Yves here. It’s become commonplace to depict Trump’s economic policies as a radical departure from recent trajectory. Michael Hudson begs to differ. He explains why the seemingly novel part, the heavy use of tariffs, represents continuity of neoliberal and libertarian policies, of reducing the role of government in commercial and private life. He contends they therefor have perilous little to do with “rebuilding” America and are intended to allow the super-rich to extract even more from ordinary citizens.

Hudson’s assessment is similar to what yours truly said from the outset: the only way Trump’s program made sense was if the aim was to induce a Russia-in-the-1990s level economic crisis so as to facilitate plutocrats buying valuable assets on the cheap. But a lot of formerly viable businesses and jobs will be destroyed to facilitate this looting.

By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City, and a research associate at the Levy Economics Institute of Bard College. His latest book is The Destiny of Civilization. Originally published at The Democracy Collective

Donald Trump’s tariff policy has thrown markets into turmoil among his allies and enemies alike. This anarchy reflects the fact that his major aim was not really tariff policy, but simply to cut income taxes on the wealthy, by replacing them with tariffs as the main source of government revenue. Extracting economic concessions from other countries is part of his justification for this tax shift as offering a nationalistic benefit for the United States.

His cover story, and perhaps even his belief, is that tariffs by themselves can revive American industry. But he has no plans to deal with the problems that caused America’s deindustrialization in the first place. There is no recognition of what made the original U.S. industrial program and that of most other nations so successful. That program was based on public infrastructure, rising private industrial investment and wages protected by tariffs, and strong government regulation. Trump’s slash and burn policy is the reverse – to downsize government, weaken public regulation and sell off public infrastructure to help pay for his income tax cuts on his Donor Class.

This is just the neoliberal program under another guise. Trump misrepresents it as supportive of industry, not its antithesis. His move is not an industrial plan at all, but a power play to extract economic concessions from other countries while slashing income taxes on the wealthy. The immediate result will be widespread layoffs, business closures and consumer price inflation.

Introduction

America’s remarkable industrial takeoff from the end of the Civil War through the outbreak of World War I has always embarrassed free-market economists. The United States’ success followed precisely the opposite policies from those that today’s economic orthodoxy advocates. The contrast is not only that between protectionist tariffs and free trade. The United States created a mixed public/private economy in which public infrastructure investment was developed as a “fourth factor of production,” not to be run as a profit-making business but to provide basic services at minimal prices so as to subsidize the private sector’s cost of living and doing business.

The logic underlying these policies was formulated already in the 1820s in Henry Clay’s American System of protective tariffs, internal improvements (public investment in transportation and other basic infrastructure), and national banking aimed at financing industrial development. An American School of Political Economy emerged to guide the nation’s industrialization based on the Economy of High Wages doctrine to promote labor productivity by raising living standards and public subsidy and support programs.

These are not the policies that today’s Republicans and Democrats advise. If Reaganomics, Thatcherism and Chicago’s free-market boys had guided American economic policy in the late nineteenth century, the United States would not have achieved its industrial dominance. So it hardly is surprising that the protectionist and public investment logic that guided American industrialization has been airbrushed out of U.S. history. It plays no role in Donald Trump’s false narrative to promote his abolition of progressive income taxes, downsizing of government and privatization sell-off of its assets.

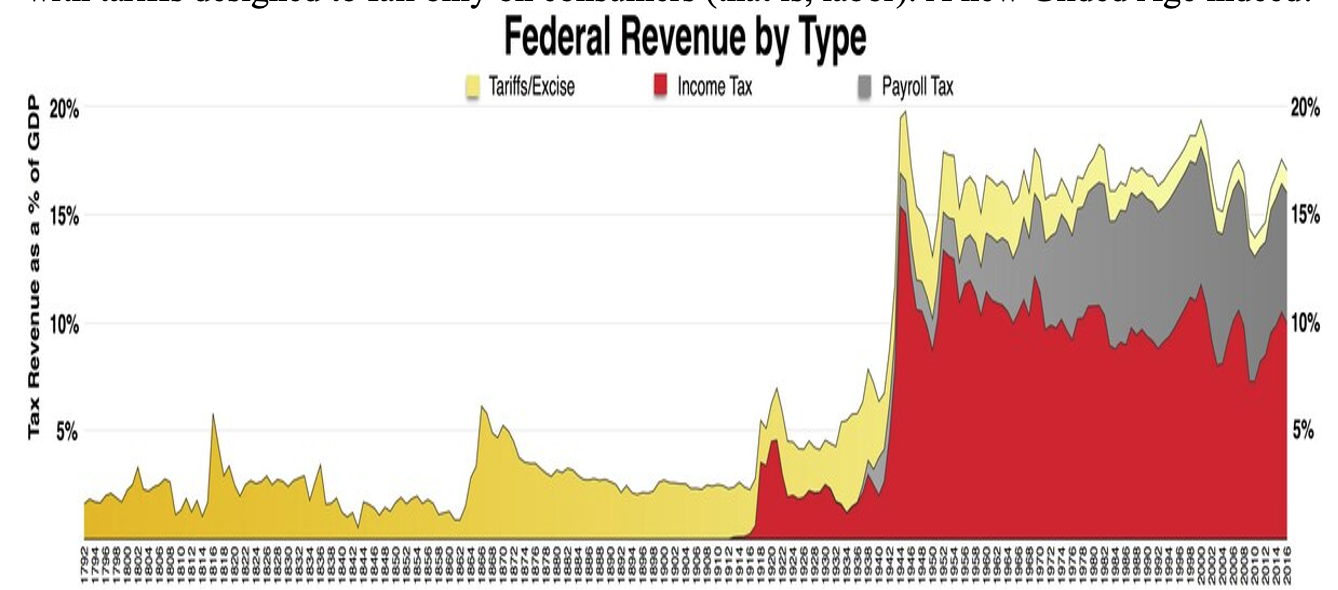

What Trump singles out to admire in America’s nineteenth-century industrial policy is the absence of a progressive income tax and the funding of government primarily by tariff revenue. This has given him the idea of replacing progressive income taxation falling on his own Donor Class – the One Percent that paid no income tax prior to its enactment in 1913 – with tariffs designed to fall only on consumers (that is, labor). A new Gilded Age indeed!

Source: https://en.wikipedia.org/wiki/File:Federal_taxes_by_type.pdf

In admiring the absence of progressive income taxation in the era of his hero, William McKinley (elected president in 1896 and 1900), Trump is admiring the economic excess and inequality of the Gilded Age. That inequality was widely criticized as a distortion of economic efficiency and social progress. To counteract the corrosive and conspicuous wealth-seeking that caused the distortion, Congress passed the Sherman Anti-Trust Law in 1890, Teddy Roosevelt followed with his trust busting, and a remarkably progressive income tax was passed that fell almost entirely on rentier financial and real estate income and monopoly rents.

