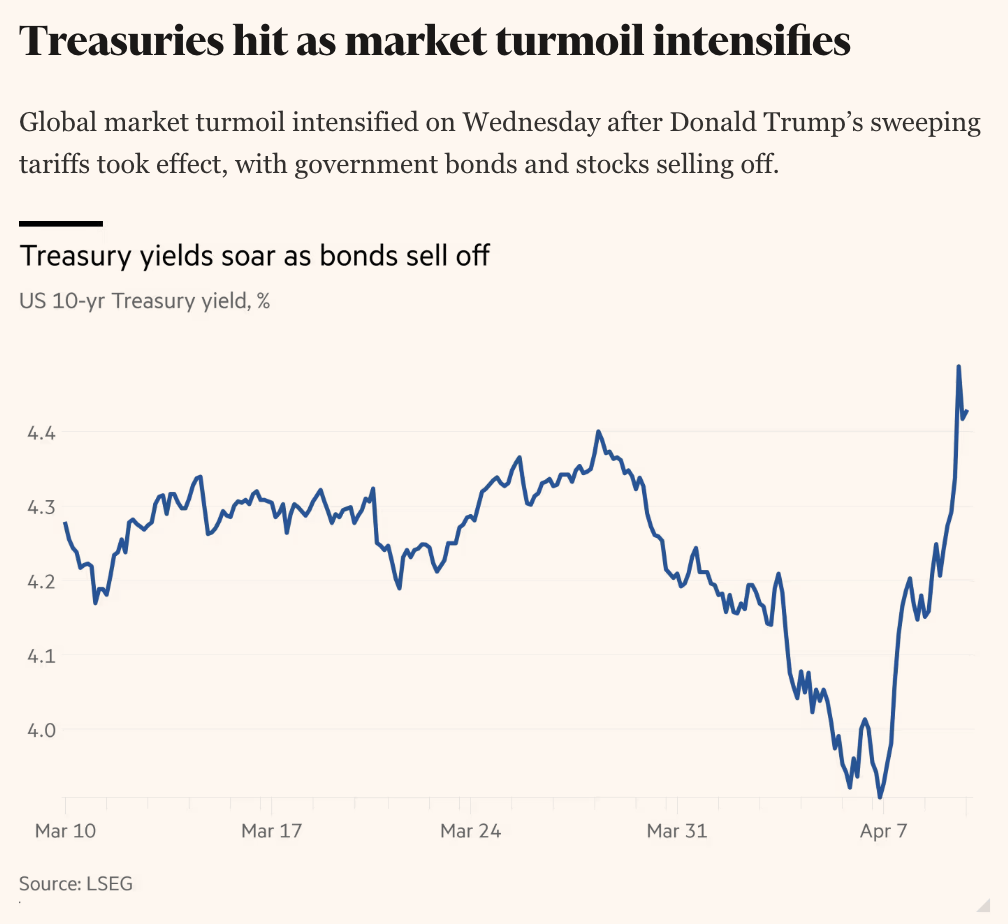

The Financial Times also made the Treasury bond selloff its lead entry:

Ed Yardeni of Yardeni Associates said the sell-off in Treasuries, typically a haven for investors during periods of market stress, was signalling that the “Trump administration may be playing with liquid nitro”.

Investors and economists have warned that Trump’s tariffs have increased the risk of a recession in the US, the world’s biggest economy, as well as a new bout of inflation.

As investors raced to price in slower global growth, oil prices extended their slump. Brent crude futures, the international benchmark, dropped to a four-year low of $60.13 a barrel.

Keep in mind that Yardeni is close to a permabull.