Trump thus is promoting a simplistic and outright false narrative of what made America’s nineteenth century policy of industrialization so successful. For him, what is great is the “gilded” part of the Gilded Age, not its state-led industrial and social-democratic takeoff. His panacea is for tariffs to replace income taxes, along with privatizing what remains of the government’s functions. That would give a new set of robber barons free reign to further enrich themselves by shrinking the government’s taxation and regulation of them, while reducing the budget deficit by selling off the remaining public domain, from national park lands to the post office and research labs.

The Key Policies That Led to America’s Successful Industrial Takeoff

Tariffs by themselves were not enough to create America’s industrial takeoff, nor that of Germany and other nations seeking to replace and overtake Britain’s industrial and financial monopoly. The key was to use the tariff revenues to subsidize public investment, combined with regulatory power and above all tax policy, to restructure the economy on many fronts and shape the way in which labor and capital were organized.

The main aim was to raise labor productivity. That required an increasingly skilled labor force, which required rising living standards, education, healthy working conditions, consumer protection and safe food regulation. The Economy of High Wages doctrine recognized that well educated, healthy and well fed labor could undersell “pauper labor.”

The problem was that employers always have sought to increase their profits by fighting against labor’s demand for higher wages. America’s industrial takeoff solved this problem by recognizing that labor’s living standards are a result not only of wage levels but of the cost of living. To the extent that public investment financed by tariff revenues could pay the cost of supplying basic needs, living standards and labor productivity could rise without industrialists suffering a fall in profit.

The main basic needs were free education, public health support and kindred social services. Public infrastructure investment in transportation (canals and railroads), communications and other basic services that were natural monopolies was also undertaken to prevent them from being turned into private fiefdoms seeking monopoly rents at the expense of the economy at large. Simon Patten, America’s first professor of economics at its first business school (the Wharton School at the University of Pennsylvania), called public investment in infrastructure a “fourth factor of production.”[1] Unlike private-sector capital, its aim was not to make a profit, much less maximize its prices to what the market would bear. The aim was to provide public services either at cost or at a subsidized rate or even freely.

In contrast to European tradition, the United States left many basic utilities in private hands, but regulated them to prevent monopoly rents from being extracted. Business leaders supported this mixed public/private economy, seeing that it was subsidizing a low-cost economy and thus increasing its (and their) competitive advantage in the international economy.

The most important public utility, but also the most difficult to introduce, was the monetary and financial system needed to provide enough credit to finance the nation’s industrial growth. Creating private and/or public paper credit required replacing the narrow reliance on gold bullion for money. Bullion long remained the basis for paying customs duties to the Treasury, which drained it from the economy at large, limiting its availability for financing industry. Industrialists advocated moving away from over-reliance on bullion by the creation of a national banking system to provide a growing superstructure of paper credit to finance industrial growth.[2]

Classical political economy saw tax policy as the most important lever steering the allocation of resources and credit towards industry. Its main policy aim was to minimize economic rent (the excess of market prices over intrinsic cost value) by freeing markets from rentier income in the form of land rent, monopoly rent, and interest and financial fees. From Adam Smith through David Ricardo, John Stuart Mill, to Marx and other socialists, classical value theory defined such economic rent as unearned income, extracted without contributing to production and hence an unnecessary levy on the economy’s cost and price structure. Taxes on industrial profits and labor’s wages added to the cost of production and thus were to be avoided, while land rent, monopoly rent and financial gains should be taxed away, or land, monopolies and credit could simply be nationalized into the public domain to lower access costs for real estate and monopoly services and reduce financial charges.

These policies based on the classical distinction between intrinsic cost-value and market price are what made industrial capitalism so revolutionary. Freeing economies from rentier income by the taxation of economic rent aimed at minimizing the cost of living and doing business, and also minimizing the political dominance of a financial and landlord power elite. When the United States imposed its initial progressive income tax in 1913, only 2 percent of Americans had a high enough income to require them to file a tax return. The vast majority of the 1913 tax fell on the rentier income of financial and real estate interests, and on the monopoly rents extracted by the trusts that the banking system organized.

How America’s Neoliberal Policy Reverses Its Former Industrial Dynamic

Since the takeoff of the neoliberal period in the 1980s, U.S. labor’s disposable income has been squeezed by high costs for basic needs at the same time as its cost of living has priced it out of world markets. This is not the same thing as a high-wage economy. It is a rakeoff of wages to pay the various forms of economic rent that have proliferated and destroyed America’s formerly competitive cost structure. Today’s $175,000 average income for a family of four is not being spent mainly on products or services that wage-earners produce. It is mostly siphoned off by the Finance, Insurance and Real Estate (FIRE) sector and monopolies at the top of the economic pyramid.

The private-sector’s debt overhead is largely responsible for today’s shift of wages away from rising living standards for labor, and of corporate profits away from new tangible capital investment, research and development for industrial companies. Employers have not paid their employees enough to both maintain their standard of living and carry this financial, insurance and real estate burden, leaving U.S. labor to fall further and further behind.

Inflated by bank credit and rising debt/income ratios, the U.S. guideline cost of housing for home buyers has risen to 43% of their income, far up from the formerly standard 25%. The Federal Housing Authority insures mortgages to guarantee that banks following this guideline will not lose money, even as arrears and defaults are hitting all-time highs. Home ownership rates fell from over 69% in 2005 to under 63% in the Obama eviction wave of foreclosures after the 2008 junk-mortgage crisis. Rents and house prices have soared steadily (especially during the period the Federal Reserve kept interest rates low deliberately to inflate asset prices to support the finance sector, and as private capital has bought up homes that wage earners cannot afford), making housing by far the largest charge on wage income.

Debt arrears also are exploding for student education debt taken on to qualify for a higher-paying job, and in many cases for the auto debt needed to be able to drive to the job. This is capped by credit-card debt accumulating just to make ends meet. The disaster of privatized medical insurance now absorbs 18 percent of U.S. GDP, yet medical debt has become a major cause of personal bankruptcy. All this is just the reverse of what was intended by the original Economy of High Wages policy for American industry.

This neoliberal financialization – the proliferation of rentier charges, inflation of housing and health-care costs, and the need to live on credit beyond solely one’s earnings – has two effects. The most obvious is that most American families have not been able to increase their savings since 2008, and are living from paycheck to paycheck. The second effect has been that, with employers obliged to pay their labor force enough to carry these rentier costs, the living wage for American labor has risen so far above that of every other national economy that there is no way that American industry can compete with that of foreign countries.

Privatization and deregulation of the U.S. economy has obliged employers and labor to bear the rentier costs, including higher housing prices and rising debt overhead, that are part and parcel of today’s neoliberal policies. The resulting loss of industrial competitiveness is the major block to its re-industrialization. After all, it was these rentiercharges that deindustrialized the economy in the first place, making it less competitive in world markets and spurring the offshoring of industry by raising the cost of basic needs and doing business. Paying such charges also shrinks the domestic market, by reducing labor’s ability to buy what it produces. Trump’s tariff policy does nothing to address these problems, but will aggravate them by accelerating price inflation.