It’s not as if Treasuries are the only pain point :

:

Adam Tooze noted earlier this week that where Treasury prices would settle out would be the result of the interplay between investors with two different theories of the tariffs case:

Treasuries are a general-purpose safe haven. Investors who are selling their shares, driving stock market prices down, have to park their cash somewhere. The obvious place are US Treasuries. In the “normal” course of a stock market correction, we would expect to see bond prices going up as stock prices go down, as investors shuffle from one to the other. As bond prices go up, the yield (the effective interest rate) goes down. This tends to lower interest rates and ease pressure on businesses. This is the see-sawing, balancing effect of markets operating across assets. Again, it is painful, but it is good news. People take losses. But it suggests that the financial system is still working. As Katie Martin commented in the FT in the last few hours, this is the one to watch.

As the Wall Street Journal commented 10 minutes ago (I kid you not), the market is hard to read right now because longer term bond yields have to price in inflation, and Trump’s tariffs are clearly terrible for inflation. So right now we have safe-haven demand driving Treasury prices up (causing yields to come down) and inflation fear driving Treasury demand down (causing yields to go up). All of us are trying to read through the fog.

Now that does mean that the post by Murphy below is overegging the pudding a tad. Given Trump’s doggedness about tariffs and their baked-in inflationary impact (at least until the eventual depression kills demand stone cold dead) will make investors particularly leery of holding longer-maturity bonds. But the general idea still applies.

As an aside, criminal negligence by the Treasury in the Obama, Trump 1.0, and Biden eras plays a meaningful role in the freakout over Federal interest costs now. The Treasury should have done as much funding on the long end of the yield curve as humanly possible during the ZIRP era. Instead it borrowed in short maturities. Admittedly, longer-dated debt would eventually roll off and have to be refunded at higher cost, but that process would have taken time and blunted the impact of rate increases.

By Richard Murphy, Professor of Accounting Practice at Sheffield University Management School and a director of the Corporate Accountability Network. Originally published at Funding the Future

This chart has been published by the FT in the last few minutes:

The world has reacted to Trump’s deliberate act of massive risk creation by sending the message that it will not buy US debt. The result is that the price of that debt is falling, and so the effective interest rate on it is rising very rapidly.

This is the exact opposite of what Trump says he wants. He says he wants the US interest rate to fall by a lot. In bond markets, you cannot achieve that by alienating the people who might buy your debt, and that is what he is doing.

What’s the fallout?

First, as I note this morning, he might utterly overturn those markets, and in effect default on large parts of US debt by demanding that those holding it swap that debt for long-term or perpetual debt at very low rates.

Secondly, do not rule out that he will do large-scale quantitative easing, with all the downsides that go with that.

Third, do not presume that we will escape from this unscathed. Where US interest rates go tends to suggest where the rest of the world will move. There is, then, very bad news in all this.

Fourth, without coordinated action to work around Trump, there is no way the rest of the world can manage this fallout. It either combines against Trump or is divided and ruled by him, with disastrous consequences.

Fifth, do not expect wealthy America to be happy about any of this. They will react. But they may not react in a way that we think desirable. Their tendency towards autocracy is now well known.

Sixth, then, freedom has a fight on its hands. That chart implies an ugliness is coming our way.

Is there any indication on who is selling bonds, domestic investors or overseas ones like central banks?

If both stocks and bonds are being sold off, then what vehicles are being bought into? commodities, precious metals?

Simply holding cash long term makes them subject to the same inflationary pressures as Treasuries, does it not, since money market rates also essentially follow medium duration Fed rates?

Trump is getting us to stress test the financial system for use cases that don’t seem to have been planned for.

It would be ironic if it was overseas central banks selling off or not buying long-term US securities in order to increase liquidity to meet the costs of the effects of Trump’s tariffs in their own countries. That would not have been planned for. Might now make it too difficult for NATO countries to meet that 5% target that Trump was demanding.

‘I shot an arrow into the air, it fell to earth, I knew not where’

The Financial Times reported the culprit as an unwinding of the basis trade. Same thing happened at the beginning of Covid. Then the Federal Reserve provided the liquidity for the hedge funds to unwind their positions.

I remember that (COVID era treasuries getting hit.)

REITs started getting margin calls from banks. These guys borrow short to lend long. The yield curve moved too fast, and their hedges blew up in their faces like a trick cigar on Wile-E-Coyote.

No talk of margin calls just yet, but this time some other sector will likely blow up. Fun times!

Two weeks ago Bloomberg reported that a “panel of financial experts”recommended the Federal Reserve create a bailout mechanism if something like the Covid unwinding of the basis trade were to happen again. Not sure if the link below will work.

https://archive.md/kgPyp

Thank you for that link. It filled in a few blanks in my mind.

The mortgage REITs that got into trouble in March 2020 were the ones that used lots of leverage. They make money by the spread between short-term borrowing to go long agency mortgage debt (Fannie, Freddie stuff that is backstopped by the taxpayers.)

These spreads are nothing much to get excited about, except when you use leverage to turn the crank seven, eight, ten times. Then we’re talking real money.

Well, it all worked great until it didn’t. Sounds like a very similar scenario is playing out with hedge funds and the basis trade.

Jay Powell may want to cancel any vacation plans he has for the next 3 months.

Here is the Bloomberg link.

https://archive.md/1z3qX

Ah, thanks! I don’t have a subscription to FT, so couldn’t get to the article.

A followup: how does the Fed provide liquidity to hedge funds? Did the Feds simply buy assets at face value in order to inject liquidity into these funds?

Or are they loans subject to the Fed rates? A look at the yield curve in May 2020 [from https://www.ustreasuryyieldcurve.com/ ] shows yields up to 3Y to be close to 0.0%. Today’s yield curve has a low of 3.6% over the entire horizon. Does this imply more pain for hedge funds?

The articles report that it is investors selling to cover margin calls.

The central banks are unlikely to be selling. The last thing they wan’t is to drive their currencies up v the dollar. This would make them less competitive in Latin America, Africa, the Middle East, and Europe. The renminbi and Southeast Asian currencies have all weakened v. the dollar since the tariff announcement.

They don’t have to buy anything. They can keep cash in banks or as settlement balances at their broker, but the money is likely going to a fair degree to lenders. However, the Swiss franc and gold are up. Industrial commodities are down.

Margin Calls! That makes sense too as BitCoin has taken a hit recently as well. People are liquidating other assets to make the covers.

Thank you.

I was just about to pipe up about the articles that have mentioned the margin calls.

Lower rates in certain places and there is more buying on margin.

Just now, big jump in stocks.

This may give a reprieve from selling treasuries in order for some to raise cash for their margin calls.

But so many moving parts to everything right now…

One of the things about the crazy behavior around the administrations tariff policy is that it’s built upon a ton of assumptions AND appears to have not undergone any game theory (or equivalent) analysis of possible outcomes. I’m sure some of the Treasury sell off is general international investor panic and portfolio adjustments by foreign investors moving to diversify out of dollar investments, but I also suspect some of it is a direct result of the costs of the tariffs. Many of our trading partners with whom we have large trade deficits have huge piles of dollar assets… namely US Treasuries, and they need liquid dollars to pay for those tariffs. The textbook assumption is that the exporting country will need to sell more of its currency to buy dollars to pay the dollar denominated tariffs. However, if one is sitting on a ton of US Treasuries and needs to pay dollar denominated tariffs it’s far simpler to just start selling your Treasuries for dollars than to buy them in the FX market.

Additionally, the administration is assuming that the dollar will appreciate in the short term which effectively would negate some, most or all of the inflationary aspects of the tariffs. However, if a nation wanted to weaponize some of their Treasury assets there is plenty of supply to do that and cause the dollar to devalue instead which would mean the tariff costs don’t get negated but pasted onto consumers. I don’t think most countries would take this approach, but when you slap China with 104% tariff and have effectively declared all out economic war, it’s possible that going nuclear with their Treasuries is now possibly more than a thought experiment.

No, you have this wrong. Have you not ever paid import duties?

The US buyer pays the tariff, not the exporter.