This situation is unlikely to change any time soon, because the beneficiaries of today’s neoliberal policies – the recipients of these rentier charges burdening the U.S. economy – have become the political Donor Class of billionaires. To increase their rentier income and capital gains and make them irreversible, this resurgent oligarchy is pressing to further privatize and sell off the public sector instead of providing subsidized services to meet the economy’s basic needs at minimum cost. The largest public utilities that have been privatized are natural monopolies – which is why they were kept in the public domain in the first place (i.e., to avoid monopoly rent extraction).

The pretense is that private ownership seeking profits will provide an incentive to increase efficiency. The reality is that prices for what formerly were public services are increased to what the market will bear for transportation, communications and other privatized sectors. One eagerly awaits the fate of the U.S. Post Office that Congress is trying to privatize.

Neither increasing production nor lowering its cost is the aim of today’s sell-off of government assets. The prospect of owning a privatized monopoly in a position to extract monopoly rent has led financial managers to borrow the money to buy up these businesses, adding debt payments to their cost structure. The managers then start selling off the businesses’ real estate for quick cash that they pay out as special dividends, leasing back the property that they need to operate. The result is a high-cost monopoly that is heavily indebted with plunging profits. That is the neoliberal model from England’s paradigmatic Thames Water privatization to private financialized former industrial companies such as General Electric and Boeing.

In contrast to the nineteenth century’s takeoff of industrial capitalism, the aim of privatizers in today’s post-industrial epoch of rentier finance capitalism is to make “capital” gains on the stocks of hitherto public enterprises that have been privatized, financialized and deregulated. A similar financial objective has been pursued in the private arena, where the financial sector’s business plan has been to replace the drive for corporate profits with making capital gains in stocks, bonds and real estate.

The great majority of stocks and bonds are owned by the wealthiest 10 percent, not by the bottom 90 percent. While their financial wealth has soared, the disposable personal income of the majority (after paying rentier charges) has shrunk. Under today’s rentier finance capitalism the economy is going in two directions at once – down for the industrial goods-producing sector, up for the financial and other rentier claims on this sector’s labor and capital.

The mixed public/private economy that formerly built up American industry by minimizing the cost of living and doing business has been reversed by what is Trump’s most influential constituency (and that of the Democrats as well, to be sure) – the wealthiest One Percent, which continues to march its troops under the libertarian flag of Thatcherism, Reaganomics and Chicago anti-government (meaning anti-labor) ideologues. They accuse the government’s progressive income and wealth taxes, investment in public infrastructure and role as regulator to prevent predatory economic behavior and polarization, of being intrusions into “free markets.”

The question, of course, is “free for whom”? What they mean is a market free for the wealthy to extract economic rent. They ignore both the need to tax or otherwise minimize economic rent to achieve industrial competitiveness, and the fact that slashing income taxes on the wealthy – and then insisting on balancing the government budget like that of a family household so as to avoid running yet deeper into debt – starves the economy of public injection of purchasing power. Without net public spending, the economy is obliged to turn for financing to the banks, whose interest-bearing loans grow exponentially and crowd out spending on goods and real services. This intensifies the wage squeeze described above and the dynamic of deindustrialization.

A fatal effect of all these changes has been that instead of capitalism industrializing the banking and financial system as was expected in the nineteenth century, industry has been financialized. The finance sector has not allocated its credit to finance new means of production, but to take over assets already in place – primarily real estate and existing companies. This loads the assets down with debt in the process of inflating capital gains as the finance sector lends money to bid up prices for them.

This process of increasing financialized wealth adds to economic overhead not only in the form of debt, but in the form of higher purchase prices (inflated by bank credit) for real estate and industrial and other companies. And consistently with its business plan of making capital gains, the finance sector has sought to untax such gains. It also has taken the lead in urging cuts in real estate taxes so as to leave more of the rising site value of housing and office buildings – their rent-of-location – to be pledged to the banks instead of serving as the major tax base for local and national fiscal systems as classical economists urged throughout the nineteenth century.

The result has been a shift from progressive taxation to regressive taxation. Rentier income and debt-financed capital gains have been untaxed, and the tax burden shifted onto labor and industry. It is this tax shift that has encouraged corporate financial managers to replace the drive for corporate profits with making capital gains as described above.

What promised to be a harmony of interests for all classes – to be achieved by increasing their wealth by running into debt and watching prices rise for homes and other real estate, stocks and bonds – has turned into a class war. It is now much more than the class war of industrial capital against labor familiar in the nineteenth century. The postmodern form of class war is that of finance capital against both labor and industry. Employers still exploit labor by seeking profits by paying labor less than what they sell its products for. But labor has been increasingly exploited by debt – mortgage debt (with “easier” credit fueling the debt-driven inflation of housing costs), student debt, automobile debt and credit-card debt just to meet its break-even costs of living.

Having to pay these debt charges increases the cost of labor to industrial employers, constraining their ability to make profits. And (as indicated above) it is such exploitation of industry (and indeed of the whole economy) by finance capital and other rentiers that has spurred the offshoring of industry and deindustrialization of the United States and other Western economies that have followed the same policy path.[3]

In stark contrast to Western deindustrialization stands China’s successful industrial takeoff. Today, living standards in China are, for much of the population, broadly as high as those in the United States. That is a result of the Chinese government’s policy of providing public support for industrial employers by subsidizing basic needs (e.g., education and medical care) and public high-speed rail, local subway and other transportation, better high-technology communications and other consumer goods, along with their payments systems.

Most important, China has kept banking and credit creation in the public domain as a public utility. That is the key policy that has enabled it to avoid the financialization that has deindustrialized the U.S. and other Western economies.

The great irony is that China’s industrial policy is remarkably similar to that of America’s nineteenth-century industrial takeoff. China’s government, as just mentioned, has financed basic infrastructure and kept it in the public domain, providing its services at low prices to keep the economy’s cost structure as low as possible. And China’s rising wages and living standards have indeed found their counterpart in rising labor productivity.

There are billionaires in China, but they are not viewed as celebrity heroes and models for how the economy at large should seek to develop. The accumulation of conspicuous large fortunes such as those that have characterized the West and created its political Donor Class have been countered by political and moral sanctions against the use of personal wealth to gain control of public economic policy.

This government activism that U.S. rhetoric denounces as Chinese “autocracy” has managed to do what Western democracies have not done: prevent the emergence of a financialized rentier oligarchy that uses its wealth to buy control of government and takes over the economy by privatizing government functions and promoting its own gains by indebting the rest of the economy to itself while dismantling public regulatory policy.

What Was the Gilded Age That Trump Hopes to Resurrect?

Trump and the Republicans have put one political aim above all others: cutting taxes, above all progressive taxation that falls mainly on the highest incomes and personal wealth. It seems that at some point Trump must have asked some economist whether there was any alternative way for governments to finance themselves. Someone must have informed him that from American independence through the eve of World War I, by far the dominant form of government revenue was customs revenue from tariffs.