If you apply that absurd model that Trump’s economic adviser Stephen Miran is floating then the poster is right about tariffs being paid by the exporting nation. In their economic universe they are banking on the effects tariffs usually have on the exchange rate of the exporting nation, the currency of which might devalue due to reduced trade and thus reduced demand for their domestic currency. It works mathematically only though if the currency of the exporting nation depreciates at the same rate as the tariff rate,. In the absurd model of the trump administration the exchange rate advantage the USD gains against the currency of the exporting nation and the tariff rate completely offset each other, leaving consumer prices unchanged and even generate revenue for the government. Though this lacks any substance of becoming an economic reality because of countervailing effects Trump is nevertheless selling this as an economic strategy.

Why were paper U.S. Savings Bonds discontinued? Always a great gift from Grandma.

Please use a search engine for questions like this.

this reads like a LLM engagement farm question from a bot.

Nothing personal if OP is really a Mk. 1 H. Sap.

Ha! My son received a paper $100 bond as a gift in the early 2010s with a coupon rate of just over 2% (I believe it was a 20 year bond). After a few years we did the math and the “math wasn’t mathing” on the projected purchasing power of that $100 bond 20 years later. So we cashed it in at a national bank.

It took 5 minutes to find an employee who actually knew the process of how to cash in a paper bond. They brought out a wizened old woman in a yellow pant suit from some back office. She took another 10 minutes to remember the process on their computer system. She was loving the attention as all the employees under 30 had never seen a paper bond and had NO idea they cashed them in at the bank. Several employees gathered round her as she went through the arcane steps on the bank’s computer software to complete the transaction – something she had not done in many years, she noted. A few minutes later we emerged with our $100 and promptly bought something that would retain value over 20 years with the “proceeds.”

Ha! For all the youngsters out there, I can personally vouch for having human beings around just to handle this kind of thing – they knew where all the bodies were buried and why (institutional knowledge it was called).

Thanks for the memory. I knew and dated one back in my day; well coiffed white hair, pants suit, but not yellow. Names are withheld to protect my innocence (haha)

The military, at least the Navy, used to push savings bonds. You paid by “allotment” from your pay so much a month and eventually DFAS or whomever managed mil pay at the time would kick out a savings bond. My wife has a stack of these since she was in charge and so if you want the troops to do it you need to lead. Some of these actually paid an insane interest rate, but they stop adding interest after 30 years (EE).

Navy Federal Credit Union seems like the only place that will take them in any more, probably due to the many members who bought these back then.

Of course today they want you to do everything online through Treasury Direct.

Similar experience for me a couple of years ago, except I had a large stack of paper bonds, some dating back to my first regular job in 1984(!!!). The task was turned over to someone my age, which is to say old, and she had to type the serial number and issue date for every bond in my stack into some ancient software. It took over an hour. On the plus side, it’s the only time I got any sort of competent customer service from Bank of America (it was the last thing I did before closing my accounts there).

Yves thank you for this.

I do not follow bonds. I was wondering about events the past week or so.

I think a lot of people need cash…. More people think they need cash.

Buffet has been long cash.

It’s a dash for cash! The Bank of Sealy is a storage option.

That’s what I was thinking, but while that’s kind of the go-to idea for someone like me whose wealth level is of the couch lint variety, I thought the Big Fish had better options than the Ancient International Bank of Mattress. Some of the commentary here is helping me understand the harder parts of these articles. That’s why this site is my first and favorite stop every morning!

Additionally, I do not believe for one hot minute that the Baaaad Banks are insulated from this. I have no data; I have just a hunch.

So I’m about to violate the “assume incompetence, not malice” aphorism…because Trump has been on or near Wall Street for 55 years. He knows how this works.

Launching and then escalating unprecedentedly aggressive trade actions during auction week for 10’s and 30’s which are owned widely by foreign central banks, one of which is our global adversary and the particular target of such trade actions, and during which period there is a very large and leveraged “cash equivalent” basis trade that is widely held on the street would seem to be, well, less than accidental. Should, or rather, when something breaks, the Fed would be expecter to be intervening to help out, implicitly mitigating the impact of the tariffs and tolerating a rise in prices. Should they NOT do so, well, its a national emergency, after all, and maybe someone should intervene on the Fed. Or so game theory might play out.