It is easy to see the lightbulb that went off in Trump’s brain. Tariffs don’t fall on his rentier class of real estate, financial and monopoly billionaires, but primarily on labor (and on industry too, for imports of necessary raw materials and parts).

In introducing his enormous and unprecedented tariff rates on April 3, Trump promised that tariffs alone, by themselves, would re-industrialize America, by both creating a protective barrier and enabling Congress to slash taxes on the wealthiest Americans, whom he seems to believe will thereby be incentivized to “rebuild” American industry. It is as if giving more wealth to the financial managers who have deindustrialized America’s economy will somehow enable a repeat of the industrial takeoff that was peaking in the 1890s under William McKinley.

What Trump’s narrative leaves out of account is that tariffs were merely the precondition for the nurturing of industry by the government in a mixed public/private economy where the government shaped markets in ways designed to minimize the cost of living and doing business. That public nurturing is what gave nineteenth-century America its competitive international advantage. But given his guiding economic aim to untax himself and his most influential political constituency, what appeals to Trump is simply the fact that the government did not yet have an income tax.

What also appeals to Trump is the super-affluence of a robber-baron class, in whose ranks he can readily imagine himself as if in a historical novel. But that self-indulgent class consciousness has a blind spot regarding how its own drives for predatory income and wealth destroy the economy around it, while fantasizing that the robber barons made their fortunes by being the great organizers and drivers of industry. He is unaware that the Gilded Age did not emerge as part of America’s industrial strategy for success but because it did not yet regulate monopolies and tax rentier income. The great fortunes were made possible by the early failure to regulate monopolies and tax economic rent. Gustavus Myers’ History of the Great American Fortunes tells the story of how railroad and real estate monopolies were carved out at the expense of the economy at large.

America’s anti-trust legislation was enacted to deal with this problem, and the original 1913 income tax applied only to the wealthiest 2 percent of the population. It fell (as noted above) mainly on financial and real estate wealth and monopolies – financial interest, land rent and monopoly rent – not on labor or most businesses. By contrast, Trump’s plan is to replace taxation of the wealthiest rentier classes with tariffs paid mainly by American consumers. To share his belief that national prosperity can be achieved by tax favoritism for his Donor Class by untaxing their rentier income, it is necessary to block awareness that such a fiscal policy will prevent the re-industrialization of America that he claims to want.

The U.S. Economy Cannot Be Re-Industrialized Without Freeing It From Rentier Income

The most immediate effects of Trump’s tariff policy will be unemployment as a result of the trade disruption (over and above the unemployment flowing from his DOGE cutbacks in government employment) and an increase in consumer prices for a labor force already squeezed by the financial, insurance and real estate charges that it has to bear as first claims on its wage income. Arrears on mortgage loans, auto loans and credit-card loans already are at historically high levels, and more than half of Americans have no net savings at all – and tell pollsters that they cannot cope with an emergency need to raise $400.

There is no way that disposable personal income will rise in these circumstances. And there is no way that American production can avoid being interrupted by the trade disruption and layoffs that will be caused by the enormous tariff barriers that Trump has threatened – at least until the conclusion of his country-by-country negotiation to extract economic concessions from other countries in exchange for restoring more normal access to the American market. While Trump has announced a 90-day pause during which the tariffs will be reduced to 10% for countries that have indicated a willingness to so negotiate, he has raised tariffs on Chinese imports to 145%.[4] China and other foreign countries and companies already have stopped exporting raw materials and parts needed by American industry. For many companies it will be too risky to resume trade until the uncertainty surrounding these political negotiations are settled. Some countries can be expected to use this interim to find alternatives to the U.S. market (including producing for their own populations).

As for Trump’s hope to persuade foreign companies to relocate their factories to the United States, such companies face the risk of him holding a Sword of Damocles over their heads as foreign investors. He may in due course simply insist that they sell out their American affiliate to domestic U.S. investors, as he has demanded that China do with TikTok.

And the most basic problem, of course, is that the American economy’s rising debt overhead, health insurance and housing costs already have priced U.S. labor, and the products it makes, out of world markets. Trump’s tariff policy will not solve this. Indeed, his tariffs by increasing consumer prices will exacerbate this problem by further increasing the cost of living and thus the price of American labor.

Instead of supporting a regrowth of U.S. industry, the effect of Trump’s tariffs and other fiscal policies will be to protect and subsidize obsolescence and financialized deindustrialization. Without restructuring the rentier financialized economy to move it back toward the original business plan of industrial capitalism with markets freed from rentierincome, as advocated by the classical economists and their distinctions between value and price, and hence between rent and industrial profit, his program will fail to re-industrialize America. Indeed, it threatens to push the U.S. economy into depression – for 90 percent of the population, that is.

So we find ourselves dealing with two opposing economic philosophies. On the one hand is the original industrial program that the United States and most other successful nations followed. It is the classical program based on public infrastructure investment and strong government regulation, with rising wages protected by tariffs that provided the public revenue and profit opportunities to create factories and employ labor.

Trump has no plans to recreate such an economy. Instead, he advocates the opposing economic philosophy: downsizing government, weakening public regulation, privatizating public infrastructure, and abolishing progressive income taxes. This is the neoliberal program that has increased the cost structure for industry and polarized wealth and income between creditors and debtors. Donald Trump misrepresents this program as being supportive of industry, not its antithesis.

Imposing tariffs while continuing the neoliberal program will simply protect senility in the form of industrial production burdened by high costs for labor as a result of rising domestic housing prices, medical insurance, education, and services bought from privatized public utilities that used to provide basic needs for communications, transportation and other basic needs at subsidized prices instead of financialized monopoly rents. It will be a tarnished gilded age.

While Trump may be genuine in wanting to re-industrialize America, his more single-minded aim is to cut taxes on his Donor Class, imagining that tariff revenues can pay for this. But much trade already has stopped. By the time more normal trade resumes and tariff revenue is generated from it, widespread layoffs will have occurred, leading the affected labor to fall further into debt arrears, with the American economy in no better position to re-industrialize.

The Geopolitical Dimension

Trump’s country-by-country negotiations to extract economic concessions from other countries in exchange for restoring their access to the American market no doubt will lead some countries to succumb to this coercive tactic. Indeed, Trump has announced over 75 countries have contacted the U.S. government to negotiate. But some Asian and Latin American countries already are seeking an alternative to the U.S. weaponization of trade dependency to extort concessions. Countries are discussing options to join together to create a mutual trade market with less anarchic rules.

The result of them doing so would be that Trump’s policy will become yet another step in America’s Cold War march to isolate itself from trade and investment relations with the rest of the world, including potentially with some of its European satellites. The United States runs the risk of being thrown back onto what has long been supposed its strongest economic advantage: its ability to be self-sufficient in food, raw materials, and labor. But it already has deindustrialized itself, and has little to offer other countries except for the promise not to hurt them, disrupt their trade and impose sanctions on them if they agree to let the United States be the major beneficiary of their economic growth.

The hubris of national leaders trying to extend their empire is age-old – as is their nemesis, which usually turns out to be themselves. At his second inauguration, Trump promised a new Golden Age. Herodotus (History, Book 1.53) tells the story of Croesus, king of Lydia c. 585-546 BC in what is now Western Turkey and the Ionian shore of the Mediterranean. Croesus conquered Ephesus, Miletus and neighboring Greek-speaking realms, obtaining tribute and booty that made him one of the richest rulers of his time, famous for his gold coinage in particular. But these victories and wealth led to arrogance and hubris. Croesus turned his eyes eastward, ambitious to conquer Persia, ruled by Cyrus the Great.

Having endowed the region’s cosmopolitan Temple of Delphi with substantial gold and silver, Croesus asked its Oracle whether he would be successful in the conquest that he had planned. The Pythia priestess answered: “If you go to war against Persia, you will destroy a great empire.”

Croesus optimistically set out to attack Persia c. 547 BC. Marching eastward, he attacked Persia’s vassal-state Phrygia. Cyrus mounted a Special Military Operation to drive Croesus back, defeating Croesus’s army, capturing him and taking the opportunity to seize Lydia’s gold to introduce his own Persian gold coinage. So Croesus did indeed destroy a great empire – but it was his own.

Fast-forward to today. Like Croesus hoping to gain the riches of other countries for his gold coinage, Trump hoped that his global trade aggression would enable America to extort the wealth of other nations and strengthen the dollar’s role as a reserve currency against foreign defensive moves to de-dollarize and create alternative plans for conducting international trade and holding foreign reserves. But Trump’s aggressive stance has further undermined trust in the dollar abroad, and is causing serious interruptions in the supply chain of U.S. industry, halting production and causing layoffs at home.

Investors hoped for a return to normalcy as the Dow Jones Industrial Average soared upon Trump’s suspension of his tariffs, only to then fall back when it became clear that he was still taxing all countries 10 percent (and China a prohibitive 145 percent). It is now becoming apparent that his radical disruption of trade cannot be reversed. The tariffs that Trump announced on April 3, followed by his statement that this was simply his maximum demand, to be negotiated on a bilateral country-by-country basis to extract economic and political concessions (subject to more changes at Trump’s discretion) have replaced the traditional idea of a set of rules consistent and binding for all countries. His demand that the United States must be “the winner” in any transaction has changed how the rest of the world views its economic relations with the United States. An entirely different geopolitical logic is now emerging to create a new international economic order.

China has responded with its own tariffs and export controls as its trade with the United States is frozen, potentially paralyzed. It seems unlikely that China will remove its export controls on many products essential for U.S. supply chains. Other countries are searching for alternatives to their trade dependency on the United States, and areordering of the global economy is now under negotiation, including defensive de-dollarization policies. Trump has taken a giant step toward the destruction of what was a great empire.

______

[1] The three usual factors of production are labor, capital and land. But these factors are best thought of in terms of classes of income recipients. Capitalists and workers play a productive role, but landlords receive rent without producing a productive service, as their land rent is unearned income that they make “in their sleep.”

[2] In contrast to the British system of short-term trade credit and a stock market aimed at making quick gains at the expense of the rest of the economy, Germany went further than the United States in creating a symbiosis of government, heavy industry and banking. Its economists called the logic on which this was based the State Theory of Money. I give the details in Killing the Host (2015, chapter 7).

[3] America’s deindustrialization has also been facilitated by U.S. policy (starting under Jimmy Carter and accelerated under Bill Clinton) promoting the offshoring of industrial production to Mexico, China, Vietnam and other countries with lower wage levels. Trump’s anti-immigrant policies playing on native Americanism are a reflection of the success of this deliberate U.S policy in deindustrializing America. It is worth noting that his migration policies are the opposite of those of America’s industrial takeoff, which encouraged immigration as a source of labor – not only skilled labor fleeing Europe’s oppressive society, but also low-wage labor to work in the construction industry (for men) and the textile industry (for women). But today, by having moved directly to the countries from which immigrants performing U.S. industrial labor previously came, American industry has no need to bring them to the United States.

[4] The White House has pointed out that Trump’s new 125% tariff on China is on top of the 20% IEEPA (International Emergency Economic Powers Act) tariffs already in place, making the tariff on Chinese imports an unpayably high 145%.

Hudson’s assessment is similar to what yours truly said from the outset: the only way Trump’s program made sense was if the aim was to … facilitate plutocrats buying valuable assets on the cheap.

I’ve just finished a FT piece that reached essentially the same conclusion and was in NC links today, but you didn’t furnish an archived version (I don’t think). So for those who can’t get through the paywall there —

Transcript: Are US tariffs just the beginning? W. Abraham Newman

https://www.ft.com/content/71d93317-e5d7-47bb-ab10-5b5816cb49c6

https://archive.ph/b3BQ8

Both the left-of-center and right-of-center love to assume that Trump is playing 4-D chess. He isn’t. He, and the West Wing’s brightest kids from the short bus, are just dolts when it comes to understanding the complexity of modern civilizational logistics—which require a scalpel to undo bad decisions; not a pile of TNT.

(IMO ymmv)

Of course, maybe his is a 4-D genius—-if so dam*, managing to manipulate the Democrats into running the most idiot candidates to oppose him—twice!

Does the DT or any of his kakistocrat crew even know how to play chess? The incompetence and buffoonery is tragically humorous, as usual. But the sycophant-stenographers in the mass media, as you say, make ridiculous speculation and wishful thinking. It looks like many in the DT2 regime are drug-addled and have mental health problems, including the Orange Idiot himself.

And the loyal opposition don’t have to run quality candidates, as we have no democracy and no meaningful choice. Oligarchies will be oligarchies, but we have a BigMoney Public Relations Democracy to distract and divide the plebs.

A fascinating post this if a bit depressing. Footage emerged after Hurricane Katrina hit new Orleans showing street scenes and a lot of people overseas remarked that these were like scenes out of a third world country. But Trump and his cohort want to make it so for the majority of the population all the time just so a tiny minority of oligarchs can benefit. This will not end well and will make the US a very unstable country. One part of this stood out to me where it said-

‘The second effect has been that, with employers obliged to pay their labor force enough to carry these rentier costs, the living wage for American labor has risen so far above that of every other national economy that there is no way that American industry can compete with that of foreign countries.’

I can guess what those oligarchs are thinking. Years ago I read how Amazon was paying their people so little that they qualified for food stamps. It was the only way those workers could survive. Maybe that might be their idea of the future though the way that Trump is cutting back on people qualified for food stamps, that may not be such a workable idea.

A few years ago, it was reported, and I saw physical proof of it being true, that WalMart new hires were shown how to apply for Food Stamps when First Indoctrinated.

Stay something or other.

Yes, Walmart did it decades before Amazon.