No, Trump is not even remotely “Wall Street adjacent”. Borrowing from banks to finance real estate (and casinos) bears no resemblance to the securities trading side of the house. They are different universes. I am also highly confident that Trump couldn’t care less what the Treasury auction schedule is. He’s too busy golfing and talking to Bibi about when to attack Iran.

Orange Man not only is not versed in the inner workings of banks and the world of finance, but he has in fact said himself that he is not a fan of banks.

The crown of this article is at the end: the fallout. Particularly No. 5. The last and most ominous one. I admit to having been mulling over this myself, the last two days. Ever since the bloodletting on the financial markets began reaching “real crash” proportions.

There are a lot of extremely wealthy, extremely powerful people who have literally lost entire treasures. They may decide to put a stop to this before any more damage, from their perspective, is done.

On the other hand didn’t the boss of Blackrock say today that the stock market still needs to shed another 20%? And he sure is managing a real big chunk of the money of these very wealthy and very powerful people. So who is he now speaking for? Cognitive dissonance? A secret master plan? In cahoots with Orange Man?

Time will tell.

90 day pause on most tarries.

the Bond market has spoken.

Shaken, not stirred.

OK, so now there is announced a 90 day pause on tariffs for all countries that did not retaliate and want to negotiate and the DOW is up 2,641 at the moment.

Gad, I really hate the focus on the stock market. It’s a frigging casino and the gamblers are addicts. There is not one bit of evidence that any of those companies are less vulnerable and better prepared for multinational games of chicken today than yesterday. But hey we can get them cheap, let’s buy!

(And why anyone believes that the 90 day pause can’t be called off tomorrow or next week … well I don’t get who they are depending on to keep that from happening.)

“There is not one bit of evidence that any of those companies are less vulnerable and better prepared for multinational games of chicken today than yesterday.”

Indeed. There are so many moving parts other than the one reason the financial press wants to present to the masses for the jump.

Things to consider: the price of options, covering margin calls….and more things I don’t know about.

Is it buy the dip, sell the rip? (for those who are traders)

Questions abound….

For instance, I don’t know what this means:

Trump’s tariff walk-back unleashed flood of systematic buying. Here’s how much was poured into the market, Nomura says

By

Joseph Adinolfi

President Trump’s decision to delay some of the tariffs announced last week for 90 days unleashed a flood of buying on Wednesday, as systematic funds and options dealers scrambled to ramp up their exposure to stocks, according to Nomura’s Charlie McElligott.

The ensuing rally has also set the stage for what would be, according to McElligott’s model, the largest daily buying on behalf of leveraged ETFs on record.

Dear Yves- is this at all possible? And how disruptive would it be during the next 4yrs? TY and my apology if I already missed this thread.

https://www.cfr.org/blog/how-trump-can-control-fed

Jerome Powell’s term ends in May 2026.

It just makes me wonder: what’s the emergency that can’t wait for the administration? What or who is it that can’t hold out until May 2026?

‘without coordinated action to work around Trump, there is no way the rest of the world can manage this fallout. It either combines against Trump or is divided and ruled by him, with disastrous consequences.’

Politics is concentrated economics – expect to see the rhetoric against those Reds in China go into overdrive and talk about ‘freedom’ ramp up….I will bet a lot that the EU will fall into line. What they SHOULD be doing is getting on the phone to China. There is not a single leader in the west (perhaps with the exception of Mark Carney now in Canada) that has the capacity and integrity to see what’s happening. We are about to see the world fall into two trading blocks. How ASEAN responds will be important but not critical as long as BRICS stays together. Two key indicatorsc are Vietnam and Saudi. They will want to perform a balancing act: let’s see how much the Empire threatens and bribes them. Trump has blinked and has lost the narrative battle – but only for the time being. ‘The west’ will fall into line – just watch. They are more neo-liberal than the USA these days. They NEED a master….