And that all corresponds to the recent Times article about local service workers in Ski Town, Colorado needing to provide pay stubs and be interviewed, just so they can live in their cars.

There’s a good chance that the Social Darwinist/Eugenics behavior and rhetoric is going to reach previously unimaginable levels sooner than we imagine, in direct proportion to the spread of immiseration.

Matthew 12: 25

“But Jesus knew their thoughts, and said to them: “Every kingdom divided against itself is brought to desolation, and every city or house divided against itself will not stand.”

He was killed for wanting to bring debt cancellation… or how they called it then ‘The Year of the Lord”

Interesting how the medieval Catholic Church used DEBT on European Kings if they refused to send their arms and weaponry to make further inroads in grabbing territories in The Middle East/Elsewhere.

And during that time, to help make the Church super wealthy, it was St. Augustine who changed the meaning of DEBT that Jesus originally espoused. Saintly Augustine twisted “Debt” to mean sexual deviations. Sex is Sin. An avenue by which the Church used against the poor and rich to keep the money flowing into The Vatican.

As Protestantism rose, they picked up this same routine.

It still stands today, especially within the US Evangelical adherents.

St Augustine is my confirmation name.

Time to take Original Sun back for the dregs!

Augustine’s greatest blasphemy is ‘Original Sin’; for how can Augustine conclude that sex is a source of evil, when sex was created by God( Who has declared that all of creation is Very Good) ? And from his concept of original sin, the Christians have been among the worst purveyors of guilt and shame, and the resultant hatred, self-hatred, and cruelty that results thereafter.

Augustine has blasphemed against God and led the whole church astray. As a Catholic, I would have his doctrine disavowed, and have his bones exhumed and burnt at the stake. 😄

“facilitate plutocrats buying valuable assets on the cheap”

Indeed. Some of the stories about how some businesses are in a state of being like “frozen in place” is making that the more likely case.

Unlike Russia in the 90s, there could be a more global aspect to this round of economic tightening.

The Russian oligarchs that came by their wealth and power as a result of the 90s are really eager to “normalize” more business relations with the USA.

Yves Smith and Michael Hudson confirm my crude reaction to the DT2 policies: more asset-stripping, privatization, and gouging the public. Another crude analogy is they want to burn the house down, collect the insurance and then to buy up everything at “fire sale prices”.

“We had to destroy the country to save it.”

The policy of rabid ideologues everywhere, everywhen.

“What also appeals to Trump is the super-affluence of a robber-baron class, in whose ranks he can readily imagine himself as if in a historical novel. But that self-indulgent class consciousness has a blind spot regarding how its own drives for predatory income and wealth destroy the economy around it, while fantasizing that the robber barons made their fortunes by being the great organizers and drivers of industry.”

And there are elite officials in European countries that get teary-eyed over how their ancestors lived during that era, which they called The Belle Époque.

Thanks for the great piece. Hudson is NC at its best.

As for

“labor’s living standards are a result not only of wage levels but of the cost of living”

this is why some of us risk scorn by defending bargain retail. Over the last few decades Americans have at least been given a low cost of living via all that off shore labor exploitation as well as subsidies to domestic agriculture–one place where government intervention continues alive and well.

Now Trump even wants to blow up that in order to further the greed of his native class. After a few months it has become obvious (or more obvious) that he is not only dumb but lazy with only a few Fox News fueled notions rattling around in his head and a dedication to making “deals” for himself and his family.

There is the plus side though that peer to peer war is unlikely to promote this sort of grifting which is why some of us find an attack on Iran to be unlikely. Whereas slow and mostly off the radar genocide in Gaza–with a resulting Kushner Riviera–would be right up his alley.

“There is the plus side though that peer to peer war is unlikely to promote this sort of grifting which is why some of us find an attack on Iran to be unlikely.’

So many don’t want or need that attack. But there are still too many power brokers that can’t imagine living with an Iran with any power.

Power that has grown unchecked for so long starts to believe it can never be checked. They think resistance is a bump in the road. They preach to themselves and others that taking “no” as an answer is not an option.

What you stated is a reasonable take on the situation and the world is dealing with extremisms, obsessions, and compulsions.

Maybe we should should drop Waltz on Tehran and problem solved. There are some hints that Trump may not be as tight with his hired cronies as the overseas observers–who read the same blogs about America as we do–think. Larry Johnson says Vance and Trump Jr. are supposedly against an attack.

Here’s suggesting that what Trump wants is a pacified ME so businesses like his can thrive. If Iran makes a few gestures in that direction it may be enough. They haven’t done much about the Palestinians so far.

Whereas Netanyahu is nuts and thinks he can fool the US into joining him in taking down Iran’s leadership. Russia is unlikely to go along.

The Rabid Z—-st clique, both in America and the Middle East is in a “No F—s” mode of existence. Evidence here is the report that those Patriot and THAAD anti air batteries are being sent to protect Nevatim Airbase in the Negev. That happens to be the main airfield for military aviation in the country. It also is the spot where Iran sited its almost stage-managed hypersonic missile strike in October of 2024, which was very successful. Being stage-managed, the damage was almost cosmetic in nature, as if it was a “proof of concept” demonstration. So, someone is taking seriously the idea that the Iranians can inflict heavy damage on Israels air forces, on the ground. Thus the added air defense assets.

The above, unfortunately, is a sign that the Usual Suspects are forging ahead with the frankly insane “Eretz Ysrael Project.”

The Bulletin of Atomic Scientists Clock must be somewhere in the milliseconds before Armageddon region by now.

Stay safe. Keep your Potassium Iodide tablets handy.

such a well rounded over view. exactly as i have said, the smoot-hawley tariffs would never have worked well without the new deal, and visa versa.

as Keen has said, well here we are, something had to be done to reverse neo-liberalism, but trump doing it wrong.

The irony of Trump is that for those wishing for less government, now have government, in the form of “l’etat, c’est moi” in their laps 24/7. What is disturbing: the total abdication of Congress and the sounds of silence of the people of the US. It remains to ber seen, if the general population will accomodate themselves to remaining debt serfs while Project 25 creates what might as well be the institutionalisation of a plantation economic system and Rule by Divine Right in which the Masters live in their Big Houses attended by a Domestic Staff, and serviced by a Professional Class, while the Field Hands do their work managed by the likes of AI.

Great post! Dead on, unfortunately.

Trump’s managed to land a wrecking ball on what remains of our economy so they are going to have to destroy the last vestiges of the New Deal/Great Society to get those oligarch billionaire mega corporation tax cuts. It’s the only large non-DOD pile of money left to grab so good bye Social Security and Medicare. It was

fundamental to American societyfun while it lasted, but Elon needs to be a trillionaire.Why would the administration totally stop a program that takes money out of everyone’s paycheck when the financial sector could keep that mechanism and take a cut (or “rents”)?

Not knocking SS security. Just looking at it from the perspective of some rentiers…

But they would also want to lower payments considerably to satisfy other oligarchs.

Michael Hudson has throughout his career detailed the problems we are experiencing and provided the background histories of how we got here. The issues needing addressing have been examined extensively.

What is missing is a plan that can be implemented within a very short time frame (less than 30 days) that would immediately end all the horrors MH describes that are destroying the 99% and causing the downward spiral of the USA.

We need action RIGHT NOW not at the next election, which very well may be cancelled due to some manufactured crisis. We are a nation of very smart people on the whole. Why can’t we eliminate the cancer causing the problems?

This is where I find myself these days as well. I’ve been reading Hudson et al for almost 20 years now. I know he advocates for a debt jubilee and other MMT proposals, but practically how does one get it done? At this point, even having the conversation with someone for the upteenth time feels like that old man yells at cloud meme.

Academic papers don’t seem to help. Protesting doesn’t seem to help. Calling my congress-critter doesn’t seem to help. Voting doesn’t seem to help. I could go on. If anyone has any ideas, sing me up.

St. Luigi has resurrected an old idea. Direct action against the facilitators of the pernicious doctrine.

See the history of Russia at the end of the Nineteenth Century on up till 1917.

Yes, there are long established courses of action to reach these ends. “Propaganda of the Deed” at scale, or outright insurrection/revolution. People of the US, having been so successfully propagandized into believing that the only acceptable form of protest is of the non-violent (safely ignored) variety, while at the same time, oddly enough, worshiping pseudo-deities of “Founding Father” type (whose methods are not discussed), are not quite ready for the answer, as yet. They seem to be rapidly approaching that acceptance, however.

Plans “implemented within a very short time frame (less than 30 days)”, seem to me, plans not well thought out. While I could agree that action “RIGHT NOW, not at the next election” may be called for, I can think of no such precipitous[my word] actions that might accomplish what you appear to be suggesting — [?]staunching the wounds and halting murderous hands from working further harm. As an old man, I view calls to action “RIGHT NOW” as invitations to self-destruction. Long history and recent experiences strongly argue that faced with a stronger, better armed opponent, direct assault is a suicidal strategy and an especially bloody and suicidal tactic. And as an old man, I tend to associate action “RIGHT NOW” with various forms of frontal assault either violent or non-violent. I believe action must await careful planning of attacks an enemy cannot anticipate. While such attacks could be actions “RIGHT NOW”, such actions do not presently have sufficient support from an analytical study of warfare in the present situation. I fear that too much operates from automatic knee-jerk reaction and facile recollections of past conflicts. The 1910s-1920s and 1930a were periods of complex rebellion — ill characterized as action “RIGHT NOW”.

“The most important public utility, but also the most difficult to introduce, was the monetary and financial system needed to provide enough credit to finance the nation’s industrial growth.”

I don’t understand the logic of you arguing for the necessity of banking having to be an “important public utility.”

Back in 2014, Richard A. Werner published what I believe was the first empirical study on how banks actually work, helping to end the debate on whether banks are (a) mere financial intermediaries passing on savings deposits as loans to borrowers or whether (b) they need central bank reserves or deposits to lend these on to their customers (fractional reserver theory), so that each bank is an intermediary; but, in aggregate, more money is created by the banking system in a collective fashion or (c) whether they are not financial intermediaries at all but, instead, creators of the money supply so that each bank creates new purchasing power that is added to the money supply when it extends a loan, thus deciding about the amount and allocation of new money creation–a pivotal function in the economy.

Werner’s empirical tests rejected the financial intermediation and fraction reserve theories and seemed to showed that banks don’t need prior savings, nor central bank reserves or other deposits to lend. Instead, banks create new money when they do what is called bank lending and add it to the money supply. Bank loans, in essence, add new purchasing power.

It seems to me that banks (especially small banks) occupy a pivotal role in the economy as they undertake the task of creating and allocating new purchasing power.

It is for this reason we need the “right” type of banks that take the “right” decisions concerning the important question of how money should be created.

I am currently persuaded that decisions made by small banking units and their loan officers in local communities with strict guidance on the creation and allocation of money–in order to prevent the worst excesses of capitalism and steer the economy towards a path that benefits the average citizen–is the best option.

I am persuaded that we need to decentralize power in our monetary system not centralize it.

Richard and I are old friends, and we have no disagreements. Of course banks create credit. That’s what MMT explains, and what I’ve explained for years, often at conferences where Richard and I both appear to discuss the issue.

I think an important thing to remember when discussing the currency creation by banks vs the federal government (or federal reserve) is the difference in relative permanence. Banks only create money that exists in the short term- for the length of the loan. They create the currency when they make the loan, and destroy it as the principle of the loan is repaid (They get to keep the interest, which is extra- and this is why it is such a huge deal when governments adopt balanced budgets, or outright surpluses- Where does that interest come from then? The banks have to ramp up lending and continually increase credit in order to pay the interest on loans made in the past- and therein lies the problem, when the government is not running deficits, people tend to take out less credit, and even if the banks want to increase lending volumes, people just are not interested, and this is how you end up with credit crunches that collapse economies- There is simply not enough money in circulation to enable repayment of all of those loans).

Currency creation by the government or central bank circulates for far longer when the government operates a deficit, and in an economy that runs on extracted interest and rents, the money supply has to continually increase, one way or another, or else you get an economic black hole.

(There are other economic systems of course, but this one is ours, whether we like it or not)

As noted by one person above, wwe need a plan, a solution to the issues Mr Hudson tells us about. In the past,, he has noted it will take a revolution in order to bring change. Revolution is not a near term, 20 day plan.

I don’t have any answers to solve the issues raised by Mr. Hudson; does any one else have

some practical, realistic solutions, action plans, etc. Not having any ideas myself, I’d like to hear the solutions that others propose.

The problem is that we have been the ones selected to fix the problem. We were so hoping to be able to pass that one on to the next generation while we enjoy the last vestiges of credit on demand, the system in place since 1981.

We all know that the plutocrats are going to have to be pulled out of their mansions and their assets seized as in so many times in the past but it really sucks to be the ones who are going to have to bell the cat.

First thing is to take a lot of the power away from employers, who have never had it so good. Don’t look to China for help the working class is just as bad off there, only physically better off for a while. This is a class war nothing else. I would stockpile for a general strike but I am old and wouldn’t lose much even if it all went bad.

Yep- the only long term solution is to eliminate the employer class, be they capitalists or petite bourgeoisie. They gotta go.

Self- employment, (strictly) family businesses, or employee-owned co-ops for everyone.

(Kermit The Frog screams and waves his froglegs in excitement in the background)

The problem is …

Dietrich Bonhoeffer, a German theologian and anti-Nazi resistance fighter, identified stupidity as a greater threat than evil itself. Unlike malice, which can be confronted, stupidity is immune to logic, resistant to reason, and dangerously convinced of its own rightness. Bonhoeffer observed how Nazi Germany transformed intelligent individuals into blind followers, illustrating how stupidity spreads in society when people surrender their independent thought for conformity.

This video explores Bonhoeffer’s insights into stupidity as a socio-psychological phenomenon, showing how it enables authoritarianism, propaganda, and mass manipulation. It also provides practical steps to resist stupidity, such as maintaining critical thinking, avoiding groupthink, recognizing manipulation tactics, and embracing intellectual independence.

In a world filled with misinformation and blind loyalty, Bonhoeffer’s warning remains more relevant than ever. To combat stupidity, we must stay critical, stay aware, and refuse to be ruled by ignorance.

https://www.youtube.com/watch?v=MoReVkF-UZ0

Kinda hard to disseminate information when Capital endlessly funds disinformation to advance a social agenda based on Natural Order. Instead one gets cookie cutter Sunday school felt board economic tropes with a side of full immersion atomistic individualism advertising. Seems the only sure thing is more billionaires being minted, seemingly as if via their financial super powers they will dominate global markets and thus rule the world like in the good old days …

So you’re saying that stupidity is deliberately manufactured BY evil people. That’s what creating narratives is all about — and propaganda, as I describe in J is for Junk Economics.

Trump may indeed believe that tariffs will revive industry. That is because he WANTS to believe it, to serve his tax-cutting aims. And as my book on America’s Protectionist Takeoff shows, the American School has been uniformly expurgated from histories of economic thought.

Without going long form, Mr Hudson. I don’t ascribe to evil anything as people both – individually and group dynamics – is just about goals. Trump got the whole idea of tariffs from someone else, internalized it via his simple view of global economics e.g. tiny window to look at everything.

Not that one should consider his romantic economic period a sound/functional system, nor that one should think in this day it could be repeated. Its akin to those that think WE could go back to living like in the OT and that would be a good thing.

Personally, I am in the camp that views his antics will just hasten the the results of what neoliberalism has wrought. As you would well know its a big tent filled with all kinds of misinformed or plain old ideological zealots. That they can get in the heads of the unwashed spans all of human history.

I would add that stupidity is just another term in this context with ignorance. Only question is when it becomes self inflicted, hence why your book on Junk Economics is important. Mass hysteria/delusions is a thing sadly, see views on Russia/China – induced.

I hear Michael Hudson, but I am not convinced that Trump is merely engaging in his tariff war to help donors with lower taxes. Most donors (including Elon Musk) are vehemently against Trump’s tariff war. I think Trump genuinely believes that tariffs would magically reindustrialize USA.

If the words of Stephen Miran (Trump’s economic advisor) are anything to go by, it seems that Trump expects countries that have been tariffed to come to him on bended knees to beg for relief. At that stage, Trump will blackmail them into buying lots of American junk that they don’t need in exchange for removing the tariffs. In that way, Trump would be able to pretend that America’s trade deficits with other nations have been eliminated.

Of course, the whole thing backfired when Japan unexpectedly refused to play ball and began to sell treasury bonds, causing Trump to panic and suspend the tariff war with all countries (except China).

https://www.japantimes.co.jp/business/2025/04/13/economy/japan-us-tariffs-treasurys/

Japan isn’t planning to use its U.S. Treasury holdings as a negotiation tool to counter U.S. tariffs in talks scheduled between the two governments for April 17.

“As an ally, we would not intentionally take action against U.S. government bonds, and causing market disruption is certainly not a good idea,” Liberal Democratic Party policy chief Itsunori Onodera said on an NHK television program Sunday….”

‘As an ally, we would not intentionally take action against U.S. government bonds’?

As I read that, it’s saying that if the US has no allies, only vassals and victims — or those it seeks to victimize — Japan will no longer be an ally.

And it may happen for perfectly ordinary reasons beyond the immediate control of the Japanese political authorities but it would not necessarily be an intentional act against US government bonds by the Japanese government, however inconvenient it may be for the current US administration.

My reading as well. Polite Japanese warning.

You note that “I think Trump genuinely believes that tariffs would magically reindustrialize USA.”

I suspect that this is correct. However, at this moment I feel at a complete loss to understand what role Trump’s beliefs are playing in policy making. Maybe it doesn’t matter, the consequences can be predicted and debated; we probably don’t need to understand the internal thought process of Trump or his team. Nonetheless, I am utterly baffled and frustrated when I try to put together a model of what Trump (and his team’s) beliefs really are. It’s almost as though he doesn’t think. Perhaps he is pure charlatanism without anything but instinct to fool people into thinking he knows what he is doing.

Perhaps more subtly Trump.or his advisers believe that tariffs will *relatively* reindustrialise the USA by de-industrialising others (mainly its vassals). It will be the least dirty shirt in the laundry basket.

So for Trump tariffs equal:

– tax cuts

– fiscal headroom for continuing costs of Empire

– relative industrial and geopolitical advantage over Eurasia

What’s not to like?

We don’t know this. Many of the most important people behind Republican projects, Project 2025, and the narrative of making America Great Again and right-wing Christian fundamentalist stay well out of the public eye.

Obviously some tariffs are inconvenient for some reason – damage to an industry or a threat Republicans in the mid-terms – and will go away or be modified.

Anyway, I’ve come to believe that Trump thinks Gloria Swanson vanquished the thoroughly evil William Holden, that is the point of the movie, and he wants us face down dead in a pool.

Besides the tariffs, a great deal of government was fee based. If you were a US Marshal, a postmaster, an alcohol tax collector, a reservation supplier, etc, your nominal salary was fairly low and you were expected to operate your sinecure as a business. And sometimes the rewards for selectively not doing the job could greatly exceed those for doing it

When one looks at the baseline 10% tariffs this is quite clear. This applies to a host of countries with whom the United States already runs a trade surplus and which supply largely commodities, many of which could not be produced in the US in any case. Most of Central America’s exports to us, for example, consist of coffee, bananas, and cacao, which basic botany and environmental biology dictate cannot be produced in any quantity in the US. This is simply a regressive 10% levy on the importer and the consumer. And the exporter, more often than not, is a US firm.

The members of the cabinet of billionaires, of course, have no reason to care one iota about the price level of olives, coffee, chocolate, bananas, shoes, clothing. Such items represent far less than a tiny rounding error in their income assets. They care somewhat more about their already not huge income tax, which these revenues are seen as potentially replacing. It’s rather like an importa only VAT.

It’s symptomatic of the metropole further tightening its grip upon, and further exploiting, its periphery. Eventually the empire implodes …

You can’t understand economics without understanding the accompanying history. Michael Hudson is brilliant in this regard. His works are required reading.

Join Yanis Varoufakis & Michael Hudson in conversation on debt and its implications for Global South – North relations: *Monday 14 April*

moderated by economist and author Ann Pettifor.

This is part of the Michael Hudson Lecture Series. https://www.youtube.com/live/JmAeVwCJWoU

As Karl Kautsky originally wrote and Rosa Luxembourg immortalized, “As things stand today capitalist civilization cannot continue; we must either move forward into socialism or fall back into barbarism.”

America almost always chooses barbarism …